Crypto markets are trading cautiously ahead of a major macro catalyst, with the US CPI due at 13:30 UTC and volatility expected to rise into the release.

Bitcoin is holding near $86,700 as traders avoid taking directional bets, while

Ethereum has slipped below $2,850 amid thinning liquidity across risk assets. High-beta majors including Solana, XRP, and BNB continue to face pressure as capital rotates into lower-volatility positions.

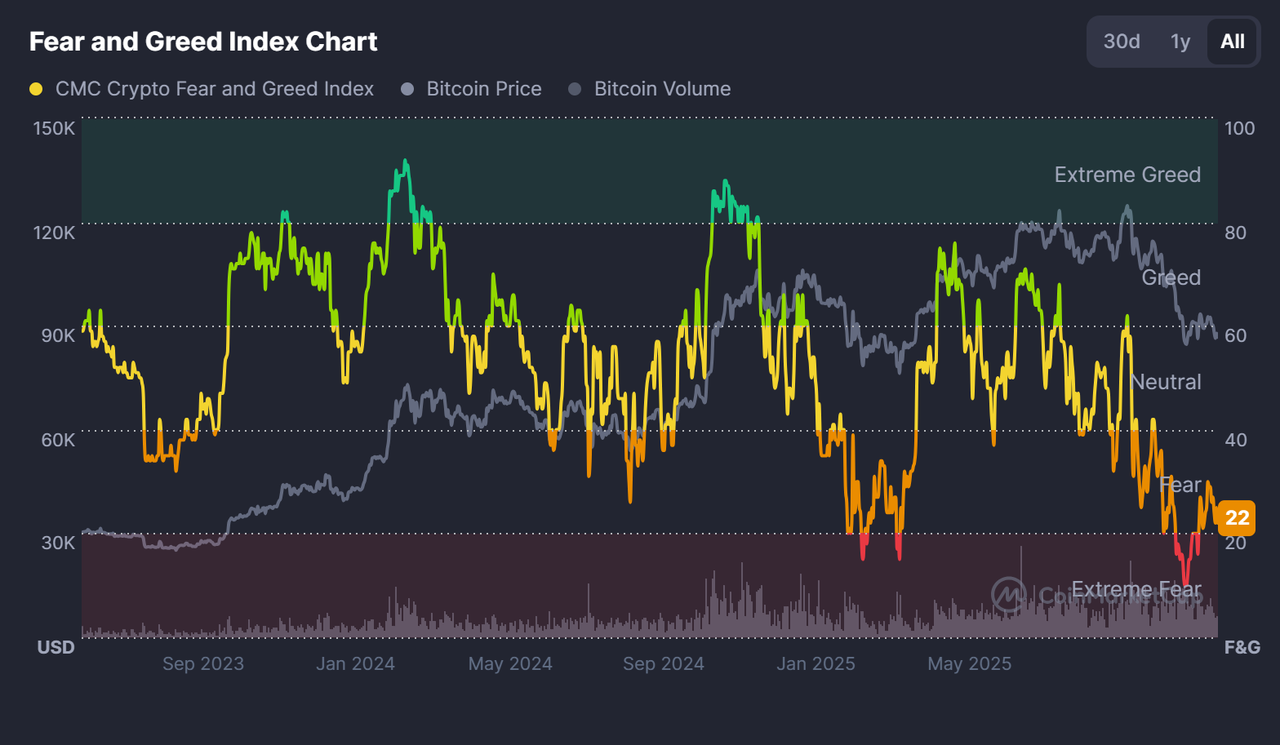

Sentiment remains fragile: the

Fear & Greed Index at 22 reflects a defensive posture, and the Altcoin Season Index at 18 signals a clear Bitcoin-dominant environment. Even so, ETF flows turned positive with +$344.7mn on December 17, showing institutions continue to accumulate despite spot-market de-risking.

CMC Crypto Fear and Greed Index - Source: Coinmarketcap

The stage is now set for CPI to determine whether consolidation holds or deeper volatility emerges.

Crypto Market's Fundamental Drivers and News Cycle

Tie in the macro events from today’s Sandmark feed, focusing only on relevant fundamentals:

1. US CPI Takes Center Stage (13:30 UTC)

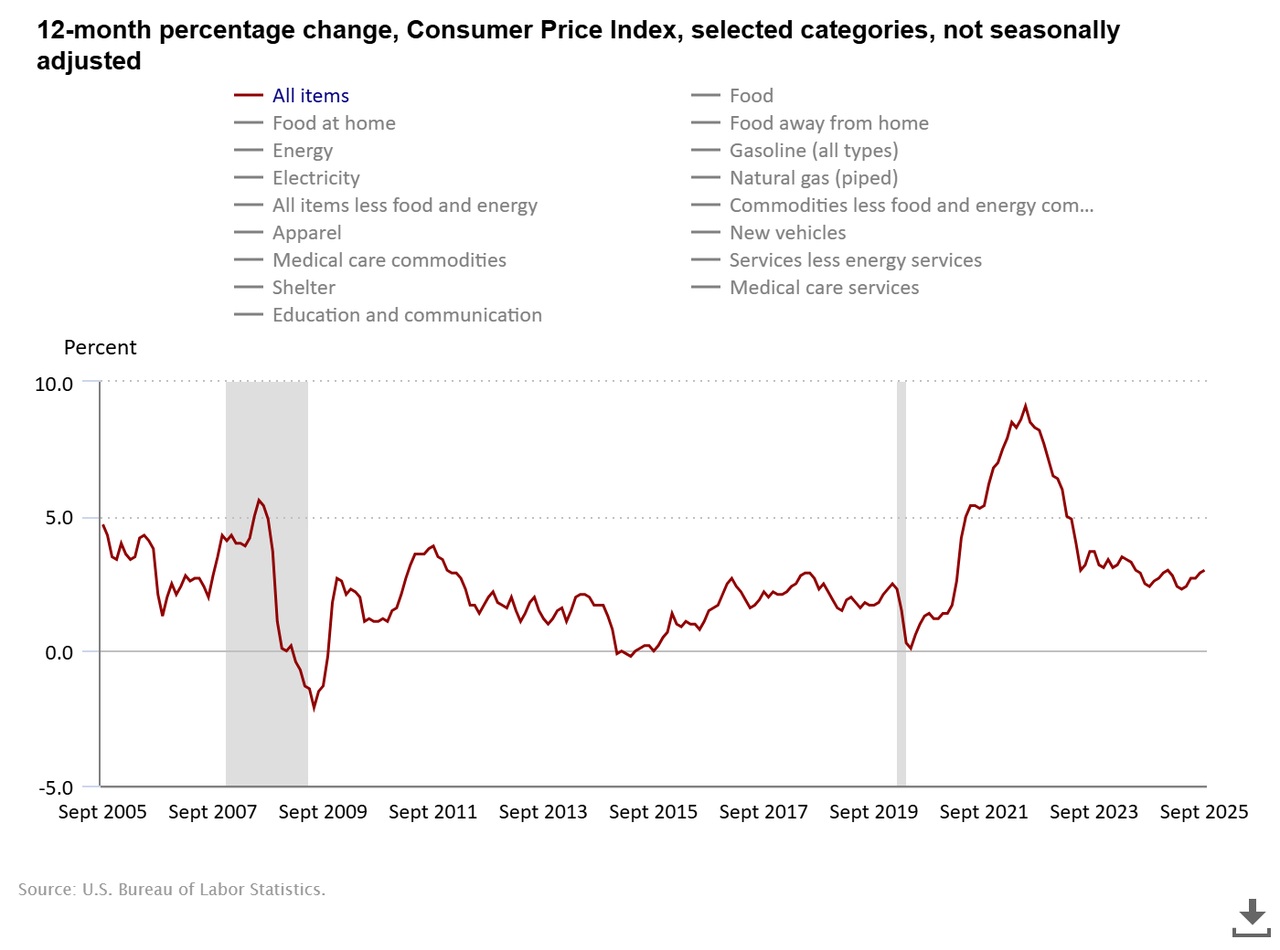

Today’s Consumer Price Index (CPI) report from the

US Bureau of Labor Statistics (BLS) is the key event driving global markets. Inflation has held near 3%, with the latest reading rising to 3.0% from 2.9%, while energy and food costs remain firm. Core inflation has eased slightly, but not enough for the Federal Reserve to signal rapid rate cuts. With growth cooling at the same time, the Fed faces limited room to adjust policy.

For newer crypto traders, CPI matters because it shapes expectations for interest rates.

• Higher inflation usually strengthens the US dollar and reduces liquidity, which tends to pressure Bitcoin, Ethereum, and high-beta altcoins.

• Softer inflation, on the other hand, can lift risk assets as traders anticipate easier financial conditions.

With forecasts pointing to a 3.1% reading today, any deviation, higher or lower, may trigger immediate volatility across BTC trading pairs on BingX.

2. BOJ Policy Shifts Become the Next Macro Focus

Once CPI is absorbed, attention will shift to Japan, where the Bank of Japan is nearing its next major rate decision. The BOJ last held its benchmark short-term rate at 0.5%, the highest since 2008, with a 7–2 vote in October. Two board members again pushed to raise rates to 0.75%, signaling internal pressure to continue tightening after decades of ultra-loose policy.

Japan matters for global markets because it is the world’s largest foreign creditor. Even small rate adjustments affect global liquidity: higher Japanese yields often draw capital back into yen-denominated assets, strengthening the currency and reducing access to cheap funding worldwide.

For crypto traders:

• Higher Japanese rates can tighten global liquidity.

• Tighter liquidity generally pressures BTC, ETH and high-beta assets like SOL, AVAX, and XRP.

• BOJ surprises have historically amplified volatility during risk-off periods.

The BOJ’s latest projections show FY 2025 core inflation at 2.7% and GDP growth rising to 0.7%, giving policymakers room to justify another hike if conditions hold.

3. UK Opens Inquiry Into Crypto’s Role in Political Funding

The UK has launched an independent review into foreign interference in political donations, including the use of cryptocurrencies. The move follows the jailing of former Reform MEP Nathan Gill, who admitted receiving £40,000 in Russian-linked payments to promote pro-Moscow positions. Bloomberg

reported that the review will assess whether digital assets create new channels for covert funding and whether current election safeguards are sufficient. The inquiry signals heightened regulatory scrutiny, a factor that can weigh on crypto sentiment during volatile macro conditions.

4. Nasdaq Moves Toward 24-Hour Trading to Compete With Crypto

Nasdaq has

filed with the SEC to extend weekday equity trading to 23 hours per day, aiming to align more closely with crypto’s 24/7 market structure. Reuters noted that foreign holdings of US equities reached $17tn last year, supporting rising demand for overnight access.

The exchange plans to operate from 04:00–20:00 ET, pause for one hour, then reopen 21:00–04:00 ET starting in 2026. Longer equity trading hours increase cross-market correlation, meaning macro events and equity volatility may spill into Bitcoin and altcoins more quickly.

5. DTCC Begins Tokenizing US Treasuries on Canton Network

The Depository Trust & Clearing Corporation (DTCC), the main backend settlement utility for US stocks and bonds, has

started tokenizing a small set of US Treasuries on the Canton Network, with a pilot expected in 2026. Treasuries are the world’s most widely used collateral, so moving them onchain signals rising institutional adoption of blockchain. For crypto traders, it strengthens the long-term case for regulated tokenization.

BTC, ETH Technical Analysis for December 18

Bitcoin Price Forecast: Bearish Flag Breakdown Puts $80K–$83K in Focus

Bitcoin is approaching a decisive technical moment as price remains capped below key trend indicators on the 4-hour chart. BTC continues to trade under the 50-EMA near $88,600 and the 100-EMA around $89,600, confirming that short-term momentum remains bearish. These moving averages have repeatedly rejected recovery attempts, reinforcing seller control.

Bitcoin Price Chart - Source:

BingX

Structurally, Bitcoin has broken down from a well-defined bearish flag, following the sharp rejection from the $94,000 triple-top resistance zone. The subsequent retest of the $89,800

pivot area failed, aligning with a descending

trendline and signaling continuation rather than reversal. This type of retest often precedes a fresh directional move.

Momentum supports caution.

Relative Strength Index (RSI) near 40 suggests weak bullish conviction, with recent candles showing indecision rather than accumulation. If BTC loses $85,300, downside targets open toward $83,100 and $80,600, completing the flag’s measured move. A bullish scenario requires a reclaim above $90,000, which could spark a relief rally toward $94,000.

Ethereum Price Forecast: Is ETH Headed for $2,500 or Setting Up a Bounce?

Ethereum remains under firm technical pressure on the 4-hour chart, though a straight move to $2,500 is not yet a done deal. ETH has slipped decisively below

Exponential Moving Average, such as, the 50-EMA near $3,020 and the 100-EMA around $3,055, confirming a short-term bearish trend shift after rejecting the $3,450 cycle high. That rejection formed a lower high, reinforcing the broader descending structure.

Price has also broken below a rising trendline that previously supported the rebound from the $2,600 base, signaling a failed bullish continuation. Momentum supports the downside. RSI near 28 shows ETH is oversold, but recent

candles still reflect active selling rather than clear exhaustion.

Ethereum Price Chart - Source:

BingX

Technically, a move toward $2,720 looks likely, with a deeper flush opening the $2,500–$2,490 support zone. Oversold conditions could spark a short-term bounce toward $2,970, but only a sustained reclaim above $3,000 would meaningfully weaken the bearish outlook.

Forward Outlook: How to Trade Crypto Markets Today

The near-term direction hinges on how markets digest US CPI and whether inflation surprises force a repricing of rate expectations. A softer print could stabilize risk sentiment and trigger short-term relief rallies, while a hotter reading may accelerate downside volatility across crypto. Beyond CPI, the BOJ’s policy stance remains a critical liquidity variable. Until inflation cools convincingly or central banks signal clearer easing, crypto markets are likely to stay range-bound, reactive, and headline-driven rather than trend-led.