Layer-1 blockchains (L1) are the backbone of the decentralized web, processing transactions, executing

smart contracts, and supporting the next generation of decentralized applications (

dApps). As the industry matures in 2025, dozens of layer-1 chains are competing for market share, but two platforms are clearly dominating the growth narrative:

Solana and

Sui.

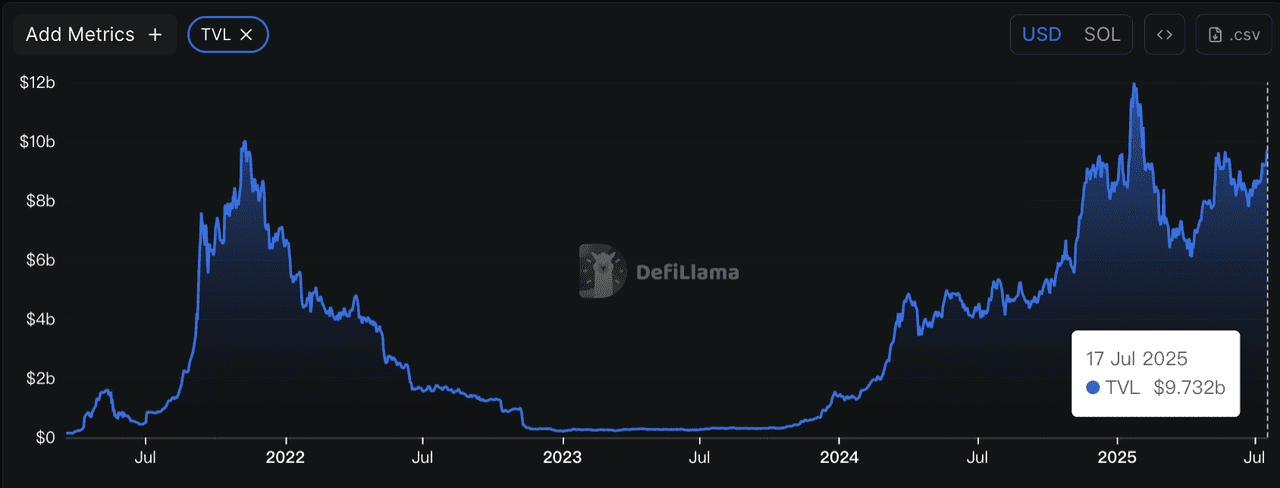

While the overall blockchain

Total Value Locked (TVL) market has grown approximately 100% in 2024-2025, both Solana and Sui have significantly outpaced this trend. Solana achieved 140% TVL growth and Sui posted an exceptional 220% expansion, demonstrating their ability to capture disproportionate market share.

Yet beneath these strong numbers, their design philosophies, technical foundations, and market approaches are fundamentally different. As Web3 transitions from experimentation to real-world utility, the competition between these two chains has become one of the most defining dynamics in blockchain infrastructure. Understanding their differences provides insights for anyone looking to participate in the evolving crypto ecosystem.

Solana vs Sui: A Quick 2025 Overview

Layer-1 blockchains are the base layer of the decentralized web. They process transactions, run smart contracts, and host decentralized applications (dApps). Today, they also compete on scalability, cost-efficiency, and user experience.

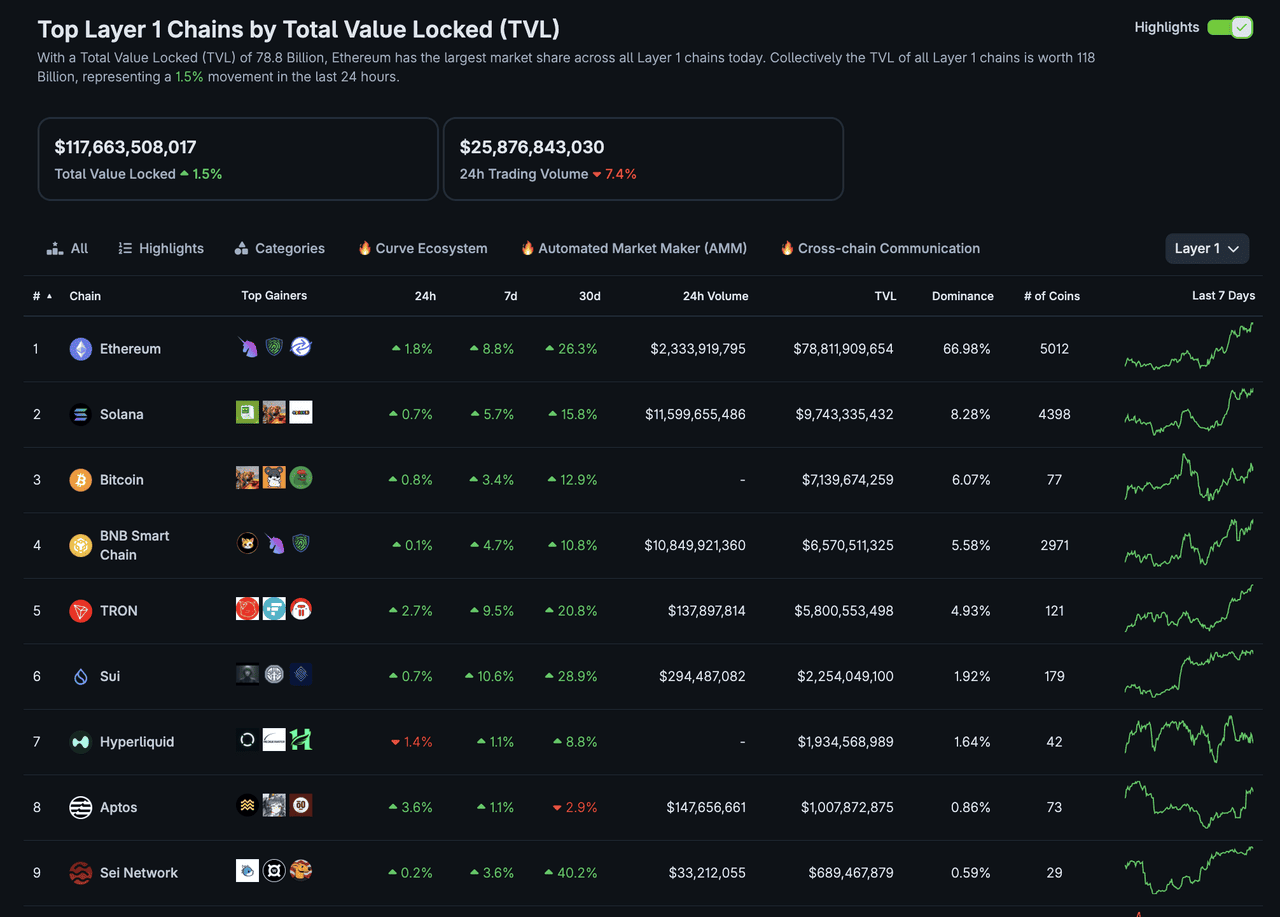

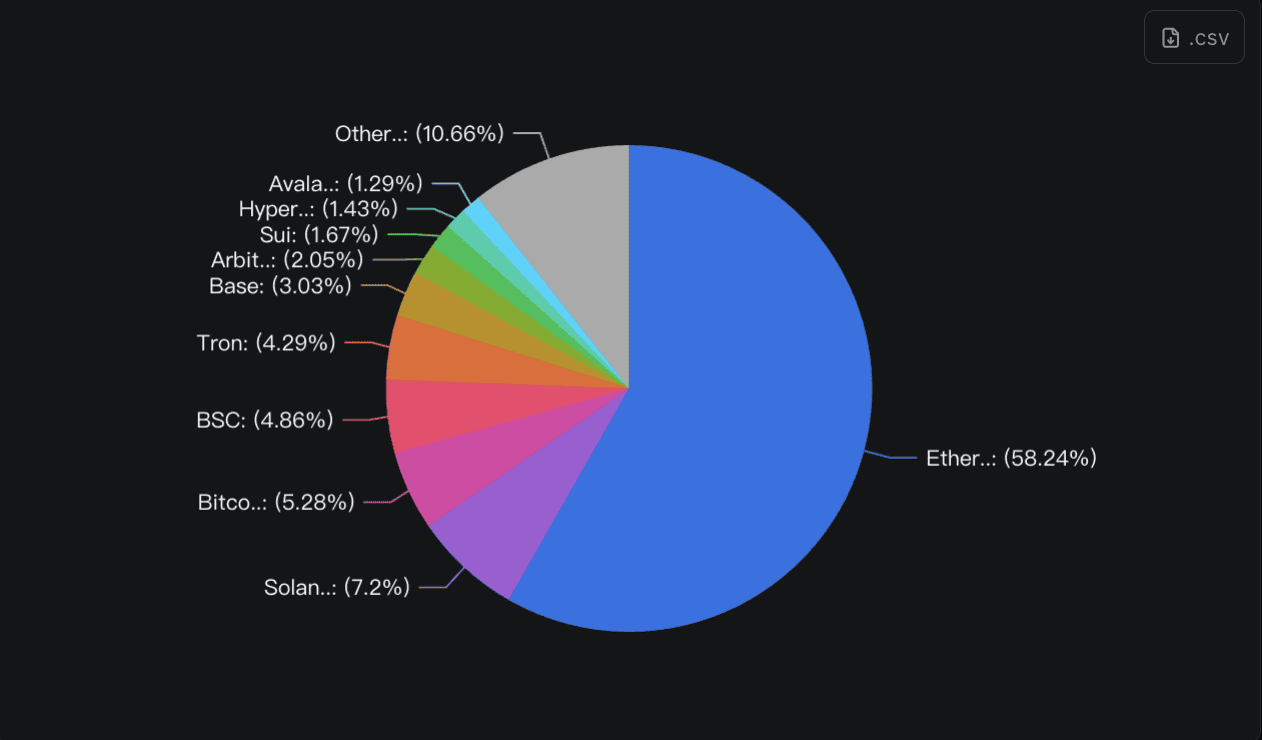

TVL across all blockchains has reached over $132 billion | Source: CoinGecko

In 2025, the blockchain landscape is more competitive than ever before. The total value locked (TVL) across all blockchains has reached over $132 billion, representing approximately 100% growth throughout 2024-2025. While this market-wide expansion demonstrates the industry's maturation, two platforms have significantly outpaced this trend. Among the top 10 chains by TVL, Solana and Sui stand out among most dynamic blockchian ecosystems, with Solana leading a remarkable recovery surge and Sui demonstrating unprecedented growth velocity for a new platform.

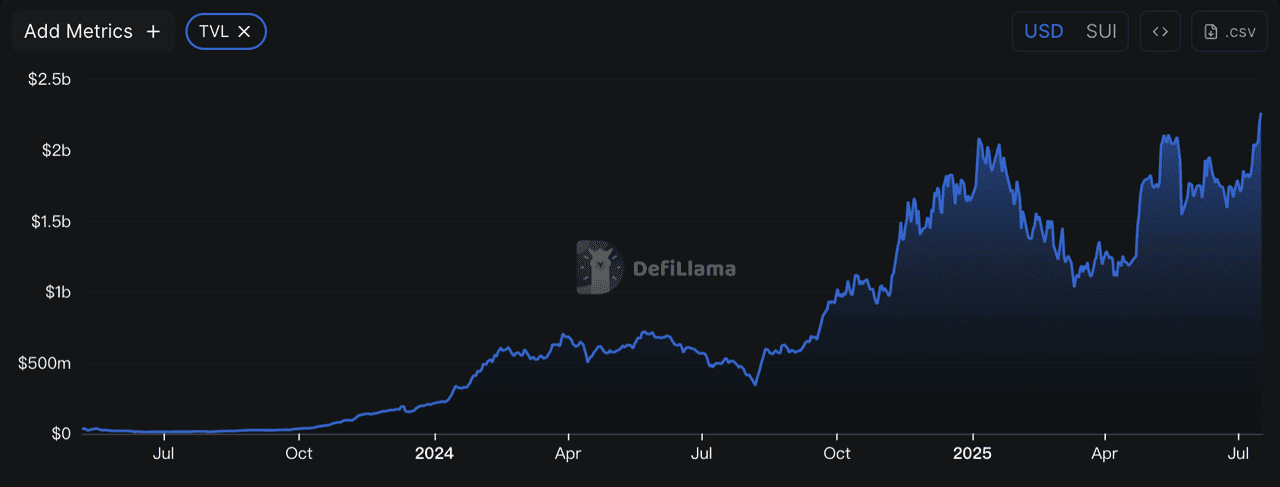

Solana achieved a 140% growth rate in 2024-2025 | Source: DefiLlama

• Solana is the established "

Ethereum killer" that has mounted an impressive comeback, achieving approximately 400% TVL growth from its 2022-2023 lows of around $2 billion to $9.68 billion today. Even in the recent

bull market of 2024-2025, Solana has maintained strong momentum with approximately 140% TVL growth, outperforming the overall market by 40%

and demonstrating sustained ecosystem expansion. With a market cap of $94.7 billion and strong ecosystem activity, Solana's recovery represents one of the most significant turnaround stories in crypto.

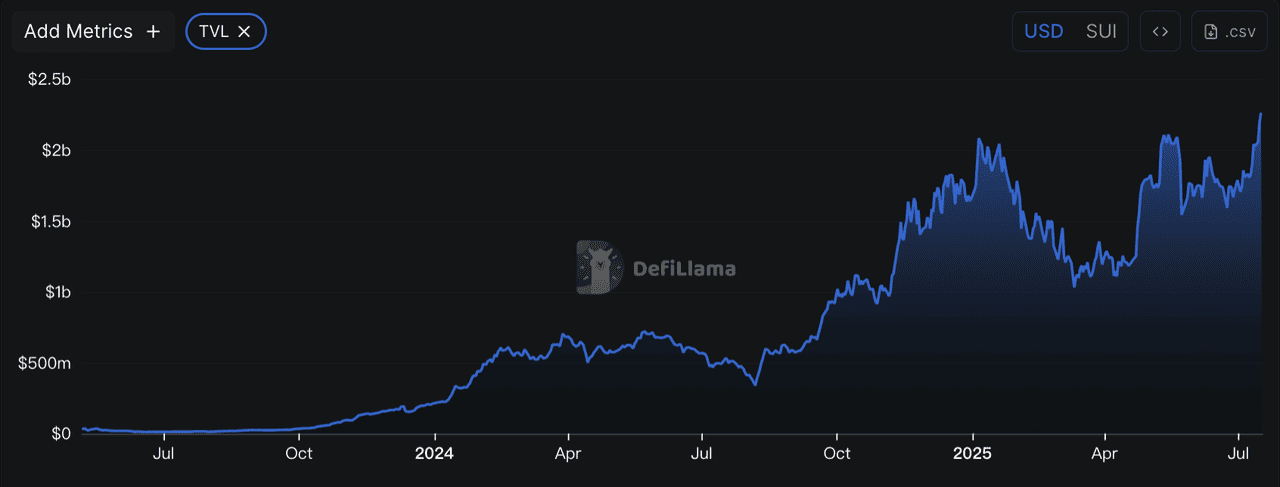

Sui delivered 220 % growth in 2024-2025

• Sui is the breakthrough newcomer that has built $2.27 billion in TVL from zero since its 2023 launch, with an exceptional 220% growth rate in 2024-2025 alone. This more than doubles the overall blockchain market growth and outpaces even established chains during the current market cycle, ranking Sui sixth by TVL among all L1 blockchains, with a market cap of $13.87 billion achieved in two years. Sui's accelerating growth trajectory showcases the potential for next-generation blockchain platforms to rapidly capture market share and establish meaningful ecosystem value.

Each platform serves different needs within the blockchain ecosystem, and both continue to play important roles in advancing Web3 technology.

What Are Layer-1 Blockchains and How Do They Work?

Layer 1 Blockchains Ranking | Source: CoinGecko

Layer-1 blockchains are the base layer of decentralized networks that process transactions and maintain consensus without relying on another blockchain. Think of them as the "main highway" of the crypto ecosystem, where all the core functions happen.

Unlike Layer-2 solutions that build on top of existing chains, L1 blockchains like Solana and Sui handle everything from transaction processing to smart contract execution to

validator consensus. They compete on speed, cost, security, and developer experience.

Popular L1 chains use different approaches to achieve scalability. Some focus on faster consensus mechanisms, others on parallel processing, and newer chains like Sui are experimenting with entirely different data models. The goal is always the same: process more transactions faster and cheaper while maintaining security and decentralization.

In 2025, L1 blockchains have become essential infrastructure for the digital economy. But not all blockchains are built the same. Let's look closer at how Solana and Sui compare.

What Is Solana (SOL)?

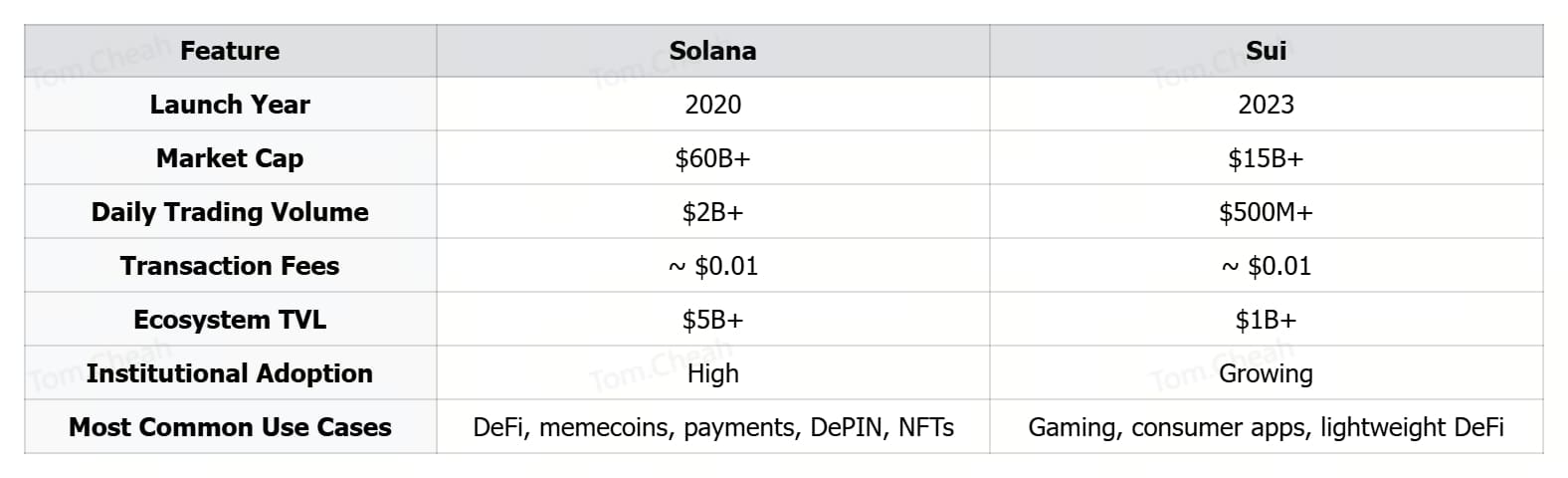

Launched in 2020 by Solana Labs,

Solana (SOL) has grown into one of the most widely adopted and battle-tested Layer 1 blockchains. Known for its speed and low costs, it handles over 3,000 transactions per second with fees typically under $0.01. By mid-2025, SOL ranks as the 4th largest cryptocurrency, with a market cap exceeding $60 billion.

Built on the Proof of History (POH) consensus mechanism, Solana has made major strides in performance and reliability. It now maintains 99.9% uptime and has processed more than 50 billion transactions. The recent

Alpenglow and Firedancer upgrade further improved its networking layer, optimizing throughput under high demand.

Solana is the second-largest blockchain ecosystem after Ethereum | Source: DefiLlama

The Solana ecosystem has experienced explosive growth in 2024-2025, now commanding 7.16% of total blockchain TVL market share, making it the 2nd largest blockchain ecosystem after Ethereum's dominant 58.28% share.

The platform has become synonymous with

Solana memecoins success, with popular tokens like

WIF and

BONK demonstrating Solana's ability to support viral token launches and attract millions of retail users. This momentum has spawned dedicated

memecoin launchpads like

Pump.fun and

Letsbonk.fun, which have further democratized token creation and onboarded new users to the ecosystem.

This retail activity is complemented by serious real-world integrations such as

Solana Mobile, partnerships with Visa and PayPal, and expanding development in areas like

DePIN infrastructure. The Solana Foundation continues to fuel this momentum through grants and developer incentives.

Strengths of Solana Blockchain

1. Proven Track Record and Performance: Solana consistently handles millions of daily transactions and has maintained strong usage across both bull and bear markets.

2. Mature Ecosystem: Solana supports a wide range of

DeFi protocols, consumer applications, and tooling. With over $5 billion in Total Value Locked (TVL) and hundreds of live dApps, it offers developers and users a robust and established environment.

3. Memecoin-Led Ecosystem Momentum: Solana has become the center of 2025’s memecoin boom, with high on-chain activity,

liquidity, and user onboarding driven by community tokens.

4. Low Fees and Fast Execution: Transactions settle in seconds with costs under a cent, offering one of the smoothest and most affordable user experiences in crypto.

5. Institutional and Payment Integration: Collaborations with major players like Visa and PayPal have brought Solana closer to real-world commerce and broadened its enterprise use potential.

Weaknesses of Solana Blockchain

1. Past Network Reliability Issues: Solana’s early history included several significant outages, which damaged trust in its reliability. While recent upgrades have addressed these issues, the perception risk remains.

2. Centralization and Token Distribution: A large share of SOL tokens is held by insiders and early investors. This raises concerns about decentralization and the potential for concentrated governance influence or sell pressure.

3. Market Volatility: SOL remains highly correlated with overall crypto market trends and is prone to sharp price swings, which may limit its appeal for conservative investors.

4. Rising Competition: New entrants like Sui are gaining attention with innovative architectures and strong developer focus. This puts pressure on Solana to maintain its technical edge and ecosystem growth.

What Is Sui (SUI) Layer-1 Blockchain?

Sui is a layer-1 blockchain developed by Mysten Labs, founded by former Meta engineers behind the Diem project. Launched in 2023, it uses the Move programming language and an object-centric data model that enables parallel processing and improved scalability.

By mid-2025, Sui claims a theoretical throughput of over 100,000

TPS and has reached a

market cap of over $15 billion, placing it in the top 20 cryptocurrencies. Its growth is driven by strong venture backing, a focus on gaming and consumer use cases, and features like sponsored transactions and session keys that improve user experience.

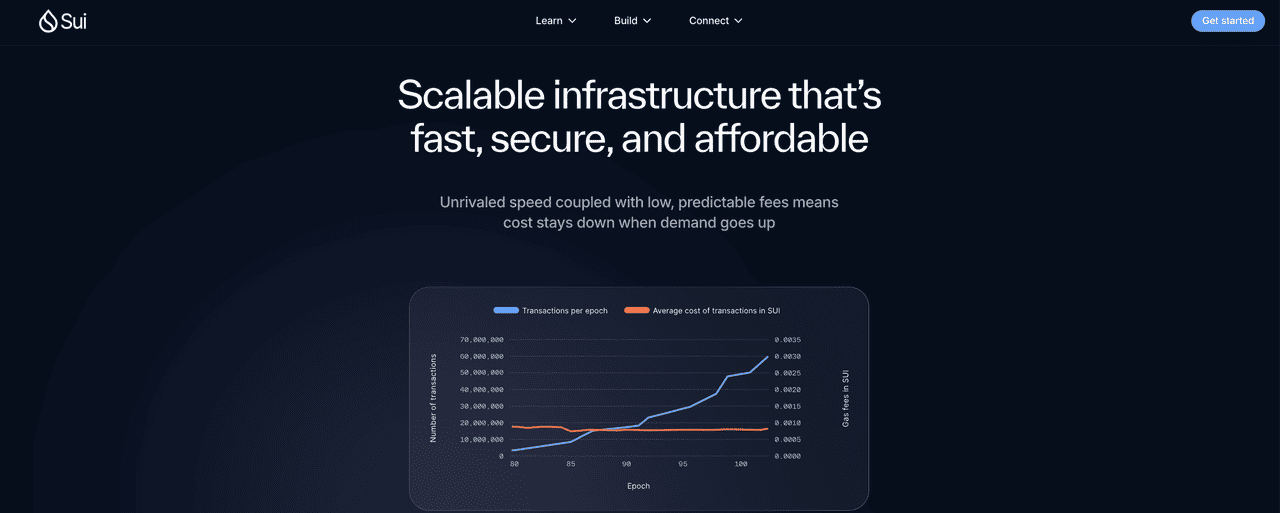

Sui delivered 220 % growth in 2024-2025

Despite being only a bit more than two years old, Sui has rapidly climbed to No.6 among all L1 blockchains by TVL, capturing 1.89% of the total blockchain market share with over $2.26 billion locked in its ecosystem. The platform hosts 179 different tokens, demonstrating a diverse and growing ecosystem. Sui now supports native

USDC and several DeFi and gaming projects. Its architecture is especially suited for high-frequency trading and complex in-game interactions. With support from a $50 million ecosystem fund and partnerships with gaming studios, Sui is positioning itself as a blockchain built for real-world adoption.

Strengths of Sui Blockchain

1. Next-Generation User Experience: Features like sponsored transactions and seamless

Sui wallet flows offer a Web2-like experience that lowers entry barriers for mainstream users.

2. Early Investment Opportunity: As a relatively new chain, Sui offers high-growth potential for early adopters and developers.

3. High-Frequency Trading and DeFi Capabilities: Sui’s parallel architecture is ideal for complex DeFi apps and fast-paced transaction environments.

4. Strong Financial and Technical Backing: Backed by top VCs and led by experienced engineers, Sui has strong resources for long-term growth.

5. Innovative Technical Architecture: The object-centric model and Move language appeal to developers seeking scalable, modular infrastructure.

Weaknesses of Sui Blockchain

1. Limited Track Record: As a 2023 launch, Sui still lacks long-term performance data and battle-tested reliability.

2. Smaller Ecosystem and Lower Liquidity: Fewer live apps, lower trading volume, and limited composability compared to more mature chains like Solana.

3. Higher Risk Profile: As a newer network, Sui faces greater execution risks and uncertainty around ecosystem growth.

4. Token Distribution Concerns: Questions remain about token allocation fairness and concentration among early stakeholders

5. Adoption Challenges: Competing with established platforms for developers and users remains a key obstacle.

Sui vs. Solana: Key Differences

Both Solana and Sui serve important but different roles in the blockchain ecosystem. Rather than direct competitors, they represent complementary approaches to Web3 infrastructure. Solana appeals to users who value established liquidity and proven stability, while Sui attracts those interested in next-generation consumer experiences and gaming applications. Understanding both platforms provides valuable insights into the diverse directions blockchain technology is heading.

Solana leads with strong market traction, deep liquidity, and a mature ecosystem that supports DeFi, memecoins, and real-world integrations. The platform attracts investors and users seeking scale, reliability, and immediate utility across diverse blockchain applications.

Solana excels in proven performance, high usage volume, and battle-tested infrastructure.

Sui targets the next wave of Web3 users with its consumer-focused architecture and emphasis on gaming and app-friendly design. Though still early, the platform is building momentum around innovative use cases and superior user experience features.

Sui stands out for early-stage growth potential, technical innovation, and mainstream adoption focus.

How to Buy SUI and SOL on BingX

SUI and SOL, two leading layer-1 blockchain tokens, are available for trading on BingX. Users can access them through the spot market and use them within their respective ecosystems, including DeFi protocols and consumer applications on Sui, as well as memecoins, DePIN, and NFT platforms on Solana.

Here’s a step-by-step guide on how to buy SUI and SOL on BingX

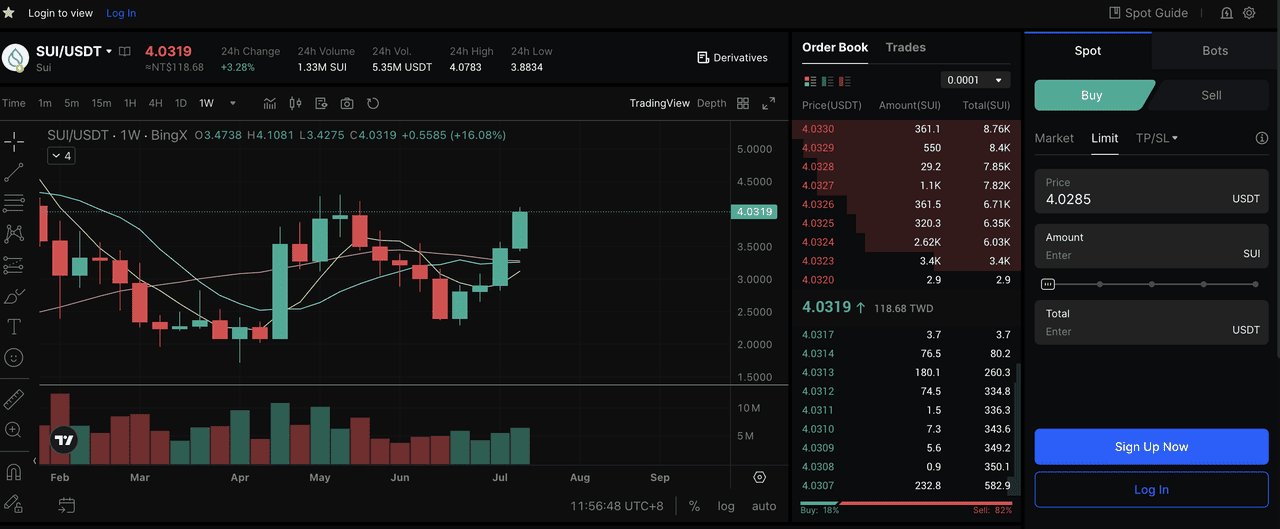

SUI/USDT trading pair on BingX spot market

Step 1: Log In or Create an Account

Log in to your BingX account. If you don’t have one, you can register using an email or mobile number. Completing identity verification (

KYC) is required for full access to trading features.

Step 2: Deposit Funds

Go to the Buy Crypto section to deposit funds into your account. BingX supports several payment options such as bank transfer, credit or debit card, and peer-to-peer (P2P) transactions.

Step 3: Find the SOL/USDT or SUI/USDT Pair

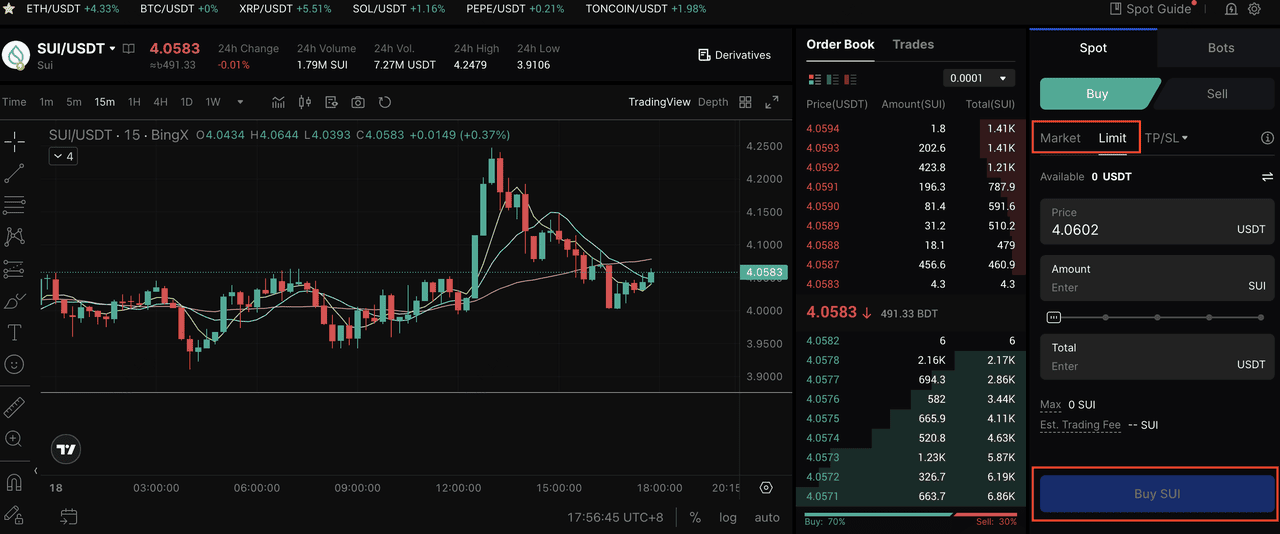

SUI/USDT trading pair on BingX spot market

Step 4: Place Your Order

Choose between a

Market Order to buy at the current price or a Limit Order to set your preferred entry. Enter the amount and confirm the order.

Key Considerations When Investing in Solana and Sui

SOL and SUI serve as native tokens for their respective blockchains, but they differ significantly in maturity, risk, and value accrual.

1. Liquidity and Market Access: SOL has higher trading volume and deeper liquidity, making it easier to trade with less slippage. SUI, while growing, remains more volatile with thinner markets.

2. Track Record and Risk: Solana offers a longer history, more regulatory precedent, and established usage. Sui, launched in 2023, is earlier in its lifecycle with higher upside potential but greater uncertainty.

3. Tokenomics: SOL uses an inflationary model with decreasing issuance and 6-8% annual staking rewards. SUI has a fixed 10 billion token cap with a gradual release schedule and no ongoing inflation.

4. Ecosystem Value Accrual: Solana’s ecosystem generates stable transaction fees and staking yields. Sui’s mechanisms are still developing, with returns more dependent on future adoption.

5. Unlock Schedules: Both tokens have structured unlocks that may affect market dynamics. Solana’s is more established; Sui’s may introduce added volatility due to its shorter trading history.

6. Regulatory Outlook: SOL benefits from a longer compliance record. SUI may face stricter scrutiny as newer tokens often attract additional attention under evolving regulations.

Conclusion

The parallel rise of Solana and Sui signals an important inflection point for blockchain technology. Their combined success in capturing significant market share demonstrates that the industry has moved beyond the single-chain dominance model toward a multi-chain future where specialized platforms can thrive.

What makes their competition particularly significant is how it reflects the broader maturation of Web3. Solana's recovery and continued growth validates the importance of network effects and ecosystem depth, while Sui's rapid ascent proves that innovative technology and superior user experience can still disrupt established markets.

Their divergent paths also highlight how blockchain infrastructure is becoming more sophisticated and purpose-built. The days of one-size-fits-all solutions are giving way to platforms optimized for specific use cases and user needs. This specialization is ultimately beneficial for the entire ecosystem, driving innovation and expanding the total addressable market for blockchain applications.

As both platforms continue to evolve and capture value in 2025, they're not just competing for market share but defining what the next generation of blockchain infrastructure will look like and how billions of users will eventually interact with decentralized technology.

Related Readings