Decentralized exchanges (DEXs) have entered one of their strongest growth phases in 2025. Monthly trading volume surpassed 613 billion dollars in October, setting a new all-time high as traders shifted on chain during heightened volatility and new market narratives. Within this surge, Uniswap, PancakeSwap and SushiSwap remain three of the most recognizable AMM-based DEXs, each rooted in different blockchain ecosystems and attracting different types of users. Although all three rely on automated market makers, their liquidity designs, incentive structures and ecosystem strategies have evolved in distinct ways. These differences shape how each DEX operates in 2025 and what role it plays in a more mature DeFi landscape.

Uniswap vs. PancakeSwap vs. SushiSwap: DEX Performance Overview in 2025

Decentralized exchange activity expanded significantly in 2025 as more traders moved on-chain for transparency,

self-custody and faster settlement.

DEX Markets Exceed 3 Trillion USD in 2025 With Year-to-Date Volume Up 260% to 390%

According to

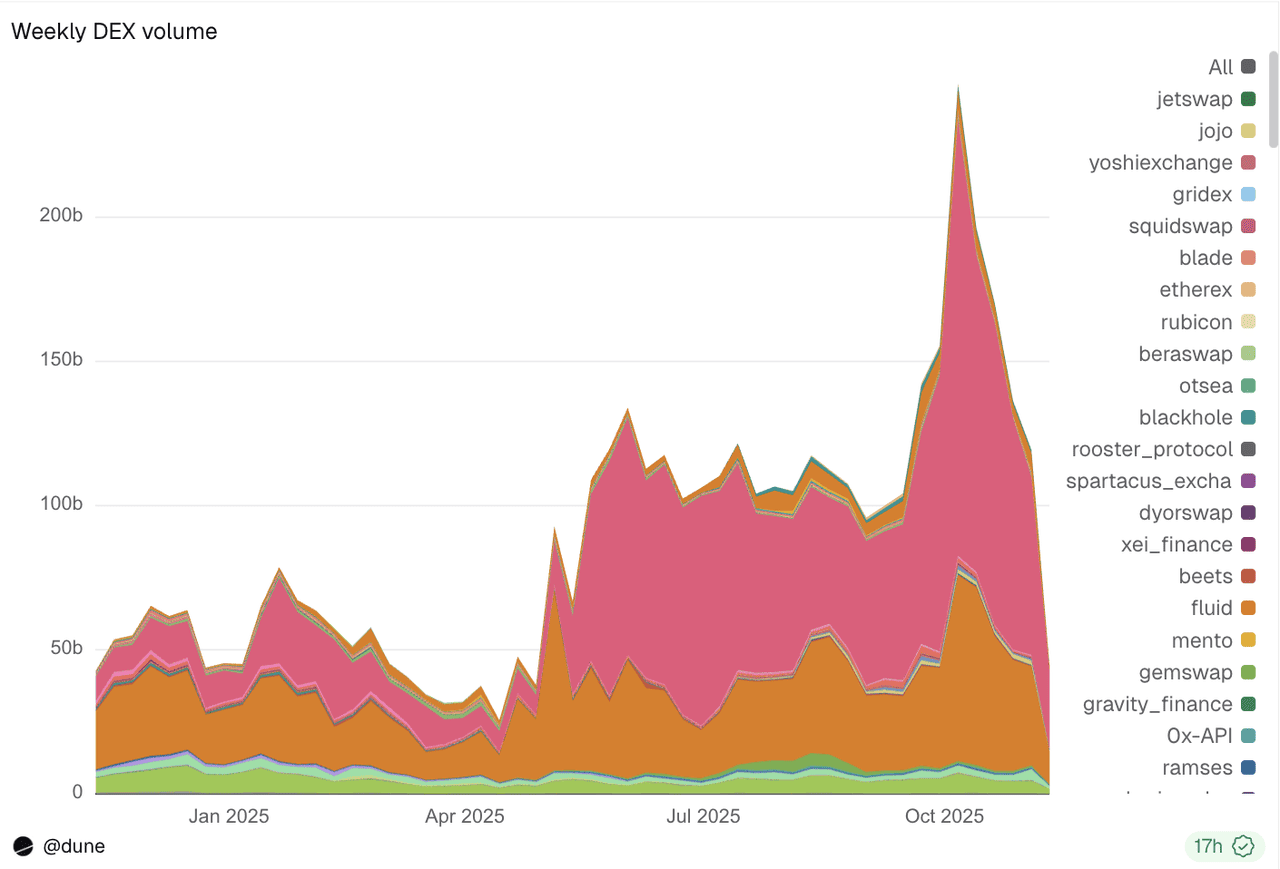

Dune Analytics, weekly DEX trading volume started the year at roughly 45 to 60 billion USD, then accelerated through Q3 and reached over 220 billion USD in October, the strongest weekly level recorded this year. This represents an approximate 260% to 390% increase from the January baseline. The surge in activity contributed to an estimated 3.0 to 3.4 trillion USD in cumulative DEX volume from January to early November, marking one of the strongest yearly expansions for the sector.

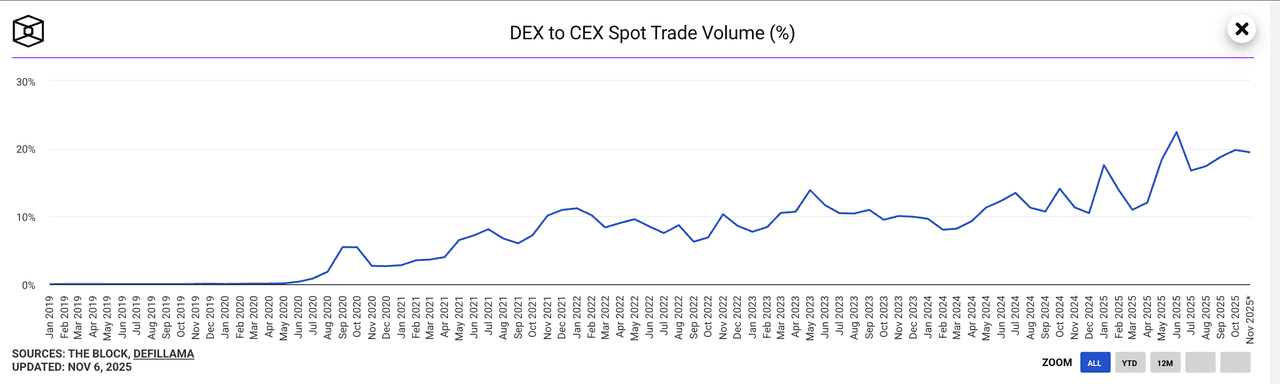

DEX-to-CEX volume ration has increased over years | Source: The Block

Data from The Block reports the DEX to CEX volume ratio increasing to 19.84% in October, up from 18.83% a month earlier. This rise reflects a gradual shift toward decentralized execution, supported by stronger on-chain participation and growing preference for transparent, permissionless trading. Combined with the 120% to 140% year-to-date increase in sector-wide trading activity, the expanding market share signals that 2025 is shaping up to be a landmark year for on-chain trading adoption.

DEXs trading volume surged 300% during peak in October 2025 | Source: Dune

Uniswap: 1.1 Trillion USD in Annual Trading Volume with UNIfication Fee Switch Rollout

Uniswap remained one of the most widely used DEXs in 2025, supported by deep liquidity and strong activity across Ethereum and its

layer 2 networks. According to Token Terminal, Uniswap processed about 1.1 trillion USD in trading volume over the past 365 days and recorded its largest single-month volume in October at 116.6 billion USD. This shows that traders continue to rely on Uniswap during periods of volatility and that its pools remain a primary source of liquidity across the

Ethereum ecosystem. The rollout of UNIfication in November 10, 2025, a governance update that redirects a portion of protocol fees toward UNI buybacks and burns, strengthened confidence in its long-term value capture model. Uniswap’s consistent placement near the top of weekly DEX rankings underscores its importance as a core execution venue.

PancakeSwap: Leading With 1.2 Trillion USD Fueled by BNB Memecoin Wave

PancakeSwap leads the DEX category in 2025 and surpassed Uniswap in annual trading volume. Over the past year, PancakeSwap generated about 1.2 trillion USD in trading volume according to Token Terminal, slightly higher than Uniswap. Weekly Dune Analytics data shows PancakeSwap handling around 25.8 billion USD in weekly volume in November, supported by fast and low-fee transactions. Much of this activity was amplified by new

Chinese memecoins launches on

Four.meme, which triggered a

BNB meme season in October 2025 and drove a surge in speculative trading. This concentrated burst of activity boosted PancakeSwap’s momentum and strengthened its position as one of the most active AMM ecosystems across any chain.

SushiSwap: Lower Liquidity and Declining Share in 2025

SushiSwap continued to operate across multiple chains in 2025 but played a smaller role compared with its earlier peak years. Weekly data from Dune and aggregate rankings from Token Terminal place SushiSwap outside the top 10 DEXs by 365-day trading volume, reflecting thinner liquidity and slower user growth. Its trading activity remained modest relative to Uniswap and PancakeSwap, and its market share has continued to decline throughout the year. While SushiSwap still serves niche communities and specific cross-chain assets, its overall footprint in 2025 is noticeably smaller as newer and more liquid AMMs capture the majority of on-chain trading flows.

What Is Uniswap and How Does It Work?

Uniswap is a decentralized exchange built on

Ethereum that lets users trade tokens directly from their wallets without relying on centralized intermediaries. It is powered by an

automated market maker (AMM) model, where liquidity providers deposit token pairs into pools and traders swap against those pools at algorithmically determined prices. This design removes the need for an order book and provides continuous liquidity for thousands of assets on Ethereum and its expanding layer 2 ecosystem.

Since launching in 2018, Uniswap has introduced several important upgrades that improved capital efficiency and developer flexibility. Uniswap v3 added concentrated liquidity, enabling

liquidity providers to allocate capital within defined price ranges. The upcoming v4 architecture expands this flexibility with hooks, allowing developers to implement custom pool logic such as dynamic fees, on-chain limit orders or automated rebalancing strategies. Uniswap now supports trading across networks including

Arbitrum,

Optimism,

Base, and

Polygon, reinforcing its position as a core liquidity venue for on-chain markets.

2025 Uniswap Economic and Ecosystem Outlook

• Trading performance: Uniswap processed roughly 1.1 trillion USD in the past 365 days and recorded its largest-ever monthly volume in October at 116.6 billion USD

• Value alignment: UNIfication enhances the link between protocol usage and UNI holder benefit, reinforcing confidence in long-term economics

• Ecosystem strength: A well-capitalized treasury and active governance support ongoing development, security and multi-chain expansion

UNI Tokenomics Overview

• Max supply: 1 billion UNI

• Vesting completion: Initial allocation fully vested in 2024

• Governance role: UNI holders vote on protocol upgrades, fee switches and ecosystem funding

• Treasury management: The Uniswap Foundation oversees grants, tooling, audits and long-term ecosystem support

• Buyback mechanism: UNIfication (launched November 2025) redirects a portion of protocol fees to purchase UNI on the open market and burn it

• Fee switch and value-accrual goal: Transforms UNI from a pure governance token into an asset tied to protocol revenue

What Is PancakeSwap and How Does It Work?

PancakeSwap is a

decentralized exchange built on BNB Chain that allows users to trade tokens directly from their wallets using an automated market maker (AMM) model. Liquidity providers supply token pairs to liquidity pools, and traders swap against those pools at algorithmically determined prices. Its low-fee environment and fast block speeds make PancakeSwap especially popular among retail traders, memecoin communities and users seeking inexpensive on-chain execution.

Launched in 2020, PancakeSwap has grown into one of the most active AMMs across all ecosystems. Although its core activity remains on BNB Chain, the protocol has expanded to multiple networks, including Ethereum, Arbitrum and Aptos. Beyond token swaps, PancakeSwap also offers yield farming, prediction markets, a lottery system and a native launchpad, making it a broad consumer-facing hub within the BNB Chain ecosystem.

2025 PancakeSwap Economic and Ecosystem Outlook

• Trading performance: Generated roughly 1.2 trillion USD in the past 365 days and led weekly DEX rankings in late 2025

• Retail momentum: Benefited from a BNB Chain memecoin wave, triggered by new token launches on Four.meme, which peaked in October and significantly lifted trading activity

• Execution advantage: Fast block times and low fees continue to attract high-frequency retail users and speculative flows

• Ecosystem expansion: Multi-chain deployments broaden access while BNB Chain remains its dominant liquidity base

CAKE Tokenomics Overview

• Emission model: CAKE has no fixed max supply, with emissions distributed to liquidity providers and stakers

• Emission reduction: Tokenomics 3.0 reduced daily emissions to slow inflation and improve long-term sustainability

• Burn mechanism: Portions of fees from swaps, perpetuals, IFOs, lottery and other products are used to burn CAKE

• Deflation target: Long-term objective to steadily reduce circulating supply and increase value density

• Governance role: CAKE holders participate in governance decisions across the protocol

• Treasury usage: Supports ecosystem incentives, operations, community initiatives and product growth

What Is SushiSwap and How Does It Work?

SushiSwap is a decentralized exchange that originally launched in 2020 as a community-driven fork of Uniswap. It became widely recognizable during DeFi Summer 2020 after executing a strategic “Vampire Attack” that attracted a large share of Uniswap’s liquidity through higher farming incentives. Like other AMMs, SushiSwap enables users to trade tokens directly from their wallets through liquidity pools rather than an order book, and early on it gained traction with yield farming, staking and additional DeFi products layered around its AMM.

Over time, SushiSwap expanded into a multi-chain DEX operating across Ethereum, Arbitrum, Polygon, Avalanche and several other networks. The protocol introduced features such as Kashi lending and BentoBox, aiming to broaden its product suite beyond standard swaps. While it remains recognizable for its historical role in the DeFi ecosystem, many of these products have since been deprecated or scaled back, and SushiSwap has gradually lost competitiveness as newer AMMs and chain-native DEXs captured stronger liquidity and user growth.

2025 SushiSwap Economic and Ecosystem Outlook

• Trading performance: Positioned outside the top 10 DEXs by 365-day volume according to Token Terminal and Dune Analytics

• Liquidity depth: Lower liquidity across major pairs compared with Uniswap and PancakeSwap

• Market share: Declining contribution to overall DEX volume throughout 2025

• User retention: Maintains niche communities and multi-chain users, but overall growth momentum has slowed

SUSHI Tokenomics Overview

• Max supply: Approximately 250 million SUSHI

• Emission model: New SUSHI distributed to liquidity providers and stakers

• Governance role: SUSHI holders vote on proposals, treasury usage and protocol direction

• Value alignment: Historical xSUSHI revenue-sharing model has evolved, with reward structures shifting over time

• Treasury usage: Allocated toward development, community operations and ongoing protocol maintenance

Uniswap vs. PancakeSwap vs. SushiSwap: Key Metrics Comparison (2025)

As DEX activity climbed to new highs in 2025, the performance gap among major AMMs became more noticeable. Uniswap, PancakeSwap and SushiSwap each evolved along different trajectories, resulting in distinct liquidity profiles, fee structures and user bases. The table below highlights their most important differences to help clarify how each protocol currently stands in the market.

• Uniswap: Best for deep liquidity, reliable execution and multi-chain trading across Ethereum and its L2 ecosystem.

• PancakeSwap: Best for fast, low-cost retail trading and high-volume memecoin activity on BNB Chain.

• SushiSwap: Best for niche multi-chain users who rely on its broader but smaller liquidity footprint.

| Category |

Uniswap |

PancakeSwap |

SushiSwap |

| DEX Ranking (365D Volume) |

#2 overall |

#1 overall |

Outside Top 10 |

| Core Chain |

Ethereum + L2s |

BNB Chain (primary) |

Multi-chain |

| 365-Day Trading Volume |

1.1T USD |

1.2T USD |

~9B USD |

| Peak Monthly Volume (2025) |

116.6B USD (Oct) |

325B USD (Jun) |

~1.1B USD (Oct) |

| Typical Fees / UX |

Higher on Ethereum L1, low on L2 |

Very low fees, fast execution |

Moderate fees, slower UX |

| Liquidity Depth |

Deep across major assets |

Strong on BNB Chain pairs |

Weak and inconsistent |

| Ecosystem Breadth |

AMM + v3 CL + v4 hooks + L2 routing |

AMM + launchpad + prediction + lottery |

Basic AMM + limited product set |

| Token Model |

Buyback + burn via UNIfication |

Emission cuts + aggressive burns |

Governance + evolving fee models |

| Strengths |

Deep liquidity, multi-chain reach |

Retail momentum, low-cost trading |

Recognizable brand, multi-chain presence |

| Weaknesses |

Higher L1 gas costs |

Reliance on BNB Chain activity |

Shrinking liquidity and usage |

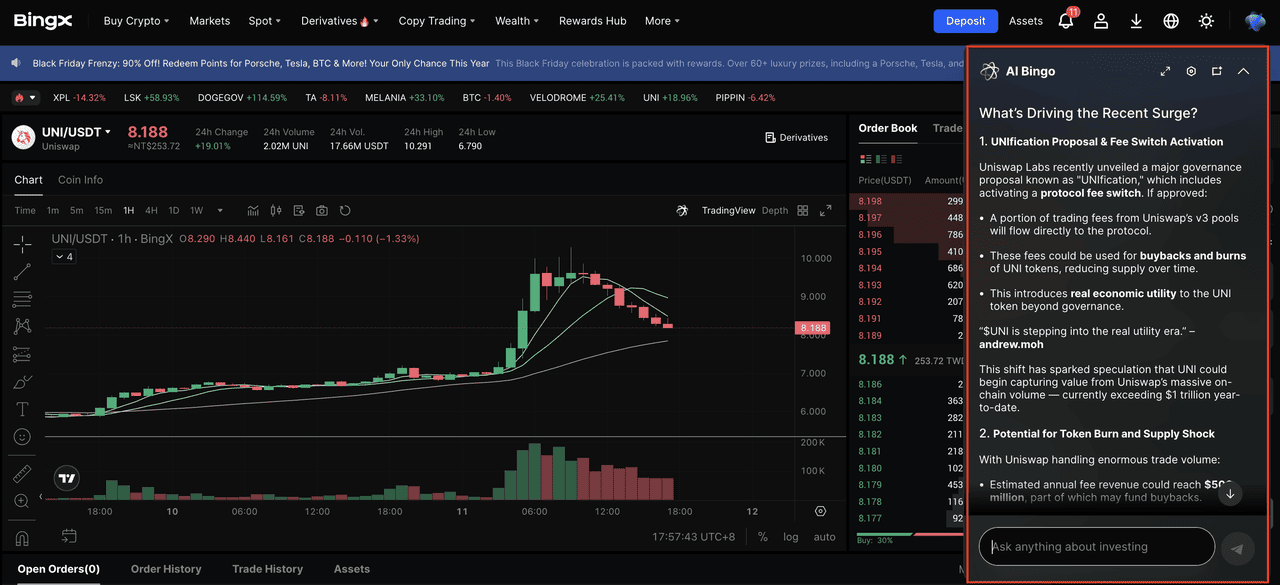

How to Buy and Trade UNI, CAKE and SUSHI on BingX

BingX supports UNI, CAKE and SUSHI across both Spot and Futures markets, giving users the flexibility to build long-term positions or trade short-term market movements.

BingX AI is integrated directly into the trading chart to identify key support and resistance levels, market trends and potential entry points.

Step 1: Search for the Trading Pair

Choose Spot if you want to accumulate tokens for long-term holding. Choose Futures if you want to trade price swings with long or short positions.

Step 2: Activate BingX AI

Tap the AI icon on the chart to access automated insights, including price structure, volatility changes and potential breakout zones.

Step 3: Place Your Order

Use a market order for instant execution or a limit order to set your preferred entry. For Futures, configure leverage,

stop-loss and take-profit levels before confirming your trade.

Step 4: Manage Your Position

Spot purchases will appear in your BingX wallet. Futures positions can be monitored, adjusted and closed directly in the trading interface.

Final Thoughts

Uniswap offers the deepest liquidity and most reliable execution across Ethereum and its L2 ecosystem. PancakeSwap leads in retail-driven activity on BNB Chain, supported by fast transactions and low fees. SushiSwap remains active across multiple chains but holds a much smaller share of overall DEX liquidity in 2025.

Choosing among the three depends on trading priorities. Users who value execution quality tend to prefer Uniswap, those seeking low-cost and high-volume retail markets gravitate toward PancakeSwap, and niche multi-chain traders may still use SushiSwap for specific pairs. Understanding these differences helps traders select the venue that aligns best with their strategy.

Related Reading