XRP is the native token of the XRP Ledger, a

Layer-1 blockchain designed for fast, low-cost global payments. It’s used by banks and financial institutions to move money across borders without delays or high fees. A typical XRP transaction settles in seconds and costs a fraction of a cent. In March 2025, the SEC ended its years-long legal battle with Ripple by reaching a settlement, easing regulatory uncertainty around XRP and paving the way for spot XRP ETF applications to move forward.

ETFs, or Exchange-Traded Funds, are traditional finance products that let you invest in assets like stocks or commodities through a regular brokerage account. They’re popular for their simplicity, transparency, and low fees. Crypto ETFs bring that same convenience to digital assets like

Bitcoin,

Ethereum, and now potentially, XRP. Several other crypto ETFs, such as

Solana ETFs,

Sui ETFs, and Avalanche ETFs, are also under SEC consideration, signaling broader interest in regulated access to emerging blockchain ecosystems.

What Is a Spot XRP ETF?

An XRP ETF is a type of investment fund traded on stock exchanges that gives you exposure to the price of XRP, without having to buy, store, or manage crypto directly. It tracks the real-time value of XRP, just like a stock ETF mirrors the performance of a company’s shares.

There are two types of crypto ETFs: spot ETFs and futures ETFs. A spot XRP ETF would hold actual XRP tokens in custody. This means when you buy a share, the fund buys real XRP behind the scenes. A futures ETF, on the other hand, tracks XRP’s price using

derivative contracts, not the token itself.

Spot ETFs are seen as more accurate and transparent because they reflect real market prices. You also avoid risks tied to futures like contract rollover fees or tracking errors.

Investing in an XRP ETF gives you the benefits of crypto exposure without needing a

digital wallet or managing

private keys. It’s a familiar, regulated investment vehicle for both retail and institutional investors.

How Does an XRP ETF Work?

Here’s how it works step-by-step:

1. An asset manager (like Franklin Templeton or WisdomTree) sets up the ETF and partners with a stock exchange such as Cboe BZX.

2. The manager files for approval with the U.S. Securities and Exchange Commission (SEC).

3. Once approved, authorized participants (usually big trading firms) deliver XRP tokens to a secure custodian, like Coinbase Custody.

4. In return, the fund issues ETF shares, which are sold on stock exchanges to the public.

5. If demand rises, more XRP is bought and held to create new shares. If demand drops, shares are redeemed for XRP.

The ETF’s price stays close to XRP’s actual market value thanks to this creation and redemption process. Fund managers also benchmark prices using trusted indexes, such as the CME CF Ripple-Dollar Reference Rate. This setup ensures price accuracy, secure custody, and daily portfolio transparency.

For you, that means you can buy and sell XRP ETF shares just like stocks, without touching the crypto itself.

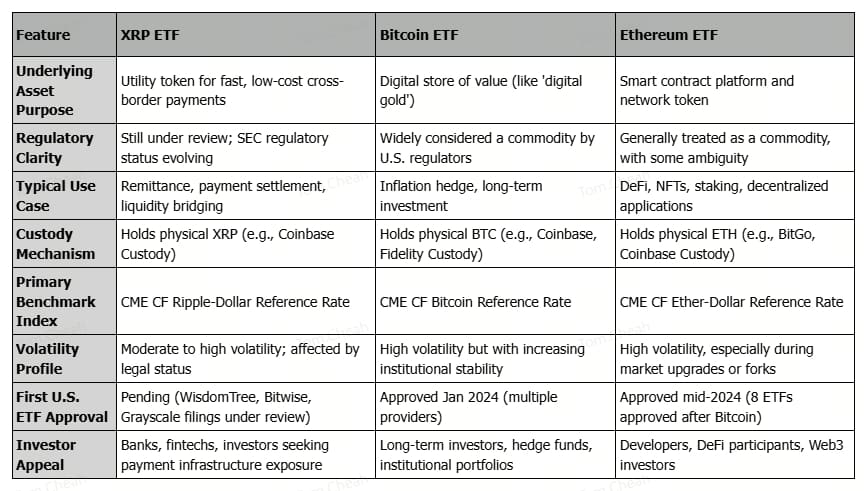

How Does an XRP ETF Differ From Bitcoin and Ethereum ETFs?

Unlike Bitcoin and

Ethereum ETFs, which represent assets often viewed as a store of value (BTC) or a

smart contract platform (ETH), an XRP ETF is tied to a utility-focused token built for fast, low-cost cross-border payments. This makes XRP ETFs more appealing to investors interested in the future of global financial infrastructure rather than inflation hedges or

DeFi ecosystems. Additionally, XRP's legal and regulatory history sets it apart, while

BTC and

ETH are widely regarded as commodities, XRP's classification has been debated, which can influence how its ETFs are treated by regulators and perceived by investors.

Current Landscape of XRP ETFs

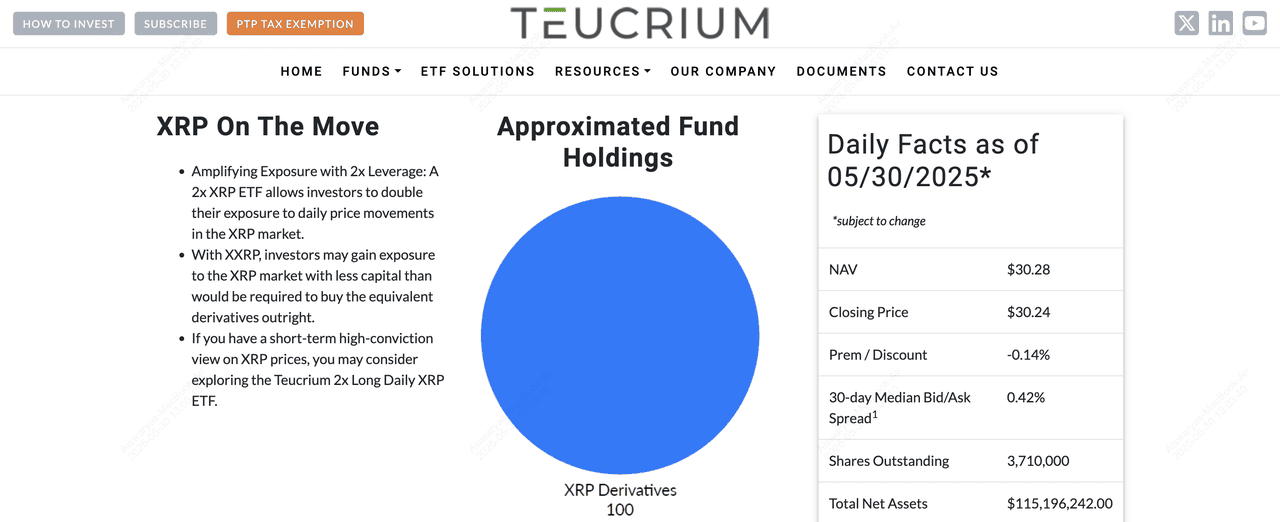

Teucrium's XXRP ETP | Source: Teucrium

As of May 2025, the U.S. market has one XRP-focused ETF: the Teucrium 2x Long Daily XRP ETF (ticker: XXRP). Launched in April 2025, XXRP offers investors twice the daily return of XRP's price movements. It's designed for short-term traders aiming to capitalize on XRP's volatility. The fund achieves this leverage through derivatives like swaps and futures, rather than holding XRP directly.

On its debut, XXRP saw significant trading activity, with over 215,000 shares exchanged, indicating strong investor interest . However, it's essential to note that leveraged ETFs like XXRP are intended for short-term strategies and come with higher risk, especially in volatile markets.

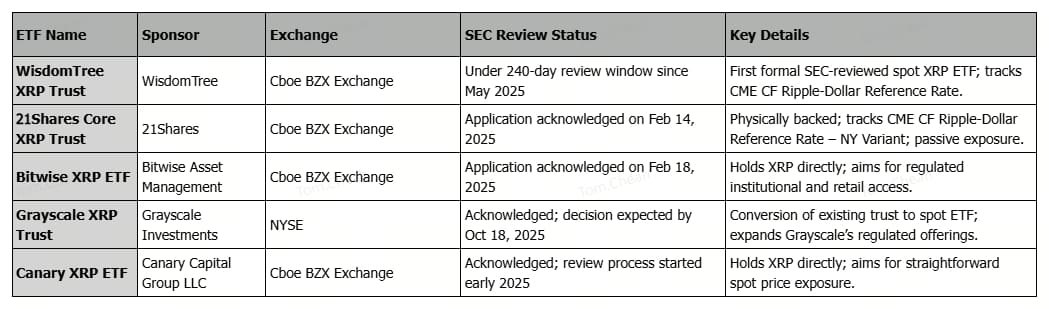

As of May 30, 2025, the U.S. Securities and Exchange Commission (SEC) is formally reviewing the following XRP ETF applications:

1. WisdomTree XRP Trust: The WisdomTree XRP Trust is the first U.S.-based spot XRP ETF to undergo formal SEC review. Filed via the Cboe BZX Exchange, this proposed ETF aims to give investors direct exposure to the market price of XRP without the need to hold the token themselves. It tracks the CME CF Ripple-Dollar Reference Rate and officially entered the SEC's 240-day review window in May 2025, marking a milestone in XRP’s path toward mainstream financial adoption.

2. 21Shares Core XRP Trust: 21Shares submitted its Core XRP Trust application to the SEC on February 14, 2025, via the Cboe BZX Exchange. The trust seeks to offer passive, non-speculative exposure to XRP, tracking the CME CF Ripple-Dollar Reference Rate – New York Variant. Designed as a physically backed ETF, it avoids leverage or derivatives and is currently under formal SEC review within the standard 240-day evaluation period.

3. Bitwise XRP ETF: Bitwise Asset Management’s proposed spot XRP ETF, filed on February 18, 2025, is also under SEC review through the Cboe BZX Exchange. The fund would hold actual XRP tokens in custody and aims to provide regulated access to XRP for institutional and retail investors alike. The SEC's acknowledgment of the filing initiated the start of a maximum 240-day review window.

4. Grayscale XRP Trust: Grayscale Investments is seeking to convert its existing XRP Trust into a publicly traded spot ETF on the NYSE. The SEC formally acknowledged this application earlier in 2025, triggering a decision deadline of October 18, 2025. The proposed conversion reflects Grayscale’s broader push to expand its suite of crypto investment vehicles into fully regulated, exchange-listed products.

5. Canary XRP ETF: Canary Capital Group has filed an application for a spot XRP ETF via the Cboe BZX Exchange. This proposed fund would hold XRP directly and is designed to provide straightforward exposure to the asset’s spot price. The SEC acknowledged the application in early 2025, launching the standard review process that could extend up to 240 days.

When Could a Spot XRP ETF Launch?

The U.S. Securities and Exchange Commission (SEC) is currently reviewing multiple XRP ETF applications. Notably, Bitwise's proposal to list the Bitwise 10 Crypto Index Fund, which includes XRP, has had its decision deadline extended to July 31, 2025. Similarly, Franklin Templeton's spot XRP ETF application is under review, with a decision expected by June 17, 2025.

The SEC's review process typically spans up to 240 days, allowing time to gather public feedback and assess market implications. While delays are common, analysts remain optimistic about potential approvals later in 2025.

Approval of an XRP ETF would be a significant milestone, potentially increasing institutional investment and providing a regulated avenue for exposure to XRP. However, the SEC's decisions will also set precedents for how other altcoin ETFs are evaluated, influencing the broader crypto market's integration into traditional finance.

Risks and Key Considerations of XRP ETFs

Investing in XRP ETFs offers convenience but comes with specific risks:

1. Market Volatility: Cryptocurrencies like XRP are known for price swings. While ETFs can provide exposure without direct ownership, they don't shield you from market volatility.

2. Tracking Errors: ETFs aim to mirror XRP's price, but discrepancies can occur due to fees, liquidity issues, or fund management strategies. This means the ETF's performance might not always align perfectly with XRP's market price.

3. Regulatory Uncertainty: The SEC's stance on XRP and crypto ETFs continues to evolve. Changes in regulations can impact ETF operations and investor confidence.

4. Management Fees: ETFs charge fees for management and operations. Over time, these fees can affect your overall returns.

5. Liquidity Concerns: While ETFs are generally liquid, extreme market conditions can affect their tradability, potentially leading to wider bid-ask spreads.

Other Ways to Invest in XRP Beyond ETFs

If you're interested in direct exposure to XRP, consider purchasing the cryptocurrency itself. This approach offers more control and flexibility.

How to Buy XRP on BingX: A Step-by-Step Guide

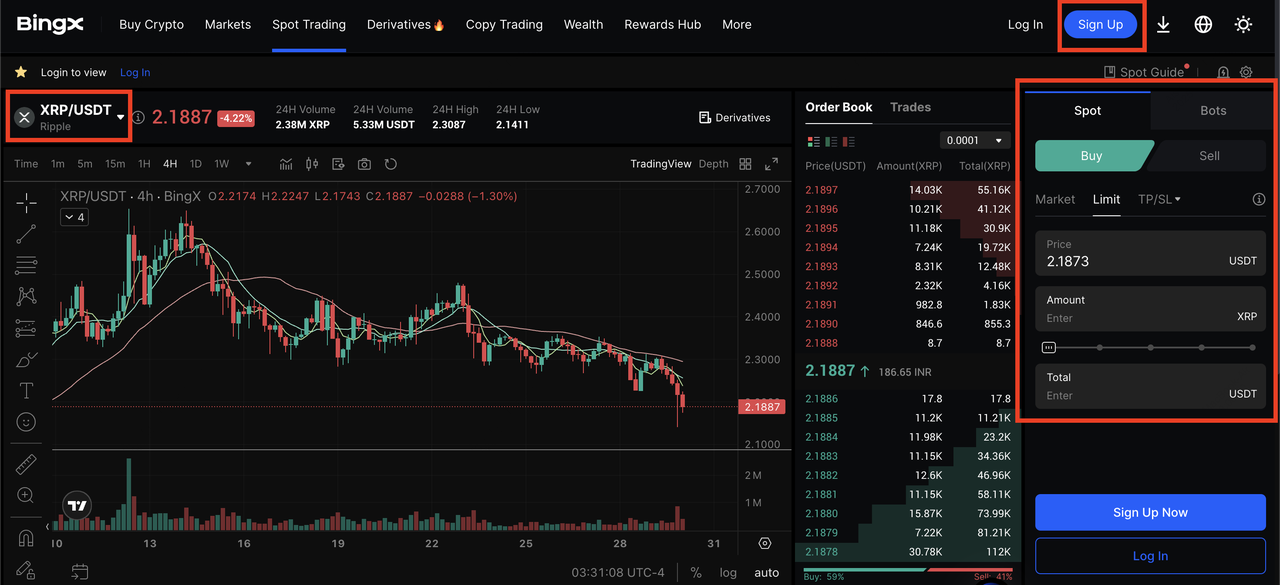

If you don’t want to wait for an ETF, you can buy XRP directly on a crypto exchange. Here’s how to get started with XRP trading on BingX in just a few simple steps.

1. Create an Account: Visit

BingX and sign up using your email or phone number.

2. Complete KYC Verification: Provide necessary identification documents to comply with regulations and unlock full platform features.

3. Deposit Funds: Choose a payment method, such as Google Pay or Apple Pay for speed, bank transfer for fiat support, or

P2P trading for zero-fee transactions.

4. Buy XRP: Navigate to the

Spot Trading section, select XRP, enter the amount, and confirm your purchase.

5. Secure Your Assets: Consider transferring your XRP to a personal wallet for enhanced security.

Conclusion: What an XRP ETF Means for Investors and the XRP Market

The approval of a spot XRP ETF could be a turning point for both investors and the broader XRP ecosystem. By offering easy access through traditional brokerage accounts, XRP ETFs would likely attract new demand from retail traders and institutional investors alike. This increased demand could lead to price appreciation, especially if inflows mirror the early success of Bitcoin and Ethereum ETFs.

ETFs also bring added liquidity to the market, making it easier to buy and sell XRP without large price swings. Just as important, regulatory approval of an XRP ETF could signal greater clarity around XRP’s legal status, reducing uncertainty and boosting investor confidence.

For investors, XRP ETFs offer a convenient and regulated way to gain exposure without the need to manage private keys or crypto wallets. However, they also come with risks, such as market volatility, tracking differences, and evolving SEC guidelines. As regulatory frameworks mature and more ETF applications move through the approval process, XRP’s role in mainstream finance may grow significantly.

Staying informed about these developments will help you make better investment decisions as the future of XRP ETFs continues to unfold.

Related Reading

FAQs on XRP ETFs

1. Are there any XRP ETFs available now?

Yes, the Teucrium 2x Long Daily XRP ETF (XXRP) is available in the U.S., offering leveraged exposure to XRP's price movements.

2. What are the risks of investing in XRP ETFs?

Risks include market volatility, regulatory uncertainties, tracking errors, liquidity concerns, and management fees.

3. How does an XRP ETF differ from buying XRP directly?

An ETF offers indirect exposure through traditional brokerage accounts, while buying XRP directly involves holding the cryptocurrency in a digital wallet.

4. Can XRP ETFs impact the price of XRP?

Yes, increased accessibility and demand through ETFs can lead to higher trading volumes and potentially drive up XRP's price.