Global interest in cryptocurrencies continues to rise, following the SEC’s approval of spot Bitcoin and Ethereum ETFs in 2024. Building on that momentum, attention has turned to Solana, where the first U.S.

Solana staking ETF launched in July 2025, recording $12 million in inflows and $33 million in trading volume on its debut. That fund now manages more than $300 million in assets.

In the months that followed, issuers including Fidelity, Franklin Templeton, Grayscale, VanEck, and Bitwise filed and later amended applications for spot Solana ETFs, adding details on staking and redemption. Those filings are now reaching final SEC deadlines, turning October 2025 into what analysts are calling “ETF Month.” The decisions could not only determine the launch of Solana spot ETFs but also pave the way for similar blockchain-linked products.

Discover what a spot Solana ETF is, how it works, and when investors can expect spot Solana ETFs to launch in the U.S. amid growing institutional demand.

Polymarket's odds for a Solana ETF approval in the US | Source: Polymarket

Surging Interest in Crypto ETFs: Spotlight on Solana

The recent launch of spot Bitcoin and Ethereum ETFs in 2024 and the impressive performance of

Solana's native token,

SOL, have energized the cryptocurrency world. With nearly $900 million in assets flowing into spot Ethereum ETFs since their late July 2024 debut and the largest

Bitcoin ETF, the iShares Bitcoin Trust (IBIT), now holding over $20 billion since January 2025, investor appetite for crypto exposure is stronger than ever.

Meanwhile, SOL has seen significant volatility in 2025 but surged by about 37% over the past 3 months, reflecting renewed enthusiasm for the Solana platform. This momentum has sparked speculation about the possibility of a U.S. spot Solana ETF joining the crypto investment landscape.

What Is Solana (SOL)?

Source: SOL price on

BingX

Solana (SOL) has emerged as a standout performer in 2024 and still making waves in 2025, gaining recognition for its scalability, low transaction costs, and high-speed performance. Often called an “

Ethereum killer,” Solana's ecosystem has rapidly expanded, featuring a thriving decentralized finance (

DeFi) sector, booming

NFT projects, and a growing memecoin market. These advancements have boosted Solana's reputation and attracted significant institutional interest, positioning it as a key player in the crypto market. Over the past year, Solana's price has increased dramatically, making it one of the best-performing leading crypto assets. Solana's on-chain activity has surged, driven by increased memecoin activity and the launch of new tokens in its ecosystem. This growth has powered

Solana's DeFi ecosystem, with many meme tokens actively traded on decentralized exchanges like

Raydium and

Jupiter. As a result, Solana's total value locked (TVL) has risen significantly in 2025, reflecting the platform's expanding influence.

Solana is a fast, scalable, and user-friendly blockchain platform designed to support a wide range of applications. Its standout features include:

1. High Speed and Low Fees: Solana can process thousands of transactions per second at much lower costs than many other blockchains, making it attractive for a variety of uses.

2. Proof of History Consensus Mechanism: Solana uses a unique combination of proof of stake (

PoS) and proof of history (PoH) to achieve its efficiency. PoH helps verify the order of transactions without the heavy computational demands of traditional proof of work systems.

3. Smart Contracts: Like Ethereum, Solana enables developers to create decentralized applications (

dApps) using smart contracts, opening the door to innovations in finance,

gaming, and supply chain management.

In 2025,

Solana is rolling out major upgrades including Firedancer, a high-performance

validator client developed by Jump Crypto, and Alpenglow, a new consensus protocol aimed at sub-second finality. These upgrades are expected to boost throughput, reduce latency, and further solidify Solana’s position as a leading

Layer 1 blockchain.

Key Uses of Solana

Solana is widely used across several sectors in the blockchain space thanks to its speed and low transaction costs. In decentralized finance (DeFi), it powers leading projects like Jupiter (a top DEX aggregator), Meteora (liquidity management), and Marginfi (lending and leverage). For NFTs, platforms such as

Magic Eden and Tensor offer marketplaces where users can mint, buy, and trade digital art, collectibles, and in-game items efficiently and with low fees.

Beyond finance and NFTs, Solana supports popular blockchain games like Aurory, Star Atlas, and Mini Royale: Nations, all of which rely on fast, inexpensive transactions to deliver seamless gameplay. It's also gaining ground in areas like supply chain transparency, with use cases still emerging. In payments, Solana enables fast, low-cost transactions through tools like Solana Pay, which lets merchants accept crypto payments directly from

wallets. These examples highlight Solana's growing role as a versatile platform for both developers and end users.

What Is a Solana ETF?

An Exchange-Traded Fund (

ETF) is an investment fund traded on stock exchanges, tracking the performance of specific assets or indices. ETFs offer convenience,

liquidity, and regulatory oversight, making them a preferred choice for many investors seeking exposure to stocks, bonds, commodities, and now, cryptocurrencies.

A Solana ETF is a proposed investment fund designed to track the performance of Solana's native cryptocurrency, SOL. It allows investors to gain exposure to Solana's price movements through traditional brokerage accounts, eliminating the need to manage crypto wallets or

private keys. By purchasing shares of a Solana ETF, investors can participate in Solana's growth in a secure and regulated manner.

How Would a Solana ETF Work?

Although Solana ETFs are not yet approved in the U.S., their potential operation would mirror that of existing cryptocurrency ETFs:

• Creation of the ETF: A financial institution acquires SOL or related financial instruments to back the ETF.

• Fund Structure: The ETF's value is tied to SOL's market price or derivatives, and shares represent a portion of the fund's total assets.

• Trading on Exchanges: The ETF is listed on stock exchanges, allowing investors to trade shares during market hours.

• Valuation: The Net Asset Value (NAV) reflects the total value of SOL held by the ETF divided by the number of outstanding shares.

• Management and Fees: The fund charges a management fee, typically a small percentage of its assets.

Spot Solana ETF Applications with the U.S. SEC

The race to launch the first spot Solana ETF is intensifying, with multiple financial institutions submitting applications to the U.S. Securities and Exchange Commission. These proposed ETFs aim to provide regulated exposure to Solana, enabling investors to benefit from the blockchain's growth without directly purchasing or managing cryptocurrency.

1. VanEck Solana Trust: Filed in June 2024, VanEck became the first firm to submit an S-1 registration with the SEC for a U.S.-based spot Solana ETF. The proposal aims to track the price of SOL directly and highlights Solana’s scalability, low transaction costs, and expanding decentralized application ecosystem, positioning the blockchain as a strong alternative to Ethereum.

2. 21Shares Core Solana ETF: Also filed in June 2024, 21Shares submitted an S-1 application to list a spot Solana ETF on the Cboe BZX Exchange. The filing emphasizes Solana’s decentralized nature and argues that SOL should be classified as a commodity under U.S. regulations, further supporting its eligibility for a spot ETF product.

3. Bitwise Solana ETF: In November 2024, Bitwise refiled an S-1 with the SEC after initially registering a Solana ETF through a Delaware statutory trust. The updated filing reflects the company’s shift toward more formal SEC engagement and reaffirms its intention to provide institutional access to Solana through a spot investment vehicle.

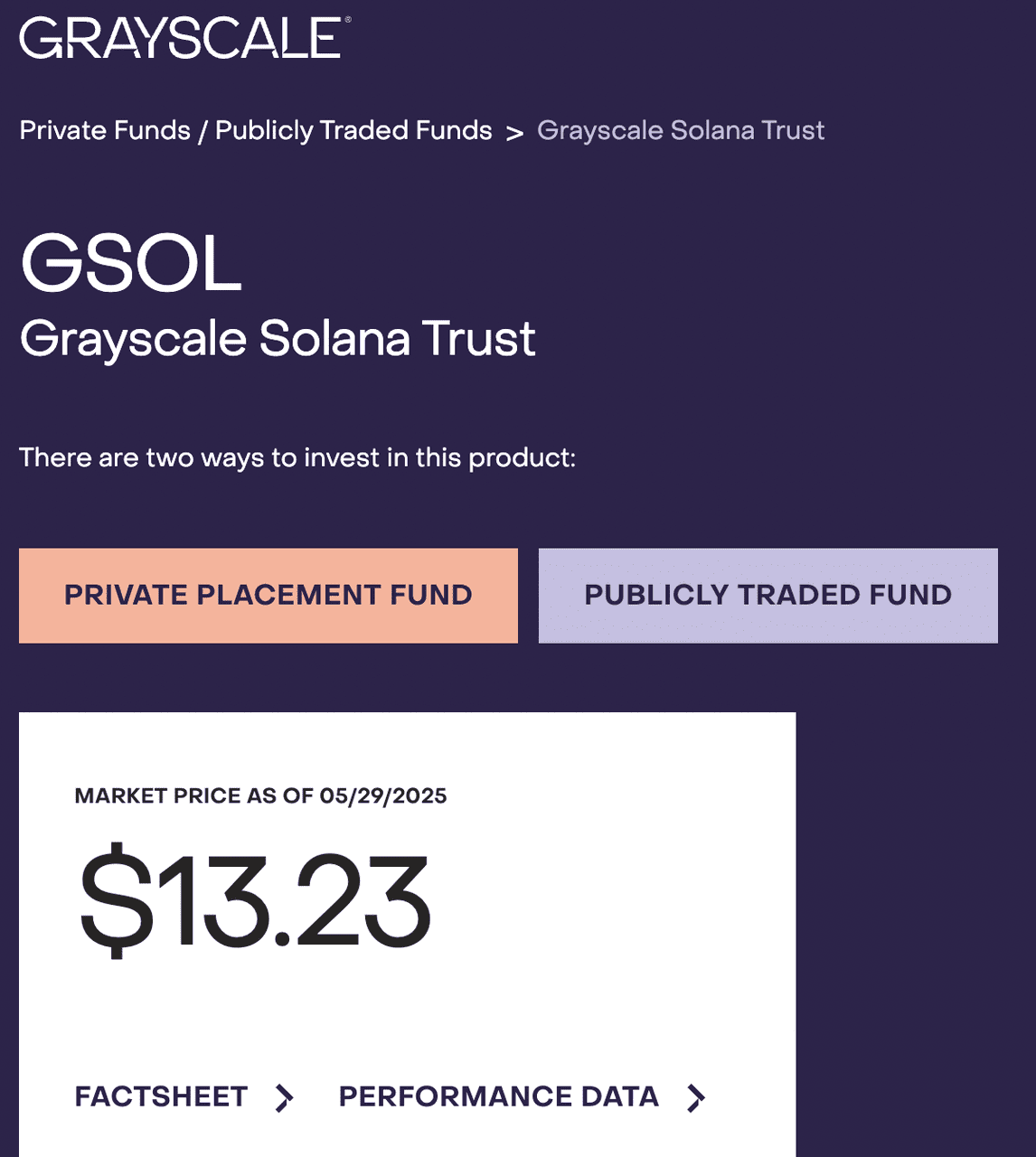

4. Grayscale Solana Trust (Conversion to Spot ETF): Filed in January 2025, Grayscale applied to convert its existing Solana Trust (GSOL), with over $134 million in assets under management, into a spot ETF to be listed on NYSE Arca. The move builds on Grayscale’s experience in the ETF space and aims to offer greater liquidity and market access for SOL investors.

5. Canary Solana ETF: Filed between late 2024 and early 2025, Canary Capital’s S-1 application for a Solana ETF is part of a broader effort that includes filings for Litecoin and Ripple. The firm points to growing market maturity and a post-election shift in regulatory outlook as key reasons for pursuing altcoin ETF approval.

6. Franklin Templeton Solana ETF: In March 2025, Franklin Templeton filed both S-1 and 19b-4 forms with the SEC to list a spot Solana ETF on the Cboe BZX Exchange. As the sixth major applicant, the filing reflects increasing institutional demand for Solana exposure and marks another step toward mainstream altcoin ETF adoption.

Regulatory Challenges and Market Optimism for a U.S. Spot Solana ETF

Despite the progress in filing these applications, regulatory challenges remain the primary hurdle. The SEC has historically been cautious about crypto-related ETFs, citing concerns about market manipulation, transparency, and investor protection. However, changes in regulatory leadership and growing institutional demand could pave the way for approving spot Solana ETFs and other crypto products.

The approval of spot Ethereum ETFs has fueled optimism about a U.S. spot Solana ETF. However, experts caution that regulatory hurdles remain significant. The approval of Ethereum ETFs does not guarantee similar approvals for other cryptocurrencies. The future of a Solana ETF will depend on regulatory decisions, the evolution of Solana's ecosystem, and broader political trends in the U.S.

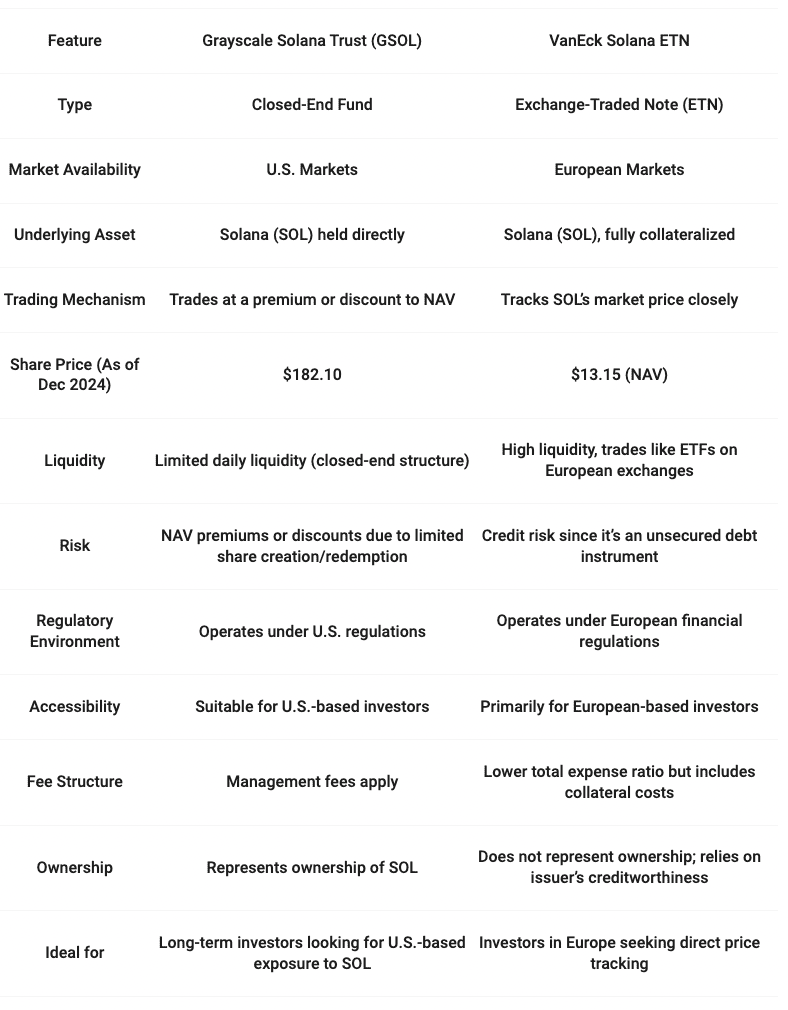

Beyond Spot Solana ETFs: Current Products in the U.S.

Unlike in Canada, spot Solana ETFs are not yet available to U.S. investors. While U.S.-listed Solana ETFs are still awaiting regulatory approval, there are existing alternatives that provide indirect exposure to SOL. There are ETF-like products, such as the Grayscale Solana Trust (a closed-end fund) and the VanEck Solana ETN (an exchange-traded note). Closed-end funds trade intraday like ETFs but do not allow for daily share creation or redemption, which can result in premiums or discounts to net asset value. ETNs are debt securities that track an underlying asset but do not represent ownership of that asset.

1. Grayscale Solana Trust (GSOL)

The Grayscale Solana Trust is a closed-end fund designed for traditional brokerage accounts. It offers exposure to Solana's native token by holding SOL as its underlying asset. Unlike ETFs, closed-end funds like GSOL do not create or redeem shares daily, which means shares can trade at a premium or discount to the fund's net asset value (NAV), depending on market demand.

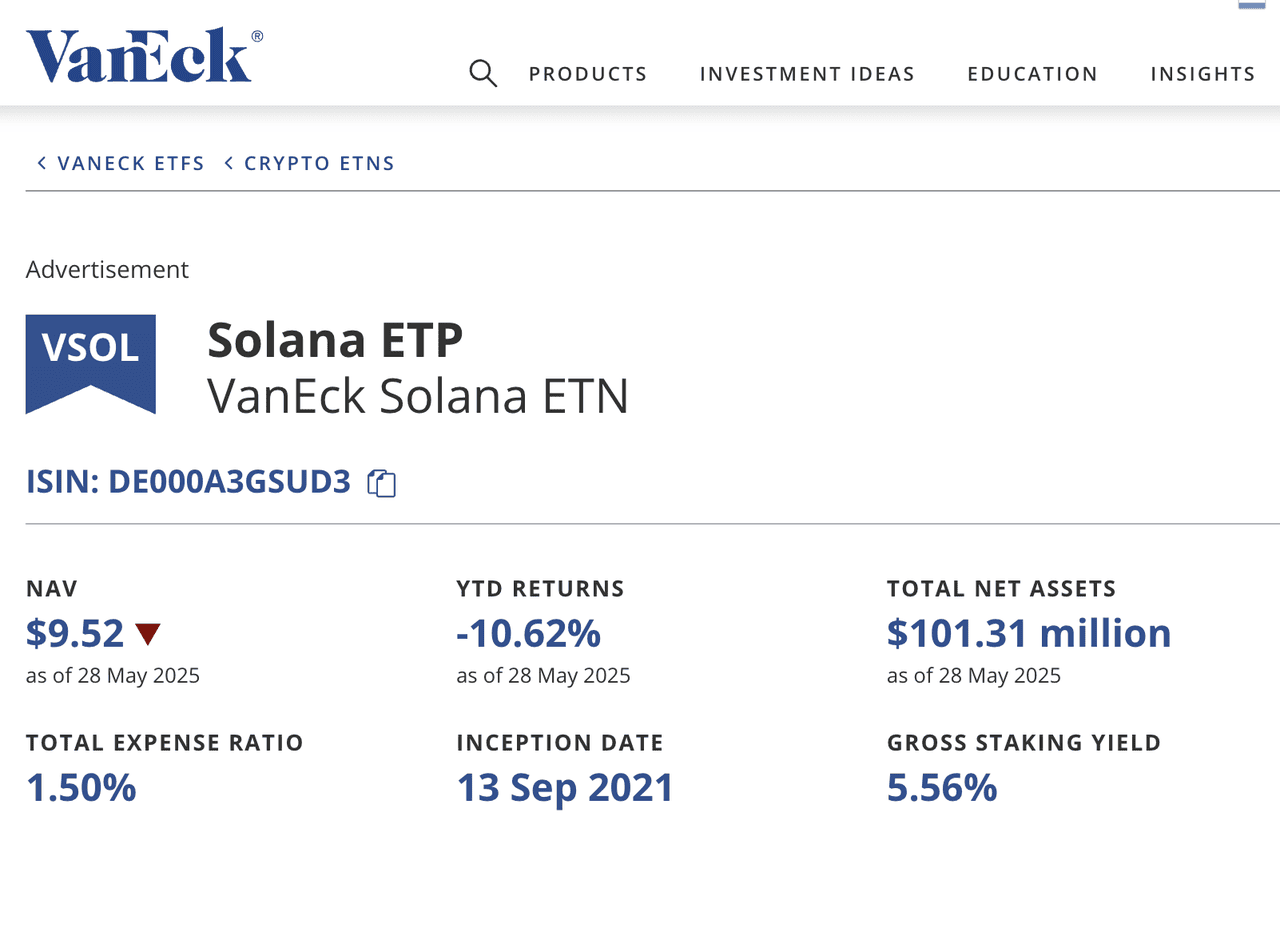

2. VanEck Solana ETN

The VanEck Solana ETN is available primarily in European markets. This exchange-traded note tracks the price of SOL, providing similar exposure to an ETF but with a different structure. ETNs are unsecured debt instruments issued by financial institutions and do not represent ownership of the underlying asset, relying instead on the issuer's creditworthiness.

Key Considerations for Investors

Both the Grayscale Solana Trust and the VanEck Solana ETN offer indirect exposure to Solana, but their unique structures come with distinct pros and cons:

• Grayscale Solana Trust: Easier access for U.S.-based investors but may have price discrepancies due to trading at premiums or discounts to NAV.

• VanEck Solana ETN: Available in Europe and closely tracks SOL prices but introduces credit risk as it is not an equity-backed fund.

It is important for investors to understand these nuances and evaluate whether these products align with their investment goals and risk tolerance.

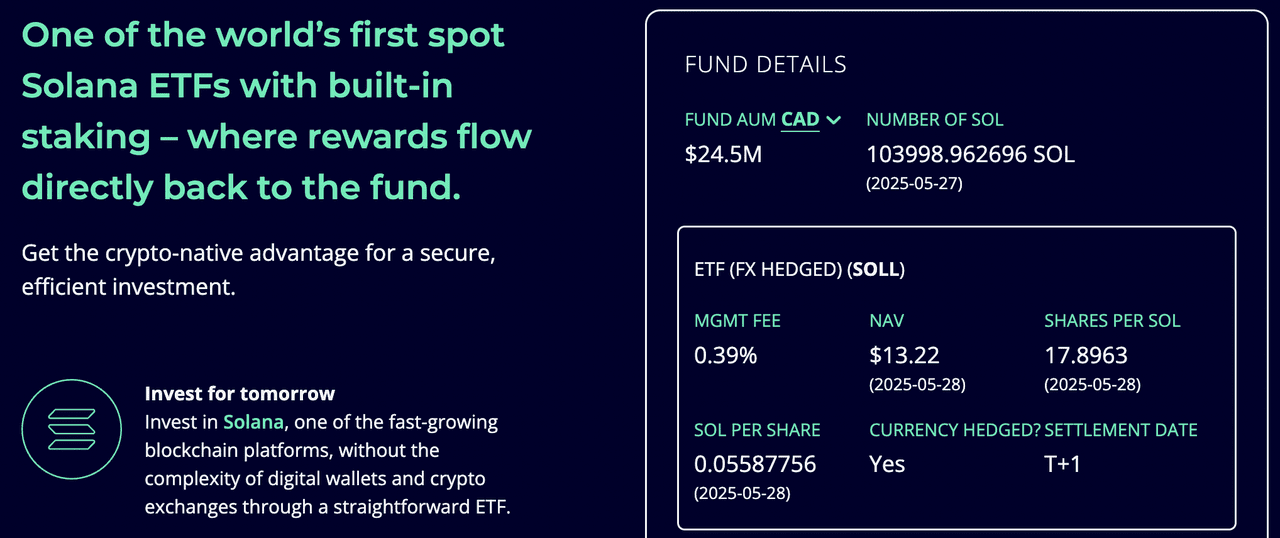

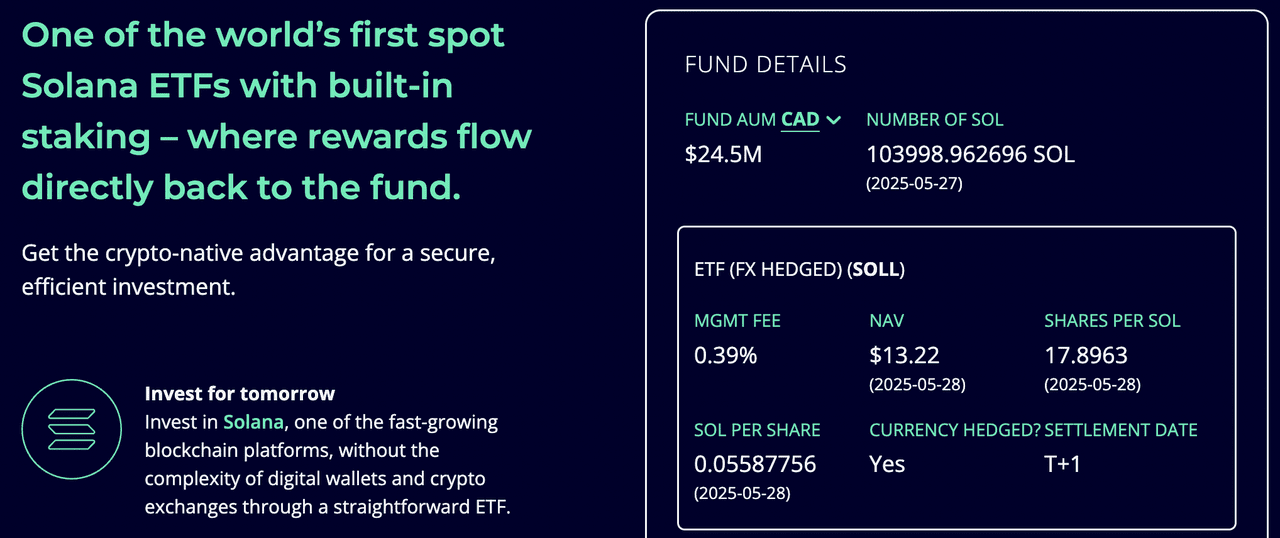

Spot Solana ETFs Debut on the Toronto Stock Exchange

On April 16, 2025, the Toronto Stock Exchange made history by listing four spot Solana ETFs, following approval from the Ontario Securities Commission (OSC). This milestone established Canada as the first country to offer spot Solana ETFs with staking features, marking a significant leap forward for both the Solana ecosystem and global cryptocurrency investment options.

Canada Leads with Innovative SOL Crypto Investment Products

The OSC granted approval to spot Solana ETFs managed by four prominent asset managers: 3iQ, Purpose Investments, Evolve, and CI Financial. These funds differ from products that merely track Solana's price. Instead, they hold actual SOL tokens, providing investors with direct ownership of the underlying asset. To ensure security, the funds use institutional-grade cold storage custody.

Each ETF tracks a unique Solana-related index, offering investors a range of strategies with on-chain asset backing. Despite their structural differences, all four ETFs are intended as long-term investment vehicles, reflecting the issuers' confidence in Solana's potential, especially within the decentralized finance (DeFi) sector.

Security and Regulatory Assurance

The new Solana ETFs are structured to meet stringent regulatory requirements, providing peace of mind for investors. Institutional-grade custody solutions and the oversight of the OSC ensure that assets are protected and that the funds operate transparently. The launch of spot Solana ETFs with staking on the Toronto Stock Exchange opens up exciting new opportunities for both individual and institutional investors. These products combine the ease and security of traditional ETF investing with the innovative potential of blockchain technology and staking rewards. As Solana continues to grow as a leading blockchain for DeFi, NFTs, and Web3 applications, these ETFs offer a convenient and regulated way to participate in its future.

SOL Staking ETF: A New Dimension for ETF Investors

A standout feature of the recently launched U.S. Solana staking ETF is its integration of

SOL staking rewards. Managed by REX-Osprey and supported by Anchorage Digital as the staking partner, the fund allows the SOL tokens it holds to actively participate in securing the Solana network. In return, the network issues staking rewards, which can potentially enhance investor returns.

Additionally, Canada made waves in April 2025 by introducing four spot Solana ETFs (from Purpose, 3iQ, Evolve, and CI/Galaxy) on the Toronto Stock Exchange. These funds similarly integrate SOL staking, earning an estimated 2–3.5% in annual yield, and could even cover or exceed management fees.

This innovative approach not only provides exposure to Solana’s price movements but also offers the added benefit of staking yields. With Solana generally delivering higher staking returns than Ethereum, the ETF could present greater income opportunities compared to similar crypto ETF products.

When Will a Spot Solana ETF Launch?

Regulatory sentiment around altcoin ETFs is heating up, particularly for Solana. Leading analysts Eric Balchunas and James Seyffart of Bloomberg now assign a 95% probability that spot ETFs for Solana, XRP, and Litecoin will receive SEC approval, with final decisions due in October 2025. They have also described the current period as a “wave of new ETFs,” with up to 16 applications including Solana facing deadlines this month.

Bloomberg analysts' expectations for a Solana ETF launch | Source: X

Prediction markets echo this confidence. On

Polymarket, contracts now assign a 99% probability that a Solana ETF will be approved by the end of 2025, reflecting strong investor optimism. This is a sharp shift from earlier in the year, when bets in April placed the odds at only 77% by year-end and 34% by July, showing how sentiment has strengthened as SEC deadlines approach.

Should You Invest in a Solana ETF?

Investing in a Solana ETF can offer several advantages, especially for traditional investors. It provides an easy way to gain exposure to SOL without dealing with crypto wallets, private keys, or exchanges. Since ETFs are regulated financial products, they come with enhanced investor protections. Some funds may even include a mix of Solana and other assets, helping you diversify within a single investment. ETFs also trade on public stock exchanges, offering better liquidity and ease of entry or exit.

However, there are risks to consider. Like SOL itself, a Solana ETF is subject to market volatility and may see large price swings based on investor sentiment and macroeconomic trends. The structure of certain products, such as exchange-traded notes (ETNs) or closed-end funds, may introduce additional complexities, including credit risk or the chance of trading at a premium or discount to net asset value (NAV). Understanding these factors is essential before adding a Solana ETF to your portfolio.

Conclusion

As applications for spot Solana ETFs progress and regulatory attitudes evolve, these products could soon provide investors with a new way to access the Solana ecosystem.

Even before U.S. approval, Solana has demonstrated its momentum with the launch of the first U.S. staking ETF in July and Canadian spot SOL ETFs with staking earlier this year. With October 2025 marking key SEC deadlines, the outcome of these decisions will play a pivotal role in shaping the next stage of market access. For those interested in DeFi, NFTs, or the broader world of web3, following Solana’s trajectory is a valuable step toward understanding the evolving landscape of digital assets. As the crypto market continues to mature, the spotlight on Solana and the push for new investment products are set to intensify.

Related Reading