Raydium (RAY) is a

decentralized exchange (DEX) and automated market maker (

AMM) built on the

Solana blockchain. It offers fast, low-cost trading and provides on-chain

liquidity to OpenBook's central limit

order book, making it a key player in the

Solana DeFi ecosystem. Raydium combines the efficiency of Solana's high-speed infrastructure with the flexibility and innovation of decentralized finance, enabling users to trade, earn, and participate in new token launches seamlessly.

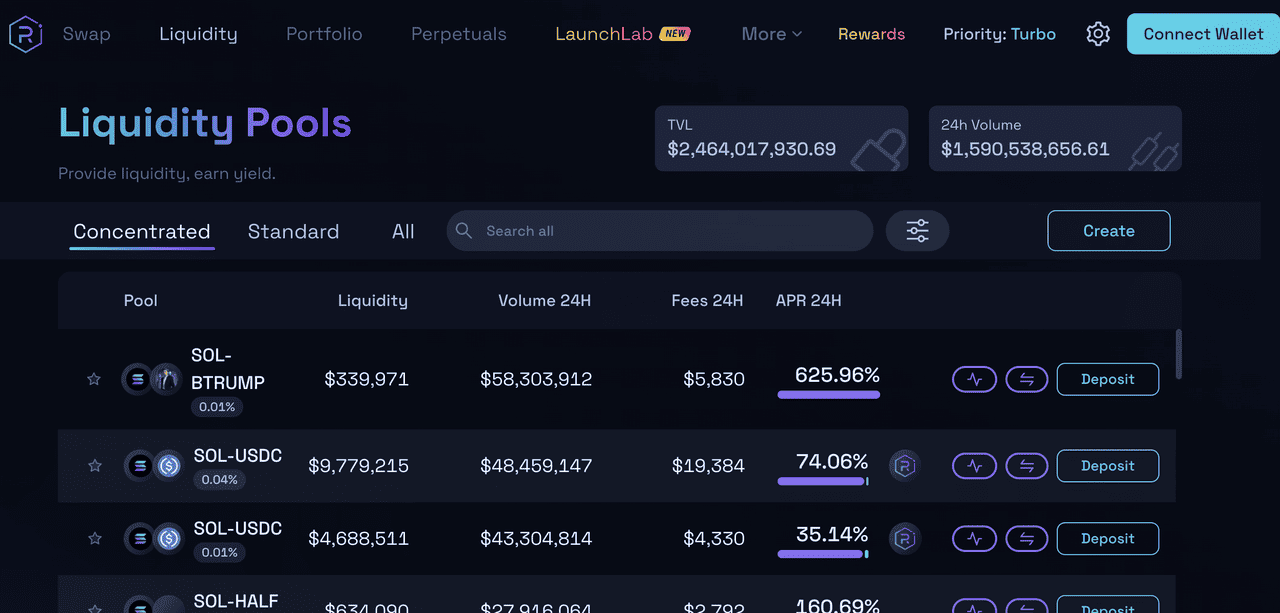

As an AMM, Raydium enables permissionless trading of digital assets using liquidity pools funded by users who lock their tokens. These pools power trading pairs, allowing anyone to swap tokens directly and efficiently. What sets Raydium apart is its hybrid model: it merges the flexibility and speed of AMM trading with the depth of Serum's order book, creating a highly liquid platform with low fees and fast execution.

This setup benefits traders with efficient swaps and tight spreads, while liquidity providers earn rewards in RAY, Raydium's native utility token. Users can also stake RAY to earn additional rewards, making Raydium a cornerstone of Solana's DeFi ecosystem for efficient, low-cost trading and

passive income.

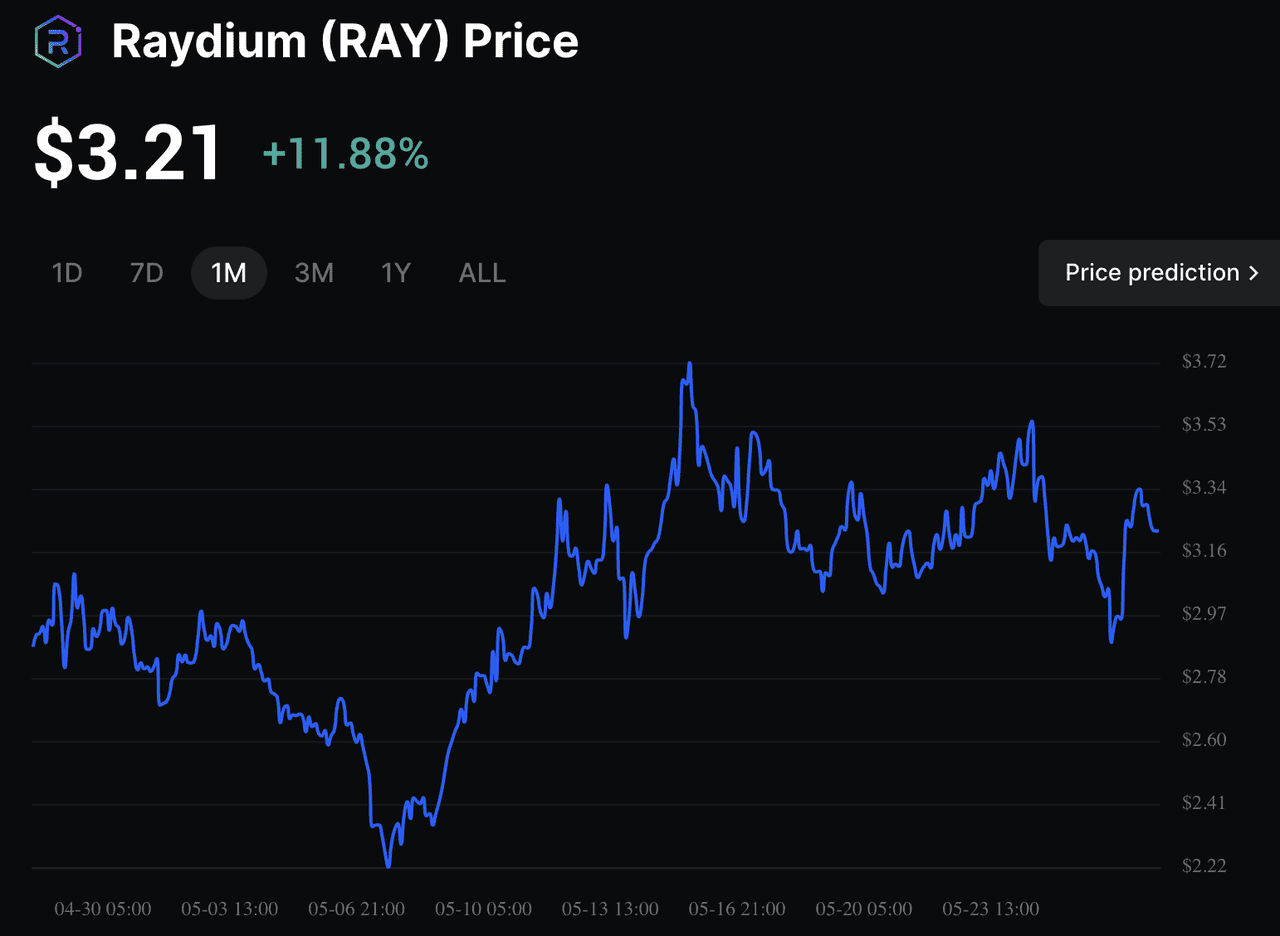

How Did Raydium Become Popular?

Raydium's popularity soared in 2024, particularly during the memecoin craze fueled by its integration with

Pump.fun, a Solana-based

memecoin launchpad. As new tokens launched and trading volumes surged, Raydium became the go-to platform for

Solana memecoin enthusiasts, offering deep liquidity and ultra-low fees. By mid-2024, Raydium's trading volume had increased by 200% compared to the previous year, and its total value locked (TVL) skyrocketed from under $130m to over $2.2b, making it the largest

DEX on Solana.

Who Created Raydium?

Raydium was developed by a pseudonymous team with members known as AlphaRay, XRay, GammaRay, StingRay, and RayZor. AlphaRay leads strategy and business development, bringing expertise in algorithmic trading, while XRay oversees the technology. GammaRay, StingRay, and RayZor contribute in areas like marketing, trading, and security. The team began exploring DeFi in mid-2020, aiming to solve issues they saw in existing systems. By building their own code and forming partnerships, most notably with Serum, they launched Raydium's

mainnet in February 2021.

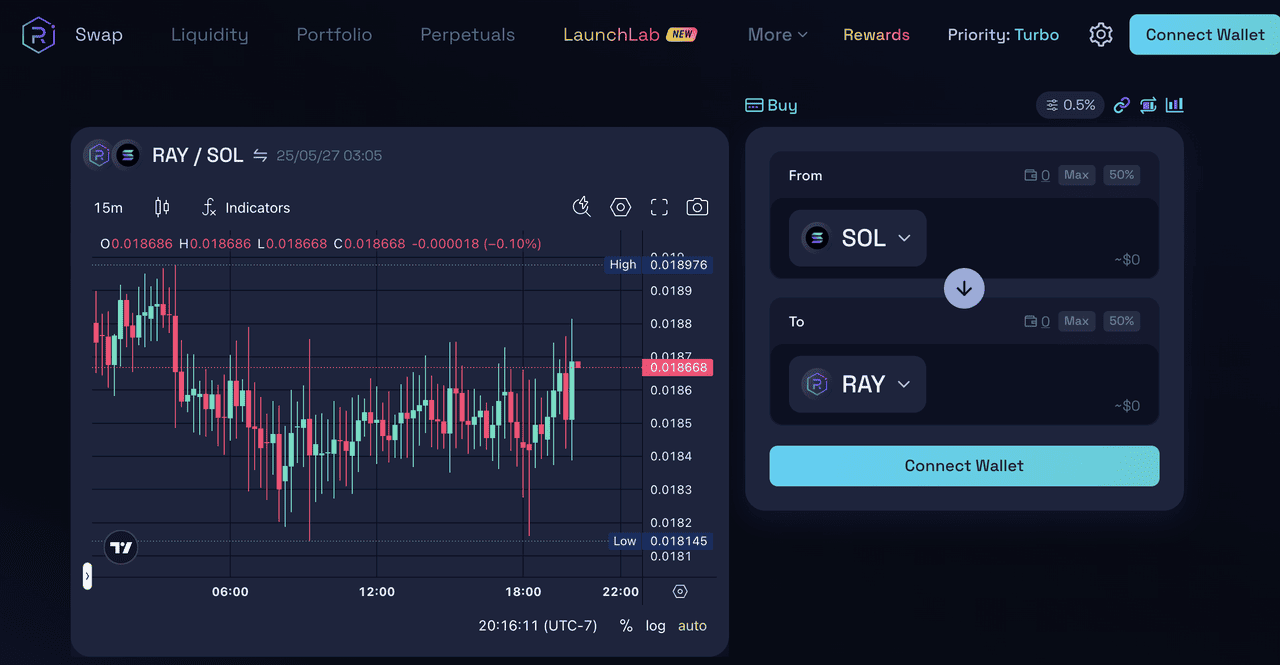

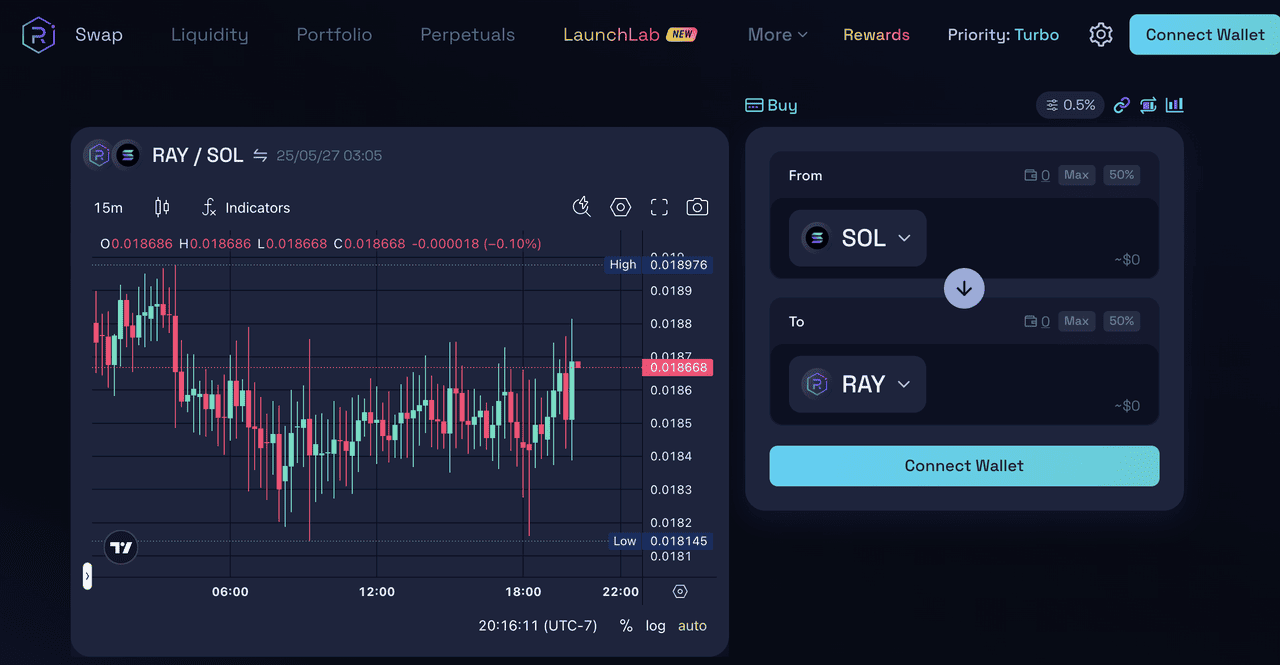

How Does Raydium DEX Work?

Source: Raydium

Raydium uses an automated market maker (AMM) model to power its liquidity pools, supporting fast transactions and minimal fees. Traders can swap tokens instantly, while liquidity providers (LPs) earn a share of trading fees based on their contribution to the pool. Unlike most DEXs, Raydium provides on-chain liquidity to OpenBook's central limit order book, allowing trades on Raydium to interact with other Solana DEXs for better pricing and deeper liquidity. The platform also supports advanced features like

limit orders,

yield farming, and permissionless pool creation, making it ideal for both beginners and advanced DeFi users.

Traditional exchanges use order books to match buyers and sellers, while Raydium's integration with Serum allows it to tap into a decentralized version of this model using smart contracts. On the AMM side, Raydium utilizes liquidity pools where users trade against pooled assets provided by liquidity providers. Unlike

Ethereum-based AMMs, Raydium leverages Solana's speed and low fees, bypassing high

gas costs and slow execution times.

By combining its own AMM pools with Serum's order book, Raydium can source liquidity from both, ensuring efficient and cost-effective trades. Liquidity providers receive LP tokens for their contributions, which can be staked for additional returns. Through dual reward farming, providers can boost their yields even further. Users can also stake RAY to collect a share of platform trading fees and gain access to AcceleRaytor, Raydium's launchpad for new projects.

Raydium supports new project launches via AcceleRaytor, helping raise capital and grow the Solana ecosystem. By blending AMM pools, order book access, and a launchpad, Raydium delivers a comprehensive DeFi experience, making it a top choice for decentralized trading and

yield farming on Solana.

What Can You Do on Raydium?

Raydium offers a suite of features for traders and investors:

• Swap tokens instantly with minimal fees and deep liquidity.

• Provide liquidity to pools and earn a share of trading fees.

• Trade using limit orders for more control over entry and exit prices.

• Stake LP tokens in yield farms to earn additional rewards.

• Participate in Raydium's AcceleRaytor launchpad for early access to new projects.

• Stake RAY tokens to earn rewards and take part in platform governance.

• Explore trending memecoins and new DeFi projects, especially those launched via Pump.fun.

Raydium's user-friendly interface, fast transaction speeds, and seamless wallet integration make it accessible for users of all experience levels.

Raydium's Key Features

Raydium stands out for several reasons:

• Lightning-fast, low-cost transactions powered by Solana.

• Permissionless pool creation, allowing anyone to launch new pools and incentivize liquidity.

• Multiple pool types, including concentrated liquidity and constant product pools, for flexible liquidity strategies.

• Ecosystem rewards and "Burn & Earn" features that let projects renounce control over liquidity while still earning trading fees.

• A smart routing engine that finds the best swap paths across Raydium pools and the broader Solana ecosystem.

What Is $RAY Token?

$RAY is the native SPL token of the Raydium platform on Solana. It plays a central role in the Raydium ecosystem as both a governance and rewards token. By holding RAY, users can participate in the platform’s decision-making process, voting on proposals and future developments. RAY holders also earn a share of trading fees generated on Raydium, with 0.22% of each trade going to liquidity providers and 0.03% allocated to the staking pool. Staking RAY not only allows users to earn a portion of these fees, but also grants access to exclusive opportunities such as participating in new project launches through Raydium’s AcceleRaytor launchpad. This makes RAY essential for those looking to influence the platform’s direction and maximize their earning potential within the Raydium and Solana DeFi ecosystem.

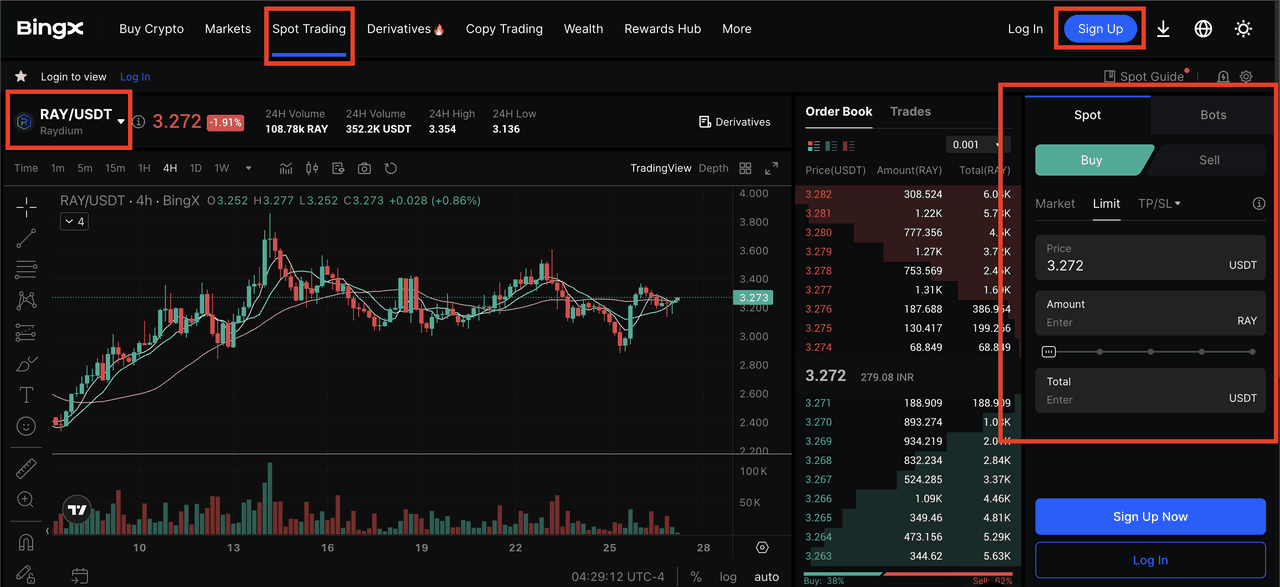

How to Buy Raydium (RAY) on BingX

If you're interested in acquiring Raydium (RAY), BingX offers a straightforward platform for purchasing this Solana-based token. With various payment options and a user-friendly interface, BingX simplifies the process of buying RAY for both new and experienced crypto investors. Here's how you can buy RAY tokens on BingX in five easy steps:

1. Create a BingX account by registering with your email and setting a strong password.

2. Complete security settings by verifying your email and phone, enabling two-factor authentication, and finishing

KYC if required.

3. Deposit funds such as

USDT or

SOL into your BingX wallet.

5. For those interested in trading price movements, you can also access

RAY derivatives on BingX.

Store RAY Tokens Securely

1. Store RAY on BingX and Make Your RAY Holdings Work for You

After buying RAY tokens on BingX, store your tokens directly on the BingX platform for convenience and instant access to a wide variety of trading tools. BingX provides institutional-grade security, including cold and hot wallet separation, regular audits, and a 100% Proof of Reserve system to ensure your assets are fully backed.

2. Hold RAY in Self-Custody Wallets

After purchasing Raydium (RAY) on BingX, you can also choose to store your tokens in self-custody for greater control and security. As a Solana-based token, RAY is compatible with several non-custodial wallets like Phantom, Solflare, and Backpack Wallet, all of which support SPL tokens and allow users to interact with Solana dApps. These wallets provide private key control, hardware wallet integration, and browser extensions or mobile apps for easy access. Always back up your recovery phrase securely, and consider using a hardware wallet like Ledger for added protection when storing large amounts of RAY or other digital assets long term.

Conclusion

Raydium is a cornerstone of Solana's DeFi ecosystem, offering a powerful combination of fast, affordable trading, deep liquidity, and innovative tools for earning yield. Its explosive growth driven by the memecoin boom and integration with Pump.fun highlights its status as the leading DEX on Solana. Whether you're swapping tokens, providing liquidity, or exploring new DeFi opportunities, Raydium offers a user-friendly and efficient platform. Always remember to do your own research and manage your risks when participating in DeFi.

Related Reading

Source: Raydium

Source: Raydium Source: Raydium

Source: Raydium Source: BingX

Source: BingX