BounceBit (BB) is emerging as the first purpose-built

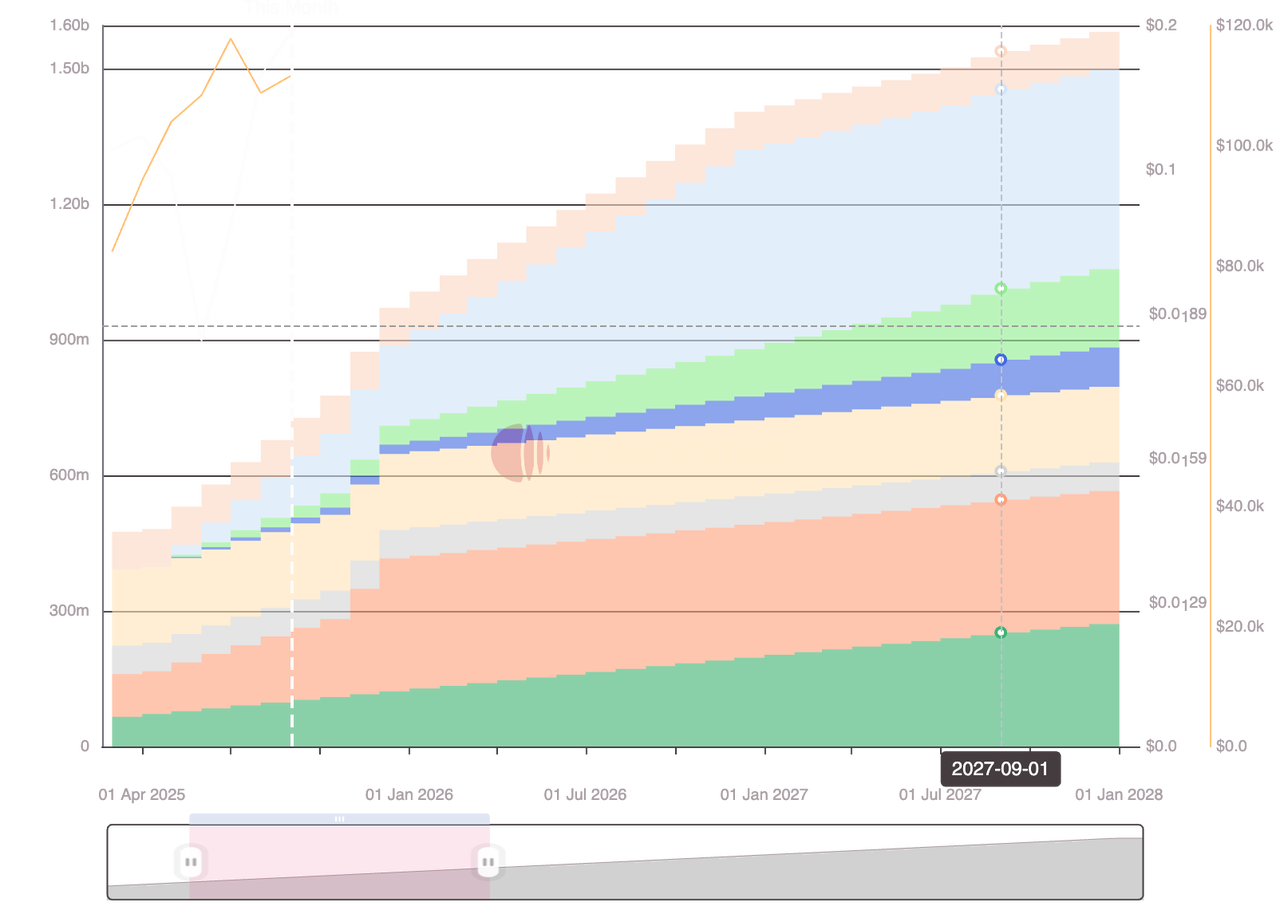

Bitcoin restaking Layer-1 chain, uniquely combining institutional trust with DeFi innovation. As of September 2025, it has attracted over $516 million in TVL (total value locked) with a growing suite of CeDeFi products, including BounceBit Prime, a high-yield strategy that blends

tokenized real-world assets (RWAs) with crypto yield tools.

BounceBit CeDeFi Yield's TVL and revenue | Source: DefiLlama

In this guide, we break down how BounceBit works, from the basics of “Bitcoin restaking” to its key features, how to get involved, and how you can trade BB tokens on BingX.

What Is BounceBit (BB) and How Does It Work?

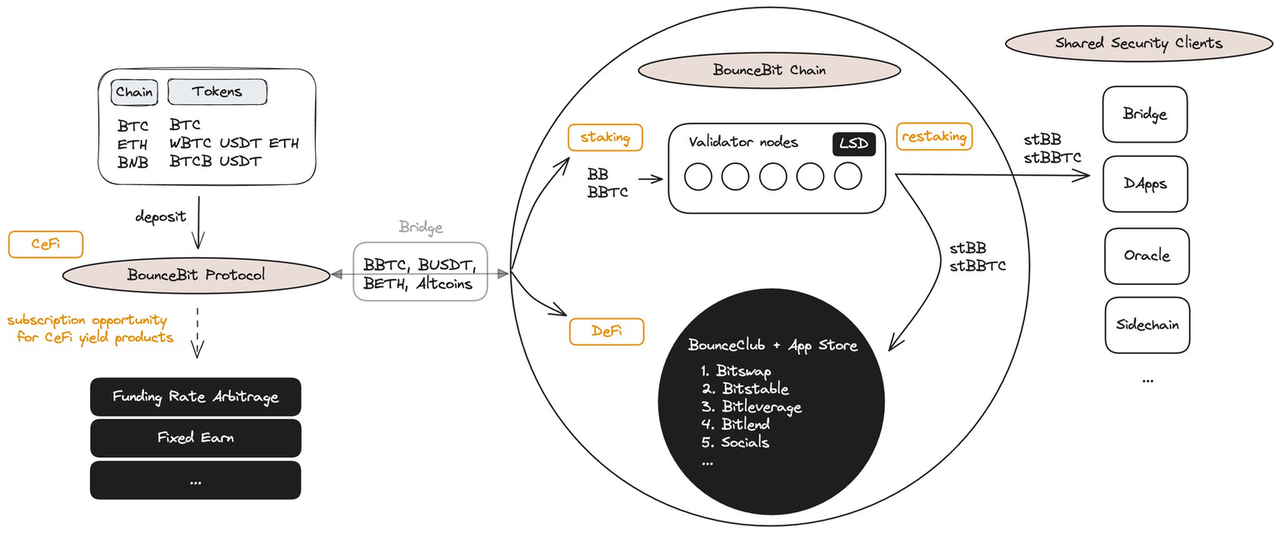

BounceBit is a

Bitcoin-centric, EVM-compatible Layer-1 that uses a CeDeFi design: your BTC stays with regulated custodians off-exchange for safety, while an on-chain “mirror” or a Liquidity Custody Token, e.g., BBTC/BBUSD, lets you stake, restake, and use DeFi without parking funds on an exchange. Operationally, this is enabled by integrations like Ceffu’s MirrorX for off-exchange settlement, marrying custody protections with on-chain utility.

In Aug 2025, BounceBit integrated Franklin Templeton’s tokenized money market fund into BB Prime, letting collateral earn Treasury yield while also powering

crypto arbitrage, for layered returns from one pool of capital.

How BounceBit works | Source: BounceBit docs

As per Messari, BounceBit reported ~$514.2 million in TVL by end-May 2025 and ~$6.78M YTD fees through May, mostly organic, and not emissions-driven. An upcoming BB token event is slated for 00:00 UTC on Sep 10, 2025, with ~42.89 million BB, around 6.31%, of circulating/released supply unlocking, valued at roughly $6.4 million as of writing.

BB token unlocking in September 2025 | Source: Tokenomist

BounceBit Prime Brings Institutional Yields On-Chain

BounceBit Prime (launched June 2025) is the platform’s “pro” vault that puts tokenized Treasuries, like BlackRock’s BUIDL and Franklin Templeton’s money-market funds, on-chain and combines them with crypto-native, market-neutral strategies, e.g., basis/funding-rate arbitrage and options.

In practice, you deposit once, and Prime handles the rest: your collateral earns the base Treasury yield while the strategy layer seeks extra return from delta-neutral trades; in a published trial using BUIDL as collateral, the blended approach achieved ~24% annualized. It’s built to hide the complexity, with no manual rolling, hedging, or rebalancing required.

Why BounceBit Stands Out

BounceBit's focus has drawn measurable traction because it packages institutional protections with on-chain utility that everyday users can actually tap.

• Bitcoin-first design: BounceBit is purpose-built around BTC; validators stake BB + BBTC to secure the network, making Bitcoin the primary economic anchor rather than an altcoin afterthought.

• CeDeFi hybrid model: User assets sit in regulated custody, e.g., Ceffu, Mainnet Digital, and are mirrored on-chain as LCTs like BBTC/BBUSD, so you can earn yield and use DeFi while keeping funds off-exchange.

• High-value RWA integration: BB Prime added Franklin Templeton’s tokenized money market fund in August 2025, so the same collateral can earn Treasury yield while powering crypto arbitrage, providing layered returns from one pool of capital.

• EVM compatibility: Developers can deploy Solidity apps and reuse

Ethereum tooling with full EVM support, accelerating dApp launches and integrations on BounceBit.

• Trust & compliance: Prime operates under a BVI Approved Investment Manager framework and the ecosystem uses KYC/KYT/AML with partners like Elliptic, plus multi-layer custody for institutional-grade risk controls.

What Is BB Token: Utility and Tokenomics to Know?

BB is BounceBit’s native asset used to:

1. Secure the chain in a dual-token Proof-of-Stake with BBTC (tokenized BTC). Validators/delegators stake BB (and BBTC) to earn rewards.

2. Pay gas for transactions and smart-contracts.

3. Govern protocol upgrades via on-chain voting

4. Act as a liquid medium of exchange across BounceBit apps, with a wrapped version, WBB, for DeFi routing.

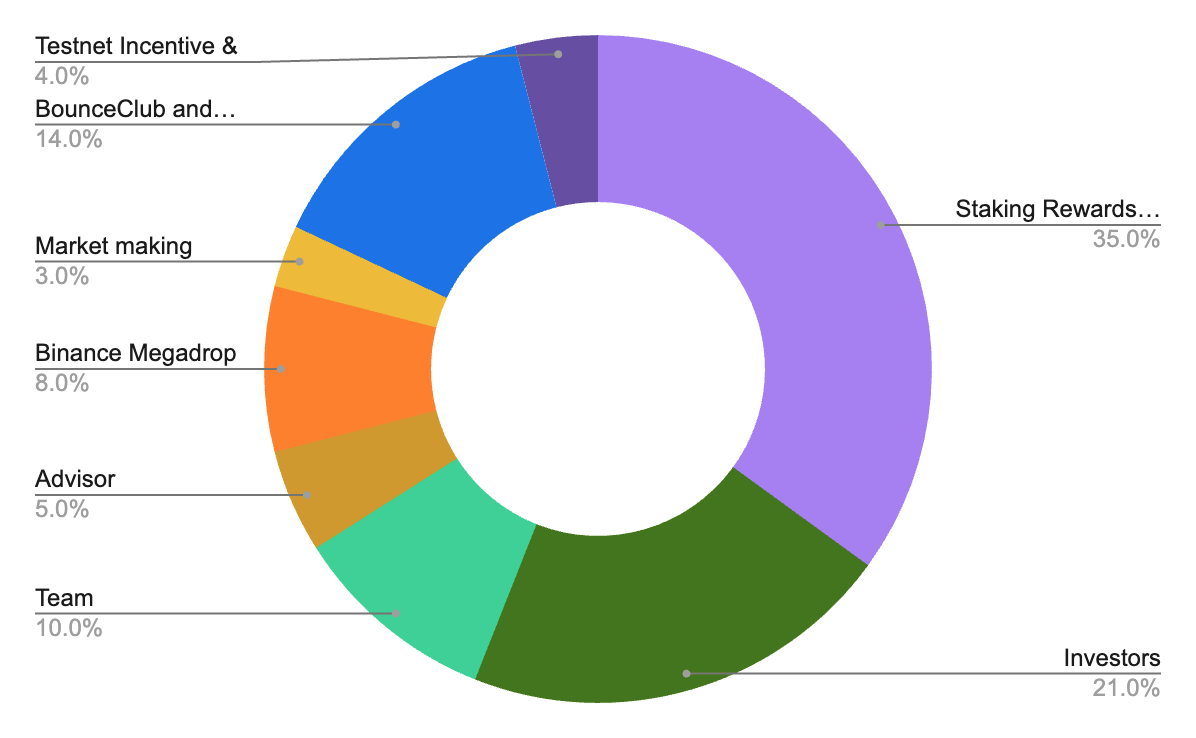

BB Token Allocation

BB token distribution | Source: BounceBit docs

BB has a fixed max supply of 2,100,000,000, set as a “21×” nod to Bitcoin’s 21M. Future burn mechanisms are not precluded and would be decided by governance.

• Staking Rewards & Delegation Program – 35%: distributed over 10 years to participants who secure the network.

• Investors – 21%: 12-month lock, then 5% monthly unlock.

• Team – 10%: 12-month lock, then 2.5% monthly unlock.

• Advisors – 5%: 12-month lock, then 2.5% monthly unlock.

• BounceClub & Ecosystem Reserve – 14%: 4.5% at TGE, then 12-month lock, followed by 6 months of 6.5% monthly unlock, then 2.5% monthly.

• Binance Megadrop – 8%: unlocked at TGE.

• Testnet & TVL Incentives – 4%: unlocked at TGE.

• Market Making – 3%: unlocked at TGE.

What Is Bitcoin Restaking on BounceBit?

Restaking lets your

BTC work twice. You place BTC with a regulated custodian, get an on-chain mirror like BBTC, and then stake + restake that BBTC to secure the BounceBit chain and plug into yield strategies, without leaving assets sitting on an exchange. Here's how BTC restaking works on BounceBit:

1. Deposit BTC → get BBTC: You onboard with a supported custodian. Your BTC is held off-exchange for safety, while you receive BBTC, a 1:1 on-chain representation, in your wallet.

2. Stake BBTC and BB: Delegate your BBTC, optionally paired with BB, to validators to help run the network and earn base staking rewards.

3. Add the “restake” layer: Opt into market-neutral strategies, e.g., basis /

funding-rate arbitrage, or structured products via Prime that aim to add extra yield on top of

staking.

4. Stay liquid with stBBTC: When you join

liquid staking, you receive stBBTC, which you can use in DeFi to lend, LP, collateral, while rewards accrue in the background.

5. Exit anytime: To unwind, redeem stBBTC→BBTC and withdraw BTC from custody; note that unbonding windows, strategy settlement cycles, and provider fees may apply.

For example, you deposit 0.10 BTC → wallet shows 0.10 BBTC. You stake BBTC and choose the Auto strategy. Over time, your position reflects validator rewards from securing the chain, plus strategy yield from delta-neutral trades.

If you picked liquid staking, you’ll see stBBTC in your wallet, which you can deploy in dApps while rewards continue accruing. To exit, unwind the strategy, redeem to BBTC, then withdraw BTC back to your external wallet.

Why Restake Bitcoin via BounceBit?

You get more from the same BTC. Restaking lets one deposit secure the chain and fuel market-neutral strategies, so you’re not splitting funds across platforms. Your assets stay off-exchange with regulated custody while you still use them on-chain. If you choose stBBTC, you keep earning while re-using that position across DeFi, lend, LP, or post as collateral, without giving up staking rights.

1. BTC holders: deposit to mint BBTC, stake it, and optionally enable Auto/Prime; use stBBTC for flexibility.

2. Institutions: use Prime for one-ticket, compliance-aware exposure that blends Treasury-style yield with delta-neutral crypto.

3. Developers: build on the EVM chain and design around LCTs and stBBTC to tap the restaking rails.

Keep it simple and safe. Before you join, check the lockup or unbonding time, any performance fees, and what could go wrong with the strategy. And remember: “market-neutral” doesn’t mean risk-free; smart-contract, custody, and execution risks still apply. Start small, learn the flow of stake → restake → DeFi, then size up.

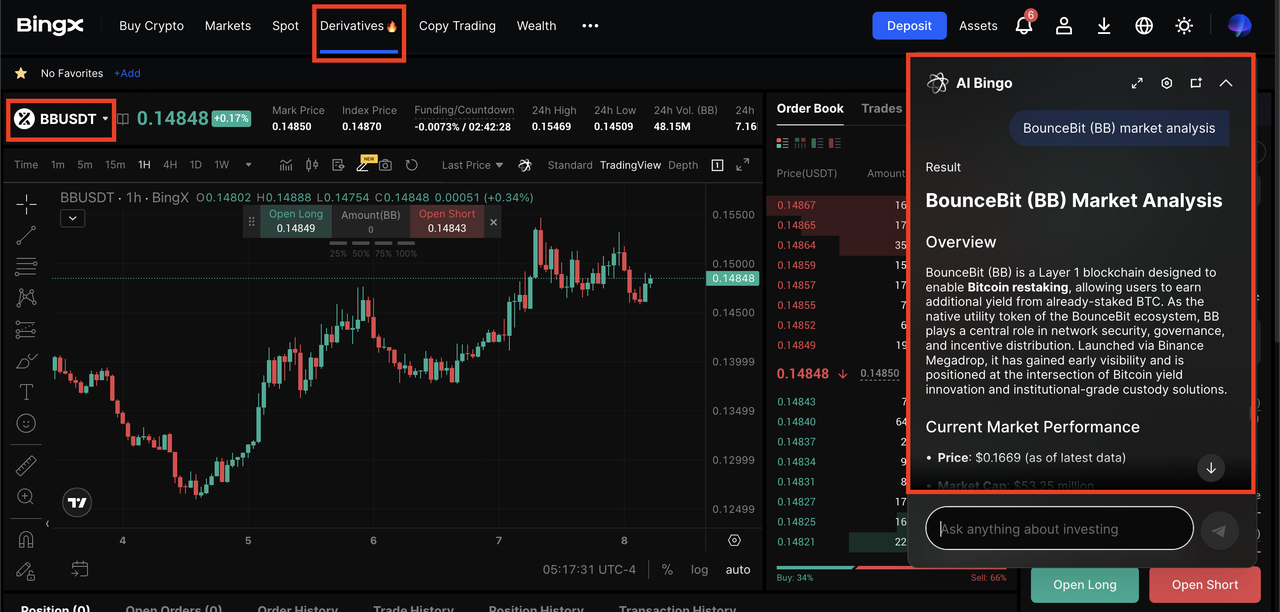

How to Trade BounceBit (BB) on BingX

Below is a simple, step-by-step guide for spot and futures. You can also try

BingX AI, the built-in assistant that explains features, surfaces market data, and helps you plan entries/exits right inside the exchange.

Buy and Sell BB on the Spot Market

1. Create & verify your account, then deposit crypto or fiat funds. You can add

USDT via card/bank or transfer from another wallet/exchange.

2. Move funds to Spot if they’re in Funding and search “

BB/USDT” in the

Spot market. BB is available to trade on BingX; you’ll see the pair listed among Spot markets.

3. Choose order type:

•

Market = instant at current price (good for beginners).

• Limit = set your price; order fills when the market reaches it.

4. Set amount → Buy/Sell BB. You can review or cancel open orders from the Orders tab before they fill.

5. Use BingX AI for context: ask it to summarize BB news, provide on-chart indicators, or draft a

dollar cost averaging (DCA) plan before you place orders.

Practical tips: Start with small sizes; consider placing a limit sell target and a

stop-loss on your plan; and always double-check the token and pair before confirming.

Trade BBUSDT Perpetuals on the Futures Market

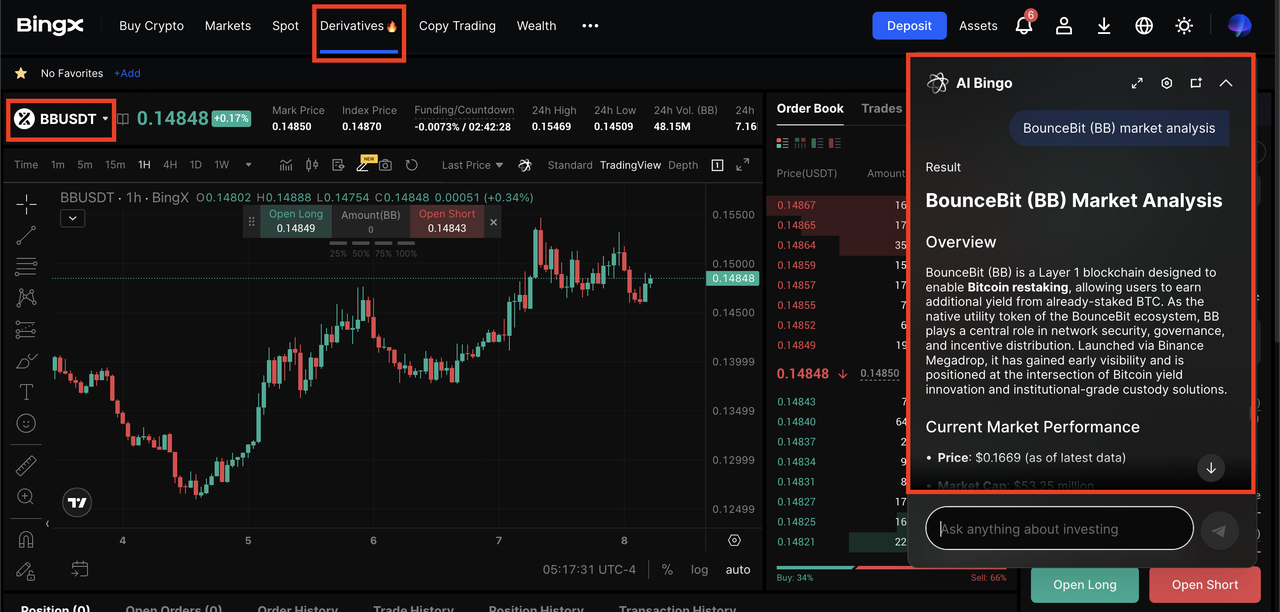

BB/USDT perpetual contract on the futures market powered by BingX AI

1. Enable

Futures and transfer USDT to your USDⓢ-M Perpetual account. New traders can also try Futures Kickoff, a one-click, beginner-oriented mode.

3. Select margin mode (Isolated for capped risk per position is beginner-friendly; Cross shares margin across positions) and choose conservative leverage, e.g., 2–5x to start. You can review maintenance margin rules in BingX docs.

4. Pick order type such as Market/Limit, set size, and pre-define take-profit and stop-loss levels, so risk is controlled from the start.

5. Watch funding rates & liquidation price on the order ticket; adjust size/leverage if the liquidation price is too close. Ask BingX AI to pull funding,

open interest (OI), long-short snapshots or to help position-size to a fixed % of equity.

Futures risk reminder: Perpetuals are leveraged and can be liquidated; even “market-neutral” strategies fluctuate. Start small, use Isolated margin, place hard stops, and review margin tiers before scaling.

Final Thoughts

BounceBit (BB) positions Bitcoin as a productive asset by combining regulated custody with on-chain utility, restaking, and RWA integrations. Its design aims to improve capital efficiency for BTC holders while offering developers EVM tooling and institutions a pathway to structured, compliance-aware yield strategies.

That said, outcomes are not guaranteed. Participants should consider smart-contract risk, custody and counterparty risk, execution/strategy risk, e.g., basis or funding-rate shifts, liquidity and token-unlock effects, and evolving regulation. As with any crypto product, start small, review documentation and fees, and only allocate capital you can afford to lose.

Related Reading