Stablecoins have become one of the most important building blocks in the digital asset ecosystem. Pegged to traditional currencies like the U.S. dollar, they combine the speed and flexibility of crypto with the price stability needed for real-world use. This balance has made them central to digital payments, trading, and decentralized finance (

DeFi).

By mid-2025, the stablecoin market has reached over 255 billion dollars in total capitalization, up from approximately 172 billion in late 2024. This sharp growth reflects a broader shift in how stablecoins are used. While

Bitcoin and

Ethereum continue to capture headlines, stablecoins now drive the majority of on-chain activity. In 2024, they processed more than 27 trillion dollars in transaction volume, and momentum has carried into 2025 as adoption expands across consumer, enterprise, and institutional sectors.

In 2025, stablecoins are no longer just a tool for crypto trading. They are becoming essential infrastructure for cross-border payments, corporate treasury management, and everyday financial transactions. From

Circle’s landmark IPO to the introduction of comprehensive federal legislation like the

US Genius act, this year marks a pivotal moment in the evolution and adoption of stablecoins.

What Is a Stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a consistent value over time. Most are pegged to a fiat currency such as the U.S. dollar, but some also track other assets like the euro, gold, or even a basket of currencies. The goal is to offer a predictable unit of value that users can rely on, especially in contrast to the volatility seen in cryptocurrencies like Bitcoin or Ethereum. By combining the stability of traditional assets with the speed and flexibility of blockchain networks, stablecoins provide a practical foundation for digital payments and on-chain financial applications.

This price stability makes stablecoins useful across a wide range of financial activities. They serve as a reliable medium of exchange, a digital store of value, and a unit of account within decentralized applications. Users can hold stablecoins in a digital wallet, transfer them globally in seconds, or use them within blockchain-based platforms for lending, payments, and savings.

To build trust, many stablecoins are supported by transparency measures such as

third-party audits or real-time reserve reporting. These practices help ensure that the value of a stablecoin is backed by assets held in reserve and can be redeemed when needed.

Key Features of Stablecoins

• Price Stability: Pegged to assets like fiat currencies to maintain consistent value

• Blockchain Integration: Operate on decentralized networks with fast and borderless transfer capabilities

• Global Accessibility: Usable by anyone with internet access, without requiring a traditional bank account

• Programmability: Easily integrated into

smart contracts and decentralized applications

• Transparency: Often supported by public audits or on-chain reserve data to verify backing

• Cost Efficiency: Often cheaper and faster than traditional banking rails for both domestic and cross-border transactions

Why Stablecoins Matter in 2025

In 2025, stablecoins have evolved from a trading tool into foundational financial infrastructure. They now serve as the digital rails for payments, business operations, and on-chain ecosystems. This transformation has been driven by three interlocking forces: regulatory clarity, institutional adoption, and widespread real-world demand.

1. Regulatory Clarity: The GENIUS Act Sets the Foundation

The most important policy development of the year was the passage of the GENIUS Act, the first federal framework for stablecoin regulation in the United States. Approved by the Senate in June 2025, it introduced clear legal requirements for stablecoin issuance, oversight, and consumer protection.

Under the law, stablecoins must be backed one-to-one with U.S. dollars or Treasury securities. Issuers are required to conduct monthly audits, follow anti-money laundering standards, and provide redemption rights and priority claims in bankruptcy. The act also creates legal pathways for both banks and licensed fintech companies to participate as issuers.

In parallel, the European Union has begun enforcing its Markets in Crypto-Assets (MiCA) regulation, which sets standardized requirements for reserve management, custody, and licensing across the eurozone. This regulatory clarity has helped accelerate the growth of

euro-pegged stablecoins such as EURC and EUROe, which are gaining traction in euro-denominated DeFi applications, cross-border payments, and enterprise finance.

Together, these regulatory milestones reduce compliance uncertainty and signal that stablecoins are moving into a more mature phase. With oversight increasingly aligned to traditional financial standards in both the U.S. and EU, stablecoins can now be more confidently adopted across global markets.

2. Institutional Adoption: From Hesitation to Full Entry

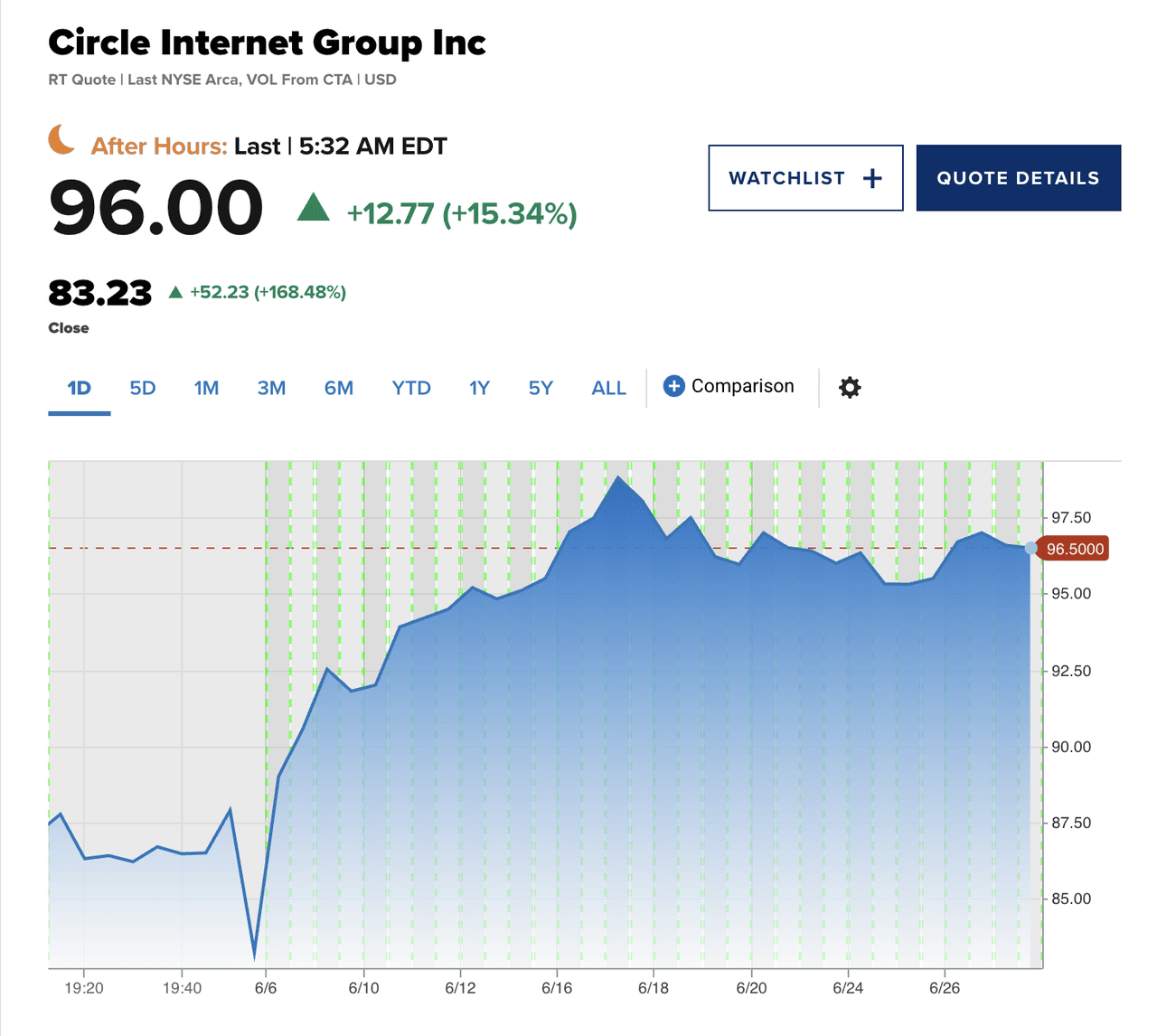

With policy clarity in place, institutions have begun entering the stablecoin market at scale. Circle’s IPO in June 2025 marked a major turning point. The company opened at $31 per share and surged 168% on its first day of trading, achieving a market valuation of over $18 billion. This event showed that investors view stablecoin infrastructure not as speculative, but as core to the next era of finance.

Circle (CRCL) Price Marked a 168% Gain from the IPO Price | Source: CNBC

Traditional financial players are also launching stablecoin products of their own. Over a dozen major institutions, including JPMorgan, Citigroup, Bank of America, PayPal, Stripe, and World Liberty Financial, have announced new offerings or secured licenses. JPMorgan introduced JPMD, a deposit token designed for institutional settlements. PayPal continues to roll out

PYUSD across its global payments network, while Ripple has launched

RLUSD, a fully backed stablecoin integrated into its cross-border payment infrastructure.

World Liberty Financial (WLFI) is expanding the use of

USD1, a stablecoin designed to align with pro-regulatory frameworks and serve as a digital payment instrument across both retail and enterprise use cases.

The use cases are broad and expanding. For banks and fintechs, stablecoins are being adopted to simplify cross-border payments, optimize treasury operations, enable real-time merchant settlement, and streamline B2B invoicing. This shift marks a change in perception: stablecoins are no longer viewed as disruptive threats, but as tools for financial modernization.

3. Real-World Demand: Scale, Speed, and Everyday Utility

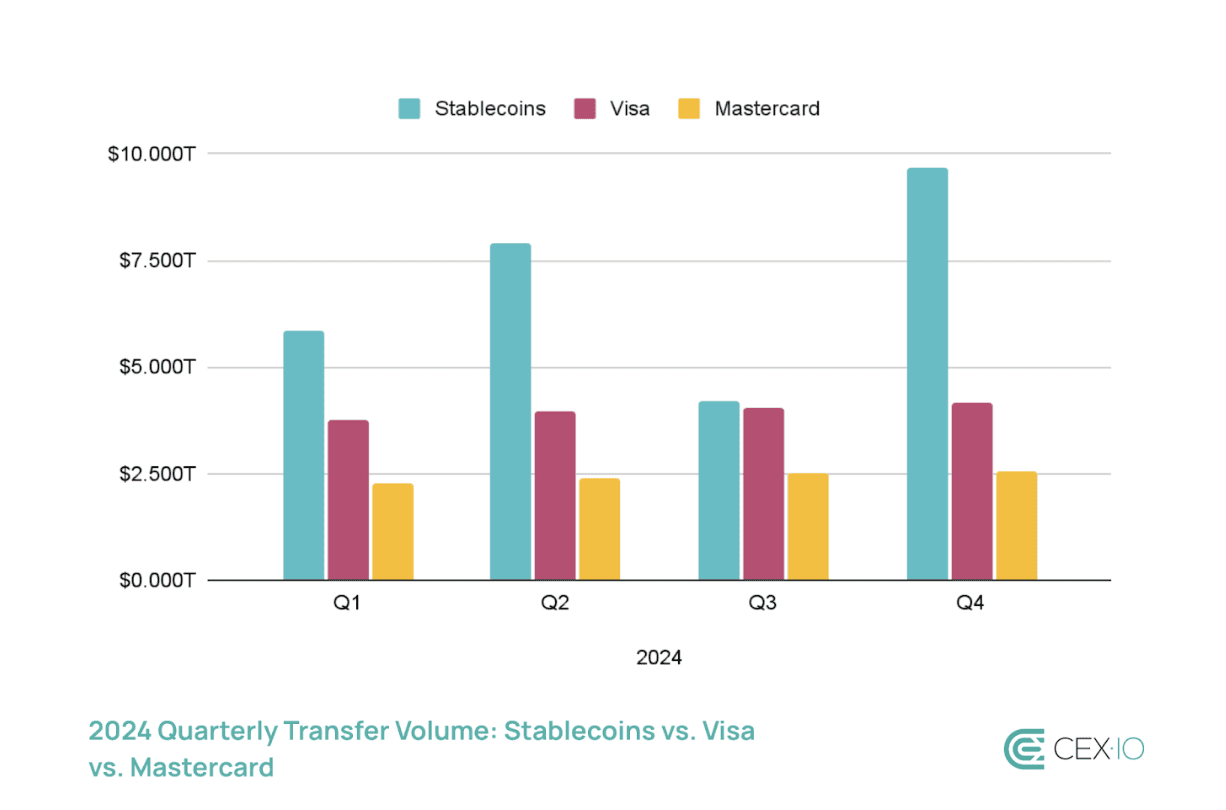

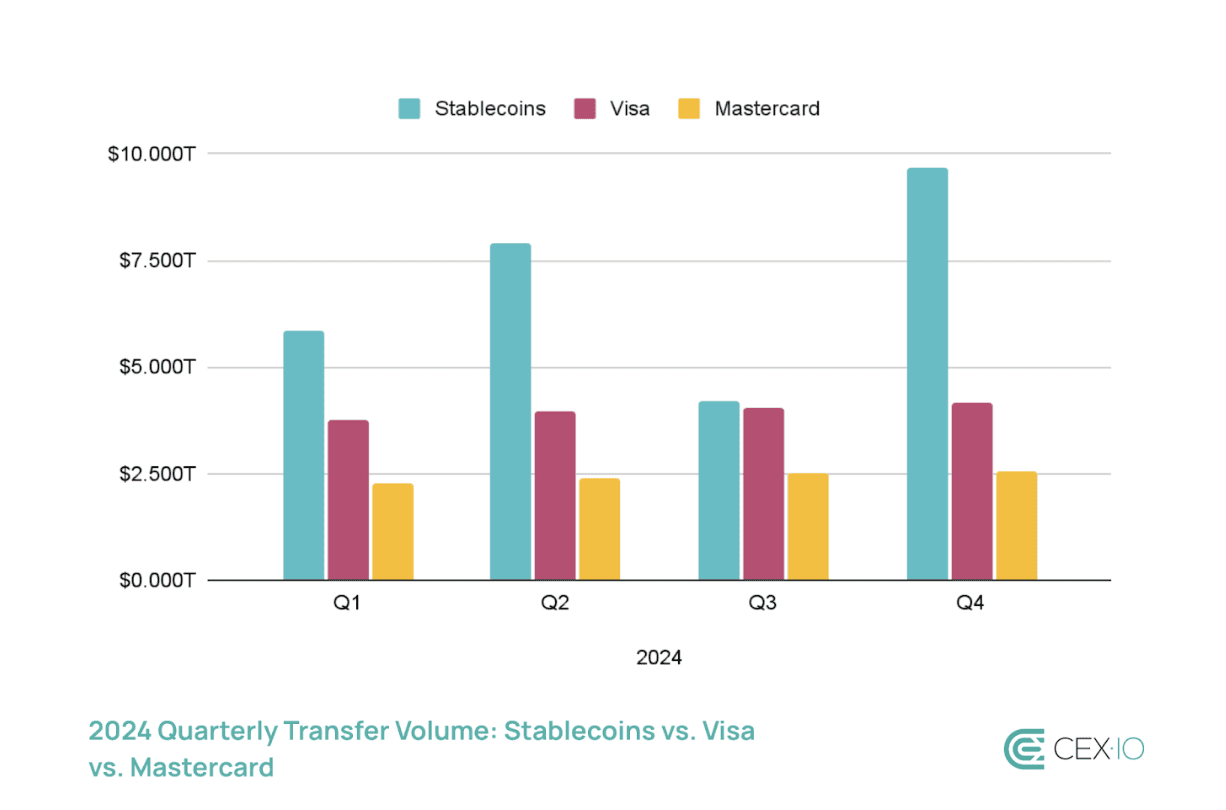

Alongside regulatory and institutional momentum, stablecoin usage has surged across consumer and enterprise markets. In 2024, total transaction volume for stablecoins surpassed $27.6 trillion, exceeding the combined activity of Visa and Mastercard. That pace has only increased in 2025. In May alone, Ethereum

Layer-1 processed over $480 billion in stablecoin volume.

Total Stablecoin Transaction Volume in 2024 Exceeded That of Visa and Mastercard Combined | Source: Cex.io

The appeal lies in their speed, accessibility, and efficiency. Unlike legacy systems, stablecoins settle in minutes or seconds, operate 24/7, and offer significantly lower transaction costs. This makes them attractive for both small-scale remittances and large-scale commercial settlements.

Adoption is also visible on-chain. As of mid-2025, stablecoins have reached a

market capitalization of over $255 billion, up 59% from the previous year. They now represent about 1% of the

U.S. M2 money supply. Over 121 million

wallets hold stablecoins, and nearly 20 million are active each month.

Businesses are integrating stablecoins into their workflows for payments, liquidity management, and yield strategies. For users in emerging markets, they offer protection against inflation and access to dollar-denominated value without needing a traditional bank account.

Together, these developments signal a clear shift. Stablecoins are no longer speculative instruments tied to the crypto cycle. They are programmable, compliant, and increasingly indispensable in a digitized economy.

What Are the Different Types of Stablecoins?

Stablecoins use different mechanisms to maintain their peg to a stable asset, such as a fiat currency, a commodity, or a basket of assets. Understanding these categories is essential to evaluating their design trade-offs, risk profiles, and appropriate use cases. Below is a breakdown of the six main types of stablecoins in use as of 2025.

1. Fiat-Collateralized Stablecoins

Fiat-backed stablecoins are the most dominant category by market share. As of mid-2025, they account for more than 85% of all stablecoin capitalization, with

USDT and

USDC alone representing over $180 billion combined. These tokens are deeply integrated across centralized exchanges, fintech payment networks, and DeFi protocols. Due to their strong regulatory alignment and liquidity, they serve as the default form of digital dollars in most crypto ecosystems.

In addition to U.S. dollar-pegged stablecoins,

euro-pegged stablecoins such as

EURC and

EURE are also gaining traction, particularly in European markets and for FX-related DeFi use cases. While smaller in scale, they provide important infrastructure for euro-denominated settlements and cross-border payments within the EU.

How Does a Fiat-Collateralized Stablecoin Work?

These stablecoins are backed 1:1 by reserves of fiat currency such as U.S. dollars or euros, held in bank accounts or low-risk instruments like short-term Treasury bills. The issuer ensures that each token can be redeemed for its underlying asset and publishes regular attestations or audit reports to verify solvency. While highly usable and compliant, this model depends on centralized custody and institutional trust.

2. Crypto-Collateralized Stablecoins

Crypto-backed stablecoins represent a smaller but vital segment of the stablecoin market, accounting for an estimated $8 to $10 billion in circulating supply. They are central to the decentralized finance ecosystem, where users seek permissionless, non-custodial alternatives to fiat-backed assets. DAI alone has more than 500,000 active holders and is integrated into hundreds of DeFi applications.

How Crypto-Collateralized Stablecoins Work

These stablecoins are minted by depositing volatile cryptocurrencies, like ETH or wBTC, into overcollateralized smart contracts. To protect the peg, users are required to deposit more value than they borrow. If the collateral drops below a certain ratio, automated

liquidation occurs. This model removes counterparty risk but relies on robust on-chain governance and market health.

3. Commodity-Collateralized Stablecoins

Examples:

PAXG (Paxos Gold),

XAUT (Tether Gold)

Commodity-backed stablecoins make up a niche but growing segment of the market. As of 2025, PAXG and XAUT each hold between $400 million and $600 million in circulation. Their adoption is most common among investors seeking inflation hedges, particularly in emerging markets or volatile economic regions. With rising geopolitical and monetary uncertainty, demand for tokenized gold has increased year-over-year.

How Commodity-Pegged Stablecoins Work

Each token is backed by a specific amount of a physical commodity, typically stored in secured vaults. The issuing institution manages custody and redemption, with each token representing a redeemable claim on the underlying asset. While useful for asset diversification, these stablecoins depend on centralized entities and regular audits to ensure credibility.

4. Algorithmic Stablecoins

Examples:

FRAX (Frax Finance),

AMPL (Ampleforth), formerly UST (Terra)

Algorithmic stablecoins are experimental and currently represent less than 2% of total stablecoin market capitalization. While they aim to provide scalable, decentralized alternatives without requiring traditional collateral, they have a mixed track record. The collapse of TerraUSD (UST) and its sister token LUNA in 2022 marked one of the most significant failures in the space, leading to broader scrutiny of fully algorithmic models. Since then, newer designs such as partially collateralized or circuit-breaker-enabled systems have emerged. FRAX, for example, remains one of the most active projects in this category, with integrations across multiple chains and protocols.

How Does an Algorithmic Stablecoin Work?

Algorithmic stablecoins do not rely on direct asset reserves. Instead, smart contracts manage token supply based on market demand. When a token trades above its target price, the protocol increases supply to bring the price back down. When demand drops and the price falls, supply contracts. Some systems use dual-token structures, such as a stabilizing asset and a governance or utility token, to help manage supply changes. Others introduce partial collateral to improve resilience. These models rely heavily on market confidence, liquidity, and consistent usage to function as intended.

5. Yield-Bearing Stablecoins

Yield-bearing stablecoins are one of the fastest-growing categories in 2025, with a combined market capitalization exceeding $3 billion. These assets have attracted strong institutional and DeFi interest as users seek stable-value instruments that also generate passive income. USDY and USYC are backed by tokenized U.S. Treasury bills and are being adopted in treasury management, on-chain lending, and savings protocols.

Ethena’s USDe stands out for its synthetic dollar approach and rapid user growth, especially within derivatives-heavy DeFi ecosystems. USDe has gained attention for offering high native yields and strong integration across staking platforms and modular blockchains.

How Yield-Bearing Stablecoins Work

Yield-bearing stablecoins are typically backed by income-generating assets such as short-term U.S. government bonds or delta-neutral positions. USDY and USYC pass yield directly from Treasuries to token holders, either through periodic payouts or token appreciation. USDe, by contrast, uses a synthetic dollar model backed by ETH collateral and short futures positions to maintain price stability while generating returns from funding rate arbitrage. Depending on the structure, these stablecoins may be issued by regulated institutions or operate under protocol-level governance. Regulatory scrutiny tends to be higher when interest is distributed to retail users, especially in jurisdictions with securities laws.

6. Hybrid Stablecoins

Examples: RToken (Reserve), new-generation FRAX models

Hybrid stablecoins are still in the early stages but are gaining attention for their adaptive architecture. Although they represent a small share of total supply, they are actively used in emerging markets and experimental ecosystems. RToken, for example, supports localized currency pegs and community-managed collateral baskets. These projects are exploring new approaches to financial inclusion and regional currency design, particularly in underserved economies.

How Hybrid Stablecoins Work

Hybrid stablecoins combine elements from different categories, such as fiat collateral, crypto reserves, and algorithmic supply control, to improve resilience and flexibility. Some models use variable reserve ratios or diversified collateral types that can adjust based on market conditions. The goal is to create systems that remain stable across different stress scenarios. While promising, these designs often involve greater technical complexity and require strong governance to manage collateral, parameters, and protocol upgrades effectively.

How to Buy Stablecoins on BingX: A Simple Step-by-Step Guide

Buying stablecoins on BingX is fast and beginner-friendly. Here’s a simple guide to help you get started.

Step 1: Sign Up and Verify

Go to

BingX.com or open the BingX app. Create an account with your email or phone number. Complete identity verification to unlock full trading features.

Step 2: Add Funds

Click “Deposit” in your wallet. You can transfer crypto from another wallet or buy crypto using fiat with supported methods like credit cards or bank transfers.

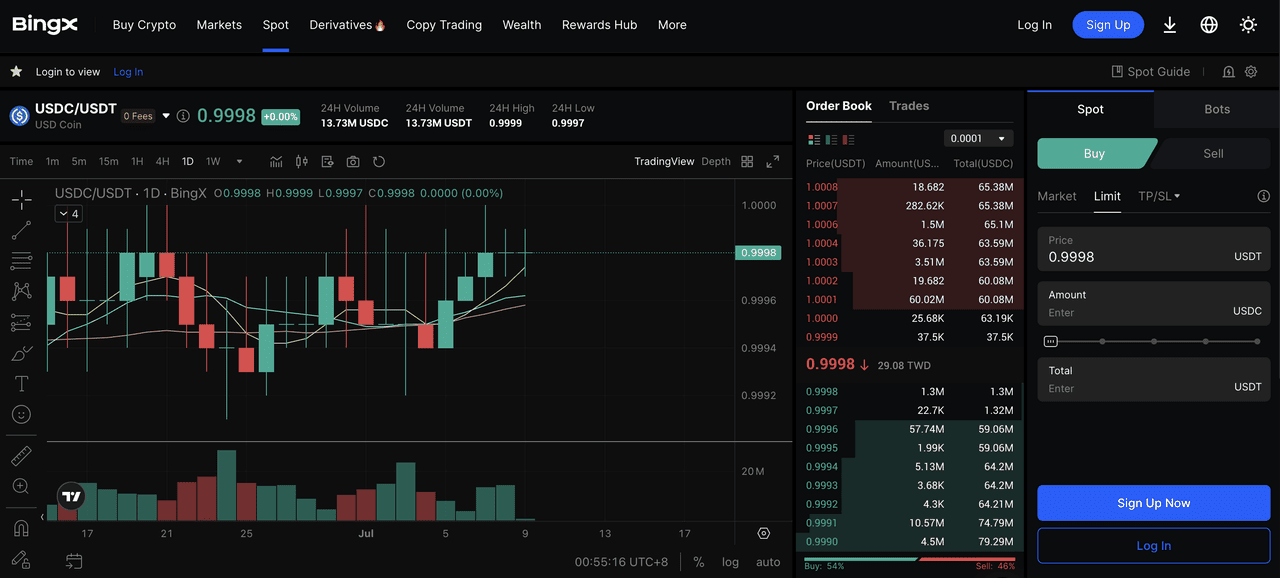

Step 3: Choose a Stablecoin

Use the Spot market to search for stablecoins such as USDT, USDC, PYUSD, or USDe. Select a trading pair that matches your funding method.

Step 4: Place an Order

Choose “

market order” to buy instantly at the current price. Enter the amount and confirm your purchase.

Step 5: Use or Hold

After purchase, your stablecoins appear in your wallet. You can hold, convert, transfer, or use them for trading on BingX, or participating in DeFi activities.

Key Considerations Before Investing in Stablecoins

Before buying or holding stablecoins, it's important to understand the risks and limitations involved. While stablecoins offer many benefits, not all are created equal. Here are a few factors to keep in mind:

1. Reserve Transparency: Check whether the issuer provides regular audits or

proof-of-reserve reports. Fiat-backed and yield-bearing stablecoins should show exactly what assets back each token.

2. Centralization Risk: Some stablecoins rely on a single company or custodian. This can introduce operational dependencies, such as the ability to freeze accounts or modify policies based on regulatory requirements.

3. Peg Stability: Look at the token’s historical price performance. Algorithmic or hybrid stablecoins may be more prone to depegging during volatile markets. For example, TerraUSD (UST), an algorithmic stablecoin, lost its peg in 2022 due to extreme market conditions and liquidity pressure.

4. Regulatory Exposure: Regulatory treatment varies by region. Yield-bearing stablecoins and algorithmic models may face tighter restrictions, especially if offered to retail users. Some may be classified differently depending on how they are structured.

5. Use Case Fit: Choose a stablecoin that matches your purpose. For example, USDC is often preferred for compliance and DeFi, while USDT is widely used for trading due to its global availability and liquidity.

Future Outlook for the Stablecoin Market

Stablecoins are poised for continued growth, with total market capitalization already above $255 billion in 2025 and projections suggesting the market could surpass $500 billion by 2028. Transaction volume exceeded $27 trillion in 2024, reflecting strong demand across payments, savings, and decentralized finance.

This momentum is expected to continue as institutions enter the space, regulations become clearer, and new models like yield-bearing and programmable stablecoins gain traction. These innovations are pushing stablecoins beyond trading and into real-world financial infrastructure, supporting everything from cross-border settlements to tokenized asset flows.

While risks around peg stability, technical design, and compliance remain important to monitor, the stablecoin sector is steadily progressing toward greater maturity. For both individuals and institutions, stablecoins represent a practical and scalable foundation for the next generation of digital finance.

Related Reading