The Solana Virtual Machine (SVM) is the core execution environment that powers

smart contracts on the Solana blockchain, enabling high-speed and low-cost transactions at scale.

As blockchain infrastructure continues to evolve, virtual machines have become essential for enabling smart contract execution and powering decentralized applications (

dApps). While many networks have built on earlier models,

Solana introduced a different design focused on performance from the ground up. The Solana Virtual Machine reflects this priority. By combining parallel processing with a localized fee structure, it allows the network to process thousands of transactions per second efficiently. For builders and users alike, SVM represents a new chapter in blockchain scalability.

What Is a Virtual Machine?

A virtual machine (VM) is a software-based system that emulates the functions of a physical computer. In the context of blockchains, a VM serves as the execution layer where smart contracts run. It processes transactions, manages the network’s state, and ensures that all changes are validated across the network.

Unlike traditional VMs used for isolated computing environments, blockchain virtual machines are decentralized. Every

validator node runs its own copy of the VM, which helps maintain consensus, security, and fault tolerance across the network.

What Is Solana Virtual Machine (SVM) and How Does it Work?

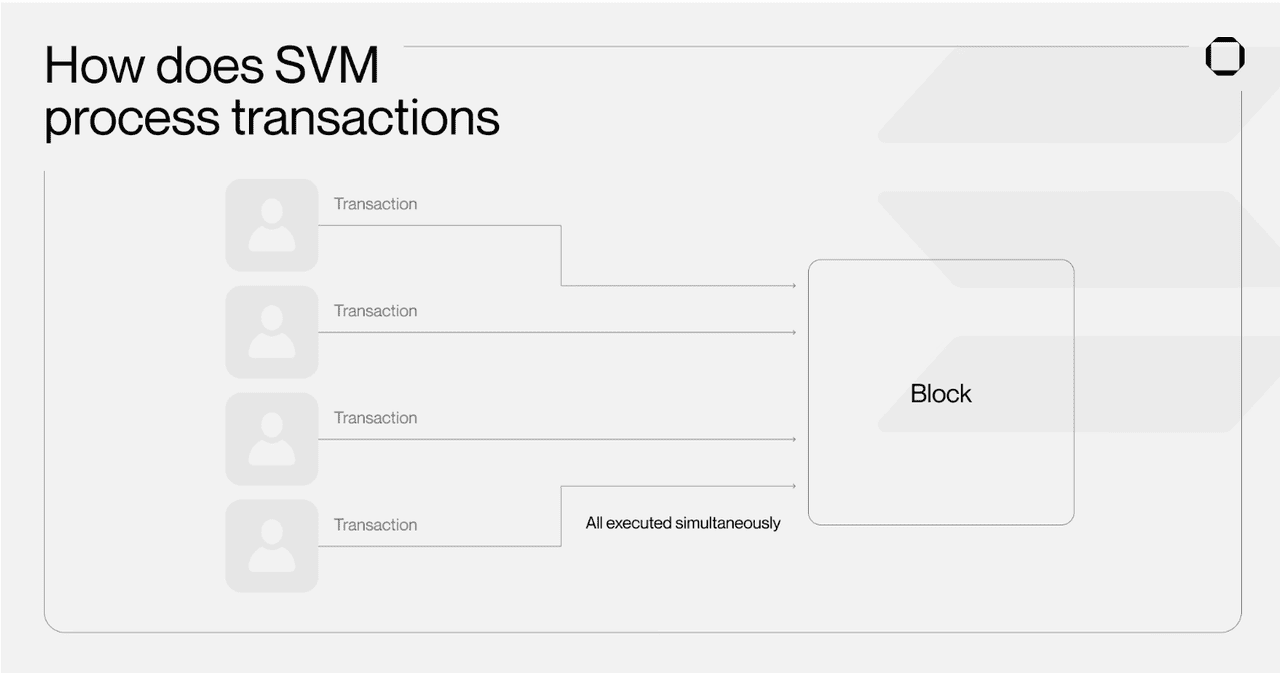

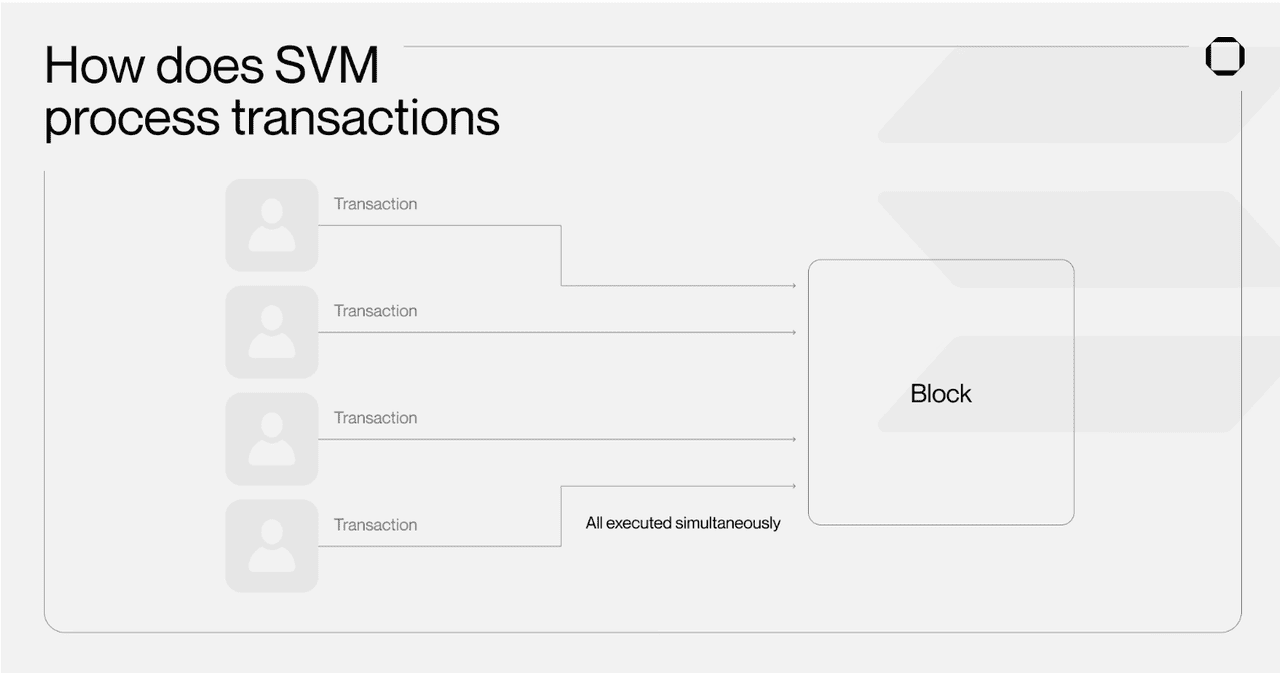

The Solana Virtual Machine (SVM) is the core execution environment that runs smart contracts and decentralized applications on the Solana blockchain. Each validator runs its own SVM instance, creating a decentralized system that isolates failures and enables parallel transaction processing.

Source: Squad.so

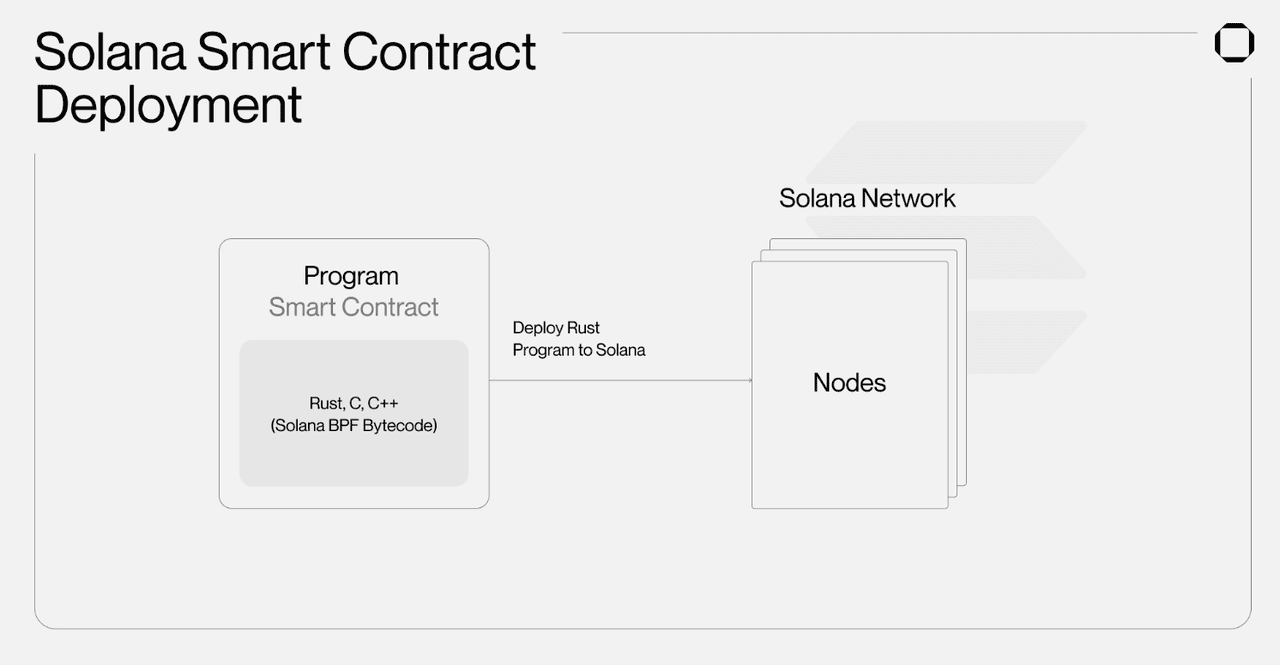

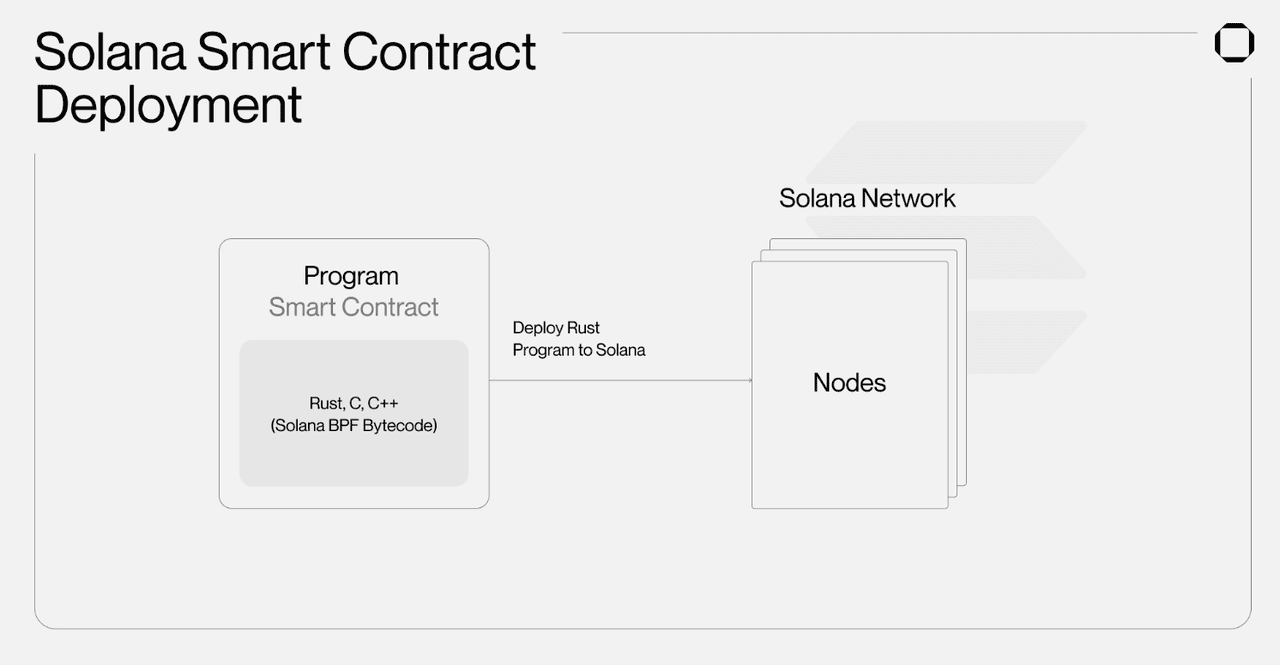

Smart contracts on Solana are written in Rust, C, or C++, with Rust being preferred for its performance, memory safety, and concurrency. Code is compiled into BPF bytecode for efficient execution across the network. This high-performance foundation supports everything from decentralized exchanges like

Jupiter and

Raydium to high-traffic platforms such as

Pump.fun, where thousands of

Solana memecoin transactions occur rapidly.

The SVM operates across validator nodes in a coordinated system:

1. Smart Contract Execution and Synchronization: When a smart contract is deployed, it is compiled into Berkeley Packet Filter (BPF) bytecode and executed simultaneously by validator nodes. This distributed execution model ensures that all validators process the same transactions and reach identical state updates, maintaining consensus across the network. The BPF environment provides strong isolation and performance, allowing Solana to make full use of modern processors.

This model is critical for applications that demand fast and consistent processing, such as real-time trading on

Solana-based DEXs or automated vault interactions in DeFi protocols.

Solana Wallets like Phantom or Backpack depend on this level of performance to deliver smooth experiences, even during heavy user activity.

Source: Squad.so

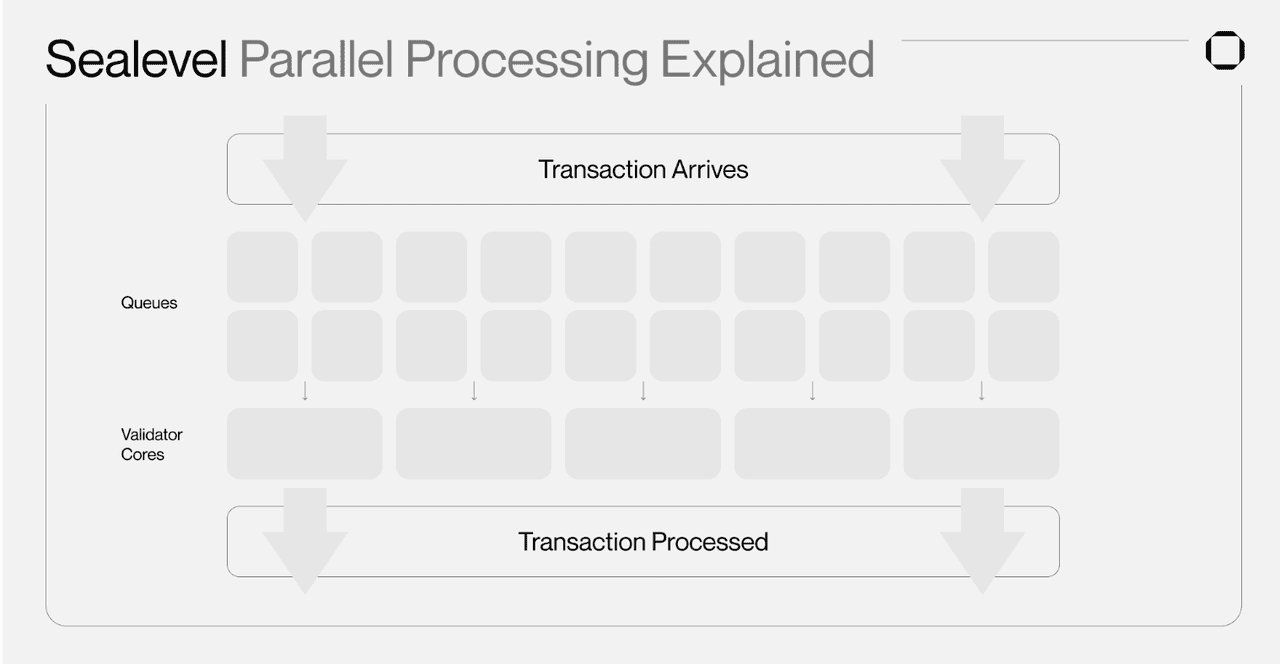

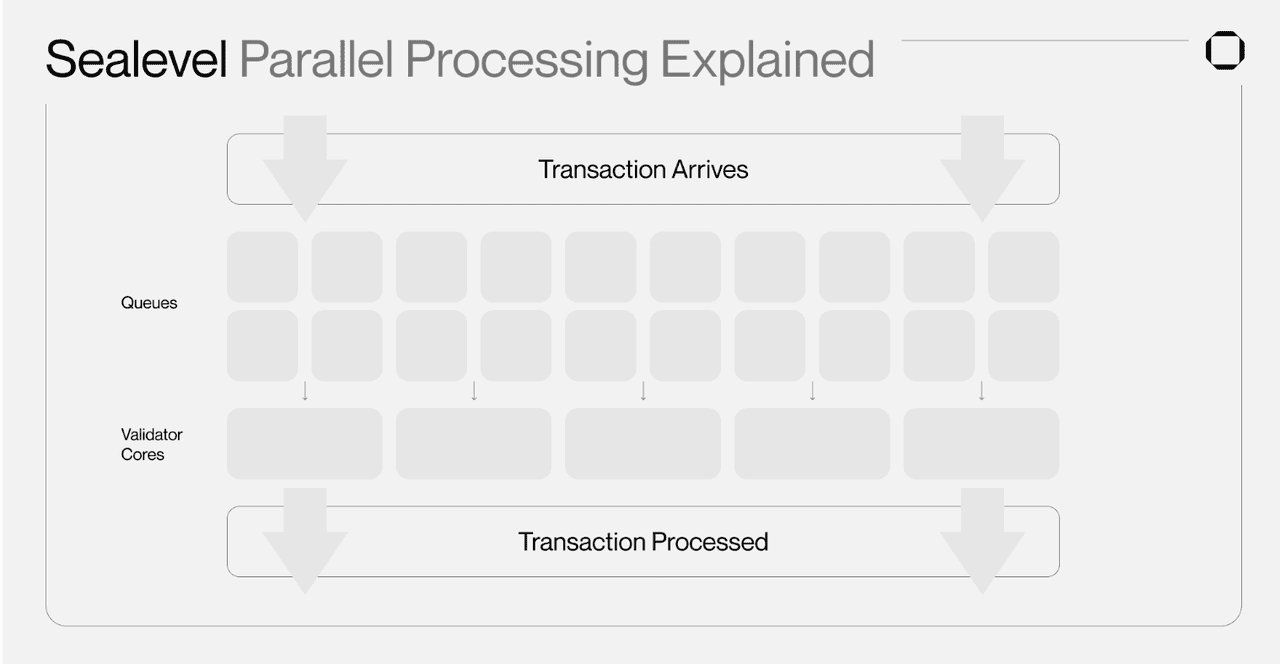

2. Parallel Processing with Sealevel: Sealevel, Solana's runtime engine, scans each transaction to determine which accounts it interacts with. If two transactions do not touch the same accounts, they can run in parallel across different CPU cores. This allows the system to maximize hardware usage by executing multiple operations at once, while any overlapping transactions are automatically sequenced to maintain accuracy and prevent conflicts.

This architecture powers highly interactive platforms like

LetsBONK.fun, where users mint and trade memecoins in real time. Even during massive traffic surges, Solana remains responsive because its parallel processing model handles volume without delay.

Source: Squad.so

3. Optimistic Concurrency Control: Sealevel also uses an optimistic concurrency model. It assumes most transactions will not conflict, so it processes them in parallel right away. If a conflict is detected after execution, the affected transaction is rolled back and retried in the correct order. This approach preserves network consistency while maintaining the benefits of parallel speed.

This system is especially effective in high-volume environments such as

NFT mints, token

airdrops, or meme-driven trading apps. It allows the network to keep moving forward quickly while handling conflicts quietly in the background, giving users a seamless experience even when activity spikes.

SVM vs EVM: Key Differences

The Solana Virtual Machine (SVM) and

Ethereum Virtual Machine (

EVM) are both designed to run smart contracts and power decentralized applications. While they serve the same purpose, they’re built on different design principles, which lead to different strengths in performance, cost, development experience, and scalability.

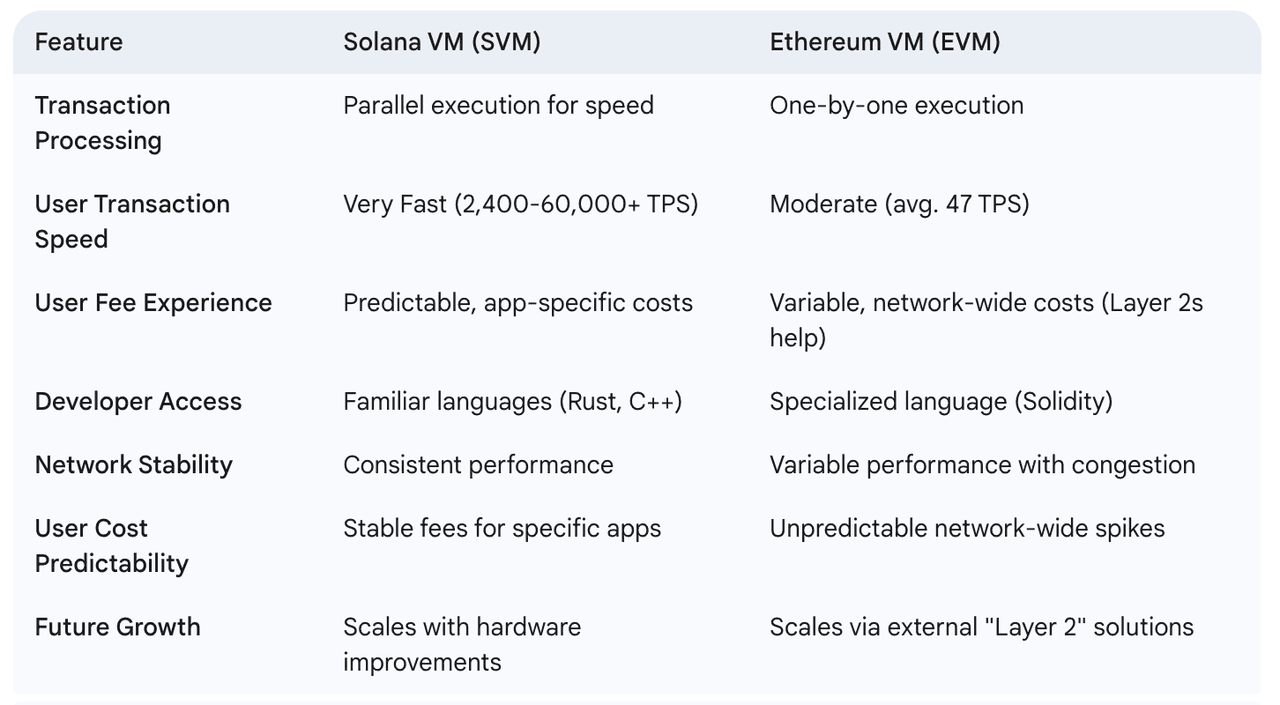

How Fast Apps Feel: Runs in Parallel vs One at a Time

SVM is designed to handle many transactions at the same time. It spreads the work across multiple cores in each validator’s computer, helping the network stay fast and responsive even when activity is high. This makes it a strong fit for apps that need real-time updates, like games or trading platforms.

EVM processes transactions one by one. This approach is simpler and easier to follow, which has helped Ethereum earn a strong reputation for reliable and secure execution. While it may slow down during peak times, the model is time-tested and well-understood by developers.

Fee: Separated Pricing vs Shared Costs

SVM uses a localized fee system. Each application has its own fee market, so if one app becomes busy, it won’t raise the cost for others. This makes transaction fees more predictable, especially for apps that depend on consistent pricing.

EVM uses a shared fee system. When one app gets popular, it can raise fees across the whole network. This creates less predictability, but also encourages innovation in scaling solutions, like rollups, that aim to reduce congestion and bring costs down.

Developer Experience: Familiar Languages vs a Focused Toolset

SVM supports languages like Rust and C++, which are commonly used in traditional software development. For many developers, this means they can start building on Solana without needing to learn a completely new language.

EVM relies on Solidity, a language created specifically for smart contracts. It takes some time to learn, but it comes with the benefit of a large, active community, mature tools, and a wide range of ready-to-use code libraries.

Scalability: Scales with Hardware vs Expands with Additional Layers

SVM is built to take advantage of better hardware. As validator machines become faster and more powerful, the network can naturally scale by using more processing cores to handle more transactions at once.

EVM takes a different path. Instead of relying on hardware upgrades, Ethereum is scaling through a multi-layer approach. Layer 2 solutions like rollups move much of the transaction activity off the main chain, helping the network grow while keeping its foundation simple and secure.

Top 5 SVM Projects Beyond Solana to Watch in 2025

The most compelling evidence of SVM's advantages comes from major blockchain projects choosing to adopt it outside of Solana's native chain, where they have alternatives like EVM. These deliberate adoptions demonstrate SVM's technical superiority and are creating a multi-chain SVM ecosystem.

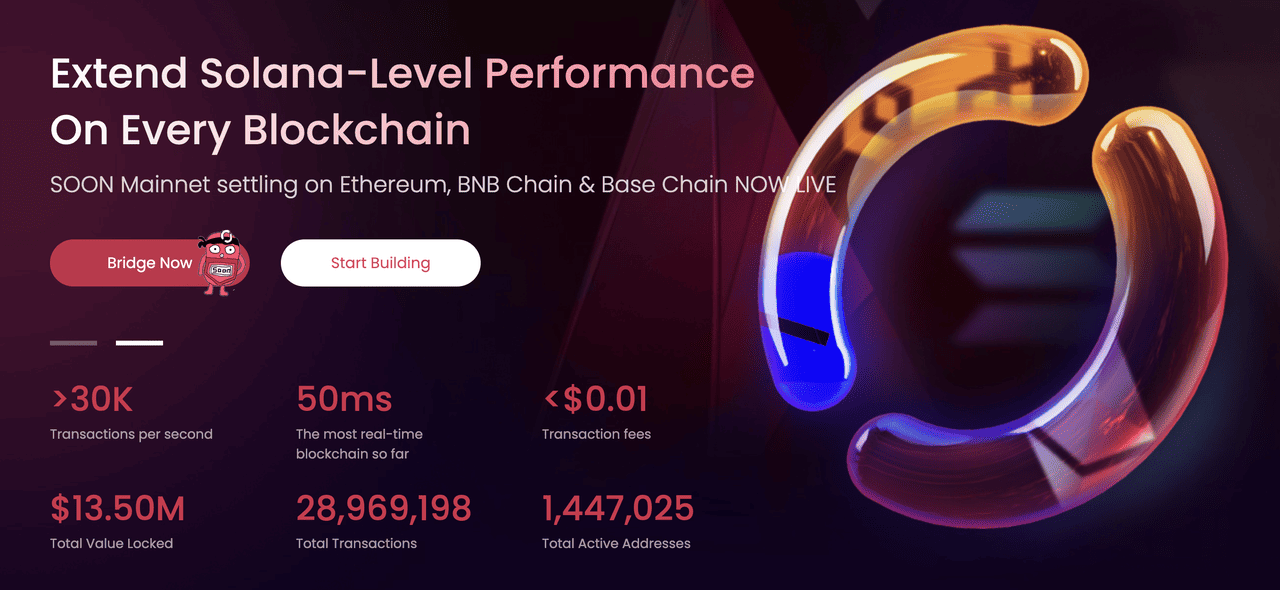

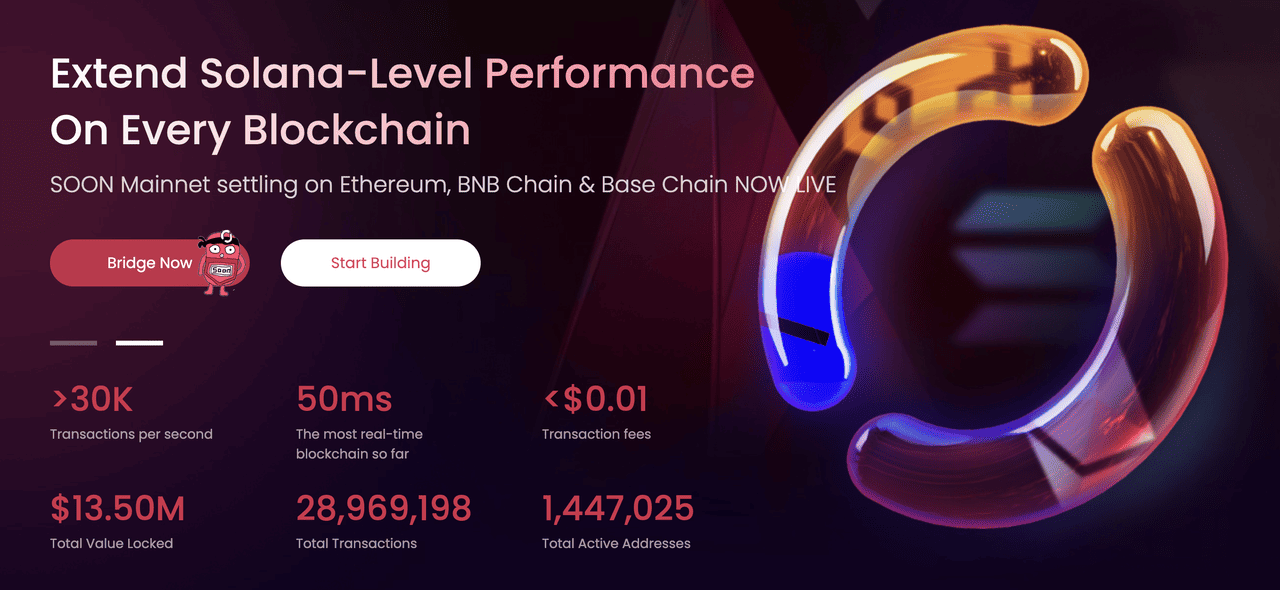

SOON: Multichain Layer 2 Infrastructure Stack

Source: Soo.Network

SOON Network is a high-performance rollup protocol that brings the Solana Virtual Machine to other blockchain ecosystems, allowing developers to launch fast, scalable chains on

Ethereum,

BNB Chain, and more. The platform launched its Alpha mainnet in January 2025 and raised $22 million through an

NFT sale, demonstrating strong market validation for SVM expansion beyond Solana's native chain.

By decoupling SVM from Solana's consensus mechanism, SOON delivers low-cost execution with Ethereum-level security and liquidity. The protocol combines three core components: SOON

Mainnet as a

Layer 2 rollup settling on Ethereum, SOON Stack as a modular framework for launching SVM-based chains, and InterSOON as a messaging layer for native cross-chain communication. With claims of 50-millisecond block times compared to Solana's 400 milliseconds, SOON showcases how SVM's architecture can be optimized for rollup environments while maintaining superior performance across multiple blockchain networks.

Sonic SVM: Gaming-Focused Chain Extension

Source: Sonic.game

Sonic SVM is the first chain extension on Solana, specifically designed for gaming applications and what they call the "industry's first TikTok App Layer." Built using the HyperGrid framework, Sonic enables sovereign game economies that process millions of requests per second while settling back onto Solana

Layer 1. The platform launched its $SONIC token in January 2025, raising $12 million in Series A funding to fuel its growth in the Solana gaming ecosystem.

What sets Sonic apart is its compatibility with both Solana and Ethereum Virtual Machine programs, allowing developers to write EVM applications and execute them as SVM contracts. The platform has partnered with over 20 ecosystem partners including Backpack and

Pyth, while signing contracts with more than 10 game studios. Sonic's architecture reduces transaction costs by up to 100x compared to regular Solana transactions while maintaining native composability with Solana's existing programs and liquidity.

Eclipse: Ethereum's High-Performance SVM Layer

Source: Eclipse

Eclipse is a modular rollup framework that uses SVM for execution while settling transactions on Ethereum. The project leverages Celestia for data availability and RISC Zero for

zero-knowledge proofs, creating a hybrid architecture that brings SVM's performance benefits to Ethereum users. Eclipse targets throughput capabilities similar to Solana's 2,400+ TPS while maintaining Ethereum's security guarantees, with transaction costs as low as $0.0002.

What sets Eclipse apart is its efficient state handling mechanism that requires specific state specifications for each transaction, optimizing processing efficiency. The platform recently secured $50M in Series A funding and supports

DeFi,

gaming, and consumer applications. Eclipse's fraud proof architecture operates without intermediate state serialization, using RISC Zero to create

ZK proofs of SVM execution while

Celestia ensures historical data integrity.

Termina by Nitro Labs: Cross-Chain Bridge to Cosmos Ecosystem

Source: Termina.technology

Nitro Labs originally developed an optimistic rollup called Nitro that enabled Solana applications to run natively on

Sei, a Cosmos-based blockchain. The project leveraged SVM's execution environment to provide IBC compatibility, allowing Solana dApps to expand into the

Cosmos ecosystem without code modifications. By utilizing SVM's multi-threaded architecture, Nitro achieved significantly higher throughput than traditional single-threaded rollups.

The company has since pivoted to focus on Termina, a Network Extension Platform that scales applications directly within the Solana ecosystem rather than cross-chain deployment. After raising $4M in late 2024, Termina now offers modular infrastructure including zkSVM provers, SVM engines, and data modules that allow developers to create custom-tailored scaling solutions. While the original cross-chain vision demonstrated SVM's versatility beyond Solana, Termina's success reflects the growing demand for high-performance infrastructure within the Solana ecosystem itself.

Atlas by Ellipsis Labs: Verifiable Finance Infrastructure

Source: Atlas.xyz

Atlas is a high-performance Layer 2 blockchain built on a custom implementation of the Solana Virtual Machine, designed for "verifiable finance" applications that require traditional finance performance with DeFi transparency. Developed by Ellipsis Labs, the team behind Phoenix

DEX which has processed over $50 billion in trading volume on Solana, Atlas addresses infrastructure challenges of building financial primitives on general-purpose blockchains.

The platform settles to Ethereum mainnet while using SVM for execution, enabling developers to deploy existing Solana programs with full compatibility. Atlas features 50-millisecond slot intervals with full state merklization, capable of handling 65,000+ transactions per second with near-zero costs. After raising $21 million from Haun Ventures, Atlas launched its private testnet and plans mainnet deployment in Q2 2025, targeting sophisticated financial applications like orderbook-based trading and efficient credit markets.

How to Evaluate Solana SVM Projects Before Investing

With the growing number of SVM-based projects across multiple chains, investors need a systematic approach to evaluate opportunities and identify legitimate projects with strong fundamentals.

1. Technical Architecture Assessment: Examine whether the project leverages SVM's core advantages like parallel processing and localized fee markets. Verify that cross-chain projects have solved technical challenges such as state validation and fraud proofs. Check GitHub activity, code quality, and security audits to ensure the team understands SVM's requirements rather than copying existing code.

2. Team and Ecosystem Evaluation Research the founding team's experience with blockchain development and SVM implementation, particularly those with Solana or DeFi backgrounds. Evaluate partnerships with reputable organizations, venture backing, and protocol integrations. Look for active developer communities, regular updates, and transparent communication about achievements and challenges.

3. Market Positioning and Use Case Validation Assess whether the project addresses genuine needs that benefit from SVM's advantages, such as high-frequency trading or gaming. Examine

tokenomics for fair distribution and reasonable inflation rates. Compare metrics like

TVL, daily users, and transaction volume against competitors, considering that early-stage SVM projects may have lower numbers but higher growth potential.

Solana 2025 Upgrades: What Firedancer and Alpenglow Mean for SVM

Solana's network upgrades will enhance performance across the entire SVM ecosystem, benefiting not only native Solana applications but also cross-chain SVM implementations like Eclipse, SOON, and Nitro.

Firedancer: The Game-Changing Validator Client

Firedancer, developed by Jump Crypto, represents a complete rewrite of Solana's validator software scheduled for full deployment in 2025. The upgrade has already demonstrated processing over 600,000 transactions per second on testnet, compared to Solana's current theoretical limit of 50,000 TPS. Currently in intensive testing phase, Firedancer employs a modular architecture for better fault isolation and more efficient memory management. This client diversity significantly reduces network vulnerability and enhances overall network resilience.

Alpenglow: Revolutionary Consensus Protocol

Alpenglow represents Solana's largest protocol change ever, developed by Anza's research team. The upgrade replaces Solana's existing consensus systems with new components called Votor and Rotor, aiming to achieve transaction finality in just 100-150 milliseconds compared to the current 12.8 seconds. The new system allows blocks to reach finality through faster pathways depending on network approval, while reducing validator costs and operational complexity. The official timeline targets early 2026, but the team hopes to potentially showcase Alpenglow at Breakpoint 2025.

Network Capacity Improvements

Beyond these major upgrades, Solana plans to double its block space by 2025 and has already achieved a 20% increase in block capacity with recent releases. Additional improvements include enhanced security and optimized processing capabilities. All SVM-based rollups and cross-chain implementations will inherit these performance benefits, making the entire SVM ecosystem more powerful and reliable.

Final Thoughts

The Solana Virtual Machine is rapidly evolving from a Solana-exclusive technology into a multi-chain standard that could reshape the blockchain landscape. Major projects across different ecosystems are choosing SVM over established alternatives, demonstrating genuine competitive advantages that extend far beyond marketing hype. This cross-chain adoption signals a fundamental shift in how developers and institutions view blockchain performance requirements.

For investors and developers, the SVM expansion represents a significant opportunity as the blockchain industry moves toward high-performance infrastructure. As traditional networks face scalability challenges, SVM-based solutions offer a pathway to previously impossible applications and use cases. The key is identifying projects that genuinely leverage SVM's capabilities rather than following trends. With proper evaluation and strategic positioning, early participants in the SVM ecosystem could capture substantial value as mainstream adoption accelerates across multiple blockchain networks.

Related Reading