After a significant correction post-token launch, the momentum picked up once again following the July 22 release of Sahara’s Data Services Platform (DSP). In just one week, SAHARA surged over 60 percent, with 24-hour trading volume increasing more than 1900 percent, briefly hitting 0.16 US dollars before stabilizing near 0.13. Its

market cap now stands above 260 million dollars, signaling renewed market interest driven by platform utility rather than early-stage speculation.

This article explores Sahara AI’s evolving ecosystem, the

tokenomics and utility of its native token, and what market conditions and milestones could shape SAHARA’s price trajectory in the months ahead.

What Is Sahara AI and How Does It Work?

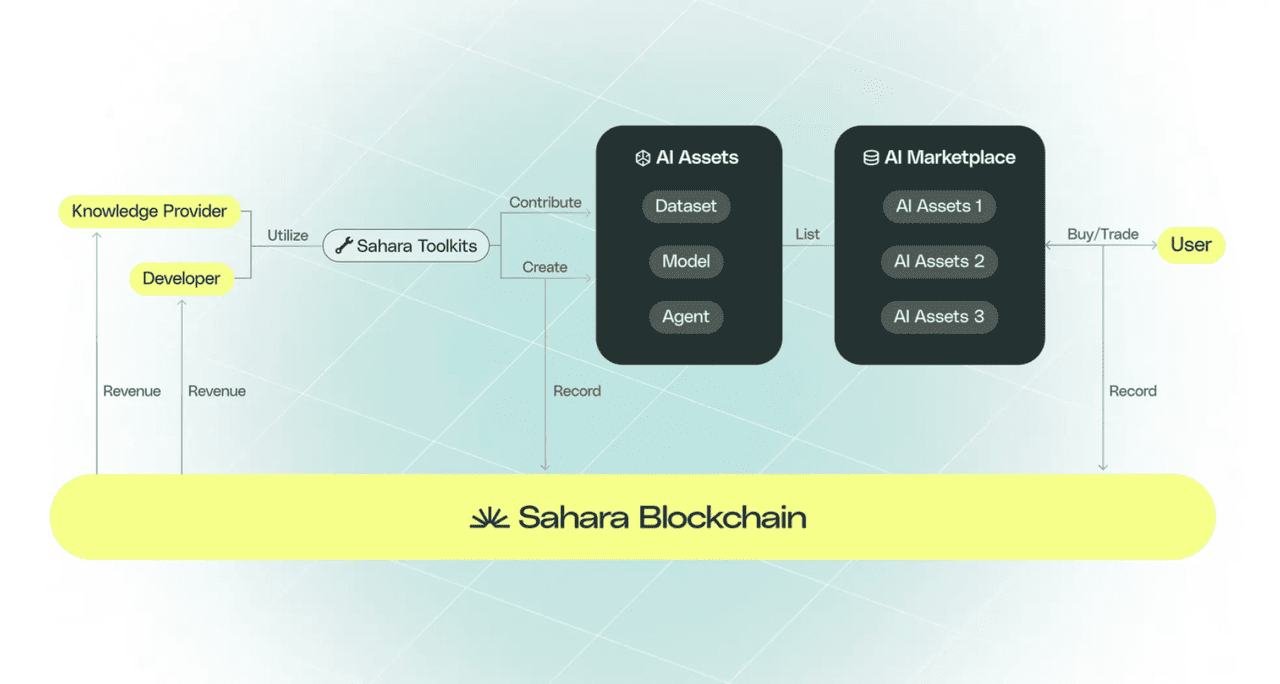

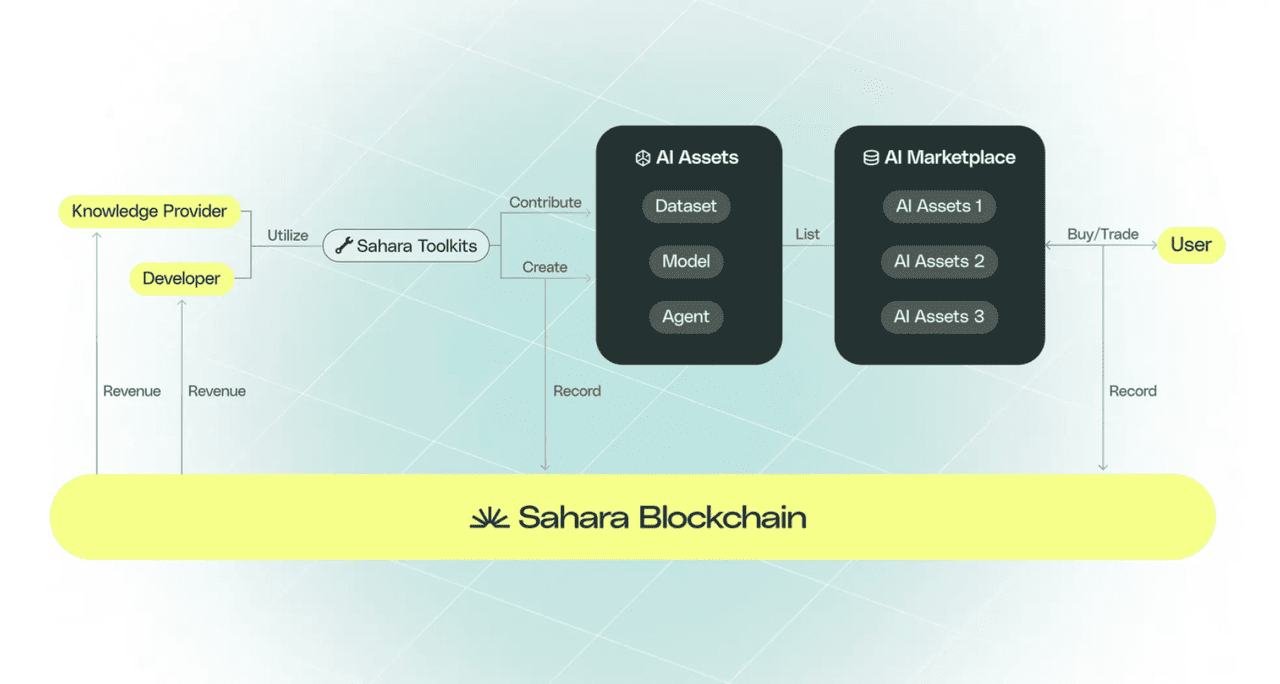

An overview of Sahara AI blockchain | Source: Sahara AI litepaper

Sahara AI is a decentralized platform that allows users to build, train, and monetize artificial intelligence using blockchain technology. Instead of AI being controlled by large tech firms, Sahara gives ownership and rewards back to contributors, including developers, data labelers, and researchers. Launched on its own custom-built

Layer 1 blockchain, Sahara supports dataset licensing, on-chain model training, attribution tracking, and decentralized governance through the Sahara DAO. The project is backed by major investors like Binance Labs, Polychain Capital, Sequoia, and Pantera, and has grown to over 200,000 contributors and 3 million+ annotated datasets.

Sahara operates through a four-layer architecture that forms the foundation of its AI-native blockchain ecosystem. The Application Layer enables users to upload datasets, train AI models, and interact with dashboards. The Transaction Layer records ownership, licensing, and attribution for each AI asset. The Data Layer manages secure storage using decentralized (IPFS) and cloud systems. Finally, the Execution Layer powers real-time model training and deployment using privacy-preserving compute protocols. This full-stack setup ensures transparency, ownership, and monetization across every step of the AI lifecycle.

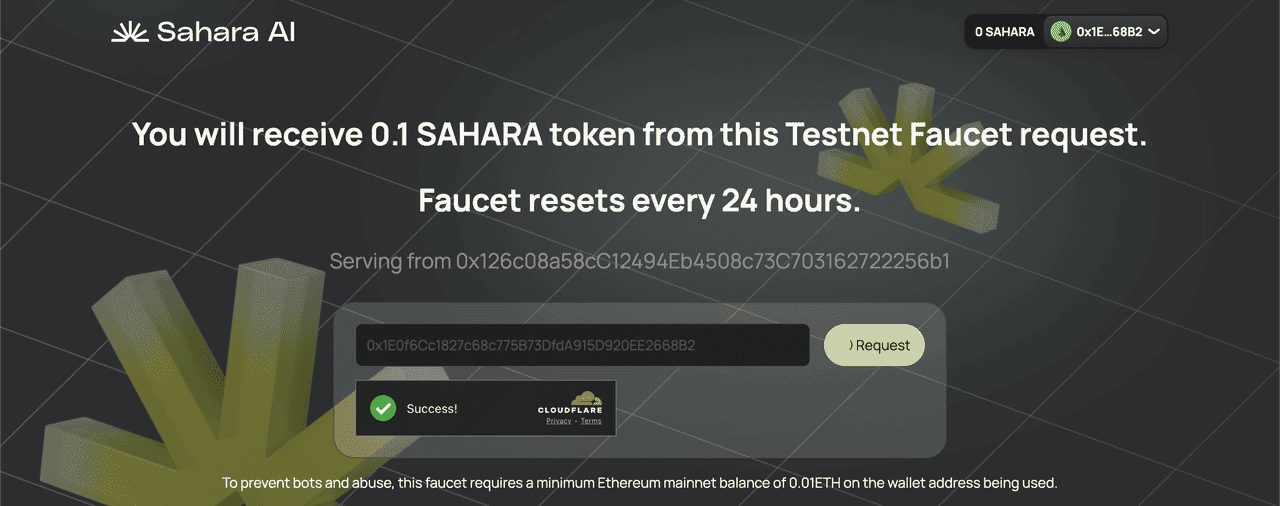

Sahara AI Airdrop Overview

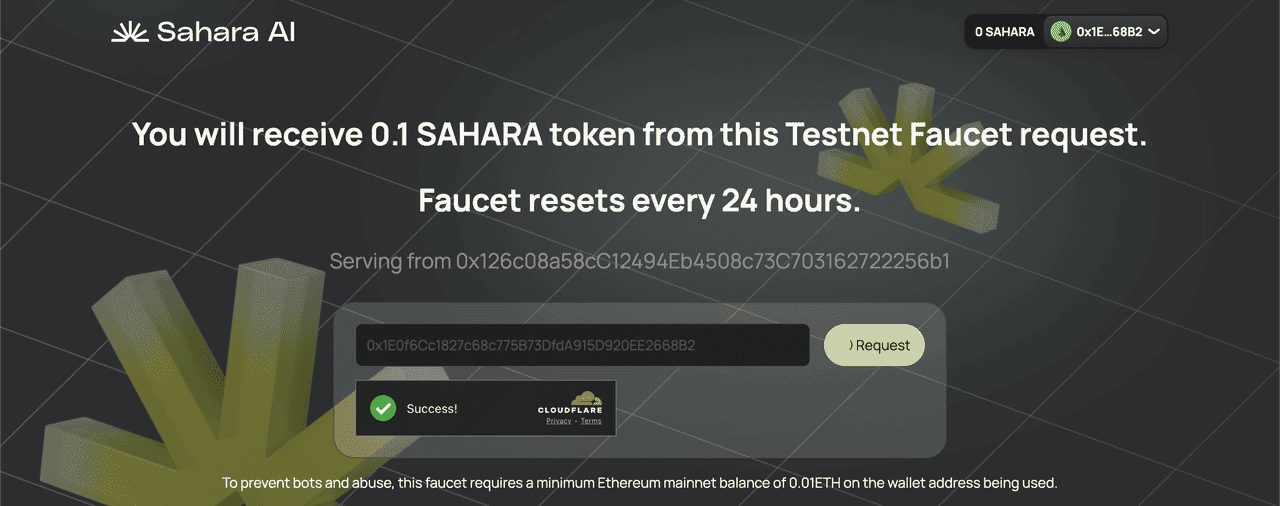

Sahara AI is currently running a live airdrop campaign through its SIWA public testnet, offering contributors the chance to earn future $SAHARA tokens. Participants can upload AI datasets in formats like .csv or .json and mint them as ERC-721 ownership

NFTs, proving authorship and enabling future licensing. Users also complete data labeling tasks and on-chain quests, which help train AI models while building their contribution history on-chain.

To further boost eligibility, players can join the Sahara Legends mini-game, where collecting Soulbound NFTs, such as the exclusive Fennec Fox, adds to your overall leaderboard score. Airdrop allocations are determined by a combination of Sahara Points, NFT collections, task completion, and contribution quality. The snapshot period is ongoing, with the Token Generation Event (TGE) and token distribution expected to take place in Q3 2025.

What Is the SAHARA Tokenomics?

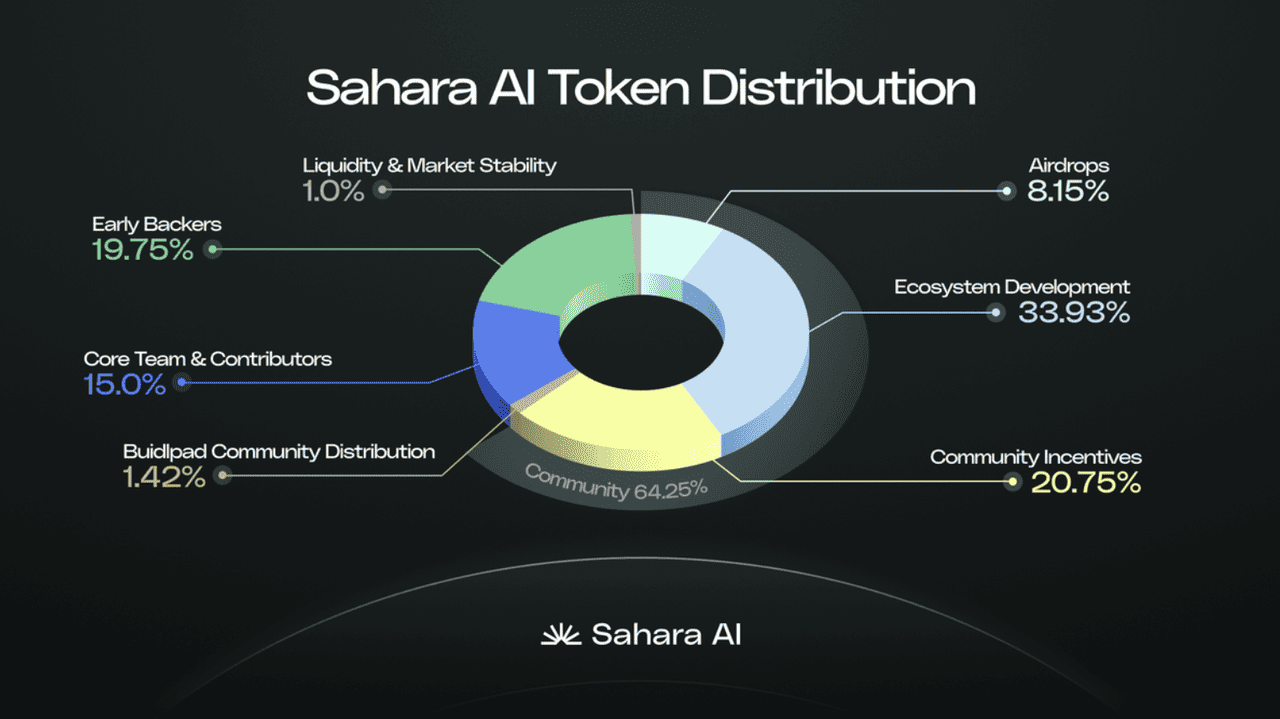

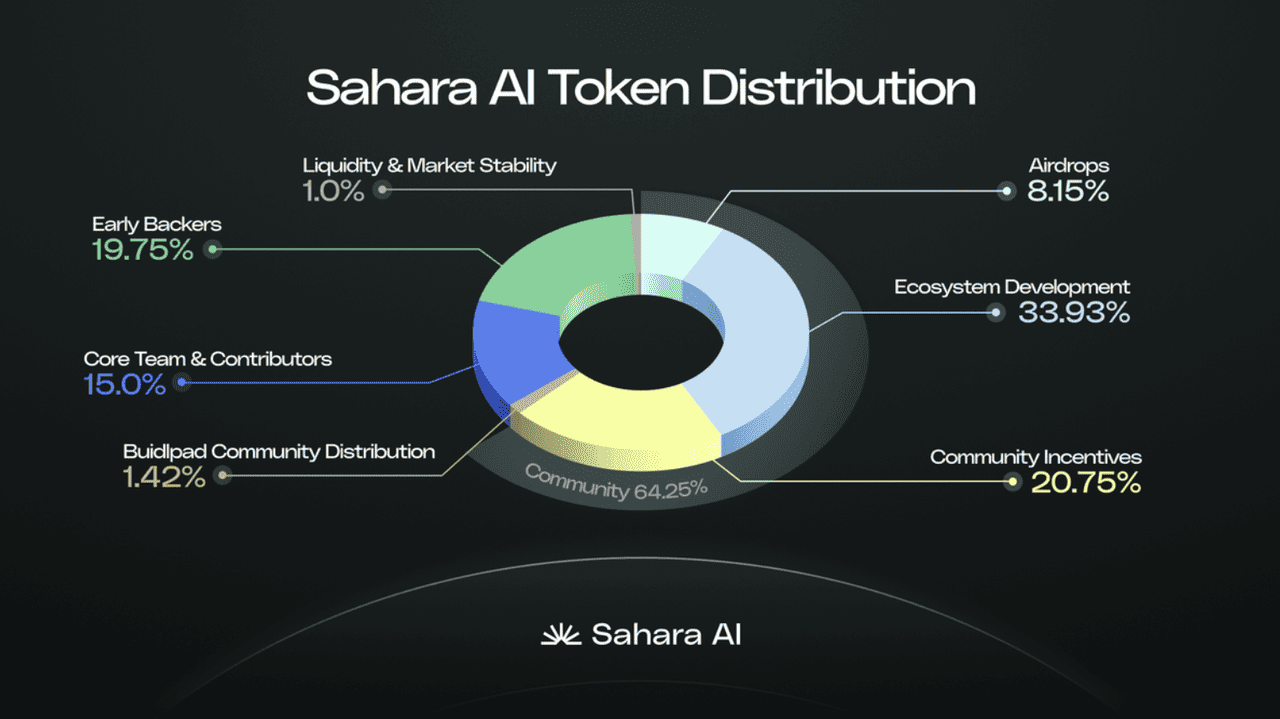

SAHARA’s token distribution is designed to support sustainable growth and reward real contributors. The total supply is capped at 1 billion tokens, allocated as follows:

1. Community-focused allocations - 64.25%

The majority of the supply is dedicated to ecosystem growth and public participation.

• Airdrops (8.15%) were distributed to early contributors through campaigns like the Knowledge Drop and early platform participation.

• Ecosystem development (33.93%) funds grants, validator rewards, liquidity incentives, and protocol improvements.

• Community incentives (20.75%) support dataset contributions, agent development, ambassador programs, and regional adoption.

2. Core team and contributors - 15.00%

Allocated to Sahara Labs’ builders and advisors, with long-term vesting to ensure alignment with the project’s success.

3. Early backers - 19.75%

Given to early investors who supported Sahara’s development during its earliest stages.

4. Liquidity and market stability - 1.00%

Reserved for market-making and exchange liquidity to ensure smooth trading and tighter spreads.

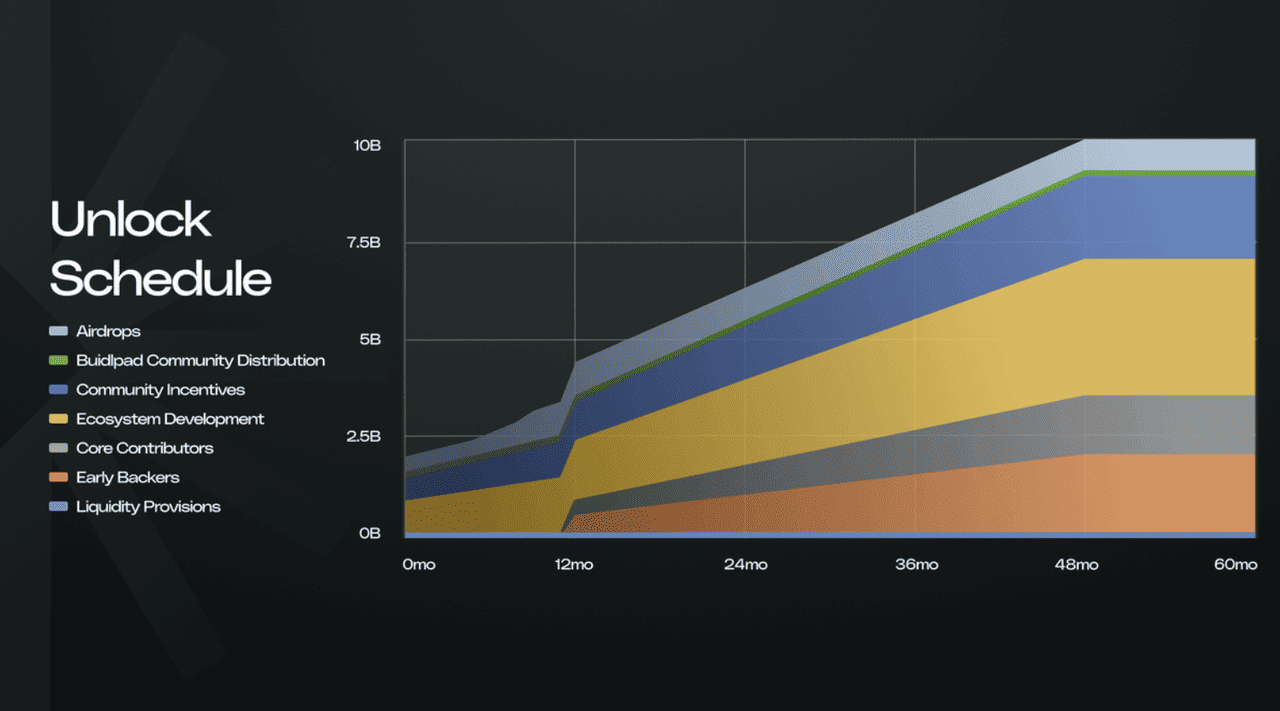

Unlock Schedule

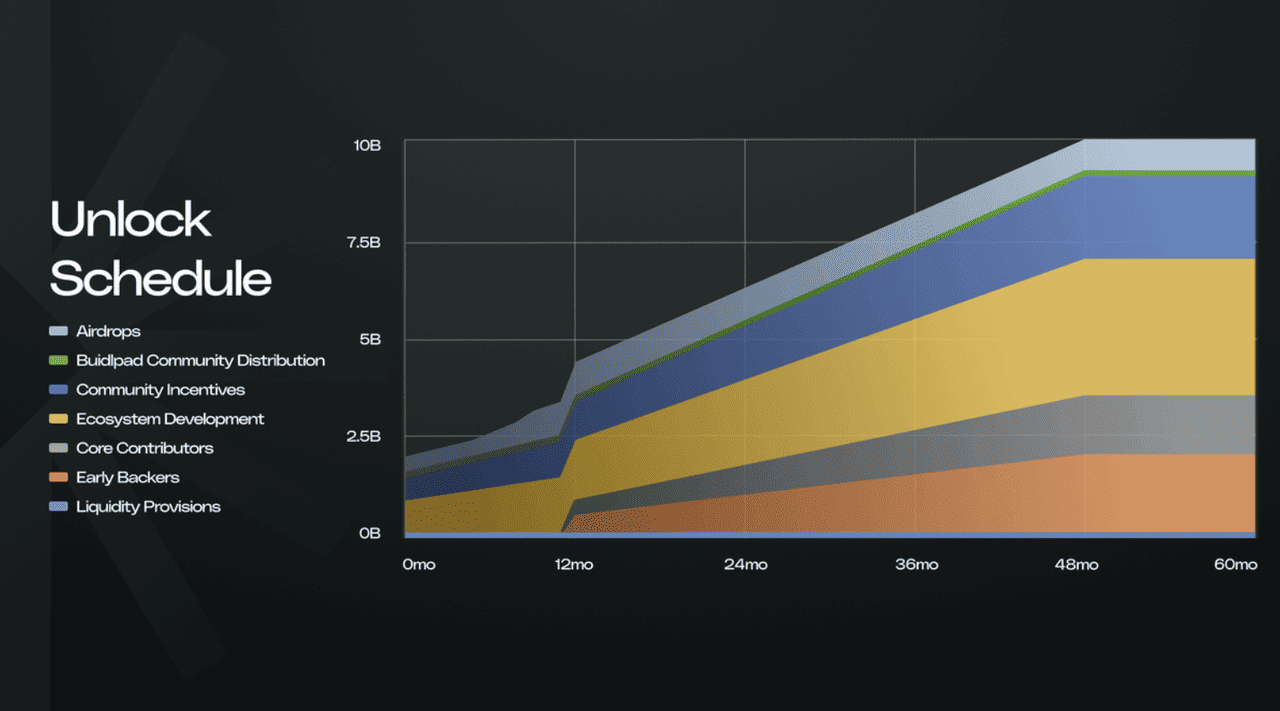

• Initial Unlock at TGE: A portion of tokens unlocks immediately to support early platform usage and liquidity.

• Long-Term Vesting: Most tokens follow a 4-year schedule with a 1-year cliff. 25% unlocks after 12 months, with the remainder released monthly over the next 36 months.

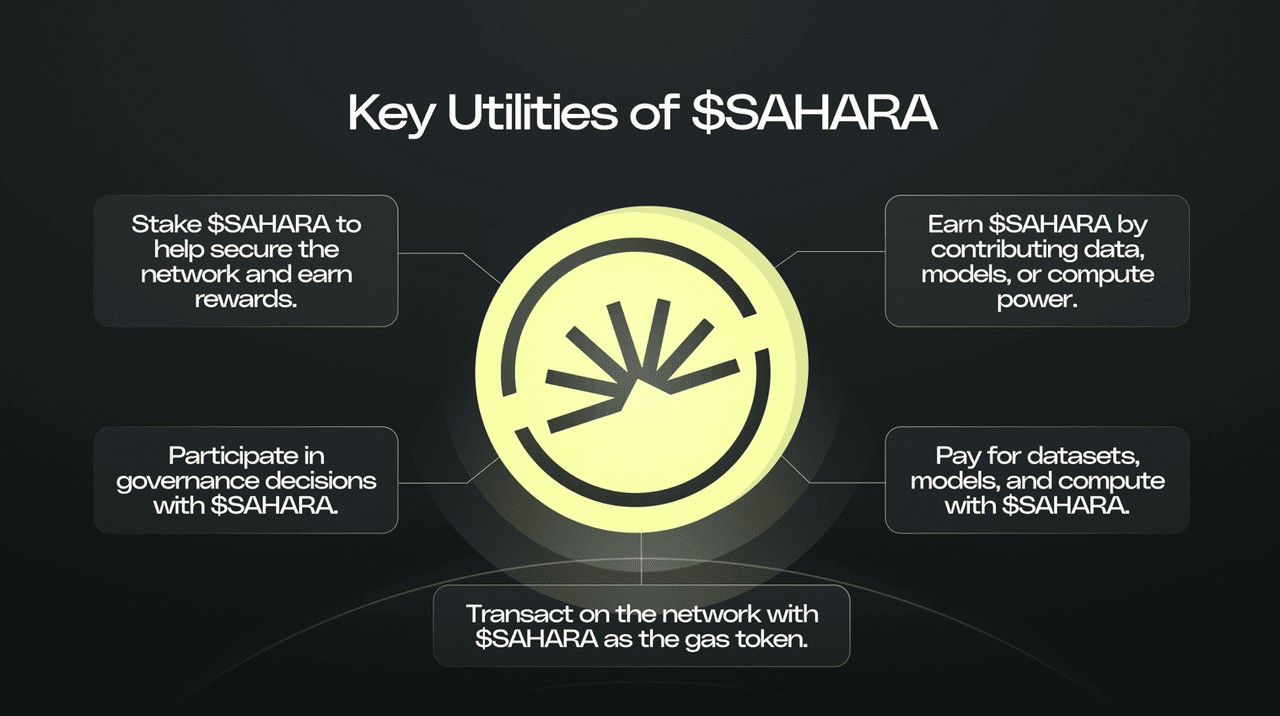

What Is the SAHARA Token Utility?

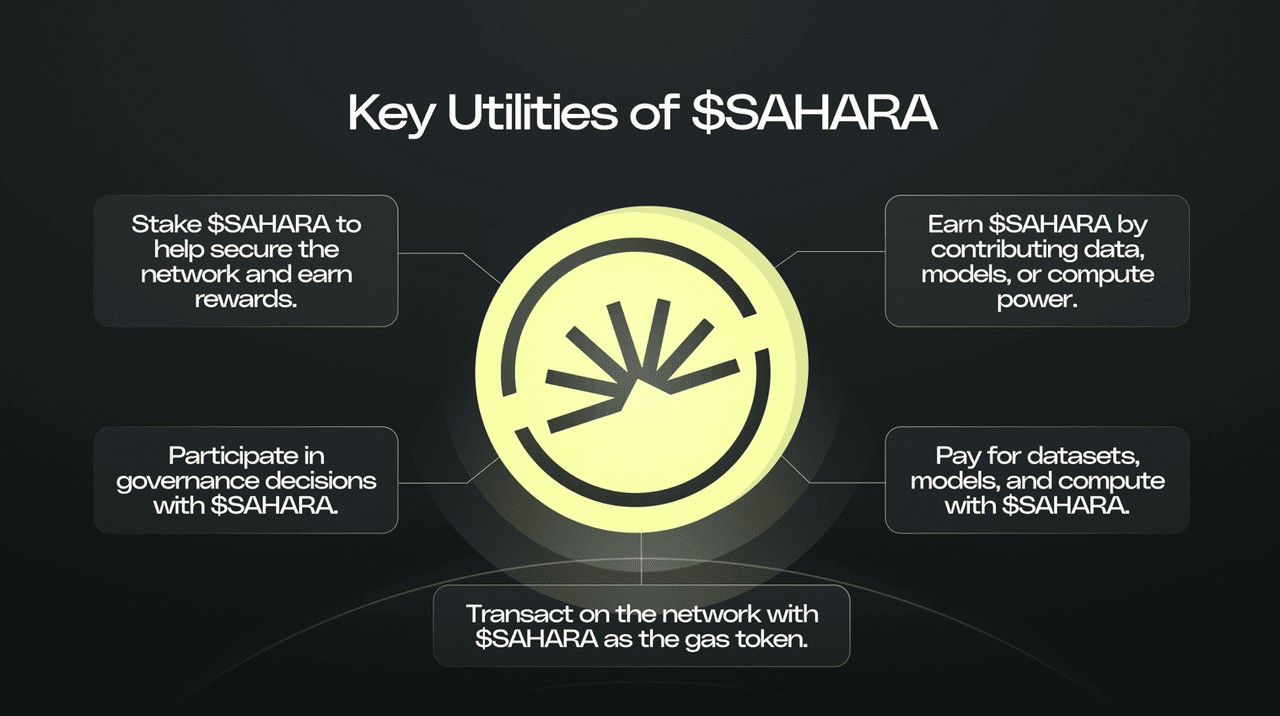

1. AI Asset Access and Licensing: SAHARA is the primary currency for accessing and licensing AI assets within the ecosystem. It is used to obtain datasets, access pretrained models, and pay for computational resources needed to train, deploy, or run

AI agents.

2. Per-Inference Payments: Each time a user runs an AI agent, they pay a small fee in SAHARA. This usage-based model supports cost-efficient access while ensuring that creators and upstream contributors are automatically and fairly compensated.

3. Network Operations: All on-chain actions within the Sahara blockchain require gas fees paid in SAHARA. These fees help maintain network security, compensate validators, and prevent spam or abuse.

4. Validator Staking and Security: Validators and delegators stake SAHARA to secure the network and participate in consensus. In return, they earn rewards for their service. Slashing penalties apply for downtime or malicious behavior to enforce reliability.

5. Ecosystem Incentives: SAHARA is used to reward contributions that support the network’s growth, such as uploading valuable datasets, building AI models, or participating in ecosystem campaigns and research initiatives.

6. Governance: SAHARA token holders can propose and vote on protocol upgrades, funding allocations, and platform policies. This ensures that the direction of Sahara AI remains community-driven and transparent.

$SAHARA was officially listed for trading on

BingX’s Spot Market on June 19, 2025, under the

SAHARA/USDT pair. This listing, complete with

ERC-20 support and immediate deposit availability, offers users a secure and liquid way to buy, sell, and hold SAHARA tokens seamlessly.

What Influences SAHARA Token Price?

Several internal and external factors can impact the price performance of SAHARA over time:

• Exchange listings like BingX and Binance Alpha, and their associated trading volume

• Mainnet adoption, especially from developers building AI tools and workflows

• $SAHARA Airdrop activity and token unlock events following the TGE

• Utility demand, such as SAHARA used to license AI datasets or models

• Market sentiment around decentralized AI and blockchain infrastructure

• Competition from other AI or Web3 protocols and overall macro conditions in crypto

While strong fundamentals and real utility may support long-term price appreciation, risks like token inflation, roadmap delays, and user attrition could apply downward pressure. Always remember that crypto markets are highly volatile, and price predictions are speculative in nature.

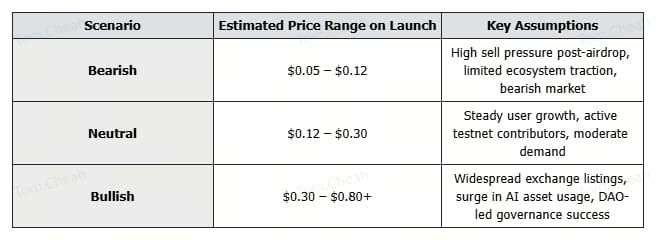

What Is the Sahara AI (SAHARA) Listing Price Prediction?

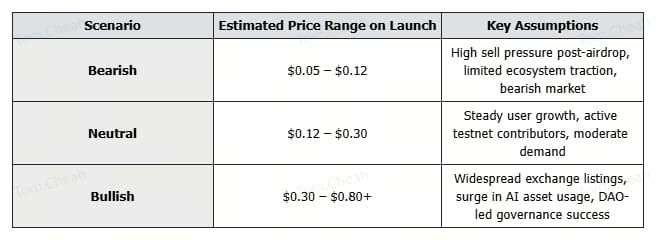

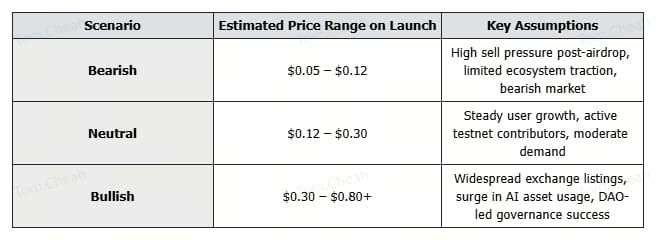

Based on insights from various analysts, the SAHARA token’s potential price trajectory in 2025 reflects a mix of market factors including

tokenomics, exchange activity, investor behavior, and ongoing ecosystem development. Forecasts typically account for multiple scenarios: bearish, neutral, and bullish. Each is shaped by factors such as user adoption, platform utility, airdrop distribution, and comparisons to similar Web3 or AI-native projects.

Momentum notably increased after the July 22 launch of Sahara’s Data Services Platform (DSP), which sparked a 60 percent price surge within one week and pushed 24-hour trading volume up by more than 1900 percent. This demonstrated how concrete product rollouts can directly influence market sentiment and token performance. These scenario-based projections aim to help investors better understand potential outcomes while weighing the risks and opportunities ahead.

Disclaimer: Price forecasts are based on publicly available data, historical patterns, and speculative modeling. They are not financial advice. Always do your own research (

DYOR), consider your risk tolerance, and avoid making investment decisions based solely on projections.

Final Thoughts

Sahara AI is an ambitious project that blends the disruptive potential of

blockchain and AI. Its growing community, real-world utility, and upcoming exchange listings have positioned the SAHARA token as one to watch in 2025.

Still, as with any early-stage crypto project, there are risks, from token unlocks and adoption uncertainty to competition in the decentralized AI space. Before investing, always DYOR and stay updated on project milestones, governance changes, and ecosystem activity.

Related Reading