Privacy coins have emerged as a specialized category in the crypto market designed to enhance user anonymity and protect financial data from public scrutiny. Unlike traditional cryptocurrencies such as

Bitcoin, where transactions are recorded on a transparent blockchain visible to anyone, privacy coins employ advanced cryptographic techniques to obscure details like sender identities, recipient addresses, and transaction amounts. This focus on confidentiality addresses growing concerns over surveillance, data breaches, and the potential linkage of digital transactions to real world identities.

Monero (XMR) stands out as the leading privacy coin, prioritizing secure, private, and censorship resistant transactions. Launched in 2014, it has become synonymous with fungibility, the idea that every unit of currency is interchangeable and indistinguishable from another, free from any taint associated with prior usage. As of January 2026, with increasing regulatory pressures on digital assets, Monero (XMR)'s emphasis on default privacy continues to attract users seeking protection from traceability, making it a cornerstone in the privacy centric cryptocurrency ecosystem.

What Is Monero (XMR)?

Monero (XMR) is an open source cryptocurrency that enables fast, inexpensive, and private payments across the globe. It operates on a decentralized blockchain, free from the constraints of traditional banking systems, such as wire transfer fees, multi-day holds, or fraudulent chargebacks. Unlike most cryptocurrencies with transparent ledgers, Monero (XMR)'s blockchain is intentionally opaque, ensuring that transactions remain confidential and untraceable by default.

At its core, Monero (XMR) functions as electronic cash, allowing users to send and receive funds without intermediaries. It is community driven, with contributions from over 500 developers worldwide, and its Research Lab continually innovates in privacy and security technologies. As of January 2026, Monero (XMR) holds a market capitalization of approximately $9.4 billion, ranking it among the top 20 cryptocurrencies by market value.

Who Created Monero?

Monero (XMR)'s origins trace back to the CryptoNote protocol, outlined in a 2013 white paper by the pseudonymous author Nicolas van Saberhagen. The first implementation was Bytecoin in 2012, but due to concerns over its premine (an alleged 80 %of coins minted unfairly), a fork occurred. In 2014, a developer known as thankful_for_today launched BitMonero based on CryptoNote. Community disagreements led to another fork on April 18, 2014, creating Monero (XMR). The project has since been maintained by an anonymous core team, with notable contributors like Riccardo Spagni (FluffyPony) serving as lead maintainer until 2019. Today, it remains a community driven effort without a single founder.

How Does Monero Blockchain Work?

Monero (XMR) operates on a proof of work blockchain where miners validate transactions using RandomX. Blocks are produced every two minutes, with rewards distributed via tail emission. A transaction begins with the sender's wallet generating a stealth address for the recipient. The sender's funds are mixed via ring signatures (now with a ring size of 16 for better anonymity), and RingCT encrypts the amount.

The transaction is broadcast anonymously, verified by miners, and added to the blockchain. Recipients scan the chain with their view key to detect incoming funds without revealing details publicly. This process ensures complete obfuscation, making Monero (XMR) ideal for private financial interactions.

What are Monero's Key Features and What Makes It Unique?

Monero (XMR)'s key features revolve around its robust privacy mechanisms, which set it apart from other cryptocurrencies:

1. Default Privacy: Every transaction hides the sender, receiver, and amount using technologies like ring signatures (which mix the sender's input with decoys), stealth addresses (generating one time addresses for recipients), and Ring Confidential Transactions (RingCT, which conceals amounts).

2. Fungibility: Unlike Bitcoin, where coins can be tainted by their history, Monero (XMR) ensures all units are identical, reducing risks for merchants accepting payments.

3. ASIC Resistant Mining: Monero (XMR) uses the RandomX algorithm, which favors consumer grade CPUs and GPUs over specialized hardware, promoting decentralization and fair participation.

4. Dynamic Scalability: It features adaptive block sizes and fees, along with a tail emission (a perpetual block reward of 0.6 XMR) to incentivize miners long term.

5. Additional Anonymity Layers: Tools like Dandelion++ for transaction propagation and integration with the Invisible Internet Project (I2P) further obscure network activity.

What makes Monero (XMR) unique is its uncompromising commitment to privacy by default. While other privacy coins offer optional privacy, Monero (XMR) mandates it for all users, eliminating the risk of selective transparency. This grassroots, developer-led approach, without a central founder or premine, fosters a resilient network resistant to censorship.

What Are Monero's Top 3 Security Features?

Monero (XMR)'s security is deeply integrated with its privacy architecture, providing robust protection against tracing, attacks, and centralization risks.

1. Core cryptographic tools include ring signatures, which mix the sender's input with decoy outputs to obscure the true origin of the funds. sSealth addresses generate unique one-time addresses for each transaction to shield recipient identities and Ring Confidential Transactions (RingCT), which encrypt transaction amounts to prevent visibility of transferred values. These features ensure complete default privacy while enhancing overall network integrity.

Mining security is bolstered by the ASIC-resistant RandomX proof-of-work algorithm, which favors consumer-grade CPUs and GPUs to promote decentralization and reduce the threat of 51% attacks from specialized hardware.

2. Additional safeguards include dynamic block sizes to prevent congestion and spam, tail emission for long-term miner incentives and sustained security, and network-level protections such as integration with Tor/I2P for IP anonymity and tools like Dandelion++ for obfuscated transaction propagation.

3. Recent upgrades, including the Fluorine Fermi hard fork enhancements against spy nodes, further strengthen resilience against surveillance and malicious network actors, making Monero (XMR) highly resistant to analysis and compromise when users adhere to secure practices.

What Is XMR Token Utility?

XMR is the native token of the Monero (XMR) network, used primarily for private transactions, payments, and value storage. It serves as the medium for fees and rewards in the ecosystem. Unlike capped supply coins like Bitcoin, Monero (XMR) has an unlimited total supply but a fixed emission rate after its initial curve, ensuring ongoing miner incentives through tail emission.

XMR's value derives from its utility in privacy preserving applications, such as anonymous donations, online purchases, and cross border transfers. As of January 2026, XMR has a circulating supply of approximately 18.4 million coins.

How to Use Monero (XMR) for Payments

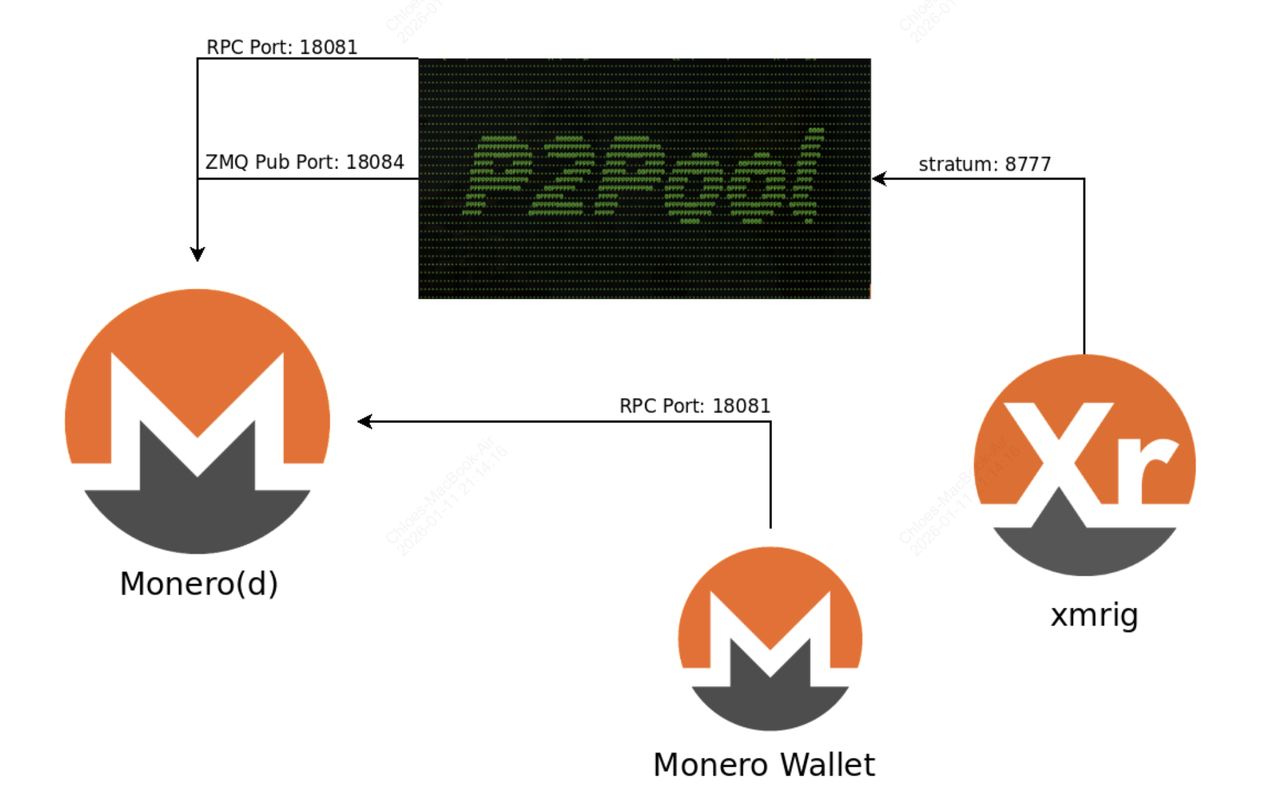

Source: How to Setup and Install Monero(d) P2pool

To use Monero, you first need a

crypto wallet that supports XMR. You can use the official Monero GUI or CLI wallet, or a third-party wallet, to generate a private Monero address. This address is what you share when receiving XMR.

Once you hold XMR in your wallet, you can send and receive payments just like any other cryptocurrency, but with much stronger privacy. Monero uses stealth addresses, ring signatures, and confidential transactions, which means the sender, receiver, and amount are all hidden on-chain. You can spend XMR with merchants that accept it, use it for peer-to-peer payments, or exchange it for other cryptocurrencies on supported exchanges.

Your wallet handles everything behind the scenes: creating transactions, signing them locally, and broadcasting them to the Monero network while preserving anonymity.

How to Mine XMR Coins on Monero Network

Monero uses a Proof-of-Work algorithm called RandomX, which is designed to be ASIC-resistant and CPU-optimized. This allows everyday computers to mine XMR efficiently, keeping the network decentralized.

You can mine Monero in three main ways:

1. Solo mining connects your Monero wallet directly to the network. It has no fees and supports decentralization, but rewards are unpredictable unless you have significant hash power.

2. Pool mining combines many miners into a single pool for steadier payouts, but it includes fees and introduces some centralization risk.

P2Pool is the recommended option. It is a decentralized pool system that offers 0% fees, instant payouts to your wallet, no custody risk, and no central operator. As of January 2026, P2Pool runs on version 4.13 with about 234 MH/s of active network hash rate.

The most popular mining software is XMRig, an open-source miner optimized for CPUs. For easier setup, Gupax provides a simple interface that runs XMRig and connects you to P2Pool automatically.

In January 2026, Monero mining is only profitable for users with very low-cost or free electricity. Most miners participate to support network privacy and decentralization rather than for guaranteed income.

Monero vs. Zcash: Similarities and Key Differences

Monero (XMR) and Zcash (ZEC) are leading privacy coins, but they differ fundamentally in their approach to privacy. While Monero (XMR) provides mandatory default privacy for every transaction through technologies like ring signatures, stealth addresses, and RingCT, Zcash (ZEC) offers optional privacy using zk SNARKs, allowing users to choose between transparent and shielded transactions.

This fundamental difference gives Monero (XMR) stronger fungibility and anonymity by default, whereas Zcash (ZEC) provides more flexibility for regulatory compliance and selective transparency. As of 2026, Monero (XMR) maintains a larger market capitalization and stronger adoption within privacy focused communities, while Zcash (ZEC) has shown impressive price performance in late 2025, potentially appealing more to institutional users due to its adjustable privacy features.

What Caused the 40% Weekly Surge in Monero in January 2026?

The

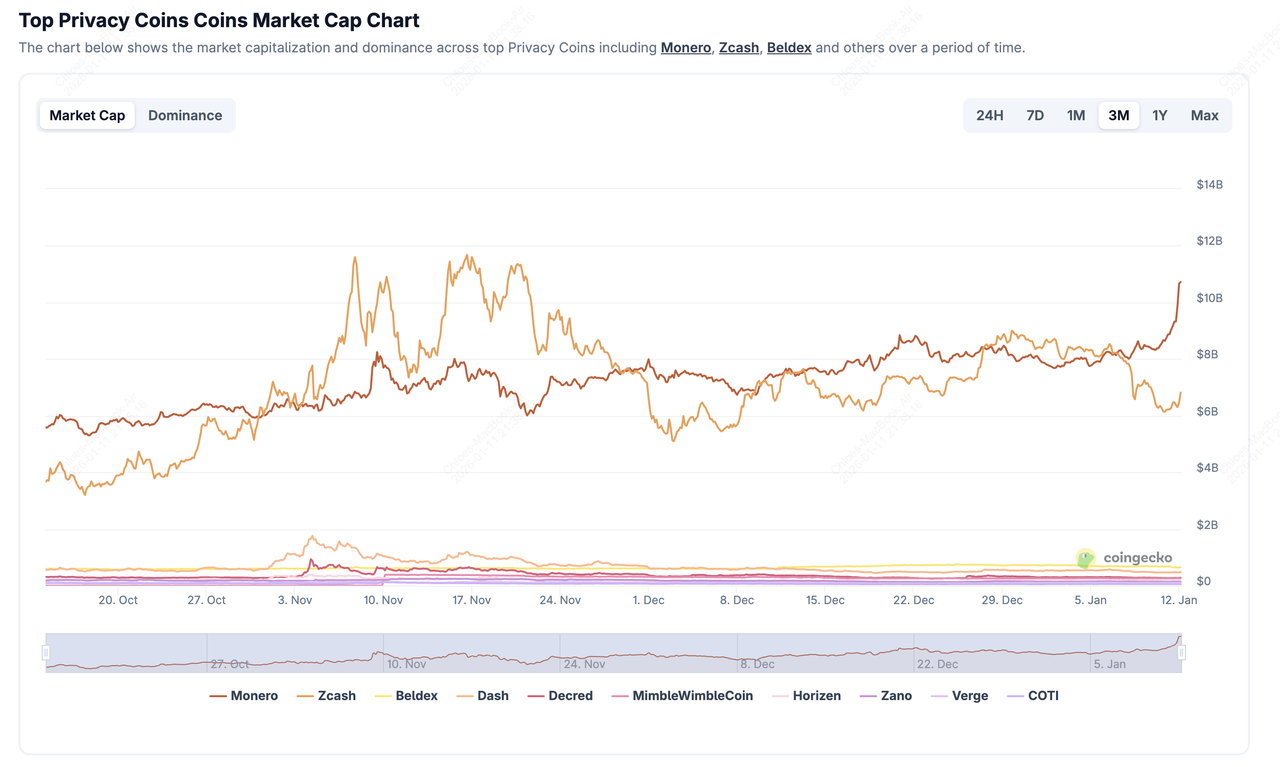

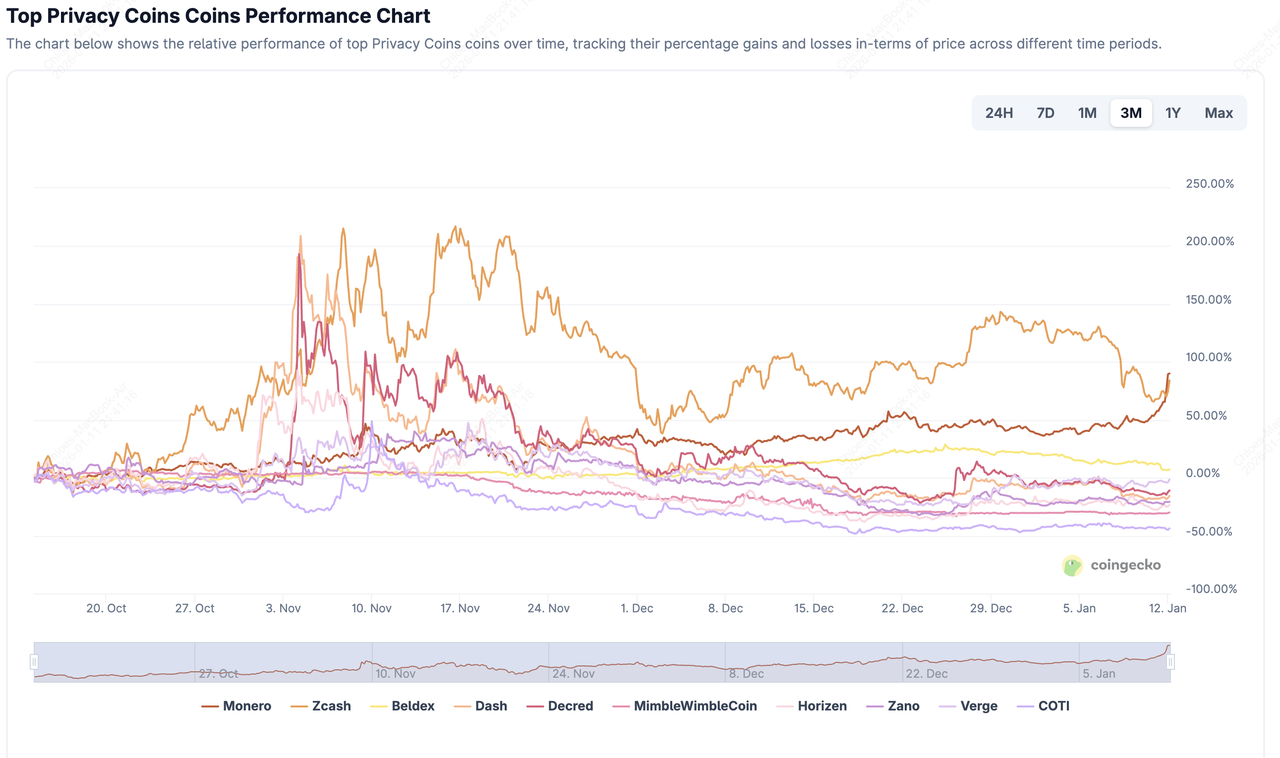

recent surge in Monero (XMR) price, observed in early January 2026, has been dramatic. As of January 11 to 12, 2026, Monero (XMR) has broken its previous all-time high (set in 2021 around $518 to $517) multiple times, climbing toward and surpassing $590 to $600 in some reports, with significant daily gains of 18 to 25% and weekly increases exceeding 35 to 40%.

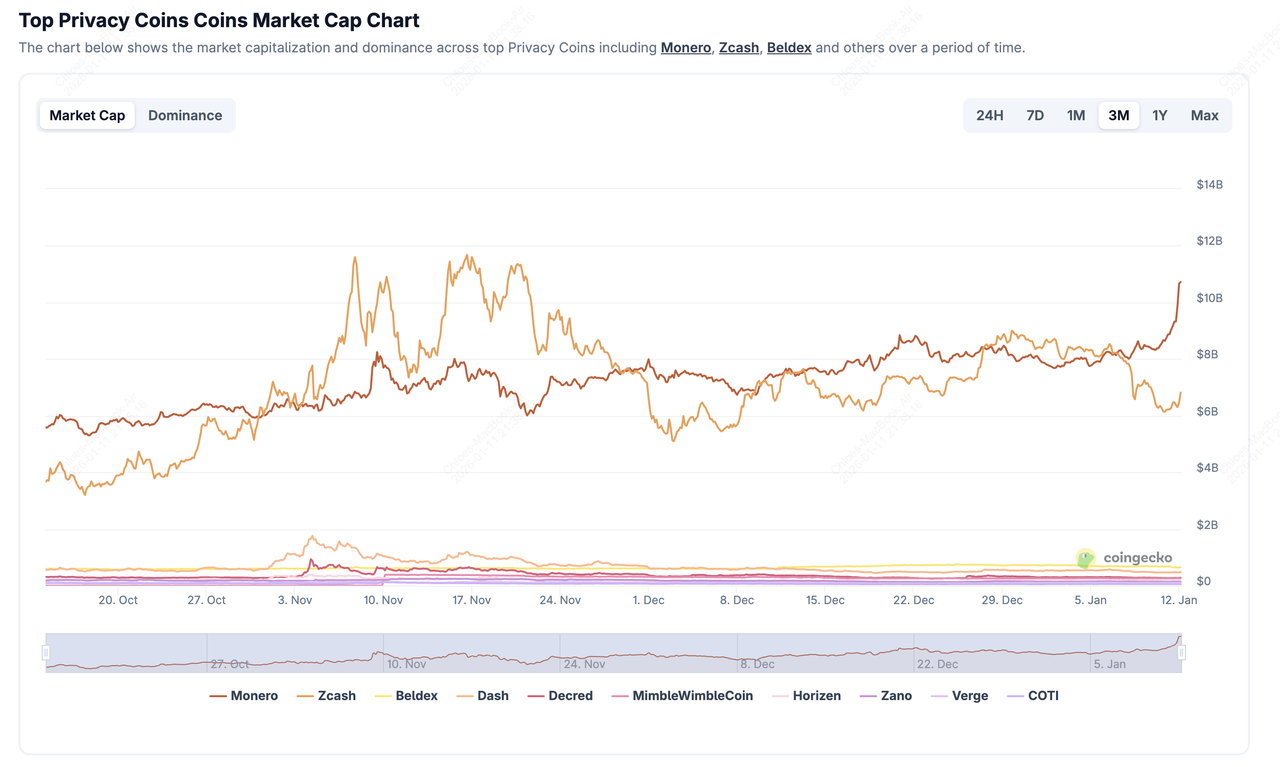

This rally has pushed its market cap close to or above $10 billion, positioning it among the top cryptocurrencies and reclaiming its spot as the leading privacy coin. Here are recent price charts showing the Monero (XMR) surge:

The primary catalyst for this explosive price movement is a major capital rotation within the

privacy coin sector, triggered by a governance crisis at rival Zcash (ZEC). In early January 2026, the Electric Coin Company (ECC), Zcash (ZEC)'s core development team, announced a mass resignation and stepped away from protocol development due to internal disputes over governance, working conditions, and board decisions.

This led to a sharp 25 to 26% drop in ZEC's price over the week, eroding investor confidence in the project's future and prompting a flight of capital from

Zcash (ZEC) to more established

privacy coin alternatives. Monero (XMR) has mandatory default privacy via ring signatures, stealth addresses, and RingCT, decentralized development model, and proven resilience, benefited directly from this shift.

Investors rotated funds into XMR, viewing it as the safer, more reliable option for true anonymity amid growing concerns over regulatory scrutiny and financial surveillance. Beyond the Zcash (ZEC) specific trigger, broader factors have amplified the momentum: Renewed demand for privacy coins in 2026, driven by tightening global regulations, such as new tax reporting frameworks like the EU's DAC8 directive effective January 1, 2026, requiring detailed transaction data from exchanges.

This has heightened interest in tools that protect against traceability and surveillance. Geopolitical instability and concerns over data security, pushing users toward anonymous digital assets. Institutional and community curiosity, with Monero (XMR)'s upgrades, such as the Fluorine Fermi hard fork enhancing network security, and consistent real world utility supporting sustained adoption.

While some sources note additional influences like user friendly wallet improvements and broader market resilience for privacy coins, the Zcash (ZEC) crisis stands out as the immediate spark for the January 2026 breakout. This surge aligns with privacy coins' strong performance in late 2025 where Monero (XMR) rose about 122 % and Zcash (ZEC) even more dramatically, but the current rally has seen XMR outperform amid the sector's internal dynamics.

How to Trade Monero (XMR) on BingX Futures

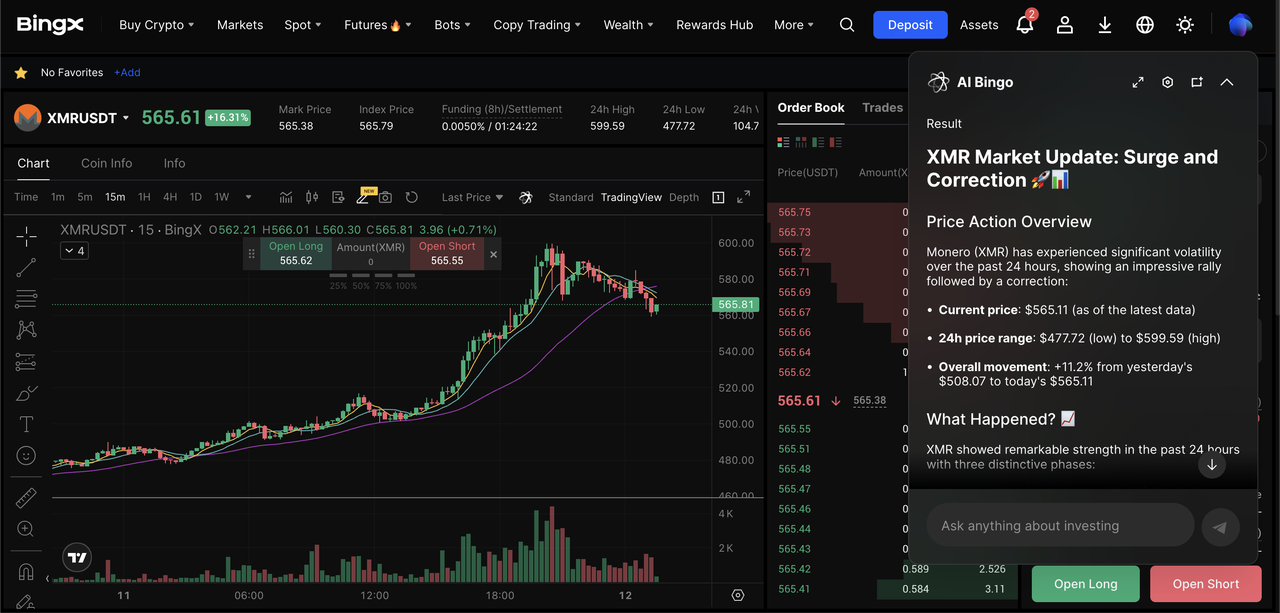

XMR/USDT perpetual contract on the futures market powered by BingX AI insights

XMR futures on BingX are USDT-settled, allowing you to trade Monero’s price movements without holding the underlying asset while using BingX’s AI-powered risk and strategy tools. Powered by BingX AI, Monero traders can access real-time market signals, risk controls, and intelligent order tools while trading XMR perpetual futures.

1. Log in to BingX and

complete KYC to unlock access to all features.

2. Deposit

USDT and transfer it to your Futures Wallet.

4. Choose your margin mode (Isolated or Cross) and set leverage.

7. Monitor your position and close or adjust it anytime from the Futures panel.

Conclusion: Is Monero a Good Investment in 2026?

Monero (XMR) represents the pinnacle of privacy in cryptocurrencies, offering untraceable transactions through innovative technologies while maintaining decentralization and accessibility. From its community forked origins to its role in fostering financial freedom, and now its explosive 2026 surge driven by capital rotation from Zcash (ZEC) and rising demand for privacy coins, Monero (XMR) addresses the limitations of transparent blockchains, making it a vital tool in an era of heightened digital surveillance.

As regulations evolve in 2026, its default anonymity may face challenges, but its robust features, dedicated ecosystem, and recent market momentum position it for continued relevance. Whether for everyday use, mining, or secure storage, Monero (XMR) empowers users to reclaim control over their financial privacy.

Related Reading