As the co-founder and CEO of Coinbase, Brian Armstrong’s wealth is unusually transparent, and volatile, by billionaire standards. Bloomberg estimates that Armstrong holds a 14% stake in

Coinbase, making

COIN equity his single largest asset. Unlike many tech founders who diversify heavily following a public listing, Armstrong remains deeply exposed to Coinbase’s performance, positioning his net worth as a real-time proxy for crypto trading activity, regulation, and institutional adoption. According to the Bloomberg Billionaires Index, Armstrong’s net worth stood at approximately $9.35 billion as of January 28, 2026, highlighting how his wealth fluctuates in near real time based on Coinbase’s valuation.

Who Is Brian Armstrong?

Brian Armstrong is the founder and CEO of Coinbase, one of the largest cryptocurrency exchanges in the United States, and one of the most influential executives in the global crypto industry. Born in 1983 near San Jose, California, he studied computer science and economics at Rice University, later earning a master’s degree in computer science. While still a student, Armstrong founded UniversityTutor.com, gaining early experience building scalable online platforms that later shaped his approach to crypto infrastructure and financial technology.

Before founding Coinbase, Armstrong worked at IBM, Deloitte, and later as a software engineer at Airbnb. While at Airbnb, he was exposed firsthand to the inefficiencies of cross-border payments, such as high fees, slow settlement times, and complex intermediaries. After discovering the Bitcoin whitepaper in 2010, he began building crypto tools during nights and weekends, a side project that ultimately led to the launch of Coinbase in 2012.

How Did Brian Armstrong Build His Wealth?

Brian Armstrong built his wealth primarily through long-term equity ownership in Coinbase, rather than early token speculation or a broad portfolio of unrelated ventures. From its early days, Coinbase differentiated itself by pursuing regulatory compliance, institutional security standards, and licensed banking relationships, a strategy that helped it become the largest U.S.-based crypto exchange.

In April 2021, Coinbase went public through a direct listing on Nasdaq (COIN). At peak intraday pricing, the company briefly approached a $100 billion market capitalization, instantly turning Armstrong into a crypto billionaire. As of 2026, Bloomberg reports that Coinbase holds approximately $516 billion in assets on its platform and generated $6.6 billion in revenue in 2024, underscoring why changes in COIN’s valuation continue to have an outsized impact on Armstrong’s net worth.

How Much Is Brian Armstrong's Net Worth in 2026: Key Estimates

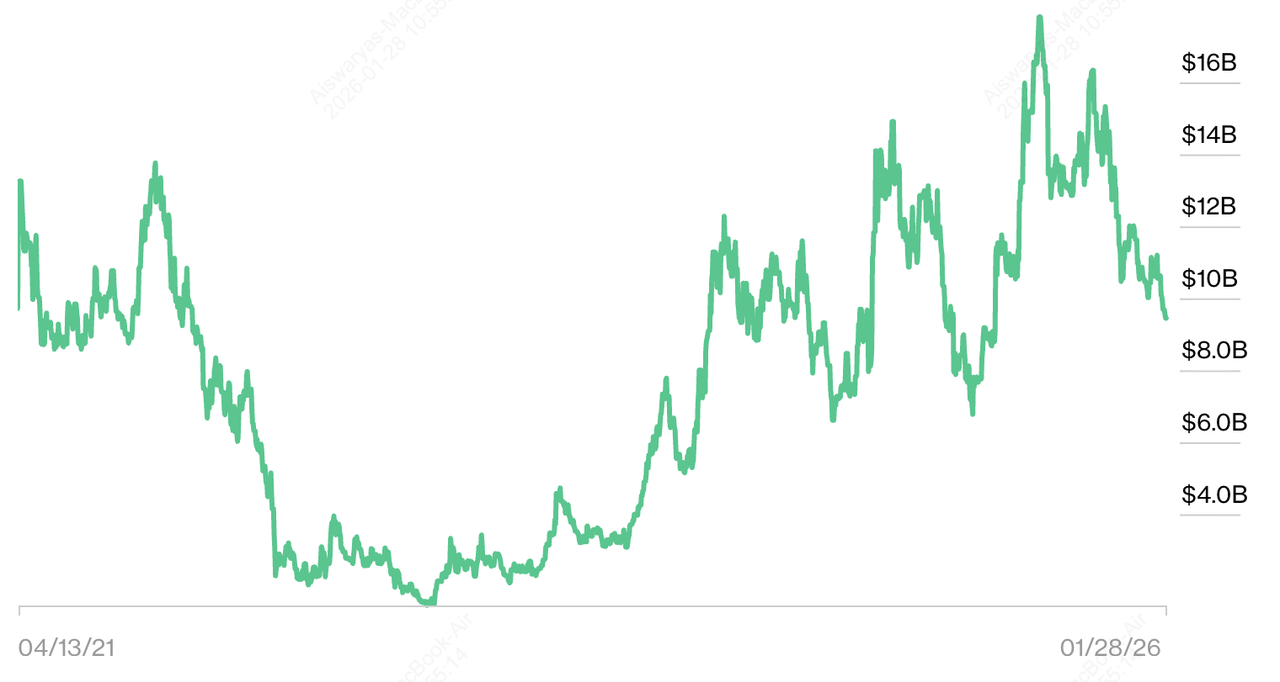

Brian Armstrong's net worth changes over the years | Source: Bloomberg

As of January 2026, real-time billionaire trackers show a narrower but still volatile range for Brian Armstrong’s net worth, driven almost entirely by

Coinbase stock (COIN) performance. The Bloomberg Billionaires Index places Armstrong’s net worth at approximately $9.35 billion as of January 28, 2026, ranking him #396 globally. By contrast, Forbes-style real-time estimates continue to extend the upper bound toward $13–14 billion during periods when COIN trades at higher valuation multiples.

This divergence is explained by three quantifiable factors.

1. COIN share price sensitivity: With Armstrong holding an estimated 14% stake directly and through trusts, a $10 move in COIN can shift his net worth by several hundred million dollars.

2. Ownership adjustments: Ongoing dilution from stock-based compensation and limited insider sales modestly reduce his percentage over time, impacting valuation math.

3. Methodology differences: Bloomberg applies stricter liquidity discounts and cash adjustments to insider-held equity, while Forbes tends to reflect spot-market pricing more directly.

Key takeaway: Armstrong’s net worth behaves less like traditional tech-founder wealth and more like a high-sensitivity indicator of Coinbase’s valuation and broader crypto market confidence.

How Has Brian Armstrong’s Net Worth Changed Over Time?

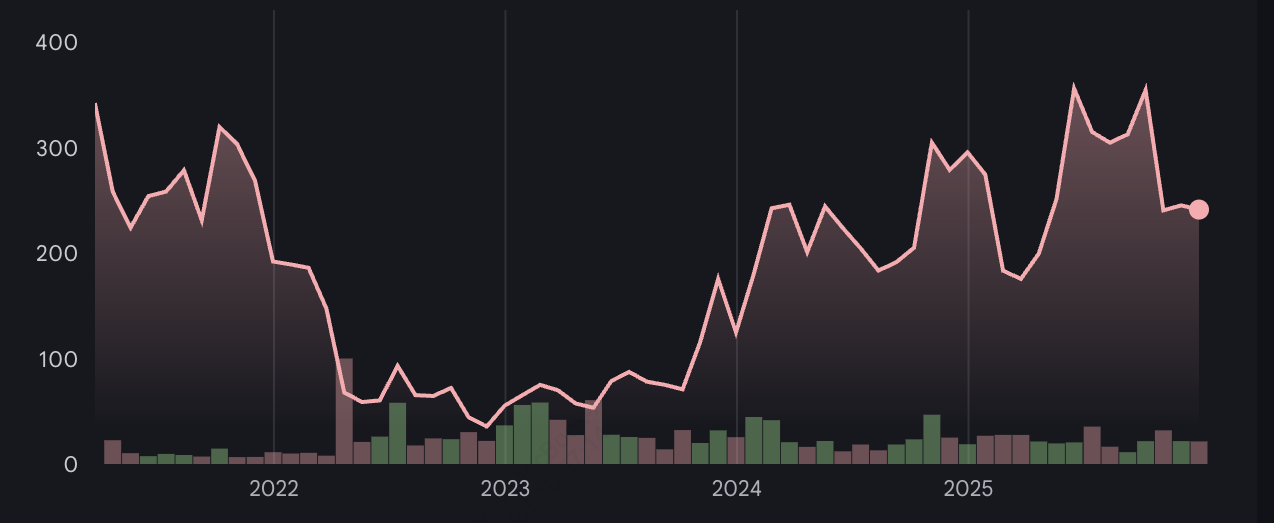

Coinbae (NASDAQ:COIN) stock performance | Source: Google Finance

Brian Armstrong’s net worth has followed a high-beta trajectory tightly linked to Coinbase’s valuation, crypto trading volumes, and regulatory sentiment, making it one of the clearest examples of market-driven founder wealth in the digital asset sector.

• 2021: Coinbase’s April 2021 direct listing coincided with a peak crypto bull market. With COIN briefly valuing the company near $85–100 billion intraday and Armstrong holding roughly 19%, major trackers estimated his net worth at $10–13 billion.

• 2022–2023: A sharp crypto downturn slashed retail and institutional trading activity. COIN fell over 80% from peak, Coinbase revenue declined, and Armstrong’s net worth compressed to approximately $2–3 billion at the trough, per Bloomberg and Forbes estimates.

• 2024–2025: Improving market sentiment, aggressive cost controls, rising institutional participation, and momentum from

spot Bitcoin ETFs helped stabilize Coinbase’s earnings outlook. COIN recovered materially, lifting Armstrong’s wealth back into high single-digit billions.

• 2026: With Coinbase trading at a steadier valuation and Armstrong’s ownership closer to 14% after dilution and limited insider sales, his net worth has stabilized in the $9–14 billion range, moving largely in lockstep with COIN’s share price.

Bottom line: Armstrong’s wealth behaves less like diversified tech-founder capital and more like a real-time barometer of crypto adoption and exchange activity, rising and falling with the industry’s participation and confidence cycles.

What Drives Brian Armstrong’s Net Worth: 4 Key Factors

Brian Armstrong’s net worth is driven by a small set of high-impact, measurable variables, with his equity stake in Coinbase acting as the dominant force and broader crypto market conditions amplifying both upside and downside.

1. Coinbase Stock (COIN): Armstrong remains Coinbase’s largest individual shareholder, holding an estimated 14% stake directly and through trusts, according to late-2025 Form 4 filings and the company’s proxy statement. Bloomberg identifies COIN US Equity as his single largest asset, meaning movements in Coinbase’s share price flow almost directly into his net worth. In practical terms, a $10 move in COIN can shift Armstrong’s estimated wealth by several hundred million dollars, depending on market capitalization and share count.

2. Crypto Market Cycles and Trading Volumes: Coinbase’s financial performance is tightly linked to overall crypto market activity. During bull markets, rising prices in

Bitcoin and

Ethereum typically drive higher retail and institutional trading volumes, supporting revenue growth and higher valuation multiples. Coinbase reported $6.6 billion in revenue in 2024, underscoring how volume-sensitive its earnings are. In bear markets, declining activity compresses margins and valuation, rapidly reducing both Coinbase’s market cap and Armstrong’s net worth.

3. Regulatory Developments and Policy Clarity: Regulatory outcomes act as a secondary but powerful driver. Clearer U.S. crypto policy frameworks or institutional-friendly rulings tend to improve Coinbase’s long-term growth outlook and investor confidence. Conversely, enforcement actions or prolonged uncertainty can pressure COIN’s valuation even during periods when crypto asset prices are rising, indirectly weighing on Armstrong’s wealth. Bloomberg’s daily net worth updates reflect how quickly these signals are priced in.

4. Limited Diversification of Personal Holdings: Unlike many public-company founders, Armstrong has not aggressively diversified his post-IPO wealth. While he has executed limited, disclosed insider sales over time, Coinbase equity still represents the overwhelming majority of his fortune. This concentration magnifies both upside during favorable market conditions and downside during industry-wide downturns, reinforcing the volatility of his overall wealth profile.

Beyond Coinbase: Armstrong's Diversified Investments and Philanthropy

Although Coinbase equity accounts for most of Brian Armstrong’s net worth, he has deployed capital and influence into a small number of mission-driven, long-duration initiatives that emphasize structural impact rather than near-term financial returns.

• GiveCrypto (2018–2023): Founded by Armstrong to test whether cryptocurrency could function as a direct, borderless aid mechanism, GiveCrypto distributed millions of dollars in crypto to thousands of recipients across Latin America, Africa, and parts of Asia. The initiative demonstrated crypto’s efficiency for direct, cross-border transfers without intermediaries and showed measurable short-term benefits. However, in December 2023, Coinbase announced it would wind down GiveCrypto after concluding that unconditional cash transfers alone did not generate sustained long-term outcomes. Remaining funds were redirected to Brink and GiveDirectly, signaling a shift toward models better suited for durable impact.

• ResearchHub: ResearchHub is a science collaboration and funding platform designed to improve how research is reviewed, rewarded, and shared. Armstrong has personally funded the project, positioning it as a “GitHub for science,” where contributors earn tokens for peer review and research input. While financially immaterial to his net worth, it reflects his belief in incentive-driven, open systems.

• NewLimit: Armstrong is a co-founder and investor in NewLimit, a biotechnology company focused on extending human healthspan through epigenetic reprogramming. Bloomberg notes that he holds an estimated 19% stake, valued using NewLimit’s $825 million post-money valuation from a May 2025 funding round. Armstrong and co-founder Blake Byers have committed a combined $110 million in personal capital, with Armstrong’s contribution partially deducted from his cash holdings.

Collectively, these initiatives account for only a minor percentage of Armstrong’s total net worth, but they underscore a consistent theme: deploying capital toward foundational infrastructure, financial, scientific, and biological, rather than short-term speculative investments.

How Does Brian Armstrong's Wealth Compare to Other Crypto CEOs?

| Leader |

Primary Entity |

Est. Net Worth (2026) |

| Changpeng Zhao (CZ) |

Binance |

$79B - $88B |

| Giancarlo Devasini |

Tether (USDT) |

$22.4B |

| Brian Armstrong |

Coinbase |

$12.7B - $15B |

| Michael Saylor |

MicroStrategy |

$10.1B |

Measured against the wealthiest figures in the crypto industry, Brian Armstrong ranks firmly within the global top tier, though below founders whose fortunes are tied to private or balance-sheet-heavy entities. As of 2026 estimates,

Changpeng Zhao remains the clear outlier, with an estimated net worth of $79–88 billion, driven by Binance’s dominant global trading volumes and private ownership structure. Giancarlo Devasini, co-founder of

Tether and CFO at Bitfinex, follows with an estimated $22.4 billion, largely supported by Tether’s cash-flow-rich stablecoin business. By comparison, Armstrong’s wealth, currently $9.35 billion per Bloomberg, with higher-cycle estimates reaching $12–15 billion, places him ahead of Michael Saylor, whose estimated $10.1 billion net worth is highly concentrated in

Bitcoin holdings and

MicroStrategy equity.

The critical distinction is transparency and risk profile. Armstrong’s wealth is derived primarily from a publicly traded, U.S.-regulated company, making his net worth directly observable through Coinbase’s share price (COIN), earnings, and regulatory outlook. By contrast, net worth estimates for Binance and Tether rely on private-company valuation models and cash-flow assumptions, while Saylor’s wealth fluctuates primarily with Bitcoin price movements. For investors, Armstrong’s position offers a clearer, data-driven signal of how exchange economics, compliance strategy, and crypto market cycles translate into measurable enterprise value, rather than opaque or model-based billionaire rankings.

What Are the Key Risks Affecting Brian Armstrong’s Net Worth?

Brian Armstrong’s net worth is highly sensitive to a small set of systemic, quantifiable risks that directly affect Coinbase’s valuation, and therefore his personal wealth.

• Extended crypto bear markets: Prolonged downturns reduce retail and institutional trading volumes, compress Coinbase’s revenue, and pressure COIN’s valuation. During the 2022–2023 cycle, industry spot volumes fell by 50–70%, COIN declined 80%+ from peak, and Armstrong’s net worth fell by multiple billions of dollars.

• Regulatory setbacks in major jurisdictions: Adverse policy actions or prolonged regulatory uncertainty, particularly in the U.S., can cap Coinbase’s growth expectations and weigh on valuation, even when Bitcoin and Ethereum prices are rising.

• Fee compression and rising competition: Increasing competition from global centralized exchanges and decentralized trading platforms has driven lower average trading fees industry-wide, reducing margins and limiting upside during moderate market recoveries.

• Bitcoin and Ethereum price volatility: Because trading activity on Coinbase is closely tied to price momentum in major assets, sharp swings in

BTC and

ETH directly affect liquidity, user activity, and investor sentiment, amplifying year-to-year fluctuations in Armstrong’s estimated net worth.

Conclusion

Brian Armstrong’s net worth in 2026 reflects more than personal success, mirroring the maturation and volatility of the crypto industry itself. His decision to remain financially concentrated in Coinbase makes his wealth a near real-time indicator of confidence in crypto infrastructure, regulation, and adoption.

For investors, tracking Armstrong’s net worth isn’t about celebrity or rankings. It’s about understanding how leadership strategy, regulatory outcomes, and market cycles interact to create, or erase, value in digital asset markets.

Related Reading

FAQs on Brian Armstrong's Net Worth

1. What is Brian Armstrong’s net worth in 2026?

As of January 2026, stimates range from $9 billion to $14 billion, depending on Coinbase’s stock price and market conditions.

2. How did Brian Armstrong make his money?

Primarily through founding Coinbase and retaining a large equity stake as the company scaled and went public.

3. Is Brian Armstrong still CEO of Coinbase?

Yes, as of January 2026, Armstrong remains CEO and the largest individual shareholder at Coinbase (COIN).

4. Has Brian Armstrong sold Coinbase shares?

Yes, in limited amounts, but he retains a substantial stake.

5. Is Brian Armstrong invested outside crypto?

Yes. He invests in biotech, science platforms, and philanthropy alongside crypto initiatives, according to data on Bloomberg and Forbes.