Ethereum is gaining momentum once again. After a quiet stretch, its recent price surge has reignited attention across the crypto landscape. But the rally isn’t just about ETH. As the backbone of

decentralized finance (DeFi) and staking infrastructure, Ethereum’s movements tend to set the pace for everything built on top of it.

This resurgence comes at a time when broader sentiment is shifting.

U.S. Crypto Week has spotlighted digital assets on the national stage, with policymakers and industry leaders engaging in more constructive dialogue. The introduction of the

Genius Act, aimed at clarifying the legal framework for crypto innovation, has added to the renewed optimism.

As ETH climbs, the rest of the network begins to accelerate. Lending markets become more active, staking grows, and core infrastructure like oracles and

stablecoins sees greater demand. These patterns go beyond price sympathy. They reflect Ethereum’s structural role as the execution layer for decentralized applications, a layer whose activity directly impacts the protocols that operate atop it. In many cases, Ethereum’s upward momentum signals increased usage, capital inflows, and governance value across the ecosystem.

Ethereum’s rally is gaining steam, and it’s lifting the entire DeFi ecosystem with it. If you’re thinking about exploring beyond ETH, you can find these top tokens on the

BingX spot market.

Why Ethereum’s Surge Lifts DeFi and Staking Tokens

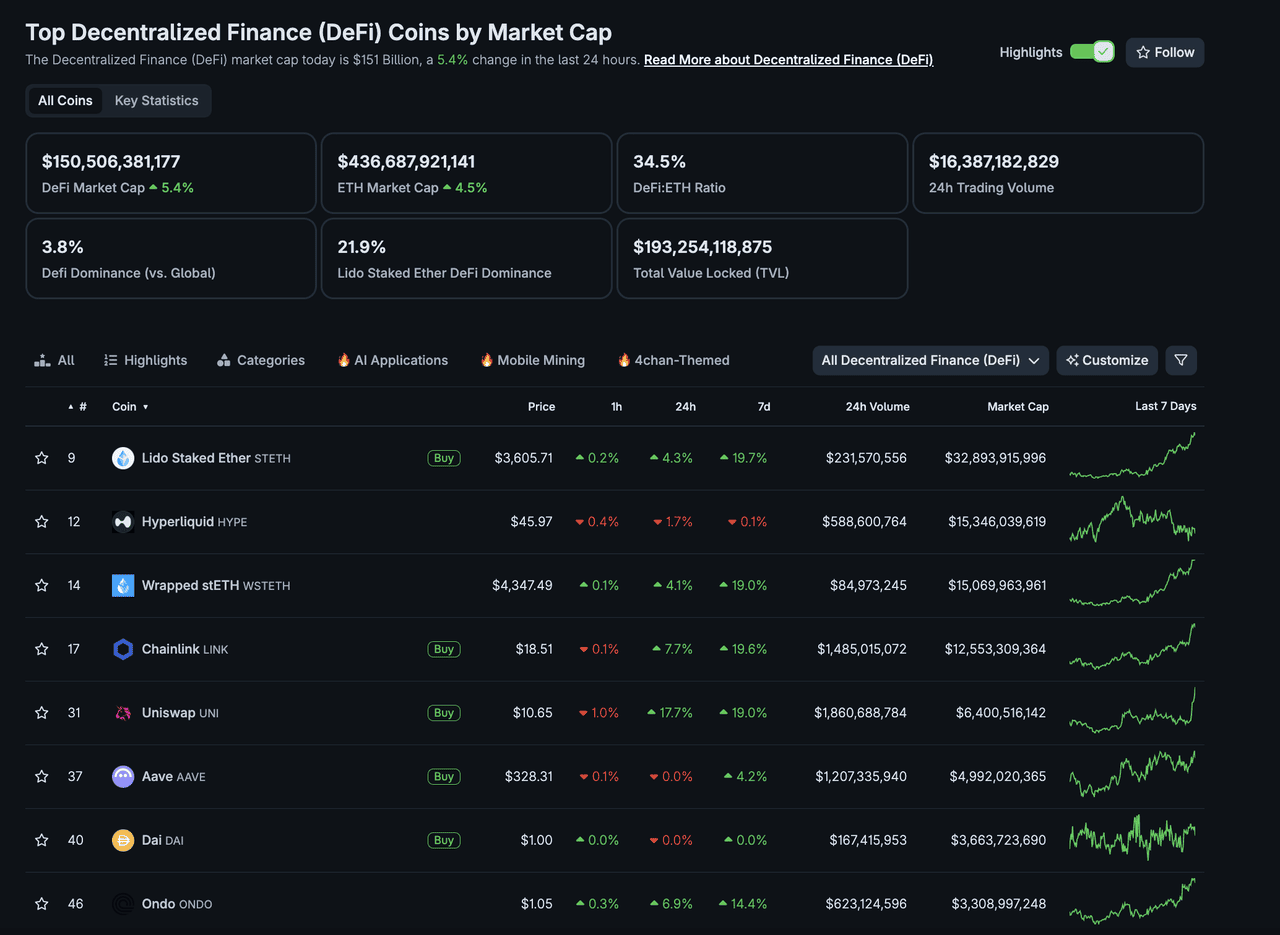

Ethereum’s recent rally, from around $3,140 on July 16 to over $3,600 by July 18, a gain of more than 14%, has sent fresh energy across the DeFi and staking landscape. Rather than being isolated price action, this surge is a catalyst that activates the broader Ethereum ecosystem.

When ETH gains value, protocols built on the network tend to see immediate effects. Trading volumes grow, capital flows into DeFi platforms, staking participation rises, and demand increases for stablecoins and oracle services. This is not just about correlation. It reflects Ethereum’s position as the execution layer for much of Web3. As network activity expands, the tools and systems that rely on it also become more relevant, often gaining in both utility and governance importance.

1. ETH Price Increases Boost On-Chain Activity and Protocol Usage

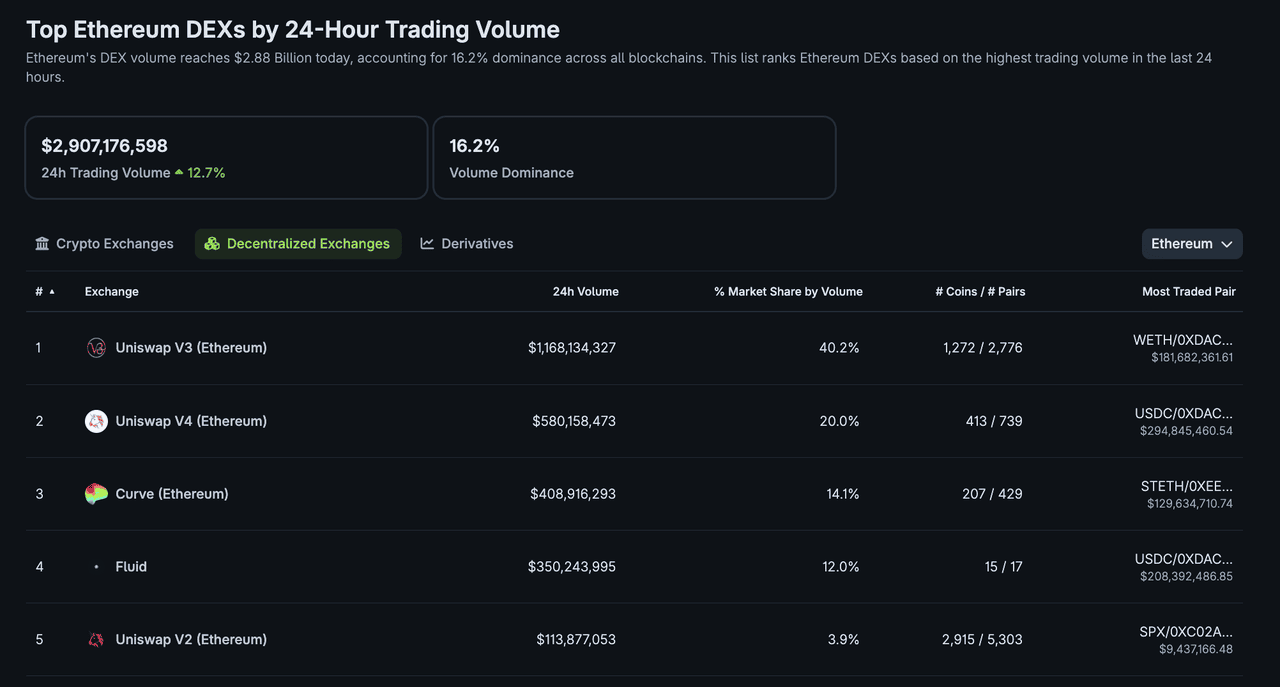

DEX trading volume surges as ETH rises | Source: CoinGecko

As the base layer for most DeFi activity, Ethereum plays a critical role in driving transaction volume and

liquidity. When ETH rallies, user engagement increases. Traders take advantage of price volatility, lending markets become more active, and capital flows into decentralized platforms.

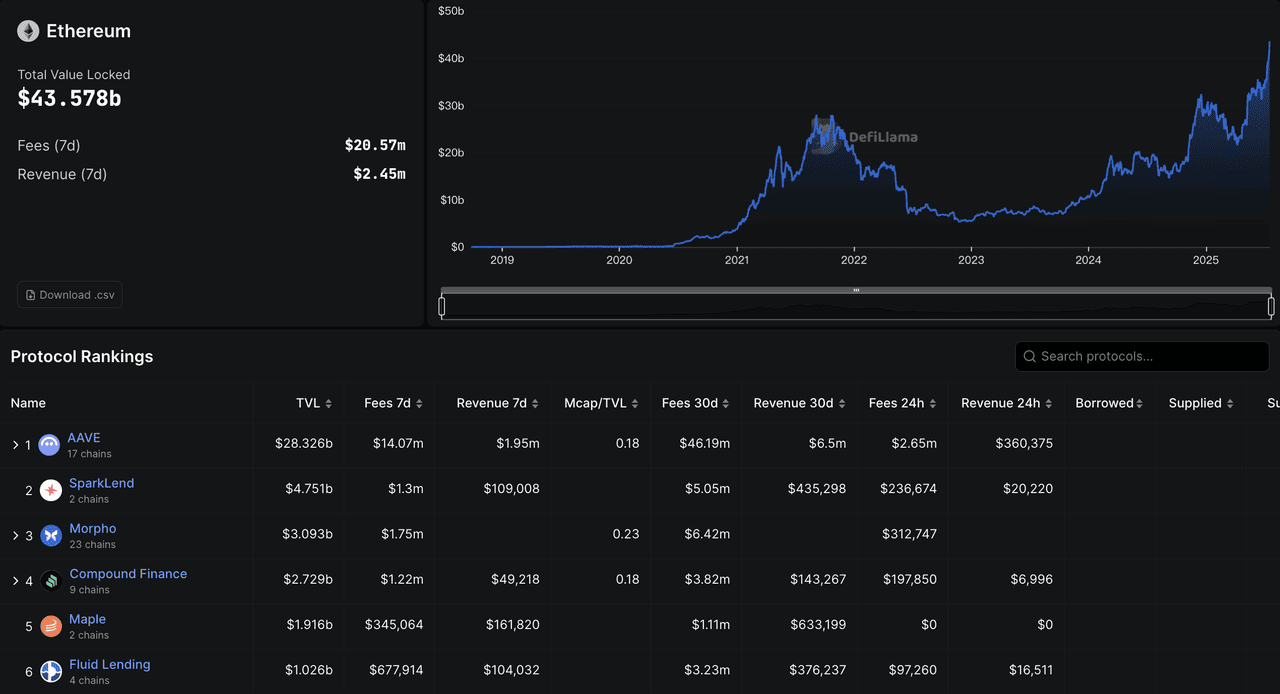

TVL growth on Ethereum affects activity on lending protocols | Source: DeFiLlama

Over the past few days, trading volumes on decentralized exchanges rose sharply. Lending protocols saw higher participation as users unlocked more value from their appreciated ETH holdings. This activity results in increased fee revenue, stronger demand for governance participation, and rising attention to protocol tokens.

2. Rising ETH Makes Staking More Attractive, Supporting Staking Infrastructure

Ethereum’s shift to

Proof of Stake(POS) has created a direct link between ETH price and staking incentives. As ETH becomes more valuable,

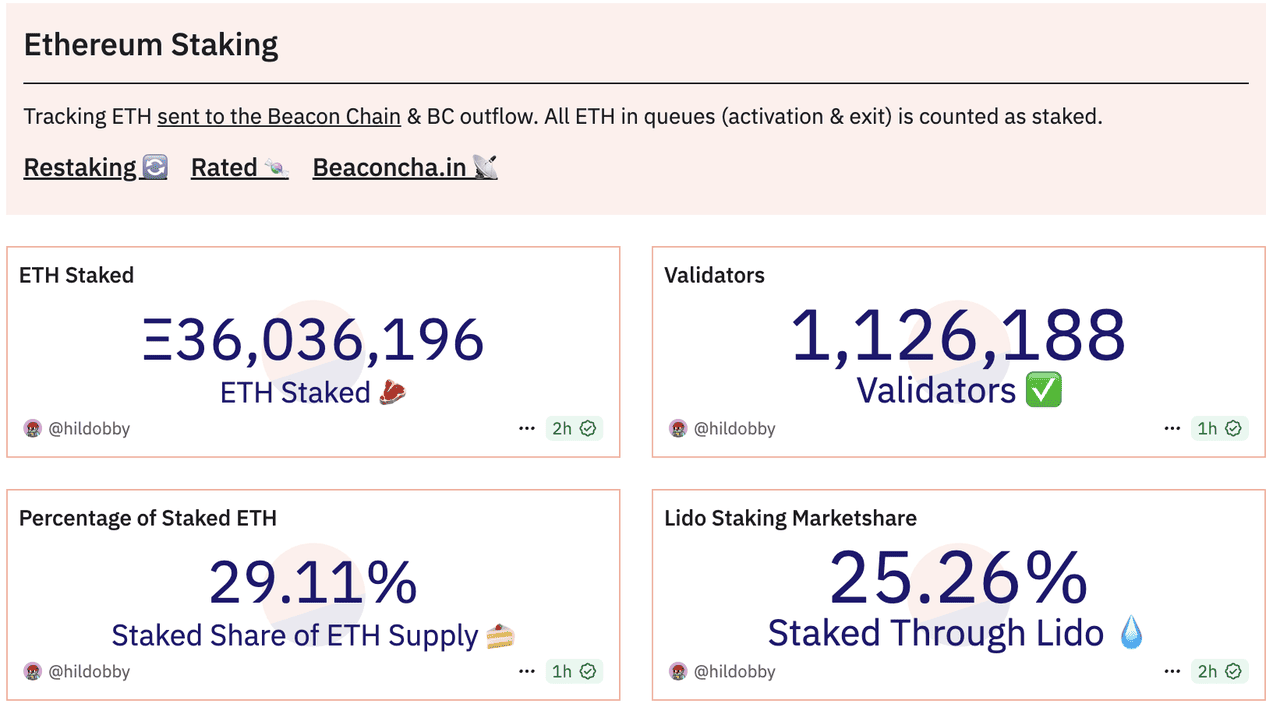

staking yields grow more appealing, encouraging more users to lock up their tokens. This in turn benefits the protocols that facilitate staking.

Liquid staking platforms have seen continued growth in participation. As of mid-July 2025, nearly 30% of the ETH supply was staked, reflecting rising confidence and interest in passive yield opportunities. The infrastructure supporting this activity sees increased usage, and the governance tokens tied to these systems become more active and visible.

3. ETH Momentum Increases Demand for Oracles, Stablecoins, and Governance

As Ethereum rallies, more

smart contracts are triggered, more

collateral is deposited, and

more stablecoins are minted. The entire stack of decentralized infrastructure comes under heavier usage, from oracles and data providers to automated market makers and collateralized lending systems.

This surge in demand increases the value of the systems that enable core DeFi functions. Tokens tied to these functions often reflect this growth. Whether used for data validation, protocol governance, or capital coordination, these assets rise in both relevance and market value when Ethereum gains momentum.

4. Expectations of Future Usage Fuel Additional Price Momentum

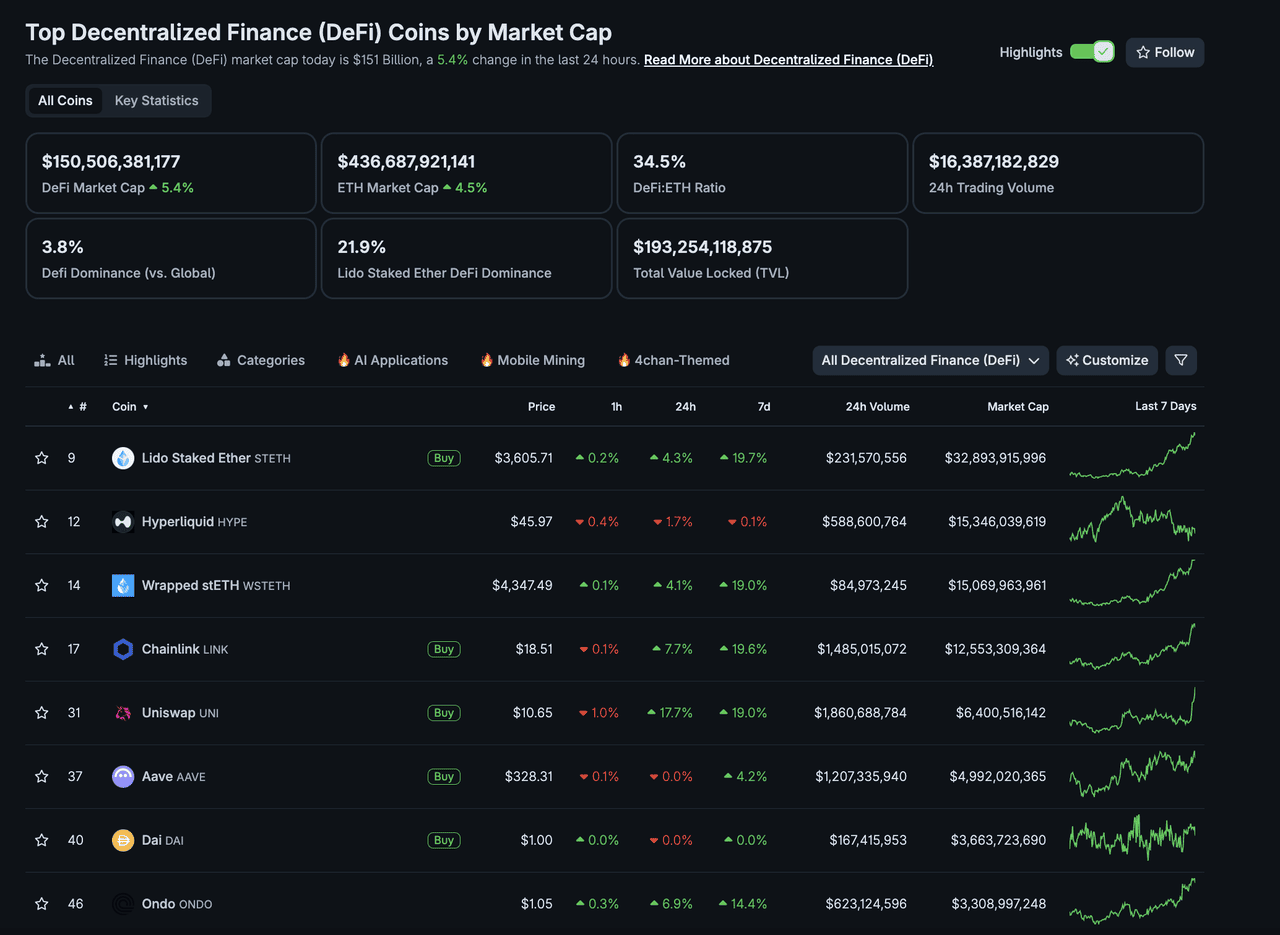

Most of the DeFi tokens rallies as Ethereum surges | Source: CoinGecko

In crypto markets, speculation plays a powerful role. When Ethereum rallies, investors begin to anticipate a wave of future activity across decentralized finance and staking. Even before real usage metrics appear, the expectation of higher protocol revenue, network traffic, and governance participation can drive token prices higher.

This feedback loop adds another layer to the Ethereum ecosystem’s bullish cycles. Rising ETH prices lead to greater interest in the apps and protocols built on top of it, and the belief that more usage is coming draws in even more capital. This speculative layer, while riskier, often acts as a short-term accelerator in upward-trending markets.

Ethereum’s rally does more than lift its own price. It revitalizes the broader decentralized economy. From increased trading activity to surging staking demand, the network’s growth directly strengthens the protocols built on top of it. In the following sections, we take a closer look at five key tokens positioned at the core of this ecosystem and examine why they deserve attention as ETH continues to rise.

Top 5 Ethereum Tokens to Watch

As Ethereum gains momentum, a select group of tokens closely tied to its infrastructure often experience amplified growth. These tokens represent core layers of Ethereum’s financial and staking ecosystems, and their value tends to rise in tandem with ETH due to their operational leverage and embedded roles within the network. Below, we explore five tokens that are especially worth watching in this cycle.

1. Uniswap (UNI)

Uniswap(UNI) is the largest decentralized exchange on Ethereum and consistently ranks among the top DeFi protocols by trading volume and

total value locked (TVL). According to

Dune Analytics, as of mid-2025, it secures over $5 billion in TVL and processes 4.83 billion in weekly trading volume across thousands of token pairs. It remains the most integrated DEX in the Ethereum ecosystem and is supported across major wallets, aggregators, and DeFi protocols.

Uniswap has established itself as the undisputed leader among decentralized exchanges, facilitating billions of dollars in trading volume and serving as the primary gateway for token swaps within the Ethereum ecosystem. As a pioneer of the

automated market maker (AMM) model, Uniswap has revolutionized how traders interact with DeFi by eliminating the need for

order books and enabling permissionless liquidity provision through its innovative constant product formula.

Why It Might Rise with ETH: When ETH rallies, trading activity on Uniswap typically surges as users rebalance portfolios and chase market momentum. This increased usage drives more protocol fees and enhances the value of UNI through governance utility and long-term alignment with Ethereum-based liquidity growth.

2. Chainlink (LINK)

Protocol Type: Decentralized oracle network

Chainlink(LINK) is the most widely used decentralized

oracle network in the blockchain industry. It has been integrated with over 1,000 projects, including nearly every major DeFi application on Ethereum, including Aave,

Compound, and more. It continues to expand into new sectors like gaming, insurance, and

real-world asset (RWA) verification. Chainlink remains the standard for reliable, tamper-proof external data feeds.

Chainlink occupies a unique and indispensable position within the Ethereum ecosystem as the leading decentralized oracle network, providing the critical infrastructure that connects smart contracts to real-world data,

APIs, and traditional payment systems. This oracle functionality is essential for the vast majority of DeFi applications, making Chainlink a foundational layer upon which much of Ethereum's DeFi ecosystem is built.

Why It Might Rise with ETH: ETH price rallies increase smart contract usage, which in turn boosts demand for Chainlink’s oracle services. As more protocols rely on real-world data, LINK benefits from rising utility and deeper integration across the Ethereum ecosystem.

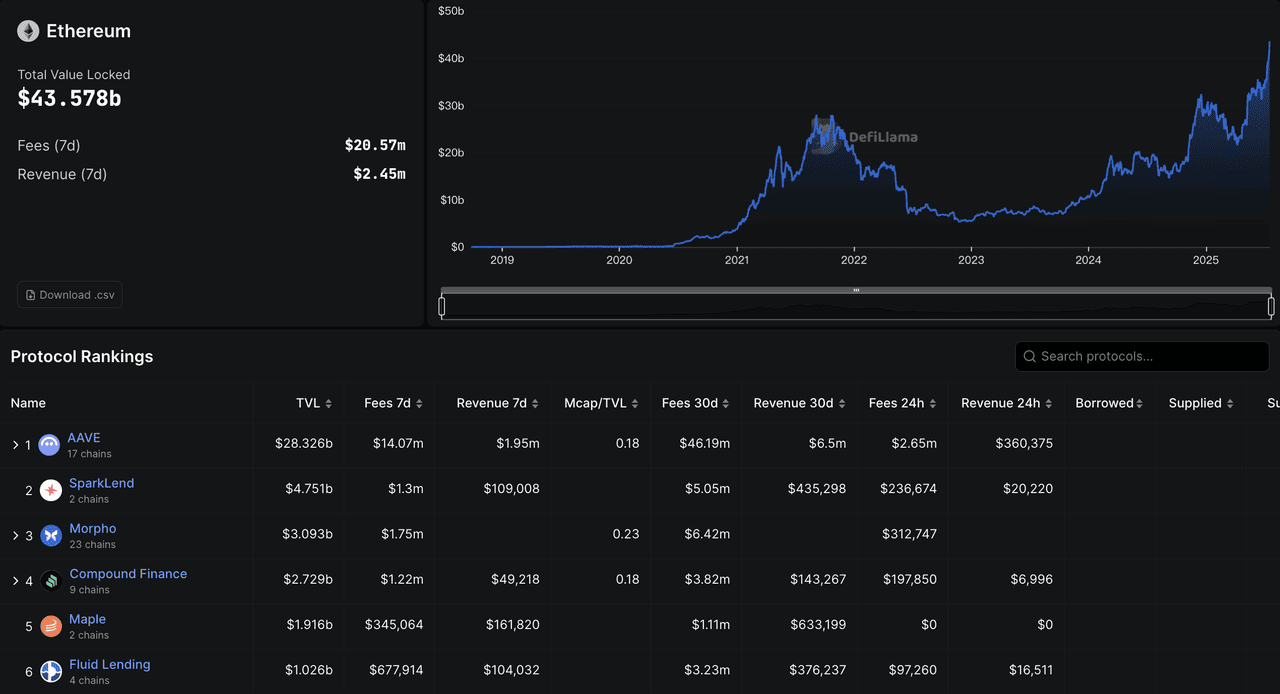

3. Aave (AAVE)

Protocol Type: Lending and borrowing platform

Aave(AAVE) is one of Ethereum’s most prominent lending protocols, consistently ranking in the top three DeFi applications by total value locked. As of mid-2025, Aave holds over $30 billion in assets across Ethereum mainnet and multiple Layer 2 solutions. It accounts for roughly 50% of the entire DeFi lending market and continues to attract users across both retail and institutional segments with its permissionless lending pools and institutional-grade features like Aave Arc.

Aave has emerged as one of the most sophisticated and feature-rich lending protocols in the DeFi space, offering users the ability to earn yield on deposits while enabling borrowers to access liquidity against their crypto holdings. The protocol's innovative approach to decentralized lending, including features like flash loans, rate switching, and credit delegation, has positioned it as a cornerstone of Ethereum's financial infrastructure.

Why It Might Rise with ETH: As ETH appreciates, the value of user collateral increases, expanding borrowing capacity and attracting more lending activity. This strengthens Aave’s protocol revenue and reinforces AAVE’s value as both a governance and safety-layer asset.

4. Maker (MKR)

Protocol Type: Stablecoin governance (DAI)

MakerDAO(MKR), now undergoing a rebrand and roadmap evolution under the name Sky (SKY), is the protocol behind

DAI, the largest decentralized stablecoin by adoption and circulation, with over $5.4 billion in active supply. DAI is integrated across nearly every major DeFi protocol on Ethereum and remains a core source of decentralized liquidity. MakerDAO has operated since 2017, making it one of the oldest and most battle-tested components of the Ethereum ecosystem.

Maker Protocol stands as one of the oldest and most established DeFi protocols, responsible for governing DAI, one of the most widely adopted decentralized stablecoins in the cryptocurrency ecosystem. The protocol's significance extends far beyond simple stablecoin creation, as DAI serves as a fundamental building block for countless DeFi applications and provides a decentralized alternative to centralized stablecoins.

Why It Might Rise with ETH: Higher ETH prices improve DAI vault collateral ratios and encourage new minting. This increases DAI adoption and boosts MKR’s relevance in protocol governance, risk management, and fee participation.

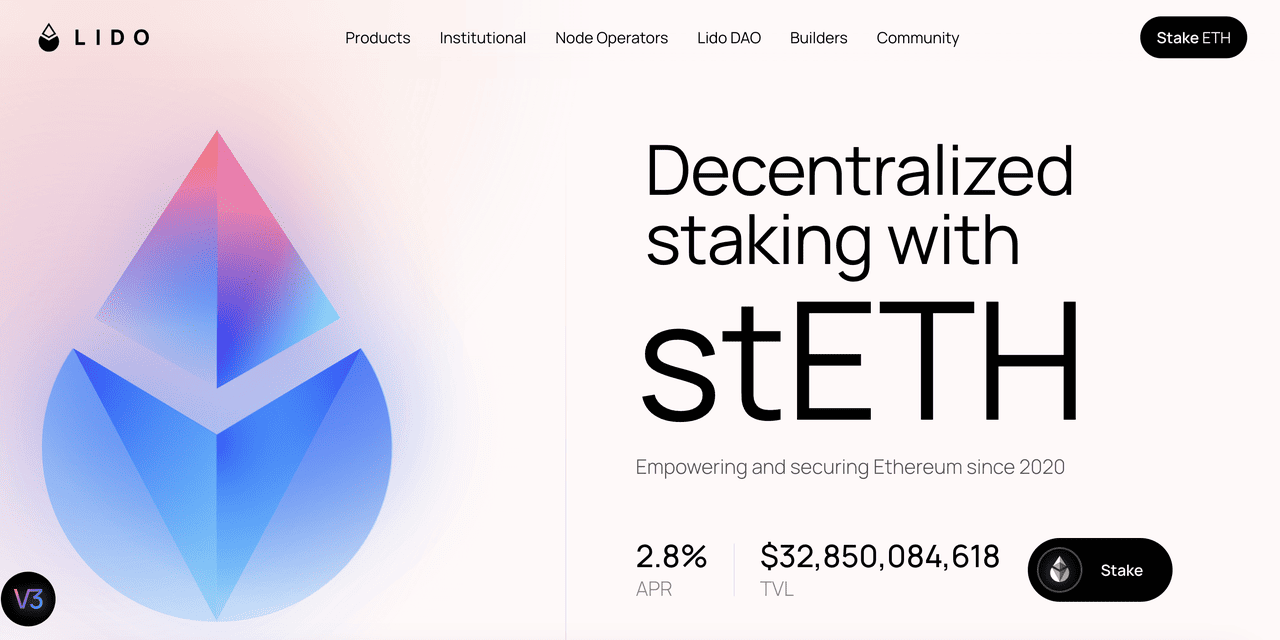

5. Lido (LDO)

Protocol Type: Liquid staking

Lido(LDO) is the dominant liquid staking provider on Ethereum, responsible for over 30% of all ETH staked on the network, equivalent to more than 9 million ETH as of mid 2025. It holds one of the largest total value locked (TVL) figures in DeFi and is deeply integrated with lending protocols, yield platforms, and aggregators. Its stETH token is one of the most utilized assets across Ethereum’s broader DeFi ecosystem.

Lido has revolutionized Ethereum staking by solving the liquidity problem that traditionally plagued proof of stake networks. Through its liquid staking protocol, users can stake any amount of ETH and receive stETH tokens that represent their staked position while remaining liquid and usable across DeFi applications. This innovation has made Lido the dominant player in Ethereum's staking ecosystem, controlling a significant portion of all staked ETH.

Why It Might Rise with ETH: ETH rallies make staking more financially attractive, leading to more deposits into Lido. Increased adoption of stETH supports LDO’s growth as both a governance token and a reflection of liquid staking demand.

Risks and Considerations in Investing in Ethereum-Related Tokens

While Ethereum ecosystem tokens offer strong upside potential, investors must remain mindful of the unique risks involved. Below are key considerations to keep in mind before investing:

1. High Volatility: Crypto assets are known for extreme price swings, often amplified by leverage, speculation, and sentiment. Token values can rise or fall sharply within short periods.

2. Smart Contract Risks: Even well-audited protocols are not immune to vulnerabilities. Bugs or exploits can lead to significant user losses and quickly impact token prices and trust.

3. Regulatory Uncertainty: DeFi protocols may face future restrictions depending on regional laws. Regulatory changes could limit protocol functionality or access, particularly in areas like token issuance or staking.

4. Protocol-Specific Risks: Each token faces distinct challenges. For example, UNI competes with other DEXs and may be affected by Ethereum’s fee model, while LDO depends on Ethereum’s staking dominance and is exposed to risks like slashing.

5. Market Sensitivity: DeFi tokens often react more sharply to macroeconomic trends than traditional assets due to their speculative nature and smaller market caps. Risk-off sentiment can cause rapid and deep corrections.

6. Due Diligence is Essential: Investors should apply proper risk management, stay informed on protocol developments and regulatory shifts, and always do their own research (

DYOR) before making decisions.

Conclusion

UNI, LINK, AAVE, MKR, and LDO represent some of the most promising Ethereum tokens positioned to benefit from ETH's continued surge, each playing integral roles in the ecosystem's DeFi and staking infrastructure. Their strong fundamentals, market leadership positions, and direct correlation with Ethereum's success make them compelling candidates for investors seeking exposure to the broader Ethereum ecosystem beyond ETH itself.

As Ethereum continues to evolve and mature, these tokens are well-positioned to capture value from the network's growth, increased adoption, and expanding use cases. Staying updated on developments through official project channels, social media platforms like X, and reputable cryptocurrency news sources will be crucial for making informed investment decisions in this rapidly changing landscape.

For those interested in exploring these opportunities further, conducting deep research into each project's fundamentals, understanding their tokenomics, and monitoring their progress within the broader Ethereum ecosystem will provide valuable insights into their long-term potential and help identify optimal entry and exit points in this dynamic market.

Related Reading