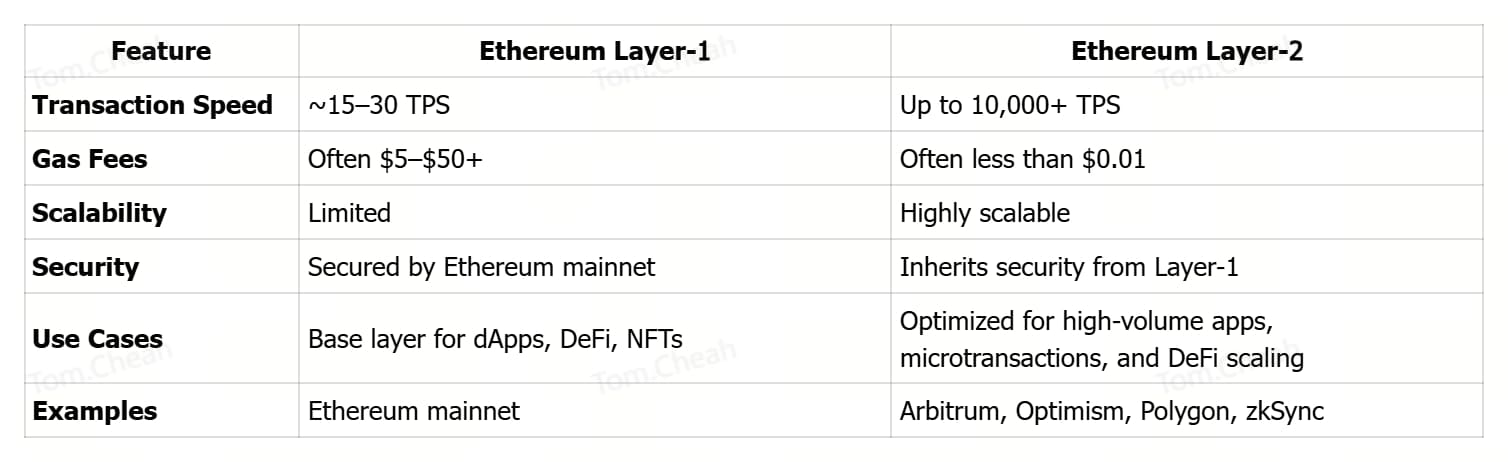

Ethereum remains the backbone of DeFi, NFTs, and Web3 innovation, but its Layer-1 limitations are impossible to ignore. In 2025, average gas fees on Ethereum have spiked as high as $150 during peak hours, and Layer-1 processes just 15–30 transactions per second (TPS). Meanwhile, Ethereum Layer-2 networks have surged ahead, offering blazing speeds of up to 40,000 TPS and slashing fees by over 95%.

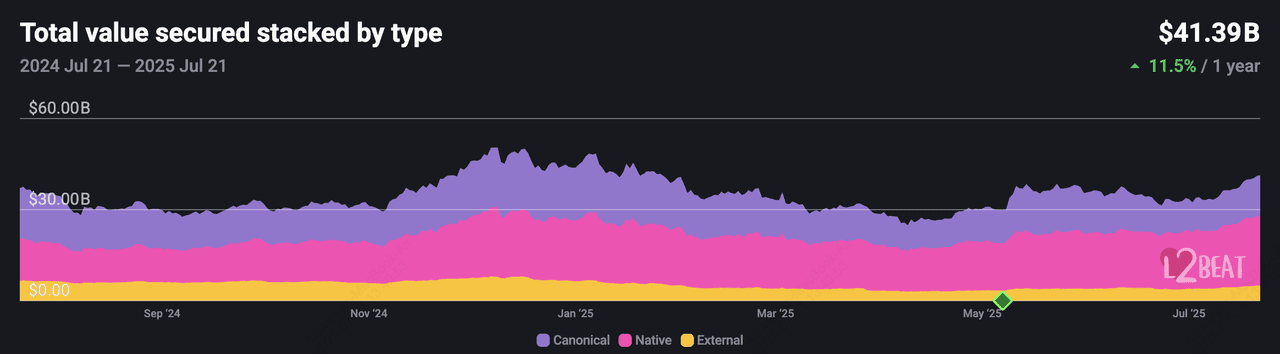

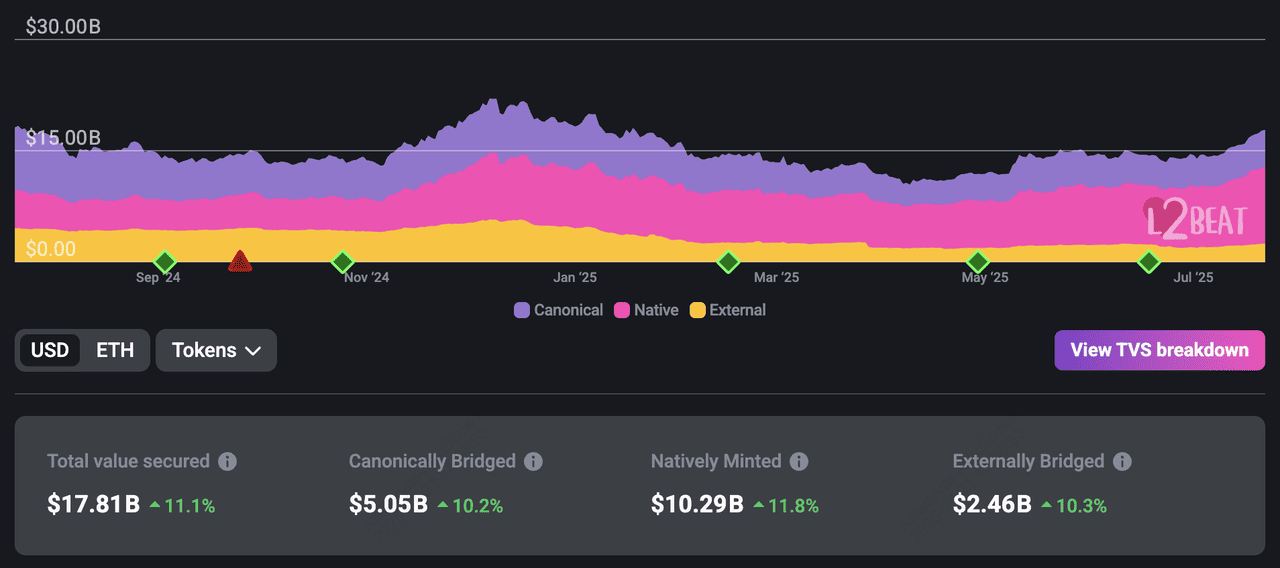

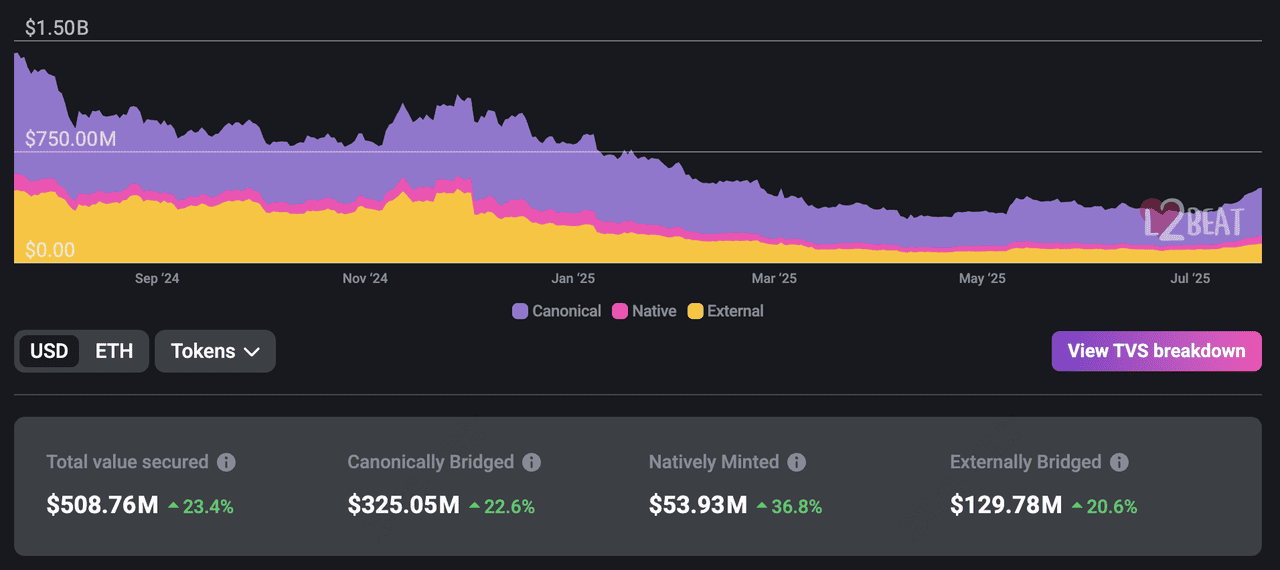

Ethereum layer-2 scaling TVL | Source: L2Beat

The numbers tell the story: total value locked (TVL) across Ethereum Layer-2s has rocketed past $52 billion, up 11.5% year-on-year. This surge comes as Ethereum itself rallied in July, driven by record ETF inflows of over $2.2 billion in July 2025 and renewed institutional interest. Activity on rollups alone accounts for millions of transactions daily, dwarfing Ethereum mainnet. With the

2025 altcoin season in full swing, leading players like

Arbitrum,

Optimism, and Base are powering ecosystems that rival traditional blockchains in size and usage.

Whether you're a beginner curious about Ethereum’s scalability or a seasoned trader eyeing opportunities, these Layer-2 projects are reshaping crypto’s future, and they’re trading now on BingX. Discover the top Ethereum Layer-2 projects of 2025 and how they’re transforming scalability, speed, and costs for DeFi, NFTs, and Web3 applications.

What Are Ethereum Layer-2 Networks and How Do They Work?

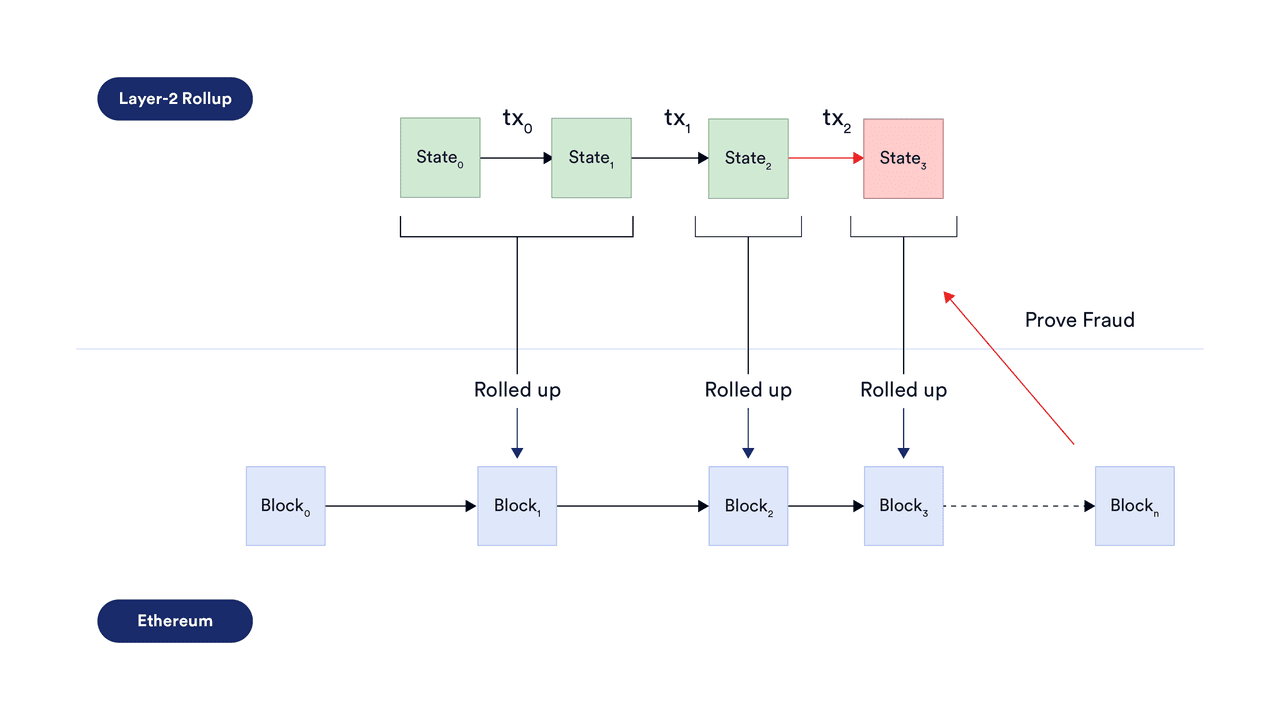

How an Ethereum layer-2 rollup works | Source: Chainlink blog

Ethereum Layer-2 networks are like express lanes built on top of the main Ethereum blockchain (Layer-1). While Layer-1 handles every transaction directly, it often gets congested, leading to slow processing times and high

gas fees. Layer-2 solutions offload most of this traffic by processing transactions off-chain or bundling them together before sending a single summary back to Ethereum for final validation. This design keeps Ethereum secure while making transactions faster and cheaper.

Ethereum Layer-1 vs. Layer-2: A Quick Comparison

There are three main types of Layer-2 technologies:

• Optimistic Rollups: Used by networks like Optimism and Arbitrum, they assume transactions are valid by default and only check them if challenged. This allows for rapid processing but introduces a small delay (known as a challenge period) when moving funds back to Layer-1.

• Sidechains: Platforms like Polygon operate as independent blockchains running parallel to Ethereum. They use their own consensus mechanisms but maintain bridges for asset transfers between the two networks.

For beginners, think of Layer-2 as Ethereum’s scalability assistant: it does most of the heavy lifting behind the scenes while letting users enjoy lower costs and lightning-fast transactions.

Why Are Ethereum Layer-2 Networks Trending in 2025?

Ethereum Layer-2 networks have become one of the hottest topics in crypto this year, driven by a perfect storm of market trends and technological innovation.

1. Lower Fees and Faster Transactions: On Ethereum Layer-1, gas fees can still spike to over $100 during peak activity. In contrast, Layer-2 networks cut these costs by up to 90%, with average transaction fees often under a cent. This makes them ideal for everyday users, DeFi traders, and even high-frequency applications.

2. Explosive Ecosystem Growth: 2025’s crypto bull run has fueled massive growth across DeFi, NFT marketplaces,

gaming dApps,

AI crypto projects, and

RWA tokenization protocols. Many of these platforms are migrating to Layer-2 networks like Arbitrum, Optimism, and zkSync to avoid congestion and deliver seamless user experiences.

3. Memecoin Frenzy and Web3 Adoption: The

rise of memecoins and social dApps has brought millions of new users into Web3. Layer-2 networks have been essential in handling this surge, enabling lightning-fast trades and low-cost transfers that keep communities engaged.

4. Ethereum Upgrades: The rollout of

EIP-4844 (Proto-Danksharding) in 2023 has supercharged Layer-2 performance by increasing data throughput and reducing costs even further. This makes rollups more efficient and scalable than ever.

5. Institutional Adoption & Regulatory Tailwinds: Following the

US GENIUS Act and

growing interest in stablecoins as trusted payment tools, financial institutions and payment providers are increasingly leveraging Layer-2 protocols for settlements and tokenized assets.

Together, these factors are transforming Layer-2s from a scaling solution into a critical infrastructure layer for Ethereum’s future.

The 7 Best Ethereum Layer-2 Projects in 2025

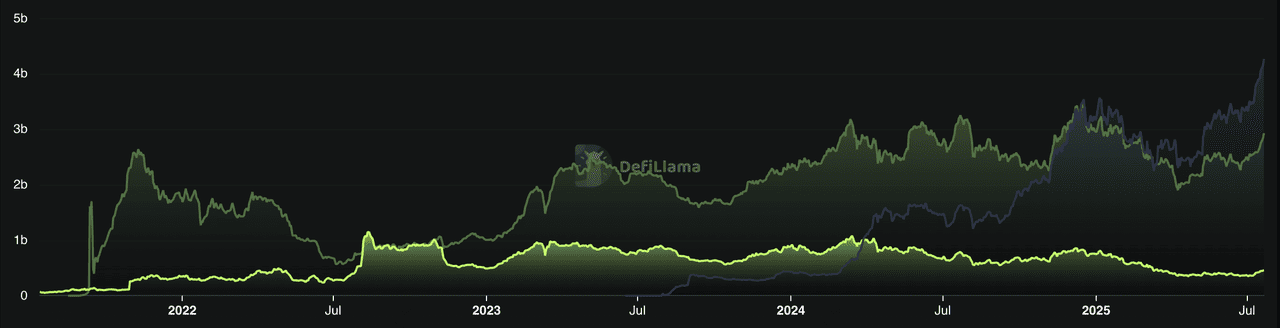

A comparison of DeFi TVL of top 3 Ethereum scaling solutions | Source: DefiLlama

Here’s a closer look at the leading Layer-2 solutions reshaping Ethereum:

1. Abitrum (ARB)

Arbitrum TVL | Source: L2Beat

Arbitrum is one of Ethereum’s leading Layer-2 scaling solutions, leveraging Optimistic Rollups to deliver high transaction throughput and low fees. With over $17.8 billion in TVL as of mid-2025, it accounts for a significant share of Layer-2 activity. The network is highly compatible with

Ethereum Virtual Machine (EVM), allowing developers to easily deploy existing Ethereum dApps without major changes. This has made Arbitrum the preferred home for top DeFi protocols like

Uniswap,

GMX, and

Aave, which thrive thanks to its fast finality and reduced costs.

Beyond scalability, Arbitrum offers a suite of tools and protocols, including Arbitrum One, Arbitrum Nova, and Orbit chains, catering to diverse use cases from DeFi to gaming. Its native governance structure, Arbitrum DAO, empowers the community to shape the ecosystem’s future. For beginners, Arbitrum’s user-friendly bridges and robust app directory make it simple to move funds and interact with dApps, while its low fees (often under $0.05 per transaction) ensure accessibility for all.

2. Base

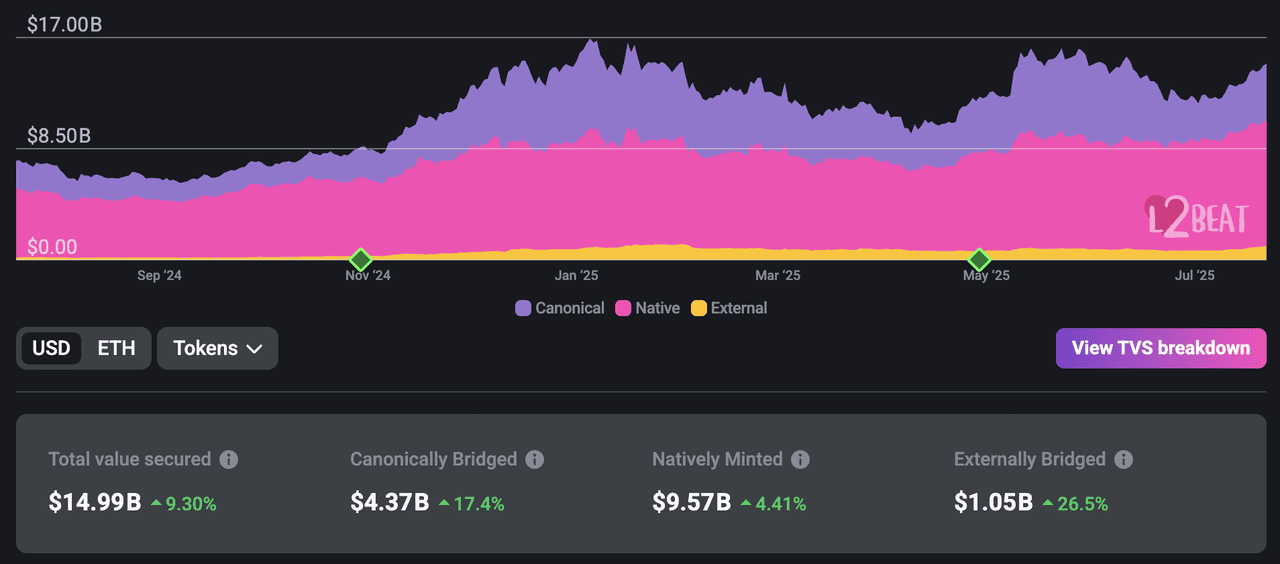

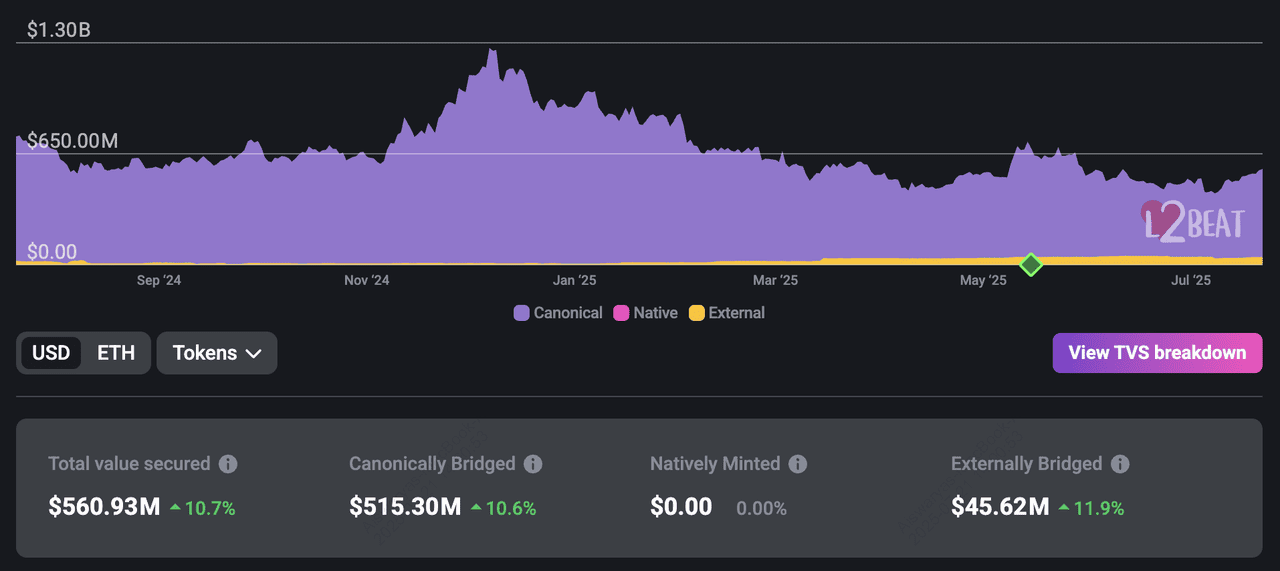

Base TVL | Source: L2Beat

Base is Coinbase’s flagship Layer-2 network, built on Optimism’s OP Stack to offer a highly scalable and beginner-friendly platform. Since its launch in August 2023, Base has seen explosive growth, surpassing $14.9 billion in total value locked (TVL) by mid-2025. As the first Layer-2 deeply integrated with a major centralized exchange, Base makes on-chain activity seamless for millions of Coinbase users. Its ecosystem includes the Base App, an all-in-one platform for trading, payments, social networking, and DeFi, designed to onboard both crypto natives and newcomers.

With features like Base Pay for USDC payments and Base Build for developers, the network caters to a wide range of users and creators. Transactions on Base are fast, with median fees often under $0.01, making it ideal for microtransactions and high-frequency

dApps. For beginners, Base’s tight integration with Coinbase eliminates complex wallet setups, allowing effortless transfers between Layer-1 Ethereum and Base. As part of the broader Superchain vision, Base plays a key role in building an open, global on-chain economy.

3. Optimism (OP)

Optimism TVL | Source: L2Beat

Optimism is a leading Ethereum Layer-2 scaling solution that uses Optimistic Rollups to boost transaction speeds and reduce costs. Built with simplicity and developer-friendliness in mind, Optimism has become the backbone for a growing network of OP Stack-powered chains, including Base,

World Chain, and Soneium. As of mid-2025, the Optimism ecosystem secures over $17 billion in assets and processes more than 17 million transactions daily across 50+ chains, highlighting its role as a key player in Ethereum’s modular scaling strategy.

The OP Stack, Optimism’s modular, open-source infrastructure, allows developers to launch scalable, customizable blockchains with Ethereum-grade security. For beginners, this means many familiar apps like Uniswap and Aave are already optimized for use on Optimism. Transactions are ultra-fast and low-cost, with fees often below $0.01. By enabling shared upgrades and interoperability in its upcoming Superchain vision, Optimism is laying the foundation for a seamless multi-chain Ethereum experience that empowers both users and builders.

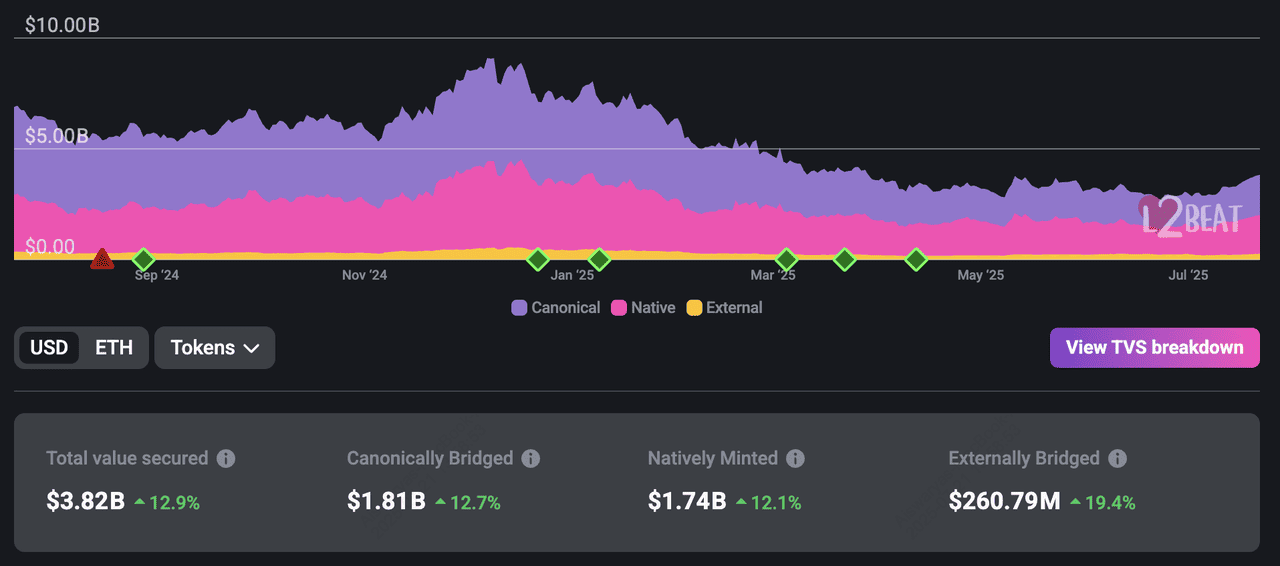

4. ZKsync (ZK)

ZKsync TVL | Source: L2Beat

zkSync is a cutting-edge Ethereum Layer-2 solution using Zero-Knowledge Rollups (zk-Rollups) to deliver ultra-secure, low-cost, and privacy-preserving transactions. As of mid-2025, zkSync powers over 19 interconnected chains in its Elastic Network, securing billions in assets and supporting millions of daily transactions. The zkEVM compatibility enables developers to deploy Ethereum smart contracts with minimal changes, while its native account abstraction and one-tap onboarding create a seamless user experience, ideal for payments, micropayments, and mainstream adoption.

For users, zkSync offers blazing-fast transactions with median fees often under $0.02 and near-instant finality. Major institutions like Deutsche Bank and UBS have tested zkSync’s technology for tokenizing real-world assets, while cities like Buenos Aires use it for blockchain-based digital identity systems. Developers benefit from zkSync Era’s familiar Solidity environment, allowing rapid app deployment. As part of its Elastic Network vision, zkSync is shaping the future of Web3 with native interoperability, shared liquidity, and a user-centric approach that makes blockchain accessible to all.

5. Linea (LINEA)

Linea TVL | Source: L2Beat

Linea is a next-generation Ethereum Layer-2 network developed by ConsenSys, leveraging zk-Rollups and native zkEVM support to deliver fast, low-cost, and secure transactions. Since its launch, Linea has become a favorite among developers thanks to its full EVM compatibility and seamless integration with popular ConsenSys tools like MetaMask and Infura. As of mid-2025, Linea supports a growing ecosystem of DeFi apps, NFT platforms, and Web3 services, aiming to make life “onchain” as easy and user-friendly as possible.

For beginners, Linea’s user-centric design enables web2-like experiences, including one-tap onboarding and IRL crypto payments through MetaMask’s debit card. With gas fees often under $0.01 and strong partnerships with over 20 security firms, Linea ensures both affordability and safety. The network’s vibrant ecosystem supports innovative projects like Verax for digital identity and Proof of Humanity to verify unique users. Excitement is also building around Linea’s upcoming token launch and airdrop, set for late 2025, which could reward early users and developers contributing to the ecosystem. As part of ConsenSys’ broader vision, Linea is helping shape a globally connected, scalable, and secure onchain economy.

6. Starknet (STRK)

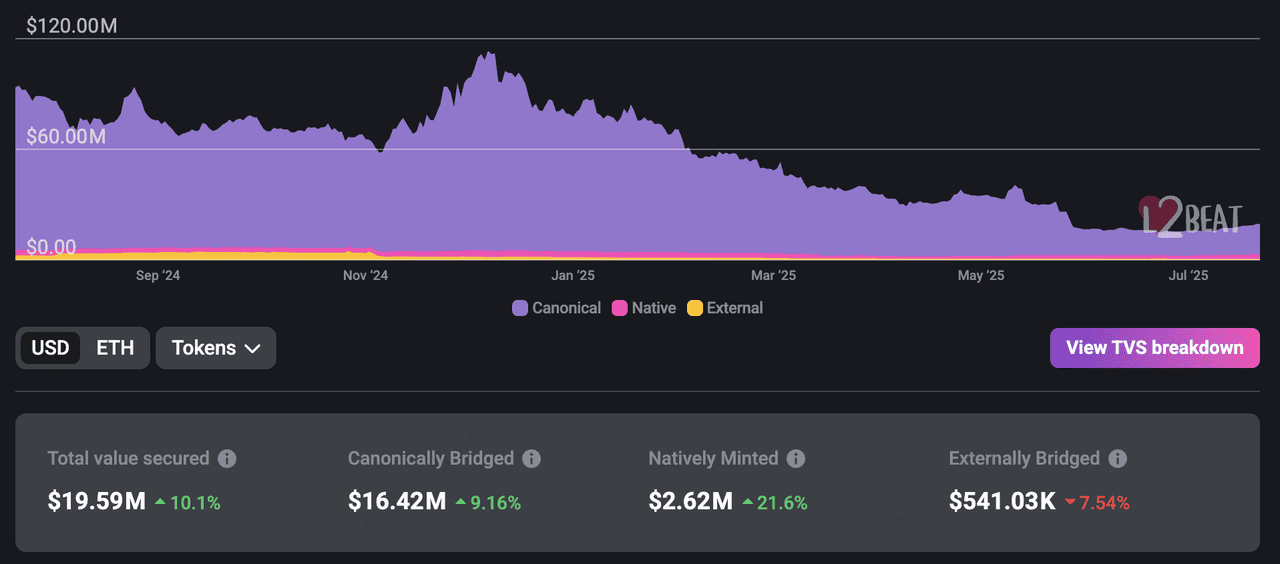

Starknet TVL | Source: L2Beat

Starknet is a powerful Ethereum Layer-2 network built with zk-Rollups and STARK proofs to deliver high scalability and unmatched security. Designed by StarkWare, it enables developers to build complex, high-performance dApps using its native Cairo programming language. As of 2025, Starknet powers leading Web3 projects like Sorare and

dYdX, proving its ability to handle millions of transactions with lower costs and faster speeds compared to Ethereum Layer-1.

For beginners, Starknet offers a seamless on-chain experience with native account abstraction, making wallets and transactions more user-friendly. Developers benefit from robust tooling, including the SN Stack and extensive resources in the Developer Hub. Gas fees are typically a fraction of a cent, and Starknet’s modular ecosystem continues to expand across DeFi, gaming, and NFT sectors. With its strong focus on security and scalability, Starknet is positioned as a key player in Ethereum’s roadmap to support the next generation of Web3 applications.

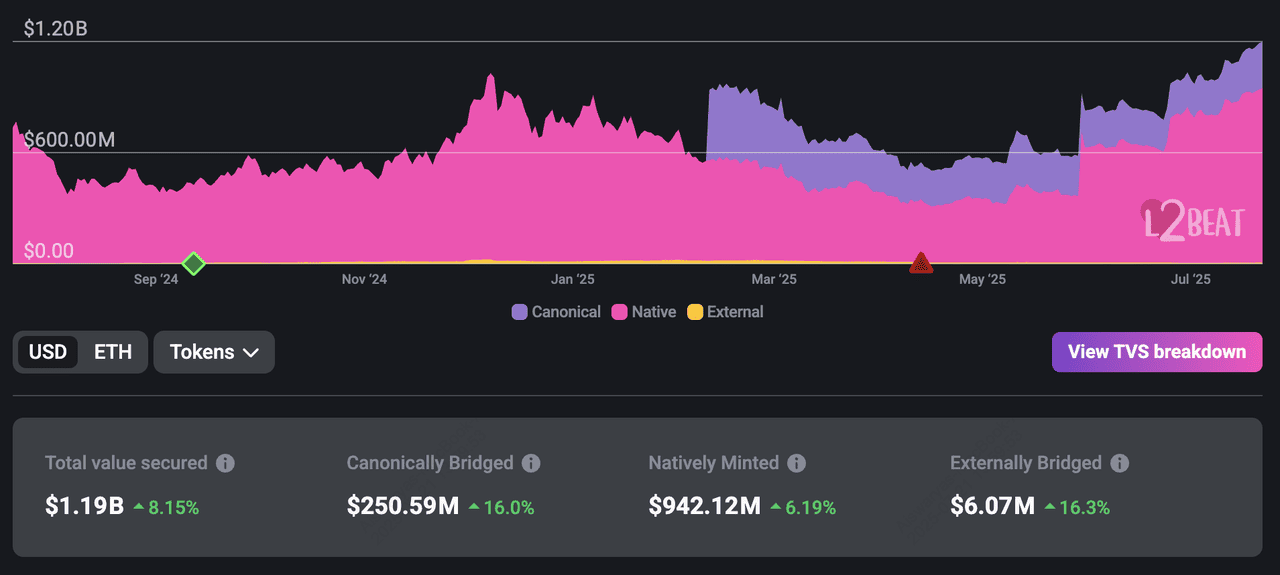

7. Polygon (POL)

Polygon zkEVM TVL | Source: L2Beat

Polygon is one of Ethereum’s most established scaling solutions, offering a hybrid framework of sidechains and zk-Rollups. Its flagship Polygon PoS chain supports over 219 million unique addresses and has processed more than 2.4 billion transactions at an average cost of just $0.015 per transaction. With Polygon zkEVM live, developers can now deploy Ethereum-compatible smart contracts with the security benefits of zero-knowledge proofs, enabling high-performance dApps across DeFi, NFTs, and gaming.

For users, Polygon’s low fees and fast transaction speeds make it ideal for everyday crypto activities, from trading on Aave to minting NFTs on OpenSea and even using Starbucks Odyssey’s loyalty program. Developers are supported by a robust infrastructure, including tools like Miden and Polygon Plonky3, as well as access to over 1.17 million deployed smart contracts. As Polygon evolves into a multi-chain ecosystem, its Aggregation Layer aims to connect sovereign blockchains for seamless interoperability and scalability across Web3.

How to Trade Ethereum Layer-2 Tokens on BingX

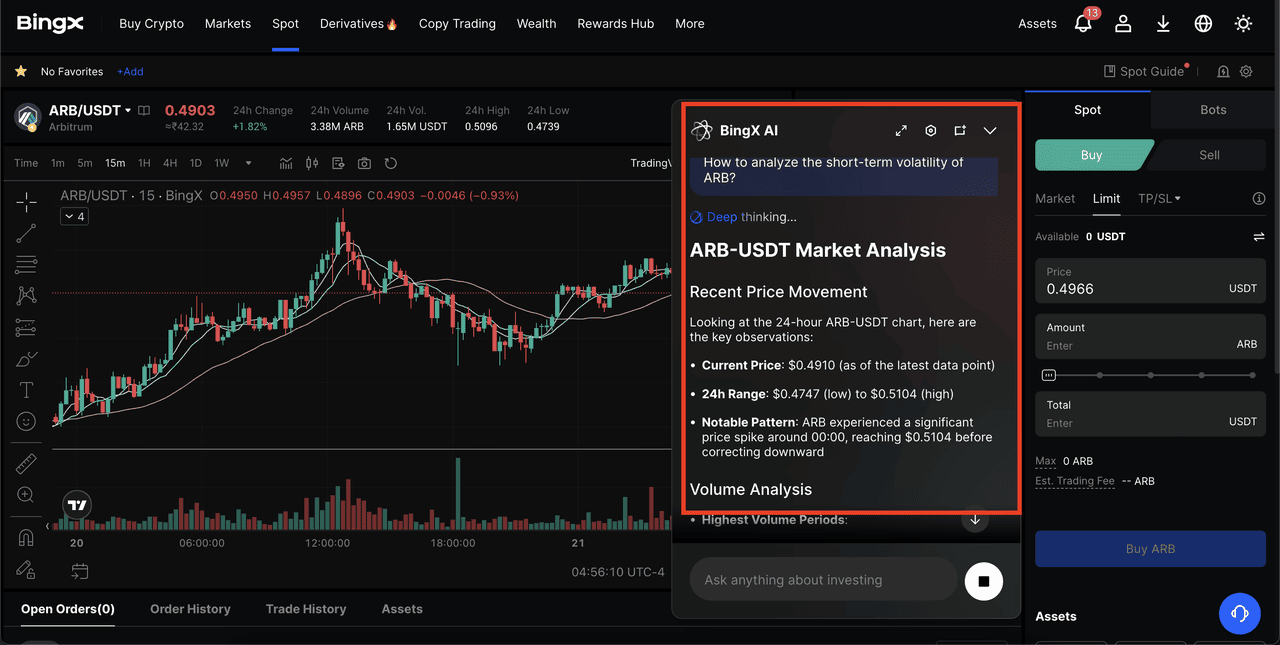

BingX AI insights on

ARB/USDT trading pair | Source: BingX spot market

BingX offers multiple ways to trade Ethereum Layer-2 tokens, making it easy for both beginners and experienced traders to get started:

1. Spot Trading: Buy and sell popular Layer-2 tokens like POL (Polygon), OP (Optimism), ARB (Arbitrum), and more directly on the BingX Spot Market with low fees and fast execution.

2. Futures Trading: Amplify your trading strategies by trading perpetual futures contracts on Layer-2 tokens. Take advantage of leverage and hedge your portfolio in volatile markets.

3. Copy Trading: Follow top-performing traders who specialize in Layer-2 tokens. With BingX Copy Trading, you can replicate their strategies automatically and learn from their trades.

4. BingX AI Insights: Use BingX

AI-powered tools to analyze market trends, predict price movements, and make smarter decisions when trading Layer-2 tokens.

Whether you’re trading for the long term or exploring short-term opportunities, BingX gives you the tools to navigate the fast-growing Ethereum Layer-2 ecosystem.

What Are the Pros and Cons of Ethereum Layer-2 Solutions?

Before diving into Layer-2 networks, it’s important to weigh their benefits and limitations. While they make Ethereum faster and cheaper, they also come with trade-offs that every beginner should understand.

Advantages

• Lower Gas Fees: Transactions on Layer-2s cost a fraction of Layer-1 fees, often less than $0.01, making them ideal for microtransactions and everyday use.

• Faster Transaction Speeds: Many Layer-2 networks process thousands of transactions per second (TPS), compared to Ethereum’s 15–30 TPS.

• Supports Complex dApps and Gaming: Layer-2s enable rich user experiences for DeFi, NFT marketplaces, and blockchain games without the lag of Layer-1.

• Retains Ethereum Mainnet Security: Most Layer-2s inherit the security of Ethereum, ensuring users’ transactions remain safe and tamper-proof.

Drawbacks

• Delayed Withdrawals: Moving funds from Layer-2 back to Ethereum Layer-1 can take hours or days, especially on Optimistic Rollups due to fraud-proof periods.

• Centralization Risks: Some Layer-2 designs rely on a small set of operators, which could pose risks to decentralization.

• Ecosystem Fragmentation: With multiple Layer-2 networks, assets and liquidity are sometimes split, requiring bridges or additional steps to move between ecosystems.

Closing Thoughts: Why Layer-2s Are Critical for Ethereum’s Future

Ethereum’s scalability relies heavily on the continued growth and adoption of Layer-2 networks. In 2025, projects like Arbitrum, Base, and zkSync are pushing the boundaries of what’s possible by enabling faster, cheaper, and more user-friendly blockchain applications. With upcoming upgrades like Danksharding on the horizon, Layer-2 solutions are set to play an even larger role in helping Ethereum scale to meet global demand.

However, it’s important to remember that Layer-2 ecosystems are still evolving. Users and investors should stay aware of potential risks such as security vulnerabilities, withdrawal delays, and ecosystem fragmentation. As with any emerging technology, careful research and cautious participation are key.

Related Reading