Bitcoin doesn’t usually react to Japanese policy the way it reacts to the Federal Reserve, but this week is different. The Bank of Japan (BOJ) is preparing for its first major policy shift in years, and global markets are already adjusting. Bond yields in Japan have surged to levels last seen in 2008, the yen is strengthening, and risk assets, including crypto, have been under pressure.

Historically, every BOJ tightening cycle has drained liquidity from global markets. And with Bitcoin still trading near a key support zone, traders want to know: Will the

BOJ rate hike trigger another sell-off, or has the market already priced it in, setting up a reversal?

In this report, we break down what BOJ tightening means for

Bitcoin, how institutional flows are shifting, why liquidity matters, and where

BTC may move next.

Why the BOJ’s Rate Hike Matters for Crypto

Japan’s interest-rate policies affect far more than its domestic economy, they influence global liquidity conditions. For nearly two decades, Japan kept interest rates near zero, enabling traders worldwide to borrow yen cheaply and invest in higher-return assets such as tech stocks, emerging markets, and increasingly, crypto.

A rate hike disrupts this machinery immediately.

When Japanese yields rise:

• Investors unwind yen-funded positions

• Capital flows back into Japan

• The yen strengthens

• Global liquidity tightens

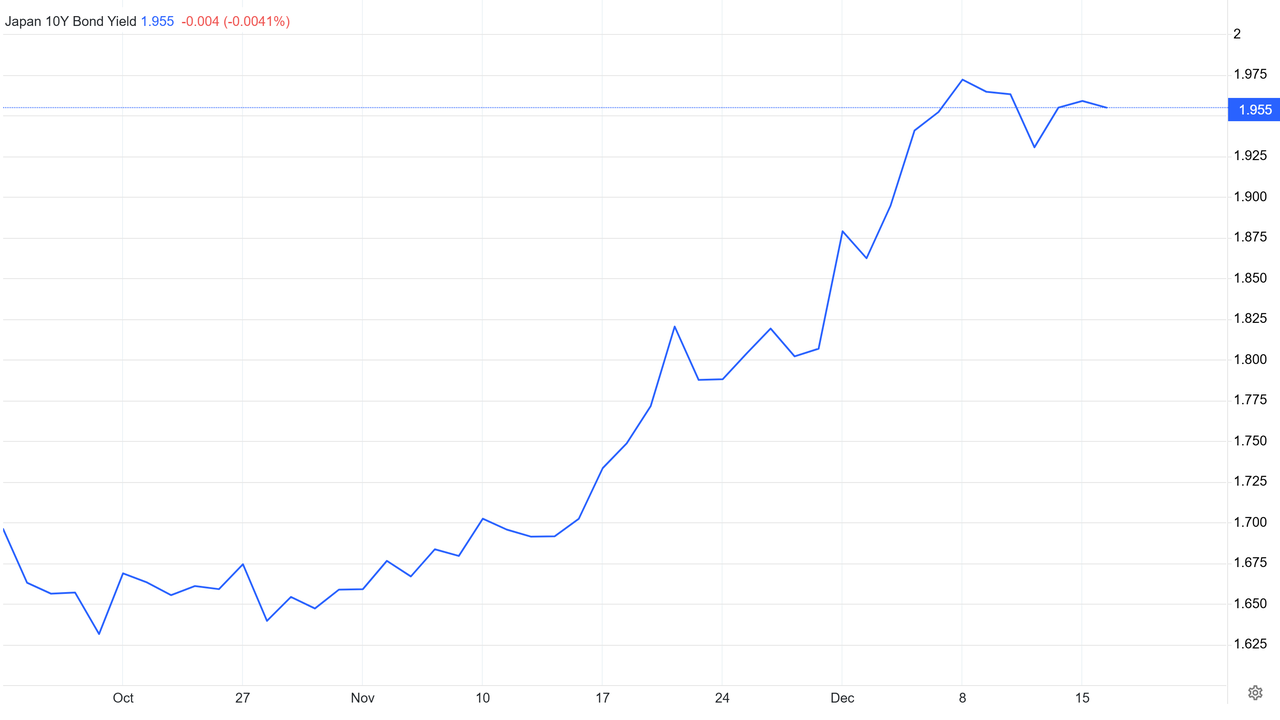

According to BingX market analysis, Japan’s government bond yields recently hit their highest level since 2008, an early warning that carry trades are unwinding.

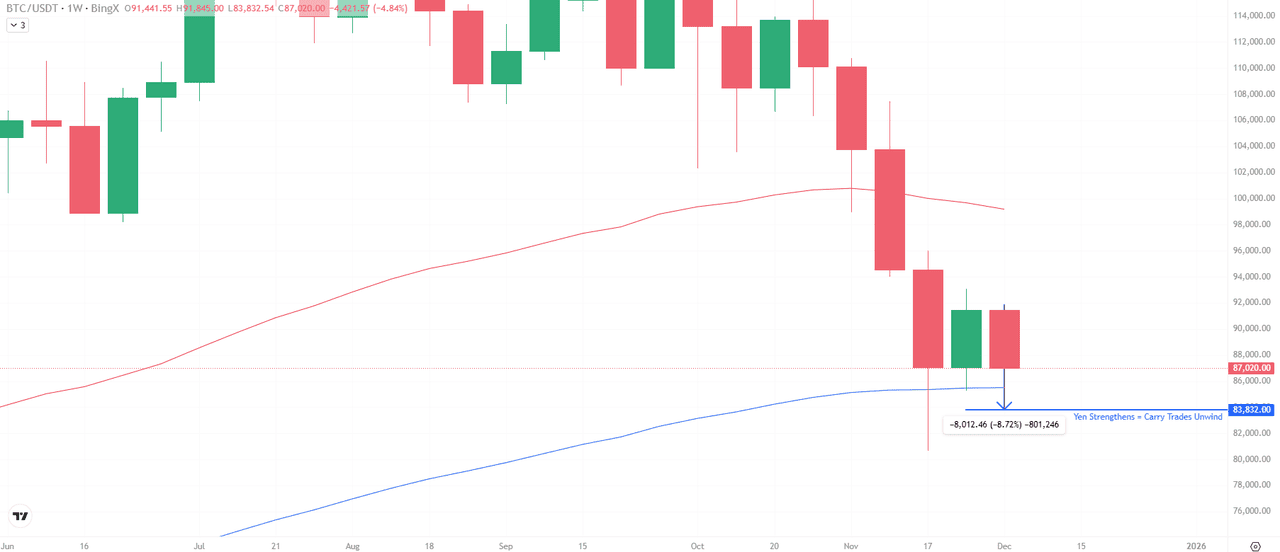

Bitcoin slid from $92,000 to $83,000 in early December as Japanese yields surged, a move consistent with past BOJ tightening cycles.

Bitcoin (BTC/USD) Price Chart - Source:

BingXWhat History Shows: Bitcoin Reacts Quickly to BOJ Signals

This pattern isn’t new. Throughout 2024, several BOJ-driven shocks produced sharp BTC declines:

• July 2024: Hawkish BOJ comments → yen strength → BTC dropped below $58,000

• October 2024: Rising Japanese yields → BTC saw another rapid pullback

Most importantly, whenever Japanese yields spiked, Bitcoin was corrected by roughly 14–17 percent, even before any official rate change occurred. Bitcoin behaves like a high-beta liquidity asset. When yen funding tightens, BTC feels it almost immediately.

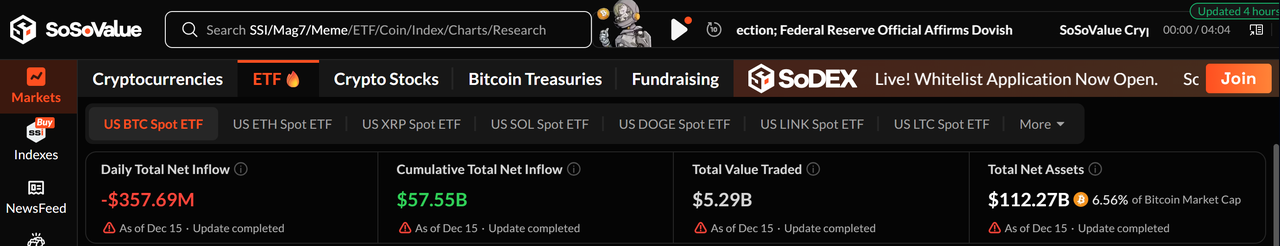

Bitcoin ETF Outflows Show the Market Is Pricing in a BOJ Rate Hike

The chart below reflects the shift in positioning. In the days ahead of the BOJ meeting, spot

Bitcoin ETFs saw persistent outflows, including a $357.69 million daily net outflow on 15 December. Total net assets dropped to $112.27 billion, while BTC slid toward $85,787.

Daily Bitcoin Spot ETF Net Outflow - Source:

SoSoValue

Such outflows typically occur when institutions turn defensive ahead of restrictive policy changes. In effect: The crypto market is already pricing in the BOJ’s tightening, even before the decision is announced.

Until the BOJ’s direction becomes clearer, liquidity-sensitive assets like Bitcoin are likely to remain under pressure.

Why Bitcoin Weakens When Japan Raises Rates

Bitcoin’s reaction to Bank of Japan (BOJ) tightening is not random. It follows a well-documented liquidity pattern supported by Bloomberg FX coverage, macro research, and historical price action. When Japan raises rates, three mechanisms tend to pressure BTC almost immediately.

1. Yen Strength = Carry Trade Unwind

For years, global investors borrowed yen at near-zero rates and deployed the capital into higher-yielding assets such as:

• US technology equities

• Emerging-market assets

• High-volatility crypto positions

This is known as the yen

carry trade. When the BOJ raises rates, yen borrowing becomes more expensive, forcing traders to unwind positions and repurchase yen. A stronger yen has historically coincided with risk-asset weakness. Bloomberg

reported that rising Japanese yields and yen appreciation increase stress across global risk markets. While Bloomberg discusses equities, not Bitcoin directly, the macro mechanism is the same, stronger yen = weaker risk appetite.

2. BOJ Tightening Reduces Global Liquidity

Bitcoin historically outperforms during periods of loose liquidity and underperforms when global liquidity tightens. BOJ hikes signal a shift away from the ultra-easy policy that fueled risk appetite for years. Markets interpret BOJ tightening as:

• fewer yen and dollar flows into high-risk assets

• reduced leverage in crypto derivatives

• lower speculative participation

Yahoo Finance

reported that rising Japanese rates pose a liquidity risk for Bitcoin due to unwind pressure on carry trades.

3. Institutional Flows React Immediately

Bitcoin spot ETF flows often weaken when Japanese yields rise and liquidity tightens. SoSoValue data shows: A stronger yen = reduced carry trade activity = institutional de-risking.

Daily Bitcoin Spot ETF Net Outflow - Source:

SoSoValue

• 15 December 2025 ETF outflow: –$357.69M

• BTC price: $85,800

• Total net assets: $112.27B

These outflows are consistent with institutional de-risking, a common reaction when liquidity conditions tighten globally.

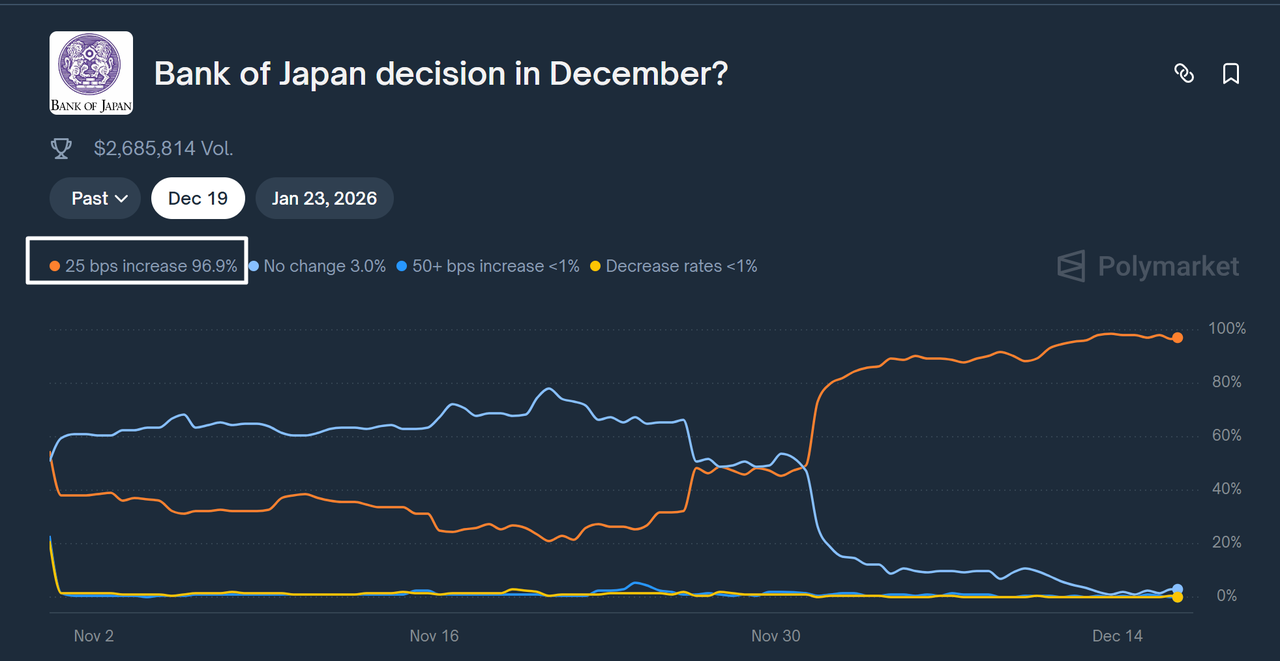

Polymarket Anticipates 90% Chance of BOJ Hiking Interest Rates

The BOJ is expected to raise its benchmark rate from 0.50% to 0.75%, the highest level in nearly 30 years. Polymarket pricing shows odds above 96%.

Bank of Japan decision in December? - Source: Polymarket

During each major period of BOJ tightening expectations, such as March 2024, July 2024, and January 2025, Bitcoin dropped between 14% and 17% as the yen strengthened and global liquidity tightened. Historical TradingView data confirms BTC consistently weakened whenever Japanese yields spiked or BOJ officials signaled a shift away from ultra-loose policy.

How Will the Crypto Market React to BOJ's Announcement?

With markets widely expecting the Bank of Japan to raise rates by 25 basis points to 0.75%, its highest level since the late 1990s, the question is no longer if the BOJ tightens, but how global markets will absorb it. For crypto traders, the signal is already showing up in price action, liquidity shifts, and institutional positioning.

1. The Market Has Already Started Pricing In Tightening

Bitcoin typically reacts ahead of BOJ decisions, not afterwards. The sharp ETF outflows seen in mid-December 2025 indicate that institutions are already reducing exposure as a precaution. The –$357.69M daily outflow on 15 December, alongside BTC slipping toward $86,000, reflects expectations of tighter liquidity and a stronger yen.

This suggests the correction is less about sentiment and more about macro-positioning—classic behaviour during global policy shifts.

2. Yen Momentum Will Dictate BTC’s Next Move

If the BOJ confirms a hike or signals further tightening:

• The yen may strengthen, accelerating carry-trade unwinds.

• BTC could face further downside pressure toward liquidity pockets identified on the chart (e.g., $82K–$78K zones).

• ETF flows may remain negative as institutions prioritise safety over speculative risk.

Conversely, if the BOJ softens its tone or delays tightening, BTC could attempt a relief bounce, driven by easing yield pressure and short-covering.

3. Crypto Volatility Likely to Increase After the Announcement

The BOJ’s rate decision is expected to be a volatility catalyst for crypto because it feeds directly into global liquidity conditions. When the BOJ tightens, borrowing costs rise worldwide, prompting traders to reduce leveraged positions and unwind risky trades. This affects crypto immediately, especially Bitcoin, which reacts quickly to shifts in funding conditions.

A policy move or even a hawkish tone can influence:

•

Funding rates on leveraged crypto trades, forcing traders to adjust positions as borrowing costs increase.

• Global risk appetite, with investors rotating out of high-volatility assets into safer alternatives.

• Cross-asset flows, as strength in the yen often coincides with weakness in Bitcoin, US Treasury yield moves, and pressure on equities.

Because Bitcoin is one of the most liquidity-sensitive assets in the world, even a small change in BOJ policy can trigger outsized swings. Traders should expect sharper intraday moves and wider ranges immediately after the announcement.

Bitcoin Technical Outlook: Is the Market Already Pricing in the Hike?

Bitcoin’s weekly chart shows a classic case of buy the rumor, sell the fact playing out ahead of the Bank of Japan’s rate decision. BTC has already unwound sharply from the $92,000 area, sliding into a major demand zone between $80,550 and $72,367, where buyers have historically stepped in.

Momentum indicators support the idea that the market may have priced in the tightening cycle.

Relative Strength Index (RSI) is deeply oversold, weekly candles are showing slowing bearish momentum, and price is testing structural support that previously triggered rallies exceeding 20–30 percent.

If the BOJ delivers the expected 25-bp hike, the absence of a surprise could release pressure, allowing BTC to bounce as liquidity fears ease.

A break above $90,000 would shift sentiment, with $100,000 acting as psychological resistance. Above this, a continuation toward $124,000 becomes increasingly likely.

BTC Trade Idea

Aggressive buyers may accumulate within $80,550–$72,367. A safer entry triggers on a bullish weekly close above $90,000, targeting $100,000 and $124,288, with stops below $72,000.

Conclusion: Liquidity Will Decide Bitcoin’s Next Move

Bitcoin’s drop into the $80K demand zone and the surge in ETF outflows show the market has already priced in BOJ tightening. With the rate hike widely expected, the next move hinges on how the yen reacts and whether liquidity tightens further.

If the BOJ sticks to expectations, BTC could stabilise or attempt a relief bounce from this oversold zone. A stronger-than-expected hawkish tone, however, risks pushing BTC toward deeper liquidity pockets.

For now, the setup is simple: Monitor yen strength, ETF flows, and BTC’s weekly close above or below the $80K–$72K demand area. These levels will dictate whether the next major move is a reversal or continuation lower.

Related Articles

FAQ: BOJ Rate Hike and Bitcoin Price

1. Why does Bitcoin react to Bank of Japan policy?

Because Japan has long been a source of cheap global liquidity. When BOJ raises rates, yen borrowing becomes more expensive, carry trades unwind, and risk assets—including BTC—face liquidity pressure.

2. Does a stronger yen always mean Bitcoin will fall?

Not always, but historically yen strength has aligned with BTC corrections. This is because capital flows back into Japan, reducing global risk appetite and tightening liquidity across markets.

3. Why are Bitcoin ETFs seeing outflows before the rate decision?

Institutional investors often de-risk ahead of policy changes. The –$357.69M outflow on 15 December reflects defensive positioning ahead of tighter liquidity.

4. Could Bitcoin bounce after the BOJ announcement?

Yes. If the hike is already priced in, BTC may follow a “buy the rumor, sell the fact” pattern and rebound from oversold conditions, especially if BOJ avoids sounding more hawkish.

5. What levels matter most for BTC right now?

• Support: $80,550–$72,367 (major weekly demand zone)

• Bullish trigger: Weekly close above $90,000

• Targets: $100,000 → $124,000 A break below $72,000 risks deeper downside.

6. How should crypto traders prepare for BOJ-driven volatility?

Reduce leverage, set wider stops, track yen strength (USDJPY), monitor ETF flows, and wait for confirmation on the weekly chart before scaling into swing positions.