Robinhood

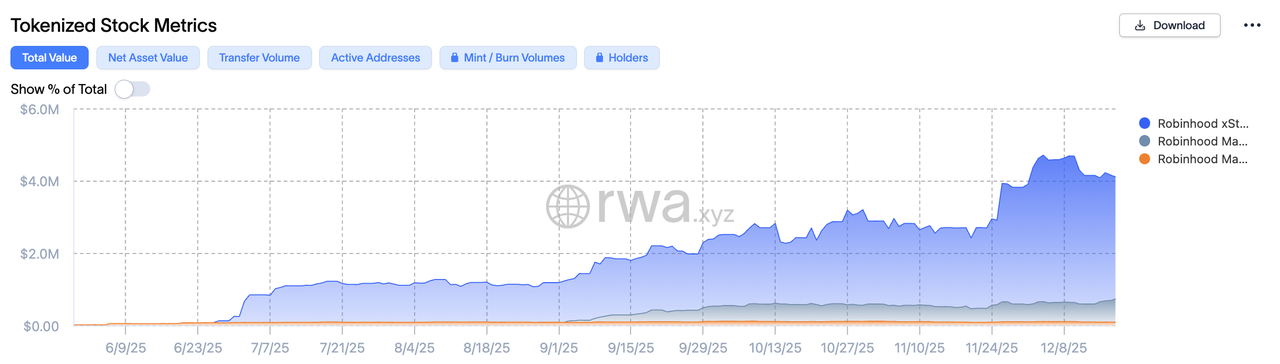

tokenized stocks are blockchain-based assets that track the market performance of Robinhood Markets, Inc. (HOOD), allowing investors to gain price exposure through on-chain tokens instead of traditional equity accounts. As stock tokenization continues to expand in 2025, products such as

HOODX (xStocks) and

HOODON (Ondo) have become two of the most accessible ways for crypto users to interact with Robinhood’s publicly traded shares.

Instead of purchasing HOOD through a conventional brokerage, investors can trade Robinhood tokenized stocks directly on crypto platforms such as BingX, using

USDT as the settlement currency. Like tokenized stocks of other leading companies like

Coinbase,

Circle, and

NVIDIA, his structure lowers entry barriers for non-U.S. users, supports fractional position sizing, and removes many of the account, custody, and market-hour limitations associated with traditional stock trading.

What Is Robinhood (HOOD) and What Does Robinhood Do?

Robinhood Markets, Inc. is a U.S.-based financial services company focused on expanding access to investing for individual users. Founded in 2013, Robinhood became widely known for eliminating trading commissions on U.S. stocks and ETFs, a move that helped bring a new generation of retail investors into public markets.

Today, Robinhood operates a multi-asset investment platform that allows users to trade and manage different financial products within a single interface. The company is publicly listed on Nasdaq under the ticker HOOD and generates revenue through a mix of trading-related and platform-based services.

Robinhood’s core products and services include:

• Commission-free trading of U.S. stocks and ETFs: Designed to lower cost barriers and simplify access to public equity markets.

• Options trading: Targeted at active retail traders, with simplified execution and risk disclosures.

• Cryptocurrency trading and custody: Support for major digital assets alongside traditional securities.

• Self-custody crypto wallets: Enable users to hold and transfer digital assets on-chain and interact with decentralized applications.

• Subscription-based services (Robinhood Gold): Offer enhanced features such as higher instant deposits, margin access, and research tools.

In recent years, Robinhood has expanded its focus beyond a pure brokerage model by exploring blockchain-based financial products, including

tokenized assets. This shift reflects the company’s broader strategy to connect traditional financial markets with crypto-native infrastructure, helping explain why Robinhood’s publicly traded shares are now available in tokenized form.

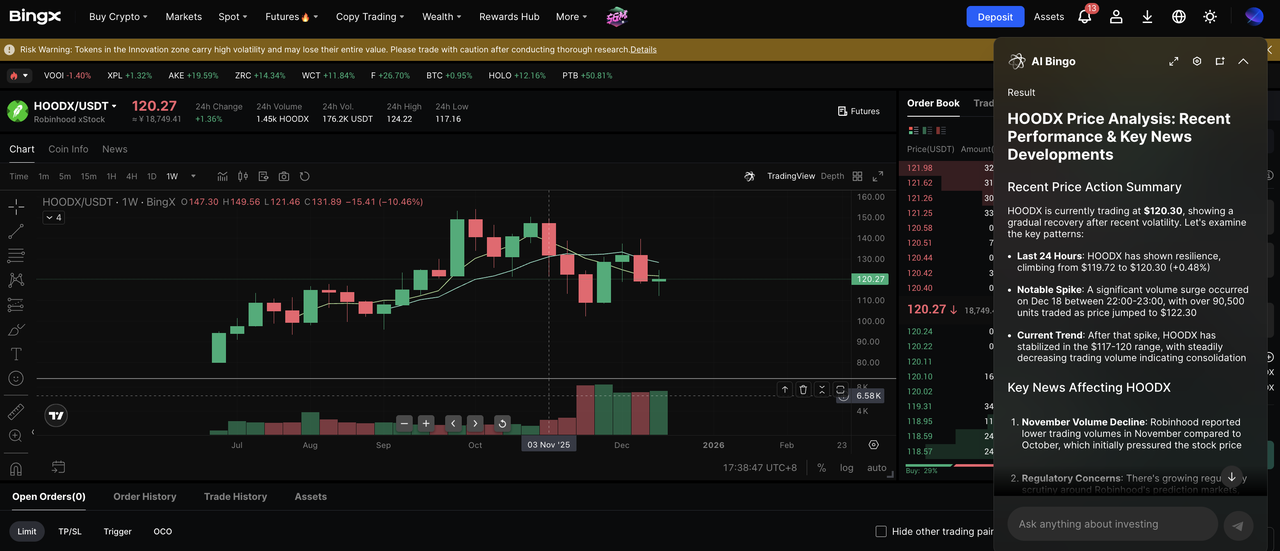

Robinhood (HOOD) Stock Price Analysis and Outlook for 2026

Robinhood (HOOD) delivered one of its strongest performances in 2025. As shown in the chart, the stock is trading around $117–$120 as of mid-December 2025, up more than 200% year-to-date. This rally reflects renewed investor confidence in Robinhood as both a retail trading platform and an increasingly crypto-aligned fintech company.

The key drivers behind HOOD’s 2025 surge include stronger revenue and earnings momentum, higher retail trading activity, and successful expansion into new products such as crypto services, prediction markets, and tokenized assets. Robinhood’s inclusion in the

S&P 500 in late 2025 also increased institutional visibility and passive fund inflows, supporting the stock’s re-rating.

Looking ahead to 2026, analyst expectations are constructive but more measured. Most forecasts point to continued growth potential, with price targets generally clustered above current levels, though with a wide range reflecting valuation sensitivity after the sharp run-up. Execution on new products, sustained crypto market activity, and regulatory stability will be key factors shaping HOOD’s next move.

In short, Robinhood enters 2026 from a position of strength, but after a 200%+ year, future gains are likely to depend more on fundamentals and delivery than multiple expansion.

What Are Robinhood Tokenized Stocks HOODX, HOODON, and How Do They Work?

Robinhood tokenized stocks are designed for investors who want price exposure to Robinhood Markets, Inc. (HOOD) without interacting with traditional stock market infrastructure. Instead of buying HOOD shares through a brokerage account, investors can access Robinhood’s stock performance through blockchain-based tokens that trade on crypto platforms.

Two primary tokenized formats currently provide exposure to Robinhood stock: HOODX, issued under the xStocks model, and HOODON, issued through Ondo Finance.

What Is HOODX Tokenized Robinhood Stock by xStocks?

HOODX belongs to the

xStocks category of tokenized equities, which prioritizes accessibility and trading flexibility for crypto users. These tokens are typically issued on widely used blockchains such as

Solana or

Ethereum and are designed to integrate easily with crypto exchanges and wallets. HOODX allows users to trade Robinhood stock exposure in smaller units, making it suitable for short- to medium-term positioning rather than traditional long-term shareholding.

What Is HOODON Tokenized Robinhood Stock by Ondo Finance?

HOODON is issued through

Ondo Finance’s tokenized equity framework, which places stronger emphasis on institutional-style structuring and alignment with regulated custody practices. While HOODON also tracks the price of Robinhood shares, it is often positioned toward users who value closer linkage to traditional market infrastructure while still accessing the asset through crypto platforms.

Although HOODX and HOODON are issued through different frameworks, they operate on similar foundational principles:

• Market-linked pricing: Token prices are designed to reflect movements in HOOD shares.

• Fractional exposure: Investors can gain exposure without purchasing a full share.

• Stablecoin-based trading: Tokens are commonly traded against assets such as USDT.

• No equity rights: Holding the token does not provide voting rights, dividends, or direct shareholder claims.

Together, these products illustrate how publicly listed companies like Robinhood are increasingly being represented inside crypto markets. For investors already operating within the crypto ecosystem, tokenized stocks offer a way to interact with traditional equities using familiar tools, without fully exiting on-chain finance.

How to Buy Robinhood Tokenized Stocks HOODX and HOODON on BingX

BingX is one of the global crypto exchanges that supports trading for selected tokenized stocks, allowing users to gain price exposure to U.S. equities like Robinhood Markets, Inc. (HOOD) without using a traditional brokerage account. On BingX, users can access Robinhood-related exposure through two different product structures: spot tokenized stocks and stock price–linked futures.

Availability may vary by region and regulatory requirements, and supported products can differ between the spot and futures markets.

Step 1: Create and Verify a BingX Account

Start by signing up on the BingX website or mobile app and completing basic account registration. To unlock full trading functionality, including deposits, spot trading, futures trading, and withdrawals, users must

complete identity verification (KYC).

Step 2: Deposit USDT or Supported Assets

Navigate to the Deposit section of your BingX account and fund your wallet. Most tokenized stock products on BingX are traded against USDT, but users may also deposit other supported cryptocurrencies. Depending on your region, BingX may offer fiat on-ramps such as card payments or bank transfers.

Step 3: Choose Between Spot Tokenized Stocks or Futures

BingX offers Robinhood stock exposure through two distinct formats, each suited to different use cases.

1. Spot Robinhood Tokenized Stocks (HOODX and HOODON)

Spot trading allows users to:

• Hold the tokenized stock directly in their account

• Gain price exposure without leverage

• Trade using USDT without owning traditional shares

This format is typically preferred by users seeking unleveraged, longer-term exposure to Robinhood’s stock price through crypto-native instruments.

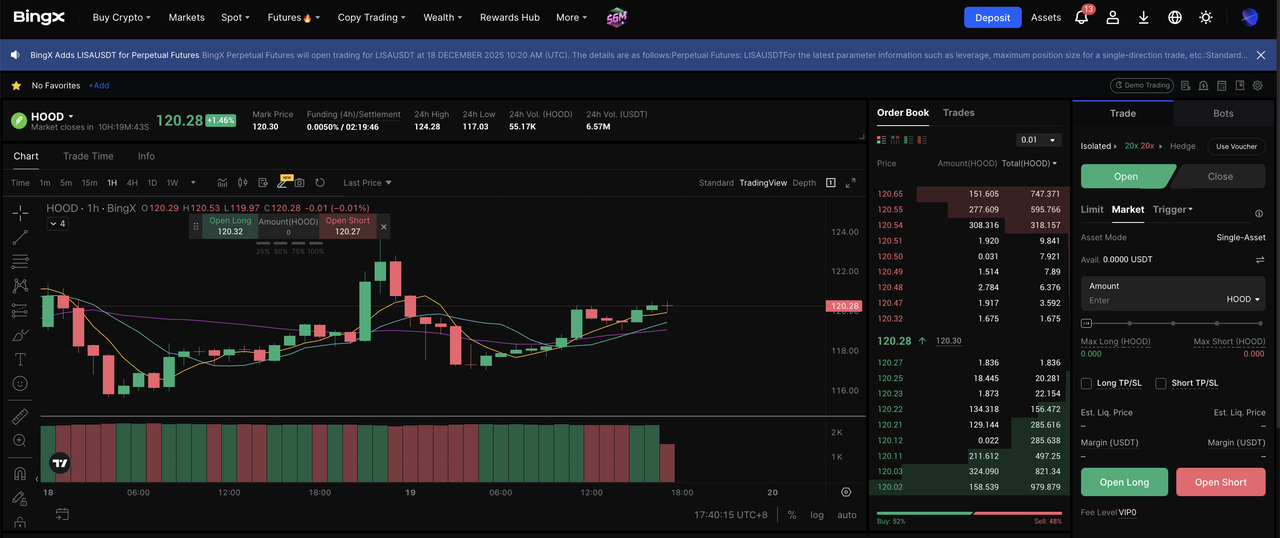

2. Robinhood Stock Price–Linked Futures (HOOD)

In addition to spot tokenized stocks, BingX

Futures market offers futures contracts linked to the price of HOOD stock. These products track Robinhood’s market price but do not represent ownership of shares or tokenized assets.

Robinhood stock futures on BingX allow users to:

• Go long or short on HOOD price movements

• Use leverage to amplify exposure

• Trade without holding any underlying equity or tokenized token

Futures products are generally more suitable for short-term trading and hedging strategies and carry higher risk due to leverage and liquidation mechanics.

Step 4: Place Your Order with the Help of BingX AI

BingX provides built-in AI-powered tools

BingX AI that offer market insights such as price trends, volatility indicators, and basic market signals. These tools can help users evaluate market conditions before placing spot or futures orders.

Users can choose between

market or limit ordersbased on their trading strategy. For futures trading, it is important to review leverage settings, margin requirements, and liquidation risks before confirming an order.

Step 5: Manage Your Position

Spot purchases of HOODX or HOODON will appear in your spot wallet, while futures positions linked to HOOD stock can be monitored through the futures dashboard. Users can hold, close, or adjust positions based on market conditions and personal risk tolerance.

By offering both tokenized stock spot trading and price-linked derivatives, BingX allows users to choose the structure that best aligns with their investment or trading goals when gaining exposure to Robinhood stock.

Considerations Before Investing in Robinhood Tokenized Stock

Before investing in Robinhood tokenized stocks, it’s important to understand how these products differ from traditional equity ownership. While they offer crypto-native access to HOOD’s price movements, they also involve structural, regulatory, and platform-specific considerations.

1. No direct equity ownership: Tokenized stocks such as HOODX and HOODON do not represent direct ownership of Robinhood shares. Investors do not receive voting rights, dividends, or other shareholder privileges typically associated with holding stocks through a brokerage account.

2. Potential price deviations: Although these tokens are designed to track HOOD’s market price, differences in liquidity, trading volume, and trading hours can result in short-term price deviations, especially during periods of market volatility.

3. Regulatory uncertainty: Tokenized equities operate at the intersection of securities regulation and crypto markets. Regulatory changes or regional restrictions may affect availability, supported products, or trading conditions over time.

4. Platform and custody considerations: Trading tokenized stocks on crypto exchanges involves reliance on exchange infrastructure, custody arrangements, and operational stability, which differ from traditional stock market systems.

Understanding these factors can help investors make more informed decisions when gaining exposure to Robinhood stock through tokenized formats.

Is Robinhood Tokenized Stock a Good Investment?

Robinhood is a growth-driven fintech stock whose performance is closely linked to retail trading activity, crypto market cycles, and new product expansion. After a strong rally in 2025, future upside will likely depend more on sustained revenue growth and execution than broad market enthusiasm.

Tokenized versions such as HOODX and HOODON reflect the same investment thesis as HOOD shares, offering price exposure through crypto markets rather than traditional brokerages. These products do not include dividends or shareholder rights, making them suitable primarily for investors focused on price appreciation.

For investors bullish on Robinhood’s long-term role in retail investing and crypto finance, tokenized stocks can offer a flexible, crypto-native way to track the company’s performance.

Related Reading

FAQs on Robinhood Tokenized Stocks HOODX & HOODON

1. Does HOODX or HOODON give me ownership of Robinhood shares?

No. HOODX and HOODON provide price exposure to Robinhood Markets, Inc. (HOOD) but do not represent direct ownership of the underlying shares or grant shareholder rights.

2. What is the difference between HOODX and HOODON?

HOODX is issued under the xStocks framework, which emphasizes crypto-native accessibility and trading flexibility. HOODON is issued through Ondo Finance’s tokenized equity model, which focuses on structured issuance and closer alignment with traditional market infrastructure.

3. Can Robinhood tokenized stocks trade outside U.S. market hours?

Yes. Robinhood tokenized stocks can be traded 24/7 on crypto exchanges, including outside U.S. market hours. However, liquidity and price stability are typically strongest during regular U.S. trading sessions.

4. Do Robinhood tokenized stocks pay dividends?

No. Tokenized stocks such as HOODX and HOODON do not distribute dividends or other shareholder benefits. Their value is based solely on price movements.

5. Are Ondo, xStocks Robinhood tokenized stocks suitable for long-term holding?

They can be used for long-term price exposure, but investors should be aware that tokenized stocks differ from traditional equities in terms of ownership rights, custody structure, and regulatory treatment.

6. Is investing in Robinhood tokenized stocks the same as buying HOOD shares on Nasdaq?

No. Buying HOOD shares through a brokerage provides direct equity ownership, while tokenized stocks offer on-chain price exposure through crypto platforms.