Tesla, Inc. is no longer viewed purely as an electric vehicle manufacturer. By 2026, Tesla sits at the intersection of AI, robotics, autonomous mobility, and energy, making it one of the most actively traded and debated equities in global markets.

In late 2025 and early 2026, Tesla entered a high-volatility phase after beating Q4 earnings expectations, reporting $24.9B in revenue, $0.50 EPS, and 20.1% gross margins. The stock reacted strongly to confirmed robotaxi expansion across seven U.S. cities, 1.1 million Full Self-Driving subscribers, and plans to begin Optimus humanoid robot production before the end of 2026, reinforcing Tesla’s shift toward AI-driven, high-margin software and robotics businesses, and keeping TSLA highly sensitive to earnings, regulatory signals, and macro tech sentiment.

For traders, this volatility is precisely what makes TSLA futures attractive. Tesla regularly sees sharp price moves around earnings releases, AI and autonomy announcements, Federal Reserve policy shifts affecting growth stocks, and broader risk-on / risk-off market rotations.

In this guide, we’ll break down what Tesla (TSLA) stock is, how it works, how it compares to Tesla tokenized stocks, and how to invest in or trade Tesla stock futures with USDT on BingX.

What Is Tesla (TSLA) and What Does Tesla Do?

Tesla, Inc. (NASDAQ: TSLA) is a U.S.-based electric vehicle and clean energy company best known for accelerating the global transition away from internal combustion engines. Founded in 2003 and led by CEO Elon Musk, Tesla designs and manufactures electric cars, battery energy storage systems, and solar energy products, positioning itself at the intersection of transportation, energy, and software.

At its core, Tesla operates across three main business segments:

• Automotive: Tesla’s largest revenue segment, covering electric vehicles such as the Model 3, Model Y, Model S, Cybertruck, and Semi. This segment also includes software offerings like Autopilot and Full Self-Driving (FSD), as well as vehicle-related services and charging access.

• Energy Generation and Storage: This segment focuses on battery-based energy solutions, including Powerwall (residential), Powerpack and Megapack (commercial and utility-scale), along with solar energy products. These offerings support grid stability, energy storage, and renewable energy integration.

• Services and Other: Includes vehicle servicing, used vehicle sales, insurance offerings, Supercharger network operations, and other after-sales services that support Tesla’s broader ecosystem.

Tesla’s stock, TSLA, is publicly traded on the

NASDAQ and is widely regarded as one of the most actively traded and volatile technology equities in global markets. Its valuation is influenced not only by vehicle deliveries and margins, but also by broader themes such as artificial intelligence, autonomous driving, battery innovation, and long-term energy transition narratives. This combination of scale, growth expectations, and market attention is a key reason Tesla has become a popular candidate for tokenized stock products.

Tesla Stock Price Prediction in 2026

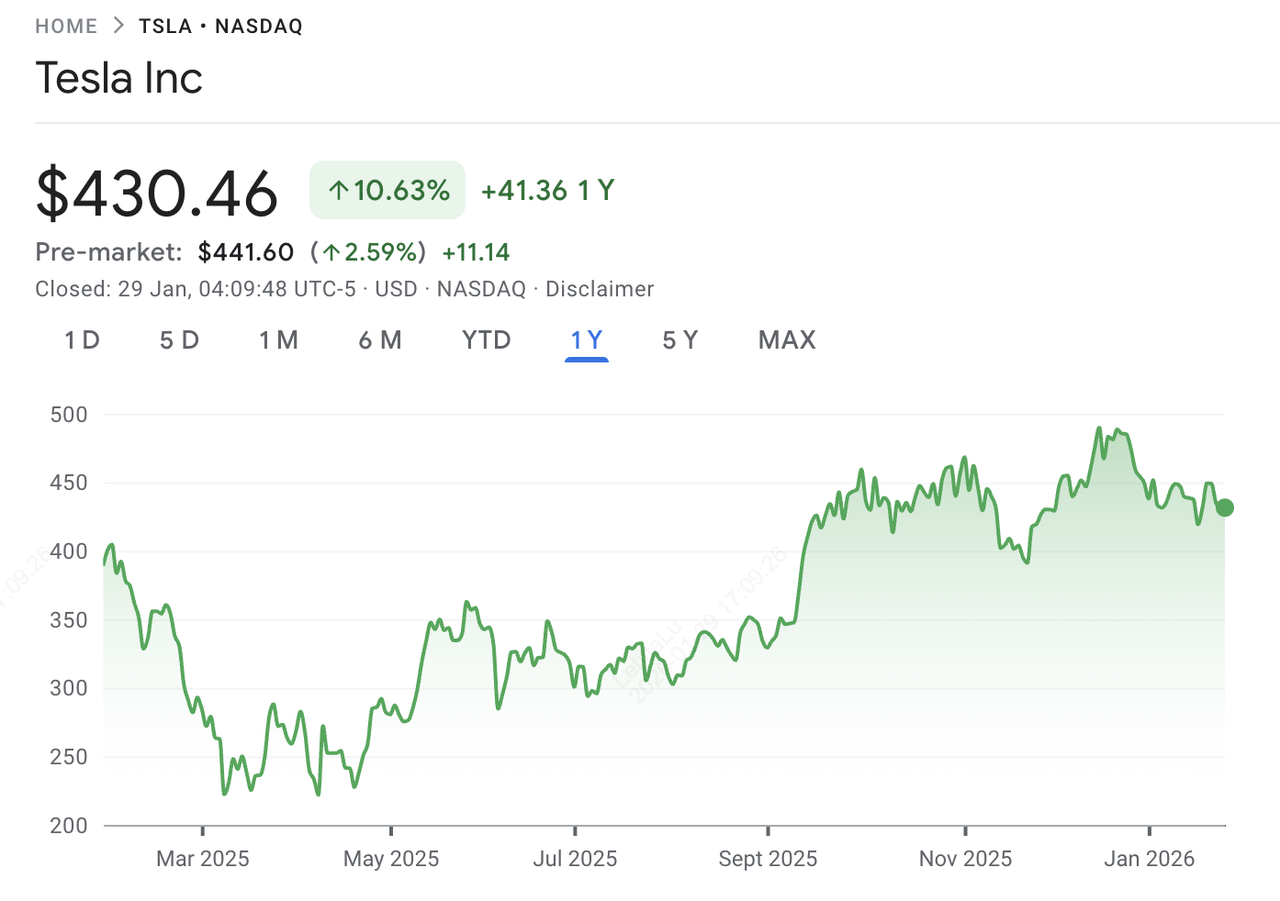

As of January 29, 2026, institutional forecasts for Tesla, Inc. reflect a wide valuation range, driven by uncertainty over how quickly autonomy, AI software, and robotics can translate into durable cash flows. While Tesla does not issue formal price guidance, earnings calls and filings consistently point to robotaxis, Full Self-Driving subscriptions, and Optimus humanoid robots as the primary drivers shaping its 2026 outlook.

Institutional Price Predictions for Tesla (TSLA) Stock in 2026

Based on research from major banks and investment firms:

• Base case: $350–$450 Reflects consensus assumptions from Goldman Sachs, Morgan Stanley, and Barclays, factoring in moderate EV growth and gradual software monetization.

• Bull case: $550–$650 Driven largely by autonomy and AI optionality, with Wedbush Securities assigning premium valuation upside if robotaxi scaling and FSD adoption accelerate faster than expected.

• Bear case: $250–$300 Assumes continued margin pressure, slower EV demand, and delayed monetization of autonomy and robotics initiatives.

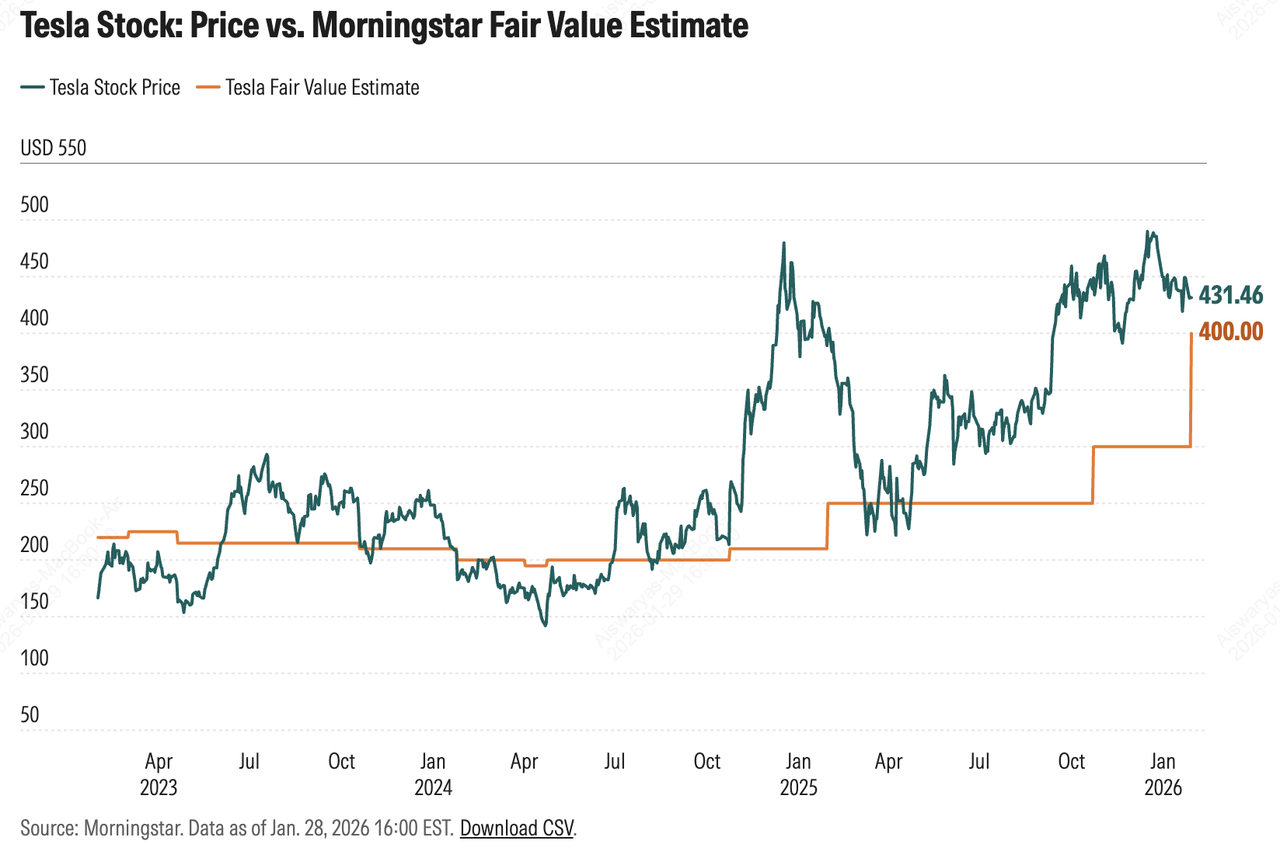

Morningstar’s Valuation View

Tesla stock price vs. Morningstar fair value estimate | Source: Morningstar

Morningstar Equity Research offers a more conservative, fundamentals-anchored outlook. Following Tesla’s Q4 earnings, Morningstar raised its fair value estimate to $400 per share from $300, citing higher long-term value from robotaxis, FSD subscription pricing, and the emerging humanoid robot business. However, Morningstar currently assigns Tesla a 3-star rating, a narrow economic moat, and a “very high” uncertainty rating, indicating that shares are trading close to fair value and remain exposed to execution and volatility risk.

Key Factors Driving Tesla’s 2026 Outlook

The following factors are based on Tesla’s official disclosures and how institutional investors interpret them in valuation models.

1. Autonomy and Full Self-Driving: Tesla consistently positions Full Self-Driving as a long-term growth pillar. Institutions view autonomy as the main upside driver, while regulatory and execution risks remain key concerns.

2. AI and Optimus robotics: Tesla increasingly emphasizes its AI infrastructure and Optimus robot. While near-term earnings impact in 2026 is limited, visible progress beyond prototypes could influence long-term valuation expectations.

3. Automotive margins and pricing: Tesla highlights cost control in a more competitive EV market. Institutional models focus on margin stability, with pricing pressure seen as the most immediate risk.

4. Energy storage growth: Tesla continues to emphasize Megapack and energy storage expansion, which institutions generally view as downside support rather than a primary upside catalyst.

What Are Tesla Stock Futures, and Why Trade Them With Crypto?

Tesla stock futures are derivative contracts that let you speculate on the price movements of Tesla, Inc. (TSLA) without owning the underlying shares. Instead of buying TSLA on a traditional stock exchange, you trade price exposure, going long if you expect the stock to rise or short if you expect it to fall, using margin.

Trading TSLA futures with crypto offers several practical advantages for active traders. Tesla is one of the most volatile large-cap U.S. stocks, with a 52-week trading range of roughly $214 to $499 and frequent double-digit moves around earnings, AI announcements, and macro tech events. On BingX TradFi, TSLA perpetual futures can be traded using USDT collateral, with leverage, 24/7 market access, and built-in risk tools like stop-loss and take-profit orders, allowing crypto-native traders to trade Tesla’s volatility efficiently without relying on U.S. market hours, stock brokers, or share custody.

What Are Tesla Tokenized Stocks TSLAX (xStocks) and TSLAON (Ondo)?

Source: BingX TSLAX Price

Tesla tokenized stocks are blockchain-based assets that track the market price of Tesla (TSLA) without requiring a traditional brokerage account. Instead of holding TSLA shares directly, investors hold on-chain tokens that provide economic exposure to Tesla’s price movements and are typically backed by real Tesla shares held by custodians.

TSLAX (Tesla xStock) is part of the

xStocks category of tokenized equities and is structured to mirror TSLA’s price performance. It is generally backed 1:1 by underlying Tesla shares held by a third-party custodian, allowing fractional access and faster settlement than traditional stock trades, while not granting shareholder rights such as voting.

TSLAON, issued by

Ondo Finance, provides Tesla price exposure through a compliance-focused tokenized structure. Like TSLAX, it is backed by real TSLA shares held in custody and does not represent ownership of Tesla, Inc.

In practice, Tesla tokenized stocks allow crypto-based access to TSLA price movements but do not confer ownership rights, voting privileges, or guaranteed dividend entitlements. Liquidity and pricing may also differ from NASDAQ-listed TSLA shares, making these products best viewed as on-chain equity exposure instruments rather than direct substitutes for traditional Tesla stock ownership.

Traditional Tesla (TSLA) Stock vs. Tesla Tokenized Stock: What’s the Difference?

Traditional Tesla (TSLA) stock and Tesla tokenized stocks both provide exposure to Tesla’s market value, but they differ fundamentally in structure, ownership, and how investors access them. Understanding these differences helps clarify which option better fits a given investment strategy.

| Feature |

Traditional Tesla (TSLA) Stock |

Tesla Tokenized Stock |

| Ownership |

Direct ownership of Tesla shares |

No ownership; token tracks TSLA price |

| Shareholder Rights |

Voting and shareholder rights |

No voting or shareholder rights |

| Dividend Eligibility |

Eligible if Tesla issues dividends |

Not guaranteed; structure-dependent |

| Trading Access |

Traditional stock exchanges |

Crypto exchanges and on-chain platforms |

| Trading Hours |

Market hours only |

Often extended or near 24/7 |

| Settlement |

Standard equity settlement cycle |

Faster, crypto-native settlement |

| Fractional Exposure |

Broker-dependent |

Commonly supported |

For users who prefer simpler exposure, BingX supports spot trading for selected tokenized stocks, making the process similar to buying other digital assets. In contrast, TSLA futures are better suited for active traders seeking leverage, short-selling, and short-term positioning around earnings, AI milestones, and macro tech volatility.

How to Trade Tesla (TSLA) Futures With Crypto on BingX

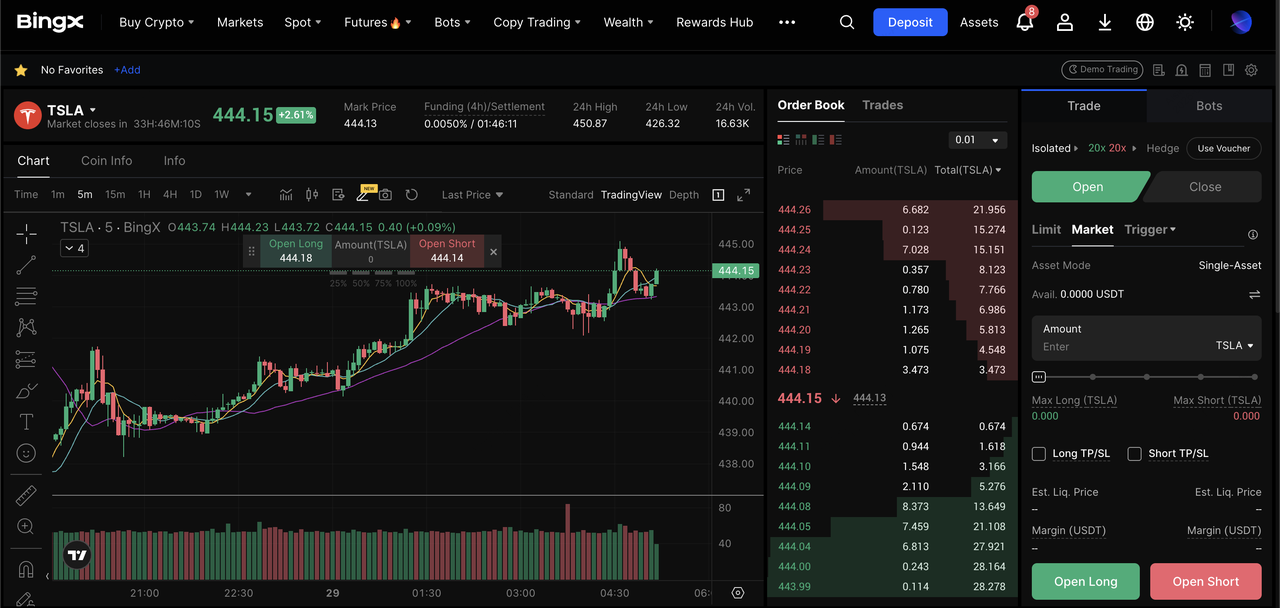

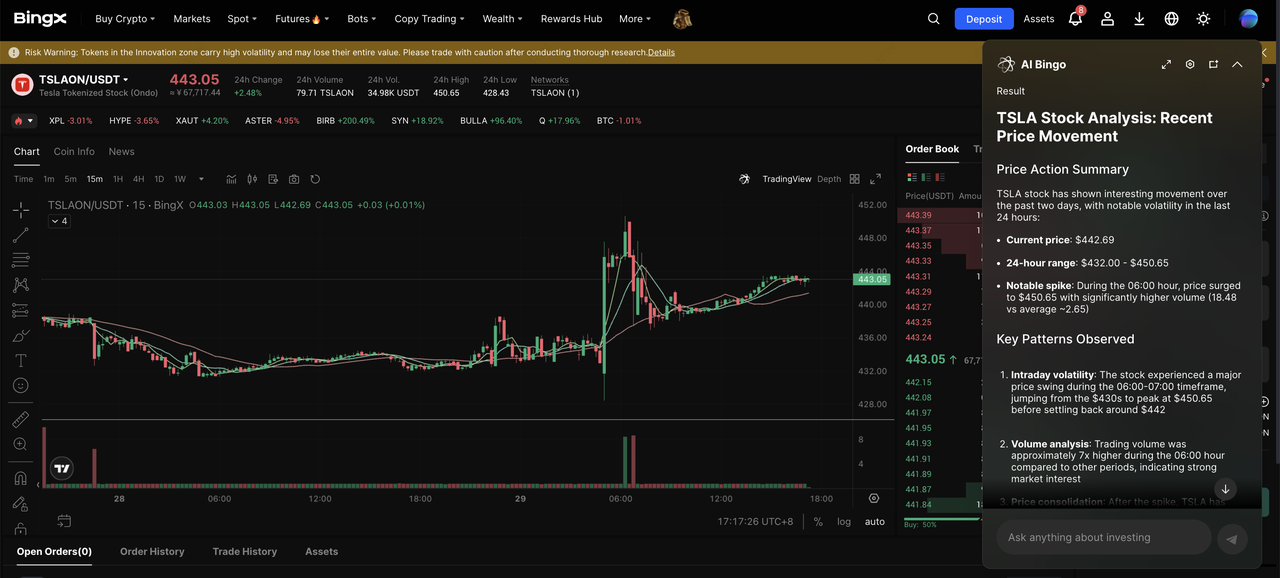

TSLA/USDT perpetual contract on the futures market

Trading Tesla futures on BingX lets you gain direct exposure to TSLA price movements using crypto collateral, combining U.S. equity volatility with the speed, leverage, and risk controls of a crypto-native futures platform.

Step 1: Create and Fund Your BingX Account

Step 2: Open the TSLA Futures Market

Navigate to Futures and USDT-Margined Contracts and select the

TSLA perpetual futures pair available on BingX. You can also access TSLA stock futures from

BingX TradFi markets.

Step 3: Choose Long or Short

• Go long if you expect Tesla shares to rise on earnings, AI milestones, or robotaxi progress.

• Go short if you anticipate pullbacks due to valuation concerns, macro tightening, or delivery slowdowns.

Step 4: Set Leverage and Order Type

Adjust leverage based on your risk tolerance. Choose a market order for immediate execution or a limit order to enter at a specific price.

Step 5: Manage Risk Actively

BingX TradFi futures provide a way to trade Tesla’s stock price directly with crypto, offering flexibility and the ability to profit from both rising and falling markets. However, due to leverage and margin requirements, this approach carries higher risk than spot trading and is best suited for experienced traders.

Alternative: How to Buy Spot Tesla Tokenized Stocks TSLAX and TSLAON on BingX

Trading Tesla futures is not the only way to gain TSLA exposure using crypto. Buying Tesla tokenized stocks on BingX spot allows investors to track the price of Tesla, Inc. using crypto without a traditional brokerage account, leverage, or liquidation risk.

Source: BingX TSLAON/USDT Spot Market

2. Deposit funds: Add

USDT or other supported cryptocurrencies to your BingX account. BingX also supports fiat on-ramps such as bank transfers or card payments in certain regions, allowing users to convert fiat into USDT directly.

3. Find the Tesla tokenized stock trading pair: Go to the

Spot Market and search for trading pairs such as

TSLAON/USDT or

TSLAX/USDT, depending on availability. Ensure you are using spot trading rather than futures.

4. Place a spot order: Choose a

market order for immediate execution or a

limit order to buy at a preferred price. Before confirming, you can use

BingX AI to view real-time market signals, trend indicators, and sentiment insights to help inform your entry. Enter the amount and confirm the trade.

5. Manage your position: After the order is filled, the Tesla tokenized stock will appear in your spot wallet. You can hold it for price exposure or sell it later through the spot market.

5 Key Considerations Before Trading Tesla Stock Futures

Before trading Tesla stock futures, it’s important to understand the unique risk profile of TSLA, where high growth expectations, AI-driven narratives, and macro tech sentiment can amplify both upside and downside moves.

1. High volatility around catalysts: Tesla, Inc. regularly experiences sharp price swings around earnings releases, robotaxi updates, AI announcements, and regulatory news. These events can trigger rapid intraday moves that increase both opportunity and liquidation risk.

2. Leverage magnifies outcomes: TSLA futures allow you to use leverage, which improves capital efficiency but also magnifies losses. Even small adverse price movements can significantly impact your margin if leverage is set too high.

3. Macro sensitivity of growth stocks: Tesla trades closely with broader tech and liquidity conditions. Interest rate expectations, Federal Reserve guidance, and Nasdaq-wide risk sentiment can move TSLA futures even without company-specific news.

4. Funding costs on perpetual contracts: Holding TSLA perpetual futures over time may incur funding fees. In sideways or choppy markets, these costs can gradually erode returns, especially on leveraged positions.

5. Execution and risk discipline matter: Because TSLA can move quickly, it’s essential to predefine position size, stop-loss, and take-profit levels before entering a trade rather than reacting emotionally to price swings.

Final Thoughts: Is Tesla (TSLA) Stock a Good Investment?

Tesla, Inc. remains one of the most influential and closely watched companies in global markets, driven by its expanding role in AI software, autonomous driving, and robotics alongside its core EV business. For traders, this combination creates frequent volatility and well-defined catalysts, making TSLA stock futures a practical instrument for short-term positioning, hedging, or tactical exposure using crypto on BingX.

However, Tesla futures are not low-risk instruments. Price movements can be sharp and unpredictable, leverage can amplify losses, and outcomes are highly sensitive to earnings results, regulatory developments, and broader tech-sector sentiment. If you trade TSLA futures, use conservative leverage, set clear stop-loss and take-profit levels, and only risk capital you can afford to lose.

Related Reading