In crypto, speed is everything. Ever felt like you were late to a party? That is because most tools tell you what happened after it’s already too late. Charts and news sites are useful, but they are often slow.

This is where Grok comes in. It is an AI tool built into X (formerly Twitter) that listens to what people are saying in real time. It does not wait for the charts to react. Instead, it picks up early chatter, mood shifts, and buzz before the price moves.

Well, it sounds interesting, right? Let us break down what Grok is, how it works, and how you can actually use it for crypto trading and stay on top of market trends.

What Is Grok and Why It Matters?

Grok is developed by xAI, Elon Musk’s AI company, and is available to X Premium+ users. Its job is simple: listen to live conversations on X-tweets, replies, hashtags, memes, and extract sentiment signals in real time.

Think of it as a market mood detector. It doesn’t scan charts or make trades. But it does pick up on sudden shifts in hype, fear, or token mentions during meme runs, major news, or influencer posts.

It’s like having your ear to the street, only faster and 24/7.

Why Does Sentiment Matter in Crypto?

Grok fills that gap by tracking what people are saying, how they’re saying it, and when the tone changes. It offers insight into what might happen before charts confirm the move.

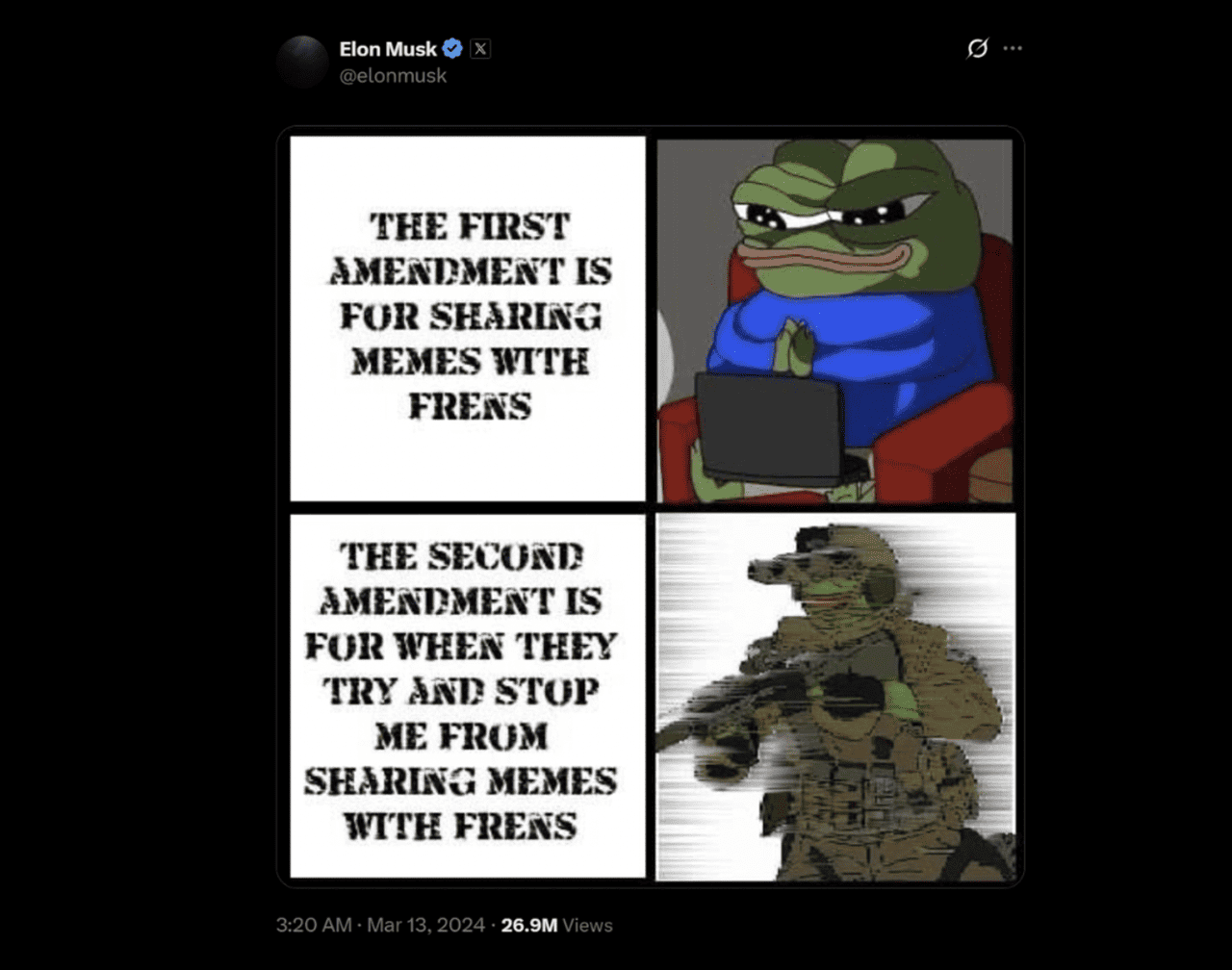

Example: PEPE Coin Pump After Musk Tweet (March 2024)

In March 2024, Elon Musk tweeted a Pepe meme. Minutes later, the PEPE coin pumped 12% and broke key resistance. Grok-style tools caught the spike instantly, well before most traders reacted.

The Grok connection: Grok-style sentiment tools would’ve picked up the sudden spike in meme-related keywords and bullish tone before most traders noticed the price move on charts.

How Grok Detects Crypto Trading Signals

So, how does Grok actually find these early trading cues? It uses real-time data from X to watch what people are saying. Then, it pulls out patterns that might hint at a price move.

Let us look at how it works.

1. Token Mention Spikes

Do you ever notice when suddenly everyone is talking about a coin? That is a major clue. Grok tracks how often tokens are mentioned, especially by verified users or in posts with lots of engagement.

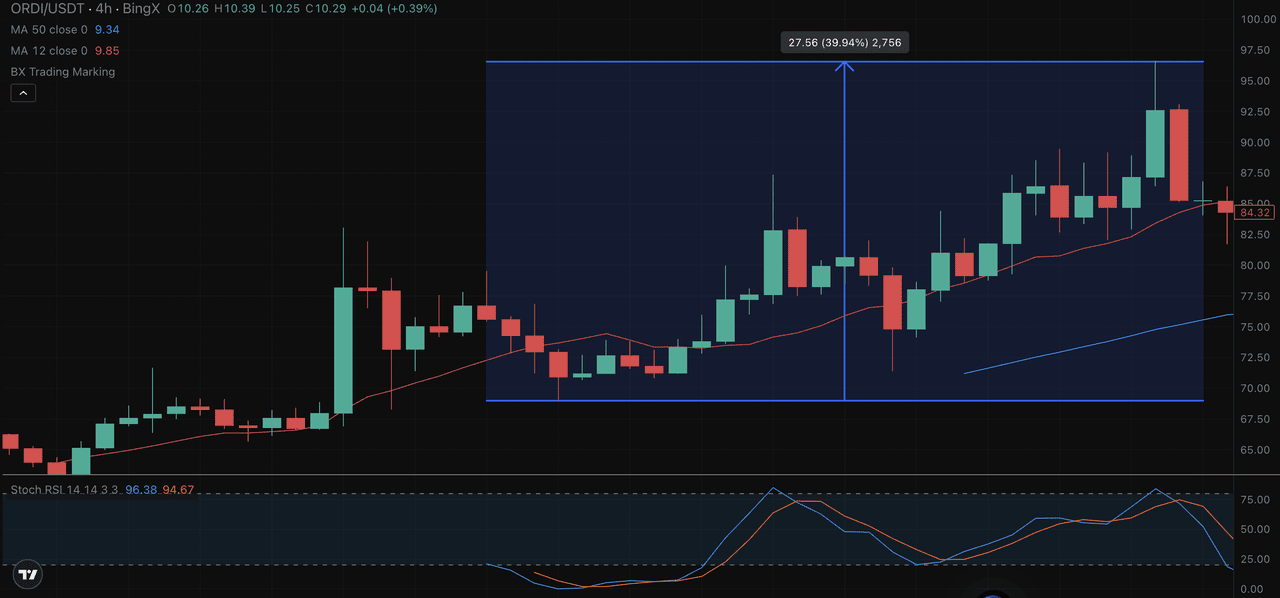

If mentions of "

$ORDI" or

"$FET" jump five times higher than normal, Grok spots it fast. And that kind of surge usually means the community is paying attention, and price action could follow.

Take February 2024 as an example. Mentions of "$ORDI" went from under 50 to over 400 in just one day. Influencers were hinting at a possible exchange listing. A couple of days later, the token price soared. Historical price charts show that ORDI hit its all-time high in March 2024 (about $95–85) on the back of broad memecoin season momentum

2. Emotional Sentiment Parsing

But it is not just how often people talk, it is also how they talk. Is the tone excited? Fearful? Bullish? Grok picks up on that, too.

It can tell if a tweet says “massive unlock coming”, which sounds bearish, or “whale is accumulating”, which feels bullish.

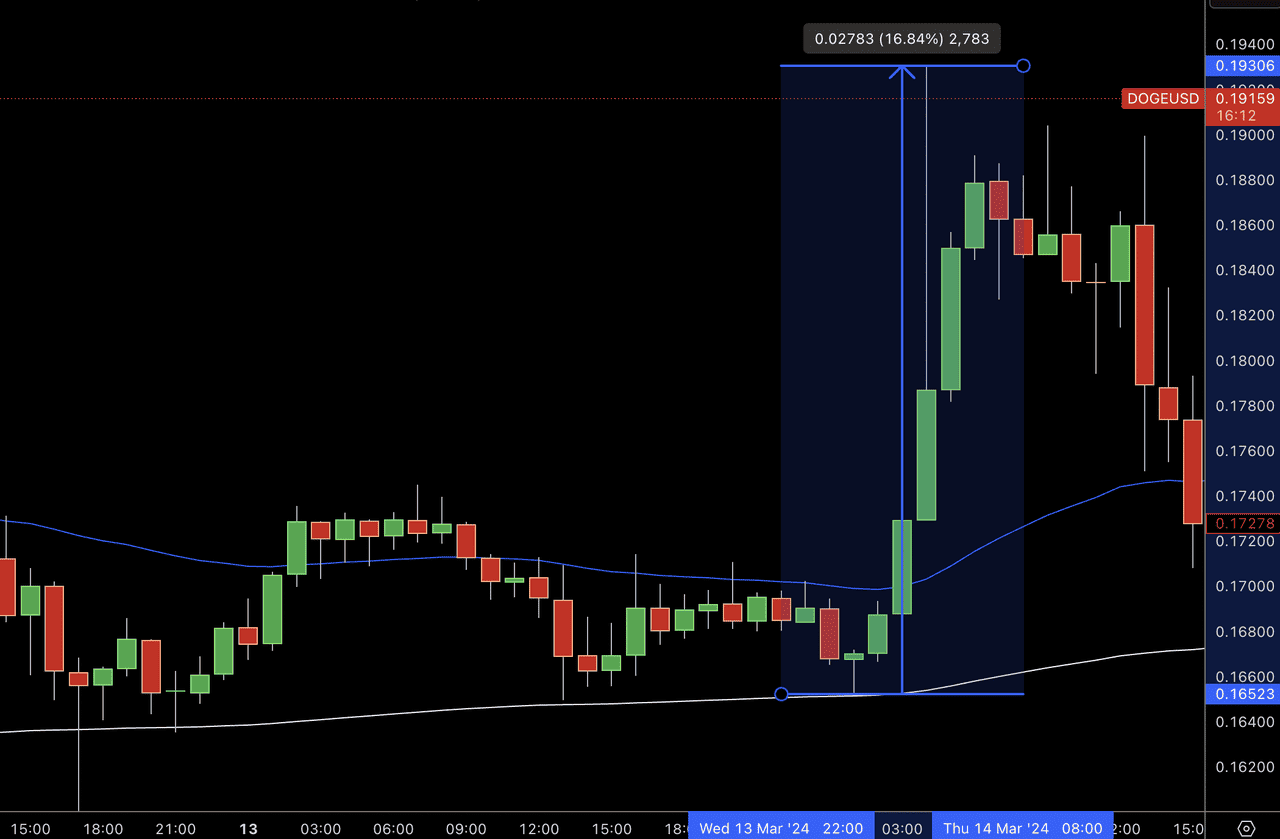

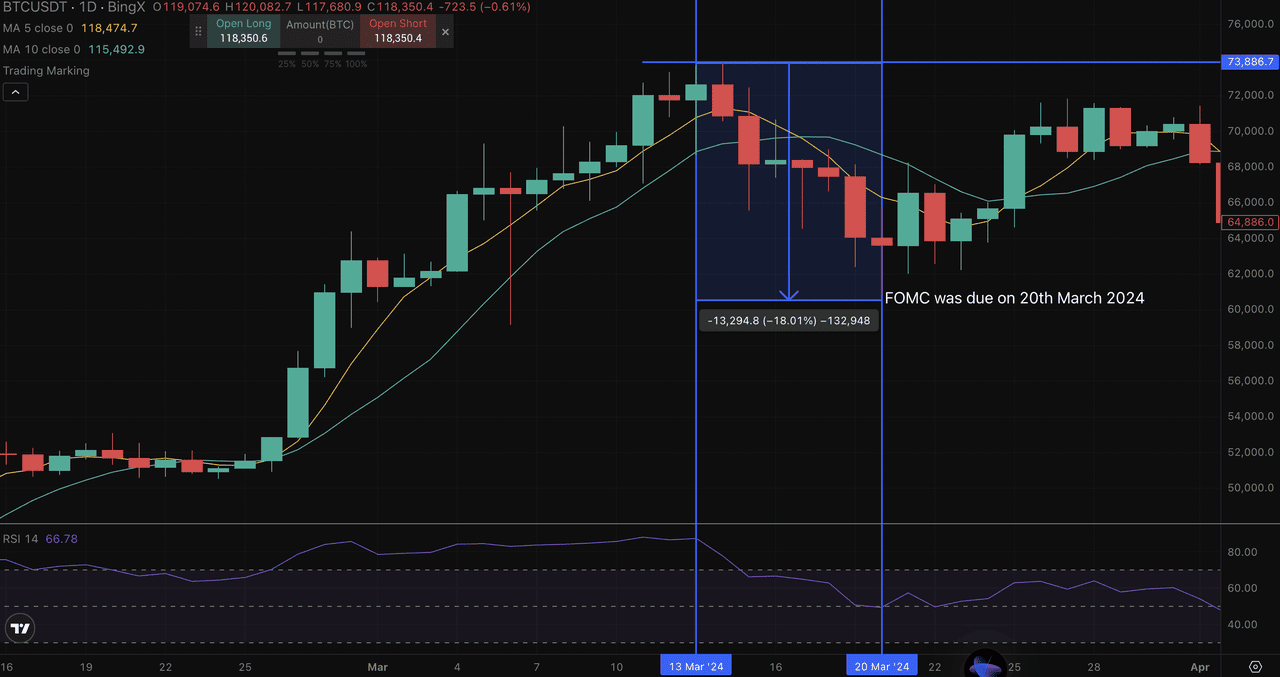

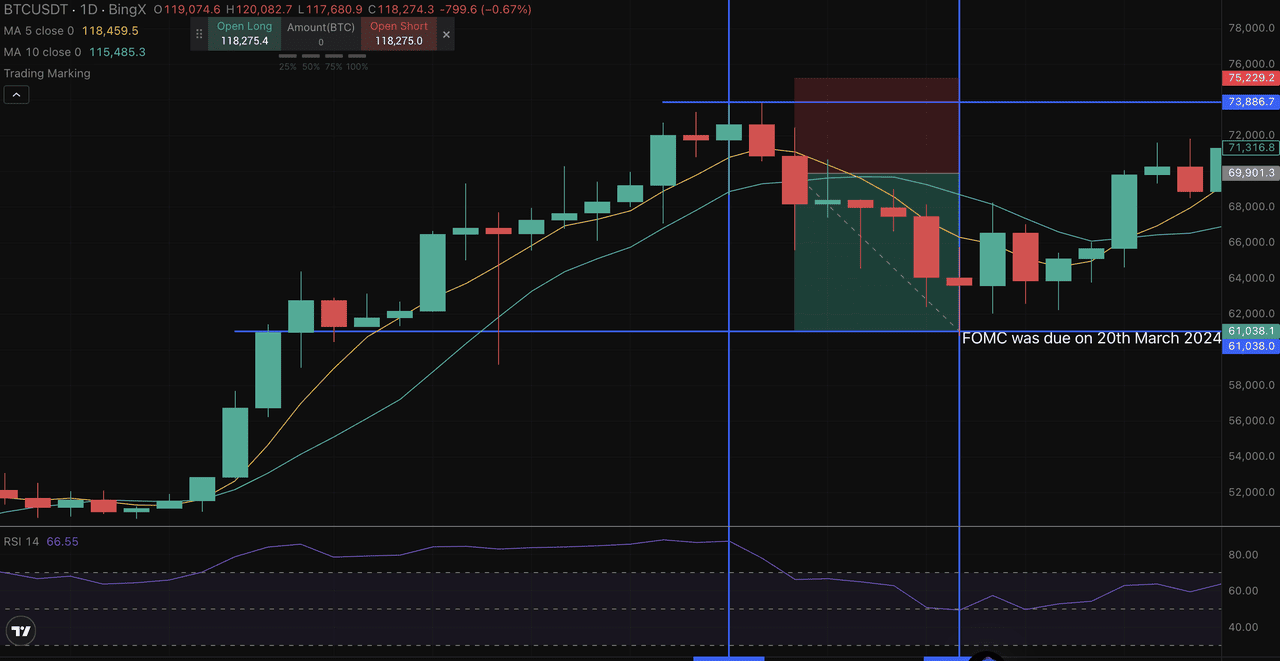

In the BTC/USD chart above, a great example came during the March 2024 FOMC meeting.

In the days leading up to the 20 March 2024 FOMC meeting, Grok detected a sharp rise in bearish sentiment across X-posts mentioning “rate hike fears,” “tightening,” and “Fed pressure” increased notably. That shift in mood was a red flag.

And sure enough, Bitcoin dropped nearly 18% from March 13 to March 20, before the FOMC even announced its decision.

How Traders Could Make A Trading Strategy Using Grok Signals

Suppose Grok picked up on this fear-driven chatter by March 13. A day trader seeing this sentiment spike could have opened a short position on

BTC/USDT perpetual futures on BingX with a modest 3-5x leverage, anticipating a drop. Below is an example screenshot of how that might look on BingX:

By acting on Grok’s early warning, traders could have positioned themselves ahead of the 18% correction, demonstrating how emotional sentiment parsing can provide a critical edge when paired with smart execution tools like BingX.

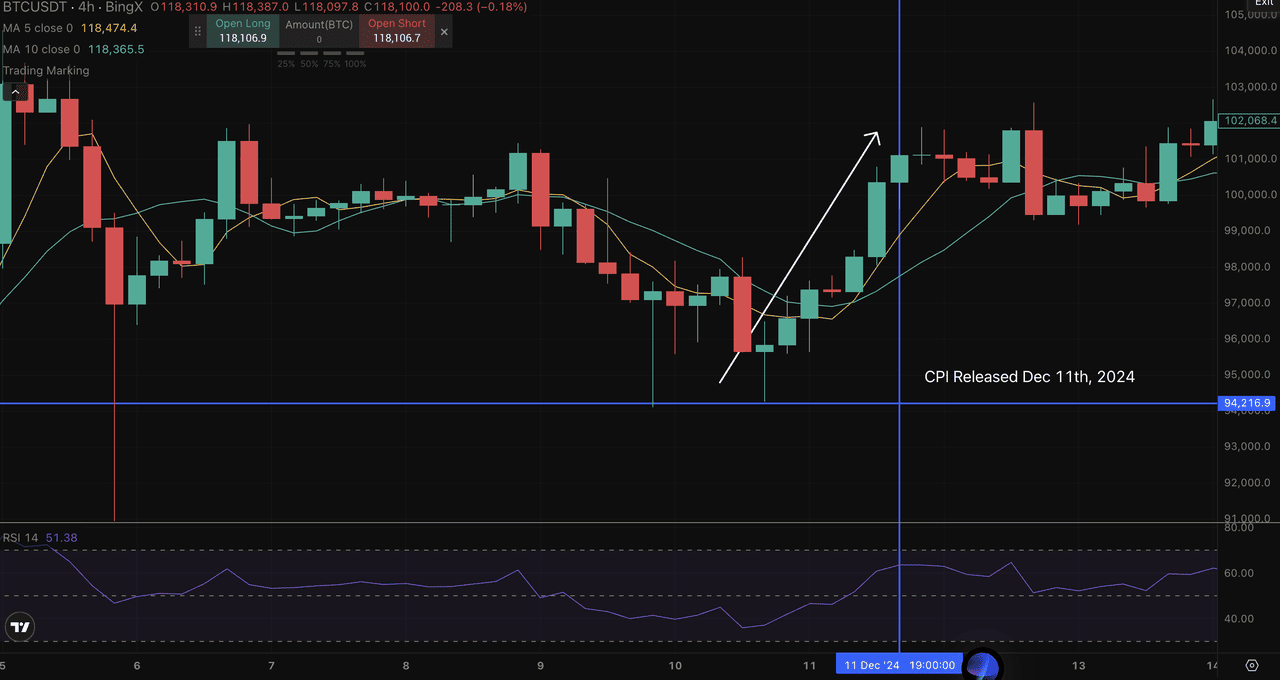

3. Macro Event Reactions

Major events like inflation reports, interest rate decisions, or new regulations, often spark emotional reactions. Grok detects those waves and matches them with token discussions.

It watches for keywords like “rate cut,” “ETF,” or “regulation.” When those phrases spike, it connects the dots.

For example, in December 2024, the CPI report showed lower inflation. Grok picked up positive sentiment building around Bitcoin and Ethereum.

Not long after, Bitcoin crossed $98,000. The bullish mood of the community gave early signs of the move.

How Traders Are Using Grok in Practice

Wondering how real traders are putting Grok to work? Let us walk through three ways it is being used right now.

1. Detecting Pre-Pump Narratives

Traders love to find hype before the pump. That is where Grok really shines. It watches for buzzwords like “next 100x,” “alpha leak,” or “airdrop coming.”

Here is an example. In April 2024, posts about TURBO, a low-profile token, started gaining attention. Dev updates and teaser tweets stirred up emotion in the community. Grok spotted this trend early, about 36 hours before the token surged 22%.

2. Spotting Divergence Between Price and Sentiment

Sometimes the price stays flat, but sentiment climbs. That is often a sign that something big is coming.

In February 2024, the FET token saw a sharp rise in chatter, mainly about AI features and new partnerships. The price had not moved yet, but Grok picked up the emotional spike. Traders who acted early caught the breakout just 48 hours later.

3. Rotating Between Memecoins

Meme coins move fast. Timing is everything. Grok helps by spotting when attention is leaving one coin and flowing into another.

Here is what happened in May 2024. Mentions of

FLOKI started rising, boosted by influencer memes and news of a new roadmap. At the same time, interest in SHIB dropped. Traders who rotated from SHIB into FLOKI saw a 15% gain.

How to Pair Grok with ChatGPT for AI Sentiment Analysis

Grok is powerful on its own, but when combined with ChatGPT, it becomes a complete sentiment-to-strategy solution. While Grok monitors live crypto chatter for early signals, ChatGPT helps traders make sense of those signals and build actionable plans around them.

1. Grok + ChatGPT for Real-Time Alert Automation

Some crypto developers are already feeding Grok’s real-time data directly into ChatGPT-based systems. The goal is to create automated alerts, or even run trading bots, based on sudden sentiment shifts.

Here’s a typical setup: Grok detects a 5x increase in "$FLOKI" mentions. ChatGPT then checks preset conditions, such as whether verified mentions exceed 300 and engagement is up 3x.

If both conditions are met, ChatGPT triggers an alert with suggested entry zones, stop-loss levels, and position size guidelines. This creates a fast, intelligent system that reacts before price action confirms the trend.

2. Using ChatGPT to Explain Strategy and Risk

Beyond automation, ChatGPT also helps traders understand why a signal matters. While Grok highlights what’s trending, ChatGPT can explain how to turn that into a strategic move.

Let’s say a low-cap token is gaining attention. ChatGPT can help analyze whether the 200-day moving average offers technical support, how sentiment shifts might impact price in low-liquidity markets, or what a safe exit strategy looks like for a meme coin rally.

This makes ChatGPT a perfect companion tool, offering context, education, and structured planning for traders of all levels.

What Are the Risks and Limitations of Using Grok?

Grok offers a major edge in detecting sentiment shifts early, but like any tool, it has limitations. If you’re planning to rely on Grok for trading decisions, it’s important to understand where it falls short.

1. No Trade Execution Capabilities: Grok is a signal generator, not a trading platform. It won’t execute trades, manage your portfolio, or make decisions for you. To act on the insights Grok provides, you’ll still need a separate platform, bot, or manual trading process in place.

2. Lacks Full Technical Analysis: While Grok can detect spikes in sentiment and token mentions, it doesn’t provide in-depth technical setups. It won’t chart

RSI divergence, identify

Fibonacci levels, or analyze

candlestick patterns. For that, tools like TradingView, CoinGlass, or your exchange’s charting suite are still essential.

3. Susceptible to Market Manipulation: Because Grok reads public data on X, it can be influenced by coordinated hype or spam. During meme coin cycles, it’s common for groups to flood the platform with bullish posts to generate FOMO. Grok might interpret this as legitimate sentiment—even if it’s just an exit pump disguised as enthusiasm.

4. Less Effective for Low-Volume Tokens: Grok performs best when there’s sufficient community activity. For obscure microcaps or low-volume DeFi tokens, there simply may not be enough chatter to generate useful signals. As a result, traders may miss opportunities or receive weak data.

5. No Personalized Risk Management: Grok doesn’t know your trading goals, position size, or risk tolerance. It won’t alert you if you’re overleveraging, entering late, or ignoring stop-loss rules. That part is still on you. Using Grok effectively requires disciplined risk management and a clear trading plan.

Should You Use Grok for Crypto Trading Signals?

Grok gives crypto traders an early edge, capturing mood shifts and emerging narratives before they show up on charts. From meme coin pumps to macro sentiment waves, Grok helps traders spot signals others miss.

But it’s still just a tool. To trade effectively, combine Grok’s insights with platforms like ChatGPT and TradingView. Let Grok show you what’s buzzing. Let ChatGPT help you turn it into a plan.

Because in crypto, the signal often comes before the spike, you just have to be listening.

FAQs on Using Grok for Crypto Trading

1. What is Grok and how does it work in crypto trading?

Grok is an AI tool built into X (formerly Twitter), developed by Elon Musk’s xAI. It monitors real-time conversations, hashtags, and trends to detect sentiment shifts before price action follows. Traders use Grok to spot early hype or fear signals in crypto markets.

2. Can Grok predict crypto prices?

No, Grok doesn’t predict prices or offer financial advice. It identifies trends in community sentiment, which can help traders anticipate potential market movements. It works best when used alongside technical tools and smart risk management.

3. Is Grok available to everyone?

Grok is only available to X Premium+ users, the highest-tier subscription on X. Access includes advanced AI features and real-time integrations, though direct trading tools are not included.

4. How is Grok different from TradingView or CoinGlass?

TradingView and CoinGlass focus on technical analysis using charts and indicators. Grok, on the other hand, focuses on real-time social sentiment analysis, detecting mood shifts and social trends before they’re visible on charts.

5. Can I automate trades using Grok and ChatGPT together?

Not directly. But developers are already integrating Grok sentiment data into ChatGPT-based workflows to trigger alerts or automate trading strategies. This pairing can help identify high-probability setups before technical signals confirm them.