Futures trading allows users to speculate on the future price of cryptocurrencies through contracts that obligate buying or selling at a predetermined price and date, or via perpetual contracts without expiration. These platforms evaluate market metrics such as volatility, open interest, funding rates, and liquidity, then enable traders to leverage positions based on risk tolerance and market outlook. By using leverage and hedging tools, futures trading simplifies engagement in volatile crypto markets and lets participants benefit from both rising and falling prices.

Key Takeaways

• Leading crypto futures platforms in 2026 include BingX, OKX, Kraken, Deribit, BitMEX, Bitfinex, and Crypto.com, each offering a mix of leverage options, deep liquidity, competitive fees, and risk management tools suited to both retail and institutional traders.

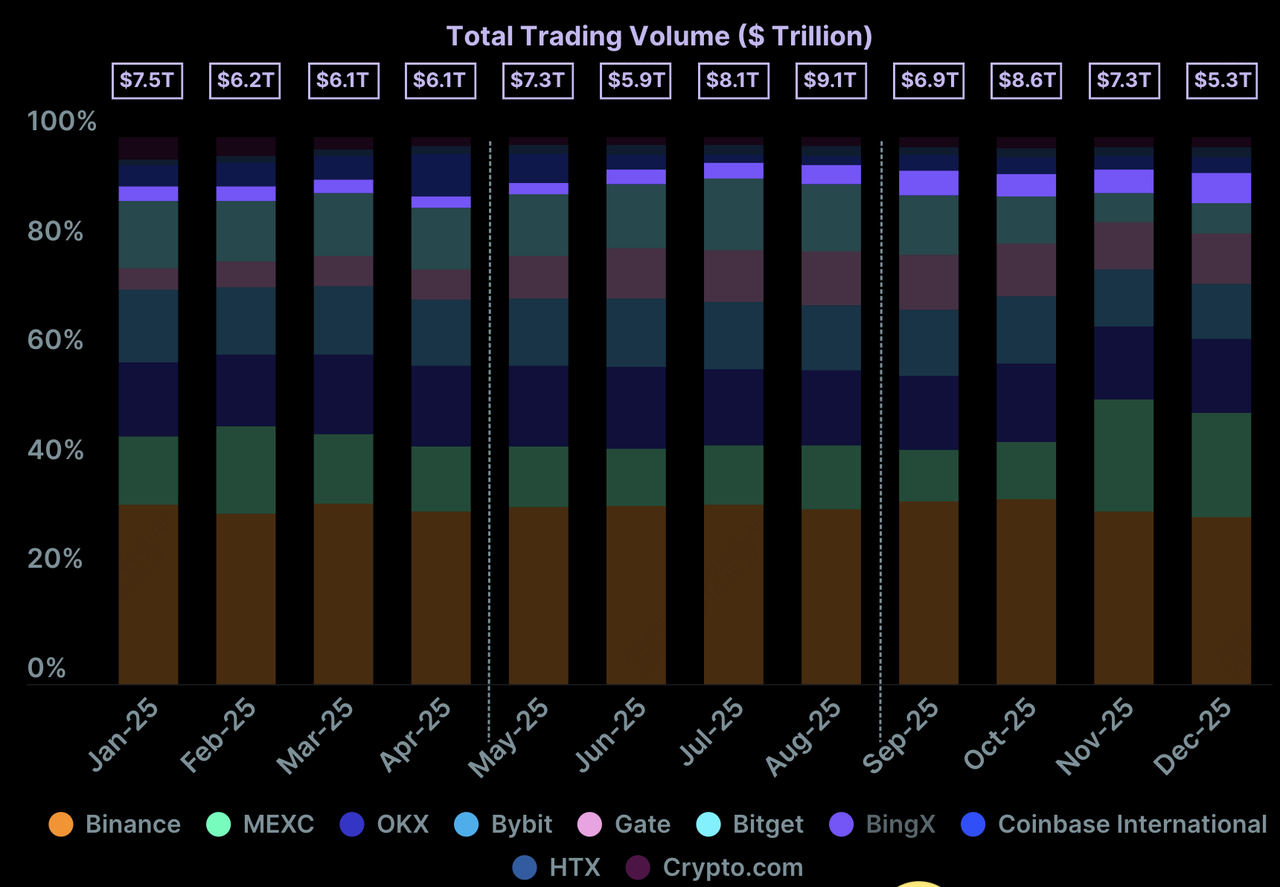

• Crypto derivatives continue to dominate market activity. According to CoinGecko’s 2025 Annual Crypto Report, total derivatives trading volume reached $86.2 trillion, up 47.4% year-over-year, with daily averages around $265 billion.

• Perpetual futures continue to dominate crypto derivatives trading. According to CoinGecko’s 2025 Annual Crypto Report, centralized exchange perpetual futures recorded $86.2 trillion in total trading volume for the year, highlighting sustained demand for leveraged trading, institutional hedging, and price discovery.

What Is Futures Trading in Crypto?

Futures trading differs from spot trading because it involves contracts rather than direct ownership of the underlying asset. Traders can speculate on price movements with leverage, which allows them to control larger positions with smaller capital. Many crypto futures platforms, including BingX, offer leverage up to 125 times or higher for major contracts. Futures trading involves risk, and positions can be liquidated automatically if losses exceed margin requirements. Key market metrics, such as

funding rates, open interest, and market depth, are important tools for assessing market conditions and guiding trading decisions. Futures can also be used for hedging existing positions, enabling traders to manage risk or amplify returns strategically. Automated tools, such as stop-loss orders, take-profit orders, and alerts for potential liquidation events, further enhance a trader’s ability to engage efficiently with the market.

Crypto Futures' Daily Trading Volume Crossed $161 Billion in 2025

BingX perpetuals total trading volume | Source: CoinGecko

Perpetual futures continued to dominate crypto derivatives trading in 2025. According to the CoinGecko 2025 Annual Crypto Industry Report, centralized exchange perpetual futures recorded $86.2 trillion in total trading volume, underscoring sustained demand for leveraged trading, institutional hedging strategies, and continuous price discovery despite a broader spot-market downturn.

Despite the total crypto market cap falling 10.4% year-on-year to $3.0 trillion, extreme volatility and a historic $19 billion liquidation event in October 2025 pushed traders toward derivatives, driving average daily trading volumes to a yearly high of $161.8 billion.

What Are the Top Futures Trading Crypto Exchanges in 2026?

Top futures trading crypto exchanges in 2026 are selected based on key metrics such as derivatives trading volume, open interest, liquidity, leverage options, fees, and risk management features. Platform stability, user experience, and security standards like insurance funds are also considered to ensure suitability for both retail and institutional traders.

These are the top futures trading exchanges that stand out in 2026 for offering accessible, secure, and intelligent leveraged options. Among them, BingX leads with its AI integration and comprehensive ecosystem.

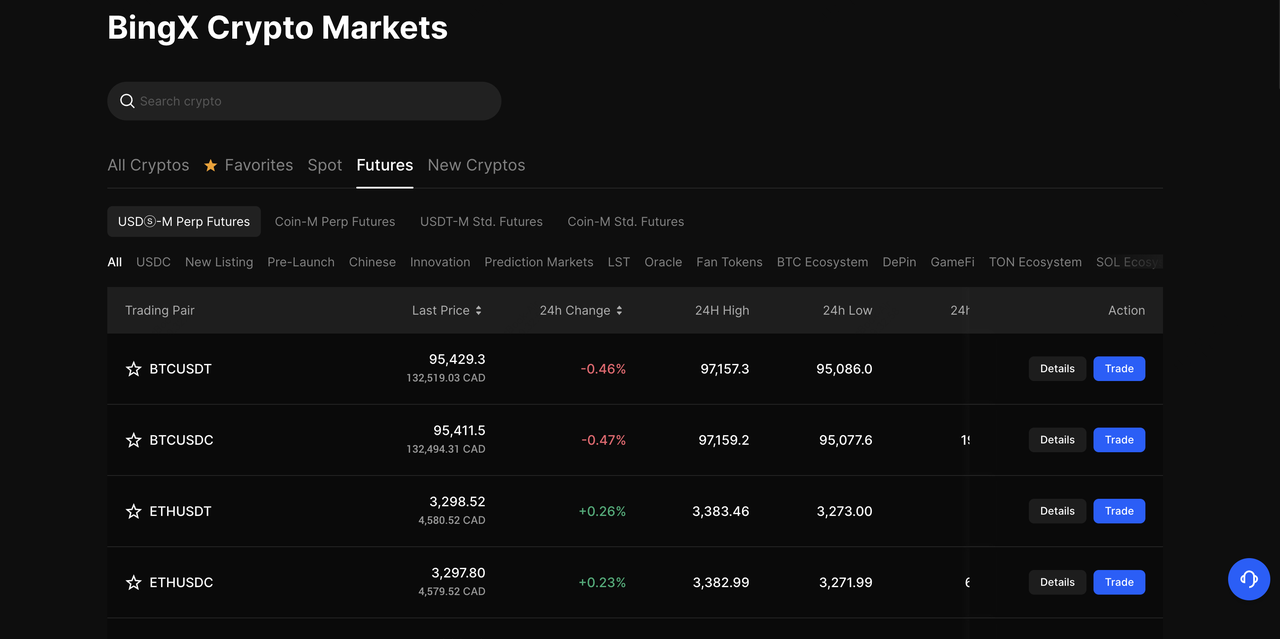

1. BingX

BingX tops the list as the premier futures trading exchange in 2026, powered by its AI centric design and innovative forward futures. As of January 2026, the platform boasts over 40 million registered users following 100% year-on-year growth in 2025, with a peak 24-hour trading volume surpassing $26 billion and ranking among the top 5 global derivatives platforms consistently throughout the year.

Its futures offerings include perpetual and forward contracts with up to 125x leverage and up to 500x leverage in select

TradFi products on over 50 instruments including

commodities and indices, zero slippage guarantees on high liquidity pairs, and seamless bot/copy integration. The exchange is further strengthened by a robust

insurance fund, designed to absorb extreme market volatility and reduce the impact of auto-deleveraging events, giving traders an additional layer of protection during sharp price movements.

BingX offers three futures trading options:

i. USDⓈ-M Perpetual Futures, which settle in

stablecoins like

USDT with no expiry and predictable PnL, ideal for high-leverage long/short strategies;

ii. Coin-M Perpetual Futures, which use crypto assets such as

BTC or

ETH as margin and settlement, suited for long-term holders looking to hedge or accumulate more coins; and

iii. Standard Futures, a BingX-exclusive product with a simplified interface that supports both USDT-M and Coin-M contracts across crypto, gold, oil, forex, and indices.

All types feature leverage to amplify positions and gains, though it also heightens

liquidation risk, so understanding margins, liquidation prices, and funding rates is essential. BingX's multi agent AI system runs non stop for technical analysis, strategy recommendation, protection, and monitoring positions, processing millions of signals daily with sub second response times and supporting over 800 perpetual pairs.

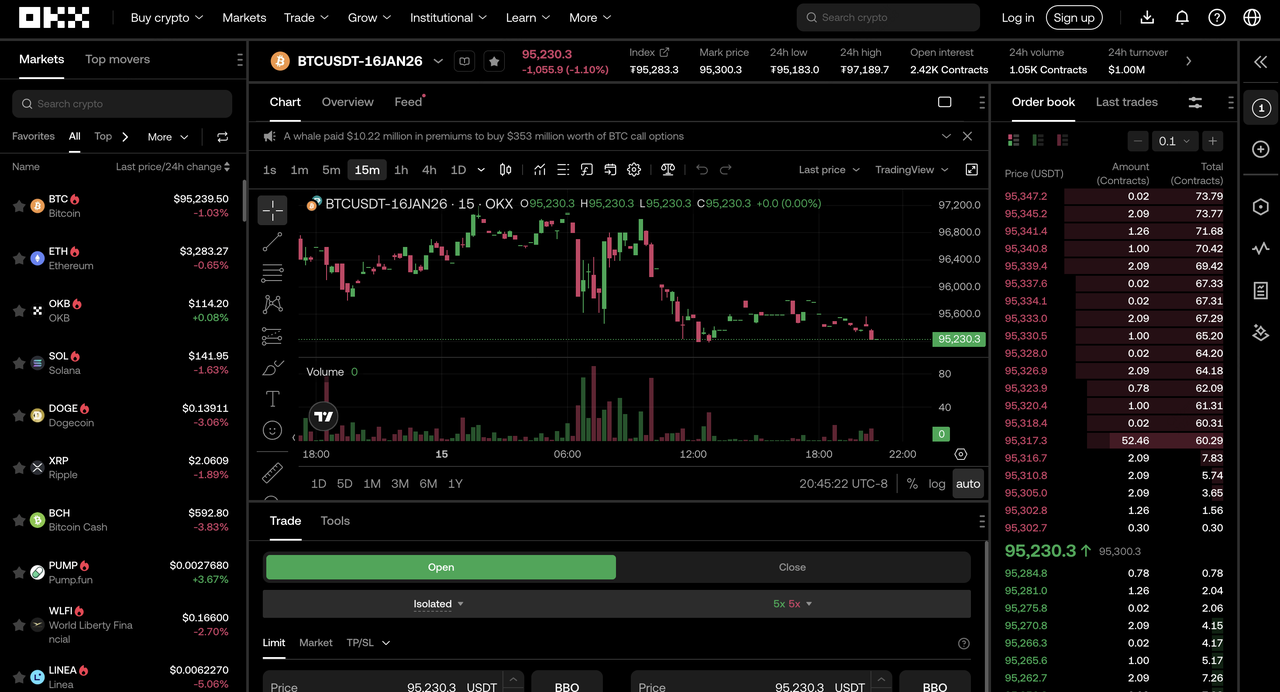

2. OKX

Source: OKX

OKX ranks as a top tier

futures trading exchange in 2026, renowned for its deep liquidity and extensive derivatives suite. The platform processed around $10.76 trillion in derivatives volume in 2025, capturing roughly 12.5% market share with daily averages of $33 billion, placing it consistently in the second tier behind leaders. It supports over 500 perpetual futures contracts with up to 100x leverage (often 125x for major pairs like

BTC USDT), low fees starting at 0.02% maker and 0.05% taker, and features like cross isolated margin modes, advanced order types including iceberg and TWAP, and robust risk management tools. OKX appeals to professional and institutional traders with its high performance execution, transparent proof of reserves updated quarterly, and global reach excluding certain restricted jurisdictions, handling average daily open interest of over $15 billion in major contracts.

3. Kraken

Source: Kraken

Kraken holds a solid position in

futures trading, emphasizing security and multi asset access. It reports significant daily

futures volumes often in the hundreds of millions to billions, with over 300 perpetual contracts, low fees starting from 0.02%, and tools like advanced charting and API driven automation. While strong for reliability and integration with traditional finance gateways, Kraken's AI features are more limited compared to multi agent systems, though it maintains high trust scores above 95% on independent audits and supports fully regulated trading environments in multiple jurisdictions.

4. Deribit

Source: Deribit

Deribit focuses on high leverage

futures and options, maintaining a dominant share of approximately 85% in BTC and ETH options with substantial

futures volumes frequently exceeding $1 billion daily and open interest regularly surpassing $10 billion. It suits aggressive, volatility driven traders with portfolio margining, advanced Greeks analysis tools, and high speed execution, but emphasizes manual execution over broad AI protections, handling record events like multi billion dollar options expiry multiple times per quarter.

5. Gemini

Source: Gemini

Gemini offers regulated

futures trading centered on compliance and security, supporting numerous assets with advanced order types and institutional grade custody. It appeals to safety focused users in regulated environments, though leverage and volume are more modest compared to specialized derivatives platforms, prioritizing insured assets up to $250 million per user through third party coverage and maintaining near perfect uptime records since launch.

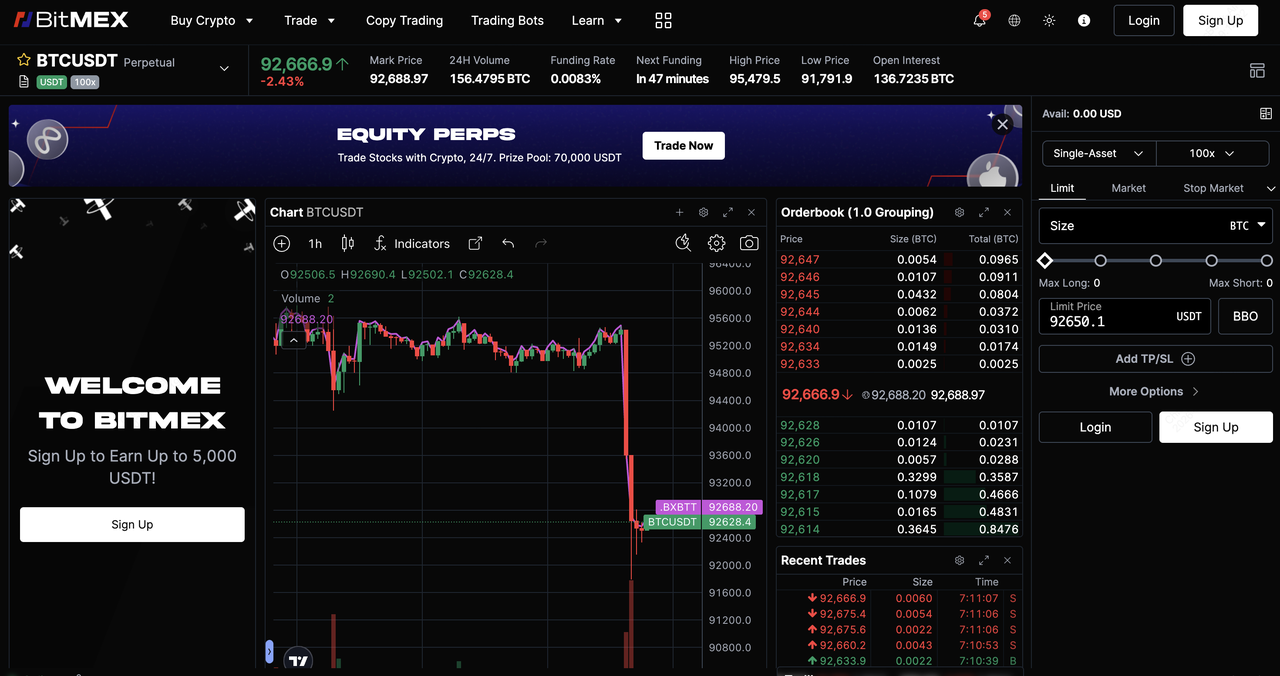

6. BitMEX

Source: BitMEX

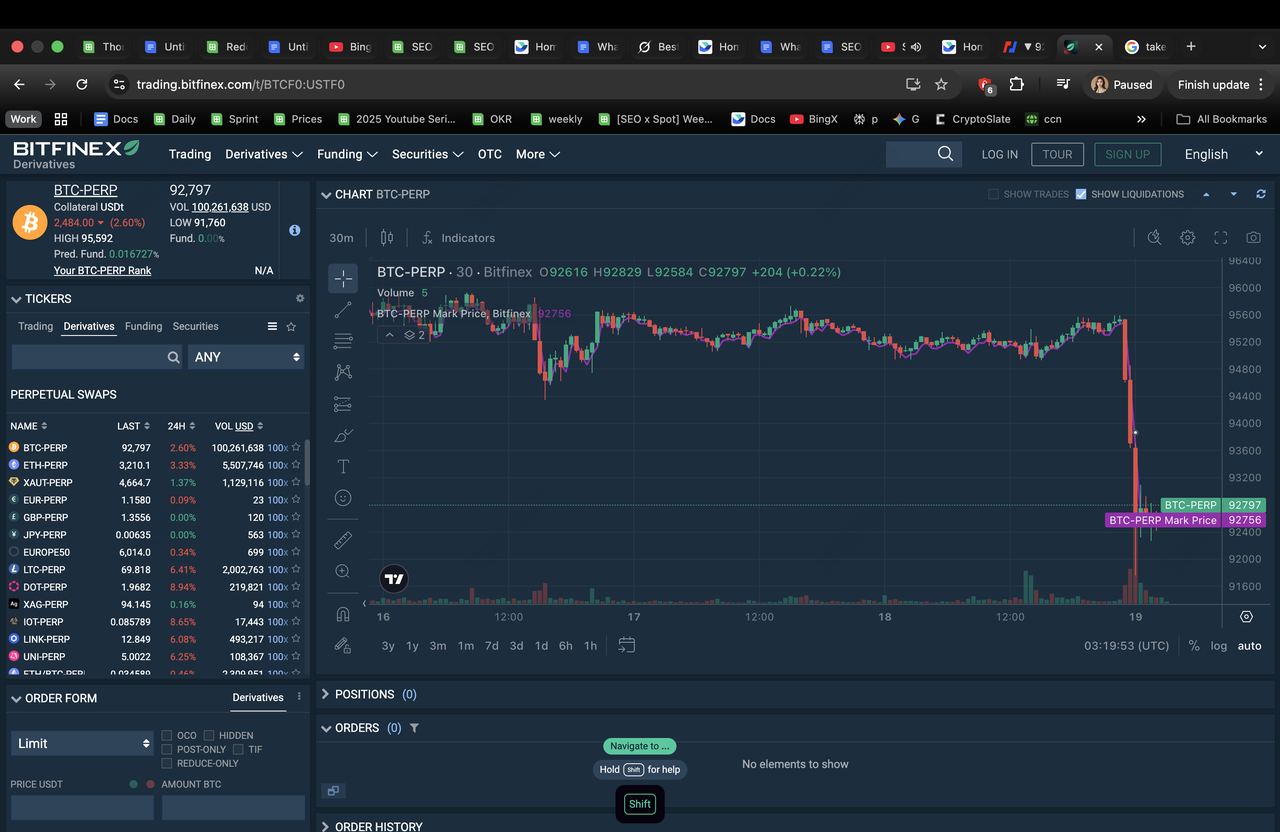

7. Bitfinex

Source: Bitfinex

Bitfinex provides a professional grade

futures trading environment in 2026, known for deep liquidity and advanced tools since 2012. It supports up to 100x leverage on major perpetual and standard futures pairs (with stablecoin margined contracts), tiered maker/taker fees starting around 0.1% maker and 0.2% taker (with volume based discounts), and over 140 derivatives pairs including strong Bitcoin focus like

BTC-USDT. Bitfinex suits precision oriented and institutional traders with features like insurance fund protection and customizable order types, though US access is limited and the lineup is smaller than mass market competitors.

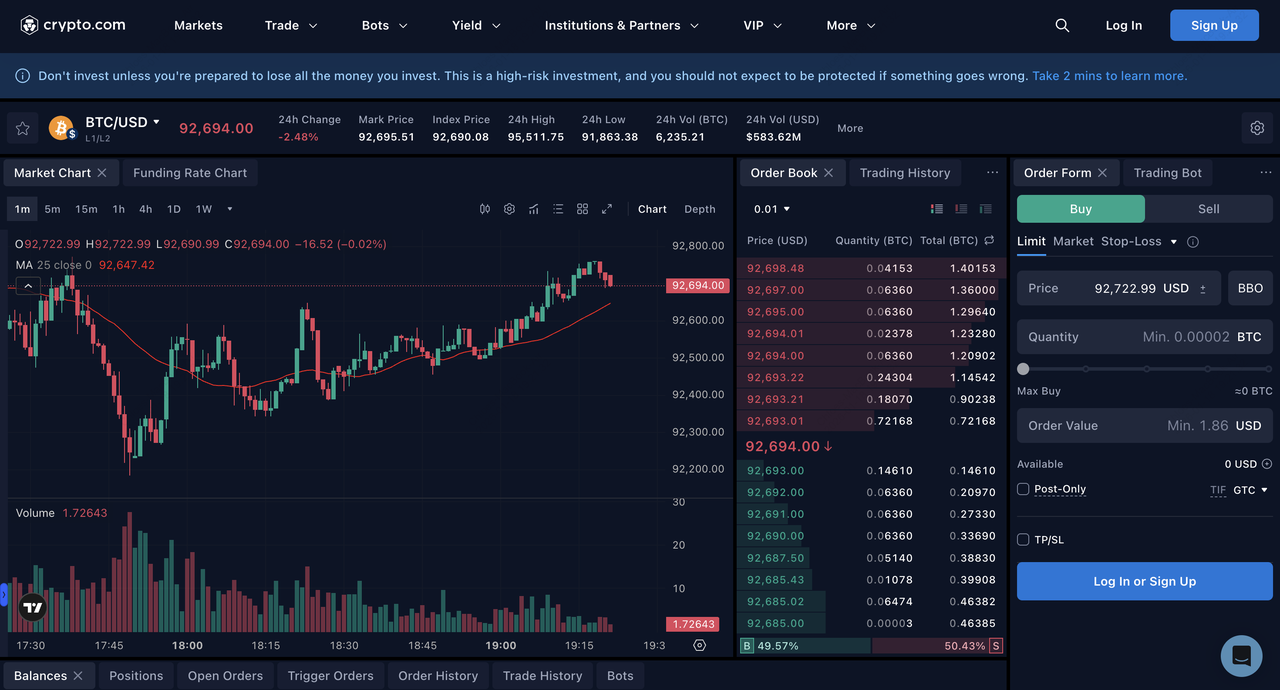

8. Crypto.com

Source: Crypto.com

Crypto.com offers accessible

futures trading in 2026 through its exchange platform, with perpetual and delivery futures supporting up to 50x leverage on BTC and ETH (lower on altcoins like 20x for meme coins), competitive fees starting at 0% maker and 0.05% taker (dropping to as low as 0.011% maker and 0.03% taker at high volumes over $5 million monthly), and reported 24 hour futures volumes in the billions (ex., around $3.9 billion in recent snapshots). It appeals to users seeking an all-in-one ecosystem with strong security, mobile access, and integration with staking/CRO rewards, though liquidity on longer dated delivery contracts remains lower and leverage caps are more conservative than specialized derivatives platforms.

Key Performance Metrics Across Leading Futures Trading Platforms: A Preview

Here's a snapshot of key performance metrics across leading futures trading platforms, using publicly available data sourced from CoinMarketCap derivatives rankings and exchange data (normalized 24h volume, open interest, and other metrics as of early 2026 snapshots):

| Exchange |

Max Leverage (Major Pairs) |

Maker/Taker Fees (Base) |

Approx. 24h Derivatives Volume (CMC est. early 2026) |

| BingX |

Up to 125x and up to 500x on select TradFi |

Tiered, often 0.02-0.045% / promotions |

$5-15B |

| OKX |

Up to 125x |

0.02%/0.05% (VIP lower) |

$20-40B (top 3-5) |

| Kraken |

Up to 50x+ |

0.02%+ (tiered) |

$0.5-3B |

| Deribit |

High (100x+ perps, options focus) |

Competitive (0.02-0.05%) |

$1-5B (options leader) |

| Gemini |

Modest (up to 20-50x) |

Tiered (low for volume) |

<$1B |

| BitMEX |

Up to 100x |

Maker rebate -0.01%, Taker 0.075% |

$1-5B (strong historical) |

| Bitfinex |

Up to 100x |

~0.1%/0.2% tiered |

$1-4B (BTC-focused) |

| Crypto.com |

Up to 50x (BTC/ETH) |

0%/0.05% (tiered to 0.011%/0.03%) |

$2-5B |

Why BingX Stands Out as the Best Futures Trading Exchange in 2026

BingX surpasses competitors as the top choice for

futures traders in 2026 via its unified AI system, outpacing bolt on features elsewhere. With extensive AI engines and analytics processing over 50 million data points daily, it oversees markets and positions in real time, delivering proactive alerts while unlocking assets like Bitcoin forward

futures and

TradFi perpetuals on over 50 traditional finance instruments, including commodities, forex pairs, stocks, and indices.

This provides pro grade support in an intuitive format unmatched by others, backed by its top tier derivatives ranking, massive user base exceeding 40 million, and average monthly active futures traders surpassing 2.5 million in late 2025 data.

What Makes BingX a Top Platform for Crypto Futures Trading?

BingX has established itself as a leading crypto futures platform in 2026, supported by rapid global adoption and strong market activity. As of 2025, the platform boasts over 40 million users worldwide, representing 100 percent year-over-year growth, and peak 24-hour trading volume across all markets has exceeded 26 billion USD. Futures trading alone often sees daily volumes around 9.3 billion USD, reflecting deep liquidity and robust order books for major pairs such as

BTC/USDT and

ETH/USDT. With over 673 active futures trading pairs, BingX provides traders with access to both major cryptocurrencies and emerging tokens, offering a diverse range of opportunities for portfolio diversification and strategic trading.

BingX distinguishes itself through a combination of competitive leverage and advanced trading features. Crypto futures leverage is competitive with top exchanges, while the recent launch of

TradFi perpetual futures offers up to 500 times leverage on assets such as forex, commodities, major indices, and select stocks, expanding the possibilities for traders beyond crypto markets. The platform also offers flexible margin modes, integration with advanced charts, and a variety of execution tools designed for both beginners and professional traders. Additionally, BingX has committed significant resources to AI-driven tools, including AI Master and AI Bingo, which help enhance trading decisions and overall user experience.

Security and trust remain central to BingX’s strategy. The platform maintains a

150 million USD Shield Fund and 100 percent Proof of Reserves, alongside ISO 27001 security certification, reinforcing confidence in solvency and operational safety. BingX also supports a thriving copy trading ecosystem, with hundreds of thousands of elite traders, allowing users to follow and replicate successful strategies while deepening community engagement. Together, these factors, strong adoption, liquidity, diverse instruments, AI integration, and robust security, position BingX as one of the most versatile and reliable crypto futures platforms in 2026.

How to Start Futures Trading on BingX: Step-by-Step Guide

Initiating futures trading on BingX is straightforward and user friendly, designed to get traders into the market quickly and securely. For example, trading gold futures on BingX lets you gain direct exposure to gold's price movements using crypto collateral, combining the depth of traditional gold markets with the speed, leverage, and risk controls of a modern crypto futures platform.

Step 1: Create and Fund Your BingX Futures Account

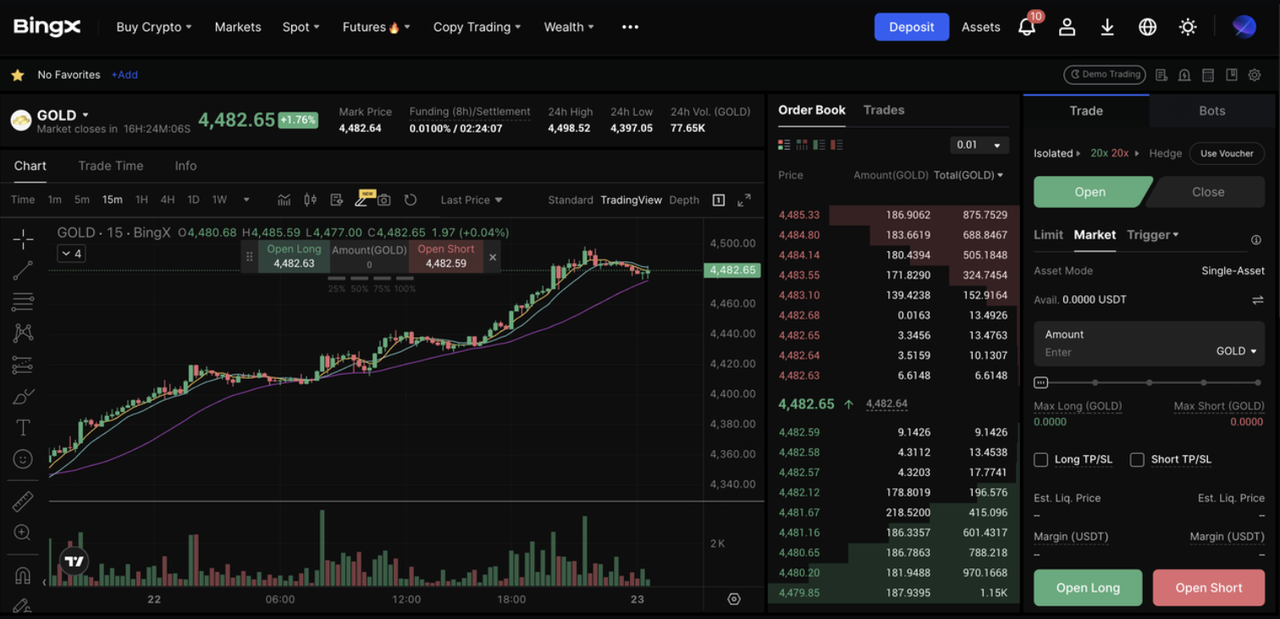

Step 2: Open the Futures Trading Interface

Go to Futures → USDT-M Contracts. Select the

gold-linked futures product or other trending perpetual futures contracts available on BingX

Step 3: Choose Long or Short

• Go long if you expect gold prices to rise, owing to inflation, rate cuts, geopolitical risk, etc.

• Go short if you expect gold prices to fall due to rate hikes, stronger USD, etc.

Step 4: Set Leverage and Order Type

Adjust leverage based on your risk tolerance. Choose market order for instant execution or limit order for a specific price entry.

Step 5: Manage Risk

Always use

stop-loss (SL) and take-profit (TP). Monitor margin levels to avoid liquidation. This approach mirrors traditional gold futures trading, but with crypto-native speed, leverage, and flexibility.

Key Considerations Before Trading Crypto Futures

Before engaging in futures trading, traders must carefully weigh several critical factors to protect capital and maintain long term sustainability in this high risk environment. Market downturns can rapidly impact even well managed positions, as sharp price corrections of 20 to 30% in 24 hours or black swan events often lead to widespread liquidations totaling billions in notional value across the ecosystem within minutes. Trading crypto futures offers flexibility and higher capital efficiency, but it also introduces risks that spot traders never face. Strong

risk management is what separates successful futures traders from those who get liquidated.

1. Position Sizing

Your position size should match your account size and risk tolerance. For instance, if you have $1,000, risking 2% per trade means a maximum loss of $20. With 5x leverage, you would open a position worth $100, not your entire account. Start small and scale only when your strategy is proven.

2. Stop-Loss and Liquidation Awareness

Future traders must always know where liquidation sits. Setting a stop-loss before entering the trade prevents unexpected wipeouts. On BingX, using Isolated Margin keeps risk limited to that single position, while Cross Margin uses your entire balance, better for experienced traders.

3. Funding Rates and Market Volatility

Perpetual futures include funding rates paid between long and short traders. Positive funding means you pay to stay long; negative funding means you pay to stay short. Understanding this cost helps you avoid holding losing positions during volatile periods. Sudden wicks can trigger liquidations, so protect entries with clear exit levels.

4. Avoiding Over-Leverage

High leverage magnifies small price moves. For example: A 1% move against you at 20x leverage equals a 20% loss. Stick to moderate leverage, 2x to 5x, especially when learning. Let skill, not leverage, drive profits.

BingX provides built-in tools like

isolated margin, stop-loss orders, take-profit zones, and liquidation alerts to help traders manage risk effectively. Responsible position sizing limited to 1 to 2% of total capital per trade, strict use of stop loss orders set at logical technical levels, and ongoing education through platform analytics and market research remain non-negotiable for anyone participating in crypto futures to achieve sustainable outcomes.

Conclusion

In 2026, futures trading exchanges have fundamentally transformed leveraged crypto engagement by offering sophisticated tools, deep liquidity exceeding $700 billion in average open interest, and innovative contract types that cater to both retail and institutional participants seeking efficient exposure and risk management. BingX stands at the forefront of this evolution through its powerful AI driven ecosystem processing millions of signals daily, advanced risk controls including real time liquidation warnings, and unique offerings such as TradFi perpetuals enabling traders to achieve professional grade results with greater efficiency and protection than ever before.

Futures trading gives you more flexibility than spot trading because you can profit in both rising and falling markets, and you can use leverage to amplify your exposure. Traders can pursue sustainable success in this dynamic and rapidly evolving futures market landscape with tools like BingX AI and leveraging the trading tips mentioned.

Related Reading