Plasma is a next-generation blockchain built for

stablecoins, delivering zero-fee USDT transfers, deep liquidity, and high-speed settlement. With its upcoming mainnet launch and token generation event (TGE) of the native token XPL, Plasma aims to position stablecoins as the core financial primitive for global payments and DeFi. XPL will power transactions, reward validators, and drive ecosystem growth across the network.

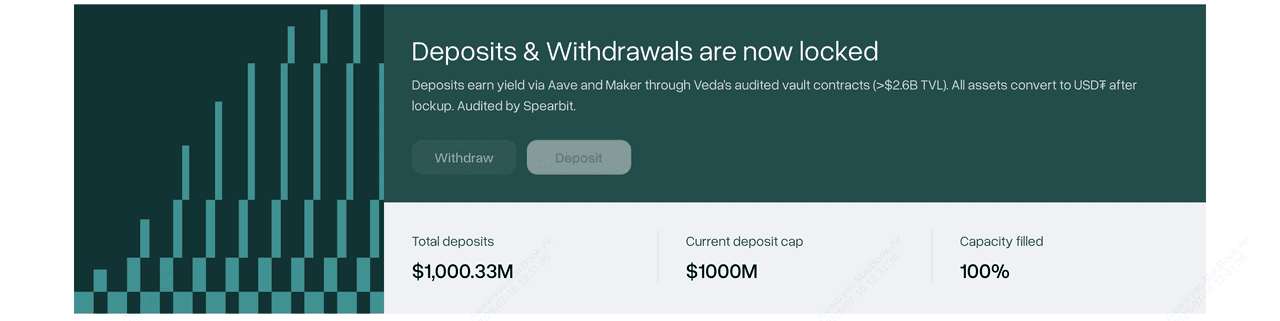

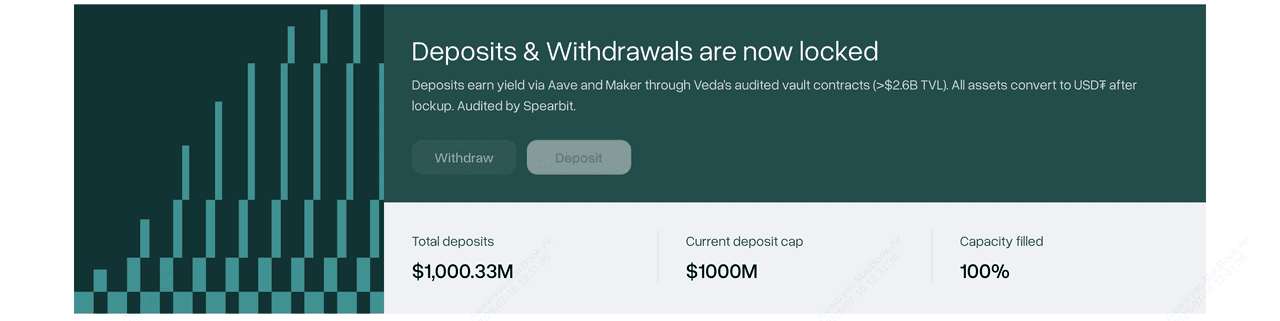

In 2025, Plasma has already secured strong traction with $1B in

Tether (USDT) deposits in June, an oversubscribed

public sale in July, a $250M yield program in August, and most recently a $200M Maple pre-deposit vault in September, all signaling heavy demand for its stablecoin-first infrastructure.

This guide covers everything you need to know about Plasma, the XPL token, the public sale, and how the project is positioning itself as the blockchain for stablecoins.

What Is Plasma Blockchain and How Does It Work?

Plasma is a new high-performance Layer 1 blockchain launched by Tether to scale stablecoin adoption globally. Purpose-built for USDT payments, settlement, and DeFi, Plasma positions stablecoins as the core financial primitive of crypto. Unlike general-purpose blockchains, it delivers zero transaction fees for USDT transfers, lightning-fast settlement, and a robust ecosystem tailored specifically for stablecoin innovation.

An overview of Plasma's working | Source: Plasma blog

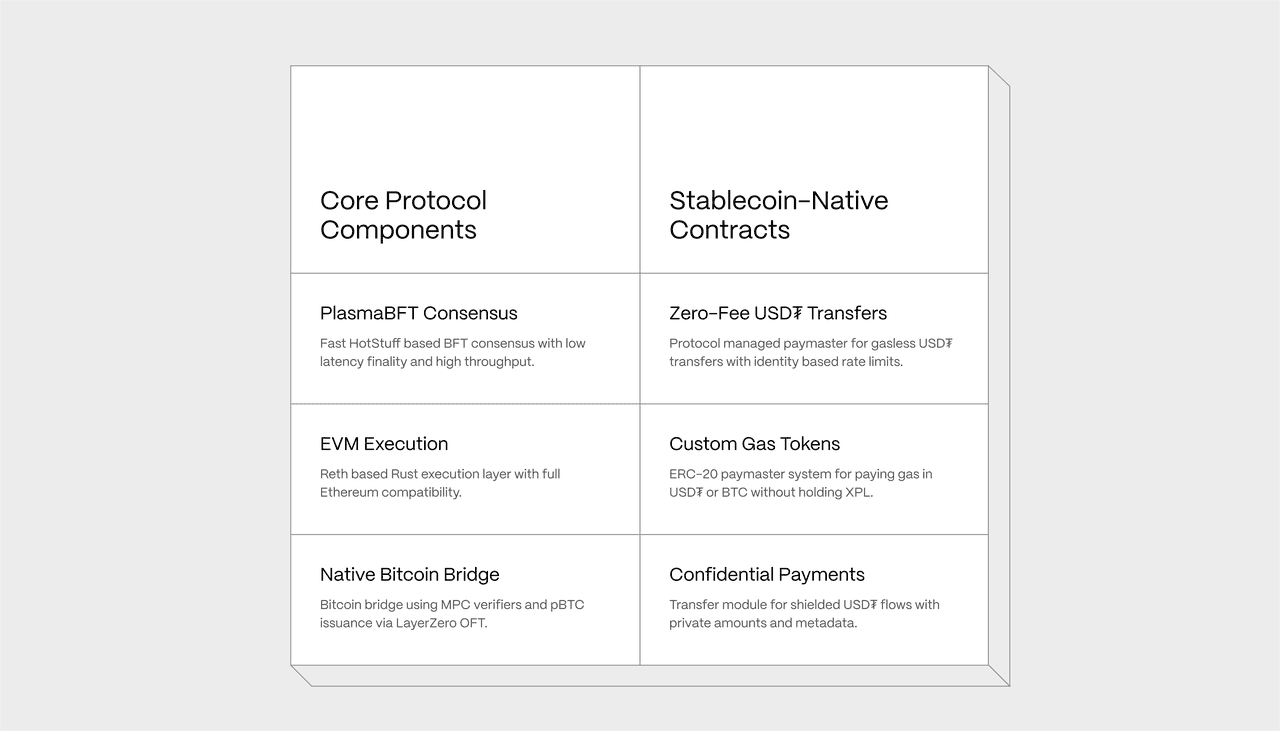

Key Features of Plasma Network

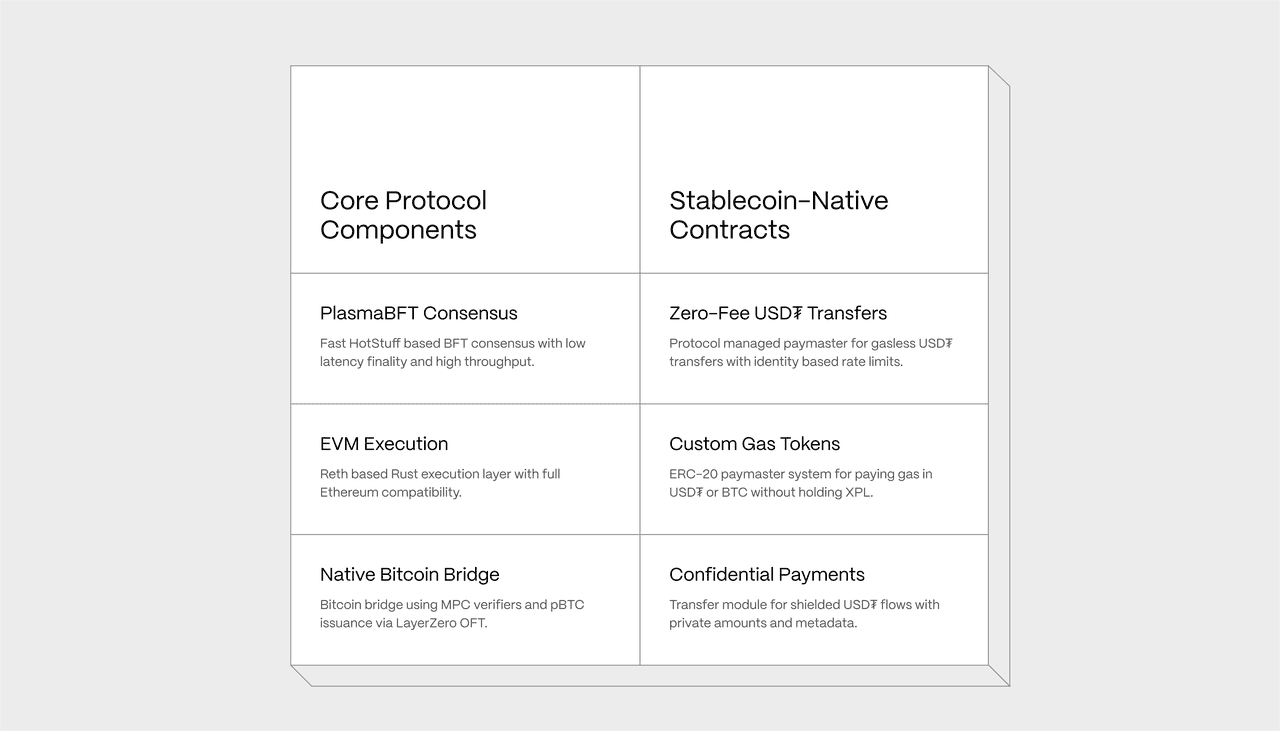

Plasma leverages a trust-minimized Bitcoin bridge and a modular EVM execution layer built on Reth. This ensures developers and users enjoy a seamless, scalable, and secure environment for building next-generation financial applications.

• Zero-Fee USD₮ Transfers: Plasma enables users to send USDT without paying any

gas fees or holding additional tokens for transactions, making it ideal for high-frequency payments and micropayments.

• High-Performance Consensus (PlasmaBFT): Utilizing a pipelined Fast HotStuff algorithm, Plasma can process thousands of transactions per second with deterministic finality achieved in seconds.

• Bitcoin-Level Security: State roots are anchored to

Bitcoin, the most secure and decentralized blockchain, ensuring robust security and minimizing single points of failure.

• Full EVM Compatibility: Developers can deploy existing Solidity contracts without modification using standard tools like Hardhat and Foundry. Users can interact seamlessly via popular wallets such as

MetaMask.

• Dedicated Ecosystem and Deep Liquidity: Plasma focuses exclusively on stablecoins, launching with over $1 billion in liquidity to support payments, DeFi, merchant settlements, and permissionless banking from day one.

Why Plasma Is Built for Stablecoins

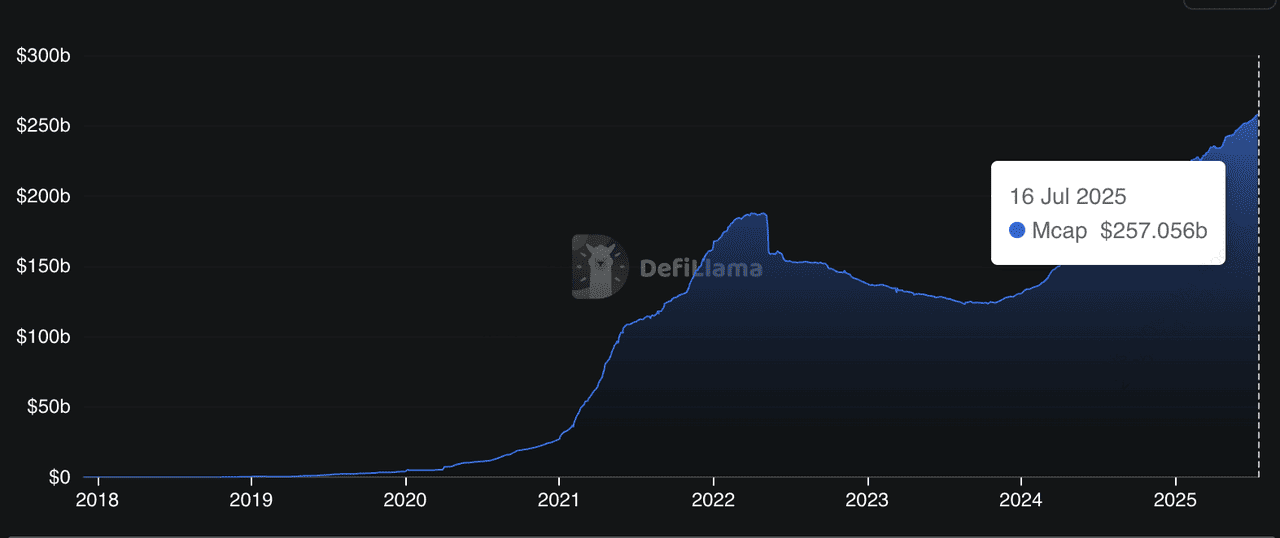

Stablecoins' total market cap | Source: DefiLlama

Stablecoins have become one of the most critical use cases in crypto, with over $250 billion in supply and trillions of dollars moved monthly across blockchains. However, most legacy networks like

Ethereum or Bitcoin were not designed with stablecoins in mind. High transaction fees, slow settlement times, network congestion, and a lack of dedicated infrastructure often limit stablecoin utility for global payments and DeFi applications. Plasma solves these pain points by offering a blockchain purpose-built for stablecoins from the ground up.

How Plasma Differs from Other Blockchains

Unlike general-purpose chains, Plasma focuses entirely on stablecoins, resulting in several unique advantages:

• Zero Transaction Fees for USD₮: Unlike Ethereum’s gas fees or Solana’s variable costs, Plasma eliminates fees for transferring USDT, making it ideal for frequent, high-volume payments.

• Native Bitcoin Integration: Plasma includes a trust-minimized Bitcoin bridge, enabling direct BTC transfers into its

EVM environment, something not possible on most chains.

• Dedicated Liquidity: Launching with over $1 billion in stablecoin liquidity ensures developers and users can transact efficiently from day one.

• Purpose-Built Architecture: While networks like Ethereum prioritize decentralization for all

dApps, Plasma optimizes for stablecoin speed, cost, and reliability.

By focusing solely on stablecoins, Plasma provides an infrastructure that can scale global payment systems, power DeFi protocols, and support financial applications without the compromises seen in multi-purpose blockchains.

What Is XPL, Plasma Network's Native Token?

XPL is the native token of the Plasma blockchain. It plays a central role in securing the network, paying for transactions, and incentivizing ecosystem participants.

XPL Token Utility

1. Transaction Fees: Used as the primary gas token for non-sponsored transactions.

2. Staking and Validation: Validators stake XPL to secure the network and earn rewards.

3. Governance: XPL holders can vote on protocol upgrades and treasury allocations.

4. Ecosystem Incentives: Rewards for developers, liquidity providers, and early adopters.

Plasma (XPL) Tokenomics

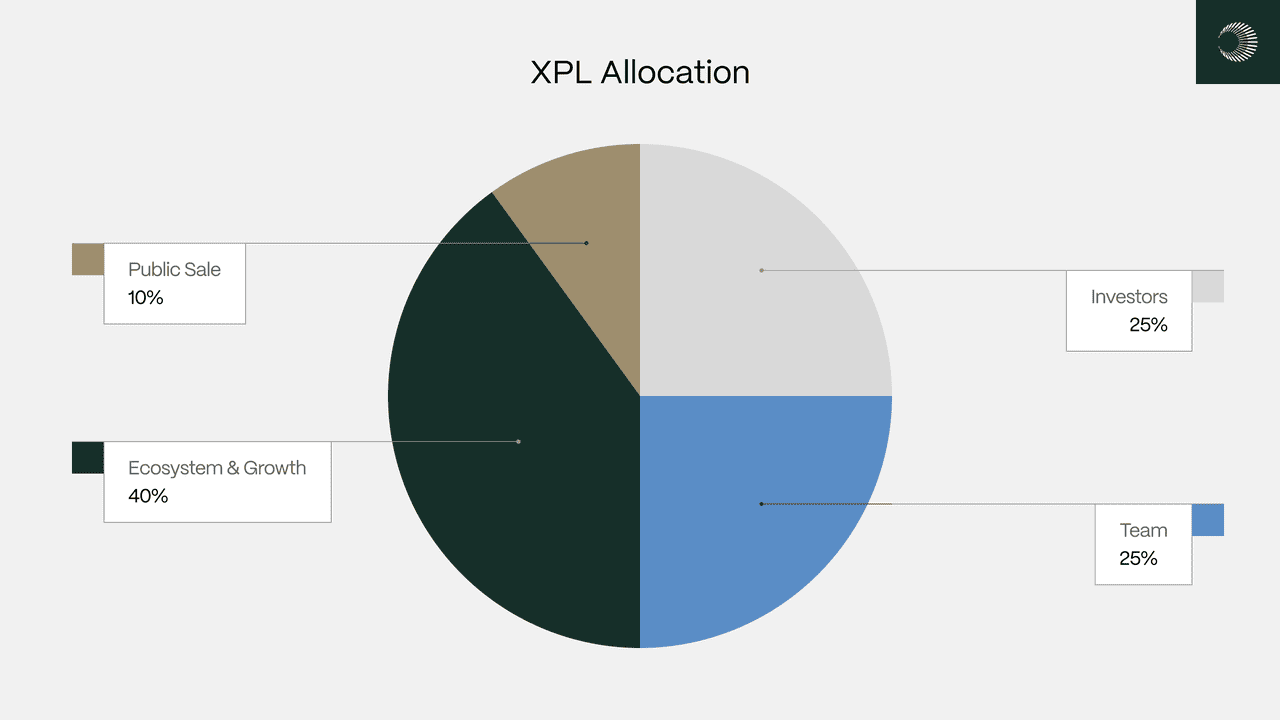

XPL token allocation | Source: Plasma docs

At launch, Plasma will issue 10 billion XPL tokens, with allocations as follows:

1. Public Sale: 10% (1 billion XPL) - Allocated to participants in the deposit campaign.

2. Ecosystem and Growth: 40% (4 billion XPL) - Designed to fund strategic initiatives for expanding Plasma’s utility, liquidity, and institutional adoption.

3. Team: 25% (2.5 billion XPL) - Incentivizes current and future service providers.

4. Investors: 25% (2.5 billion XPL) - Allocated to early backers including Founders Fund, Framework, and Bitfinex.

Validator rewards begin at 5% annual inflation, reducing by 0.5% yearly to a 3% baseline. Base fees paid on Plasma are burned following an EIP-1559-like model, balancing emissions over time.

Plasma (XPL) Token Sales: Major Events Timeline before TGE

Plasma’s native token XPL has already gone through four major fundraising and liquidity events in 2025, building strong momentum ahead of its mainnet beta launch and upcoming token generation event (TGE).

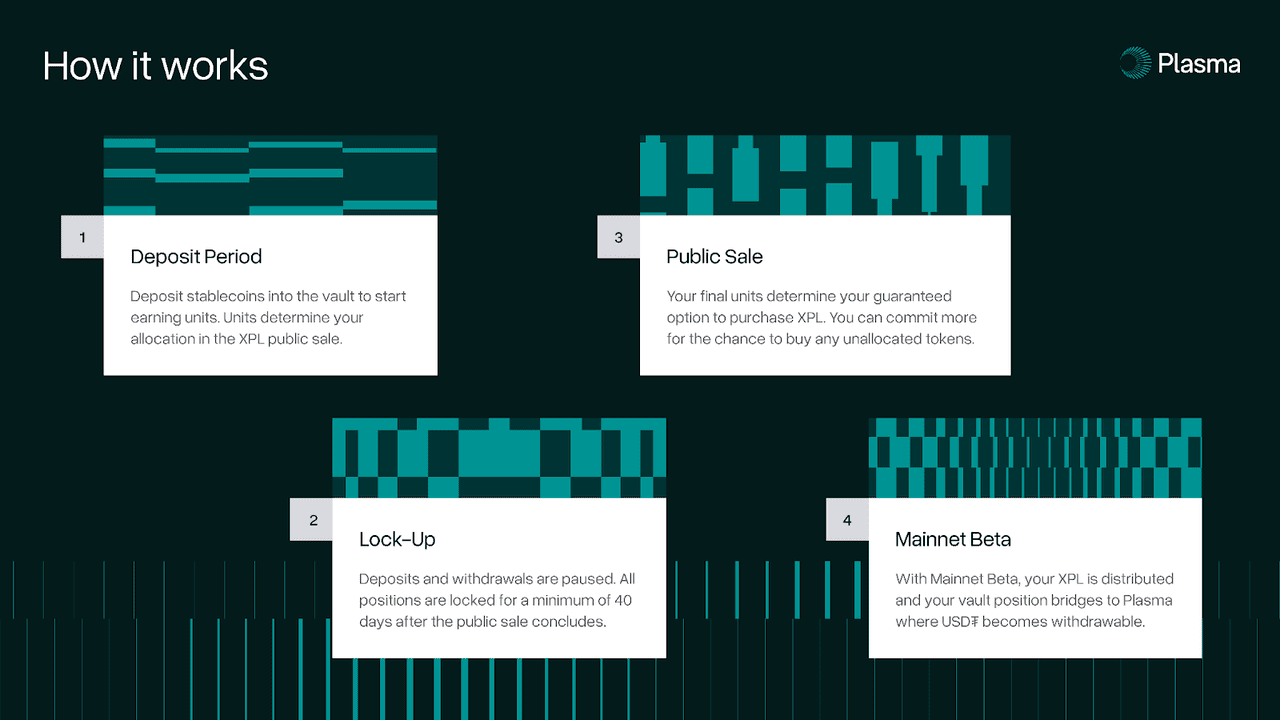

How the Plasma token public sale works | Source: Plasma blog

1. June 2025: $1B USDT Deposits

Plasma secured $1 billion in Tether (USDT) deposits, creating a deep liquidity base that signaled strong market confidence well ahead of the mainnet. This early traction laid the groundwork for subsequent sales and yield programs.

2. July 17–28, 2025: $373M Public Sale of 1B XPL on Sonar

Plasma’s first-ever public sale was conducted via Sonar by Echo, distributing 1 billion XPL (10% of supply) at a $500M valuation. The sale was heavily oversubscribed, raising ~$373 million, with over 4,000 wallets participating and a median deposit of ~$12,000. The vault-based structure rewarded time-weighted deposits, guaranteeing allocations. Non-U.S. buyers will receive tokens at Mainnet Beta, while U.S. buyers face a 12-month lockup until July 28, 2026.

3. August 20, 2025: $250M Yield Program

Plasma launched a USDT yield program capped at $250M, which filled in under an hour. Investors earned daily USDT rewards plus a share of 100M XPL tokens (1% of supply), to be distributed after TGE. This event showcased the intense demand for exposure to XPL even before mainnet.

4. September 16, 2025: Maple $200M Pre-Deposit Vault

Plasma partnered with Maple Finance to open a $200M syrupUSDT pre-deposit vault, which was fully subscribed despite requiring a $125K minimum. The vault offered XPL rewards, Maple’s institutional lending yield, boosted “Drips,” and additional DeFi opportunities once Plasma mainnet goes live with $2B supply available for borrowing on day one.

5. Mainnet Beta Launch & TGE (Upcoming)

The next milestone is the Plasma Mainnet Beta launch and the long-awaited Token Generation Event (TGE), which is expected in Q3 2025 pending official confirmation. At that time, participants will receive their unlocked XPL allocations (region-dependent) and gain the ability to withdraw stablecoin vault deposits directly on Plasma, marking the transition from fundraising and liquidity bootstrapping to live stablecoin payments and DeFi applications.

This structure rewarded long-term commitment and broad participation. For future campaigns or validator staking, monitor Plasma’s official channels and community updates for the next steps.

How to Store and Trade XPL Tokens on BingX After Launch

You can store and trade your XPL tokens directly on BingX for a seamless experience. BingX provides a secure and user-friendly platform where you can manage your XPL holdings, execute trades, and access market data in real time. As soon as XPL becomes available for trading after Plasma’s

mainnet beta launch, you’ll be able to buy, sell, or transfer your tokens easily within the BingX ecosystem.

Alternatively, XPL can also be stored in

EVM-compatible wallets like MetaMask or in

hardware wallets such as

Ledger and Trezor for added security. These options allow you to interact with Plasma’s decentralized applications and participate in

staking or governance.

Conclusion

Plasma is positioned as the first blockchain purpose-built for global stablecoin payments, offering zero fees, deep liquidity, and Bitcoin-level security. With the mainnet beta and XPL token launch approaching, it has the potential to redefine how money moves onchain. However, like any new blockchain and token launch, XPL may experience significant price volatility after its debut. Users should carefully evaluate their risk tolerance, stay alert to potential scams, and avoid interacting with unofficial claim portals.

For the latest updates on trading availability and ecosystem developments, follow Plasma’s official channels and BingX announcements.

Related Reading

FAQs on Plasma (XPL)

1. When is the Plasma mainnet beta launch?

Plasma’s mainnet beta launch is expected in Q3 2025. Follow official channels for confirmation.

2. How many XPL tokens are there?

The initial supply is 10 billion XPL, with planned inflation for validator rewards.

3. Can I still participate in Plasma campaigns?

Yes, upcoming ecosystem campaigns and staking opportunities will be announced soon.

4. Where can I trade XPL tokens?

You will be able to trade XPL on BingX and other major exchanges post-launch.

5. What makes Plasma different from other blockchains?

Plasma is purpose-built for stablecoins, offering zero-fee transfers, Bitcoin-level security, and EVM compatibility.