With the U.S. House passing the

GENIUS Act on July 17, 2025, the U.S. is set to implement its first-ever federal regulatory framework for U.S.-dollar

stablecoins. This landmark legislation requires issuers to back their tokens 1:1 with cash or short-term Treasury bills and to disclose their reserves monthly. It marks a turning point for digital assets, bringing stablecoins out of regulatory gray zones and into the heart of the American financial system.

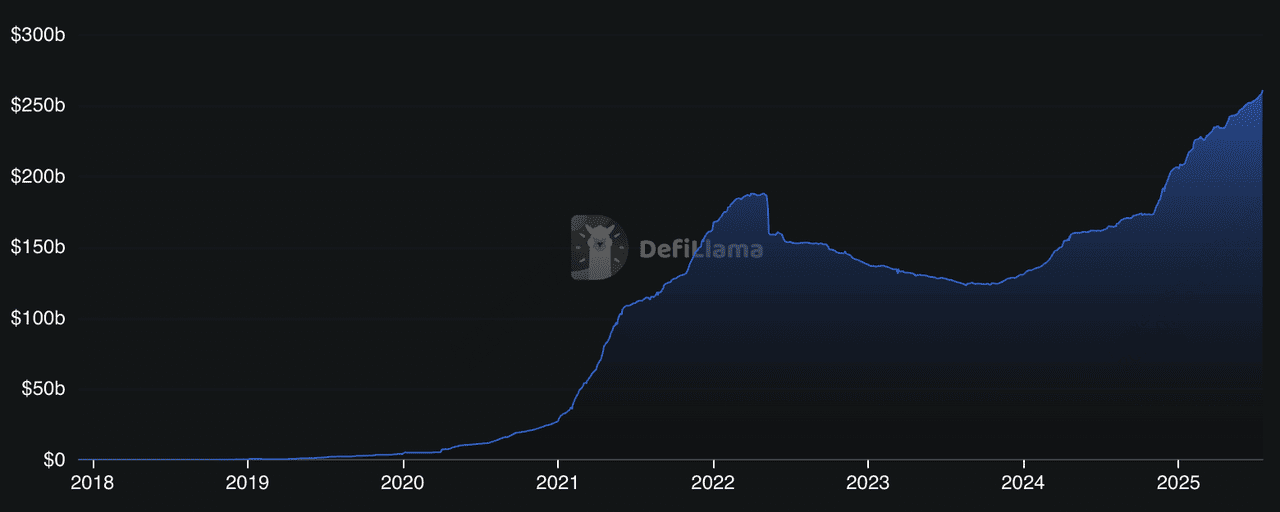

Stablecoins' total market cap | Source: DefiLlama

At the same time, the total stablecoin market has grown to over $260 billion as of mid‑July 2025, reflecting their critical role in crypto trading, cross-border payments, and decentralized finance (DeFi). Once seen as niche tools for crypto enthusiasts, stablecoins have now become essential digital dollars used by businesses, institutions, and everyday users worldwide.

In this guide, we’ll break down what stablecoins are, how they work, the different types available, and why they’re worth considering for your crypto portfolio. We’ll also spotlight 10 of the best stablecoins to hold in 2025, each offering unique advantages depending on your financial goals.

What Are Stablecoins and How Do They Work?

Stablecoins are a special type of cryptocurrency designed to hold a steady value, typically pegged to a real-world asset like the U.S. dollar, euro, or even gold. Unlike Bitcoin or Ethereum, whose prices can swing wildly, stablecoins are engineered to minimize volatility, making them ideal for everyday transactions, savings, and trading. They work by ensuring that every stablecoin in circulation is backed by something of equivalent value. This backing provides confidence that you can always redeem 1 stablecoin for 1 unit of the underlying asset, like $1 or €1.

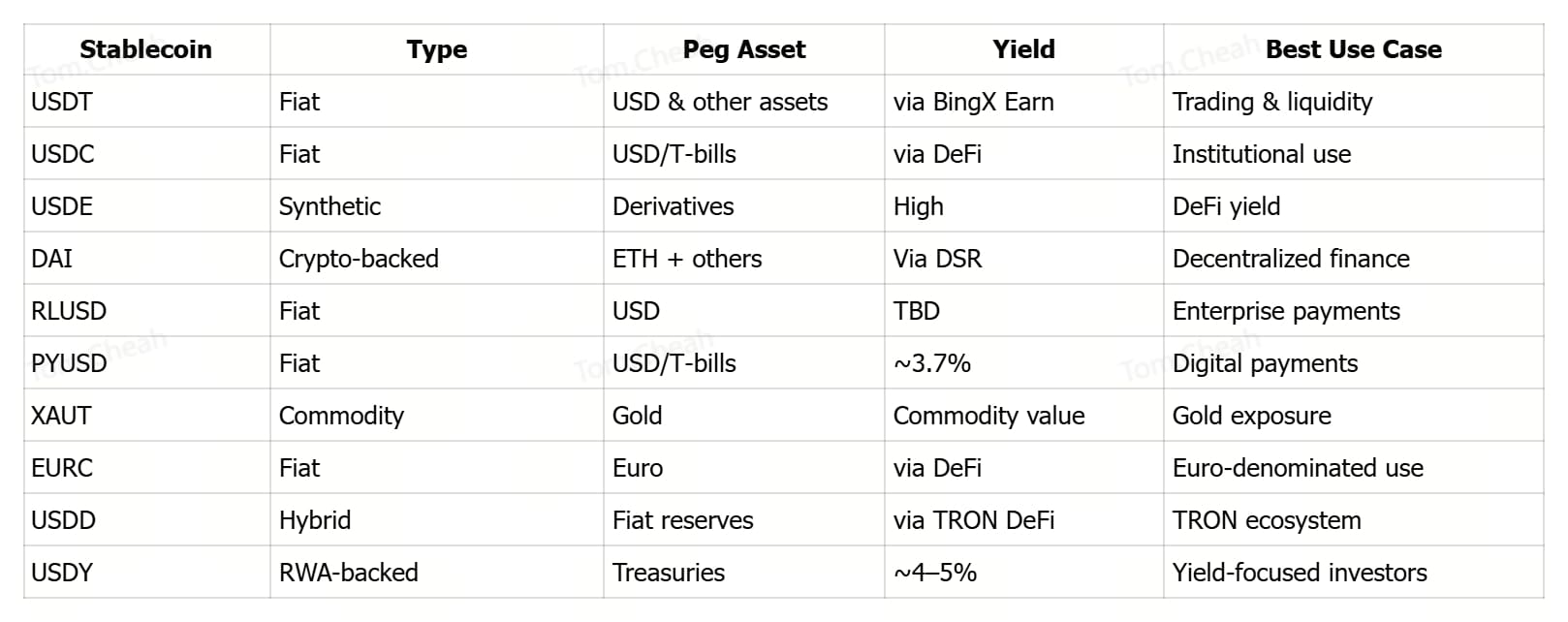

There are several types of stablecoins, each designed to hold their value using different methods. Fiat-backed stablecoins like

USDC and USDT are the most common, backed 1:1 by cash or short-term U.S. Treasuries held in reserve. Crypto-collateralized stablecoins such as

DAI use cryptocurrencies like

ETH as collateral, often requiring over-collateralization to account for price volatility.

Algorithmic stablecoins, like early USDD, rely on

smart contracts to manage supply and demand but have proven vulnerable in volatile markets.

Commodity-backed stablecoins like

Tether Gold (XAUT) are tied to physical assets such as gold, offering digital exposure to commodities. Lastly, fiat-pegged non-USD stablecoins like

Euro Coin (EURC) are pegged to other national currencies, making them ideal for cross-border transactions and users in non-dollar regions.

In 2025, stablecoins have evolved far beyond simple price stability. They now serve as digital cash for instant global payments, a backbone for DeFi protocols, and even as yield-generating assets when integrated into decentralized finance platforms. For newcomers and seasoned investors alike, understanding how they work is key to navigating the growing digital economy.

Top 10 Stablecoins of 2025

The

stablecoin market in 2025 is more diverse and sophisticated than ever, offering options for traders, savers, and even gold enthusiasts. From trusted dollar-pegged giants to innovative yield-bearing and commodity-backed tokens, these are the 10 standout stablecoins worth considering for your portfolio this year.

1. Tether (USDT): “The Global Liquidity Powerhouse”

Tether (USDT) remains the undisputed leader in the stablecoin world, with a staggering market cap of ~$159 billion and daily trading volumes often exceeding $80 billion. Launched in 2014, USDT is pegged 1:1 to the U.S. dollar and backed by a mix of assets, including cash, U.S. Treasuries, corporate bonds, and even gold. This deep liquidity makes it the default stablecoin for traders across centralized exchanges, DeFi platforms, and P2P markets worldwide. USDT’s dominance is particularly strong in emerging markets where it serves as a hedge against local currency volatility and is widely used for cross-border remittances.

Its multichain presence, supporting

Ethereum,

Tron,

Solana,

Polygon, and others, adds to its versatility for low-cost transfers. However, USDT has faced criticism over its reserve transparency and regulatory fines in past years, as it does not undergo full independent audits. Despite these concerns, Tether has proven remarkably resilient, maintaining its peg even during extreme market volatility and expanding its financial footprint by holding large Bitcoin and gold reserves. For users prioritizing speed, accessibility, and global reach, USDT remains the go-to choice.

2. USD Coin (USDC): “The Compliance Benchmark”

USD Coin (USDC), with a market cap of ~$62 billion, is widely regarded as the most transparent and regulatory-compliant stablecoin in the market. Issued by Circle, a U.S.-based fintech company, USDC is fully backed 1:1 by cash and U.S. Treasuries held in segregated accounts with top financial institutions like BNY Mellon and BlackRock. Circle publishes monthly reserve attestations verified by Deloitte, giving users confidence in its backing.

Since its launch in 2018, USDC has gained popularity among institutional investors, DeFi protocols, and enterprises seeking a stable digital dollar for cross-border payments and blockchain-based financial applications. Its regulatory alignment is reinforced by Circle’s global licenses and recent IPO on the New York Stock Exchange, further solidifying trust. While USDC’s trading volume is lower than USDT’s and its adoption in emerging markets is less extensive, it shines in environments where compliance, transparency, and security are critical. With integrations across major blockchains and DeFi ecosystems, USDC has become the preferred choice for users who value peace of mind and institutional-grade assurance.

3. Ethena USDe (USDE): “The High‑Yield Crypto Synth”

Ethena’s USDe is a next-generation synthetic stablecoin designed for crypto users who want more than just price stability. Unlike traditional fiat-backed coins, USDe maintains its $1 peg using an innovative delta-neutral strategy, pairing long positions in crypto assets like ETH and BTC with short perpetual futures contracts to offset volatility. This approach not only stabilizes its value but also generates yield, making USDe both a stablecoin and a passive income tool. As of mid-2025, USDe boasts a market cap of over $5.6 billion and has attracted more than 700,000 users worldwide.

For those seeking even higher returns, staking USDe converts it into sUSDe, a yield-bearing version that earned an impressive average APY of ~18% in 2024, with current rates ranging between 7% and 30% depending on market conditions. This makes Ethena a favorite in DeFi circles, with integrations across Aave, Morpho, and Pendle. However, users should be aware of the risks: USDe’s reliance on smart contracts, off-exchange custodians, and derivatives platforms introduces counterparty and technical vulnerabilities. Still, for crypto-native investors seeking a scalable, censorship-resistant dollar alternative with built-in rewards, USDe stands out as a bold and innovative choice in the stablecoin ecosystem.

4. Dai (DAI): “The Decentralized Original”

Dai is the first decentralized, crypto-collateralized stablecoin that revolutionized DeFi by offering a censorship-resistant, fully transparent dollar-pegged asset. Issued by MakerDAO through its Maker Protocol, DAI maintains its 1:1 USD peg using overcollateralized loans in Maker Vaults, where users lock assets like ETH, WBTC, or stETH as collateral. This system ensures DAI is always backed by more value than it represents, providing resilience even during volatile markets. As of July 2025, DAI’s supply exceeds 5.3 billion tokens, with a market cap of over $5.3 billion and millions of holders worldwide.

It is deeply integrated into the DeFi ecosystem, serving as a foundational currency across lending platforms, yield farms, and liquidity pools. Unlike fiat-backed stablecoins, DAI operates entirely on smart contracts, giving users self-custody, permissionless access, and governance rights through MKR token holders who vote on protocol changes. However, its reliance on crypto collateral means extreme market downturns can threaten peg stability, as seen during past liquidity crises. With its decentralized design and wide adoption across 400+ dApps, DAI remains the original and most trusted choice for DeFi natives seeking financial sovereignty.

5. Word Liberty Financial USD (USD1): "The America‑First Stablecoin"

USD1 is a fully fiat-backed stablecoin launched in March 2025 by World Liberty Financial (WLFI), a crypto platform co-founded by Donald Trump Jr., Eric Trump Jr., and Zach Witkoff. Pegged 1:1 to the U.S. dollar, USD1 is backed by short-term U.S. Treasuries, insured cash deposits, and high-liquidity equivalents held with BitGo Trust, a U.S.-regulated custodian. It operates on Ethereum, BNB Chain, and TRON, enabling fast, multi-chain transactions with zero mint and redemption fees, features designed to appeal to institutional investors.

Publicly endorsed by Donald Trump, USD1 blends regulatory compliance, political branding, and blockchain infrastructure, making it one of 2025’s fastest-growing stablecoins with a market cap surpassing $2.1 billion. While it offers transparency with monthly attestations and seamless settlement in 1–2 business days, USD1’s centralized model and political affiliations have sparked debates about its role in the evolving stablecoin ecosystem.

6. PayPal USD (PYUSD): “The Everyday Yield Coin”

PayPal USD (PYUSD) is a fully regulated, dollar-pegged stablecoin designed to bring crypto into the hands of everyday users. Issued by Paxos Trust and regulated by the New York Department of Financial Services (NYDFS), PYUSD is backed 1:1 with U.S. dollar reserves, Treasury bills, and cash equivalents. As of July 2025, it has crossed a $1 billion market cap, making it one of the fastest-growing stablecoins globally. What sets PYUSD apart is its seamless integration into PayPal and Venmo, enabling millions of users to buy, hold, send, and spend digital dollars without leaving their favorite apps.

It’s also live on Ethereum and Solana, with Stellar integration planned to boost global remittances and microtransactions. For crypto-savvy users, PYUSD is compatible with DeFi protocols and can be transferred to external wallets. Adding to its appeal, PayPal introduced a 3.7% annual yield program in 2025, allowing holders to passively earn rewards just by keeping PYUSD in their account. With strong regulatory backing, growing blockchain support, and real-world usability, PYUSD is positioning itself as the go-to digital dollar for both beginners and mainstream consumers.

7. Ripple USD (RLUSD): “The Enterprise Payment Tool”

Ripple USD (RLUSD) is Ripple’s fully regulated, U.S. dollar-pegged stablecoin built to power the next generation of cross-border payments and institutional settlements. Launched in December 2024 under Ripple’s subsidiary Standard Custody & Trust Company (SCTC), RLUSD is fully backed 1:1 by U.S. dollar reserves, Treasury bills, and cash equivalents held in regulated U.S. institutions. As of July 2025, RLUSD’s market cap has grown past $413 million, bolstered by regulatory approvals from both the New York Department of Financial Services (NYDFS) and Dubai Financial Services Authority (DFSA).

This makes it one of the few stablecoins with dual global regulatory oversight. Designed for speed and compliance, RLUSD operates on both the XRP Ledger (XRPL) and Ethereum, giving it flexibility for ultra-fast, low-fee payments on XRPL and full DeFi compatibility on Ethereum. Enterprises are adopting RLUSD for treasury management, FX settlements, and tokenized real-world assets, such as Dubai’s real estate deeds. Monthly

third-party audits and strict KYC/AML procedures enhance its credibility, positioning RLUSD as a trusted alternative to USDT and USDC for regulated environments. While it’s still building network liquidity compared to its larger rivals, RLUSD’s enterprise focus and Ripple’s global payment infrastructure could make it a key player in institutional digital finance.

8. Pax Gold (PAXG): “Digital Gold You Actually Own”

Pax Gold (PAXG) bridges traditional gold ownership and blockchain convenience by tokenizing physical gold into a regulated, investment-grade digital asset. Each PAXG token represents one fine troy ounce of LBMA-accredited gold stored in secure London vaults, fully custodied by Paxos Trust Company and regulated by the New York Department of Financial Services (NYDFS). Unlike gold ETFs or futures contracts, PAXG offers instant settlement, zero storage fees, and fractional ownership down to 0.01 troy ounce (~$20), making gold accessible to retail and institutional investors alike.

With a market cap of nearly $938 million and daily trading volumes surpassing $100 million, it’s among the most liquid gold-backed tokens in the crypto market. Investors can redeem PAXG for physical Good Delivery gold bars, unallocated gold, or USD at any time, though redemption incurs processing fees. Available on Ethereum,

BSC, Solana, and

Arbitrum, PAXG combines blockchain’s speed with the timeless value of gold, creating a cost-efficient

hedge against inflation and market volatility. Monthly KPMG audits and a unique lookup tool let holders verify their gold’s serial number and physical characteristics, reinforcing trust and transparency in digital gold ownership.

9. Euro Coin (EURC): “Europe’s Digital Euro”

Euro Coin (EURC) is Circle’s

euro-backed stablecoin, designed to bring the same trust, transparency, and utility as its dollar sibling, USDC, to the eurozone. Fully backed 1:1 by euros held in regulated European banks, EURC operates under a full-reserve model with monthly attestations verified by leading audit firms, ensuring users can redeem it at any time for physical euros. Compliant with the EU’s MiCA framework, EURC stands out as one of the most regulatory-friendly euro stablecoins in 2025.

It’s supported across multiple blockchains, including Ethereum, Solana,

Avalanche, Base, and

Stellar, giving developers and users flexible access to DeFi, FX trading, and cross-border payments. Businesses leverage Circle Mint and APIs to integrate EURC into treasury operations and payment rails, while individuals use it to hedge against dollar volatility or transact in euros globally. Although its market cap (~€212 million) is smaller than USDC, EURC’s multi-chain presence, instant settlement features, and enterprise-grade infrastructure make it the leading euro-pegged stablecoin for both retail and institutional users looking for euro stability in Web3.

10. USDD (USDD): “TRON’s Hybrid Stablecoin”

USDD, launched by the TRON DAO in 2022, started as an algorithmic stablecoin but has since evolved into a reserve-backed model to strengthen its dollar peg and reduce volatility risks. Fully decentralized and governed by smart contracts, USDD is designed to maintain its $1 value using an over-collateralization system backed by crypto assets like TRX, BTC, and USDT. With a current circulating supply of over 554 million USDD and a market cap of ~$555 million, it is deeply integrated into the TRON ecosystem, serving as a key liquidity layer for DeFi applications like lending, borrowing, and yield farming.

Users can mint USDD by staking collateral on TRON, providing a capital-efficient way to access stablecoin liquidity without selling their assets, while staking USDD directly offers yields that have historically reached up to 20% APY in TRON DeFi protocols. Though popular within TRON-based platforms, USDD’s adoption outside the network remains limited, and its hybrid design—blending algorithmic elements with crypto reserves—means it still carries some peg stability risks during extreme market conditions. However, with its tamper-proof design, transparency through on-chain reserve audits, and community governance via JST tokens, USDD is positioning itself as a decentralized alternative to traditional centralized stablecoins.

Why Choose These Stablecoins?

Each of these stablecoins serves a unique purpose in the crypto ecosystem, making them useful for different types of users and strategies:

• Essentials for Everyday Use: If you’re looking for reliability and wide acceptance, USDC stands out for its transparency and regulatory compliance, making it a favorite among institutions and DeFi platforms. USDT, on the other hand, dominates global trading volumes and offers unmatched liquidity for fast-moving traders. For eurozone residents or businesses, EURC provides a secure and MiCA-compliant euro-pegged option with cross-chain support.

• For Yield Seekers: If your goal is to earn passive income, PYUSD and USDY offer safe and steady returns backed by U.S. Treasuries and bank deposits, with yields around 3–5% annually, ideal for those seeking low-risk growth. Meanwhile, USDE is designed for more adventurous DeFi users, providing higher but variable yields through delta-neutral crypto strategies.

Key Considerations Before Investing in Stablecoins

Before adding stablecoins to your portfolio, it’s crucial to weigh their risks. Look for reserve transparency, including how often issuers publish audits and the quality of backing assets. Stay updated on regulatory shifts like the GENIUS Act, which could reshape stablecoin oversight in the U.S. Watch for peg volatility, especially with algorithmic or commodity-backed tokens that may struggle during market stress. For DeFi-focused coins like USDE, consider smart contract risks from potential exploits. Finally, assess issuer risk in centralized stablecoins, as counterparty failures could impact redemption and trust.

How to Hold or Trade Stablecoins on BingX

BingX supports a wide range of major stablecoins, including USDT, USDC, DAI, TUSD, and more from the top 10 stablecoins by market capitalization listed above. This gives you access to the most trusted and liquid stablecoins in the market, all within a single platform.

Here’s what you can do with your stablecoins on BingX:

1. Exchange Instantly: Swap your stablecoins for other cryptocurrencies or fiat pairs using BingX Spot Market. Trade popular pairs like

BTC/USDT or

ETH/USDC with deep liquidity and competitive fees. You can also use

BingX AI to analyze market trends and identify potential entry and exit points for your trades.

2. Trade Perpetual Contracts: Use stablecoins as collateral to

trade perpetual futures with leverage. BingX allows you to open long or short positions on leading crypto assets while managing your exposure with stablecoin balances.

3. Wealth Management Products: Grow your stablecoin holdings with

BingX’s wealth management tools. Participate in

Flexible Savings, Dual Investment, and Staking programs that let you earn passive income on USDT, USDC, and other supported stablecoins.

Whether you’re holding for stability, trading actively, or looking to earn yield, BingX offers a secure and versatile environment for managing your stablecoin portfolio.

Final Takeaway

A well-rounded stablecoin portfolio can balance stability, liquidity, yield, and diversification. USDC offers strong compliance and transparency, while USDT delivers unmatched trading liquidity. For yield, consider PYUSD or USDY; for DeFi strategies, USDE and DAI provide innovative options. Diversifiers like XAUT, RLUSD, and EURC add exposure to gold, enterprise payments, and euro markets. But remember, stablecoins are not risk-free. Reserve transparency, regulatory changes, and smart contract vulnerabilities can impact their performance. Always research thoroughly and align your choices with your risk tolerance and investment goals.

Related Reading