The landscape of

Dogecoin (DOGE) ownership has reached a unique junction of institutionalization and political relevance in early 2026. Long gone are the days when DOGE was seen strictly as a joke coin; it has now inspired a namesake U.S. government department and moved into the portfolios of major asset managers. As DOGE stabilizes around the $0.10 mark during the February 2026 market cooling, the focus has shifted from retail "To the Moon" hype to transparent, exchange-led liquidity and long-term whale accumulation.

By February 2026, the total circulating supply of Dogecoin stands at approximately 168.75 billion DOGE. Unlike

Bitcoin or

XRP, Dogecoin has no hard supply cap, adding roughly 5 billion new tokens annually to encourage usage over hoarding. Despite its inflationary nature, the concentration of supply remains remarkably high, with the top 100 addresses controlling nearly 66% of the total supply.

This article breaks down the 2026 Dogecoin Rich List, identifying the top 10 DOGE whales and the custodial entities that anchor the world's most famous

memecoin.

Who Are the Top 10 Dogecoin Holders: 2026 Entity Breakdown

When analyzing the DOGE rich list, it is critical to recognize that the largest wallets are custodial exchange wallets. These addresses do not represent the wealth of a single whale, but rather the aggregated holdings of millions of retail users.

| Rank |

Holder / Entity |

Account Type |

Balance (DOGE) |

% of Total Supply |

| 1 |

Robinhood |

Exchange Custody (Cold) |

27,164,003,566 |

17.72% |

| 2 |

Binance |

Exchange Custody |

15,700,000,000 |

7.53% |

| 3 |

Upbit |

Exchange Custody (Cold) |

11,194,081,116 |

7.30% |

| 4 |

Cryptsy (Legacy) |

Dormant Exchange |

5,031,001,968 |

3.28% |

| 5 |

Private Holder |

Individual Whale |

3,400,791,933 |

2.22% |

| 6 |

Robinhood (Hot) |

Operational Liquidity |

3,206,314,463 |

2.09% |

| 7 |

Binance (Hot) |

Operational Liquidity |

2,121,500,238 |

1.38% |

| 8 |

Dogeparty (Burn) |

Dead Address (XDP) |

1,854,588,093 |

1.21% |

| 9 |

Binance (Wallet 3) |

Exchange Custody |

1,230,000,000 |

0.81% |

| 10 |

Private Holder |

Individual Whale |

1,211,726,394 |

0.79% |

Data as of February 19, 2026. Values calculated at $0.1007/DOGE.

This concentration pattern is mirrored across the industry's most prominent assets:

• Ethereum (ETH): The

top 10 Ethereum holders list is uniquely defined by the Beacon Deposit Contract, which holds over 77 million staked ETH, alongside significant custodial reserves from Binance,

Robinhood, and the Wrapped Ether (WETH) smart contract.

• XRP (XRP): Similarly, the

top 10 XRP holders are heavily concentrated within Ripple Labs’ escrow system, managing roughly 34 billion XRP, and the

cold wallets of major exchanges like Bithumb and Upbit.

Key Insights Into the Dogecoin Whale Distribution

1. The Robinhood Hegemony: Robinhood remains the single largest custodian of Dogecoin, holding nearly 18% of the supply in its primary cold wallet. This highlights DOGE's massive popularity among U.S. retail traders who prefer user-friendly fintech platforms over native crypto exchanges.

2. The Zombie Millions: The Cryptsy wallet at Rank 4 holds over 5 billion DOGE. This is a legacy address from a defunct exchange. Because these coins have not moved since 2014, they are largely considered "lost" or illiquid, acting as a phantom supply that could cause a market shock if ever reactivated.

3. Burned for Eternity: The Dogeparty (XDP) address represents a unique chapter in DOGE history where users burned coins to create a new token. These 1.85 billion coins are cryptographically unspendable, permanently reducing the effective circulating supply.

4. Institutional Shift: 2026 marks the first year of the Dogecoin ETF era, with firms like Bitwise filing for DOGE-backed products. This is leading to a gradual shift where coins are moving from hot wallets to highly secure, regulated institutional custody.

The Dogecoin Rich List 2026: Top 10 DOGE Holders (February 2026)

This section breaks down the top 10 Dogecoin Rich List as of February 2026, highlighting 10 of the biggest DOGE holders and what their wallet concentrations reveal about ownership distribution, whale influence, and potential market impact.

1. Robinhood Exchange Cold Wallet

As of February 2026, Robinhood remains the undisputed titan of the Dogecoin ecosystem, holding 27.16 billion DOGE, nearly 18% of the total circulating supply. This wallet serves as the primary gateway for Western retail investors; interestingly, while the number of Dogecoin millionaire addresses dropped by 9.7% in the first six weeks of 2026 due to a 15% price drawdown, the balance in this specific wallet has remained remarkably inelastic. This stability indicates that despite short-term market turbulence, the core HODL conviction among Robinhood’s retail base remains at a multi-year high.

2. Binance

Binance controls a consolidated reserve of approximately 15.7 billion DOGE, positioning it as the world’s most significant provider of Dogecoin liquidity. Unlike the stagnant cold reserves of other platforms, Binance’s wallets are characterized by extreme velocity, facilitating over $300 million in daily capital movement. Their February 2026

Proof of Reserves (PoR) report confirms a 100%+ collateralization ratio, verifying that every token in this massive pool is backed 1:1, serving as a critical buffer for global institutional and retail trading pairs.

3. Upbit

Holding 11.19 billion DOGE, Upbit represents the epicenter of South Korean crypto demand, where the "Kimchi Premium" often drives local DOGE prices higher than global averages. In early 2026, on-chain data shows that Dogecoin’s daily trading volume on Upbit has frequently flipped Bitcoin and Ethereum, at times accounting for over 20% of the exchange's total turnover. This wallet is the single most important barometer for East Asian retail sentiment and high-beta speculative surges.

4. Cryptsy (Legacy Wallet)

This address is the ghost of the 2014 era, containing 5.03 billion DOGE or approx. 3.3% of supply that has remained untouched for over a decade. Tracing back to the now-defunct Florida-based Cryptsy exchange, these funds are legally frozen and technically considered zombie coins. Because the private keys are likely lost or under federal lock, this wallet acts as a passive deflationary mechanism; however, if these coins were ever to move, it would trigger a Black Swan event, potentially flooding the market with $500 million in sudden sell-side pressure.

5. Anonymous Individual Whale (AC8az...)

Holding 3.4 billion DOGE, this is the largest

non-custodial wallet on the blockchain, widely speculated to belong to an early DOGE pioneer or a high-net-worth strategic investor. On-chain forensics from late 2025 and early 2026 reveal a buy the dip accumulation strategy, with this entity adding over 100 million DOGE during recent price corrections. This wallet’s activity is often used by whale-watching bots to signal major support levels for the broader market.

6. Robinhood Operational (Hot) Wallet

Distinct from their cold storage, this operational wallet holds roughly 3.2 billion DOGE and functions as the exchange’s primary engine for daily settlements. It is the most sensitive indicator of retail fear and greed; large influxes to this address typically precede a retail-led sell-off, while massive outflows back to the cold storage at Rank 1 suggest that users are buying and "locking away" their coins for the long term.

7. Dogeparty (XDP) Burn Address

Identified by the unique DDogeparty string, this wallet contains 1.85 billion DOGE that were permanently destroyed in 2014 to mint XDP tokens. In 2026, this address serves a vital economic function: it permanently removes more than 1.2% of all DOGE from circulation, partially neutralizing the inflationary impact of the 5 billion new DOGE minted annually through mining rewards. It is the black hole of the Dogecoin galaxy, where DOGE coins go in, but they never come out.

8. Kraken

As of February 2026, Kraken maintains a robust holding of approximately 1.0 billion DOGE, positioning it as the premier bridge for North American institutional capital. Kraken's role has become mission-critical following its selection as a primary liquidity partner and reference venue for the

REX-Osprey DOGE ETF (DOJE). While U.S. Bank serves as the fund’s structural custodian, Kraken provides the essential deep-book liquidity required to track the spot price without synthetic slippage.

On-chain data indicates a steady migration of DOGE into Kraken’s secure vaults as financial advisors shift from speculative retail trading to audit-ready, 1940 Act-compliant ETF structures.

9. Gate.io and Bybit

Gate.io and Bybit round out the top tier, each managing liquidity pools ranging from 1.1 to 1.2 billion DOGE. Unlike the buy-and-hold institutional nature of Kraken, these platforms function as high-velocity hubs for global retail and derivative traders. Their wallets are characterized by massive transaction counts, frequently processing over $100 million in daily

DOGE/USDT volume. As of February 2026, both exchanges maintain a PoR ratio exceeding 120%, providing a transparent safety net that ensures the People’s Coin remains highly liquid and accessible across international markets.

10. Private Holder (A1D5s...)

Rounding out the top tier is an anonymous whale holding 1.21 billion DOGE. This address has shown intermittent activity as recently as Q4 2025, frequently moving large tranches between private wallets to obfuscate ownership. This smart money participant represents the hidden institutional layer of the memecoin market, where large-scale accumulation happens quietly away from the noise of retail social media.

How to Trade Dogecoin (DOGE) on BingX

Whether you want to ride the whale waves or secure your own "Doge-illionaire" status, BingX offers professional tools for every strategy.

Buy or Sell DOGE on the Spot Market

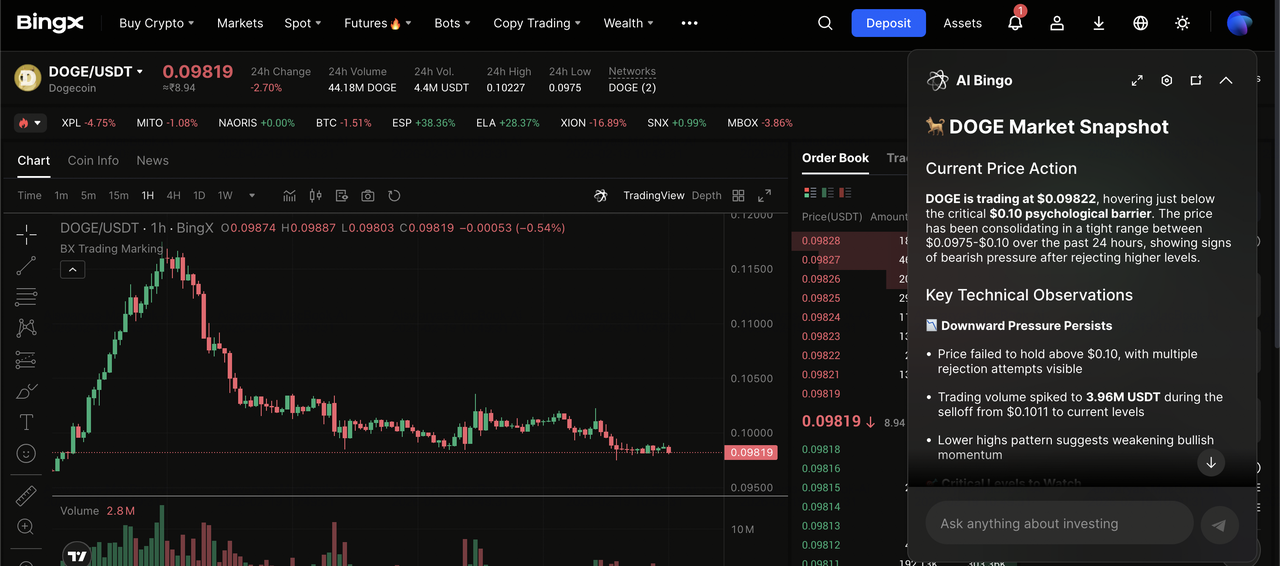

DOGE/USDT trading pair on the spot market powered by BingX AI insights

Ideal for long-term investors looking to hold through the 2026 D.O.G.E. department cycles.

1. Create and verify your BingX account.

3. Use a

Market Order for instant entry or a Limit Order to catch the key support zones.

Long or Short DOGE with Futures

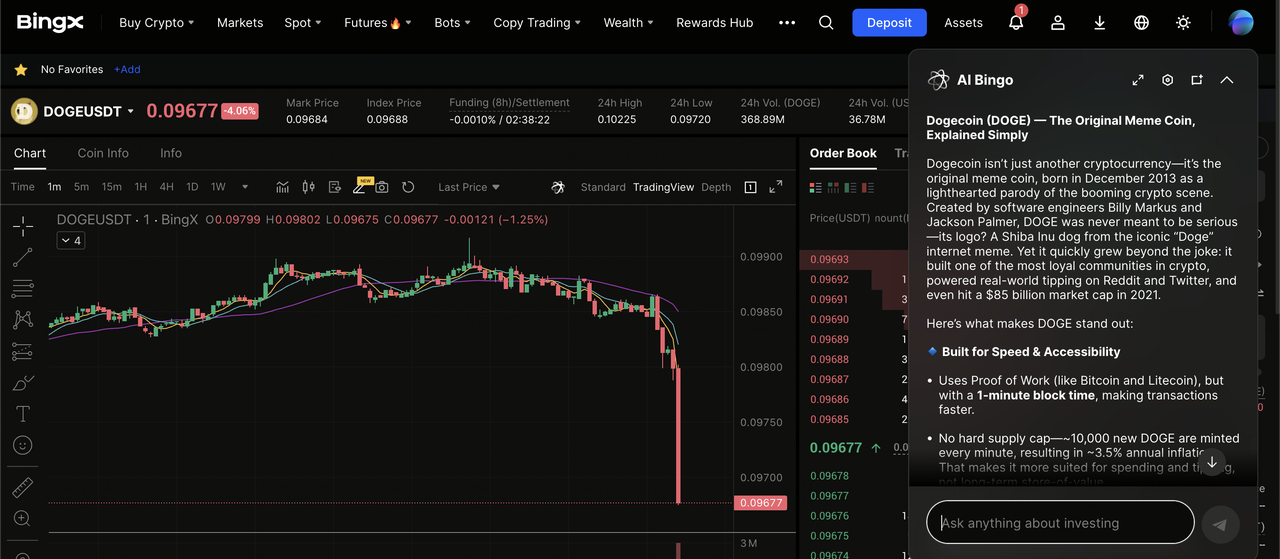

DOGE/USDT perpetuals on the futures market featuring BingX AI insights

For traders looking to profit from high-volatility events, BingX offers up to 100x leverage on DOGE Perpetual Contracts.

1. Transfer

USDT or

USDC to your Futures Account.

3. Use

BingX AI signals to identify liquidity clusters or whale "buy walls."

Dollar-Cost Averaging (DCA) Dogecoin with BingX Recurring Buy

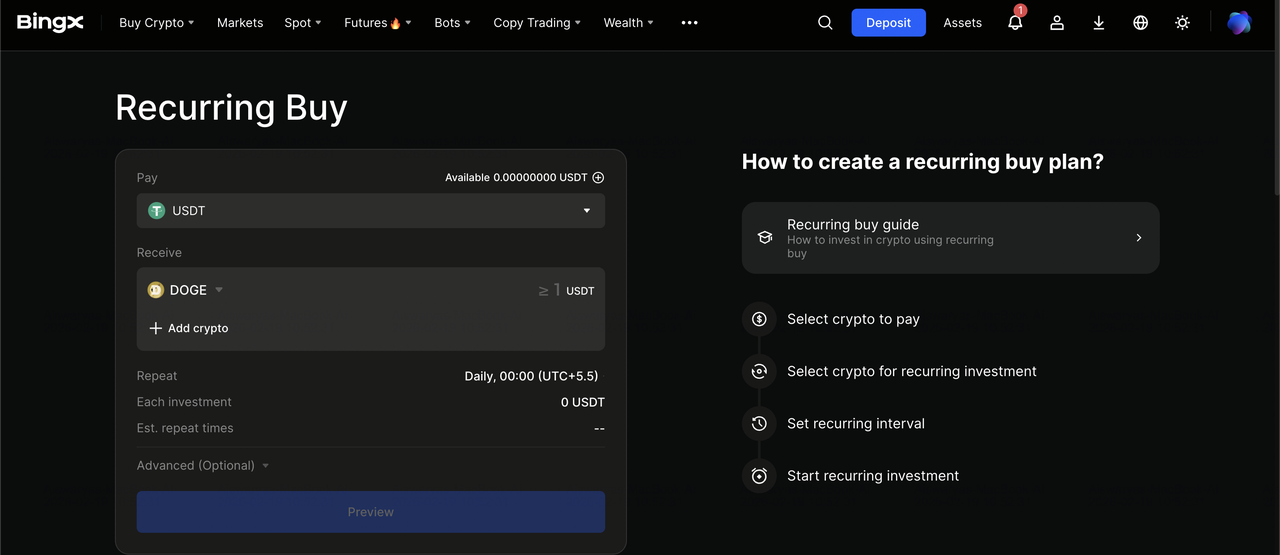

DCA DOGE on BingX Recurring Buy

BingX Recurring Buy allows you to automate your Dogecoin accumulation, effectively lowering your average entry cost over time without the stress of manual trading.

• Access Recurring Buy: Log in to BingX, navigate to Recurring Buy.

• Configure Your Plan: Select DOGE as your target asset and USDT as your payment currency.

• Automate Execution: Set your investment amount starting from a minimum of 1 USDT and frequency from Hourly, Daily, Weekly, or Monthly.

What Are the 4 Key Risks for DOGE Holders in 2026?

This section outlines the four biggest risks DOGE holders should watch in 2026, from inflation and whale concentration to Elon Musk and shifting regulatory sentiment.

1. The Inflationary Supply: With 5 billion new DOGE minted every year, the price requires a constant influx of new capital just to stay flat. If the meme hype fades, the supply can quickly outpace demand.

2. The 'Dogefather' Elon Musk Factor: While the Department of Government Efficiency (D.O.G.E.) has given the coin a new narrative, it also ties the coin's price to political cycles and the public standing of its most famous booster,

Elon Musk.

3. Concentration Risk: With the top 10 wallets controlling nearly half the supply, a single decision by an exchange or a whale to liquidate could lead to a flash crash that retail traders cannot react to in time.

4. Regulatory Reporting (1099-DA): New 2026 tax standards mean that even small tips or trades in DOGE are now subject to rigorous tracking, increasing the compliance burden for casual users.

Conclusion: Should You Follow the DOGE Whales?

The 2026 Dogecoin Rich List illustrates an asset that has successfully matured from a fringe internet joke into a central pillar of the digital finance market. While the Smart Money is increasingly represented by massive exchange and custodial holdings, these entities serve as the critical infrastructure providing the deep liquidity required for DOGE’s use as a global peer-to-peer currency. In early 2026, the stabilization of the whale population, paired with the launch of the first SEC-approved Spot DOGE ETFs, suggests that institutional participants are no longer viewing Dogecoin as a transient meme, but as a permanent top 10 digital asset with established market utility.

For crypto traders, the high concentration of supply in a select few wallets means that volatility remains a structural feature, not a temporary bug. As of February 2026, over 67% of the supply is controlled by the top 100 addresses, meaning that monitoring these Buy Walls and exchange inflows is an essential component of a data-driven trading strategy. However, investors must remain objective: Dogecoin’s inflationary model adds 5 billion tokens annually, requiring constant new demand to sustain price levels. With a

Fear & Greed Index currently reflecting extreme market caution, disciplined risk management and a neutral approach to on-chain data are your best tools for navigating the 2026 Dogecoin landscape.

Risk Reminder: Digital asset markets are inherently volatile and speculative. High concentration in whale wallets can lead to sharp, unpredictable price swings if large positions are liquidated. Never invest more than you can afford to lose, and consider the unique risks of 2026’s regulatory compliance and inflationary supply before making a trade.

Related Reading