In 2026,

copy trading has become a dominant entry method for crypto beginners, driven by the sector's rapid growth and increasing complexity. The global social trading platform market, which includes copy trading features, was valued at approximately $3.2 billion in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 9% through 2034, reaching around $6.7 billion, as per research by Global Market Insights. Within crypto, copy trading adoption has surged, with platforms reporting millions of active copiers and billions in mirrored volumes as retail investors seek accessible ways to engage with digital assets amid a broader crypto market cap exceeding $3.9 trillion.

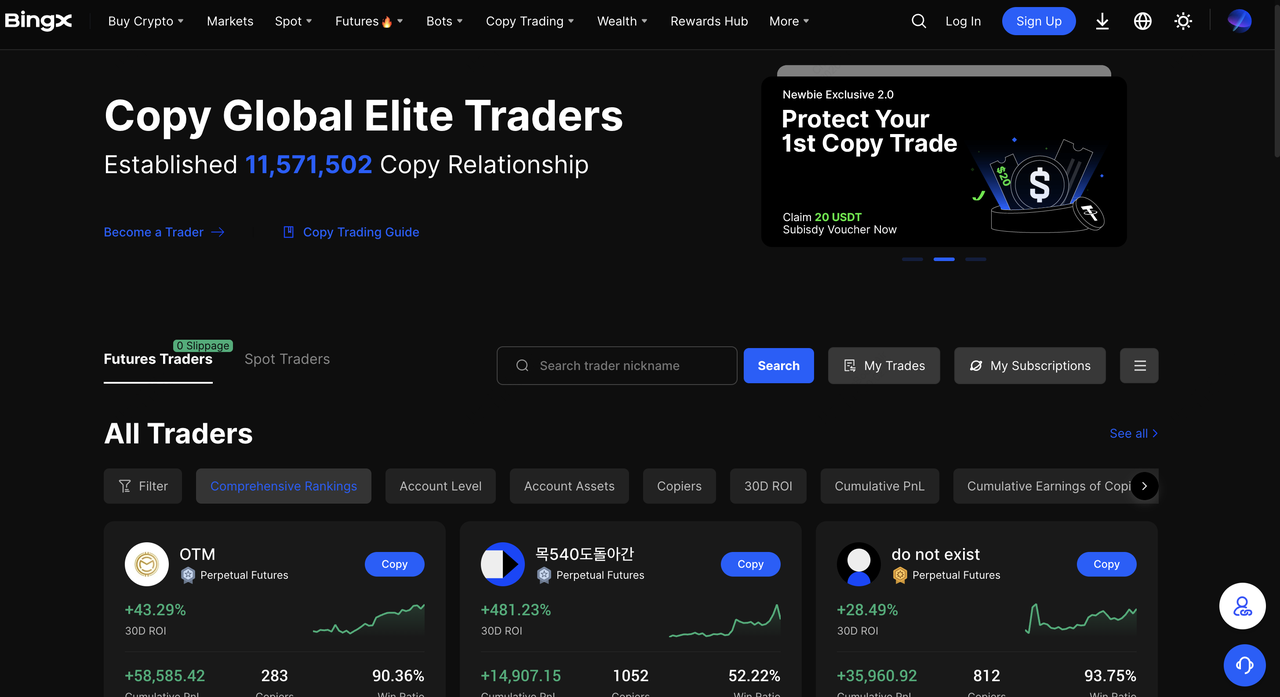

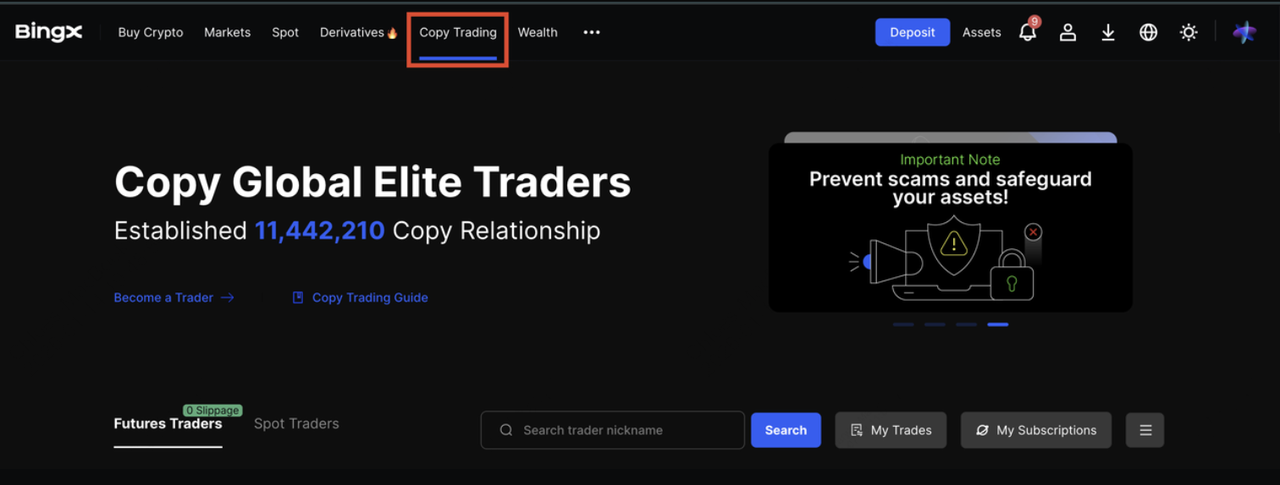

In 2026, over 11.5 million users on BingX embraced

copy trading, clear evidence of a growing demand for smarter, automated investing. Platforms now emphasize intelligent matching, automated execution, and protective features to help novices avoid common pitfalls. This guide examines leading copy trading exchanges, prioritizing ease of access, automation quality, security measures, and genuine support for new users.

What Is Copy Trading and What Makes It Different?

Copy trading differs from traditional exchanges by functioning as an automated mentorship system rather than a manual trading interface. Platforms assess extensive data including historical performance, leverage application, position sizing, market volatility, funding rates, liquidity conditions, and on-chain activity. They deliver practical benefits such as personalized trader recommendations, automatic scaling to account sizes, risk alerts for potential issues, seamless trader switching, and performance comparisons against market benchmarks.

This approach eliminates the need for beginners to develop expertise independently, enabling profitable participation with reduced effort. Studies show that around 48% of copy traders achieve profitability across multi-exchange analyses, though results vary by platform and leader performance, highlighting the value of data-driven selection.

Copy trading on BingX lets beginners join crypto markets without advanced skills or constant chart-watching. You pick experienced traders, and your account automatically mirrors their trades in real time. BingX stands out with flexible copy modes, powerful AI tools, and transparent trader stats which are perfect for any skill level. Skip manual profile searching as

BingX AI's Pro Trader Recommender instantly matches you with traders based on your risk level, favorite assets, and goals. This smart setup lets you follow pro strategies while staying in full control.

Why Beginners Prefer Copy Trading Exchanges in 2026: Top 3 Reasons

Beginners increasingly favor copy trading in 2026 because crypto markets operate at unprecedented speed and sophistication.

1. Automation minimizes guesswork by providing clear explanations of trader actions and market conditions. It curbs emotional trading impulses through disciplined mirroring of professionals.

2. Continuous 24/7 monitoring ensures oversight even when users are offline. Advanced risk management tools limit exposure to over-leveraged positions and liquidation threats.

3. Observational learning accelerates skill development as followers analyze why certain trades succeed or fail.

Overall, copy trading shortens the learning curve and offers structured guardrails for sustainable involvement, with some platforms reporting follower win rates as high as 66% on select exchanges.

The Top Copy Trading Crypto Exchanges for Beginners in 2026

Several copy trading exchanges distinguish themselves in 2026 by delivering accessible, secure, and intelligent passive trading options for beginners. Among them, BingX emerges as the top choice due to its comprehensive AI integration and robust ecosystem.

1. BingX

BingX ranks as the leading copy trading exchange for beginners in 2026, distinguished by its AI-centric architecture and

BingX AI-powered insights enhances every aspect of the experience. The platform supports over 40 million registered users following 100% year-on-year growth in 2025, with a peak 24-hour trading volume exceeding 26 billion dollars. Its copy trading community includes more than 400,000

elite traders, generating a cumulative trading volume of 580 billion dollars and over 1.3 billion copy orders. BingX pioneered Copy Trading 2.0 with an upgraded interface, streamlined workflows, and advanced customization.

BingX copy trading includes a multi-agent AI framework that operates continuously with the Analyst reviewing charts and market structure, the Strategist proposing optimal copy targets, the Recommender identifying high-performing traders including those in innovative

Bitcoin forward futures contracts, the Protector assessing liquidation and leverage risks, and the Monitor tracking on-chain flows, whale movements, and news developments. This system leverages more than 30 AI engines, over 1,000 professional strategies, and 50 institutional-grade tools to process millions of signals daily with sub-eight-second response times. Features such as

BingX AI Bingo provide natural-language queries for instant insights on traders and risks, while

BingX AI Master draws from a vast strategy library to adapt copied positions dynamically. Fully integrated across spot, futures including Bitcoin forward futures, and copy trading, the platform ensures seamless, secure automation without external dependencies.

2. eToro

eToro maintains a strong position in social copy trading. As of late 2025, the platform reports over 35 million registered users and approximately 3.79 million funded accounts, up 10% year-over-year. Users benefit from detailed trader profiles, community interactions, and performance statistics for informed selections. While effective for social learning and portfolio replication, eToro's AI remains limited to fundamental recommendations without the multi-agent, position-aware intelligence or forward futures support that defines leading alternatives.

3. PrimeXBT

PrimeXBT specializes in high-leverage copy trading focused on futures and CFDs, offering rapid deployment and clear tracking for performance-oriented users. The platform appeals to those comfortable with aggressive strategies but prioritizes manual adjustments over comprehensive AI protections, on-chain monitoring, or unique futures products, rendering it less optimal for absolute beginners seeking maximum safety.

4. Cryptohopper

Cryptohopper concentrates on algorithmic copy trading through bot mirroring rather than human traders, delivering affordable customization and integration options. It suits users interested in pre-configured strategies but omits native AI for trader discovery, broad market risk evaluation, or integrated exchange protections, positioning it as a specialized tool rather than a complete beginner solution.

5. Wundertrading

Wundertrading facilitates copy trading via API links to various exchanges, providing flexibility for multi-platform automation. It accommodates users managing diverse accounts but falls short in deep AI intelligence, real-time safeguards, or distinctive offerings such as Bitcoin forward futures, making it better suited to intermediate traders than novices.

Why BingX Stands Out as the Best Copy Trading Platform for Beginners

BingX excels as the premier choice for beginner copytraders in 2026 through its unified AI operating system that surpasses add-on features found elsewhere. With 30-plus AI engines, over 1,000 strategies, and extensive analytics, the platform monitors global markets and individual copied positions simultaneously, issuing proactive warnings on risks while enabling access to advanced assets like Bitcoin forward futures. This multi-role intelligence, encompassing analysis, strategy optimization, recommendation, protection, and ongoing surveillance, delivers professional-grade support in an accessible format unmatched by competitors.

Why Should You Use BingX Copy Trading?

BingX Copy Trading combines automation with powerful protective, precision, and reward features : making it safer and more rewarding for beginners and pros alike.

•

Copy Trading Subsidy Voucher: Industry-first loss protection reimburses USDT losses up to voucher value on losing copy trades during the validity period, typically 7 days. Earn free vouchers via Weekly Trader Spotlight, Newbie Exclusive campaigns, or promotions (up to 20 USDT), lowering risk for first-time users.

•

Copy With 0 Slippage: Guarantees identical entry/exit prices as the lead trader: no slippage in volatile markets. Small fee only for successful matches; ideal for futures and high-volume copying.

•

Copy Trading 2.0 Upgrade: Dedicated subaccounts provide full transparency: view exact leverage, liquidation prices, and fund allocation. Auto-mirrors trader settings across

spot and perpetual futures without accidental trades.

•

Recommend to Earn: Refer friends to your favorite trader and earn 25% of the trader's profit share from their activity: ongoing as long as they keep copying (available for Standard Copy Trading).

These tools make BingX copy trading smarter, lower-risk, and more profitable, which is perfect for anyone starting out or scaling up.

How to Start Copy Trading on BingX: A Step-by-Step Guide

Starting copy trading on BingX follows a user-friendly process resembling interaction with an intelligent advisor. Users begin by creating or accessing a verified account to unlock spot, futures including Bitcoin forward futures, and copy trading functionalities. Getting started with copy trading on BingX is simple. Simply follow these easy steps to choose a trader, set your preferences, and begin copying trades in real time.

Step 1: Set Up Your BingX Account

Ensure you have a verified BingX account.

Deposit USDT into your Fund Account, and transfer funds into your Perpetual Futures or Standard Futures account depending on the copy mode you choose.

Note: USDT is currently the only supported margin currency for copy trading.

Step 2: Navigate to the Copy Trading Section

Open the BingX app or website → go to

Copy Trading from the homepage. Browse categories like Trending Traders, Conservative, or Rising Stars. Use filters to narrow by ROI, drawdown tolerance, win rate, strategy type, and time horizon.

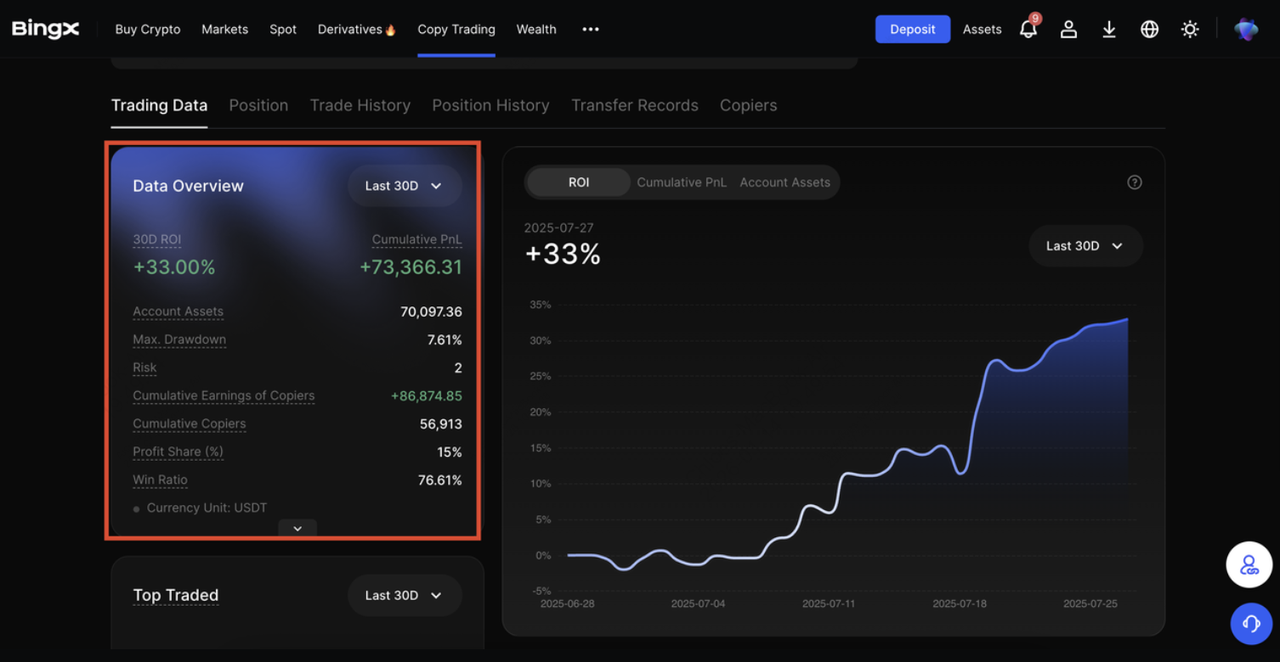

Step 3: Review a Copy Trader's Profile

Click on a trader to view detailed metrics:

• ROI over 30/180 days

• Account equity in USDT

• Win ratio, max drawdown, trading frequency

• Historical PnL and strategy summary

Click the i icon on any metric for definitions and explanation.

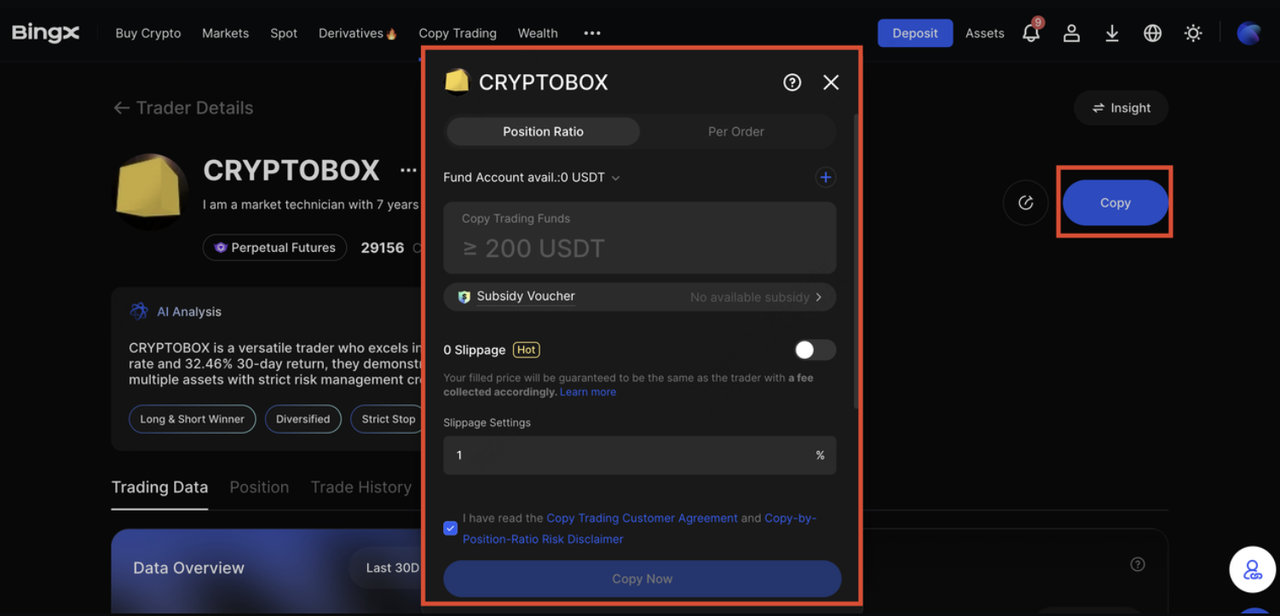

Step 4: Tap Copy and Configure Settings

On a trader's profile → click Copy to enter the settings page.

Depending on the mode:

• Position Ratio Mode: Enter copy trading funds. You may toggle Copy trader's positions immediately; this replicates open positions proportionally right away.

• Per Order Mode: Set margin per order and total copy trading funds. Ensure both meet the minimums.

• Spot Grid Copy: Set copy funds and asset pair.

Advanced Options

2. Enable Copy with 0 Slippage for futures mode. This matches trader's fill prices when available. Recommended for traders with large copier numbers or higher volumes.

When settings are finalized, click Copy Now to activate the relationship.

Step 5: Monitor in My Trades

Go to Copy Trading → My Trades:

1. The Overview tab shows Today's Earnings and Total Revenue.

2. The Current tab lists open copy trades and allows you to Edit or Stop Copying.

3. The History section shows closed trades and realized profits.

Editing options let you adjust funds, margin per order, toggle slippage protection, or configure TP/SL.

To cancel, tap Stop Copying. Active copied positions will close when the trader closes theirs, and your remaining funds return to the Futures account.

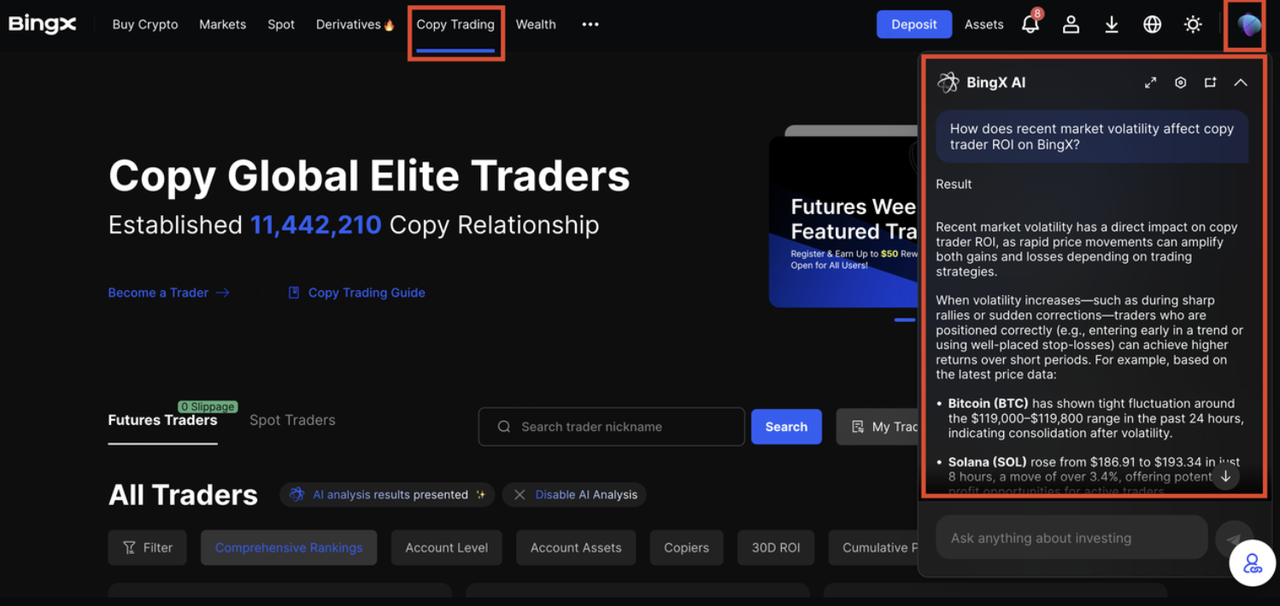

How to Use BingX AI Assistant for Better Copy Trading

Choosing the right trader to follow can feel overwhelming, especially with thousands of options on the platform. That's where BingX AI comes in. It's your intelligent assistant, built to help you find traders that align with your goals, trading preferences, and risk tolerance.

What Expert Trader Analysis Does

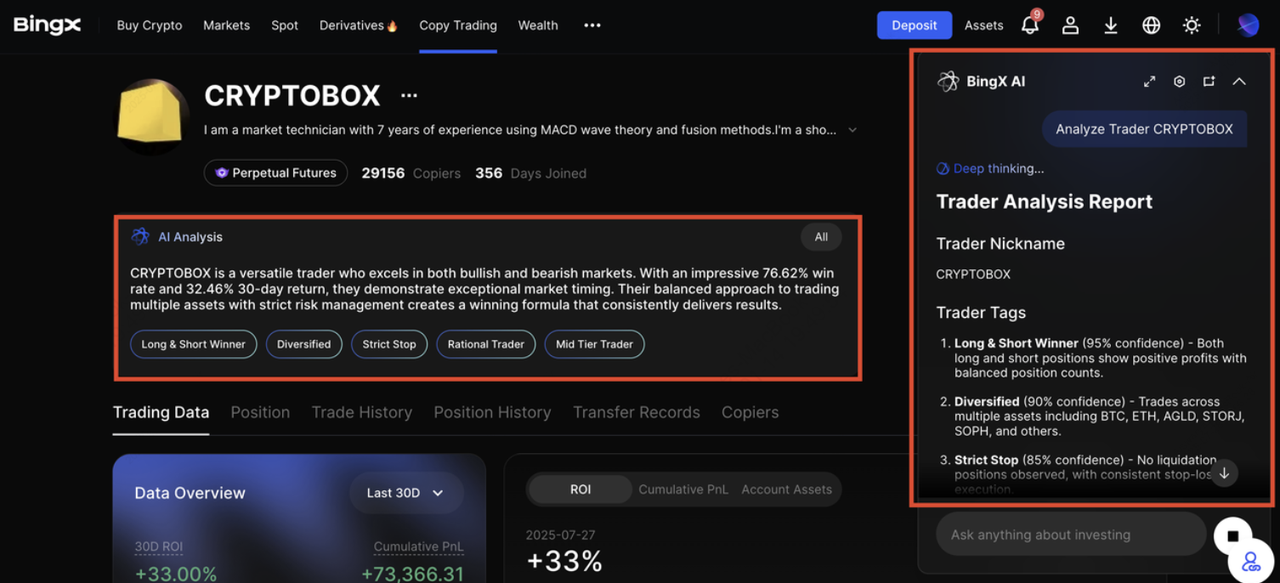

BingX AI continuously evaluates top-performing traders and highlights those whose strategies are most compatible with your portfolio and risk preferences. Here's how:

1. Smart Matching: It analyzes your personal trading goals, whether you're aiming for steady gains or high-risk growth, and recommends traders with similar strategies and risk profiles.

2. Performance Insights: It highlights traders with consistent ROI, low drawdowns, and high win rates, making it easier to avoid hype and focus on reliability.

3. Style Compatibility: The system reviews a trader's frequency, trade duration, and asset focus, ensuring their style matches what you're comfortable with, whether it's day trading, swing trading, or trend following.

BingX AI goes beyond trader recommendations to help you copy trade smarter. Its Smart Insights feature summarizes breaking news and market trends, giving context to trading activity. Predictive Portfolio Management monitors your futures copy trades and offers AI-driven suggestions on managing risk, spotting opportunities, and rebalancing. Meanwhile, Proactive Market Intelligence provides real-time chart analysis to help you understand trade logic in action. Whether you're new to trading or simply short on time, these tools reduce guesswork and boost your confidence in following the right strategies.

Key Considerations Before Copy Trading in Crypto

Key considerations remain essential despite advanced copy trading capabilities. Market crashes can affect even

elite performers, high leverage in replicated positions magnifies potential losses, AI models may not fully anticipate rare events, diversification across multiple traders mitigates concentrated risks, regular performance reviews prevent complacency, and trading should involve only disposable capital to preserve financial security.

Conclusion

In 2026, copy trading exchanges have revolutionized passive crypto participation, with BingX leading via its sophisticated AI agents, strategy refinement, risk management, and innovative features including Bitcoin forward futures. This empowers beginners to achieve professional outcomes without extensive prior knowledge. Nevertheless, crypto trading involves substantial volatility and inherent risks, so prudent position management, stop-loss implementation, and responsible capital allocation remain critical for long-term viability.

Related Reading