TRON is making waves in

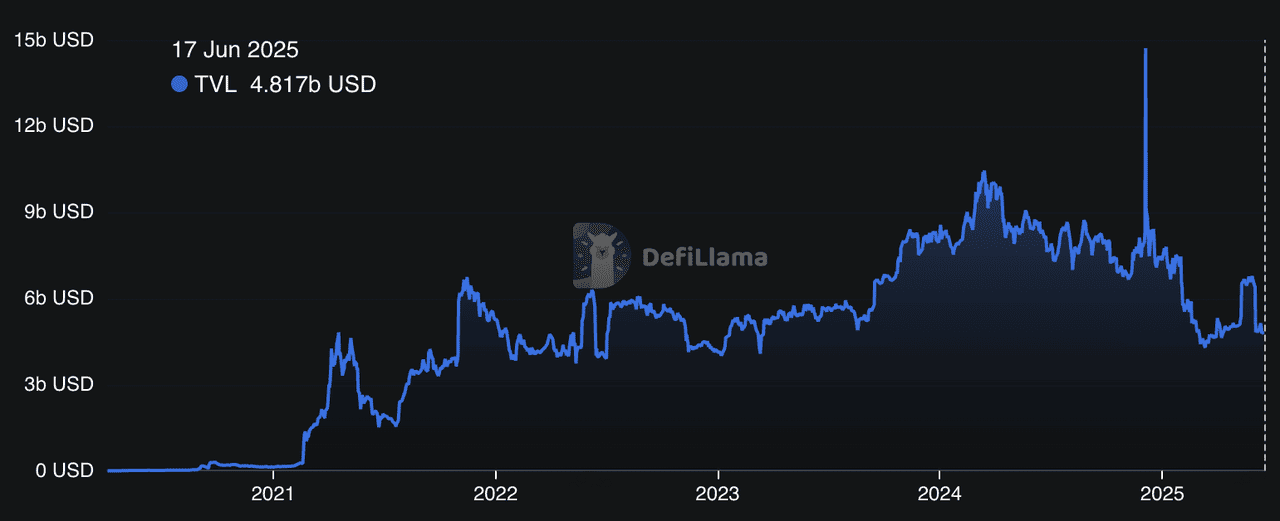

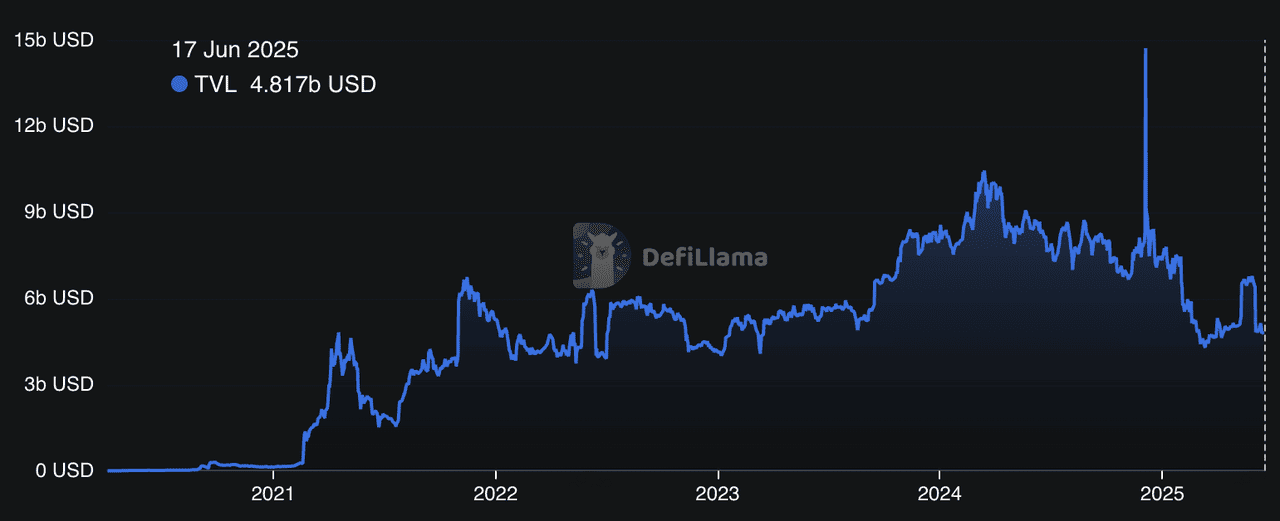

DeFi in 2025. With over $4.8 billion in total value locked (TVL) and nearly $80 billion in stablecoins flowing through its network, TRON currently ranks in the top 5 for DeFi total value locked (TVL), with over $4.9 billion secured across platforms like SUN.io and JustLend DAO.

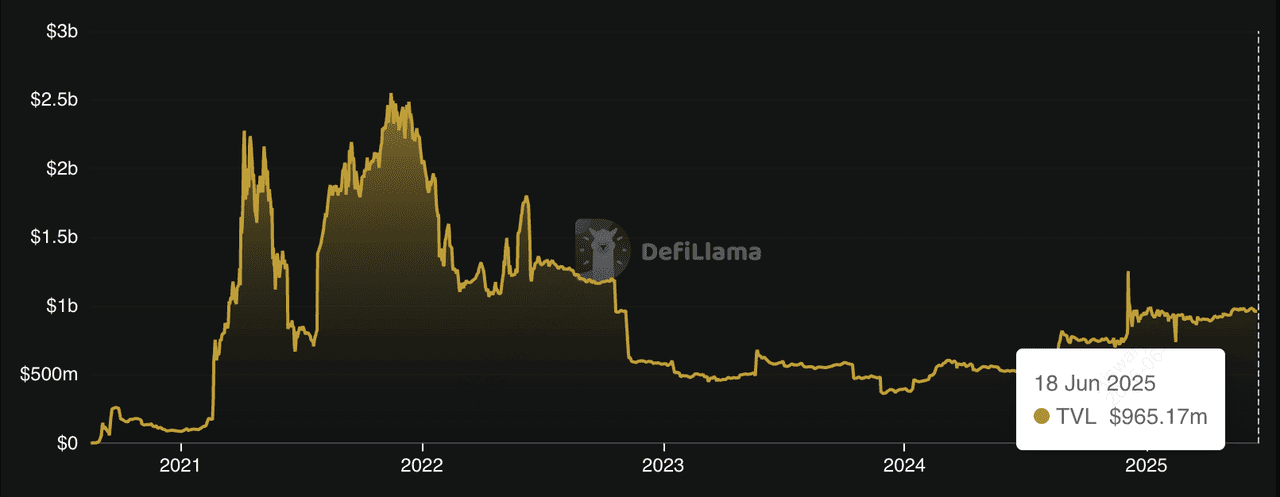

TRON's DeFi TVL growth | Source: DefiLlama

TRON’s growth metrics in 2025 reflect its expanding footprint. The network adds over 200,000 wallet addresses daily and processes more than 8 million transactions every 24 hours. Total daily transaction volume regularly surpasses $23 billion, positioning TRON among the top blockchain ecosystems by usage and capital movement. In addition, major integrations like

Chainlink oracles, which help secure more than $5.5 billion in assets, have boosted confidence in TRON’s DeFi infrastructure.

Whether you're looking to lend, stake, mint

stablecoins, or find trending memecoins, TRON has a growing set of tools for you.

In this guide, we’ll break down the top TRON DeFi projects to watch in 2025, including

JustLend DAO,

SUN.io,

USDD, stUSDT, and

SunPump. These platforms are reshaping what’s possible in decentralized finance, faster, cheaper, and more accessible than ever.

Why Is TRON's DeFi Ecosystem Growing in 2025?

TRON is a high-speed, low-cost

Layer-1 blockchain purpose-built for scalable decentralized applications. With a transaction speed of up to 2,000 TPS and near-zero fees, TRON offers the infrastructure needed for high-volume DeFi use cases like lending, stablecoin transfers, and meme coin launches. This performance edge is one reason why developers and users alike are increasingly choosing TRON over more congested networks like

Ethereum.

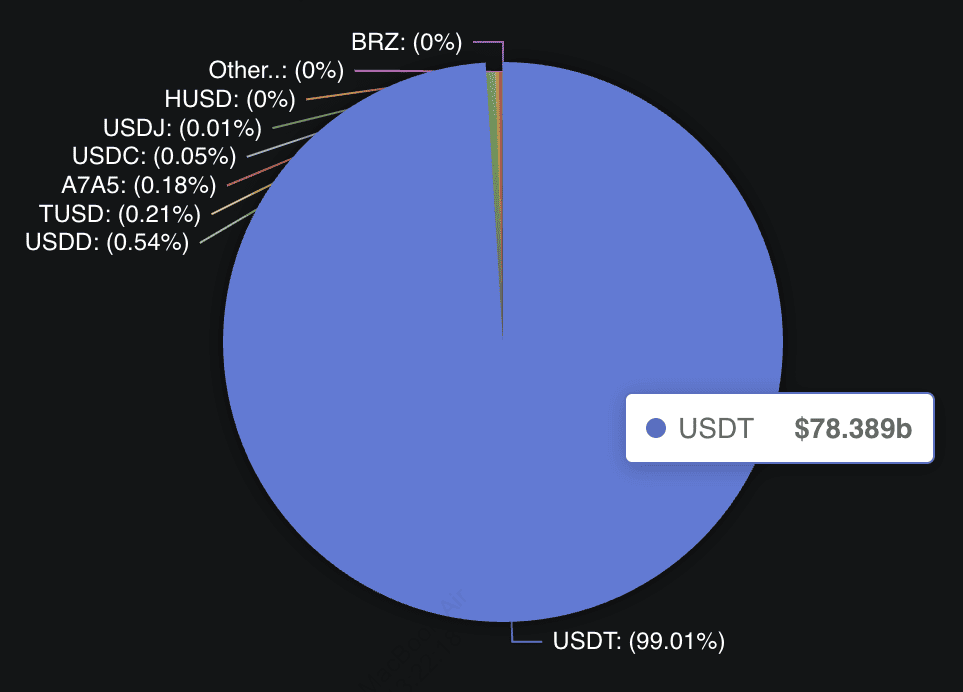

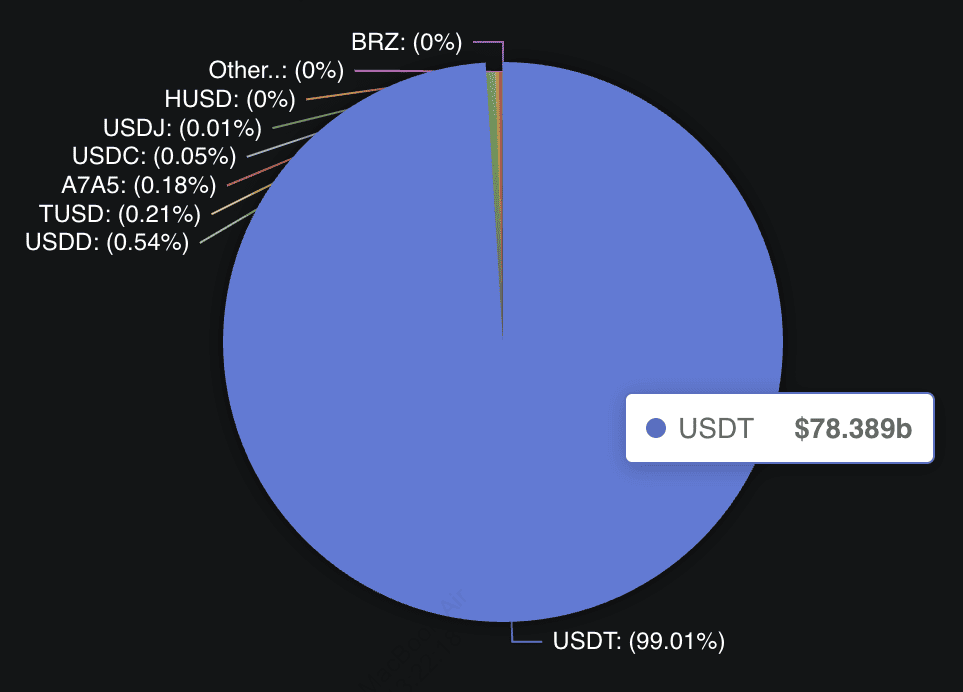

Top stablecoins on the TRON network | Source: DefiLlama

TRON has also become a stablecoin powerhouse, ranking as the second-largest blockchain ecosystem by stablecoin TVL. The network hosts more than $78 billion in

USDT, the largest on-chain supply of any blockchain, and an additional $460 million in its native decentralized stablecoin, USDD. In 2025, TRON launched

USD1, a new stablecoin backed 1:1 by short-term U.S. Treasury assets. This marks a key step in TRON’s ambition to attract more institutional capital and create a secure, regulated bridge between traditional finance and

Web3.

Beyond product launches, TRON is making strategic moves to integrate with global finance. Founder Justin Sun has hinted at taking TRON-related entities public, and the network recently saw the WLFI/SRM reverse merger proposal, which could provide TRON with indirect exposure to Wall Street. Meanwhile, newer tools like SunPump and stUSDT are expanding access to meme coin creation and

real-world asset yields, all without leaving the

TRON ecosystem.

Altogether, these developments, ranging from high throughput and stablecoin dominance to new financial products and public market ambitions, underscore why TRON's DeFi ecosystem continues to grow rapidly in 2025.

Best TRON DeFi Projects for Yield Farming in 2025

TRON's DeFi offerings include innovative tools for lending, trading, and minting stablecoins. Here are five standout projects leading the way in 2025.

1. JustLend DAO – TRON’s Largest Lending Protocol

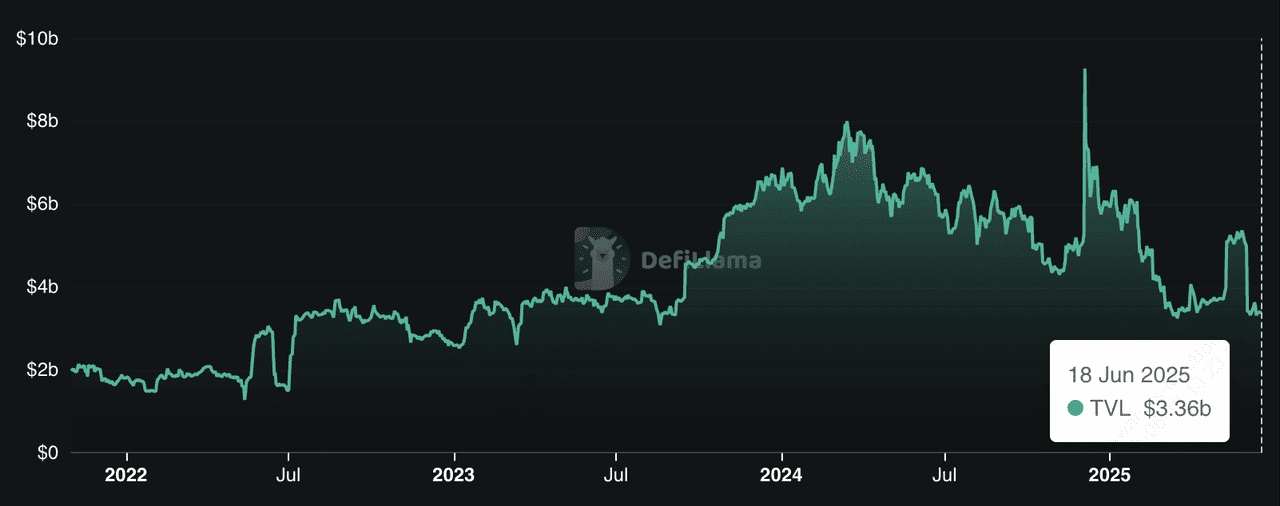

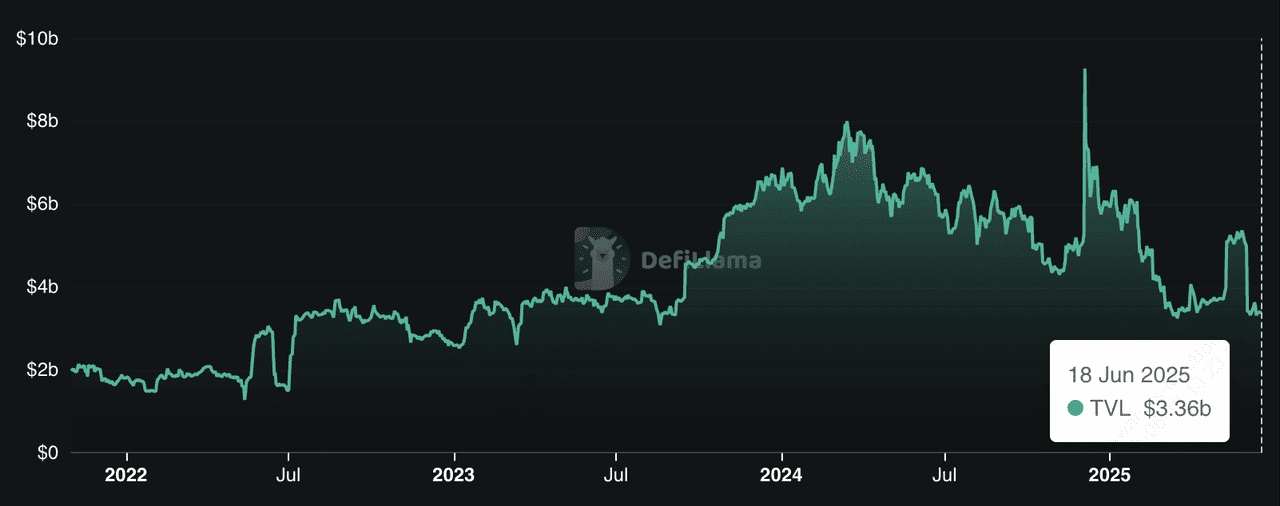

JustLend TVL | Source: DefiLlama

JustLend DAO is the largest decentralized lending platform on the TRON blockchain, with over $3.3 billion in TVL as of mid-2025. It allows you to earn passive income by lending assets like

TRX, USDT,

USDD,

SUN,

BTC, and

ETH, or borrow against your holdings by providing collateral. Everything runs on

smart contracts, meaning you can interact directly with the protocol, with no middlemen involved. Interest rates are dynamic, adjusting automatically based on real-time market demand and supply. This system ensures fair rates for both lenders and borrowers, giving you flexibility and control over your crypto.

Beyond lending and borrowing, JustLend also supports Staked TRX (sTRX) and Energy Rental, two unique features in the TRON ecosystem. You can convert TRX into sTRX with a single click and earn around 8.67%

APY, all while participating in governance and energy sharing. Instead of burning TRX to cover

gas fees, you can rent network energy, saving on costs and improving efficiency. The platform also lets you lend and earn with USDD, TRON’s decentralized stablecoin, which offers competitive yields of around 6%. Whether you're looking to earn interest, borrow assets, or manage fees more effectively, JustLend

DAO gives you a powerful toolkit to explore DeFi on TRON.

2. SUN.io – TRON’s Flagship DEX and Yield Hub

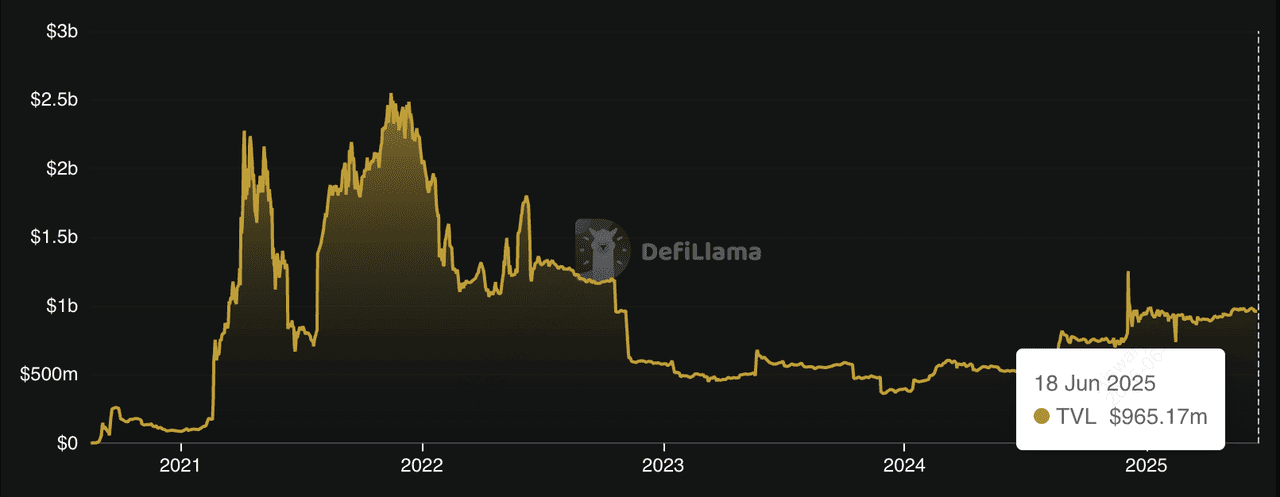

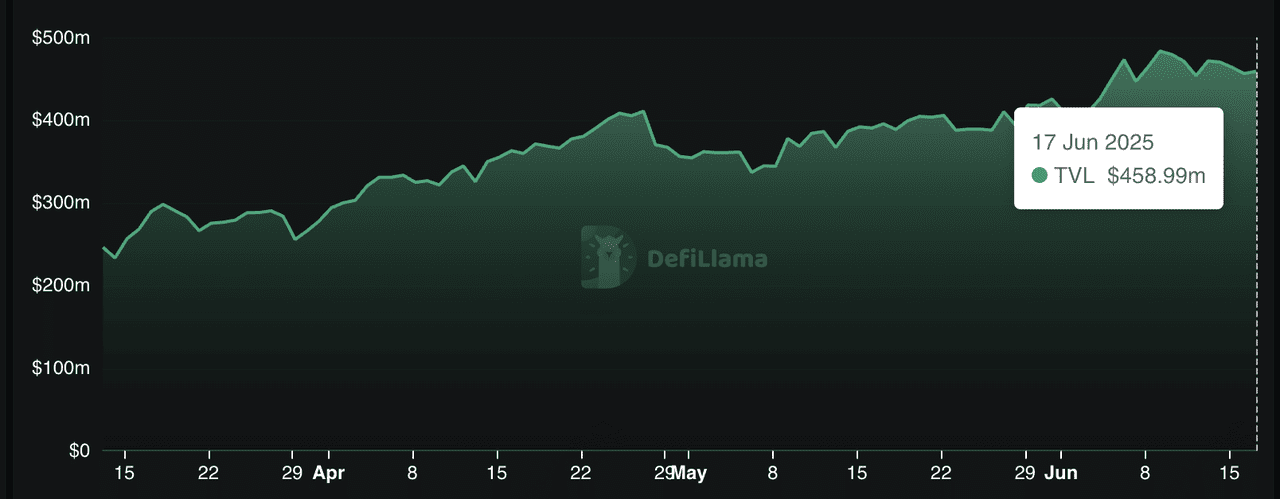

SUN.io TVL | Source: DefiLlama

SUN.io is TRON’s leading decentralized exchange (

DEX) and

yield farming platform, offering a full suite of DeFi tools for trading,

liquidity mining, and governance. With a TVL of around $965 million, SUN.io stands out as one of the most active and trusted DEXs on the TRON network. At its core is SunSwap V3, a powerful

AMM engine that enables low-slippage, low-fee token swaps. SUN.io also features a Peg Stability Module (PSM) designed for stablecoin trading, letting you mint or swap USDD and other stablecoins like USDT or TUSD at a fixed 1:1 ratio with zero fees and zero slippage.

What makes SUN.io even more compelling is its focus on community-driven rewards and governance. The platform uses the veSUN model, where users lock SUN tokens to boost their farming rewards and vote on key protocol upgrades. More than 500 million SUN tokens have already been burned, creating a deflationary effect that supports long-term value. You can also explore features like SunBoost, which lets you earn token rewards by staking LP tokens, and SunPump, a launchpad for meme coins built into the ecosystem. Whether you’re trading,

staking, or farming, SUN.io gives you a fast, affordable, and feature-rich way to participate in TRON DeFi.

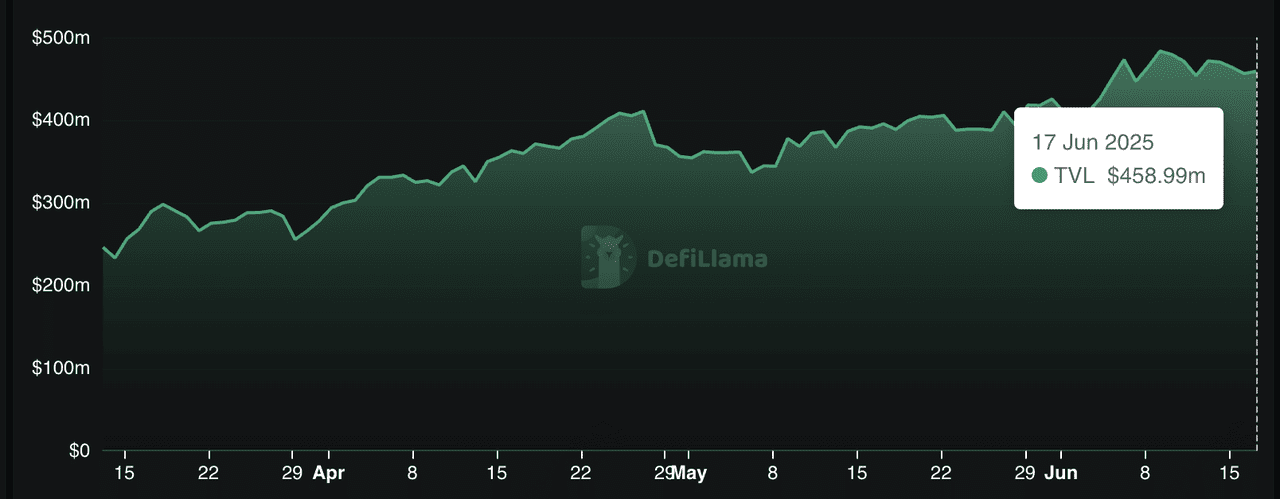

3. USDD – TRON’s Decentralized Stablecoin

USDD stablecoin TVL | Source: DefiLlama

USDD is TRON’s native decentralized stablecoin, pegged 1:1 to the US dollar and backed by over-collateralized digital assets like TRX, sTRX, and USDT. As of mid-2025, it maintains a circulating supply of around $460 million and operates without any central authority. You can mint USDD by locking supported assets or use the Peg Stability Module (PSM) to swap at a fixed 1:1 rate with zero fees and zero slippage. The stablecoin integrates tightly with JustLend DAO and SUN.io, offering lending, staking, and farming options that help you earn passive income in DeFi.

In 2025, USDD completed a major upgrade to USDD 2.0, enhancing transparency, decentralization, and cross-chain support. USDD 2.0 officially launched on January 25, 2025, marking a significant upgrade for TRON's native stablecoin. The new version is now live on TRON, Ethereum,

BNB Chain, and BTTC, with full support from leading exchanges and wallets such as

TronLink and imToken. This upgrade ensures USDD remains freeze-resistant, tamper-proof, and governed by the community. Whether you're minting stablecoins, earning yields, or bridging assets, USDD 2.0 gives you a stable, secure, and fully decentralized alternative to traditional fiat-backed coins.

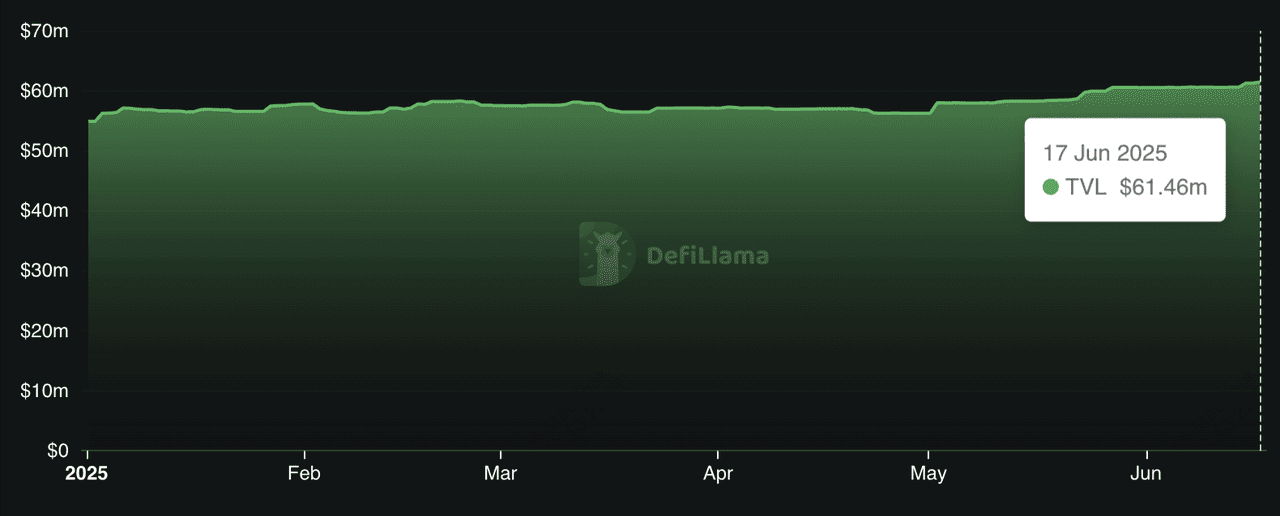

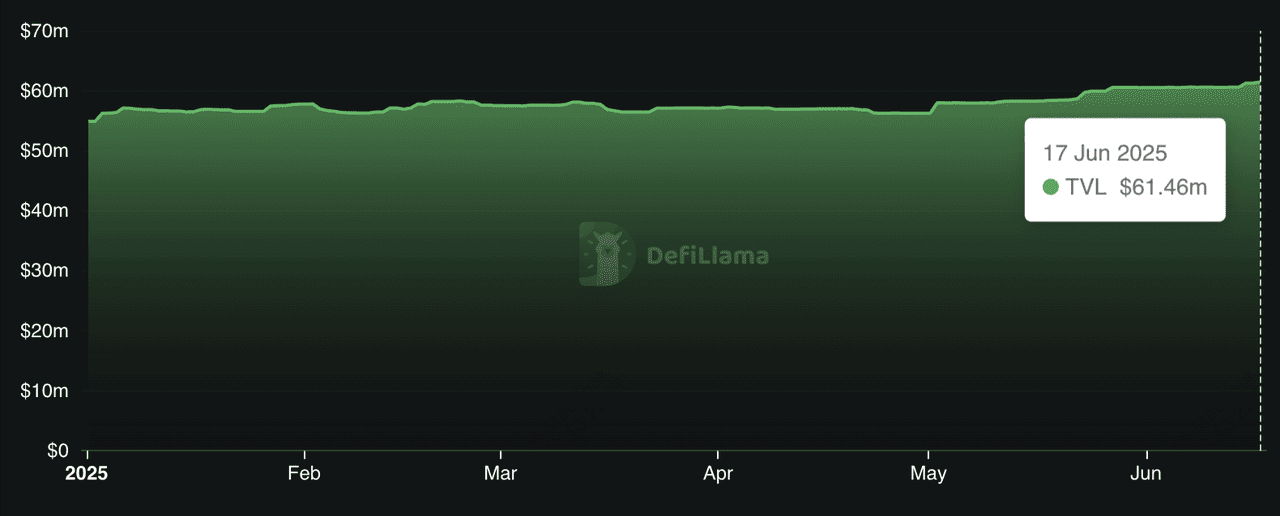

4. stUSDT – Real-World Asset-Backed Stablecoin

stUSDT TVL | Source: DefiLlama

stUSDT is a yield-generating stablecoin on the TRON blockchain that gives you exposure to real-world assets like U.S. Treasury bills. When you stake USDT or other supported stablecoins, you receive stUSDT in return, a token that earns passive income through short-term, low-risk TradFi instruments. Backed by a decentralized governance model (RWA DAO), stUSDT aims to make

RWA investments more accessible, transparent, and secure for crypto users.

What makes stUSDT unique is its seamless on-chain experience. You stay fully within

Web3 while earning rewards tied to real-world yields. The smart contract runs on both TRON and Ethereum, using Chainlink and WinkLink

oracles to maintain price stability and optimize asset performance. With over 350,000 stakers and more than $60 million in assets locked as of June 2025, stUSDT is a key part of TRON’s strategy to bridge decentralized finance and traditional markets.

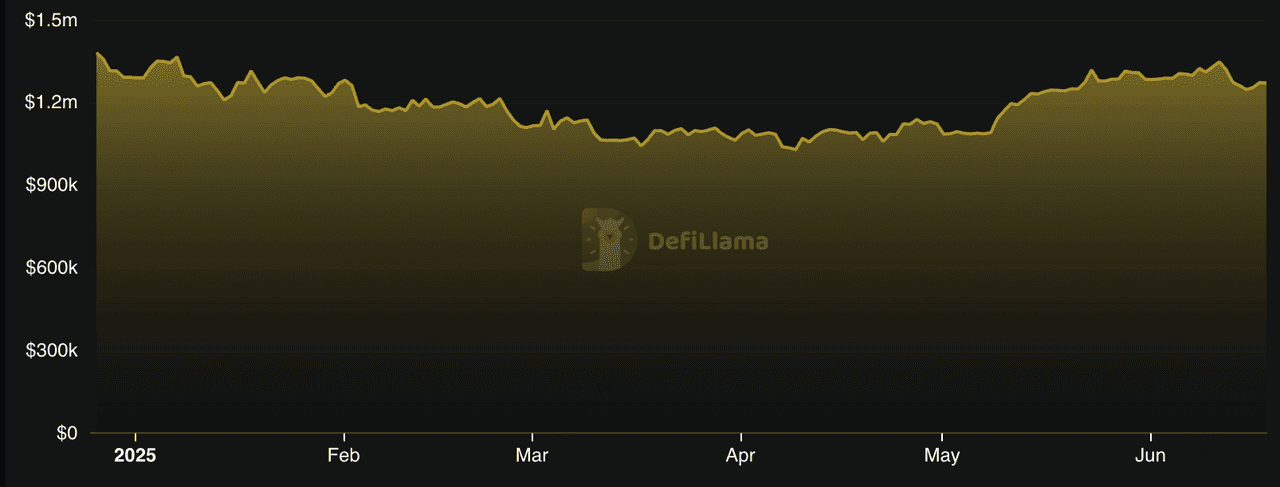

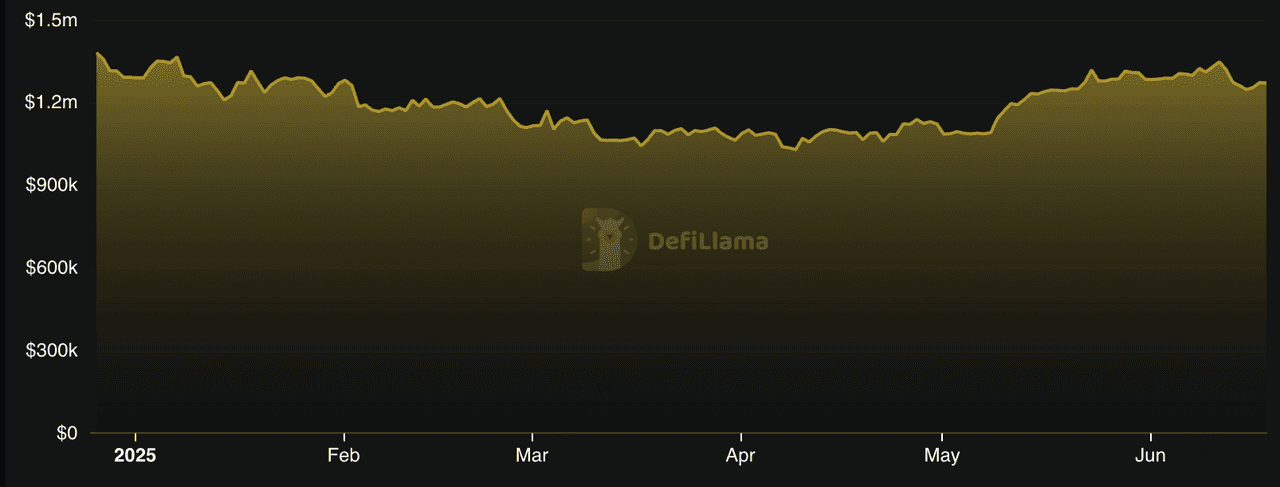

5. JustMoney - Cross-Chain DeFi Ecosystem Built for Web3

JustMoney TVL | Source: DefiLlama

JustMoney is a decentralized cross-chain ecosystem offering a full suite of tools for DeFi, Web3 payments, and token growth. Originally launched on the TRON blockchain, JustMoney has expanded across Ethereum, BNB Chain,

Polygon, and

BitTorrent Chain. Its core offerings include a multi-chain DEX (JustMoney Swap), cross-chain bridge, swap widgets, Telegram trading bots, an invoicing platform, and a decentralized payment system. Each of these products is designed to simplify crypto adoption for users, merchants, and developers. The platform also features a launchpad for token creation, a gift card system, and Explorer tools for tracking dApps and liquidity.

At the center of the ecosystem is the $JM token, a deflationary cryptocurrency that fuels swaps, payments, and rewards. JustMoney uses fees generated from its products to buy back and burn $JM tokens, reducing supply and supporting token value. Users holding $JM on TRON benefit from discounted swap fees, and liquidity providers earn passive income through reward distributions. The protocol’s mission is to bring crypto to the mainstream by offering fast, low-cost, and accessible financial services. With upcoming features like

Solana integration and Bridge v2 planned for 2025, JustMoney is positioning itself as a one-stop hub for DeFi innovation across multiple chains.

How to Get Started with TRON DeFi

Engaging with TRON's DeFi ecosystem is easier than you think. Here's a quick guide to help you set up and get started:

1. Download

TronLink, the most

popular wallet for TRON. It works as a browser extension and mobile app. After setting it up, back up your seed phrase somewhere safe.

2. You’ll need TRX, the native token of TRON. You can buy TRX directly on BingX using USDT, credit card, or local payment options. Transfer it to your TronLink wallet to pay for network fees and start interacting with

dApps.

3. Once your wallet is ready, head over to platforms like JustLend DAO, SUN.io, or SunPump. Click “Connect Wallet” and approve the connection. You can now lend, stake, swap, or launch tokens, all from your browser.

Prefer to stay on a centralized platform? Use

BingX Spot market to track and trade trending TRON tokens like USDD, SUN, or

TRON memecoins. It’s the fastest way to explore the TRON ecosystem without worrying about

seed phrases or bridging errors.

How to Stay Safe as a DeFi Trader: Top Tips

DeFi on TRON moves fast, but so do the risks. If you’re just getting started, take a few simple steps to protect your funds:

1. Always back up your seed phrase and keep it offline. Never share it, not even with someone who claims to offer support. Use wallets like TronLink or Trust Wallet, and turn on

two-factor authentication where possible.

2. Before using a dApp, check whether its smart contracts are

audited.

3. Stick to official links from trusted sources like TRONScan.

4. If you're trying a new platform, start small, just enough to test the transaction.

5. Watch out for slippage on low-liquidity pairs, especially meme coins.

6. Be careful with bridging assets across chains, as failed transfers can result in permanent loss.

7. If you're exploring real-world asset (RWA) protocols like stUSDT, make sure you understand how yields are generated and what risks they carry.

Conclusion: What's Next for TRON's DeFi Sector?

TRON has emerged as a major player in the DeFi market in 2025, with over $4.9 billion in total value locked and a growing network of fast, low-cost protocols. Whether you're lending on JustLend DAO, farming on SUN.io, or launching tokens through SunPump, TRON offers a wide range of on-chain tools built for everyday users and developers alike.

Looking ahead, new developments like the USD1 stablecoin and the proposed WLFI/SRM merger could further expand TRON’s reach, potentially drawing more institutional interest. However, as with all DeFi ecosystems, risks remain. Smart contract bugs, market volatility, and protocol changes can impact your funds. Always do your own research (

DYOR), start small, and use secure wallets when exploring DeFi on TRON.

Related Reading

TRON's DeFi TVL growth | Source: DefiLlama

TRON's DeFi TVL growth | Source: DefiLlama Top stablecoins on the TRON network | Source: DefiLlama

Top stablecoins on the TRON network | Source: DefiLlama JustLend TVL | Source: DefiLlama

JustLend TVL | Source: DefiLlama SUN.io TVL | Source: DefiLlama

SUN.io TVL | Source: DefiLlama USDD stablecoin TVL | Source: DefiLlama

USDD stablecoin TVL | Source: DefiLlama stUSDT TVL | Source: DefiLlama

stUSDT TVL | Source: DefiLlama JustMoney TVL | Source: DefiLlama

JustMoney TVL | Source: DefiLlama