Meteora is rewriting the playbook for DeFi on

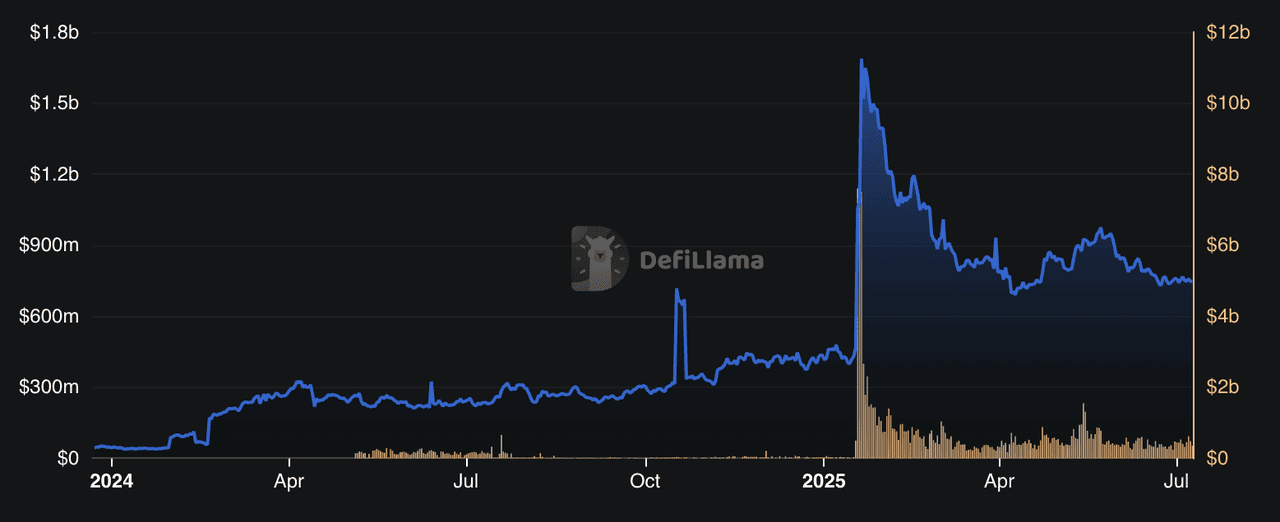

Solana. As one of the fastest-growing protocols in the ecosystem, it offers powerful tools for providing liquidity, earning dual yields, and supporting fair token launches. The numbers are hard to ignore: $39.9 billion in trading volume in January 2025, a 40× surge from December, and a TVL (total value locked) of over $750 million as of July 2025, cementing its position as a leading

Solana-based DeFi protocol.

Meteora TVL and DEX volume | Source: DefiLlama

In this guide, you’ll learn all about Meteora, Solana’s fast-growing DeFi hub offering dynamic liquidity pools, dual-yield strategies, and fair token launches, plus how to get started safely.

What Is Meteora DEX?

Meteora acts as a powerful

liquidity layer on Solana, supporting trades across major aggregators like

Jupiter and

Raydium. Instead of being a simple swap platform, Meteora provides the infrastructure for deep liquidity and efficient capital use, helping traders and projects tap into Solana’s high-speed DeFi ecosystem.

Its performance reflects this role. Trading volume surged from $987 million in December 2024 to an incredible $39.9 billion in January 2025, marking a nearly 40× increase. This growth secured Meteora over 15% of Solana’s DEX volume, placing it firmly among the top three platforms on Solana alongside Raydium and

Orca. With a treasury holding between $750 million and $1.6 billion, Meteora controls 5–7% of total Solana DeFi TVL. Globally, it now contributes 9–15% of total DEX volume, making it one of the top five decentralized exchanges (

DEXs) worldwide. These milestones highlight Meteora’s rapid rise as a key player in DeFi.

Core Features of Meteora

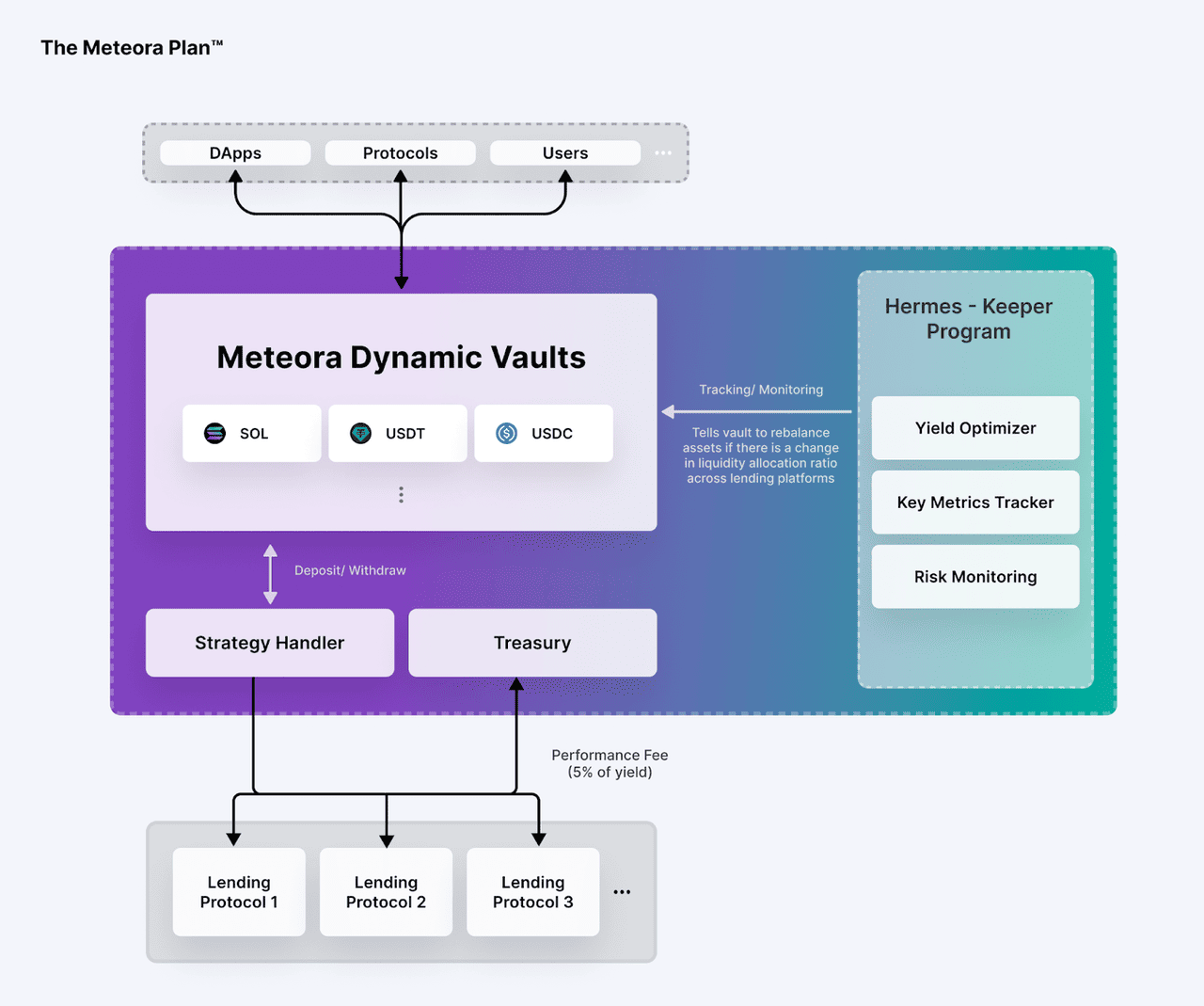

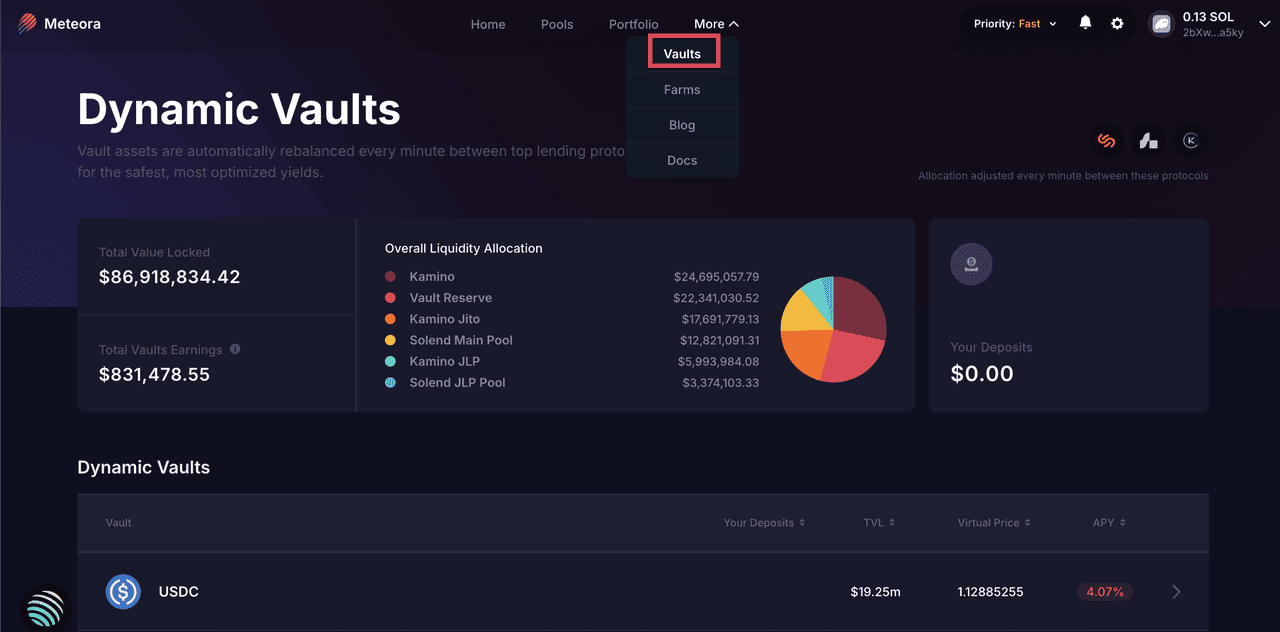

How Meteora's dynamic vaults work | Source: Meteora docs

Here’s what makes Meteora a standout:

• Dynamic AMM Pools: Classic constant-product pools with an upgrade. Unused tokens are auto-lent, letting you earn both swap fees and lending yields.

• DLMM Pools: Short for Dynamic Liquidity Market Maker, these pools use concentrated “bins” to target price ranges. Dynamic fees increase rewards during market volatility.

• Dynamic Vaults: Automatically rebalance your assets every minute across top lending protocols. Helps maximize yield on dormant capital without manual intervention.

• Alpha Vault & Memecoin Pools: Tailored for

memecoin launches. They lock liquidity and include anti-bot tools to ensure fair distribution and stronger community trust.

• M3M3 Stake‑to‑Earn: A staking system for

memecoin holders. It rewards long-term stakers with a share of earnings from locked liquidity.

Why Meteora Matters for Solana’s Memecoin Market

Meteora has quickly become a cornerstone of

Solana’s booming memecoin scene by solving some of the ecosystem’s biggest liquidity challenges. Its Dynamic Liquidity Market Maker (DLMM) and Dynamic AMM Pools help address capital inefficiency and liquidity fragmentation, two issues that often plague new token launches. This means memecoins on Meteora can access deeper liquidity with lower slippage, making them more attractive for both traders and liquidity providers. As a result, projects gain more stability, and communities feel safer engaging with new tokens.

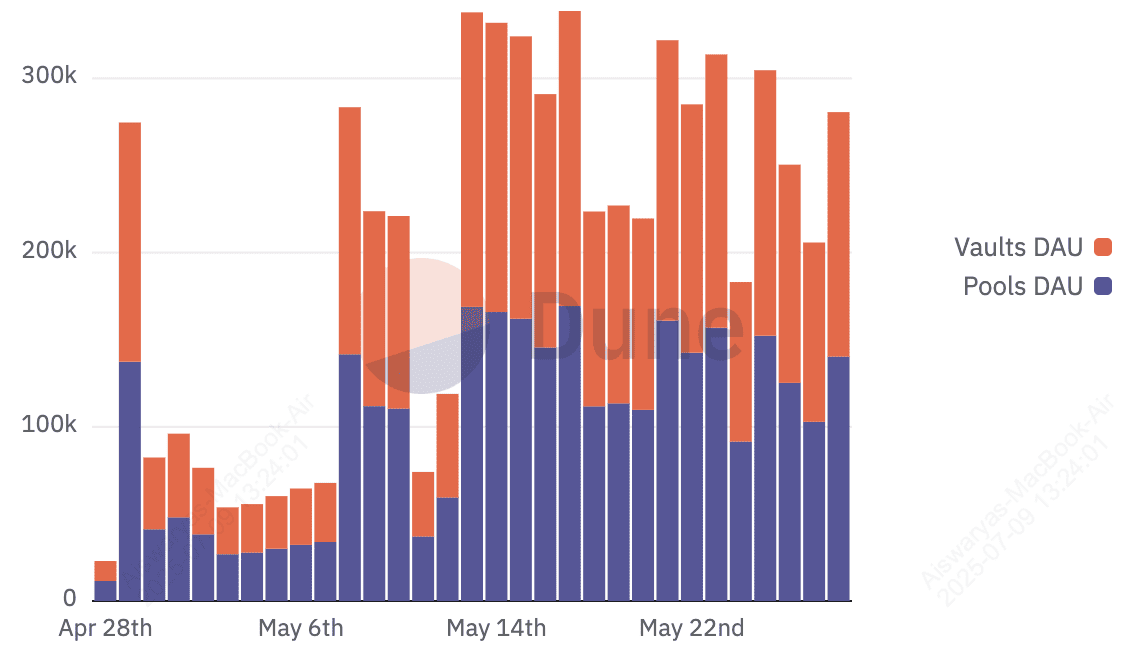

Meteora's pools, vaults, and number of users | Source: Dune Analytics

The numbers speak volumes. In May 2025, it became the highest fee-generating platform on Solana, with $5.37 million in daily fees, beating

Pump.fun and even Solana itself in daily network fees. These milestones highlight Meteora’s vital role in powering Solana’s memecoin launches and trading activity, which account for over 96% of new token launches on the network.

By integrating directly with aggregators like Jupiter and Raydium, Meteora ensures new memecoins get instant visibility and access to deep liquidity. Its fair-launch tools like Alpha Vault protect against sniper bots, while

M3M3’s stake-to-earn program encourages long-term holding. These innovations support a healthier memecoin market, helping avoid the rapid pump-and-dump cycles that often leave retail investors with losses. With partnerships and its v2 rollout introducing Dynamic Bonding Curve (DBC) mechanics, Meteora has redefined how memecoins are created and traded on Solana.

How to Get Started with Meteora: A Step-by-Step Beginner’s Guide

Getting started with Meteora is simple, even if you’re new to DeFi. The platform is designed for beginners and advanced users alike, with tools to help you provide liquidity, earn yields, and participate in Solana’s growing memecoin ecosystem. Here’s how you can dive in:

Step 1: Set Up Your Solana Wallet

Before you can start using Meteora, you’ll need a

Solana-compatible wallet such as

Phantom or Solflare. Download and install the wallet as a browser extension or mobile app, then create a new wallet and securely back up your

recovery phrase.

Once set up, fund your wallet with SOL, which is needed to pay network fees, and optionally add tokens like USDC if you plan to provide liquidity. You can easily

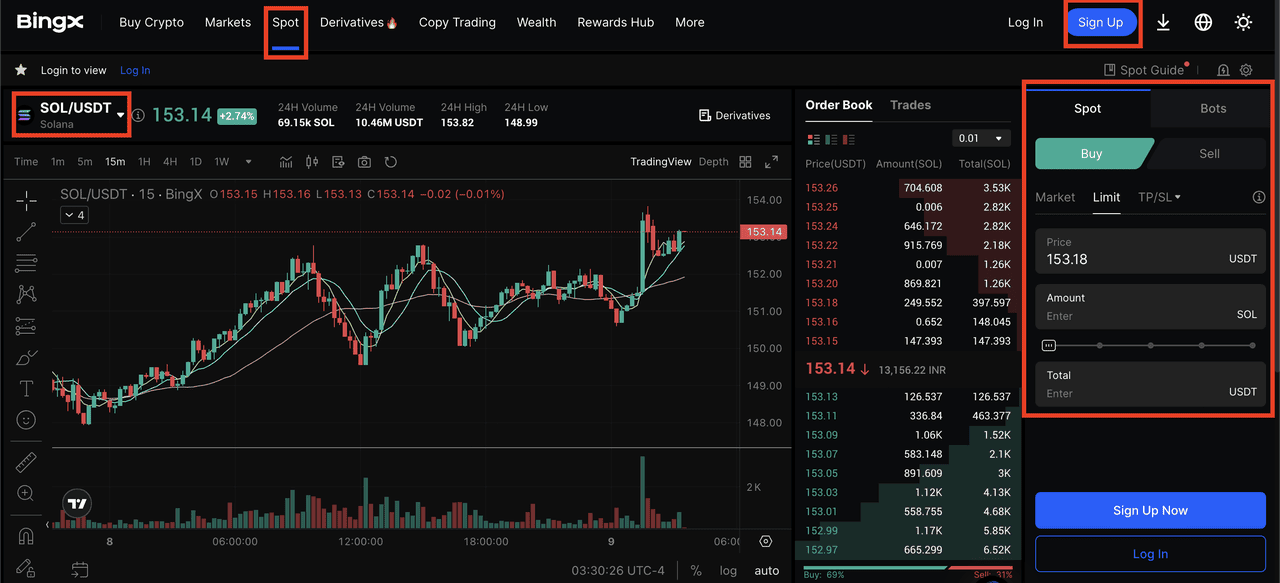

buy SOL on BingX using the

Quick Buy feature with a credit/debit card or on the

Spot Market, then transfer it to your wallet to get started.

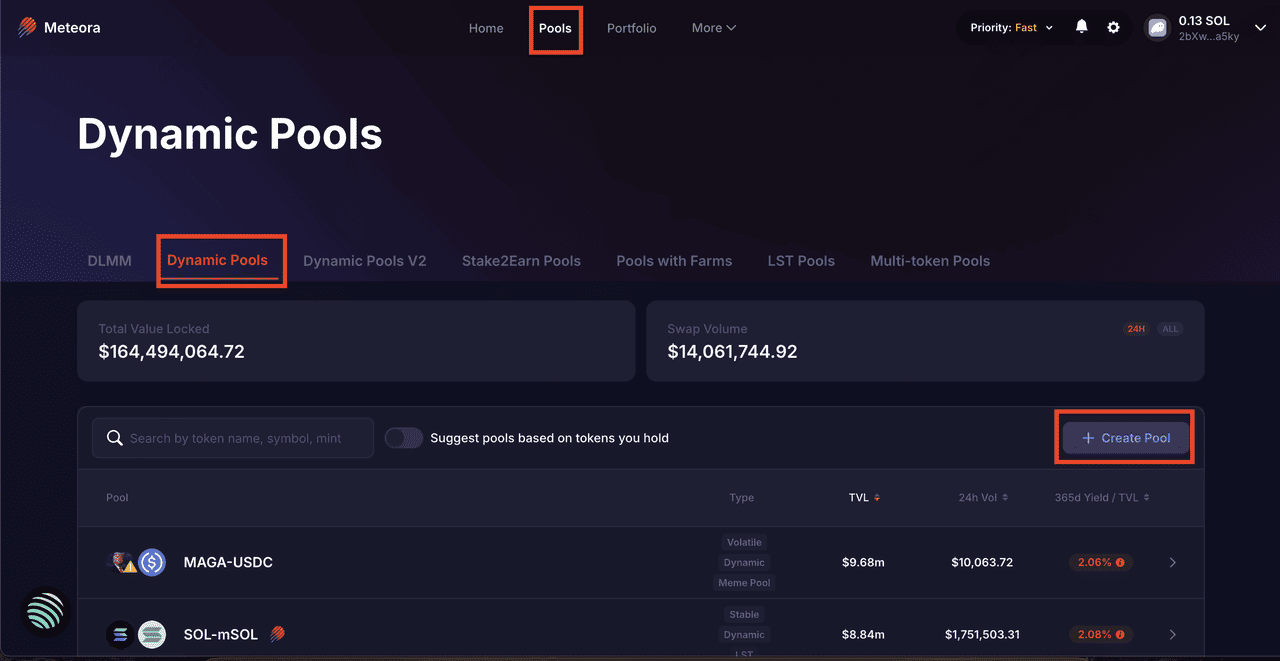

Step 2: Provide Liquidity via Dynamic AMM Pools

Dynamic AMM Pools let you earn in two ways: swap fees and lending yields.

• Select “Dynamic AMM” and pick a trading pair (e.g., SOL/USDC).

• Deposit equal value of both tokens into the pool.

• Your idle tokens are automatically lent out to top Solana lending platforms, earning additional interest.

• You can withdraw your funds anytime, along with earned rewards.

This is a great starting point for beginners since it requires minimal management.

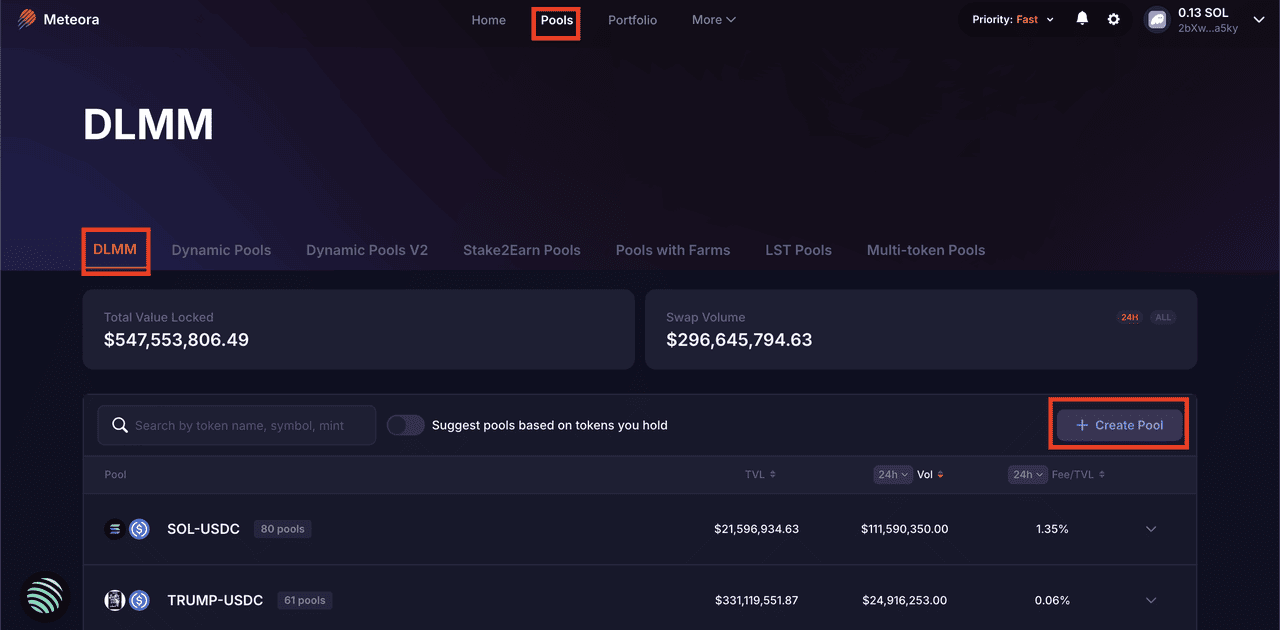

Step 3: Use DLMM Pools for Advanced Strategies

DLMM (Dynamic Liquidity Market Maker) Pools are for users who want more control over their liquidity.

• Choose a price range (called “bins”) where you want your liquidity to be active.

• Select a strategy:

- Spot: Spread funds evenly across the range.

- Curve: Concentrate liquidity around the current price for more frequent trading.

- Bid‑Ask: Place funds at the outer edges to DCA (dollar-cost average) in or out.

• Dynamic fees adjust automatically, letting you earn more during periods of volatility.

Note: DLMM Pools require some monitoring, as inactive bins don’t earn rewards.

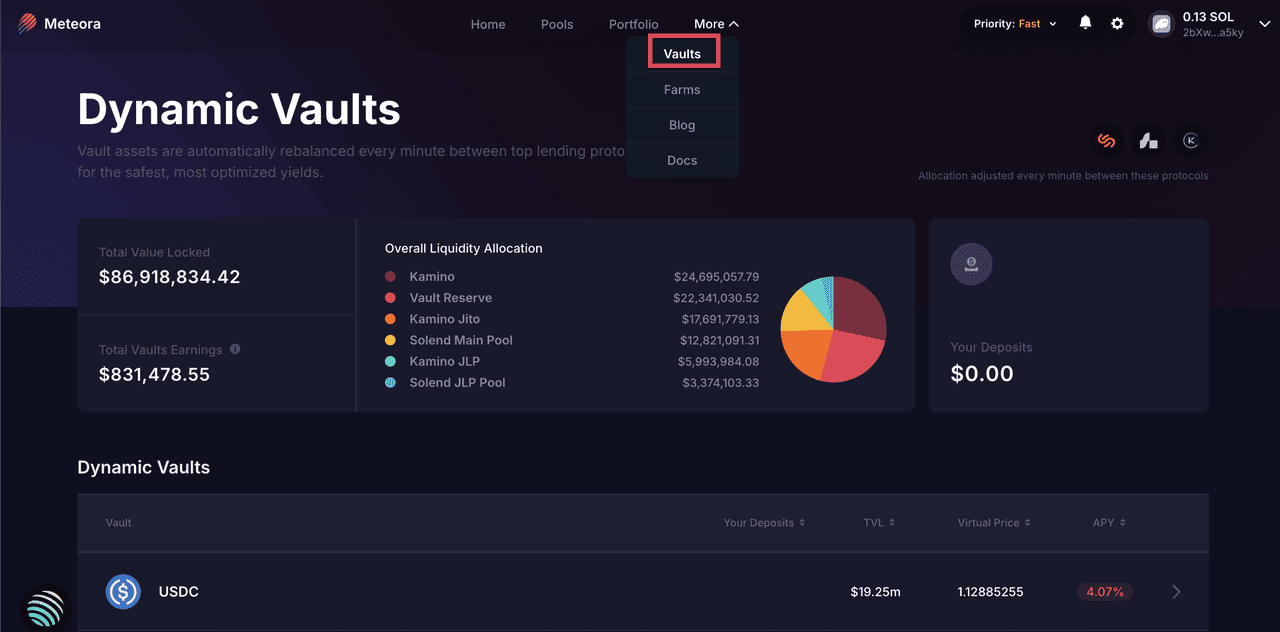

Step 4: Boost Yields with Dynamic Vaults

Dynamic Vaults let you earn pure lending yields without providing liquidity to a swap pool.

• Deposit tokens like SOL, USDC, or USDT directly into a vault.

• Your assets are automatically rebalanced every minute across Solana’s top lending protocols to capture the best returns.

• Withdraw anytime with no lock-up period.

This is ideal for passive income seekers who prefer minimal effort.

Step 5: Earn LP Points and Prepare for a Potential Meteora Airdrop

Meteora’s stimulus program rewards liquidity providers with points:

• Earn 1 point per $1 TVL held per day.

• Earn 1,000 points per $1 in fees generated daily.

• Early providers get a 1.3x multiplier for the first three months.

These points may later translate into allocations of Meteora’s potential upcoming token, expected as part of a future airdrop.

Step 6: Use Tools to Stay Ahead

Meteora has rolled out several upgrades to make your journey smoother:

• P&L Tracker: Check your profits and losses in real time.

• DLMM Monitoring Tools: Get insights into bin performance and fee generation.

• Telegram Alerts: Stay updated on market moves and pool performance.

• User Dashboards: New beginner-friendly dashboards show TVL, yield stats, and airdrop eligibility.

• Cross-Chain Plans: Upcoming integrations with

BNB Chain via Roam will expand your options.

Risks & Safety Tips

When using Meteora, be mindful of potential risks common in DeFi. Providing liquidity exposes you to impermanent loss, where your returns may be lower than simply holding the tokens. While Meteora’s

smart contracts are audited,

smart contract risks remain, so only deposit what you can afford to lose. Dynamic Vaults rely on external lending platforms, which, despite having caps and monitoring systems, carry their own risks. Lastly, if you’re in stablecoin pools, watch for rare but possible stablecoin de-pegging events that can impact your funds. Always stay informed and review pool metrics regularly.

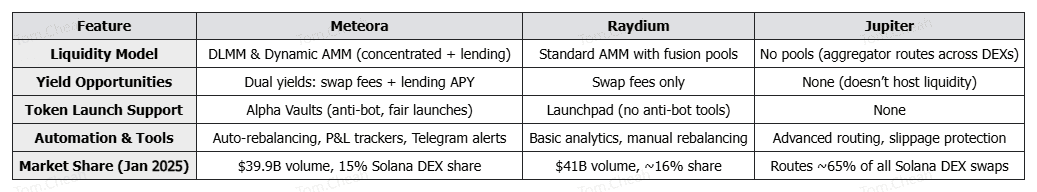

How Does Meteora Differ From Other Solana DEXs?

Meteora goes beyond a Solana DEX as a next-gen liquidity hub that focuses on capital efficiency, dual-yield generation, and fair token launches. While platforms like Raydium and Orca excel at swaps and basic AMM functionality, Meteora introduces Dynamic Liquidity Market Makers (DLMMs) and Dynamic Vaults, giving liquidity providers (LPs) more ways to earn and manage capital.

Unlike traditional AMMs, Meteora allows you to concentrate liquidity within specific price ranges using DLMM pools. This means your funds are put to work exactly where trading happens most, earning higher fees with less capital. Plus, idle assets in AMM pools are auto-lent to Solana lending platforms, unlocking an additional layer of yield, a feature rare in Solana’s DeFi ecosystem.

Meteora vs. Raydium and Jupiter

Meteora stands apart from other Solana DEXs like Raydium and Jupiter by offering a powerful blend of concentrated liquidity, dual-earning yields, and advanced launch tools. Raydium remains a popular choice due to its combination of AMM and Serum order‑book integration, offering deep liquidity and farming incentives, but it lacks built-in automation for yield optimization. With Raydium, you'll earn swap fees, but you'll have to manage all rebalancing and liquidity distribution manually. By contrast, Meteora’s Dynamic Vaults automatically rebalance deposits every minute across top lending platforms, ensuring your idle assets consistently earn optimal returns without any manual effort.

Meanwhile, Jupiter is the premier routing aggregator on Solana, ensuring you get the best swap prices across DEXs. However, Jupiter doesn’t host any liquidity, instead it relies on platforms like Meteora to supply it. In fact, after token launches, Jupiter immediately routes to new Meteora DLMM pools using its “Instant Routing” feature, thanks to the superior depth and fee efficiency of these pools. This means when you trade on Jupiter, there's a strong chance your swap will execute through Meteora’s smartly optimized infrastructure, giving you competitive pricing and supporting deep, efficient markets.

Final Thoughts: What to Expect from Meteora in 2025 and Beyond

Meteora is shaping up to be a major force in Solana’s DeFi ecosystem. With the upcoming launch of Meteora v2, users can expect a refreshed interface, enhanced analytics tools, and more user-friendly features designed to simplify liquidity management. The team is also working on cross-chain integrations, which could extend Meteora’s dynamic liquidity solutions beyond Solana and into other blockchain ecosystems.

In addition, the newly announced Meteora Capital Markets Fund, a $1 million initiative, aims to support teams building Internet Capital Markets on Solana by providing funding, infrastructure, and hands-on support. This move signals Meteora’s commitment to fostering innovation and scaling permissionless asset creation within the ecosystem. Plans for governance dashboards and improved community transparency around token allocations further suggest a push toward decentralization and greater user participation.

As with any DeFi platform, it’s important to approach with caution. Risks like impermanent loss, smart contract vulnerabilities, and lending platform dependencies remain inherent to these systems. Start small, learn how the platform works, and regularly monitor your positions. If Meteora continues to innovate and deliver on its roadmap, it could play a defining role in how liquidity is managed across blockchains in the years ahead.

Related Reading