The landscape of crypto wealth in 2026 has transitioned from speculative moonshots to institutional-grade infrastructure. While the early days of crypto were defined by pseudonymous cypherpunks, the 2026 leaderboard is dominated by the architects of the global liquidity layer: exchange owners, stablecoin issuers, and

Bitcoin treasury pioneers.

Total crypto market cap | Source: Coinmarketcap

As of February 2026, the total crypto market capitalization sits around $2.3 trillion, despite a volatile quarter. The concentration of wealth among these ten individuals offers a roadmap of where value is accruing, shifting from pure asset appreciation to the ownership of the networks and exchanges that facilitate global trade.

This article breaks down the Top 10 Crypto Billionaires of 2026, identifying the core assets and entities that power their multi-billion dollar fortunes.

The 2026 Crypto Billionaire Leaderboard: Top 10 Richest Crypto Whales

When analyzing wealth in 2026, we distinguish between On-Chain Holdings that are publicly verifiable and Total Estimated Net Worth, which includes private equity in firms like Binance and Tether.

| Rank |

Name |

Estimated Net Worth |

Primary Source of Wealth |

| 1 |

Changpeng Zhao (CZ) |

$82.8 Billion |

Binance Equity, BNB |

| 2 |

Giancarlo Devasini |

$12.3 Billion |

Tether (USDT), Bitfinex |

| 3 |

Chris Larsen |

$13.1 Billion |

Ripple, XRP Holdings |

| 4 |

Paolo Ardoino |

$9.5 Billion |

Tether Ownership |

| 5 |

Jean-Louis van der Velde |

$9.5 Billion |

Tether, Bitfinex |

| 6 |

Justin Sun |

$9.47 Billion |

TRON (TRX), Crypto Ventures |

| 7 |

Michael Saylor |

$8.6 Billion |

Strategy (MSTR), Personal BTC |

| 8 |

Brian Armstrong |

$14.2 Billion |

Coinbase Equity, ETH |

| 9 |

Michael Novogratz |

$7.5 Billion |

Galaxy Digital |

| 10 |

Donald Trump |

$7.2 Billion |

$TRUMP, NFTs, DeFi Ventures |

Data as of February 20, 2026. Estimates based on Forbes, Bloomberg, and Arkham Intelligence.

1. Changpeng Zhao (CZ)

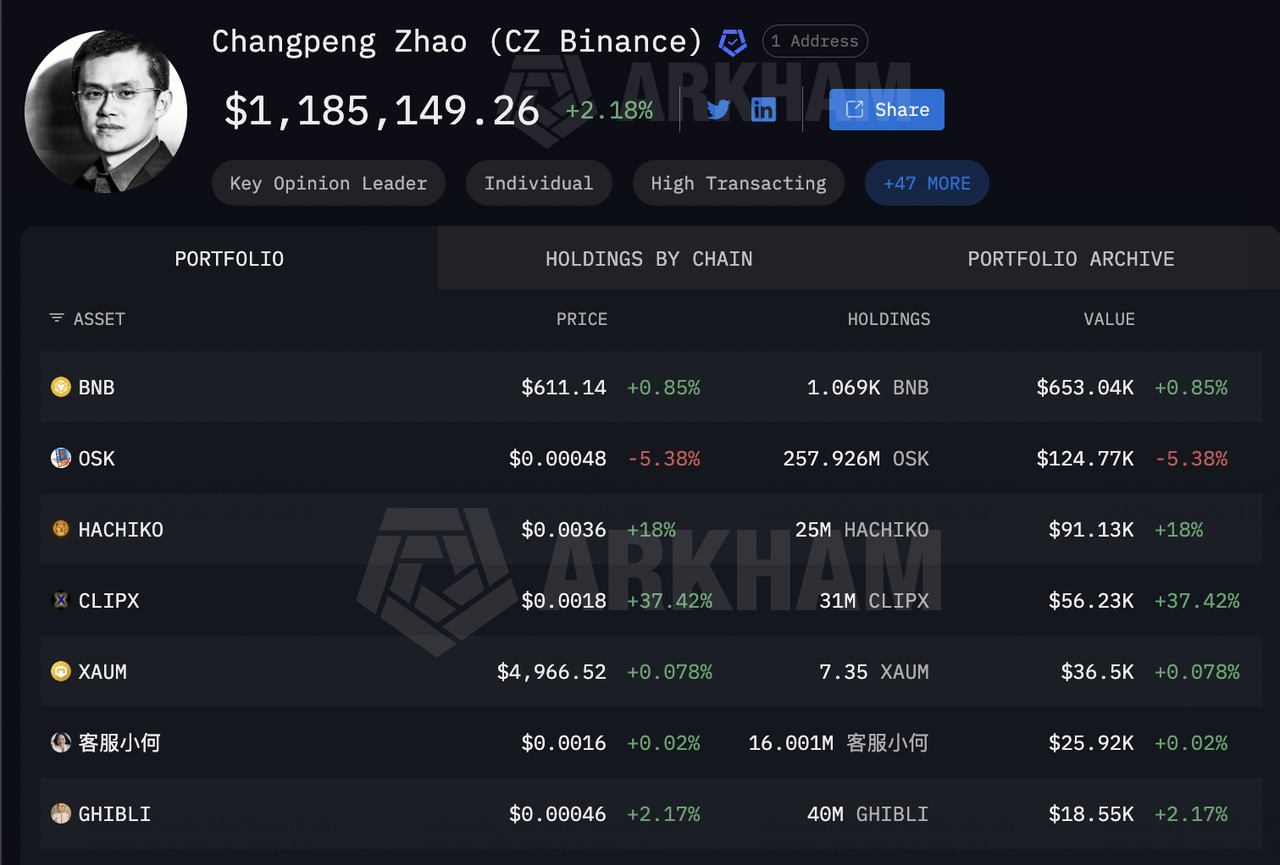

CZ's crypto holdings | Source: Arkham Intelligence

Changpeng Zhao (CZ) remains the wealthiest identifiable person in the crypto sector with a total net worth of $45.1 billion, ranking 43rd globally on the Bloomberg Billionaires Index. His fortune is underpinned by a 90% equity stake in Binance, which maintained its dominance as the primary venue for global liquidity even after his transition from the CEO role. In 2026, his personal portfolio, estimated to be 98.5%

BNB, has seen a fundamental shift in utility as BNB evolved from a simple exchange discount token into the primary gas asset for the

AI-Agent and

DePIN (Decentralized Physical Infrastructure) sectors.

Key Exposure: 98.5% BNB, 1.3% BTC.

2. Giancarlo Devasini

As the CFO and majority shareholder of

Tether, Giancarlo Devasini’s $13.2 billion net worth reflects the unprecedented profitability of the

stablecoin sector. In early 2026, Tether leveraged its $180 billion+ market cap to generate quarterly profits exceeding $1.5 billion, primarily through interest on its massive U.S. Treasury holdings. Devasini’s wealth is effectively a bet on the Tokenized Dollar, as

USDT now facilitates over 75% of all on-chain trading volume, making him the primary gatekeeper of crypto-fiat on-ramps.

Key Exposure: 47% stake in Tether Holdings Ltd., Bitfinex equity.

3. Chris Larsen

Chris Larsen’s $13.1 billion net worth is tied to the survival and expansion of Ripple Labs and the

XRP Ledger. Despite years of legal scrutiny, Ripple’s successful integration into the

Central Bank Digital Currency (CBDC) frameworks of several sovereign nations in 2025 has stabilized

XRP’s utility. Larsen’s wealth is uniquely split between private equity and a massive personal stash of XRP, positioning him as a major liquidity provider for institutional cross-border settlement systems.

Key Exposure: 5.1 billion XRP, Ripple Labs equity.

4. Paolo Ardoino

As the CEO of Tether, Paolo Ardoino’s $9.5 billion fortune is driven by his 20% ownership stake in the world’s largest stablecoin issuer. Ardoino has pivoted Tether's 2026 strategy toward technological sovereignty, investing heavily in P2P communications and Bitcoin mining infrastructure. His wealth is a direct reflection of Tether's status as a private central bank, with a balance sheet that now rivals major traditional financial institutions in U.S. Treasury holdings.

Key Exposure: 20% Tether equity, Holepunch (P2P) infrastructure.

5. Jean-Louis van der Velde

Jean-Louis van der Velde holds an estimated $9.5 billion, primarily through his foundational roles and ownership in the Bitfinex-Tether ecosystem. His wealth represents the exchange-stablecoin synergy that defined the last decade of crypto. In 2026, he remains an influential but quiet figure, managing the deep liquidity pools that connect the Bitfinex exchange to the broader Tether reserve management system.

Key Exposure: Tether Holdings Ltd. equity, Bitfinex ownership.

6. Justin Sun

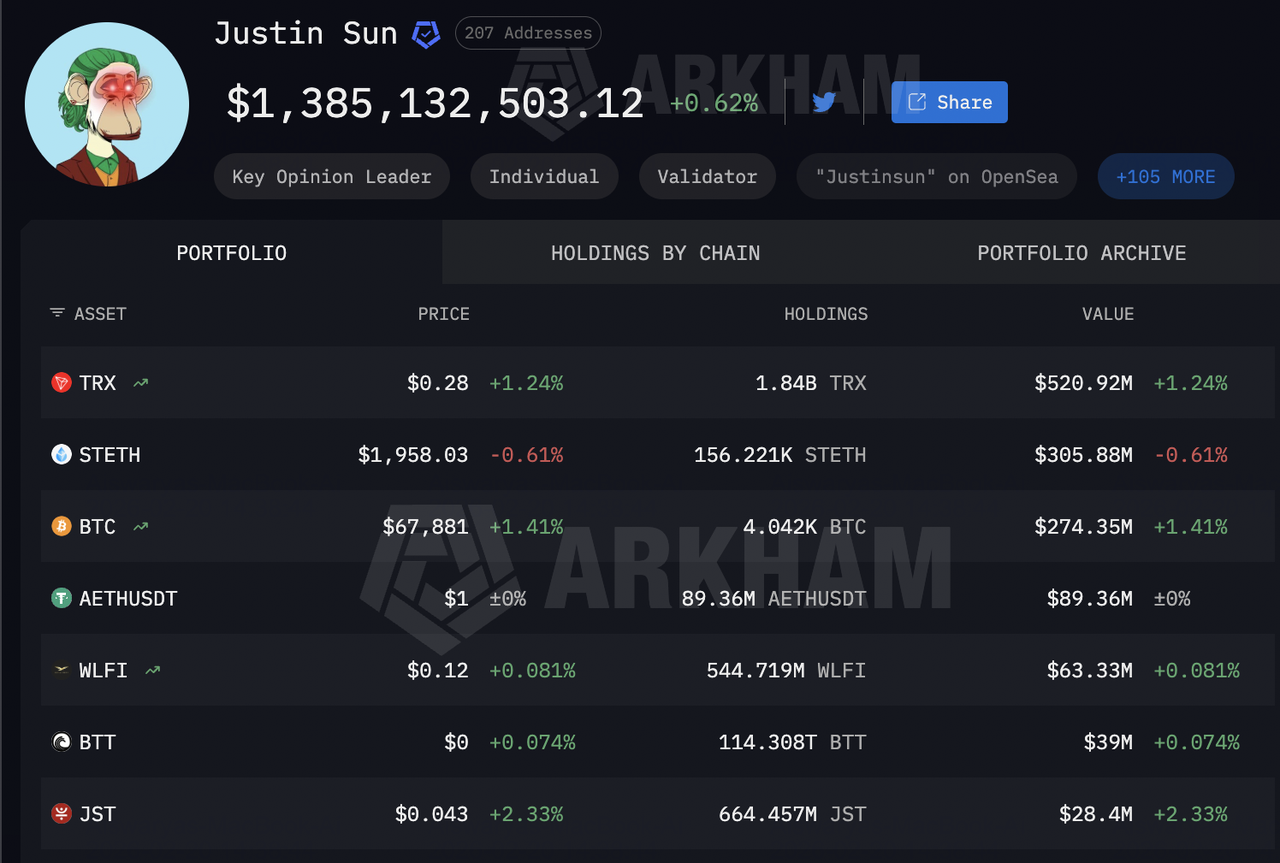

Justin Sun's crypto holdings | Source: Arkham Intelligence

With a net worth of $9.47 billion, Justin Sun is the ultimate on-chain opportunist. His portfolio is a complex web of

TRON (TRX), of which he holds 15% of the total supply,

BitTorrent (BTT), and significant stakes in the HTX and Poloniex exchanges. In 2026, Sun has increasingly positioned his wealth within the PolitiFi sector, notably through a $60 million strategic position in the Trump-linked

World Liberty Financial (WLFI) project.

Key Exposure: TRX, 49,000+ ETH, BTC, and exchange equity.

7. Michael Saylor

Michael Saylor’s $8.6 billion net worth is the most concentrated pure-play on Bitcoin among the top ten. Beyond his 9.9% stake in

Strategy (MSTR), which now functions as a Bitcoin Development Company holding over 714,000 BTC, Saylor personally holds 17,732 BTC. His wealth is a barometer for the global Orange Pill movement; in 2026, his success has turned Strategy into the first company to utilize

Bitcoin-backed credit (STRC) for perpetual capital expansion.

Key Exposure: MSTR equity, 17,732 personal BTC.

8. Brian Armstrong

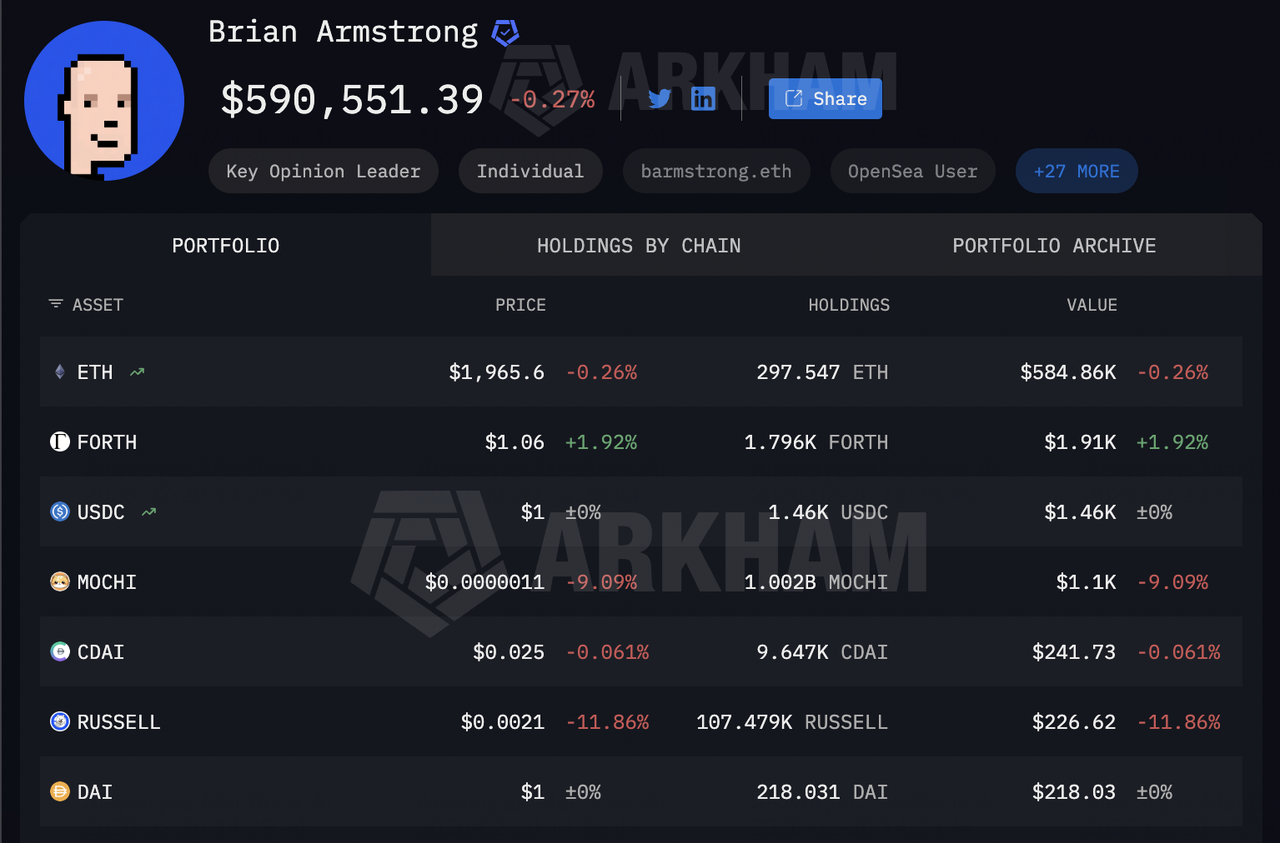

Brian Armstrong's crypto holdings | Source: Arkham Intelligence

With a net worth of $7.6 billion,

Brian Armstrong represents the institutionalization of crypto wealth through his 14% stake in

Coinbase. By February 2026, Coinbase solidified its status as the world’s most critical infrastructure provider, serving as the lead custodian for 8 out of 11 U.S.

Spot Bitcoin ETFs. Armstrong’s fortune has increasingly decoupled from pure BTC price action, instead tracking the $50 billion+ AUM (assets under management) of institutional clients and the rapid expansion of Coinbase’s

Base Layer-2 network.

9. Michael Novogratz

Michael Novogratz has a net worth of $7.5 billion, driven by his leadership of Galaxy Digital. His fortune has shifted from speculative trading to institutional service fees, as Galaxy became a primary bridge for TradFi firms entering the Bitcoin and Ethereum markets. In 2026, Galaxy’s mining division and asset management arm, overseeing billions in ETF and venture capital, are the primary engines of his wealth.

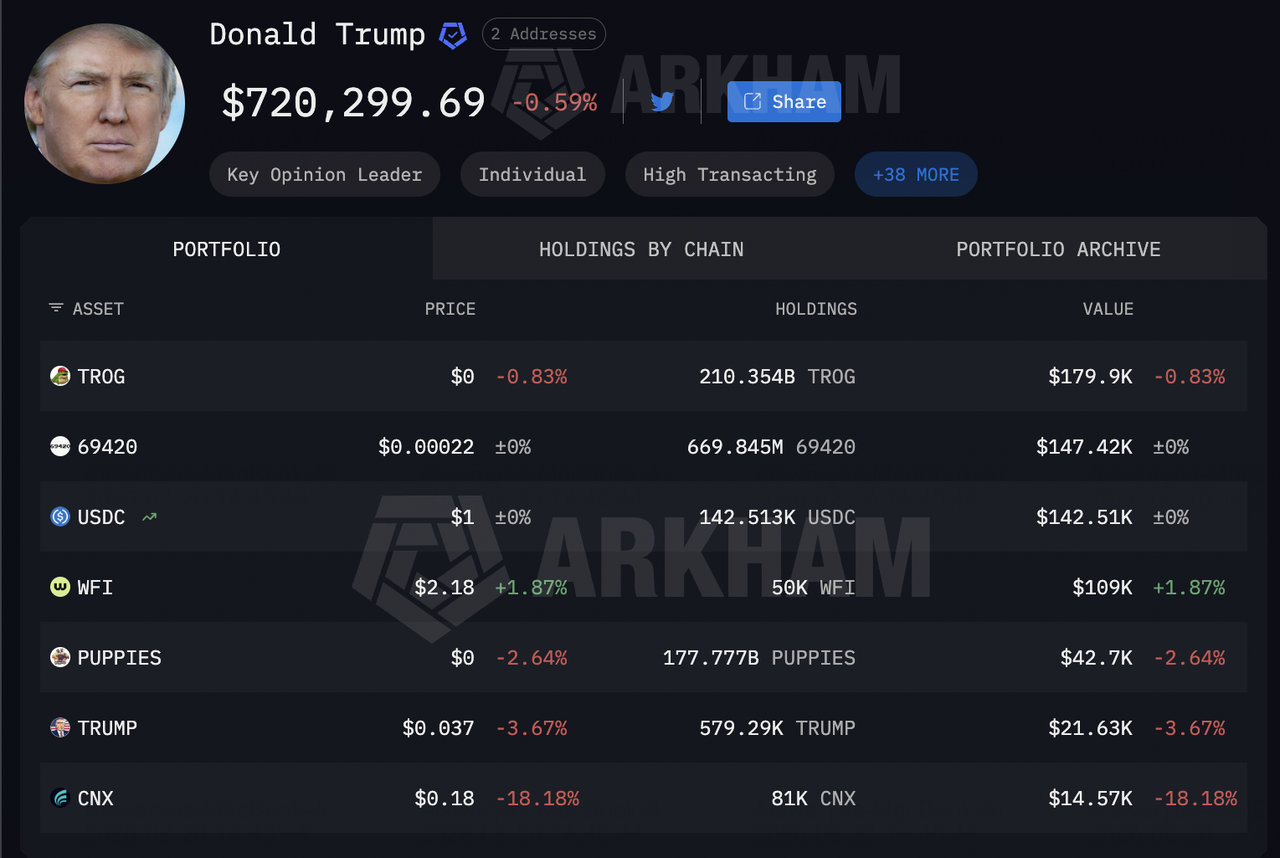

10. Donald Trump

Donald Trump's crypto holdings | Source: Arkham Intelligence

Donald Trump’s entry into the top ten with a $7.2 billion crypto-linked net worth is a milestone for Social Finance. His fortune in this sector is not derived from mining or coding, but from brand tokenization. Between his NFT royalties, licensing fees from projects like

$TRUMP, and his family’s involvement in

World Liberty Financial, Trump has demonstrated that political equity can be converted into massive digital asset reserves in the 2026 market.

Buy Official TRUMP (TRUMP)

Key Exposure: $TRUMP tokens, NFT royalty streams, WLFI interests.

The Cautionary List: Rich on Paper, Locked in Reality

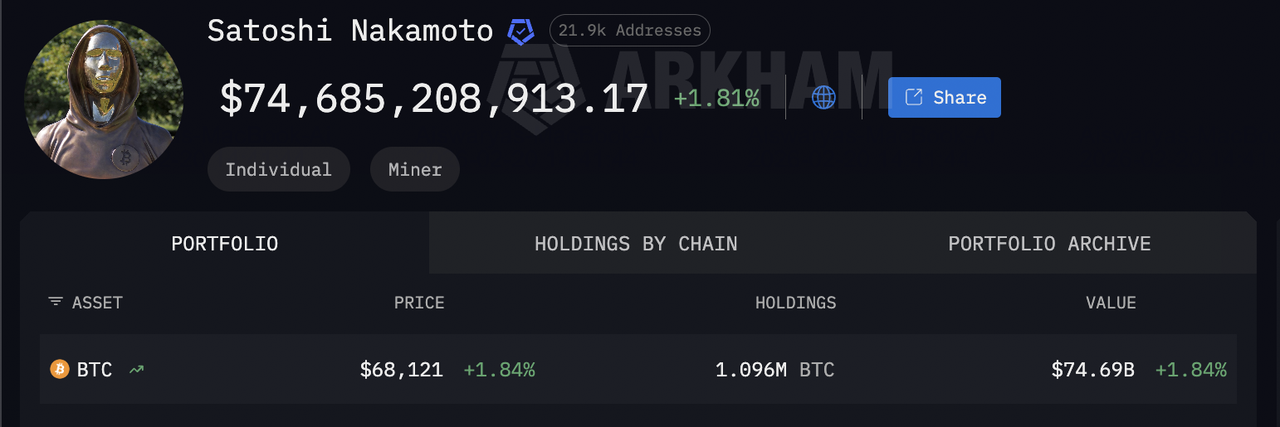

Satoshi Nakamoto's Bitcoin holdings | Source: Arkham Intelligence

A fascinating sub-sector of 2026 crypto wealth includes individuals who are billionaires on-chain but cannot spend a cent.

1. Satoshi Nakamoto ($74.6 Billion): The Bitcoin creator remains the wealthiest entity in the history of the asset class. Estimated to hold 1,096,354 BTC across 22,000 addresses, Satoshi’s wealth is the ultimate supply lock. These coins have seen zero outbound activity since 2010; any movement would be considered a Black Swan event, potentially re-pricing the entire global crypto market in minutes.

2. Rain Lohmus ($490 Million) The co-founder of LHV Bank is the victim of the world's most valuable lost Ethereum wallet. His 250,000 ETH, acquired during the 2014 ICO for approximately $75,000, is worth nearly a billion dollars in 2026. Because the private keys were lost, this supply is effectively burned, serving as a permanent deflationary gift to all other ETH holders.

3. Stefan Thomas ($477 Million) Stefan Thomas’s wealth is trapped in an IronKey hardware wallet containing 7,002 BTC. In 2026, this remains one of the most high-pressure situations in tech: the device allows only ten password attempts before permanently encrypting and wiping the data. Thomas has two attempts remaining, meaning over $477 million hangs on a single correct guess.

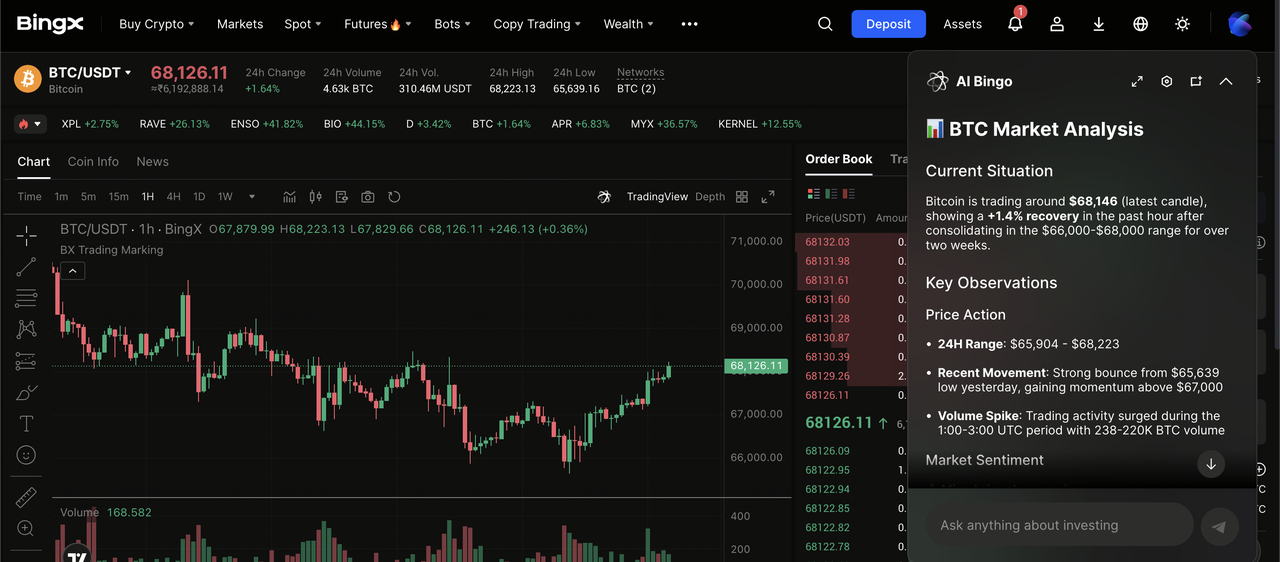

How to Trade Like the Biggest Crypto Whales on BingX

Whether you want to follow the massive accumulation of Michael Saylor or the aggressive liquidity moves of Justin Sun, BingX provides a comprehensive suite of AI-driven products designed to help you trade with institutional precision. By integrating

BingX AI Master, traders can now access real-time strategy analysis, whale-zone liquidity clusters, and personalized risk assessments that were once exclusive to hedge funds.

1. Spot Wealth Accumulation

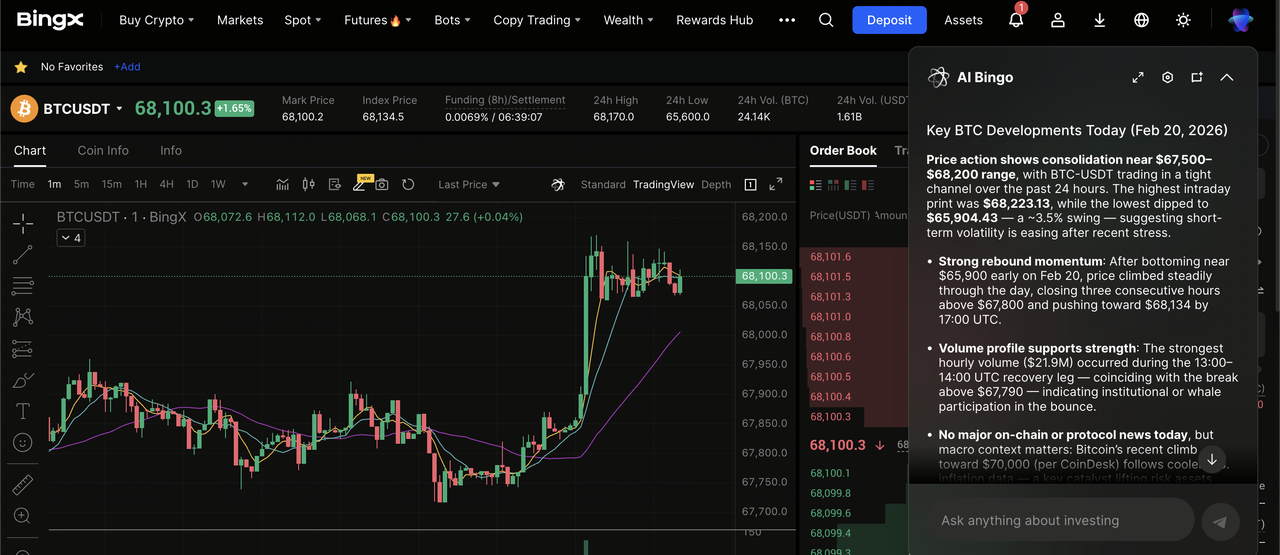

BTC/USDT trading pair on the spot market powered by BingX AI insights

For long-term HODLers who want to own the underlying asset like Michael Saylor, the BingX Spot market offers access to over 800 tokens with top-tier security.

Step 1: Deposit USDT or buy crypto directly via the Buy Crypto tab.

Step 2: Navigate to

Spot and search for your target pair, e.g., BTC/USDT or

ETH/USDT.

Step 3: Choose

Limit Order to set a specific entry price or Market Order for instant execution.

Step 4: Enter the amount and click Buy to secure your assets in your BingX wallet.

2. BingX AI-Enhanced Copy Trading

Mimic the moves of Elite Traders without needing to monitor the charts 24/7. Use the BingX AI Master to analyze trader consistency and risk metrics before committing funds.

Step 2: Use the AI filter to find traders based on ROI, drawdown, and Stability Scores.

Step 3: Click Copy on a selected profile and choose your investment amount.

3. High-Leverage Futures Trading

Capitalize on the price swings caused by whale

liquidations. BingX Futures allows you to go long or short with up to 150x leverage.

Step 2: Select Perpetual Futures and choose your trading pair.

Step 3: Select your Leverage level and Margin Mode (Isolated or Cross).

Step 4: Analyze crypto

Liquidation Heatmaps to find optimal entry points, then click Open Long or Open Short.

4. BingX Recurring Buy to DCA Crypto

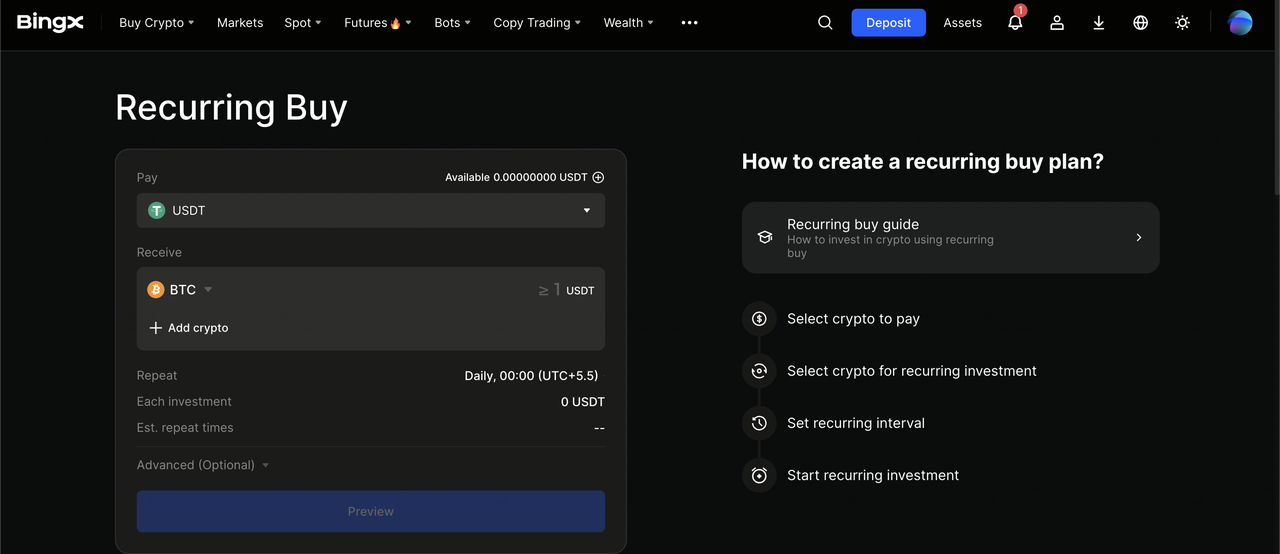

How to dollar-cost average (DCA) crypto on BingX Recurring Buy

Automate your accumulation strategy to remove emotional bias, the preferred method for building generational wealth over time.

Step 2: Select your payment currency like USDT or

USDC and up to 5 target assets, e.g.,

BTC,

ETH,

SOL.

Step 3: Set your Investment Frequency like Hourly, Daily, Weekly, or Monthly and amount.

Step 4: Confirm the plan. BingX AI will execute the buy at the exact market price during each scheduled cycle.

Track Whale Movements with BingX AI

Don't trade in the dark. BingX’s AI-driven insights monitor the blockchain 24/7 to provide:

• Whale Alerts: Notifications for large on-chain transfers to/from exchanges.

• Liquidity Clusters: Visualizing Wall of Orders where big money is waiting to buy or sell.

• Sentiment Snapshots: Real-time analysis of social trends and whale conviction levels.

Conclusion: Is the Era of the Individual Whale Ending?

The 2026 billionaire list shows a clear trend: Institutionalization. The wealthiest figures are no longer just traders; they are the owners of the infrastructure. As Bitcoin and stablecoins become integrated into national treasuries and global payments, the barrier to entry for the Top 10 continues to rise.

For retail investors, the takeaway is clear: focus on infrastructure and utility. While you may not be a billionaire, owning the assets that these titans are building upon, like BTC, ETH, and BNB, positions you for the long-term growth of the digital economy.

DYOR and use BingX tools to track where the smart money is moving next.

Related Reading