A maggio 2025,

Bitcoin ha superato la soglia dei 111.000$, stabilendo un nuovo massimo storico e riaccendendo l'entusiasmo nei mercati globali. Il rally ha coinciso con il 15° anniversario del

Bitcoin Pizza Day, un momento simbolico di quanto lontano sono arrivate le criptovalute, dall'acquisto di una pizza con 10.000 BTC a una classe di asset da trilioni di dollari. Ad aumentare il fermento, il prominente analista PlanB ha riaffermato il suo longevo modello Stock-to-Flow (S2F), proiettando che

Bitcoin potrebbe raggiungere 1 milione di dollari per coin entro la fine di questo ciclo rialzista.

Bitcoin è ora in rialzo di oltre l'85% year-to-date, con oltre 14 miliardi di dollari di afflussi netti negli ETF spot Bitcoin statunitensi quotati da gennaio 2025. L'adozione istituzionale ha raggiunto nuovi massimi, spinta dalle mosse di investimento di JPMorgan Chase, BlackRock e MicroStrategy, mentre il sentiment retail è alimentato da venti favorevoli macro e politici.

Il momentum è plasmato da veri cambiamenti strutturali: l'approvazione degli

ETF spot Bitcoin, il GENIUS Act che progredisce attraverso il Congresso per regolamentare le

stablecoin, e uno shock dell'offerta post-halving che ha ristretto l'emissione di BTC. Mentre queste forze convergono, molti analisti stanno definendo questo l'inizio di una nuova corsa al rialzo delle criptovalute, che potrebbe ridefinire le dinamiche di mercato nel 2025 e oltre.

Che Cos'è una Bull Run Cripto?

Una bull run cripto si riferisce a un periodo prolungato, tipicamente settimane o mesi, durante il quale il mercato complessivo delle criptovalute sperimenta aumenti di prezzo acuti e sostenuti, guidati principalmente da Bitcoin e spesso seguiti dalle altcoin. Questa fase è guidata da un forte ottimismo degli investitori, volumi di trading aumentati e indicatori di sentiment di mercato positivi come un Indice di Paura e Avidità di Bitcoin superiore a 75 (Avidità Estrema), o una dominanza Bitcoin che sale sopra il 50%, segnalando afflussi istituzionali.

Le bull run sono anche caratterizzate da un aumento delle tendenze di ricerca su Google, tassi di finanziamento in aumento nei futures perpetui e una rapida crescita nella capitalizzazione totale del mercato cripto, spesso superando 1 trilione di dollari in guadagni nel giro di mesi. Il termine "bull" deriva dalla spinta verso l'alto delle corna di un toro, riflettendo il momentum prevalente verso l'alto nei prezzi e nel sentiment.

Un Riepilogo delle Bull Run Storiche nel Mercato Cripto

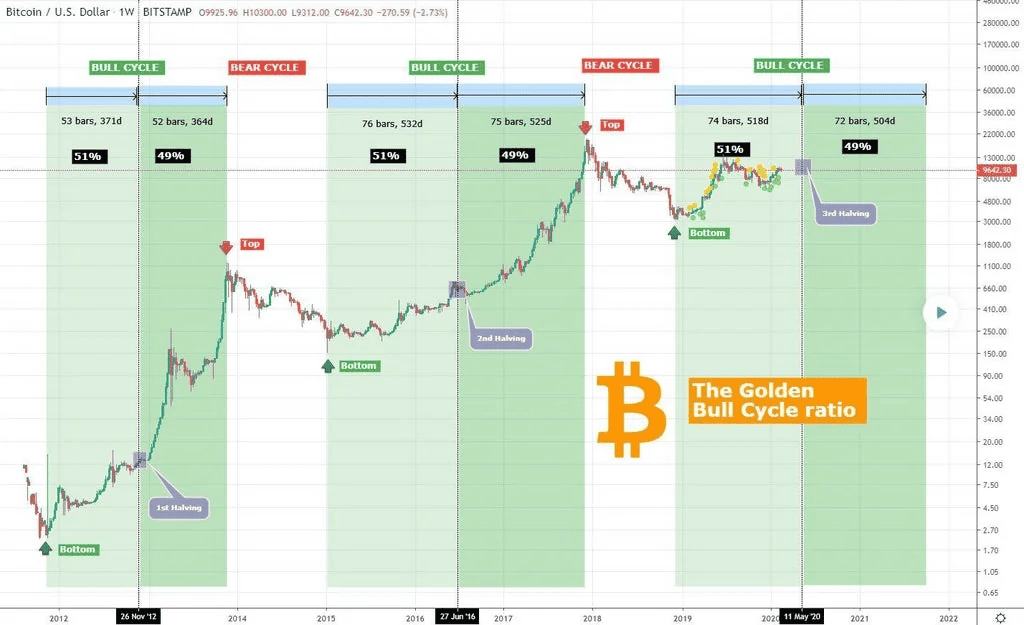

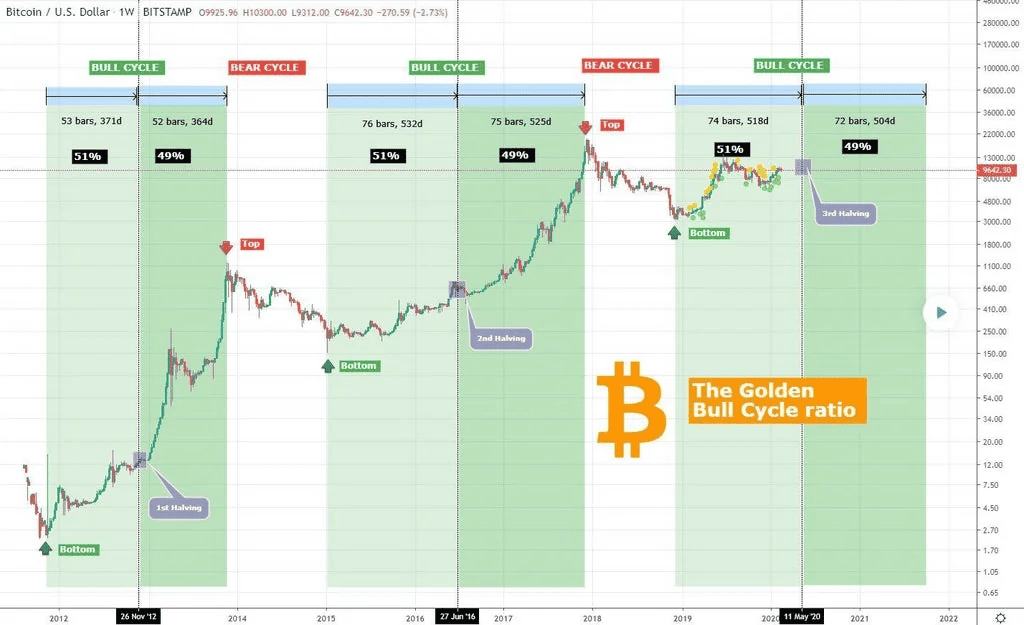

Bull run precedenti nel mercato delle criptovalute | Fonte: Reddit

Comprendere le bull run cripto del passato può fornire preziose intuizioni sul comportamento del mercato e sul sentiment degli investitori. Esploriamo tre significative bull run che hanno plasmato il panorama delle criptovalute:

1. Bull Run del 2012: La Prima Grande Esplosione di Prezzo

La prima vera bull run di Bitcoin si è verificata alla fine del 2012 e all'inizio del 2013, quando BTC è salito da circa 5$ a oltre 260$ nel giro di pochi mesi, un incredibile aumento di oltre il 5.000%. Questo rally ha seguito il primo evento di halving di Bitcoin nel novembre 2012, quando le ricompense di mining sono scese da 50 a 25 BTC per blocco, innescando uno shock dell'offerta.

Durante questo periodo, Bitcoin ha iniziato a guadagnare trazione su forum come Bitcointalk e piattaforme come Mt. Gox. Il rialzo è stato anche guidato da una copertura mediatica iniziale, dall'interesse crescente delle comunità libertarie e dall'entusiasmo di base riguardo al denaro decentralizzato. Anche se la corsa si è conclusa con una netta correzione, ha dimostrato che Bitcoin aveva potenziale di mercato e una base di utenti crescente, preparando il terreno per i futuri cicli rialzisti.

2. Bull Run del 2017: L'Ascesa di Bitcoin a Quasi 20.000$

Nel 2017, Bitcoin è passato da una valuta digitale di nicchia a un nome familiare. Iniziando l'anno a circa 1.000$, è salito a quasi 20.000$ entro dicembre, un'impennata del 1.900% che ha stupito anche gli investitori più esperti. Questo rally è stato alimentato dal boom delle Initial Coin Offering (

ICO), dove migliaia di nuovi token sono stati lanciati su

Ethereum, creando eccitazione e speculazione.

La copertura mediatica è esplosa, portando Bitcoin sotto i riflettori. Gli investitori retail si sono riversati, spesso senza comprendere appieno la tecnologia. Anche se questa bull run si è conclusa con una netta correzione all'inizio del 2018, ha gettato le basi per una diffusa consapevolezza cripto e futura adozione.

3. Bull Run del 2021: Adozione Istituzionale e Crescita DeFi

La bull run del 2021 ha segnato un punto di svolta: Wall Street ha iniziato a prestare attenzione. Aziende come Tesla, Square e MicroStrategy hanno fatto acquisti di Bitcoin multimiliardari. Allo stesso tempo, le piattaforme di Finanza decentralizzata (

DeFi) stavano guadagnando trazione, consentendo agli utenti di prestare, prendere in prestito e guadagnare rendimenti senza banche tradizionali.

Oltre all'estate DeFi del 2020-21, anche gli

NFT sono entrati in scena, introducendo la proprietà digitale alle masse. Bitcoin ha raggiunto un nuovo massimo storico di circa 69.000$ nel novembre 2021, mentre Ethereum e altre altcoin hanno seguito con rally da record. La fiducia istituzionale, i casi d'uso nel mondo reale e l'entusiasmo speculativo hanno reso questa una delle bull run più trasformative nella storia delle criptovalute.

Fasi Chiave di una Bull Run Cripto

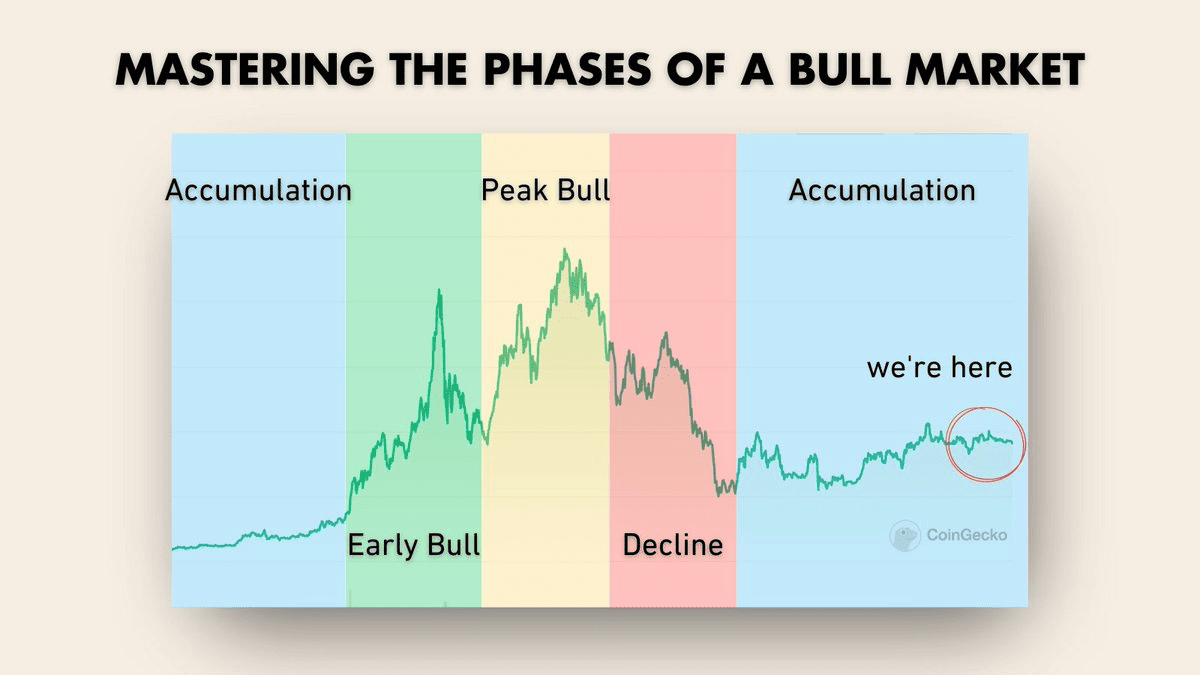

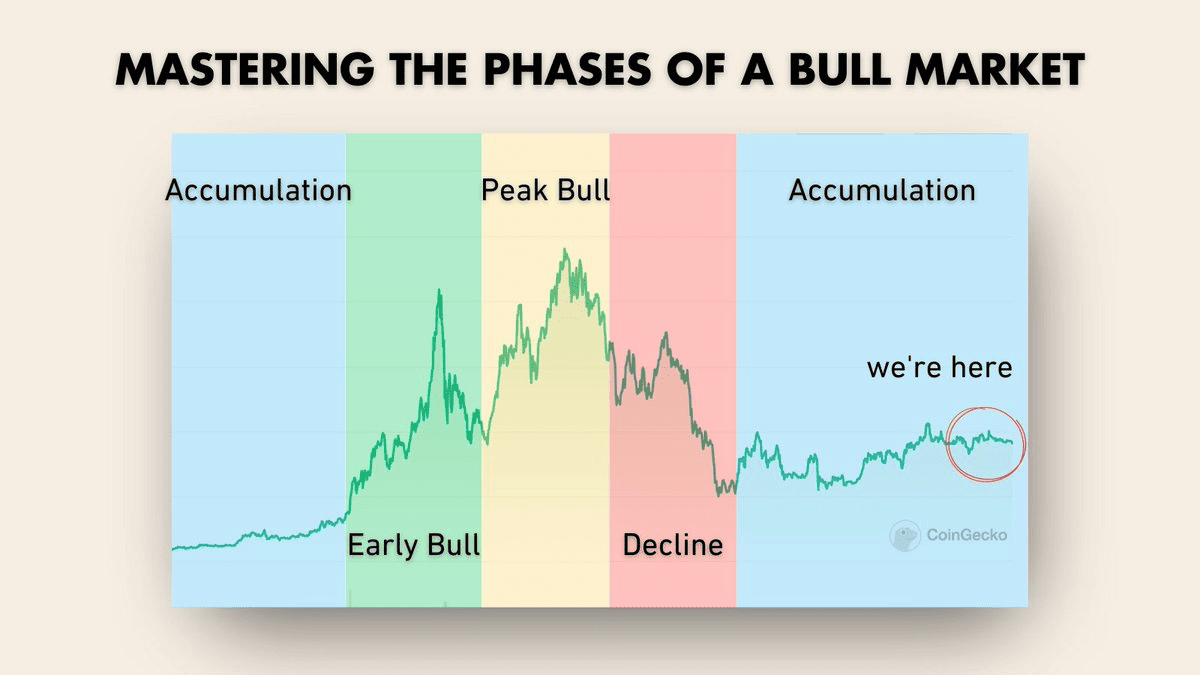

Fasi principali di una bull run nelle cripto | Fonte: @thedefiedge su X

Comprendere una bull run cripto significa riconoscere che non è solo un lungo movimento verso l'alto; si sviluppa in fasi. Ogni stadio racconta una storia diversa sul comportamento degli investitori e sul momentum del mercato.

1. Fase di Accumulazione: È qui che la bull run inizia silenziosamente. I prezzi sono bassi o si muovono lateralmente, e solo i primi credenti o i giocatori istituzionali iniziano ad acquistare. A questo punto, il sentiment del mercato è neutro o persino leggermente ribassista, ma gli investitori saggi vedono il potenziale a lungo termine e iniziano ad accumulare asset a prezzi più bassi.

2. Fase di Markup (Bull Run Iniziale): Man mano che più partecipanti notano l'aumento dei prezzi e le notizie positive, l'eccitazione cresce. Il mercato sperimenta un forte aumento della domanda, spingendo i prezzi più in alto a un ritmo più veloce. È spesso quando l'attenzione mainstream si accende, e gli investitori retail si precipitano, alimentando una rapida crescita e un'adozione più ampia.

3. Fase di Distribuzione (Declino): Ora che i prezzi sono aumentati, i primi investitori iniziano a prendere profitti. Questo porta a una maggiore volatilità, poiché alcuni partecipanti escono mentre altri si aspettano ancora che i prezzi salgano. Il comportamento di mercato conflittuale crea movimenti di prezzo instabili, e il trend rialzista generale inizia a rallentare.

4. Fase di Markdown (Accumulazione di Nuovo): Alla fine, il mercato cambia. La pressione di vendita supera la domanda, e i prezzi iniziano a scendere. Questa fase segna la fine della bull run. Alcuni investitori vanno nel panico e vendono le loro partecipazioni, contribuendo a un ulteriore momentum verso il basso. Il mercato si ripristina, e un nuovo ciclo inizia.

La Bull Run del 2025: ETF Cripto, Regolamentazione e Nuovi Driver di Mercato

A maggio 2025, Bitcoin ha infranto i record precedenti, superando i 111.000$ per la prima volta. Ma questa non è solo un'altra impennata speculativa; è una bull run guidata da chiari cambiamenti strutturali nel mercato cripto più ampio.

Cosa Sta Guidando la Bull Run Cripto del 2025?

Ecco alcuni dei fattori chiave che supportano la bull run vista in Bitcoin e altre criptovalute leader dal 2024:

1. Approvazione degli ETF Spot Bitcoin (gennaio 2024): Nel gennaio 2024, la Securities and Exchange Commission (SEC) statunitense ha approvato il primo lotto di ETF spot Bitcoin, aprendo le porte al capitale istituzionale. I prodotti di BlackRock, Fidelity e altri hanno portato Bitcoin ai conti di intermediazione tradizionali, consentendo a fondi pensione, gestori patrimoniali e investitori retail di ottenere esposizione senza custodia diretta. Questa mossa ha legittimato Bitcoin come investimento mainstream.

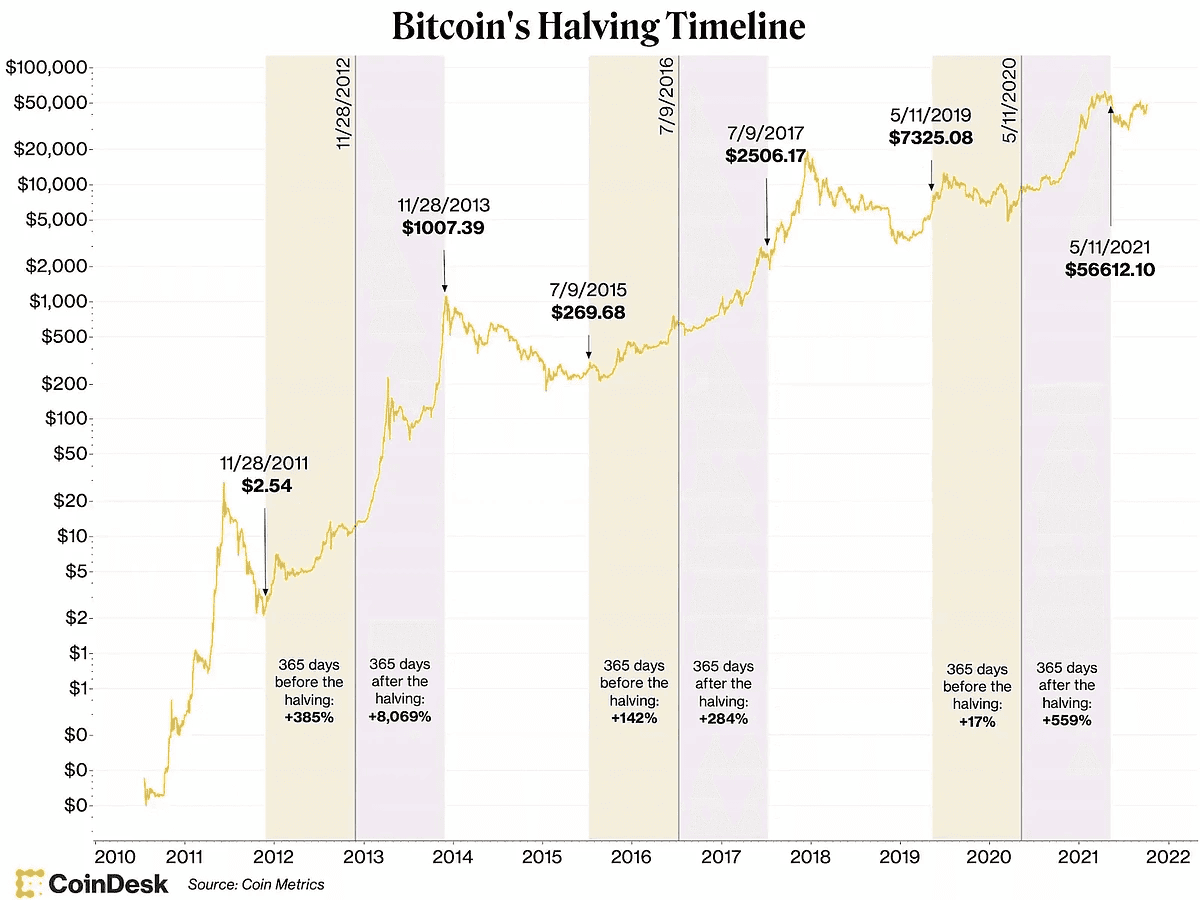

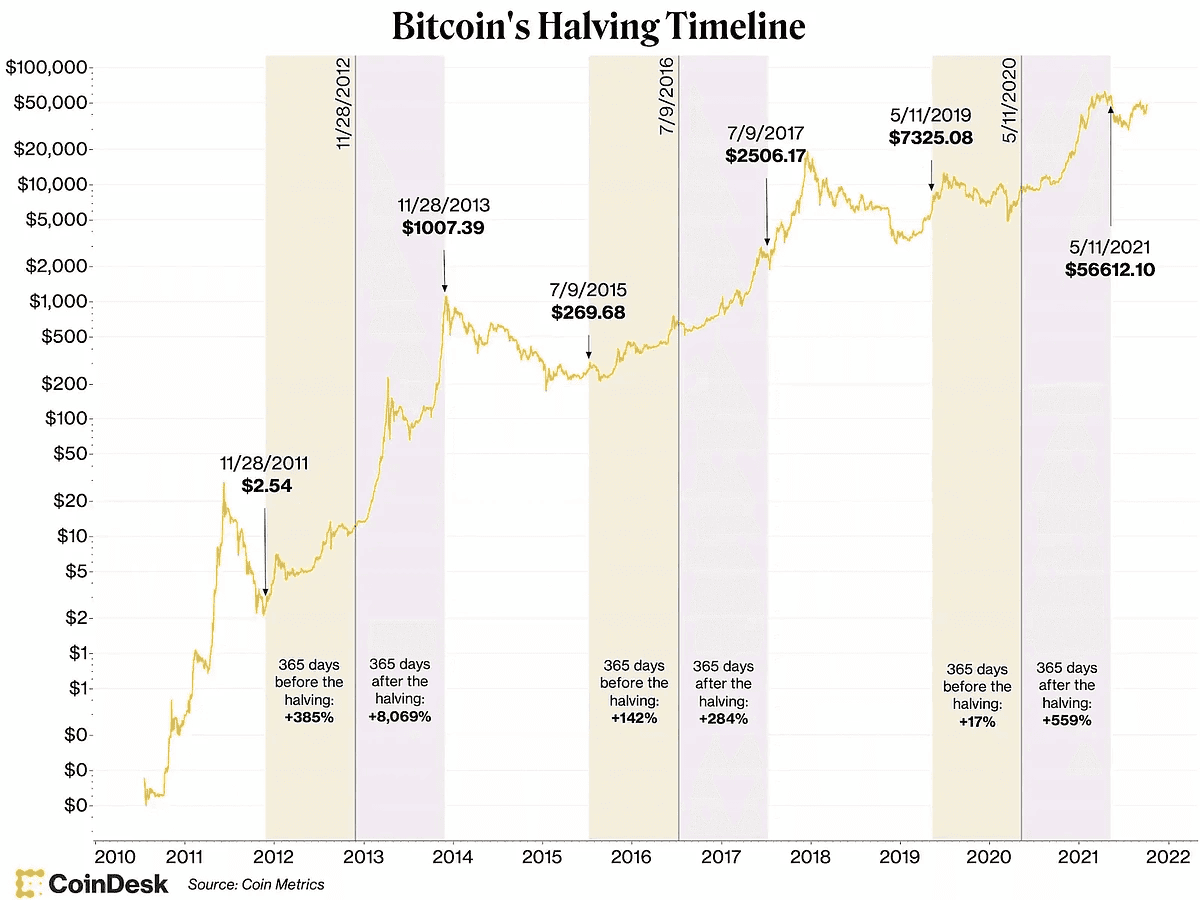

2. Quarto Halving di Bitcoin (aprile 2024): Nell'aprile 2024, il quarto evento di

halving di Bitcoin ha ridotto le ricompense dei miner da 6,25 BTC a 3,125 BTC per blocco. Storicamente, gli halving portano a shock dell'offerta che spingono i prezzi più in alto. Mentre la nuova offerta si restringeva, la domanda degli investitori continuava a crescere, amplificando il momentum rialzista.

Halving di Bitcoin e cicli di bull run: una cronologia | Fonte: CoinDesk

3. Chiarezza Normativa e il GENIUS Act: Il proposto GENIUS Act, volto a regolamentare le stablecoin e supportare l'innovazione blockchain, ha superato i suoi primi voti al Senato e segnala una posizione normativa statunitense più favorevole alle criptovalute. Il mercato ha risposto positivamente, con maggiori flussi ETF e un maggiore coinvolgimento istituzionale nei protocolli DeFi conformi.

4.

Riserve Strategiche di Bitcoin: Seguendo le orme di MicroStrategy, diverse aziende globali e persino fondi sovrani hanno iniziato ad allocare riserve in Bitcoin. Le voci di banche centrali che esplorano Bitcoin come copertura contro la svalutazione fiat hanno ulteriormente supportato le prospettive di prezzo a lungo termine.

5. Campagna Pro-Cripto di Trump: Con Donald Trump di nuovo in carica, i mercati cripto hanno fatto rally dietro la sua retorica pro-blockchain. La sua amministrazione ha fatto intendere di ridurre l'attrito normativo, espandere gli incentivi al mining e supportare l'innovazione cripto con sede negli Stati Uniti. Questo ha incoraggiato un ambiente più risk-on per gli investitori americani.

6. Venti di Coda Macroeconomici: I tassi di interesse in calo, un'economia globale in ripresa e l'inflazione in diminuzione hanno rinnovato l'appetito per il rischio in tutte le classi di asset. In questo ambiente, Bitcoin si è riaffermato come riserva di valore digitale, attirando sia investitori tradizionali che utenti nativi delle criptovalute. Ad aggiungere al momentum, un significativo aumento dell'offerta di moneta M2, che include contanti, depositi correnti e quasi-moneta facilmente convertibile, ha sollevato preoccupazioni sulla diluizione a lungo termine della valuta fiat. Mentre le banche centrali continuano politiche monetarie espansionistiche, più investitori si stanno rivolgendo a Bitcoin come copertura contro l'inflazione e il debasement monetario.

7. Tokenizzazione di Asset del Mondo Reale (RWA) e Più Casi d'Uso: Una delle tendenze più significative che alimenta la bull run del 2025 è la crescente adozione della blockchain per casi d'uso del mondo reale. La

tokenizzazione di asset del mondo reale (RWA), come obbligazioni, immobili e private equity, ha guadagnato trazione sia su blockchain pubbliche che autorizzate. Istituzioni come Franklin Templeton, BlackRock e HSBC hanno lanciato iniziative RWA, dimostrando che le criptovalute non riguardano solo il trading speculativo; stanno diventando infrastruttura centrale per i mercati finanziari globali. Questo cambiamento sta attirando nuove classi di investitori e sbloccando trilioni di valore di asset tokenizzati nei prossimi anni.

Insieme, questi elementi hanno creato le condizioni perfette per quella che molti chiamano la bull run più sostenibile finora. Con vera infrastruttura, chiarezza legale e adozione globale in accelerazione, il ciclo del 2025 sembra fondamentalmente diverso da quelli che sono venuti prima.

Come Navigare una Bull Run del Mercato Cripto da Principiante

Le bull run cripto possono essere emozionanti, ma comportano anche rischi, specialmente per i nuovi arrivati. Sapere come approcciarsi a questi rialzi con cautela e strategia è fondamentale per proteggere i propri asset e prendere decisioni informate.

1. Fai le Tue Ricerche (

DYOR): Prima di investire, prenditi il tempo per capire cosa stai comprando. Indaga sulla tecnologia, il caso d'uso e la community dietro ogni criptovaluta. Controlla i

report di audit, la

tokenomics e la roadmap del progetto. Piattaforme come l'

Accademia BingX, CoinGecko, Messari e blog di notizie cripto rispettabili possono aiutarti a valutare i fondamentali di un token. L'Accademia BingX offre guide per principianti, spiegazioni di mercato e strategie di trading avanzate, tutte progettate per aiutarti a prendere decisioni di trading più informate.

2. Gestisci il Tuo Rischio: Le bull run possono far sembrare che il mercato si muova solo verso l'alto, ma le correzioni arrivano sempre. Per proteggerti:

• Usa ordini stop-loss e take-profit su BingX per automatizzare la tua strategia di rischio.

• Imposta limiti di dimensione della posizione basati sul tuo portafoglio.

• Usa gli Strumenti di

Gestione del Rischio di BingX, come rapporti di margine e indicatori di esposizione, specialmente quando usi la leva.

Diversificare il tuo portafoglio attraverso diversi settori, come DeFi, blockchain Layer-1 e RWA, può anche ridurre la sovraesposizione a qualsiasi singola tendenza o token.

3. Evita la

FOMO (Paura di Perdere) e il Trading Emotivo: Quando i prezzi stanno pompando, è tentante saltare dentro alla cieca. Ma i trade impulsivi possono portare a pesanti perdite. Invece:

• Attieniti ai tuoi piani di entrata e uscita.

• Non seguire l'hype casuale sui social media; verifica i fondamentali.

• Usa la modalità demo trading di BingX per testare le tue strategie senza rischiare fondi reali.

• Considera il

Copy Trading su BingX, dove puoi seguire e replicare automaticamente i migliori trader con track record comprovati. Questo può aiutare i principianti a imparare il comportamento del mercato limitando il processo decisionale emotivo.

4. Rimani Informato: Le criptovalute si muovono velocemente. Aggiornamenti normativi, listing di exchange o aggiornamenti di protocollo possono scatenare rapide oscillazioni di prezzo. Per rimanere avanti:

• Segui il Blog BingX per approfondimenti di mercato regolari, analisi approfondite di progetti e consigli di trading.

• Imposta allarmi in tempo reale su BingX per livelli di prezzo, tassi di finanziamento e picchi di volume.

• Unisciti alla community di social trading di BingX, dove i trader condividono intuizioni dal vivo e sentiment.

5. Sincronizza il Mercato con Strumenti di Trading Automatizzati: BingX offre anche bot di trading automatizzati che ti aiutano a capitalizzare sulla volatilità dei prezzi senza sforzo manuale costante. Le strategie popolari includono il

Grid Trading, che piazza ordini di acquisto e vendita a intervalli preimpostati per trarre profitto dalle fluttuazioni di mercato, e la

strategia Martingale, che mira a recuperare le perdite aumentando progressivamente le dimensioni dei trade. Per gli utenti che cercano opportunità di rendimento in un mercato rialzista, il

Doppio Investimento BingX ti consente di guadagnare rendimenti bloccando cripto a un prezzo target, indipendentemente dalla volatilità a breve termine. Questi strumenti sono particolarmente utili durante le bull run quando le oscillazioni di prezzo sono veloci e frequenti, permettendoti di automatizzare i tuoi trade gestendo il rischio e massimizzando i rendimenti.

Conclusione

Le bull run sono alcuni dei momenti più emozionanti e volatili nelle criptovalute. Comprendere le loro fasi, storia e driver può aiutarti a individuare opportunità ed evitare errori costosi.

Che tu sia nuovo alle criptovalute o stia costruendo un portafoglio a lungo termine, la chiave è rimanere informato, rimanere cauto e attenersi a una strategia. Mentre la bull run del 2025 si sviluppa, non limitarti a cavalcare l'onda, impara come navigarla. Inizia in piccolo, fai le tue ricerche e ricorda: nelle criptovalute, la conoscenza è il tuo migliore asset.

Letture Correlate

Bull run precedenti nel mercato delle criptovalute | Fonte: Reddit

Bull run precedenti nel mercato delle criptovalute | Fonte: Reddit Fasi principali di una bull run nelle cripto | Fonte: @thedefiedge su X

Fasi principali di una bull run nelle cripto | Fonte: @thedefiedge su X Halving di Bitcoin e cicli di bull run: una cronologia | Fonte: CoinDesk

Halving di Bitcoin e cicli di bull run: una cronologia | Fonte: CoinDesk