MetaSoilVerse Protocol (MSVP) is at the forefront of the "verifiable asset" movement. While early

RWA projects relied on static, off-chain audits, MSV introduces a dynamic system where physical assets, such as solar farms, agricultural plots, and manufacturing infrastructure, are continuously verified on-chain. As of February 2026, the protocol has already tokenized over $27.2 million in assets, supported by a network of thousands of active stakers and 14,500+ PoAI events.

In this article, you will learn what MSV Protocol is, how its Proof-of-Asset-Integrity (PoAI) technology ensures transparency, the utility of the $MSVP token, and how to claim the

MSV Protocol (MSV) airdrop.

What Is MSV Protocol (MSVP) RWA Infrastructure?

MSV Protocol functions as a "digital twin" engine for traditional industries. It allows businesses in energy, logistics, and agriculture to represent their physical operations as Semi-Fungible Tokens (SFTs) or NFTs on the blockchain. This conversion makes illiquid wealth programmable, globally accessible, and collateral-ready.

The protocol operates through four key pillars:

1. Proof-of-Asset-Integrity (PoAI): This is MSV's "secret sauce." Instead of annual paper audits, PoAI uses real-time GPS data, IoT sensors, and drone scans to provide a continuous "health check" for assets. If a solar farm stops producing energy, the PoAI system flags it on-chain instantly.

2. Modular Compliance: MSV automates regulatory adherence through "jurisdictional plugins." These contracts handle

KYC/KYB and legal wrapping, ensuring that a tokenized warehouse in one region or a reforestation project in another meets local legal standards.

3. Yield-Bearing Vaults: Institutional-scale DeFi applications can integrate these vaults to offer yield backed by real-world performance, such as leasing fees or energy revenue.

4. Governance & Slashing: MSV aligns operator accountability with investor security. If an asset operator fails to perform, the protocol can trigger cryptoeconomic sanctions (slashing) against their staked tokens.

How Does MSV Protocol Work?

MSV Protocol transforms static physical assets into dynamic digital primitives through a multi-layered workflow that ensures trust without intermediaries.

1. The PoAI Verification Engine

The Proof-of-Asset-Integrity (PoAI) system acts as the bridge between the physical and digital worlds. It utilizes timestamped data feeds to move beyond "trust-based" assurances.

• Continuous Monitoring: IoT devices and sensors provide live performance reports, e.g., KWh output for solar energy.

• Geospatial Validation: GPS and drone data verify that the physical asset exists and remains within its designated conservation or industrial zone.

2. Programmable Yield and Leasing Logic

Once verified, assets are placed into Yield Vaults. These vaults use smart contracts to automate rent distribution or interest payments. Because the logic is embedded in the token, investors receive their share of the real-world performance directly, reducing the administrative overhead and settlement delays of traditional private markets.

3. Decentralized Management and Slashing

MSV employs a Delegated Proof-of-Stake (DPoS) style model for asset governance. Operators must stake $MSVP tokens to list assets. If the PoAI system detects fraud or non-performance, the staked tokens are slashed, providing an on-chain insurance layer for participants.

What Is the MSVP Token Used for in the MSV Protocol Ecosystem?

The $MSVP token is a functional tool that secures and powers every layer of the protocol. It has a total supply of 200 billion tokens, designed with deflationary mechanics.

• Asset Onboarding: Operators use MSVP to pay for permissioning and anti-spam protection when registering new infrastructure.

• Access to Yield Vaults: Participation in high-performance yield protocols is often "stake-gated," requiring users to hold or stake MSVP.

• Governance & Disputes: MSVP holders vote on protocol upgrades, new asset classes, and dispute resolution for operator accountability.

• Performance Fees: Fees generated by assets are often settled or facilitated via MSVP, with a portion of these fees being burned to reduce supply.

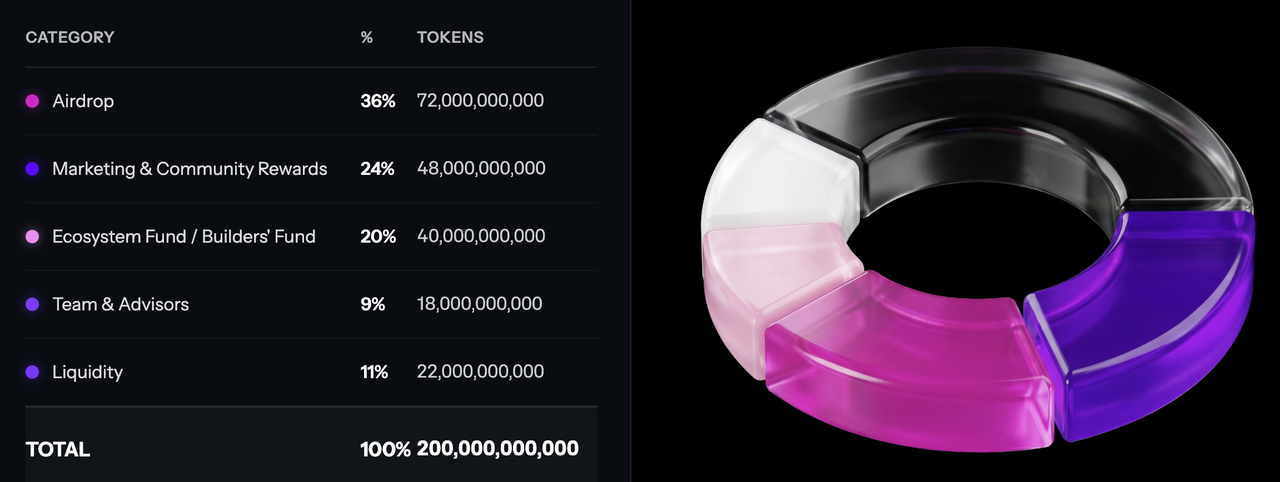

What Is MetaSoilVerse (MSVP) Tokenomics?

MSV Protocol token distribution | Source: MSV Protocol

The $MSVP tokenomics are built for long-term sustainability, featuring a sophisticated vesting schedule with a 6-month cliff for team and early contributors.

• Community Airdrops (36%): 72 billion tokens dedicated to rewarding early adopters, whitelisted participants, and community members.

• Marketing & Rewards (24%): Used for ecosystem awareness and user acquisition.

• Ecosystem & Builders Fund (20%): Progressive releases to support developers building on the MSV SDK.

• Liquidity (11%): Reserved for ensuring deep trading pools on exchanges.

• Team & Advisors (9%): Subject to long-term lockups to ensure alignment with the protocol's success.

What Is the MSV Protocol ($MSVP) Airdrop?

The MSV Protocol ($MSVP) airdrop is a strategic distribution event designed to reward early adopters and ecosystem participants who contribute to the protocol’s mission of bringing real-world infrastructure on-chain. With 36% of the total 200 billion supply (72 billion tokens) dedicated to community rewards, this multi-season campaign focuses on rewarding long-term "Early Holders" and active participants in the RWA landscape.

Rather than a simple one-time claim, the MSV airdrop typically rewards users who meet specific interaction thresholds, such as:

• Whitelisting: Securing a spot on the official waitlist portal.

• Holding & Staking: Maintaining a minimum balance, e.g., $500 worth of $MSVP, or participating in MSVP staking to earn high APR.

• Community Quests: Climbing the Zealy leaderboard by completing social tasks and educational challenges.

How to Claim Your MSVP Tokens

The claim process is integrated directly into the official MetaSoilVerse dApp and follows a structured workflow to ensure security and fair distribution.

2. Verify Tasks: Ensure you have met mandatory criteria, such as the $500 holding threshold or specific Zealy XP milestones.

3. Execute the Claim: Click the "Claim Tokens" button. MSV uses a sophisticated tokenomics-based vesting system; depending on your tier, your tokens may be unlocked automatically over several months following the initial claim.

4. Confirm on BNB Chain: Since MSVP resides on the

BNB Chain, ensure you have a small amount of

BNB in your wallet to cover the transaction gas fees.

3 Key Considerations Before Investing in MSV Protocol (MSVP)

Before allocating capital to the $MSVP ecosystem, it is essential to evaluate the unique market dynamics and operational dependencies associated with RWA infrastructure.

1. RWA Adoption Speed: MSVP’s value is tied to real-world usage. While the protocol is technically robust, its growth depends on the pace at which traditional industries like solar, agriculture, etc. adopt blockchain infrastructure.

2. Deflationary Pressure: The token features a 0.5% burn tax on transfers. While this supports scarcity, long-term investors should factor in these costs when moving assets between wallets.

3. Operational Performance: Unlike pure crypto tokens, MSVP is linked to physical performance. If the underlying assets, e.g., a tokenized wind farm, face physical damage or legal hurdles, it can impact the yield and sentiment of the associated vaults.

Final Thoughts: Is MSV Protocol (MSVP) a Good Buy in 2026?

As the market moves deeper into 2026, investor attention has increasingly shifted from pure speculation toward tangible, yield-linked value, and MSV Protocol (MSVP) has positioned itself as a core infrastructure layer for this transition. By addressing the long-standing verification bottleneck in real-world asset tokenization through its PoAI system, MSVP delivers a scalable, on-chain framework designed for institutional-grade RWA validation and settlement.

By transforming physical outputs, such as renewable energy generation and agricultural yields, into liquid, programmable digital primitives, MSVP aligns closely with the thesis that the next phase of finance centers on digitizing global physical assets. That said, $MSVP remains a high-risk investment, with value influenced by market volatility, liquidity on BNB Smart Chain, regulatory developments, real-world asset performance, and the protocol’s ability to execute its roadmap, making thorough research, diversification, and disciplined risk management essential.

Related Reading