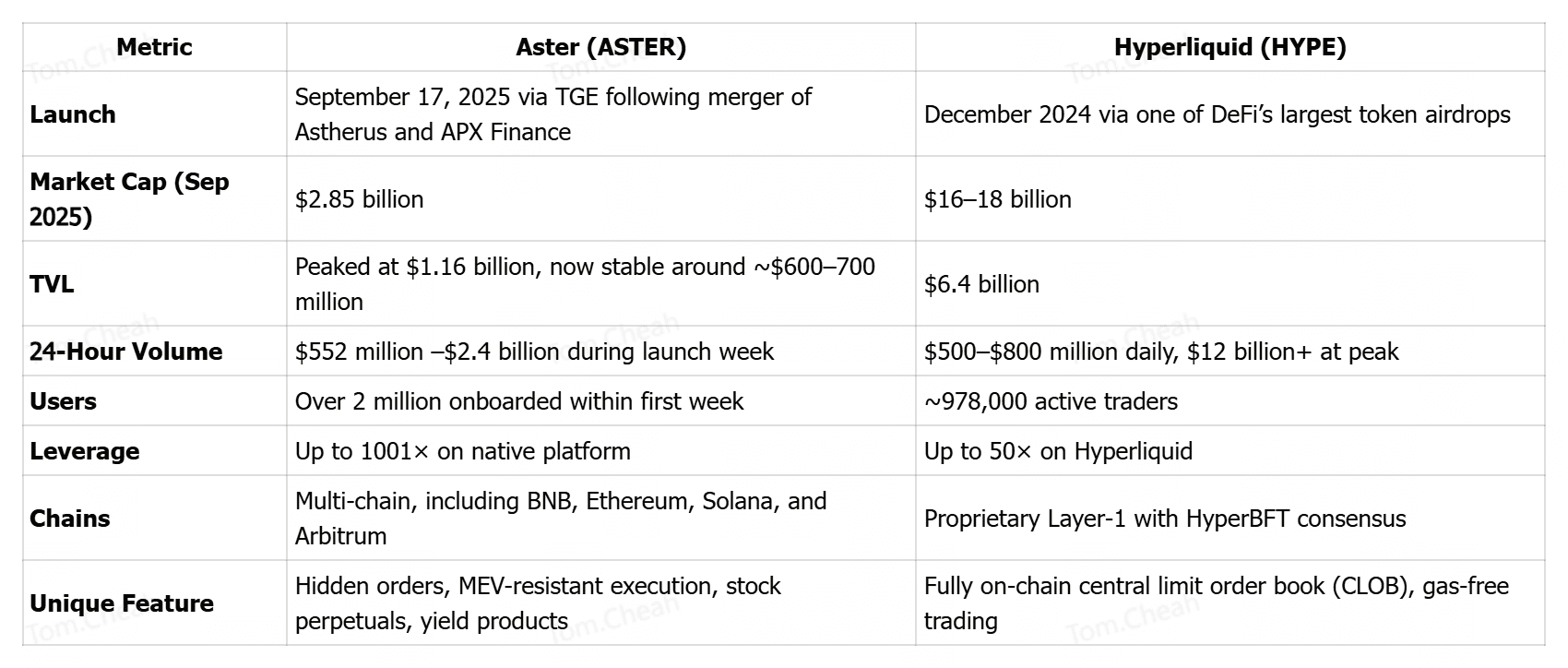

Aster (ASTER), the native token of a decentralized perpetual and spot trading platform, surged from $0.08 to an all-time high of $1.97 within days of its Token Generation Event (TGE) on September 17, 2025. Backed by CZ and YZi Labs, ASTER quickly hit a $2.85 billion market cap, drew in over 2 million users, and processed more than $544 billion in trading volume in its first week.

Meanwhile, Hyperliquid’s HYPE token remains the established heavyweight, trading in the $48–$59 range with a market cap above $16 billion, nearly 978,000 users, and over $1.5 trillion in cumulative trading volume. These contrasts highlight a defining showdown: ASTER is the explosive newcomer fueled by hype and innovation, while HYPE is the veteran backed by deep liquidity, transparency, and market dominance.

This article compares Aster (ASTER) and

Hyperliquid (HYPE), two of the biggest names in decentralized perpetual trading. Take a deep dive into their features, tokenomics, strengths, risks, and learn how to trade both tokens on BingX.

Aster vs. Hyperliquid Perp DEXs

Decentralized perpetual exchanges (perp DEXs) have become one of the fastest-growing sectors in DeFi, with trading volumes surging more than 650% year-on-year in 2025. According to DeFiLlama, the derivatives market now accounts for nearly $18.9 billion in market cap, with perpetuals alone representing over 95% of that figure. This boom reflects traders’ demand for high-leverage, on-chain products that rival centralized exchanges in speed and liquidity.

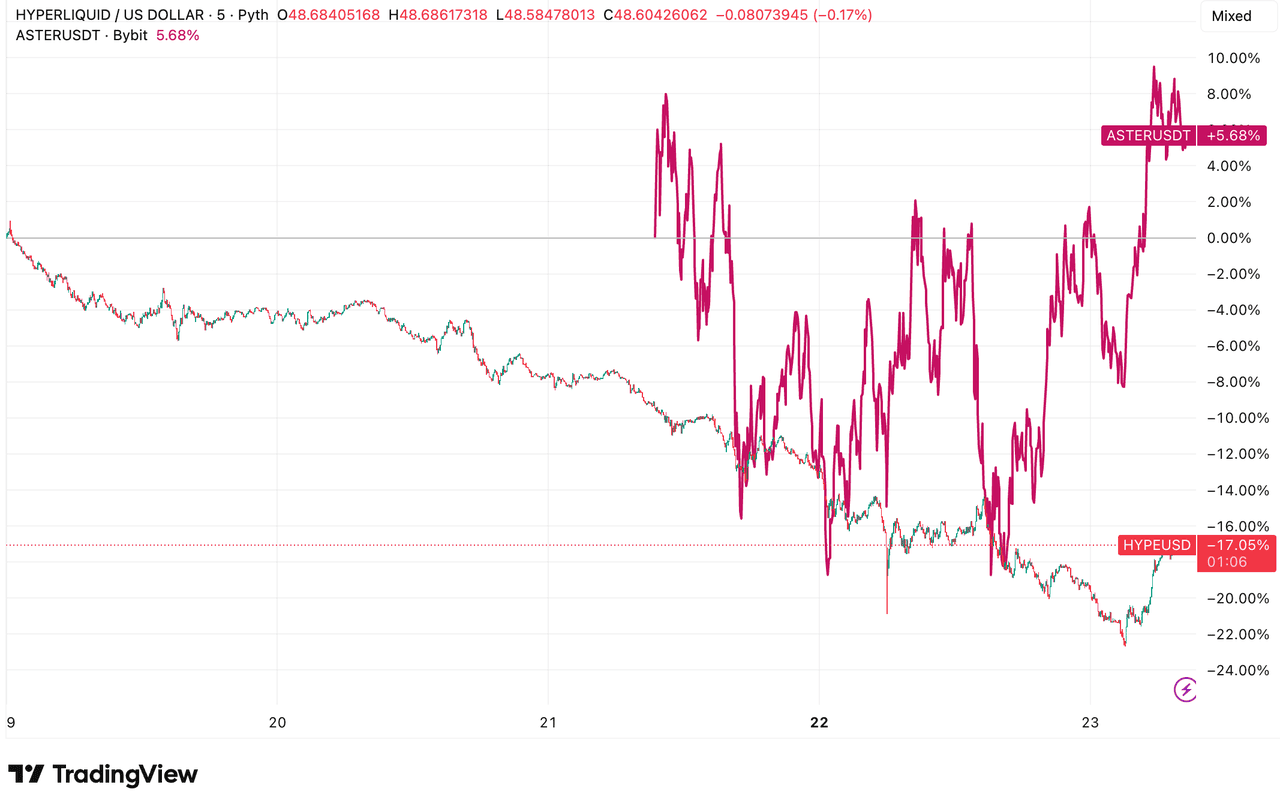

ASTER vs. HYPE performance | Source: TradingView

Within this breakout category, two names dominate the conversation. Hyperliquid (HYPE), valued at over $18 billion, controls more than 70% of the perp DEX market share, processing over $350 billion in monthly trading volume on its custom Layer-1. On the other side is Aster (ASTER), a newcomer launched on September 17, 2025, that stunned the market with a 1,500% token surge in its first week and over $2.4 billion in trading activity within days, briefly overtaking Hyperliquid in daily trading volume. Backed by YZi Labs and endorsed by CZ, Aster has quickly positioned itself as the most credible challenger to Hyperliquid’s dominance.

The ASTER vs. HYPE rivalry highlights a competition for liquidity, innovation, and user trust in the on-chain derivatives market. Hyperliquid offers proven depth and sustainable tokenomics, while Aster brings rapid adoption, extreme leverage, and unique features like stock perpetuals and hidden orders. Traders must weigh stability against growth potential to navigate opportunities in this growing sector.

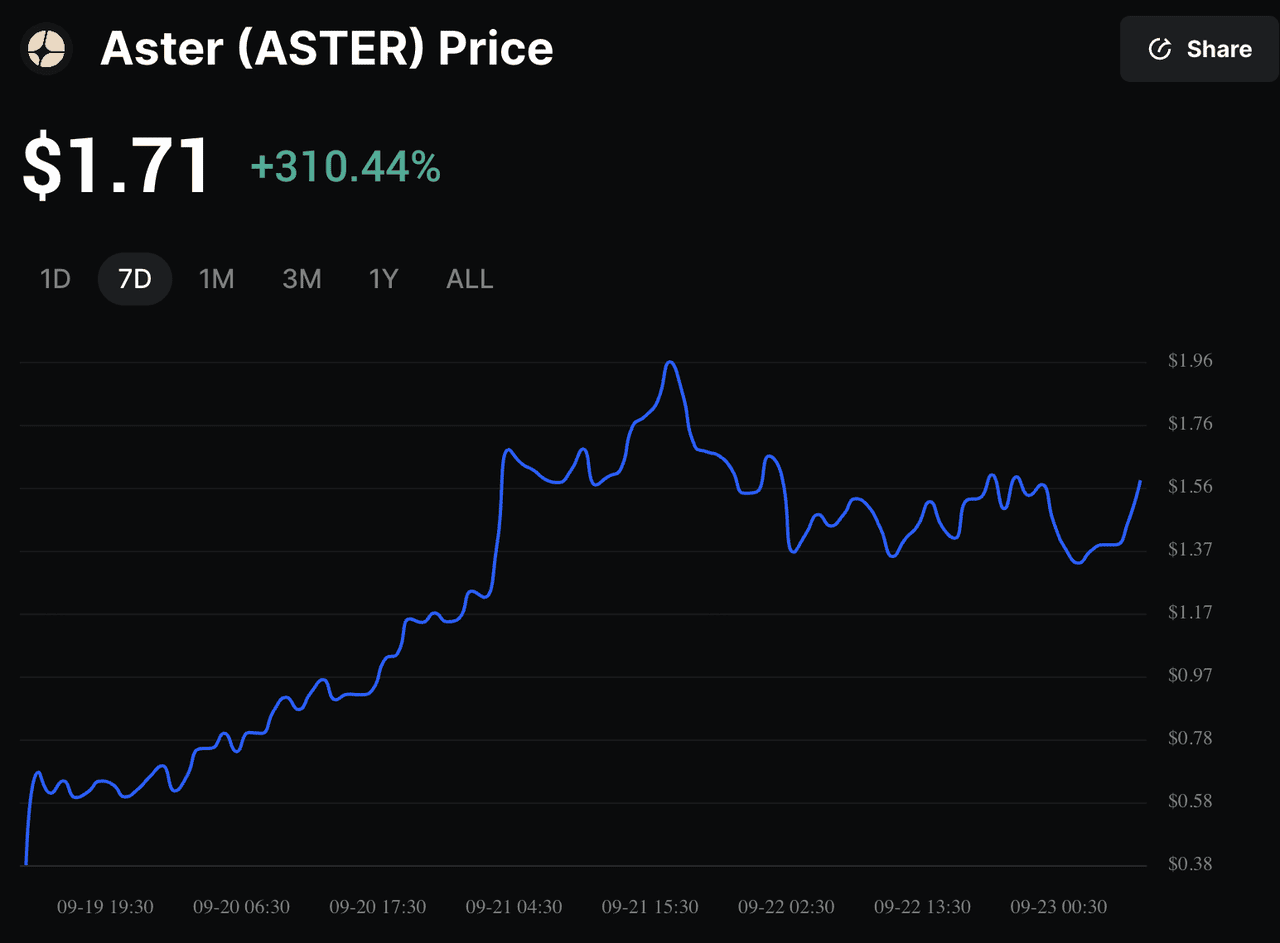

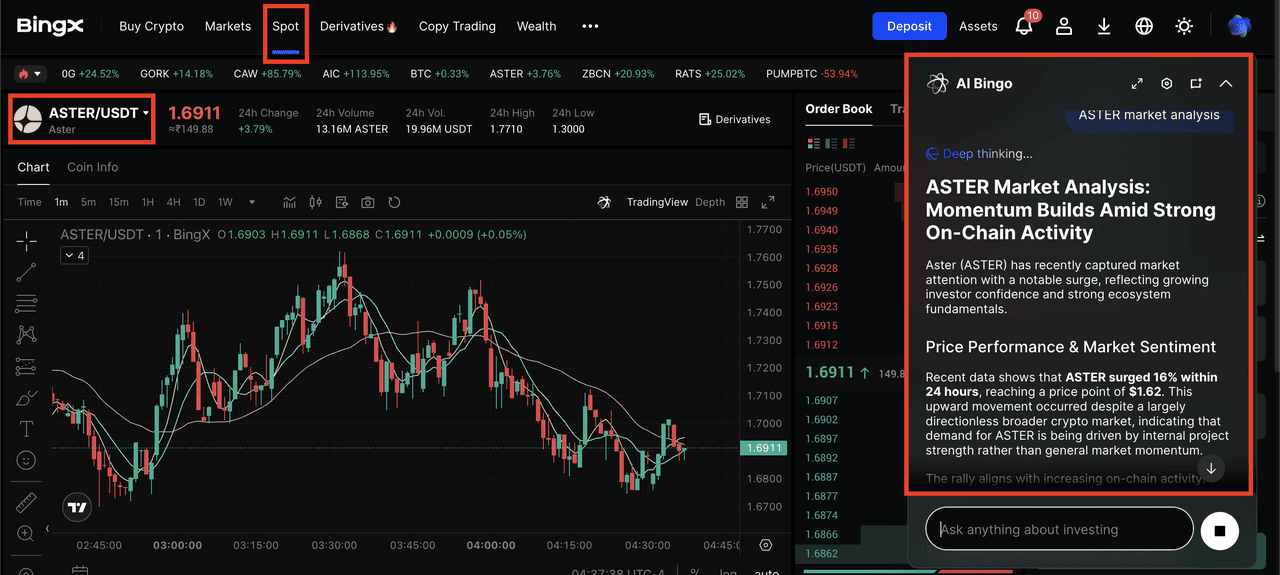

ASTER price chart on BingX

Aster is a next-generation perp DEX that blends yield products, perpetual futures, and even stock-based derivatives into one platform. It was created in late 2024 through the merger of Astherus - a yield protocol, and APX Finance - a perpetual trading platform. Backed by YZi Labs (formerly Binance Labs) and endorsed by CZ, Aster aims to disrupt Hyperliquid’s dominance.

Unlike most DEXs, Aster runs across multiple blockchains, including

BNB Chain,

Ethereum,

Solana, and

Arbitrum. It supports advanced trading tools and introduces unique features like hidden orders, which allow traders to conceal positions from the order book until execution.

Within a week after launch, Aster (ASTER) surged nearly 1,942%, reaching a market cap of over $2.85 billion with more than 2 million users onboarded. The DEX has already processed over $544 billion in cumulative trading volume, recorded $2.25 billion in 24-hour trading volume, and locked nearly $776 million in TVL (total value locked). With 1.65 billion ASTER tokens circulating out of its 8 billion supply, the project quickly established itself as one of the fastest-growing entrants in the perpetual DEX sector of the DeFi market.

As of September 2025, Aster offers four trading modes:

• Pro Mode — Full order book interface with 0.01% maker and 0.035% taker fees, multi-asset margin, and advanced tools like grid trading.

• 1001× Mode — A one-click, MEV-resistant trading mode with up to 1001× leverage, powered by the ALP liquidity pool and oracle feeds from Pyth, Chainlink, and Binance Oracle.

• Dumb Mode — A gamified prediction product for quick bets on short-term moves.

The Role of Aster (ASTER) Token in Its DEX Eacosytem

The ASTER token is the backbone of Aster’s ecosystem, designed to align traders, liquidity providers, and the broader community. It serves multiple roles: governance participation, trading and liquidity incentives, revenue sharing through buybacks, and rewards for users who stake or provide liquidity. ASTER also fuels ecosystem growth by supporting collateral flexibility across products like asBNB

liquid staking derivative and USDF

yield-bearing stablecoin, making it more than just a governance token.

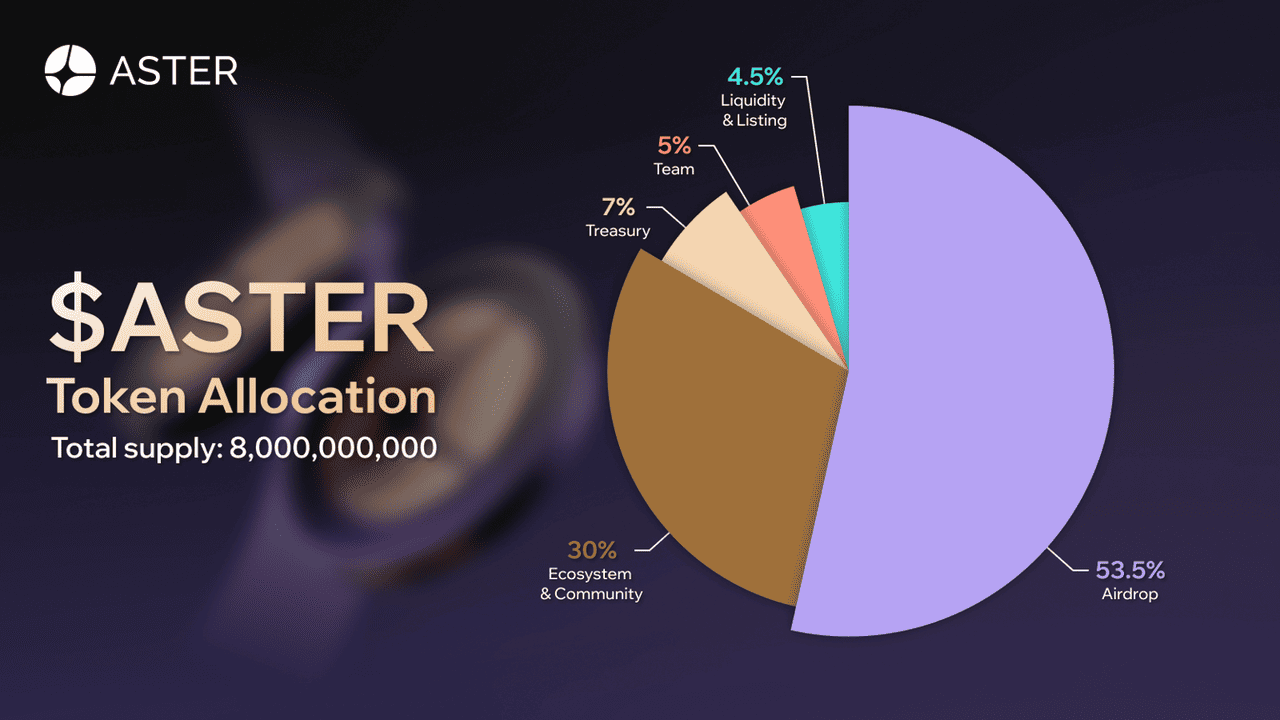

ASTER Token Allocation

ASTER token distribution | Source: Aster docs

The total supply of ASTER tokens is 8,000,000,000.

• Airdrop: 53.5% or 4.28 billion for community incentives and early supporters

• Ecosystem & Community: 30% or 2.4 billion for migration, grants, marketing, and liquidity support

• Treasury: 7% or 560 million reserved for long-term growth and partnerships

• Team: 5% or 400 million with a 1-year cliff and 40-month vesting to align incentives

• Liquidity & Listings: 4.5% or 360 million to provide exchange liquidity and market stability

• TGE Unlock: 704 million ASTER or 8.8% of supply released on September 17, 2025, with the rest distributed gradually through vesting schedules and reward programs

This structure emphasizes Aster’s community-first approach, with over 80% of the supply directed toward users and ecosystem incentives, contrasting with typical VC-heavy models in DeFi.

What Is Hyperliquid (HYPE) DEX?

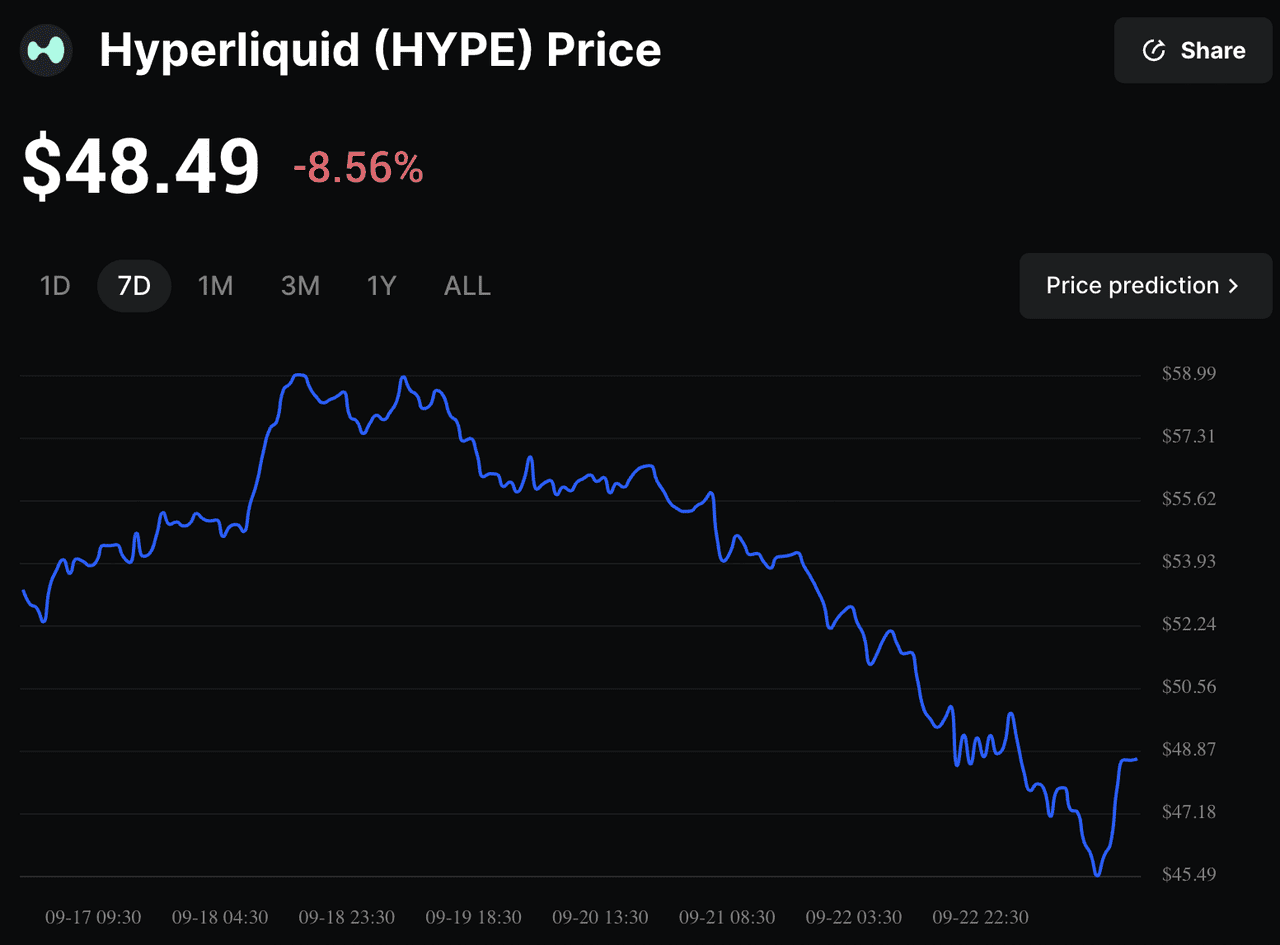

HYPE price chart on BingX

Hyperliquid (HYPE) is a decentralized perpetual exchange that runs on its own custom Layer-1 blockchain, designed specifically for trading performance. Powered by HyperBFT consensus, the network can handle more than 200,000 orders per second with block times as low as 0.07 seconds, enabling near-instant trade confirmations. Unlike most DeFi platforms, it charges zero gas fees, relying instead on low maker and taker fees of 0.01% and 0.035% respectively, making it cost-efficient for both retail and institutional traders.

What sets Hyperliquid apart is its fully on-chain CLOB. Every order, cancellation, and liquidation is recorded directly on-chain, ensuring complete transparency and censorship resistance. This structure provides deeper liquidity and tighter spreads than AMM-based models, while still maintaining decentralization. Combined with up to 50× leverage, seamless one-click trading, and community-first tokenomics, Hyperliquid offers the speed of a CEX with the trust of DeFi, making it one of the most advanced perpetual DEXs in the market.

By mid-2025, Hyperliquid (HYPE) had cemented itself as the market leader in on-chain perpetuals, commanding 73% market share and surpassing $1.5 trillion in cumulative trading volume. The platform supports nearly 978,000 users, processes over $12 billion in daily volume, and operates with lightning-fast 0.07-second block times on its custom Layer-1. With a market cap of around $16.1 billion, 333.9 million HYPE tokens in circulation, and a deflationary model fueled by fee buybacks and burns, Hyperliquid continues to showcase the scale and resilience that make it the dominant perp DEX in 2025.

Hyperliquid's key features include:

• Zero Gas Fees — Traders only pay low maker (0.01%) and taker (0.035%) fees.

• 50× Leverage — Across 130+ markets, from BTC and ETH to smaller altcoins.

• Community Ownership — No VC funding; 31% of supply was airdropped to users in one of the largest DeFi airdrops ever, valued at $1.6 billion.

• Buyback & Burn Model — 97% of fees go to buying back HYPE, reducing supply and rewarding long-term holders.

What Is Hyperliquid (HYPE) Tokenomics?

The HYPE token powers the Hyperliquid ecosystem, ensuring that users, not outside investors, remain at the center of its growth. It serves as the governance token, allowing holders to vote on protocol upgrades and market listings, while also enabling staking with yields of up to 55% APR.

Traders use HYPE for discounted fees and to access vault rewards, while the protocol reinforces value through its aggressive buyback-and-burn model, where 97% of trading fees are used to purchase and retire tokens from circulation. This structure makes HYPE both a utility and value-capture asset within Hyperliquid’s on-chain economy.

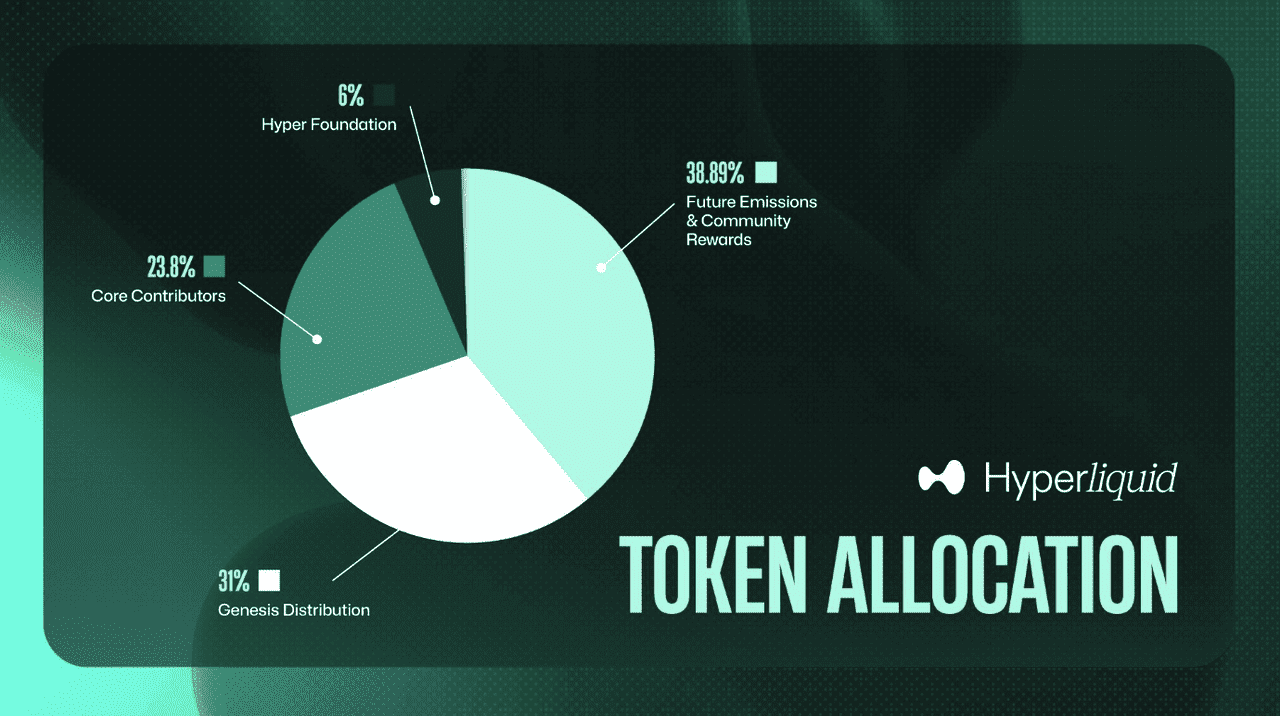

HYPE Token Distribution

HYPE token allocation | Source: NFT Evening

Hyperliquid has a fixed maximum supply of 1,000,000,000 HYPE tokens.

• Airdrop: 310 million or 31% distributed to over 94,000 users in one of DeFi’s largest airdrops

• Community Rewards & Liquidity: Ongoing allocations for traders and liquidity providers

• Team: Gradual contributor unlocks over 2 years to ensure long-term alignment

• Burn Mechanism: 97% of all trading fees are used to buy back HYPE and burn it, creating deflationary pressure

This design prioritizes community ownership and sustainability, contrasting with traditional VC-heavy token models and helping Hyperliquid maintain its position as the market leader in perp DEX trading.

Aster or Hyperliquid: Which Is Better?

Both Aster (ASTER) and Hyperliquid (HYPE) are shaping the future of decentralized perpetual exchanges, but they appeal to traders in different ways. Aster is the bold newcomer, while Hyperliquid is the seasoned leader. Understanding their respective strengths and risks can help traders decide where to allocate capital.

Pros and Cons of Investing in ASTER

Aster has captured market attention with explosive growth, surging more than 1,500% in its first week after launch. Its innovative features, including stock perpetuals, hidden orders, and 1001× leverage, offer tools that traders typically only find on centralized platforms. The project also benefits from CZ’s endorsement and backing from YZi Labs, lending credibility and strong connections to the Binance ecosystem.

Risks: Aster’s reliance on aggressive incentives and its complex smart contract design pose potential vulnerabilities. The high leverage amplifies both gains and losses, while upcoming token unlocks could introduce selling pressure and volatility.

Pros and Cons of Investing in HYPE

Hyperliquid stands out for its proven liquidity depth and dominant market share, processing over $350B in monthly trading volume on its custom Layer-1 blockchain. Its fully on-chain order book provides unmatched transparency, and its deflationary tokenomics, where 97% of fees buy back and burn HYPE, make it appealing to long-term holders.

Risks: With a market cap already above $18 billion, HYPE may offer less speculative upside compared to newer tokens. The project’s sustainability depends heavily on maintaining high trading activity, and future team token unlocks could create moderate selling pressure.

How to Trade ASTER and HYPE on BingX

Whether you want to hold tokens long-term or trade short-term volatility, BingX provides easy access to both ASTER and HYPE on its Spot and Futures markets. Here’s a step-by-step guide to help you get started.

Buy and Sell ASTER or HYPE on Spot Trading

ASTER/USDT trading pair on the spot market powered by AI Bingo

1. Create & Verify Account – Sign up on

BingX.com or the BingX app, then complete

KYC for full trading access.

2. Deposit Funds – Add

USDT using a bank card, crypto transfer, or BingX’s secure

P2P marketplace.

4. Select Order Type –

• Limit Order: Set your preferred price and wait for execution.

5. Confirm Trade – Enter the amount, click Buy (or Sell), and your tokens will appear in your Spot account.

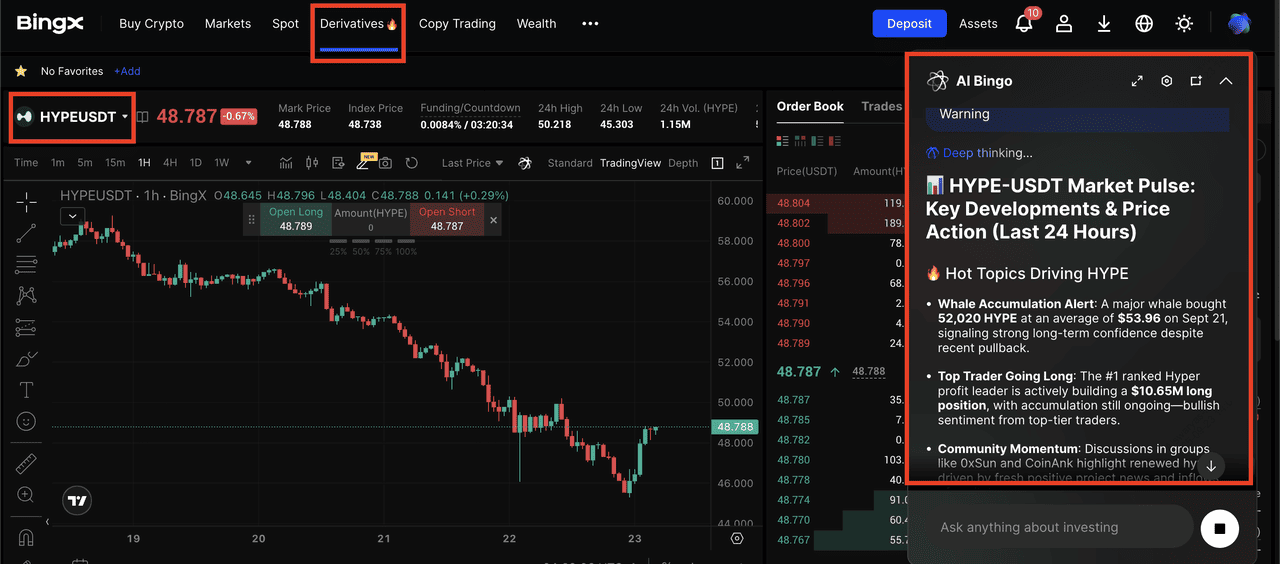

Long or Short ASTER and HYPE on Futures Market

HYPEUSDT perpetual contract on the futures market, powered by AI Bingo's insights

1. Enable Futures – Transfer USDT from your Spot account to your Futures account.

3. Set Leverage – On BingX Futures, both ASTER and HYPE contracts support leverage of up to 100×. However, beginners are advised to start with much lower leverage, e.g., 2×–3×, to reduce liquidation risk and manage volatility more effectively.

4. Open Position –

• Go Long (Buy) if you expect the price to rise.

• Go Short (Sell) if you expect the price to fall.

5. Risk Management – Always set a stop-loss and track your liquidation price. Use

BingX AI tools for real-time insights on support, resistance, and market trends.

Getting Started with Trading HYPE, ASTER Tokens

If you’re new to trading, start small with Spot trading before trying Futures, since ASTER carries higher upside but also higher risk, especially with leverage. Keep an eye on token unlock calendars, as they often trigger volatility in both ecosystems. To manage risk, consider diversifying, such as HYPE for stability and ASTER for growth potential. Finally, use BingX's AI-powered trading assistant AI Bingo to track market trends, sentiment, and strategy signals before entering positions.

Conclusion: What's Next for Aster and Hyperliquid?

Aster is the bold newcomer, drawing attention with rapid TVL growth, innovative features like stock perpetuals and hidden orders, and strong backing from CZ and YZi Labs. Hyperliquid remains the established leader, with deep liquidity, fully on-chain transparency, and a deflationary token model that continues to attract long-term users.

The real test for Aster will be liquidity retention once incentives taper off. If it sustains user activity and delivers on its roadmap, including Aster Chain with ZK privacy and intent-based trading, it could position itself as a future “blue-chip” perp DEX. Still, both ASTER and HYPE remain subject to market volatility, token unlocks, and regulatory shifts, so traders should manage risk carefully and only commit what they can afford to lose.

FAQs on Aster vs. Hyperliquid

1. Is Aster the next Hyperliquid?

Aster is growing rapidly and offers unique features like stock perps and 1001× leverage. However, Hyperliquid still controls 70%+ of the market. ASTER has potential but needs sustained liquidity and adoption to match HYPE’s dominance.

2. What’s the difference between ASTER and HYPE tokens?

ASTER powers a multi-chain DEX with strong airdrop-driven distribution, while HYPE is tied to a custom Layer-1 with deflationary buybacks. ASTER emphasizes growth incentives; HYPE emphasizes sustainability.

3. Which is riskier to trade: ASTER or HYPE token?

ASTER is newer, more volatile, and offers extreme leverage. HYPE is more established but can still swing sharply during market volatility. Beginners should size positions carefully and avoid maximum leverage.

4. Can I trade both ASTER and HYPE tokens on BingX?

Yes. Both Aster (ASTER) and Hyperliquid (HYPE) are available on Spot and Futures markets. Spot is better for long-term holding, while Futures allows leveraged trading.

Related Reading