Bitlayer is the first production-grade implementation of BitVM, transforming

Bitcoin from a passive Store of Value into a productive engine for decentralized finance. As of February 2026, Bitlayer secures over $360 million in TVL, supports a community of 700,000+ members, and hosts over 300 decentralized applications (dApps) ranging from RWA lending to high-speed gaming.

In mid-February 2026, BTR experienced a 43.76% price surge, significantly outperforming a flat broader market. This rally was primarily fueled by a massive 1,336% spike in 24-hour trading volume, signaling intense speculative interest and capital rotation into the

BTCFi narrative. Investors were further emboldened by a series of oversubscribed token rounds on platforms like CoinList and Echo, which raised an additional $5 million to accelerate the project’s multi-chain expansion.

In this article, you will learn what Bitlayer is, the technical breakthroughs of its RtEVM engine, why it is a cornerstone of the fast-growing BTCFi economy, how the BTR token powers the network, and how to buy Bitlayer on BingX.

What Is Bitlayer (BTR) Bitcoin Layer 2 Network?

Bitlayer is a

Bitcoin Layer 2 scaling solution that utilizes the BitVM framework to execute complex computations off-chain while verifying them on the Bitcoin mainnet. Historically, Bitcoin’s limited script language prevented it from hosting complex DeFi apps like Uniswap or Aave. Bitlayer solves this "programmability bottleneck" by providing a Turing-complete environment that is 100% compatible with the Ethereum Virtual Machine (EVM).

Bitlayer operates through three tightly connected pillars:

1. BitVM Bridge: A trust-minimized gateway that allows users to bridge native BTC into Bitlayer as YBTC (yield-bearing Bitcoin) with a 1-of-N security assumption, meaning only one honest participant is needed to ensure the safety of funds.

2. RtEVM (Real-time EVM): A high-performance execution layer that uses parallel processing to deliver near-instant confirmations and ultra-low gas fees, even during periods of high network congestion.

3. Bitcoin Rollup Architecture: By combining BitVM with

zero-knowledge (ZK) proofs, Bitlayer batches thousands of transactions and anchors their finality directly onto the Bitcoin blockchain, inheriting its massive

Proof-of-Work (PoW) security.

In 2025, Bitlayer transitioned from a Testnet project to a dominant L2 powerhouse. By early 2026, it has successfully expanded its YBTC asset across multiple chains including

Solana,

Ethereum, and

Base, allowing Bitcoiners to earn native yield across the entire Web3 landscape.

What Are the Key Components of the Bitlayer Ecosystem?

Bitlayer has rapidly built a full-stack infrastructure for Bitcoin-native finance, focusing on speed, yield, and cross-chain connectivity.

• BitVM Bridge (YBTC): The flagship product that provides sustainable, secure yield. As of 2026, YBTC has integrated with institutional vaults on Solana and Ethereum to maximize returns for holders.

• DApp Center: A hub for 300+ projects including Satoshi Protocol for

stablecoins, LayerBank for

lending, and Anome for Web3 gaming.

• Bitlayer Scan: A high-speed block explorer BTRScan that provides real-time transparency into the network’s rollup proofs and transaction batches.

How Does Bitlayer Bitcoin's Scaling Solution Work?

Bitlayer replaces the need for centralized wrapped Bitcoin like wBTC with a cryptographic verification system. It follows a modular rollup model that ensures Bitcoin remains the ultimate "Judge" of all transactions.

1. The BitVM Verification Scheme

Unlike other L2s that require a "soft fork" of Bitcoin, Bitlayer uses BitVM to express complex logic through existing Bitcoin opcodes like

Taproot. It uses an Optimistic Rollup logic: transactions are assumed valid unless challenged. If a fraudulent transaction is detected, a watcher can trigger a challenge on the Bitcoin mainnet to prove the fraud and slash the malicious actor.

2. RtEVM Parallel Execution

To support 150,000+ daily transactions, Bitlayer uses RtEVM. Traditional blockchains process transactions one by one; RtEVM identifies transactions that don't overlap and processes them simultaneously. This makes it ideal for high-frequency trading and high-load gaming dApps.

3. Yield Generation via YBTC

When you bridge BTC to Bitlayer, it becomes YBTC. This isn't just a placeholder; YBTC is a programmable asset that can be used as collateral in lending protocols like ENZO Finance or staked to earn native rewards. This productive Bitcoin model is the heart of the BTCFi movement.

What Is the BTR Token Used For?

The BTR token is the governance and utility backbone of the Bitlayer ecosystem, with a capped supply of 1 billion tokens. It aligns the interests of developers, node operators, and users.

• Network Governance: BTR holders vote on critical protocol upgrades, fee structures, and the allocation of the Ecosystem Incentive fund, 40% of total supply.

• Staking and Node Security: Users stake BTR to support network nodes. In exchange for securing the rollup, stakers receive a portion of the network's transaction fees.

• Fee Switch Mechanism: When activated by the DAO, a portion of protocol revenue can be used for BTR buybacks or distributed as additional rewards to long-term stakers.

• Gas and Ecosystem Utility: While BTC is often used for gas, BTR is required for specific premium features within dApps and as a primary pair for liquidity mining.

What Is Bitlayer (BTR) Tokenomics?

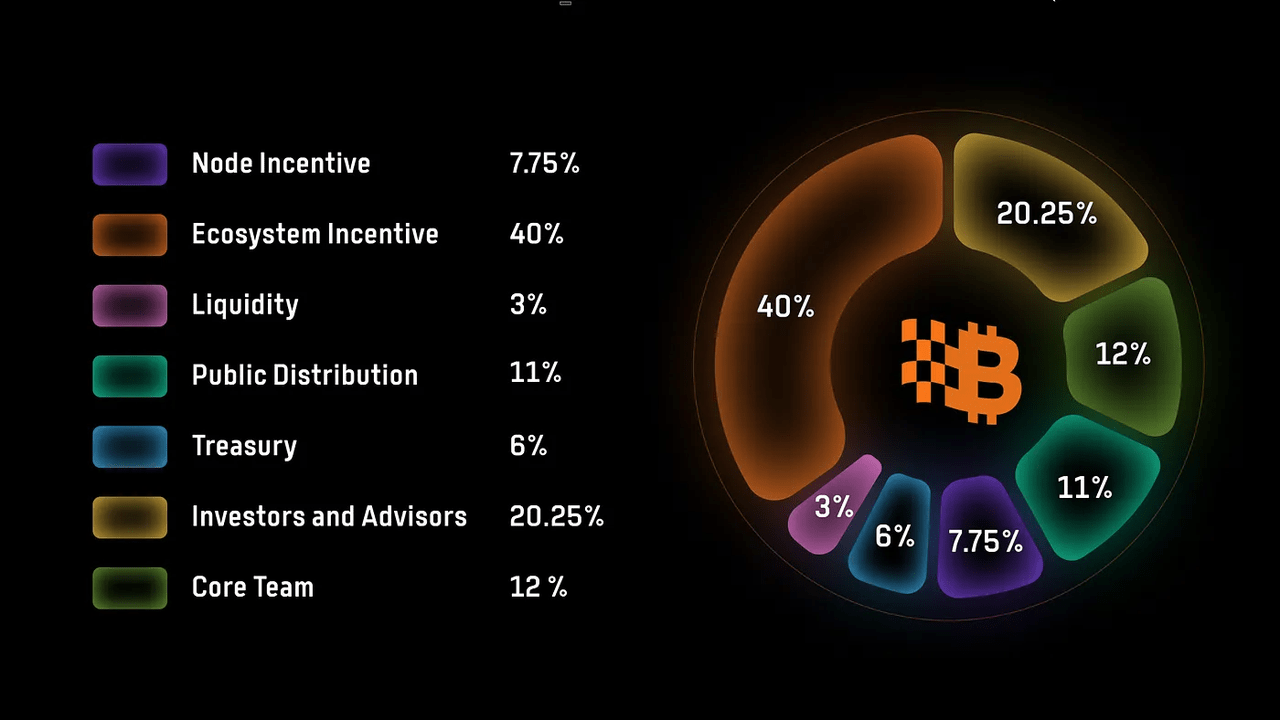

BTR token allocation | Source: Bitlayer blog

The BTR token has a fixed total supply of 1 billion tokens, with approximately 261.6 million (26.16%) currently in circulation as of February 2026.

• Ecosystem Incentives – 40% (400M BTR): Dedicated to community-driven growth through grants, developer support, liquidity mining, and marketing campaigns; 25% was unlocked at TGE, with the remainder vesting over 48 months.

• Investors & Advisors – 20.25% (202.5M BTR): Subject to a 6-month cliff followed by linear vesting over 24 months, ensuring long-term alignment with the project's success.

• Core Team – 12% (120M BTR): Allocated to contributors with a strict 24-month cliff and subsequent 48-month linear vesting (fully unlocked by month 72).

• Public Distribution – 11% (110M BTR): 79% was unlocked at TGE, with the remaining 21% vesting over 18 months after a initial 1-month cliff.

• Node Incentives – 7.75% (77.5M BTR): Used to reward validators and secure the network; rewards follow an annual halving schedule to manage long-term emissions.

• Treasury – 6% (60M BTR): 75% was available at TGE, while the final 25% vested linearly over the first 5 months to fund ongoing operational needs.

• Liquidity – 3% (30M BTR): 100% was unlocked at TGE to provide immediate trading liquidity across decentralized and centralized exchanges.

How to Trade Bitlayer (BTR) on BingX

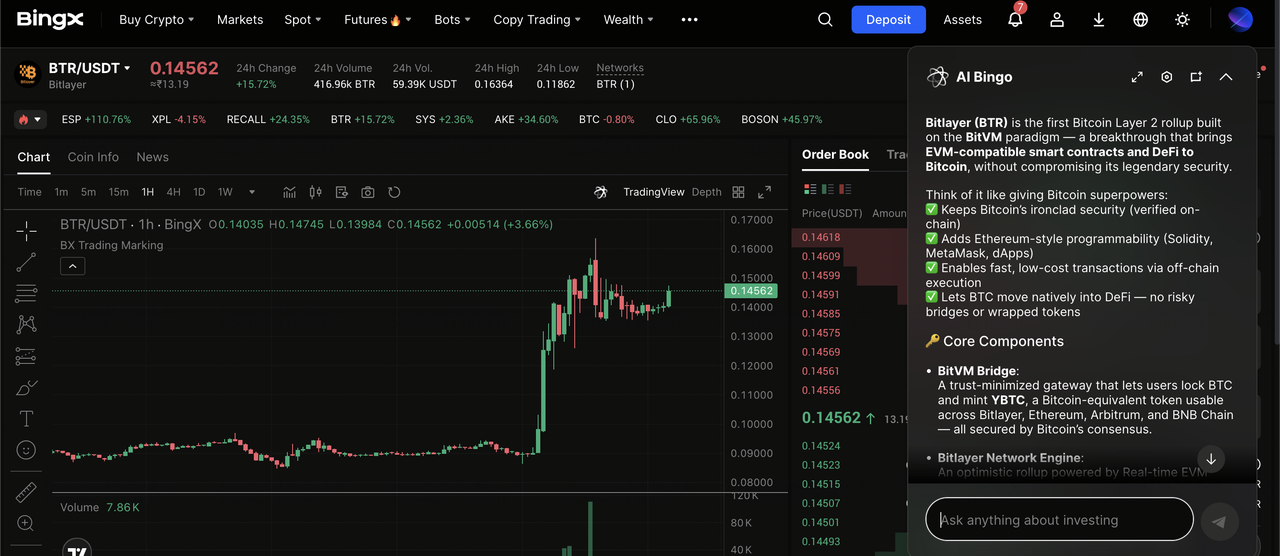

BTR/USDT trading pair on the spot market powered by BingX AI insights

Powered by BingX AI insights, you can trade BTR with real-time analytics and trend signals to navigate the volatile L2 market.

How to Buy and Sell BTR on the Spot Market

1. Create and fund your account: Sign up on BingX and

deposit USDT.

3. Execute Trade: Choose a

market or limit order to gain direct price exposure to the leading Bitcoin L2 token.

Learn more about how to

buy Bitlayer on BingX in our beginner's guide.

3 Key Considerations Before Investing in Bitlayer (BTR)

Before investing in Bitlayer (BTR), it’s important to evaluate a few core factors that can shape both its risk profile and long-term potential within the evolving Bitcoin Layer-2 ecosystem.

1. The Bitcoin L2 Race: Bitlayer competes with other Bitcoin scaling solutions like

Stacks and

Babylon. Its success depends on maintaining its lead in the BitVM implementation.

2. Technical Complexity: BitVM is cutting-edge tech. While it inherits Bitcoin's security, any bugs in the complex challenge logic could impact the network.

3. Liquidity Cycles: $BTR often sees massive volume spikes during

Altcoin Seasons. Be mindful of high turnover rates which can lead to sharp volatility.

Final Thoughts: Should You Buy Bitlayer (BTR) in 2026?

Bitlayer is no longer just a concept, but is the most advanced operational Bitcoin Layer 2 in the market today. If you believe that Bitcoin’s future lies in becoming a programmable financial layer for BTCFi, Bitlayer’s infrastructure is currently the strongest bridge to that reality.

With its Mainnet-V2 now live and a roadmap leading to enhanced Mainnet-V3 capabilities, BTR serves as a high-beta bet on the entire Bitcoin ecosystem's growth. As always, manage your risk and consider BTR as a long-term play on the infrastructure that makes Bitcoin productive.

Related Reading