2026年、BingXの1,150万人以上のユーザーが

コピートレードを利用しており、よりスマートで自動化された投資への需要が高まっている明確な証拠となっています。トップトレーダーがわずか30日間で2桁および3桁のROIを達成している中、より多くの人々が単独で取引するのではなく、専門家の戦略に従うことを選択しています。BingXコピートレードは、AIを活用したトレーダーの推奨とリアルタイムの取引レプリケーションを組み合わせることで、このアプローチをすべての人に利用可能にし、高度な取引経験がなくても自信を持って暗号資産市場に参加できるようにします。

このガイドでは、トップトレーダーの選択からリスク管理の設定、最新のコピートレード2.0ツールと

BingX AIを活用したインサイトによるパフォーマンス監視まで、BingXでコピートレードを開始するために必要なすべてを説明します。

BingX AI コピートレードとは?

BingXのコピートレードは、深い取引知識や継続的なチャート分析を必要とせずに、初心者が暗号資産市場に参加することを可能にします。自分で取引を実行する代わりに、経験豊富なトレーダーをフォローし、彼らの行動がリアルタイムであなたのアカウントに自動的に複製されます。

BingXコピートレードは、柔軟なコピーモード、AIを活用したツール、透明性の高いトレーダー分析が特徴であり、あらゆる経験レベルのユーザーが利用できます。無限のプロフィールを手動で検索する代わりに、BingX AIのプロトレーダーレコメンダーを参照できます。これは、あなたのリスク許容度、資産の好み、投資目標に基づいて、互換性のあるトレーダーとあなたをマッチングさせます。このスマートなエコシステムは、あなた自身の取引アプローチをコントロールしながら、プロの戦略に従うことを可能にします。

BingXのコピートレードにはどのような種類がありますか?

BingXは、さまざまな取引スタイルや経験レベルに合わせて、いくつかのコピートレードモードを提供しています。トレーダーの正確な戦略に密接に従うことを好むか、各取引に投資する金額をより細かく管理したいかにかかわらず、あなたに合ったコピーモードがあります。ここでは、3つの主要なオプションの内訳を説明します。

1. ポジション比率によるコピー

(無期限先物で利用可能)

これは、プロのトレーダーをコピーするための最も人気のあるモードです。あなたの取引は、トレーダーが使用する正確なポジションサイズとレバレッジを自動的に反映しますが、あなた自身の口座サイズに合わせて調整されます。例えば、トレーダーが残高の10%を使用して取引を開始した場合、あなたの割り当てられた資金の10%も使用されます。

• 理想的なユーザー:トレーダーの戦略を可能な限り忠実に再現したいユーザー

• 主な利点:トレーダーのエクスポージャーとパフォーマンスに比例して一致する

• 注意点:利益と損失の両方を含め、あなたの結果はトレーダーの結果と非常に似たものになります

2. 注文ごとコピー (固定証拠金)

(無期限先物および標準先物で利用可能)

このモードでは、トレーダーが開始する各取引に使用する証拠金の固定額を設定します。例えば、注文ごとの証拠金として20ドルを選択した場合、トレーダーがいくら投資しているかに関わらず、その正確な金額がすべてのコピー取引に使用されます。

• 理想的なユーザー:取引ごとに固定された資本使用を望み、リスクと高い資本利用率を効果的に管理する経験を持つ中級から上級ユーザー。

• 主な利点:各取引に投資する金額を正確に決定し、リスク管理に役立つ

• 注意点:あなたの取引サイズはトレーダーのサイズと完全に一致しないため、リターンが異なる場合があります

3. 現物市場注文によるコピー

(現物コピートレードのみで利用可能)

このモードでは、トレーダーのリアルタイムの現物市場注文を自動的にコピーできます。つまり、割り当てられた

USDTを使用して、買いと売りの取引が市場価格で実行されます。これは、手動で取引を管理することなく、

ビットコイン、

イーサリアム、

ソラナなどの実際の暗号資産にエクスポージャーを得るためのシンプルで低リスクな方法です。

• 理想的なユーザー:複雑な設定なしで専門トレーダーをフォローしたい初心者および受動的投資家

• 主な利点:レバレッジなし、清算リスクなしで、トレーダーの実際の現物注文と1:1で取引が実行される

• 注意点:有効で完全に約定された市場注文のみがコピーされます。グリッド戦略は現物コピートレードではサポートされていません

BingX コピートレード 2.0とは?

BingXコピートレード2.0は、BingXのソーシャルトレーディングシステムのアップグレード版であり、取引をコピーするユーザー向けに透明性、コントロール、リスク管理を強化しています。各コピートレーダー専用のサブアカウントを導入し、利益、清算価格、レバレッジレベルをより明確に追跡できるようにします。

よりスマートな資金配分、改善された実行ロジック、ポジションを中断することなく資金を追加または削除できる機能により、コピートレード2.0はリードトレーダーの戦略をより正確に複製することを保証し、ユーザーがリアルタイムでパフォーマンスを監視し、リスクを管理することを容易にします。

BingXのコピートレードの仕組み

BingXコピートレードでは、経験豊富なトレーダーをフォローし、彼らの取引をあなた自身の口座に自動的に複製することができます。フォローするトレーダーを選択すると、BingXはあなたの選択したコピーモードとリスク設定に基づいて、彼らのポジションをリアルタイムで反映します。

スマートな選択を支援するため、BingXはトレーダーをリアルタイムのパフォーマンスデータに基づいた厳選されたカテゴリに分類しています。

1. トレンドトレーダー:最近の好成績と高い知名度でユーザーに人気。

2. 保守的なトレーダー:低リスクで安定した戦略に焦点を当て、ドローダウンを最小限に抑える。

3. ライジングスター:BingX AIによってパフォーマンスが向上していると特定された、新しくも有望なトレーダー。

各トレーダーのプロフィールには、あなたの意思決定を導くための詳細な指標が含まれています。

• 30日および180日ROI:短期および中期的な収益性を測定します。

• 勝率:利益で終わった取引の割合。

• 累積PnL:トレーダーがプラットフォームに参加して以来の総純利益または損失。

• 最大ドローダウン:トレーダーの口座がピークからどれだけ減少したかを示します。

• 取引スタイル:トレーダーがスキャルピング、スイングトレード、トレンドフォローのいずれを好むかを理解します。

BingXのAIツール(エキスパートトレーダー分析など)は、あなたの目標とリスク許容度に合ったトレーダーを見つけるのにも役立ちます。組み込みの分析機能と自動取引実行により、BingXのコピートレードは、取引初心者でも暗号資産市場に簡単に参加できるようにします。

BingXでコピートレードを開始するのは簡単です。これらの簡単なステップに従ってトレーダーを選択し、設定を行い、リアルタイムで取引のコピーを開始してください。

ステップ1:BingXアカウントを設定する

認証済みのBingXアカウントを持っていることを確認してください。

USDTを入金して資金口座に入れ、選択したコピーモードに応じて無期限先物または標準先物口座に資金を移動してください。

注:現在、USDTはコピートレードでサポートされている唯一の証拠金通貨です。

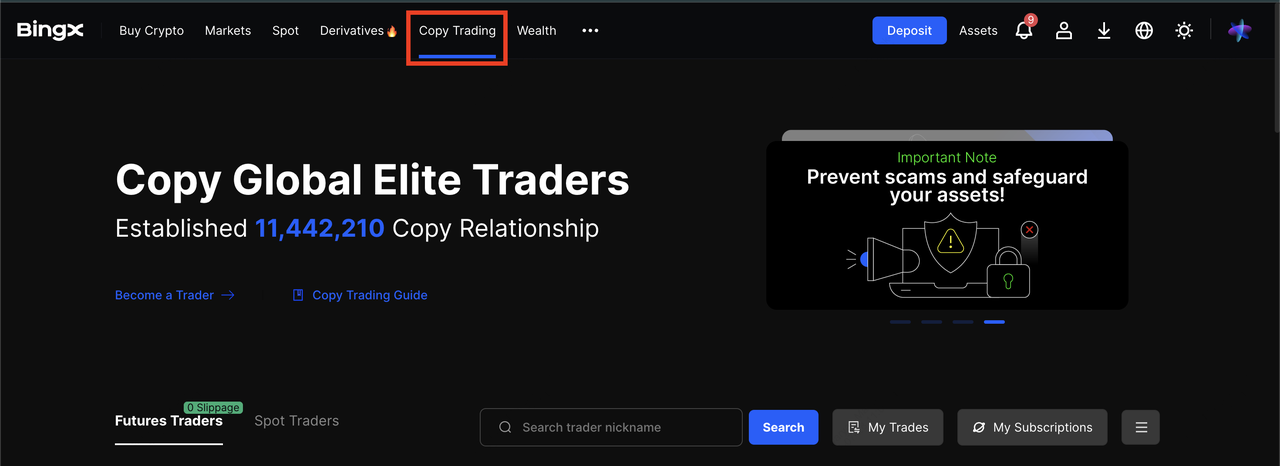

ステップ2:コピートレードセクションに移動する

BingXアプリまたはウェブサイトを開く → ホームページから

コピートレードに移動します。トレンドトレーダー、保守的、ライジングスターなどのカテゴリを閲覧します。ROI、ドローダウン許容度、勝率、戦略タイプ、時間軸で絞り込むためにフィルターを使用します。

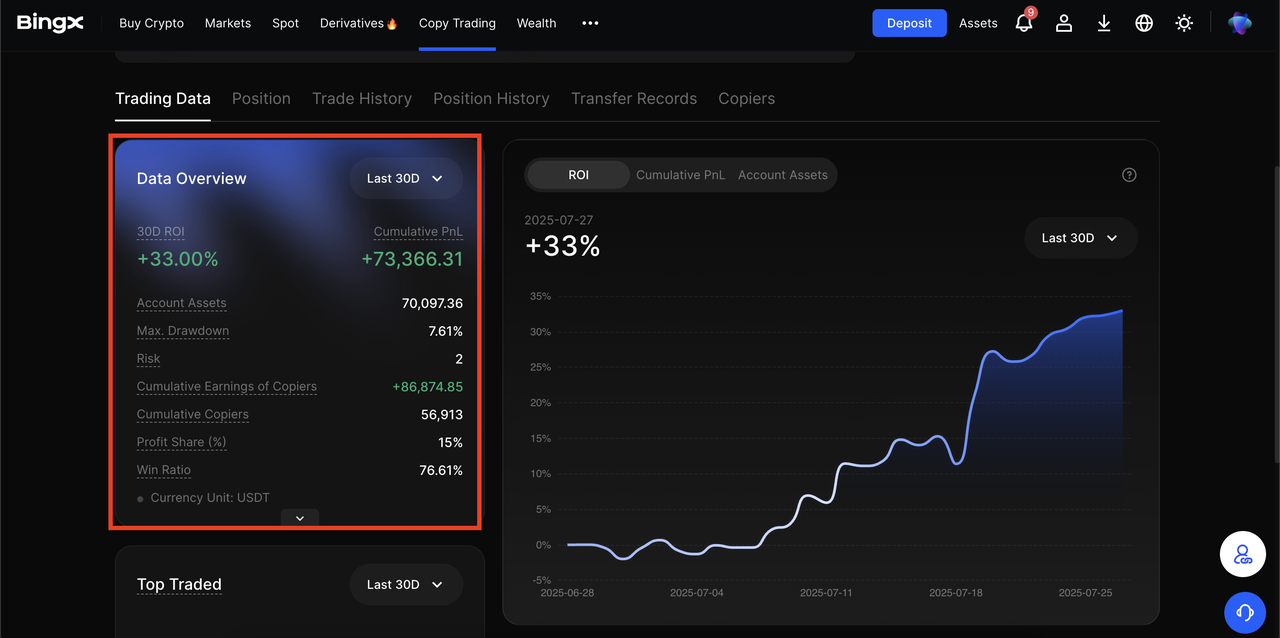

ステップ3:コピートレーダーのプロフィールを確認する

トレーダーをクリックして詳細な指標を表示します。

• 30日/180日間のROI

• USDT建ての口座資産

• 勝率、最大ドローダウン、取引頻度

• 過去のPnLと戦略の概要

定義と説明については、任意の指標のiアイコンをクリックしてください。

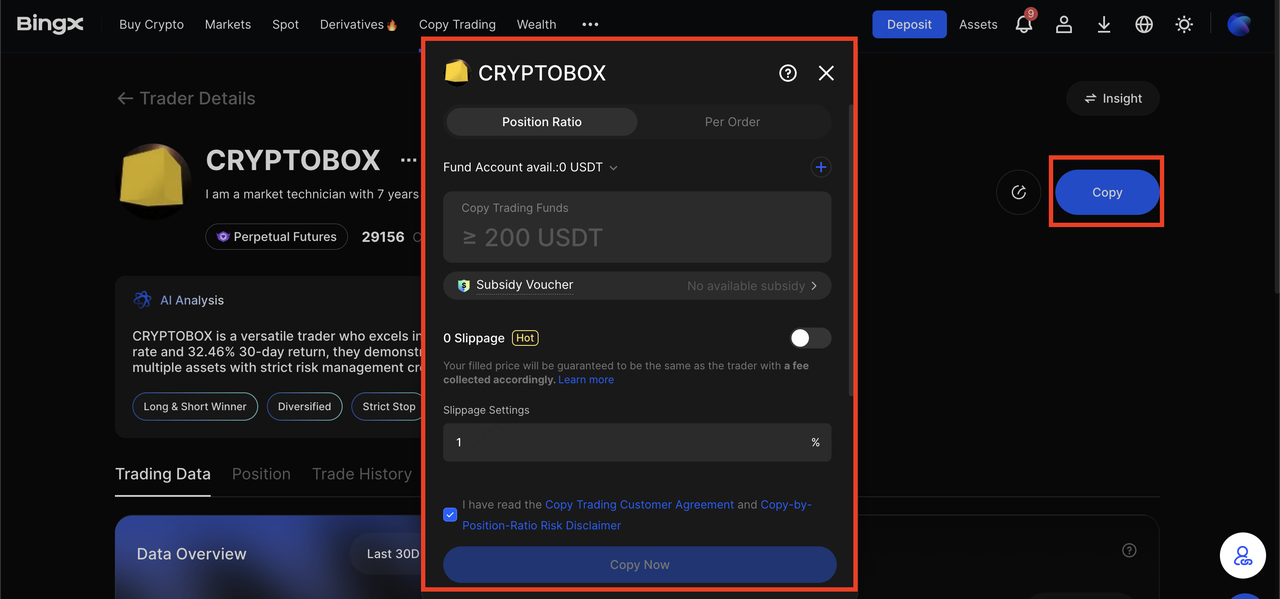

ステップ4:コピーをタップして設定を構成する

トレーダーのプロフィールで → コピーをクリックして設定ページに入ります。

モードに応じて:

• ポジション比率モード:コピートレード資金を入力します。トレーダーのポジションをすぐにコピーするを切り替えることができます。これにより、オープンポジションがすぐに比例して複製されます。

• 注文ごとモード:注文ごとの証拠金とコピートレードの総資金を設定します。両方が最低額を満たしていることを確認してください。

• 現物グリッドコピー:コピー資金と資産ペアを設定します。

高度なオプション

2. 先物モードで「スリッページ0でコピー」を有効にします。これにより、利用可能な場合にトレーダーの約定価格と一致します。多数のコピートレーダーがいる場合や取引量が多いトレーダーに推奨されます。

設定が完了したら、今すぐコピーをクリックして関係を有効にします。

ステップ5:マイ取引で監視する

コピートレード → マイ取引に移動します。

1. 概要タブには、今日の収益と総収益が表示されます。

2. 現在タブには、オープン中のコピー取引がリストされ、編集またはコピーを停止することができます。

3. 履歴セクションには、クローズされた取引と実現利益が表示されます。

編集オプションでは、資金、注文ごとの証拠金を調整したり、スリッページ保護を切り替えたり、TP/SLを設定したりできます。

キャンセルするには、コピーを停止をタップします。アクティブなコピーポジションは、トレーダーがポジションをクローズしたときにクローズされ、残りの資金は先物口座に戻されます。

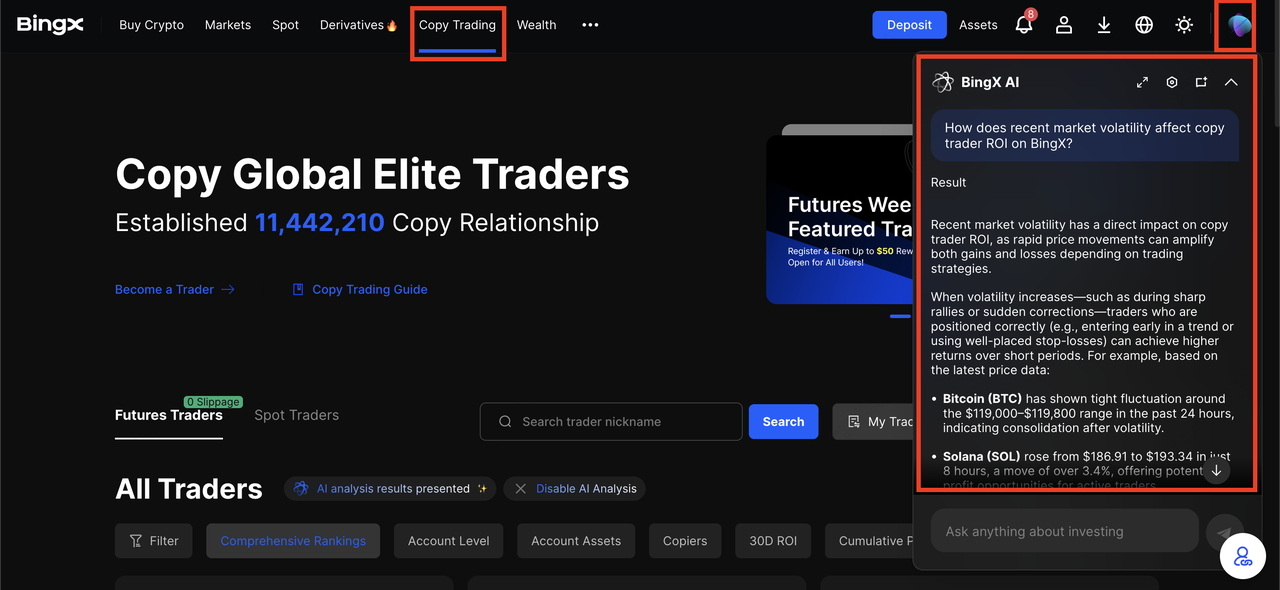

より良いコピートレードのためにBingX AIアシスタントを活用する方法

フォローする適切なトレーダーを選ぶことは、特にプラットフォーム上に何千もの選択肢がある場合、圧倒されることがあります。そこでBingX AIの出番です。これは、あなたの目標、取引の好み、リスク許容度に合ったトレーダーを見つけるのに役立つように構築されたインテリジェントなアシスタントです。

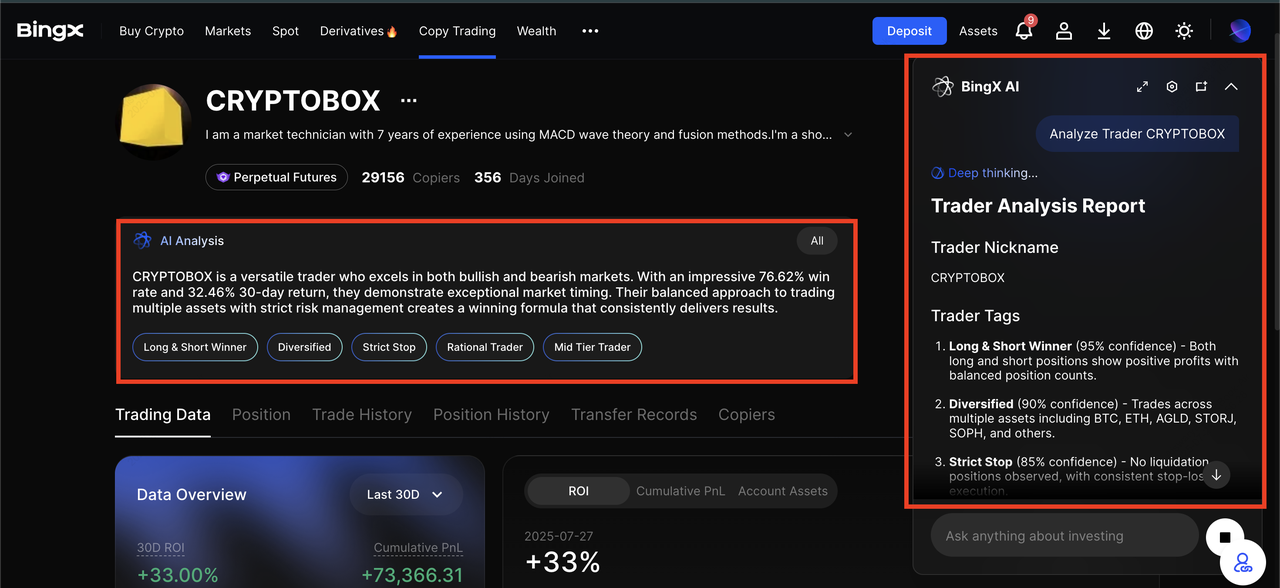

エキスパートトレーダー分析の機能

BingX AIは、常に最高のパフォーマンスを発揮するトレーダーを評価し、あなたのポートフォリオとリスク選好度に最も互換性のある戦略を持つトレーダーを強調表示します。その方法は次のとおりです。

1. スマートマッチング:安定した利益を目指すか、高リスクの成長を目指すかなど、あなたの個人的な取引目標を分析し、同様の戦略とリスクプロファイルを持つトレーダーを推奨します。

2. パフォーマンスインサイト:一貫したROI、低いドローダウン、高い勝率を持つトレーダーを強調表示し、誇大広告を避け、信頼性に焦点を当てることを容易にします。

3. スタイル互換性:システムはトレーダーの取引頻度、取引期間、資産の焦点をレビューし、デイトレード、スイングトレード、トレンドフォローのいずれであっても、彼らのスタイルがあなたが快適に感じるものと一致することを確認します。

BingX AIは、トレーダーの推奨を超えて、よりスマートなコピートレードを支援します。そのスマートインサイト機能は、速報ニュースと市場トレンドを要約し、取引活動にコンテキストを提供します。予測ポートフォリオ管理は、あなたの先物コピートレードを監視し、リスク管理、機会発見、リバランスに関するAI駆動の提案を提供します。一方、プロアクティブ市場インテリジェンスは、リアルタイムのチャート分析を提供し、取引ロジックを実際に理解するのに役立ちます。取引初心者であろうと、単に時間がないだけであろうと、これらのツールは推測を減らし、適切な戦略に従う自信を高めます。

BingX コピートレードを利用する理由:主な利点

BingXコピートレードは、自動化以上の点で際立っています。資本を保護し、執行精度を向上させ、追加の報酬を獲得するためのツールを提供します。

1. コピートレード補助金バウチャー:BingXのコピートレード補助金バウチャーは、有効期間中にUSDTでの損失(バウチャーの額面金額まで)を補償する保護バウチャーであり、リスクを軽減してコピートレードを試すことができます。毎週のトレーダースポットライトまたはコピートレード初心者限定キャンペーンを通じて、無料の補助金バウチャーを獲得できます。これは、新規ユーザーがリスクを軽減してコピートレードを試すのに最適な方法です。

2. スリッページ0でコピー:あなたの取引が選択したトレーダーの参入価格と決済価格に正確に一致することを保証します。ボラティリティの高い市場や大口トレーダーに最適です。保証された価格執行には少額の手数料がかかります。

3. コピートレード2.0アップグレード:コピートレード専用のサブアカウントにより、より高い透明性とコントロールを享受できます。正確なレバレッジ、清算価格を確認し、不要な取引をトリガーすることなく資金を管理できます。

4. 紹介して稼ぐ:友達を招待してお気に入りのトレーダーをフォローさせると、トレーダーの利益分配の25%を紹介報酬として獲得できます。紹介者がコピートレードの関係を維持している限り、収益は継続します。この機能は現在、標準コピートレードのみで利用可能です。

これらの機能により、BingXはコピートレードを、完全な初心者から上級ユーザーまで、すべての人にとってよりスマートで安全、そしてよりやりがいのあるものにします。

より良いコピートレーダーになる方法:プロのヒント

コピートレードは強力なツールですが、成功は賢明で情報に基づいた選択にかかっています。これらのヒントは、リスクを管理し、適切なトレーダーを選択し、BingXでの経験を最大限に活用するのに役立ちます。

1. 複数のトレーダーに分散投資する:すべての資金を1人のトレーダーに投入しないでください。代わりに、異なる戦略を持つ複数のトレーダーをフォローしてください。一部は迅速な日中取引(スキャルピング)に焦点を当てるかもしれませんが、他のトレーダーはより長期的なポジションを目指すかもしれません。分散投資は、あるトレーダーが不調に陥った場合でも、全体的なリスクを軽減するのに役立ちます。

2. 組み込みツールを使用してリスク制限を設定する:BingXのリスク管理設定(テイクプロフィット(TP)やストップロス(SL)など)を活用して、資本を保護してください。標準先物を使用する際には、日次コピー金額または最大コピー金額を設定して、エクスポージャーを制限することもできます。これらのツールは、一度の悪い日で投資がすべて失われることを防ぐのに役立ちます。

3. 定期的にパフォーマンスを監視する:コピートレードはより手間がかからないとはいえ、完全に受動的ではありません。定期的にトレーダーのパフォーマンスを確認してください。先月好調だったトレーダーが、今も同じように好調とは限りません。必要に応じて、コピーを一時停止または停止し、よりパフォーマンスの良いトレーダーに資金を再配分してください。

4. コピーする前にトレーダーの戦略を理解する:各トレーダーには独自のスタイルがあります。一部は高リスクで頻繁に取引(スキャルパー)し、他のトレーダーは中期的な機会(スイングトレーダー)を探し、また一部はトレンドをフォローします。彼らの取引スタイルがあなたの快適なレベルと投資目標に合致していることを確認してください。

5. 「スリッページ0でコピー」の使用を検討する:この機能は、コピーされた取引がトレーダーの注文と同じ価格で実行されることを保証し、価格差によって引き起こされる損失を回避するのに役立ちます。これは、多額の資金でコピーするユーザーや、動きの速い市場で特に役立ちます。ただし、この機能の使用には少額の手数料がかかることに注意してください。

最終的な考察

BingXのコピートレードは、シンプルさとコントロールを結びつけます。エリートの現物および先物トレーダーをリアルタイムでミラーリングしながら、自身の戦略に対する自律性を維持できます。コピートレード2.0は、専用のサブアカウント、より優れたデータ透明性、カスタマイズ可能なリスクコントロールにより、さらに進化しています。プロトレーダーレコメンダーのようなAIツールと組み合わせることで、あなたの投資スタイルに合ったトレーダーを見つけてフォローすることがこれまで以上に容易になりました。

しかし、コピートレードは利益を保証するものではないことを忘れないでください。最高のトレーダーでさえ不調な時期を経験することがあります。常に少額から始め、分散投資し、定期的に監視し、積極的にリスクを管理してください。

適切なガイダンスと規律があれば、コピートレードは投資家としての成長を加速させ、日々の苦労なしにスマートな戦略実行を学ぶのに役立ちます。