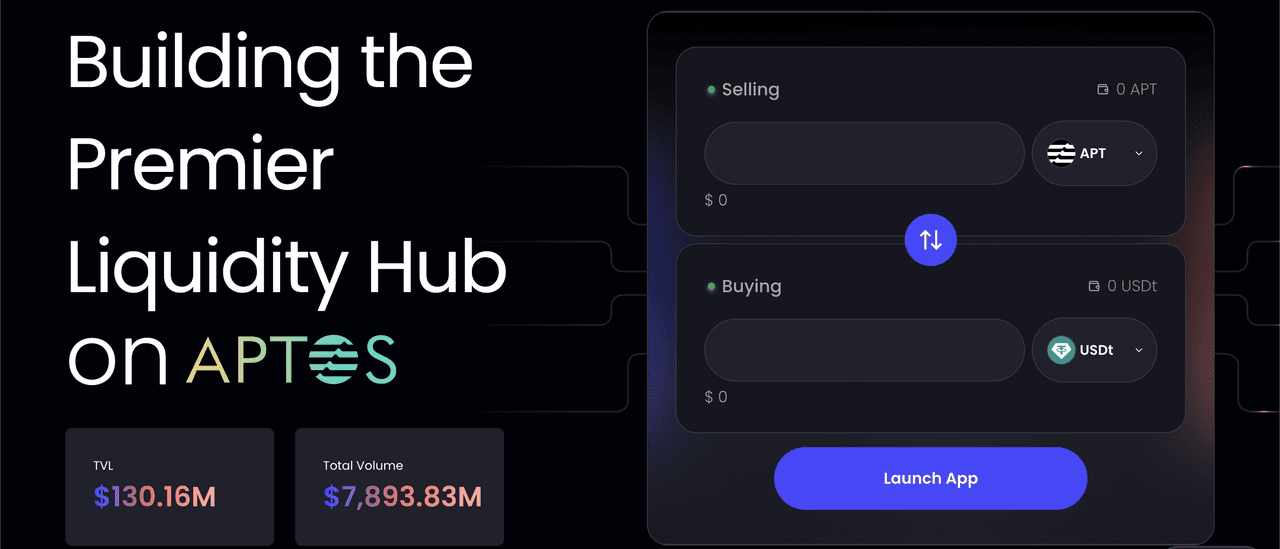

Hyperion is redefining DeFi on

Aptos with its next‑generation DEX, combining concentrated liquidity

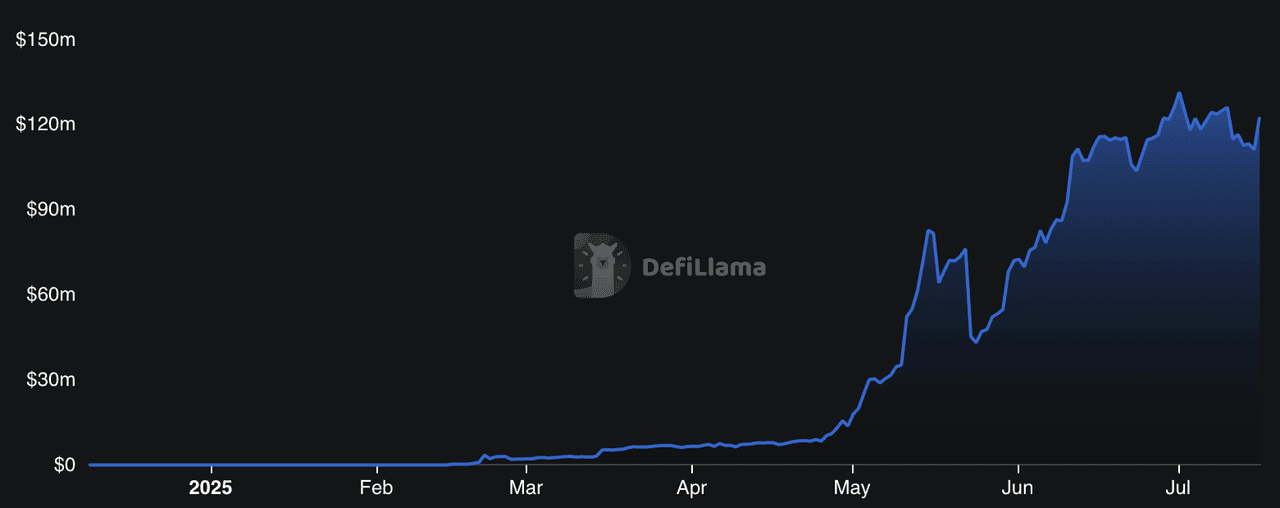

AMM (automated market maker), smart aggregation, directional strategies, and automated vaults into a single integrated platform. Over just five months, it has accumulated more than $7.1 billion in trading volume, secured $130 million in TVL (total value locked), and engaged nearly 940,000 DRIPs participants, backed by top investors like OKX Ventures and Aptos Foundation. Its dual‑token model, RION and xRION, cements its commitment to aligning user incentives with sustainable governance and platform growth.

Hyperion TVL | Source: DefiLlama

Learn what Hyperion DEX is, how it works, how to prepare for the upcoming

Hyperion airdrop, and explore RION tokenomics, utility, and future plans in this beginner’s guide to Aptos DeFi.

What Is Hyperion DEX and How Does It Work?

Hyperion is more than just a decentralized exchange (DEX); it is a full-stack DeFi infrastructure designed to make trading, liquidity provision, and yield generation seamless on the Aptos blockchain. It addresses common challenges in DeFi, such as fragmented liquidity, inefficient capital usage, and complex user interfaces, by integrating four powerful modules into a single platform.

• Smart Aggregator: Hyperion’s aggregator scans all available liquidity pools across Aptos and intelligently routes trades to find the best prices. It supports multi-hop routes (splitting a trade across multiple pools) to minimize slippage and transaction costs. For users, this means faster, cheaper, and more reliable trade execution without needing to manually compare DEXs.

• CLMM (Concentrated Liquidity AMM): Inspired by

Uniswap v3, this module lets liquidity providers (LPs) supply liquidity within specific price ranges, rather than across the entire curve. For example, an LP could focus their capital in a range where trading activity is highest, earning higher fees with less capital. This improves capital efficiency and deepens liquidity where it’s needed most.

• DLMM (Directional Liquidity AMM): Unlike traditional AMMs, DLMM supports asymmetric and directional liquidity strategies, making it ideal for volatile assets. LPs can create customized pools that respond to market trends, such as supporting one-sided liquidity to manage sudden price movements or impermanent loss risks.

• Vault Platform: For users who prefer a hands-off approach, Hyperion offers automated vaults with pre-configured yield strategies. These vaults auto-compound earnings and rebalance positions, allowing even non-technical users to participate in liquidity provision and earn returns without needing to actively manage their assets.

By combining these modules, Hyperion creates what it calls a “unified liquidity graph,”a connected network of liquidity that delivers better execution for traders and more efficient earnings for LPs.

As of July 2025, the Hyperion platform consistently records daily trading volumes between $125 million and $150 million, making it one of the top 10 DEXs globally by activity. With nearly 950,000 active DRIPs participants, over 130,000 Twitter followers, and 30,000 Discord members, Hyperion has built a robust user community. Backed by leading investors such as OKX Ventures, the Aptos Foundation, Arthur Hayes’ Maelstrom, and Mirana Ventures, it has rapidly emerged as the flagship DeFi protocol on Aptos, laying the groundwork for an expanding ecosystem of trading, liquidity, and yield-generating products.

Hyperion's Dual‑Token Model: RION and xRION

On July 10, 2025, Hyperion unveiled its dual-token model, designed to balance ecosystem utility with decentralized governance. This framework introduces two complementary tokens, RION and xRION, each with distinct roles in the platform’s long-term growth.

1. RION: This is Hyperion’s primary utility token with a fixed maximum supply of 100 million tokens. It serves multiple purposes within the ecosystem, including trading incentives, paying transaction fees, accessing premium features, and participating in liquidity programs. Users can also use RION to engage with Hyperion’s vault strategies or as collateral in future DeFi integrations planned on Aptos.

2. xRION: This is a non-transferable governance token, created when users lock their RION holdings for up to 52 weeks. The amount of xRION received depends on both the quantity of RION staked and the lock duration. Governance weight decays linearly over time but can be extended through re-locking. Holding xRION gives users the ability to:

• Vote on protocol upgrades and ecosystem proposals through Hyperion’s DAO.

• Gain priority access to token launchpads and allocation quotas.

• Unlock exclusive participation rights in future campaigns and governance perks.

This dual-token structure is specifically designed to encourage long-term user commitment and align incentives between traders, liquidity providers, and community contributors. By separating utility (RION) from governance (xRION), Hyperion ensures that active participants and dedicated holders have the greatest influence over the protocol’s evolution.

With over 940,000 users engaged in DRIPs campaigns and strong staking mechanics already in place, the RION/xRION system supports a sustainable, community-driven governance model that reinforces Hyperion’s role as a foundational layer of Aptos DeFi.

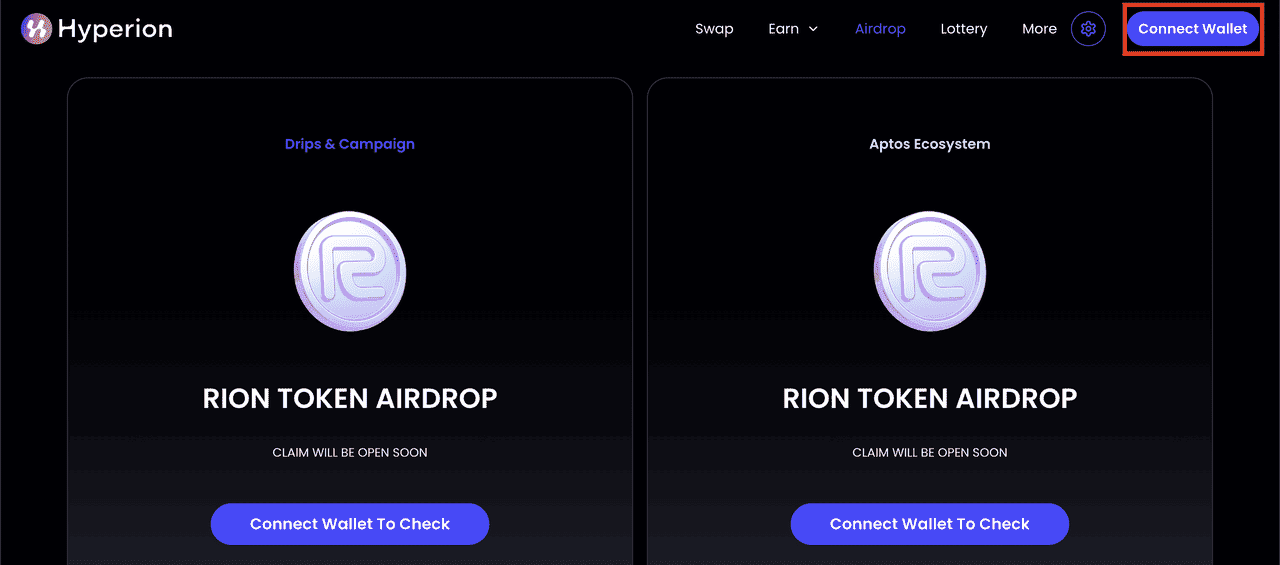

What Is the Hyperion (RION) Airdrop to Reward Early Participants?

The Hyperion Genesis Airdrop is designed to reward early users and contributors who helped grow the platform during its launch phase on Aptos. A total of 5 million RION tokens (5% of the total supply) has been allocated for this event. The distribution is split into two phases: 3% claimable at the Token Generation Event (TGE) and the remaining 2% unlocked 30 days later.

Eligible participants include traders and liquidity providers from the DRIPs Genesis season, community contributors who completed tasks or engaged with campaigns, users from collaborative events with Bitget and Gate wallets, and select Aptos early adopters through a special lucky draw. Claimants have 60 days after TGE to collect their tokens, after which any unclaimed RION will be returned to Hyperion’s incentive pool for future rewards.

The $RION airdrop not only recognizes genuine engagement but also incentivizes users to stay active as Hyperion rolls out new DeFi features and campaigns.

What Is the Hyperion (RION) Token Utility and Tokenomics?

The RION token is the cornerstone of Hyperion’s ecosystem on Aptos, designed to reward active participation while driving sustainable growth. It combines utility, governance, and incentives in a way that aligns the interests of traders, liquidity providers, and community contributors.

RION Tokenomics Overview

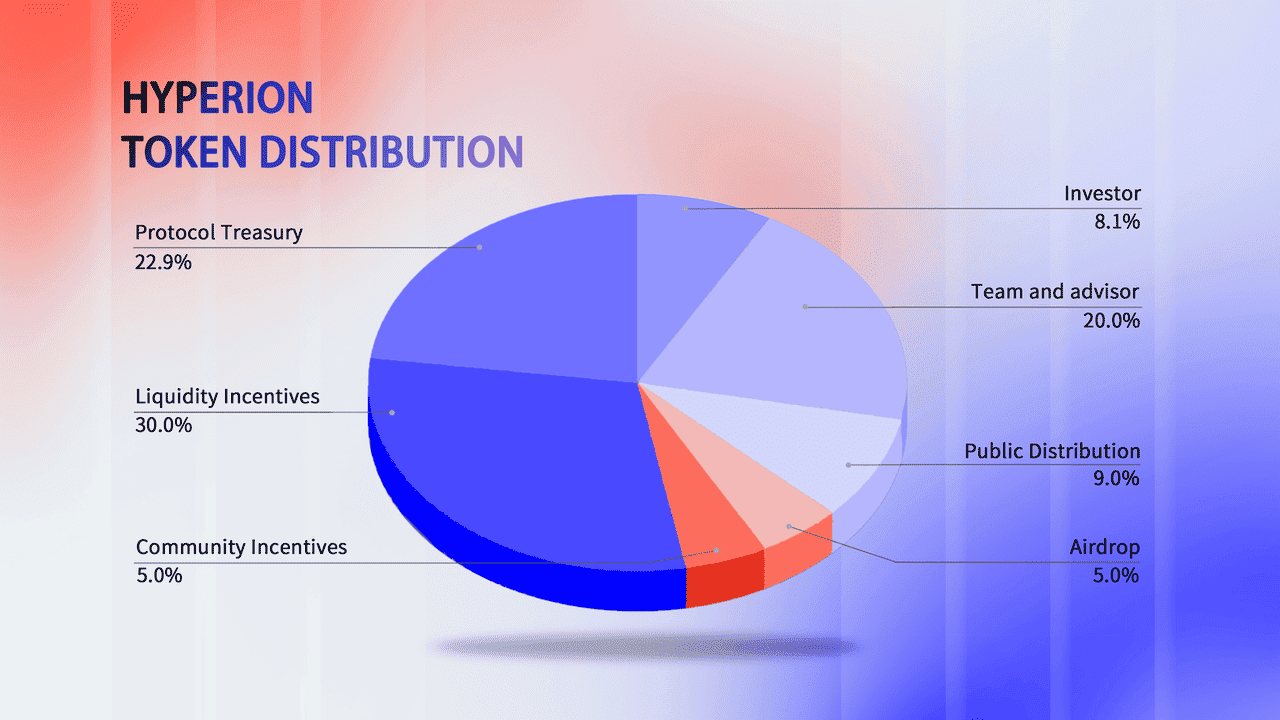

RION token distribution | Source: Hyperion docs

RION has a fixed total supply of 100 million tokens, carefully distributed to support sustainable ecosystem growth and governance:

• Genesis Airdrop (5%): Rewards early users, DRIPs participants, liquidity providers, and community contributors. The airdrop is split into two phases, 3% claimable at TGE and the remaining 2% unlocked 30 days later.

• Liquidity Mining & Incentives (30%): Allocated for Hyperion’s ongoing DRIPs programs, trading rewards, and future incentive campaigns to sustain user engagement.

• Team and Advisors (20%): Reserved for core contributors and advisors, with vesting schedules to ensure alignment with long-term protocol success.

• Treasury and Ecosystem Development (22.9%): Funds earmarked for product innovation, strategic partnerships, and additional reward programs to grow Hyperion’s presence in Aptos DeFi.

• Investors (8.1%): Allocated to early backers and investors who provided critical support during Hyperion’s development phase.

• Public Distribution (9%): Open for public participation through future events or offerings.

• Community Incentives (5%): Dedicated to community-driven initiatives, grants, and governance participation rewards.

RION Token Utility

The RION token powers multiple functions across the Hyperion platform:

• Trading and Yield Incentives: Users earn RION for trading, providing liquidity, and participating in farming activities.

• Fee Payments and Discounts: Holding RION unlocks reduced fees and premium features within Hyperion’s DEX and vault systems.

• Governance Participation: Staking RION converts it into xRION, a non-transferable governance token that grants voting rights on protocol changes, incentive programs, and ecosystem proposals.

• Launchpad Access and Quotas: xRION holders enjoy early participation opportunities in token launches and exclusive allocation quotas.

• Future Ecosystem Features: Both RION and xRION will be central to upcoming developments like AMM upgrades, BTC synthetic asset support, multichain Launchpools, and Drips Season 2 campaigns.

This utility-focused design makes RION a vital component for anyone looking to actively participate in and benefit from Hyperion’s rapidly growing DeFi ecosystem.

How to Stake RION Tokens on Hyperion to Earn xRION

Staking your RION tokens is the key to unlocking Hyperion’s governance and advanced ecosystem perks through xRION. Here’s how it works:

1. Acquire RION Tokens: You can get RION by claiming it from the Genesis airdrop, earning through liquidity provision or trading incentives on Hyperion, or purchasing it once it’s listed on exchanges like BingX.

2. Stake RION to Receive xRION: Lock your RION tokens on Hyperion’s

staking interface for a period of your choice, up to 52 weeks. The longer you lock your tokens, the higher your xRION allocation and governance weight.

3. Participate in Governance and Rewards: As an xRION holder, you gain voting rights on protocol upgrades, incentive structures, and ecosystem initiatives. You’ll also unlock early access to token launchpads, special allocation quotas, and tiered community rewards.

4. Re-lock or Unstake as Needed: xRION’s governance weight decays linearly over time. To maintain influence, you can extend your lock period (re-lock) or withdraw your RION once the lock expires to rebalance your holdings.

This staking system creates a cycle where users not only earn rewards but also actively shape Hyperion’s future, reinforcing a healthy and sustainable DeFi ecosystem on Aptos.

What’s Next for Hyperion (RION)?

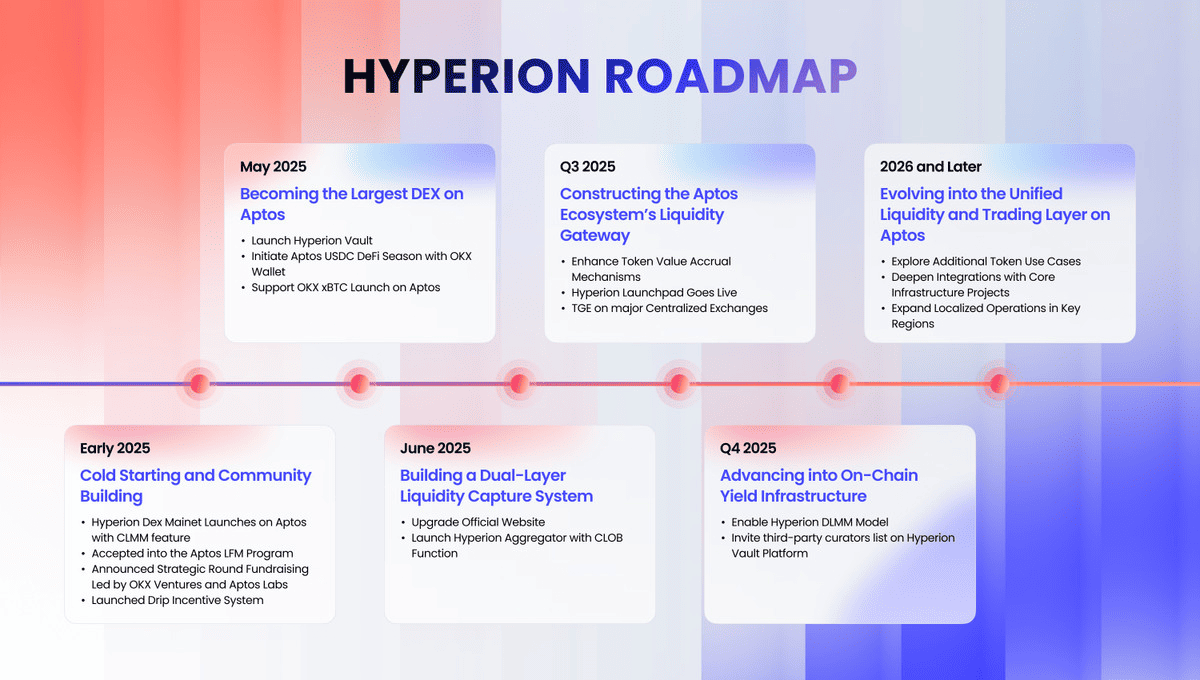

Hyperion roadmap | Source: Hyperion docs

Hyperion is entering a new growth phase with plans to expand its role as Aptos’ unified liquidity and trading layer. Backed by OKX Ventures, Aptos Foundation, and other top investors, the platform will roll out advanced Vault strategies for easier yield generation, AMM upgrades to improve trading efficiency, and a BTC liquidity hub supporting assets like xBTC and aBTC. Upcoming Launchpool initiatives and multichain collaborations aim to drive innovation and fresh liquidity, while new DRIPs seasons and trading competitions will deepen community engagement. These developments position RION and xRION holders to benefit from governance, rewards, and a growing suite of DeFi tools as Hyperion scales its ecosystem.

Hyperion’s DEX and its RION/xRION dual-token system offer a well-structured approach to building sustainable DeFi infrastructure on Aptos. As the platform evolves, RION and xRION holders will have opportunities to contribute to governance and benefit from future developments. However, it is important to verify official sources and consider the inherent risks of engaging with new tokens and DeFi protocols.

Related Reading