What Are Crypto Wallets?

Ever wondered who actually holds your crypto? The answer depends on the type of wallet you use. Crypto wallets are essential tools for storing, sending, and receiving digital assets like

Bitcoin,

Ethereum, and stablecoins such as USDT. Unlike traditional wallets that hold cash, crypto wallets store your private and public keys, the credentials you need to access your funds on the blockchain.

These wallets come in two main types: custodial and non-custodial. According to

Triple A, global crypto ownership rates at an average of 6.8%, with over 560 million crypto users worldwide since 2024, making wallets indispensable in today's digital economy.

Learn the key differences between custodial and non-custodial crypto wallets, including how they work, their pros and cons, and which type is best for your crypto storage and trading needs.

What Is a Custodial Wallet and How Does It Work?

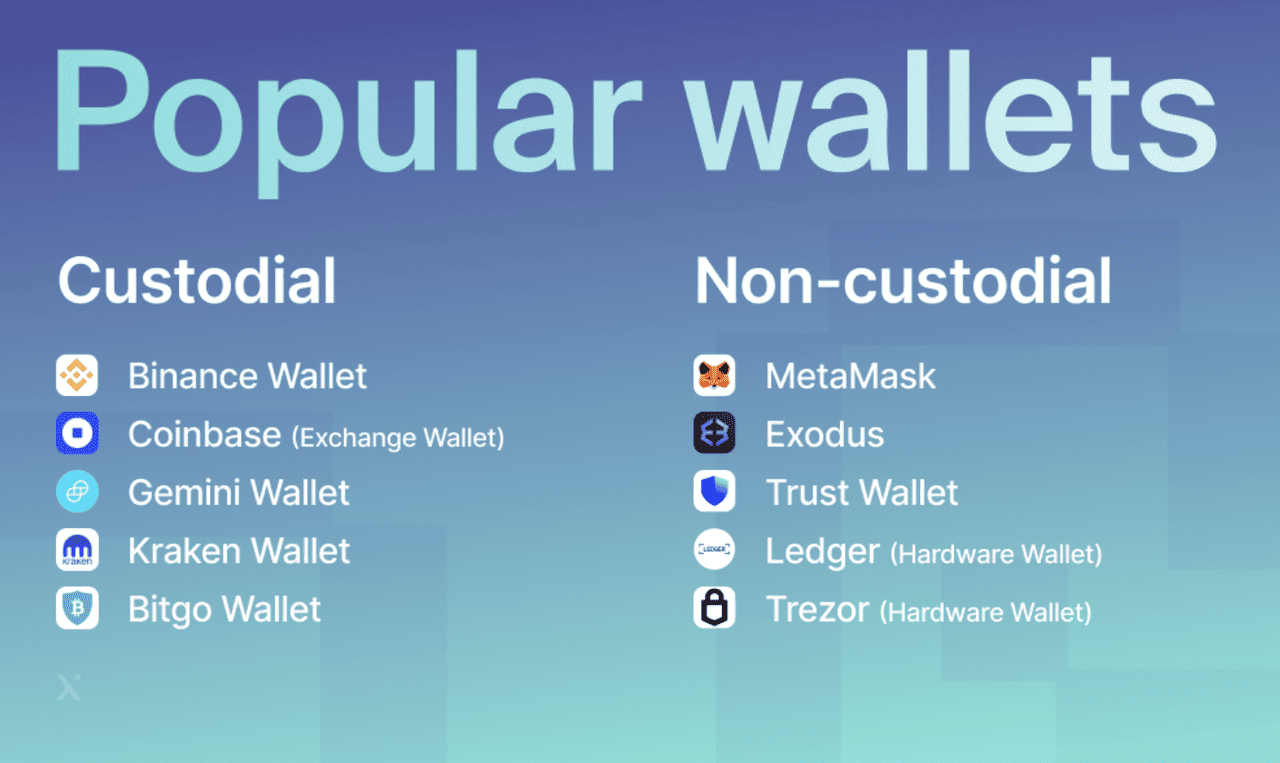

A custodial wallet is one where a third party, usually a crypto exchange such as BingX controls your

private keys. This means the platform manages the security and technical details of your wallet. Using a custodial wallet means you're trusting the provider to keep your funds safe. The main advantage of custodial wallets is their convenience. They are easy to set up, user-friendly, and often come with customer support and password recovery options. This makes them ideal for beginners who want to quickly buy, trade, and store crypto.

However, since the platform controls your keys, you do not have full ownership of your funds. The biggest benefit of handing over your

private key control to a third party is convenience. If you're not especially tech-savvy or confident in managing the security of your crypto, relying on a security-focused platform can take a lot of the pressure off. It simplifies your experience and reduces the risk of losing access due to user error. However, custodial wallets carry the risk of platform hacks or freezing of withdrawals.

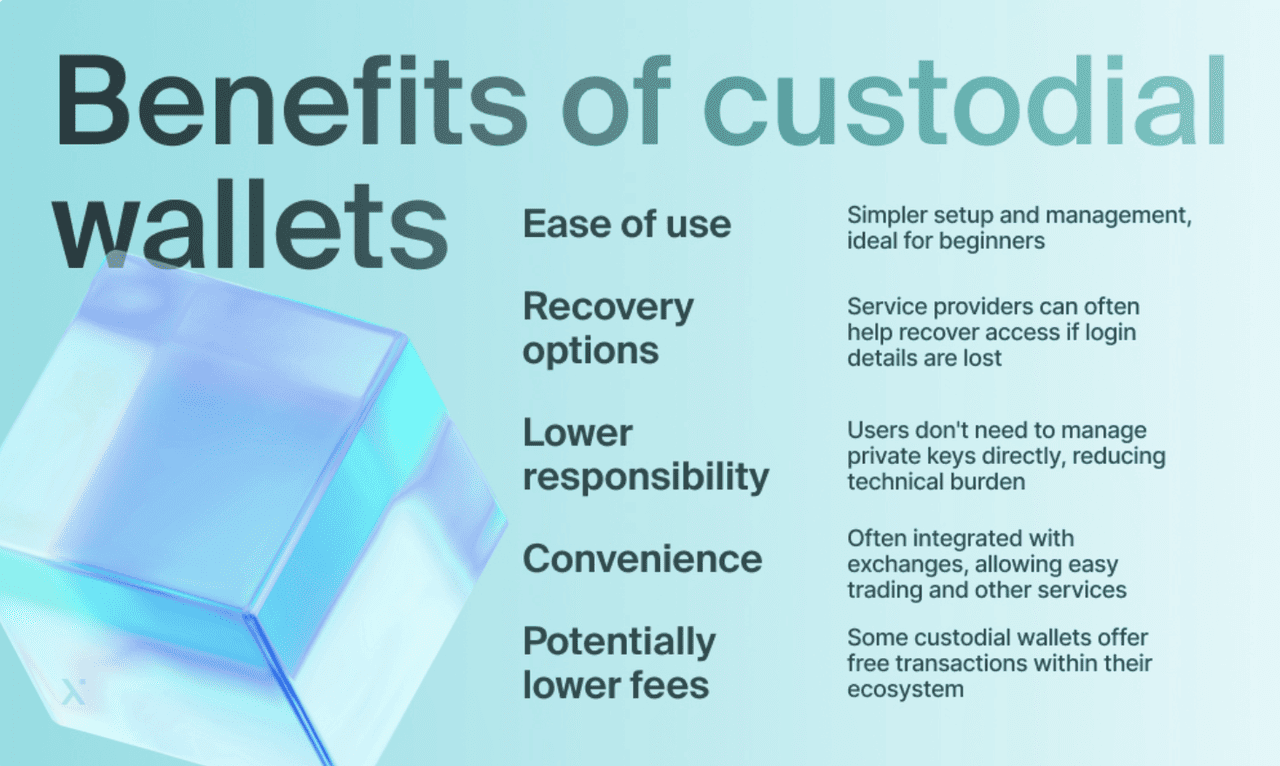

What Are the Pros and Cons of Custodial Wallets?

The convenience and support make custodial wallets appealing for many users, especially beginners. However, the trade-off is that you must trust the platform's security measures and policies. If the service is compromised or the company faces financial difficulties, your assets could be at risk. Password recovery options are helpful but also highlight that the platform has access to your keys, which means they could be vulnerable to hacking or misuse.

What Is a Non-Custodial Wallet and How Does It Work?

A non-custodial wallet, also known as a self-custody wallet or

Web3 wallet, gives you full control over your

private keys and, by extension, your crypto assets. Examples include

MetaMask,

Trust Wallet, and

hardware wallets such as

Ledger and Trezor. When you create a non-custodial wallet, you receive a recovery phrase of 12 to 24 words, which serves as a backup to restore your wallet if you lose your device. No third party has access to your keys, following the crypto mantra: "Not your keys, not your coins."

The benefit is complete control and privacy. You are the sole owner of your funds, and no centralized service can access or freeze them. Non-custodial wallets are preferred by experienced users, long-term holders, and those interacting with

decentralized finance (DeFi) platforms. However, they require responsibility: if you lose your private keys or recovery phrases, there is no way to recover your funds. You must also be vigilant against scams and follow strict security practices.

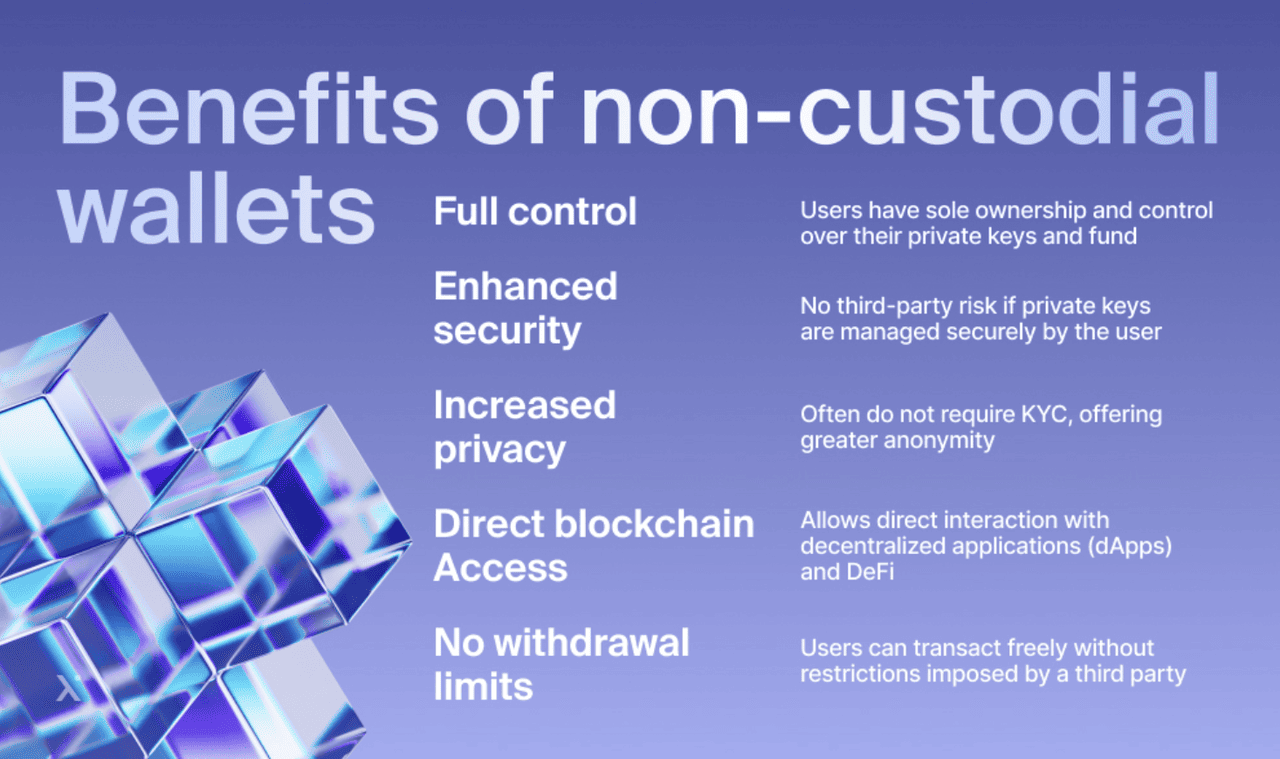

What Are the Pros and Cons of Non-Custodial Wallets?

Non-custodial wallets provide unmatched control and security since you alone hold your keys. This means no one else can access your funds without your permission. However, with great power comes great responsibility. Losing your private keys or recovery phrase means permanent loss of access to your crypto. There is no password reset. Users need to practice strong security habits, such as safely storing recovery phrases offline and being cautious of phishing or malicious apps.

For added security, you can use cold wallets which offer the highest level of protection by keeping your crypto completely offline. As long as you don't transfer funds to an internet-connected device, your assets stay out of reach from online threats. All you need to focus on is keeping the physical device safe.

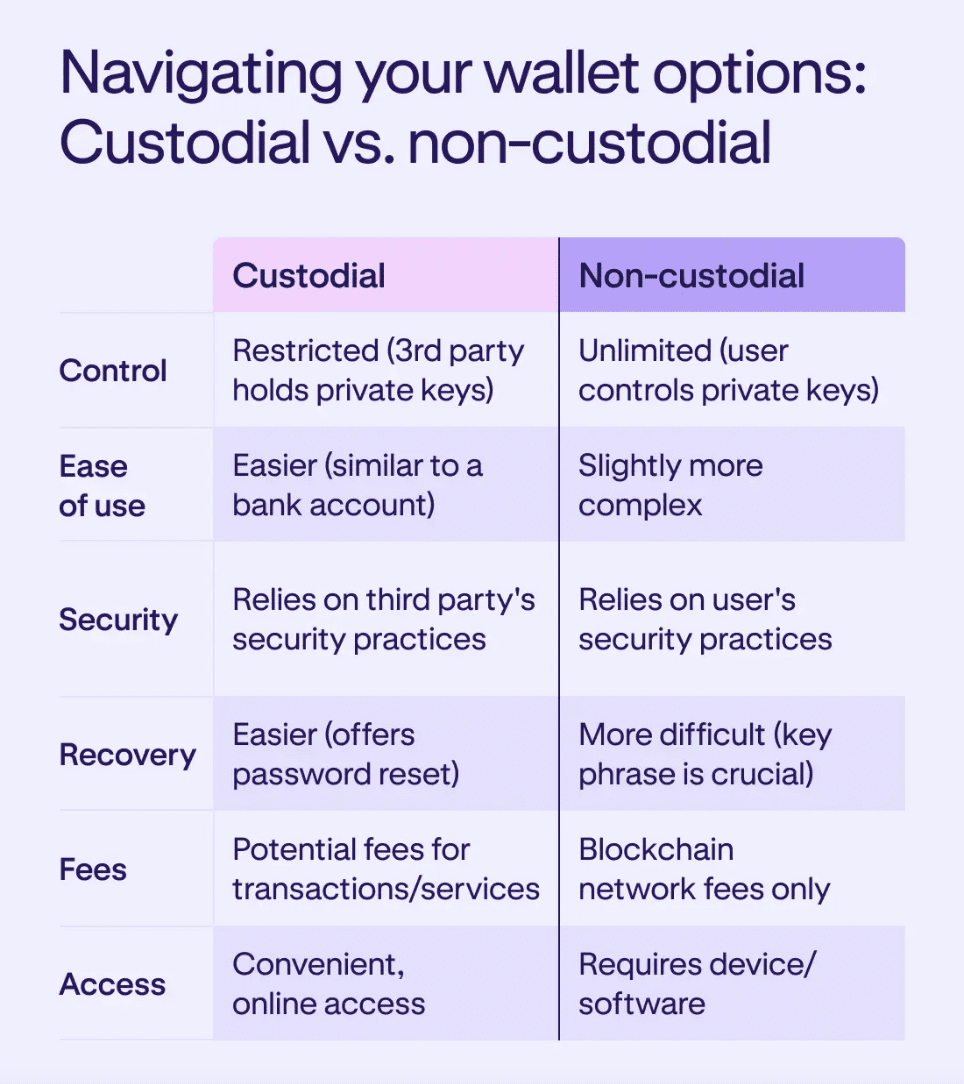

Custodial vs. Non-Custodial Wallets: Key Differences

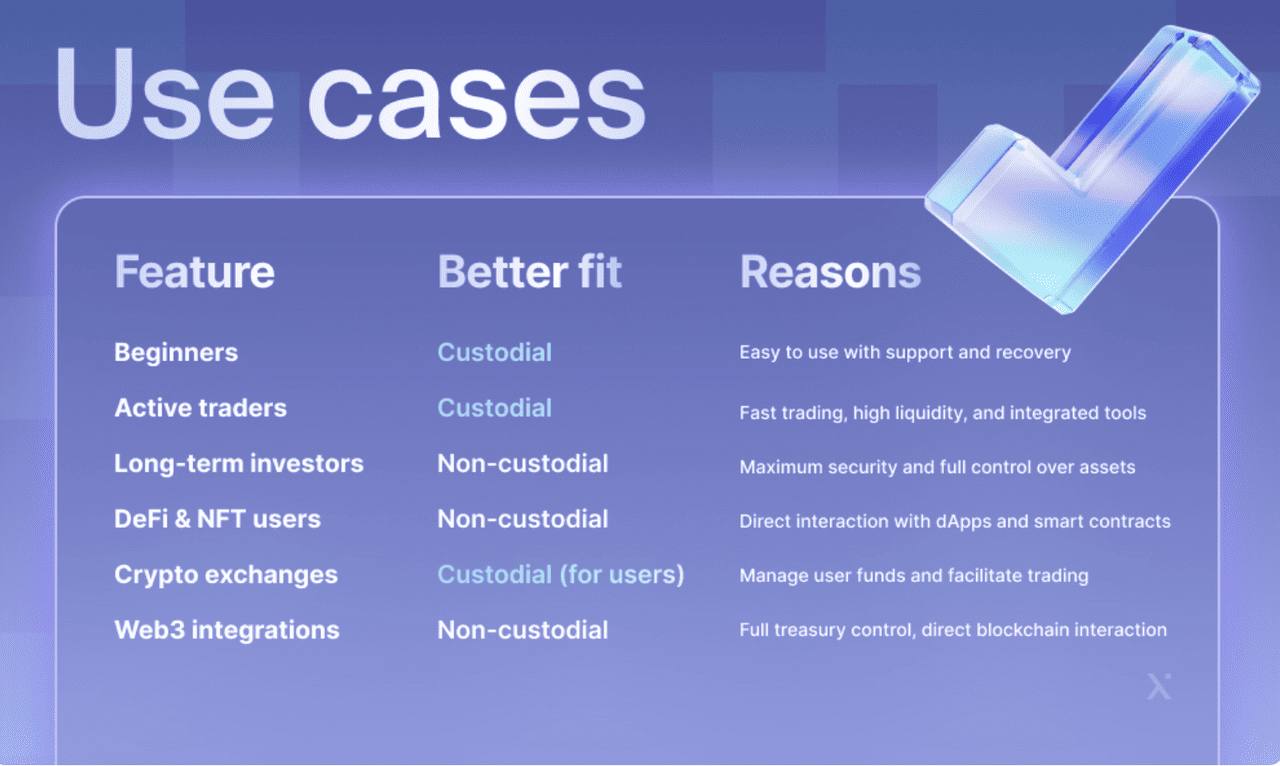

The key difference between custodial and non-custodial wallets lies in who controls the private keys. Custodial wallets offer ease of use and customer support but require trust in a third party. Non-custodial wallets offer independence and enhanced privacy but demand technical knowledge and strict self-security. Custodial wallets are suitable for beginners and frequent traders, while non-custodial wallets fit long-term holders and

DeFi users better.

Custodial wallets are managed by third-party platforms like crypto exchanges like BingX, meaning they hold your private keys for you. This setup makes custodial wallets easier to use, especially for beginners and frequent traders, and they often come with account recovery options in case you lose access. However, since a third party is responsible for your wallet's security, you're essentially placing your trust in them to safeguard your funds. Custodial wallets are regulated under laws like

KYC (Know Your Customer) and

AML (Anti-Money Laundering) which means your assets could be frozen or seized in certain situations. Wallet providers must comply with legal requests from authorities, which can affect your access.

In contrast, non-custodial wallets like

MetaMask,

Trust Wallet, or

Ledger give you complete control over your private keys. With this control comes full responsibility: if you lose your keys, there's no recovery option. These wallets are more suitable for advanced users, long-term holders, or those who regularly interact with decentralized finance (DeFi) platforms. While they offer higher security and autonomy, they also require a stronger understanding of crypto wallet management. No one can block or restrict your access when you use non-custodial wallets. This level of financial freedom appeals to those who value sovereignty and privacy, but it also means you are solely responsible for securing your assets.

Custody vs. Self-Custody: Which Crypto Wallet Is Right for You?

Choosing the right crypto wallet depends on your experience level, goals, and comfort with managing your own security. If you're just starting out and want a simple, hassle-free way to buy, sell, and store crypto, a custodial wallet, like the one offered on a regulated exchange such as BingX, is a great choice. These wallets handle the technical side for you, including key storage, customer support, and password recovery, making them ideal for beginners or frequent traders.

On the other hand, if you value full ownership and privacy, or plan to hold your crypto for the long term or use decentralized apps (dApps), a non-custodial wallet like MetaMask, Trust Wallet, or a hardware wallet gives you complete control over your assets. Just remember: you alone are responsible for keeping your recovery phrase safe, and there’s no way to recover lost funds if you misplace it.

Tip: Start with a custodial wallet if you're unsure, and move to a non-custodial wallet as you gain confidence in managing your own security and grow your crypto holdings. Many users end up using both; keeping some assets in a custodial wallet for trading, and storing larger amounts in a non-custodial wallet for long-term security.

Conclusion

Understanding the differences between custodial and non-custodial wallets is crucial for managing your cryptocurrency safely. Custodial wallets offer ease of use, platform support, and simple recovery options, making them a practical choice for beginners and active traders. Non-custodial wallets provide full control and enhanced privacy but require you to take full responsibility for securing your keys and recovery phrase.

No wallet type is entirely risk-free. Custodial wallets depend on the platform’s security and policies, while self-custody wallets carry the risk of irreversible loss if access credentials are misplaced. As you navigate the crypto market, assess your needs, technical comfort, and risk tolerance before deciding which type of wallet best fits your strategy.

Related Reading

FAQs on Custodial vs. Non-Custodial Wallets

1. What's the main difference between custodial and non-custodial wallets?

The key difference is who controls your private keys. Non-custodial wallets give you full control, while custodial wallets let a third party hold the keys for you.

2. What is a private key?

A private key is a secret code that lets you access and control your crypto. It works like a password to approve transactions. If someone else gets it, they can steal your funds. Keeping it safe is critical.

3. Is a non-custodial wallet safe?

Non-custodial wallets are usually safer from hacks since you alone control the keys. But if you lose your key or recovery phrase, you lose access forever. If someone else finds them, they can take your crypto.

4. What is the primary risk of using custodial wallets?

The risk is trusting a third party to protect your assets. They control your keys, so hacking, frozen accounts, withdrawal limits, or platform shutdowns could cause you to lose access.