The

Pump.fun ($PUMP) token launched with explosive momentum, selling out its

$500 million ICO in just 12 minutes. Backed by one of the most viral memecoin platforms on

Solana, PUMP quickly drew massive attention across trading circles. Even before it became transferable, the token racked up a staggering $649 million in open interest, placing it among the most-watched new listings globally.

Now available for spot and futures trading on BingX, PUMP offers traders a unique opportunity to capitalize on its price volatility. Whether you're betting on upside breakouts or downside reversals, this guide will walk you through how to long or short $PUMP using BingX’s advanced tools, trading features, and real-time market signals.

What Does It Mean to Long or Short PUMP Token?

• Longing PUMP gives you exposure to the asset with the expectation that its price will rise, allowing you to sell at a higher price later. On

BingX Futures, this involves opening a buy position on the

PUMP/USDT pair.

• Shorting PUMP means taking a position that profits when the price falls. This involves selling first (at a higher price) and buying back later (at a lower price) to capture the difference.

At BingX, we offer leverage options for trading PUMP futures with up to 20x leverage, which can amplify both potential profits and risks. When trading with leverage, it's essential to use proper risk management techniques, including

stop-loss orders, to prevent significant losses.

PUMP Open Interest Hits a High of Over $120 Million Before Launch

Even before its official listing, the Pumpfun ($PUMP) token sparked extraordinary interest from futures traders. According to Coinglass, pre-market perpetual volume surged 376.9% to $333 million, with open interest (OI) hitting $120.1 million, ranking PUMP among the top 20 cryptocurrencies by this key metric.

Nearly 70% of that OI came from

Hyperliquid alone, with $81.9 million in open positions, despite PUMP not yet being transferable. This level of early exposure reflects pure speculation, driven by memecoin momentum and the potential for quick gains.

Polymarket sentiment priced PUMP at $0.0052, about 30% above its public sale price of $0.004, highlighting bullish expectations. For futures traders, such concentrated open interest typically signals explosive volatility, ideal for long or short trades, but also brings liquidation risk if the market turns against crowd sentiment.

Why Trade PUMP Token on BingX Futures

BingX provides a robust and user-friendly futures trading platform for the Pumpfun (PUMP) token, packed with features to help you navigate its volatile price action confidently. Whether you’re a seasoned trader or just starting out, BingX equips you with advanced tools and intuitive workflows to level up your strategy.

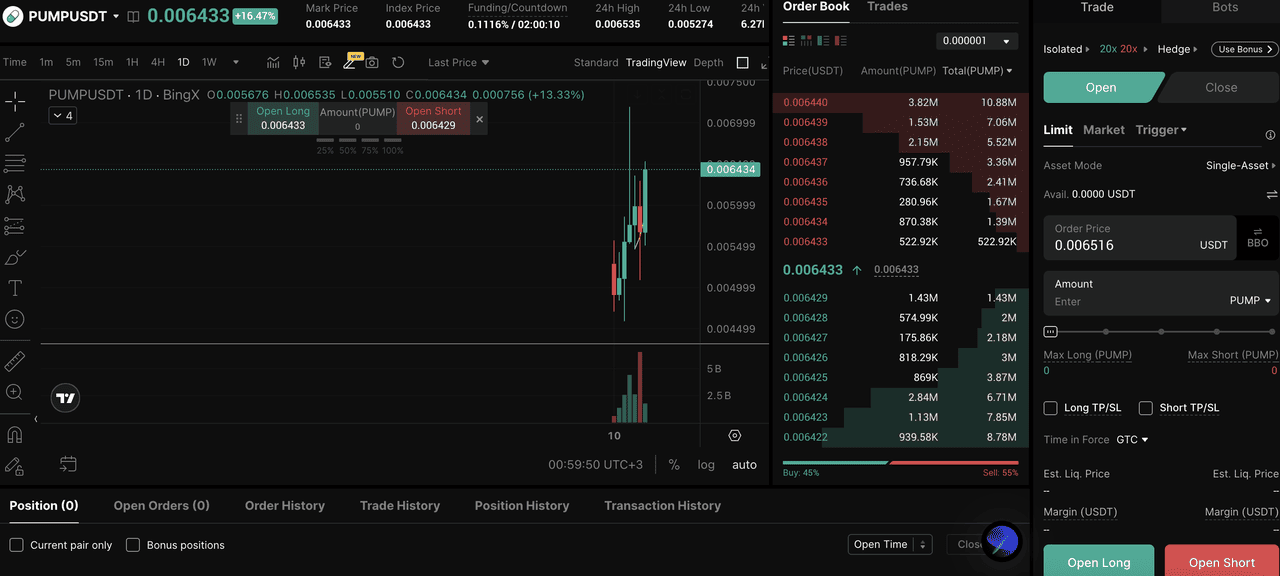

PUMP/USDT Price Chart|Source:

BingX

• Trade PUMP/USDT with up to 20x leverage: Amplify gains while managing risk through isolated and cross-margin options tailored to your trading plan.

• Advanced risk management tools: Set Take Profit and Stop Loss levels as you open positions to automate exit strategies and protect against sudden price swings.

• Isolated margin mode for volatile assets: Limit potential losses to the margin allocated for a single PUMP trade, keeping the rest of your capital safe.

• Risk calculator for smarter sizing: Plan trades with precision by calculating your risk percentage and aligning position size with your account balance.

• AI-powered trading insights: Ask

BingX AI to analyze your open PUMP positions, get risk assessments, and receive real-time recommendations for adjustments.

• Copy trading for beginners: Follow experienced traders handling PUMP price swings and automatically replicate their trades to learn and earn simultaneously.

• Seamless mobile trading experience: Get real-time alerts, track orders, and adjust positions on the go with BingX’s fully featured mobile app.

• Spot and futures support for PUMP: Switch easily between markets within the same platform as market conditions evolve.

With its powerful tools, AI assistance, and beginner-friendly features, BingX makes it easy to trade PUMP effectively, whether you’re scalping intraday moves or managing long-term positions.

How to Long PUMP on BingX: Step-by-Step

Going long means you’re buying PUMP with the expectation that its price will rise. Here’s how to open a long position on BingX Futures:

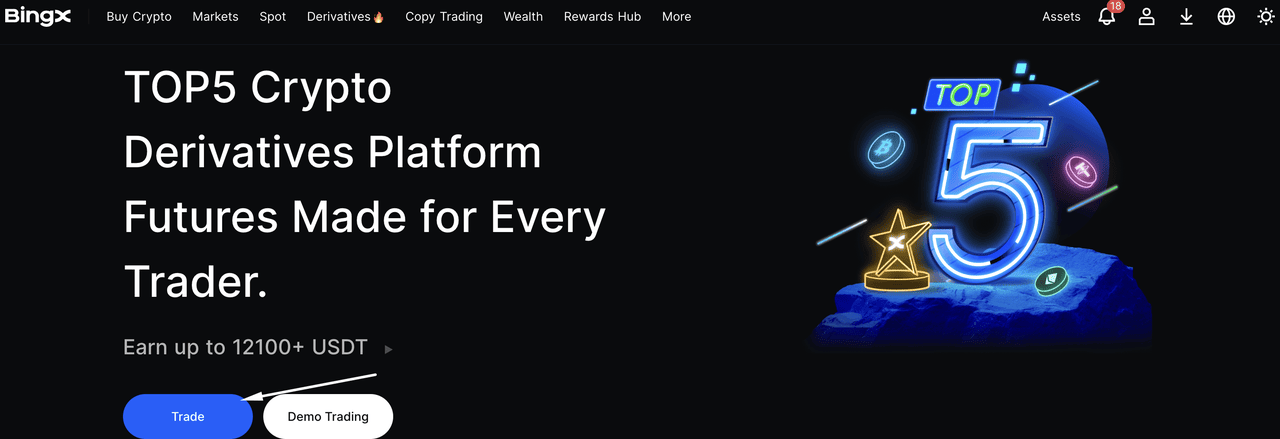

1. Account Setup: Log into your BingX account and ensure you have sufficient

USDT in your Futures Wallet. You can transfer funds directly from your main account to your Futures Wallet.

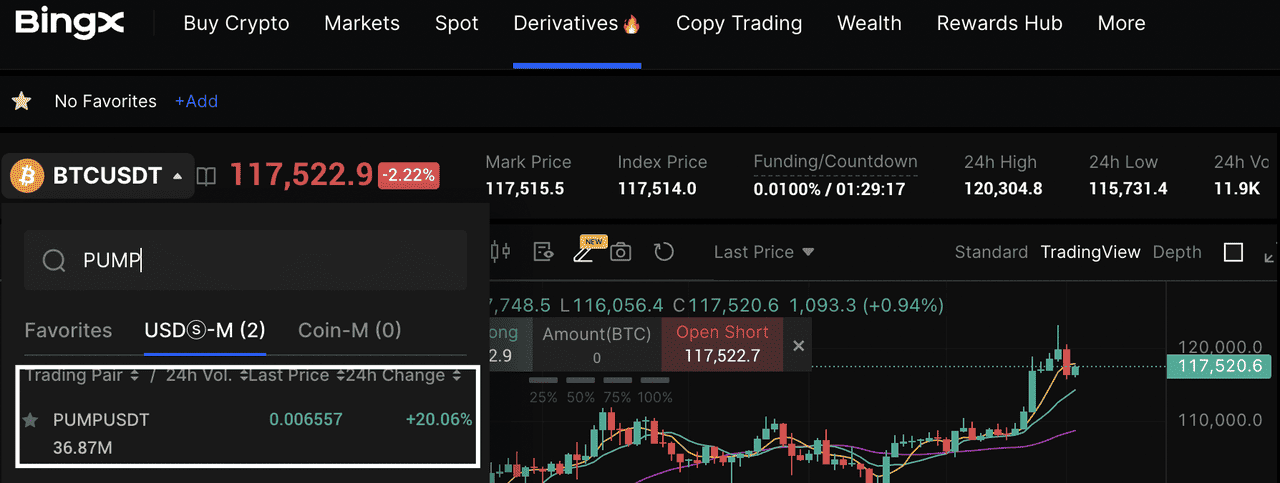

2. Find the Trading Pair: Navigate to the Futures section and search for the PUMP/USDT trading pair in the USDT-Margined section.

3. Select Position Direction: Click on the "Buy/Long" option to open a position that profits when PUMP's price increases.

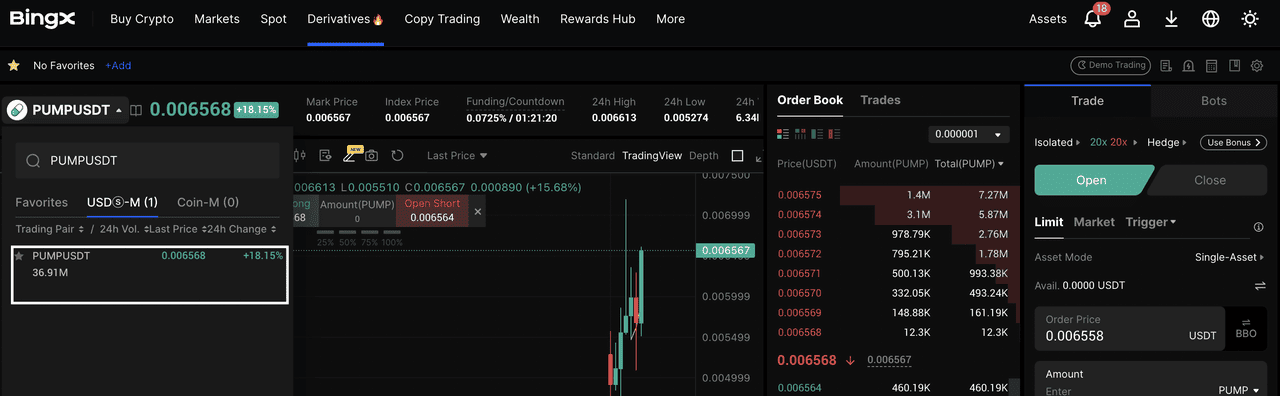

PUMP/USDT Price Chart|Source:

BingX

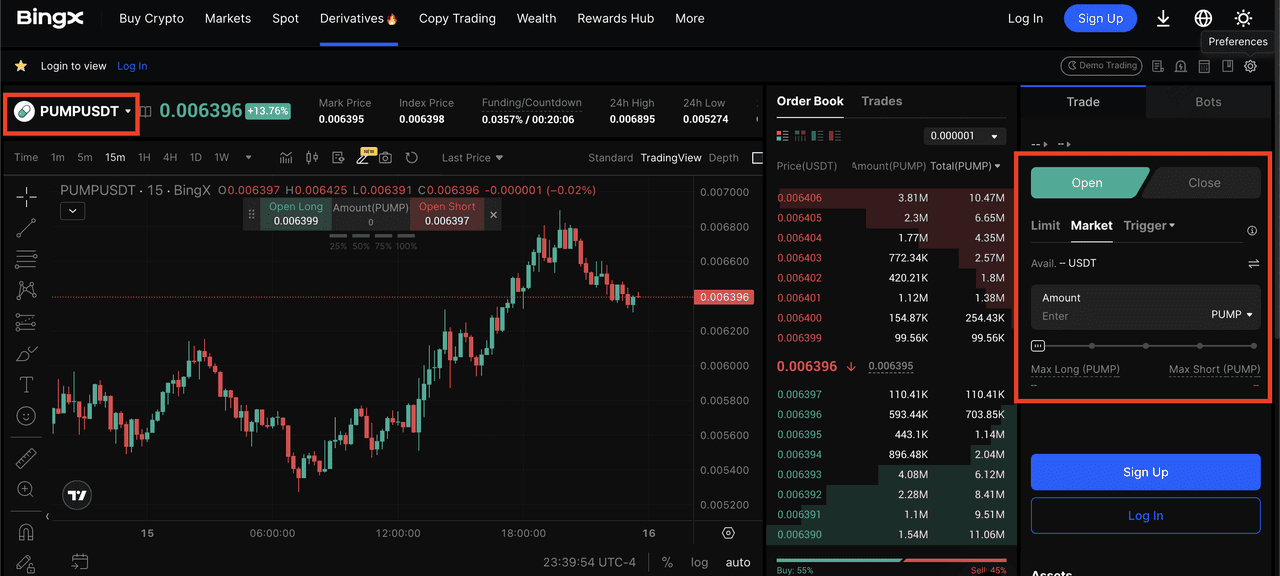

4. Configure Order Settings: Choose between

market orders (execute immediately at current price) or limit orders (execute only when price reaches your specified level).

5. Set Leverage: Select your desired leverage multiplier (e.g., 5x or 10x) based on your risk tolerance. Remember that higher leverage means higher potential profits but also increased risk.

PUMP/USDT futures trading|Source:

BingX

6. Risk Management: Define your Take Profit (TP) and Stop Loss (SL) levels to automatically close your position when certain price targets are hit.

7. Execute and Monitor: Confirm your order to open the position, then monitor your trade using BingX's charting tools.

Tip: For optimal entry timing, look for RSI readings below 30 (indicating an oversold condition) or use Fibonacci retracement levels to identify key support zones where the price may bounce. You can also ask BingX AI to analyze your open PUMP positions in real time. Get insights on risk exposure, potential profit zones, and recommended adjustments based on live market conditions.

How to Short PUMP on BingX: Step-by-Step

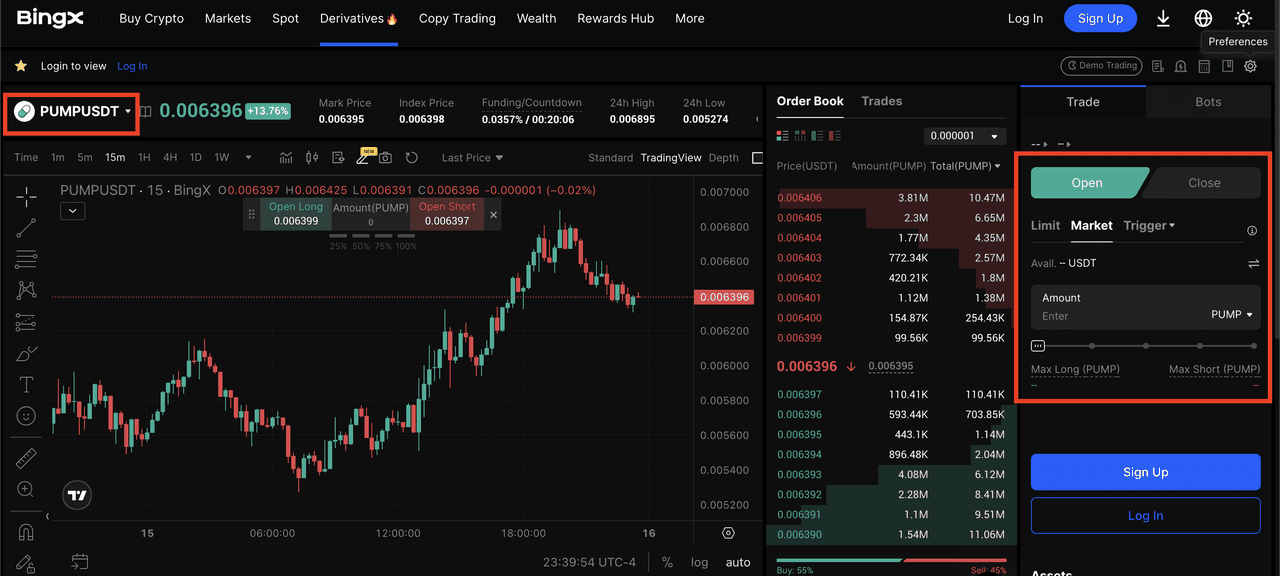

1. Access the Trading Pair: Navigate to the same

PUMP/USDT futures page in the USDT-Margined contracts' section on BingX where you would place long orders.

PUMP/USDT Price Chart|Source:

BingX

2. Select Direction: Click on the "Sell/Short" button to open a position that profits when PUMP's price decreases.

3. Identify Entry Points: Before executing, analyze the chart to identify key resistance zones, these make optimal short entry points as price often rejects from these levels.

4. Choose Conservative Leverage: For shorting volatile memecoins like PUMP, select moderate leverage (3x-5x is recommended) to give your position room to breathe through price fluctuations.

PUMP/USDT futures trading|Source:

BingX

5. Risk Management with TP/SL Levels: Define your Take Profit (TP) and Stop Loss (SL) levels to automatically close your position when certain price targets are hit.

6. Confirm with Volume Analysis: Look for declining volume during price increases or bearish candlestick formations like Dojis at resistance to confirm your short entry.

7. Plan Your Exit: Target support zones for taking profits or consider closing positions after sharp downward movements.

Important Warning: Avoid shorting PUMP during periods of airdrop announcements, platform updates, or positive news cycles that could generate sudden bullish momentum and trigger short squeezes.

Best Strategies, Indicators, and Trade Setups for PUMP

PUMP’s high volatility makes it ideal for technical traders who understand how to read momentum and structure. Here are some of the best tools and setups you can use to build long or short trades on BingX Futures.

PUMP/USDT Price Chart|Source:

BingXKey Technical Indicators

• RSI (14): 70.59 — touching the overbought zone, suggesting potential short-term exhaustion

• MACD: Bullish crossover confirmed, but histogram is flattening—momentum may be slowing

• Moving Averages:

MA 5: 0.006580

MA 10: 0.006223

MA 30: 0.005835 All three are sloping upward, indicating a short-term uptrend

• Fibonacci Levels (Retracement & Extension):

Support:

- $0.00541 (Fib 0.382)

- $0.00513 (Fib 0.5)

- $0.00459 (Fib 0.786)

Resistance:

- $0.006709 (Fib 1.618 extension)

- $0.00759 (Fib 2.618)

- $0.00848 (Fib 3.618)

• Volume: Surged to 141M+ during breakout but is starting to taper, watch for follow-through confirmation

• Candlestick Patterns to Watch:

- Rejection wicks or Doji at $0.00670–$0.00674 may indicate reversal

- Clean breakout with volume could invalidate bearish setup

PUMP/USDT Price Chart|Source:

BingXForecast Scenarios

Long Setup (Bullish Breakout Scenario)

• Entry: $0.00622 (pullback to MA 10 or Fib 0.382)

• Take Profit: $0.00759 (Fib 2.618 extension)

• Stop Loss: $0.00600

• Outlook: If RSI cools off and price holds above MA 10, a breakout continuation toward $0.00759 is likely—especially if volume expands again

Short Setup (Bearish Rejection Scenario)

• Entry: $0.00674 (current wedge + Fib 1.618 resistance zone)

• Take Profit: $0.00622 or $0.00560 (MA 10 or Fib 0.382)

• Stop Loss: $0.00685

• Outlook: RSI >70 + price failing to break above wedge and Fib extension = short opportunity with minimal risk

Common Mistakes to Avoid When Trading PUMP Futures

Trading volatile assets like PUMP on futures markets requires discipline and careful planning. Here are critical mistakes to avoid:

1. Excessive Leverage Misuse: Many new traders are tempted by high leverage (20x, 50x) without understanding liquidation risks. Stick with lower leverage, 2x to 5x, until you've built a consistent strategy and always calculate your liquidation price before entering trades .

2. Trading Without Stop-Loss Protection: Failing to set stop-loss orders is essentially gambling with your capital. Always implement stop-loss orders to automatically limit potential losses if the market moves against you.

3. Blindly Shorting During Hype Cycles: Shorting PUMP during periods of strong community excitement, airdrop announcements, or positive news can lead to devastating short squeezes and quick liquidations.

4. FOMO-Driven Entries: Chasing PUMP after it has already increased 50-100% often leads to buying near local tops. Patience and waiting for pullbacks typically yield better entry points.

5. Ignoring Volume Patterns: Volume confirms price movement. Low volume during price increases often signals weak momentum that could reverse quickly, while high volume confirms stronger trend continuation.

6. Copying Signals Without Context: Following others' trade calls without understanding their reasoning or timeframe can lead to mistimed entries and exits that don't align with your risk tolerance.

Remember: Memecoins like PUMP can reverse direction in seconds. Always plan your trades with precise entry and exit points rather than chasing price movements impulsively.

Final Thoughts: Trade the Hype, Manage the Risk

PUMP’s volatility creates opportunities for both upward and downward price moves. BingX Futures gives you the tools to trade these swings with precision, whether it’s leverage control, advanced charting, or automated risk management. However, high volatility also means sudden price spikes and liquidations are common.

BingX equips you with everything you need, including leverage control, technical charting, and automated risk tools, to navigate the chaos. Whether you’re a scalper or a swing trader, staying disciplined matters more than chasing hype.

Always approach PUMP trading with a clear plan and proper risk management. Remember, while the potential for profit is significant, losses can escalate just as quickly in leveraged markets. Trade responsibly and never risk more than you can afford to lose.

Ready to trade $PUMP? Open your long or short position on

BingX Futures now.

Related Articles

Frequently Asked Questions (FAQs)

1. What is Pump.fun ($PUMP) and why is it trending?

Pump.fun is a memecoin launchpad built on Solana that enables users to create and trade tokens instantly. Its native token, $PUMP, gained attention after its $500M ICO sold out in 12 minutes and it hit over $649M in open interest, making it one of the hottest new listings globally.

2. Can I use leverage when trading PUMP on BingX?

Yes, BingX allows up to 50x leverage on PUMP/USDT perpetual futures. While this can amplify profits, it also increases risk. Beginners are advised to start with lower leverage (2x–5x) and always use stop-loss protection.

3. How do I decide when to long or short PUMP?

Use key indicators like RSI, MACD, and Fibonacci levels. For long positions, wait for oversold RSI (<30) or bounce from support zones. For shorts, look for rejection candles near resistance or overbought RSI (>70). Always confirm with volume analysis.

4. Is it safe to short PUMP during hype cycles or airdrops?

No. Shorting during major events like airdrops or platform upgrades is risky. These can lead to short squeezes, where prices spike rapidly and liquidate short positions. It’s safer to wait for volume confirmation and bearish signals.

5. Can beginners trade PUMP futures on BingX?

Yes, BingX offers an intuitive interface, built-in TradingView charts, and a copy trading feature. Beginners can follow pro traders while learning the ropes and managing their trades with simplified tools like TP/SL and risk calculators.