Sei Network is emerging as the fastest parallel

Layer 1 blockchain, aiming to transform trading,

DeFi, and real‑time apps. It combines

EVM compatibility, parallel execution, and sub‑second finality, making it a powerful alternative to existing chains.

In 2025, Sei has burst into the spotlight. SEI token surged over 80% in a week as DeFi usage soared and TVL approached $1.1 billion. Institutional trust followed: Sei was shortlisted by Wyoming as a candidate blockchain for its state-issued stablecoin pilot. Major

DEX activity,

gaming usage, and weekly volumes set new records.

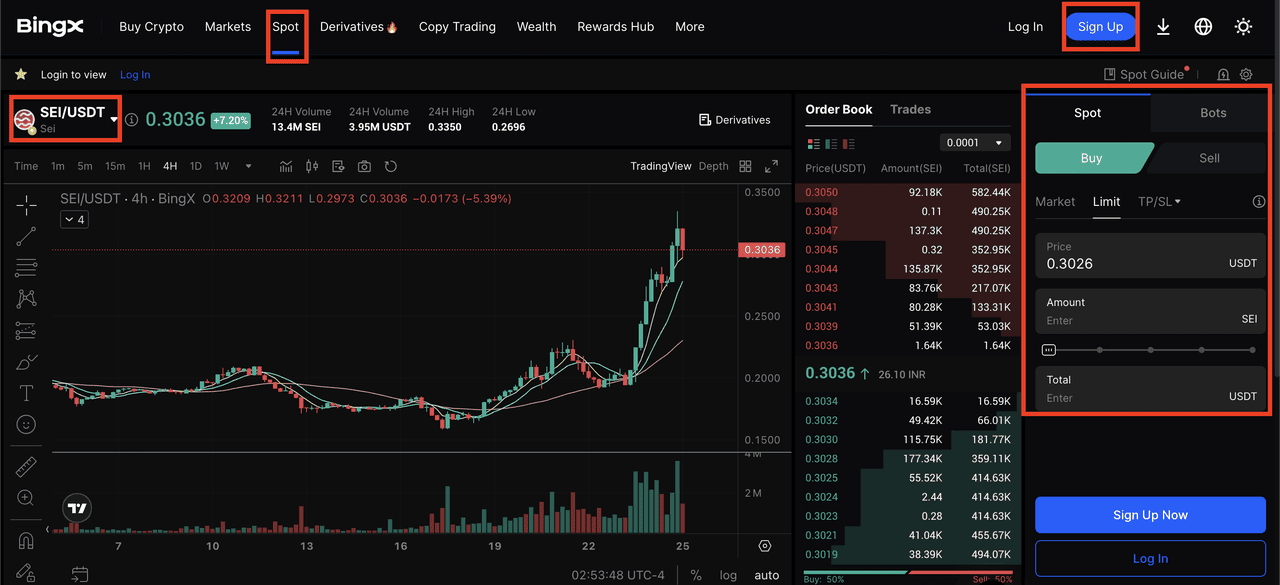

SEI price surge | Source: BingX

Curious what makes Sei tick, and why it's grabbing attention in 2025? Read on to explore the Sei blockchain's unique tech, growing ecosystem, and what this breakthrough means for users and investors.

What Is Sei Network?

Sei Network is a high-speed, open-source Layer 1 blockchain built specifically for trading, DeFi,

NFTs, and

Web3 gaming. Unlike general-purpose blockchains like

Ethereum or

Solana, Sei focuses on speed, low latency, and scalability, delivering real-time performance for high-frequency applications.

At the core of Sei’s architecture is parallel transaction execution and a built-in order-matching engine. This lets decentralized exchanges (DEXs) match and settle trades with sub-second finality, something most blockchains can’t achieve.

Sei supports the Ethereum Virtual Machine (EVM), so developers can deploy Solidity

smart contracts using familiar tools like

MetaMask, Remix, and Hardhat. It’s also built on the

Cosmos SDK, enabling cross-chain transfers via IBC (Inter-Blockchain Communication).

To achieve its speed, Sei uses Twin-Turbo Consensus:

• Intelligent Block Propagation speeds up

validator communication.

• Optimistic Block Processing reduces latency by skipping redundant steps.

With finality around 400 milliseconds, Sei delivers faster performance than Ethereum and more flexibility than Solana, making it ideal for any

dApp that needs real-time execution.

The project is backed by top investors like Multicoin Capital, Coinbase Ventures, and Jump Crypto, with over $35M in funding and a $120M ecosystem fund to support developers,

liquidity, and user adoption.

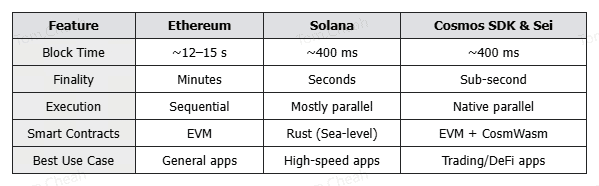

Sei vs. Ethereum vs. Solana: A Comparison

The blockchain world is full of Layer 1 networks, but few are built with trading and high-speed applications in mind. Here's how Sei compares with two of the most well-known players: Ethereum and Solana.

• Ethereum is the most widely used smart contract platform, known for its developer tools, dApp ecosystem, and strong security. But it comes with trade-offs, such as slow transaction speeds (12–15 seconds), high

gas fees, and network congestion during peak activity. It's great for general-purpose applications but not ideal for fast-paced trading.

• Solana offers high throughput and low costs, using a unique architecture that enables fast

block times. However, it has faced downtime issues, validator centralization concerns, and complex developer tooling. It's faster than Ethereum but still struggles to balance scalability with decentralization.

• Sei Network takes a different approach. It combines sub-second finality (~400ms), parallel execution, and EVM compatibility to offer a smoother, faster experience for both users and developers. By using Cosmos SDK, Sei also supports cross-chain transactions via IBC, giving it more flexibility than Solana.

What really sets Sei apart is its Twin-Turbo Consensus, a two-part system that includes Intelligent Block Propagation and Optimistic Block Processing. This speeds up transaction finality while keeping the network secure and efficient.

On top of that, Sei includes a native on-chain order-matching engine, something Ethereum and Solana don’t offer at the base layer. This makes Sei the ideal foundation for decentralized exchanges, high-frequency trading, and any application that relies on fast, fair, and transparent settlement.

Why Is Sei Gaining Attention in 2025?

Sei Network is turning heads in 2025, and for good reason. It’s not just the tech that’s impressive. The project is making big moves in the market, gaining institutional backing, and growing fast across DeFi.

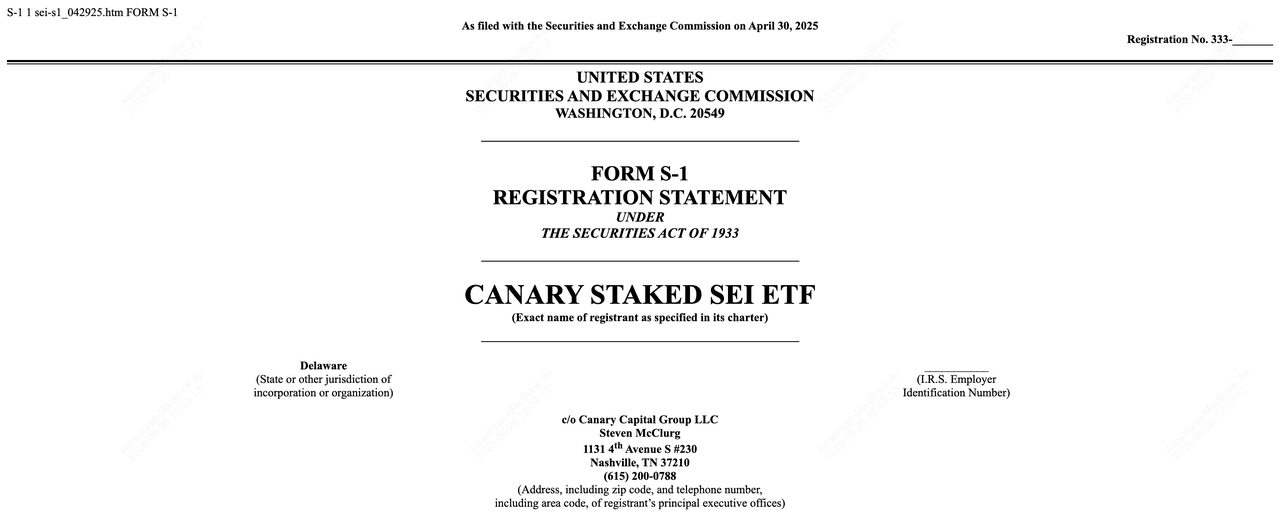

In early 2025, Wyoming selected Sei as a potential blockchain for its upcoming state-backed

stablecoin pilot (WYST). This places Sei alongside major players like Ethereum, Solana, and

Avalanche. At the same time, Canary Capital filed for the first SEI ETF, with a staking component. If approved, this would give institutional investors regulated access to SEI, while boosting the token’s credibility and visibility.

SEI Token and On-Chain Activity Strengthens

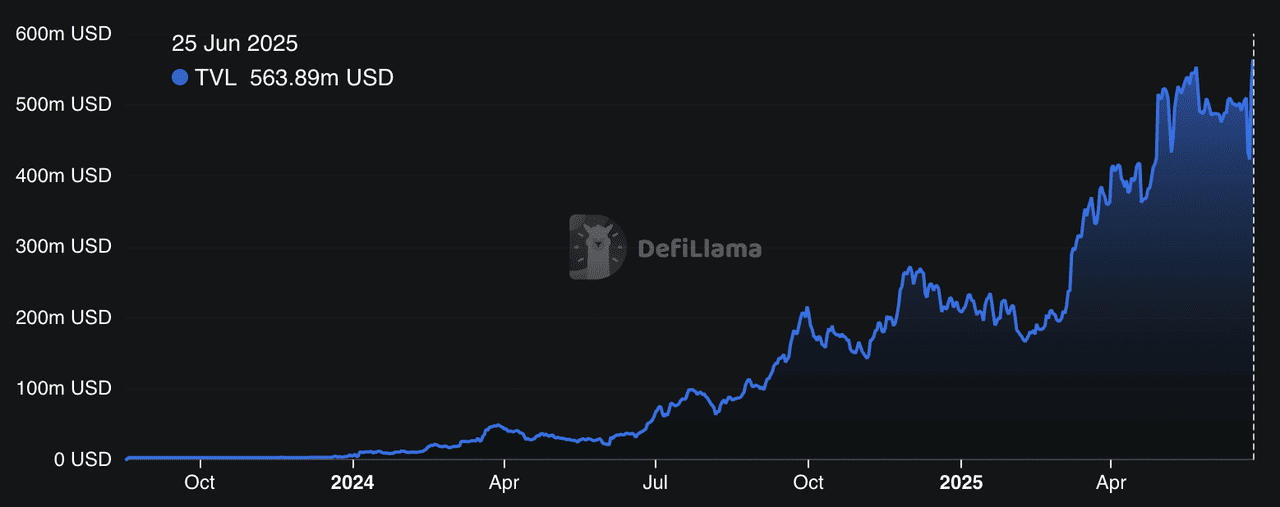

SEI’s price has surged between over 80% in the past week. Analysts link this rise to both speculative interest and real growth. As more DeFi protocols launch on Sei and user demand grows, momentum continues to build.

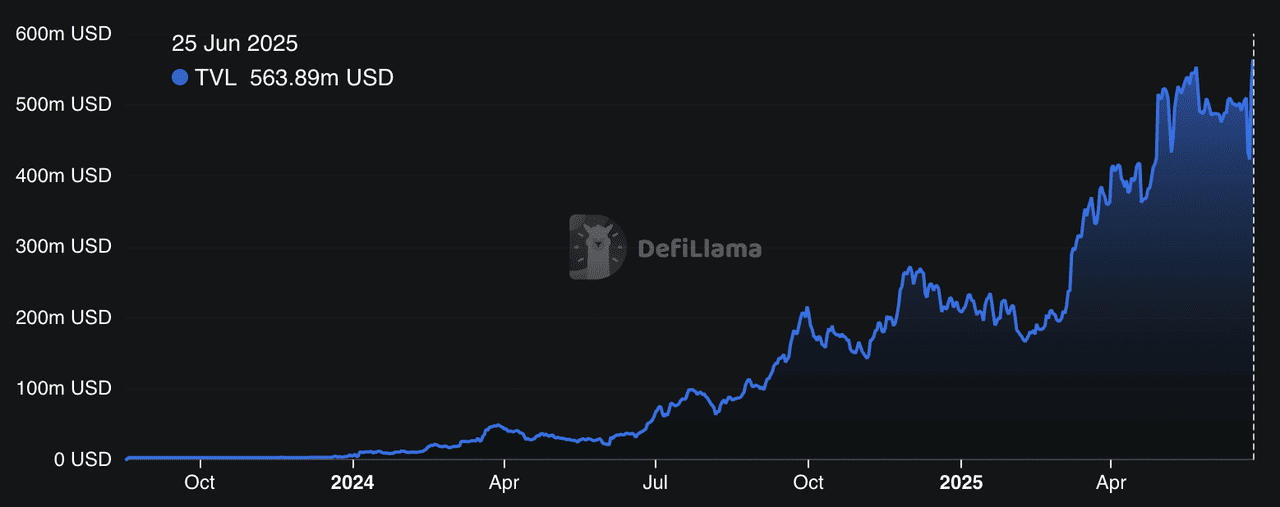

Sei's DeFi TVL | Source: DefiLlama

Behind the price action is serious on-chain activity. Sei now has over 28 million active addresses and a Total Value Locked (TVL) exceeding $1 billion as of June 2025. Platforms like Yei Finance and DragonSwap are driving this growth, while newer apps in NFTs, GameFi, and

staking are expanding Sei’s footprint. Sei network's DeFi TVL alone exceeds $560 million at the time of writing.

Sei's AI Integration via MCP

Another reason Sei is gaining attention? Its bold leap into AI integration through the

Model Context Protocol (MCP). This new feature allows

AI agents, like ChatGPT or Claude, to interact directly with the Sei blockchain. Using natural language, developers can check balances, read smart contracts, transfer tokens, and more. MCP bridges

AI with Web3 infrastructure, making blockchain tools more accessible and developer-friendly. As the demand for AI-driven automation in crypto rises, Sei is positioning itself as one of the first Layer 1s to offer seamless

AI-to-blockchain interaction.

A Look at the Sei Ecosystem

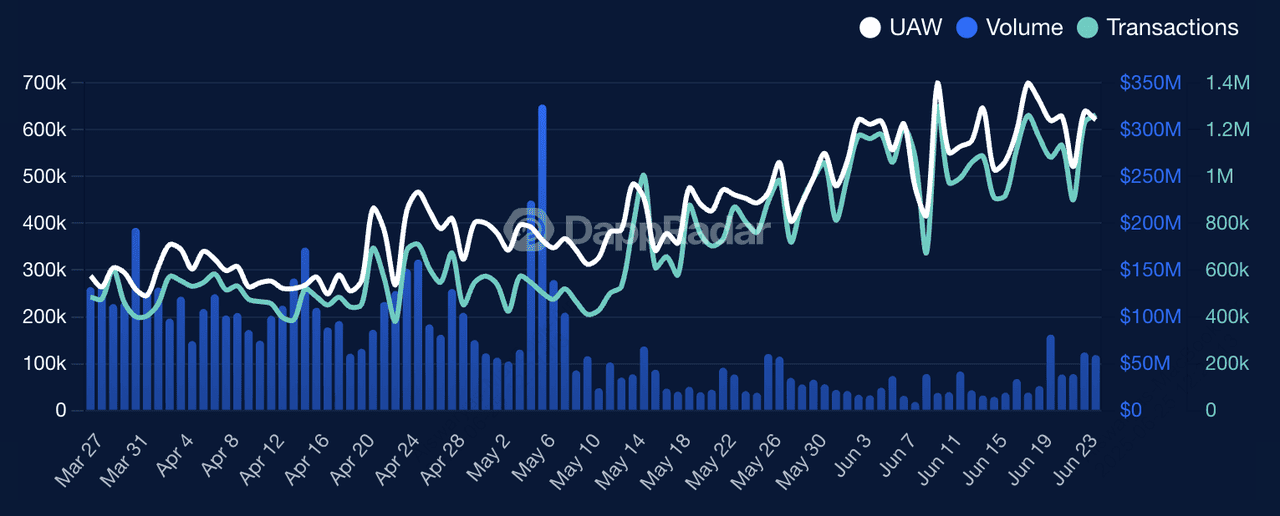

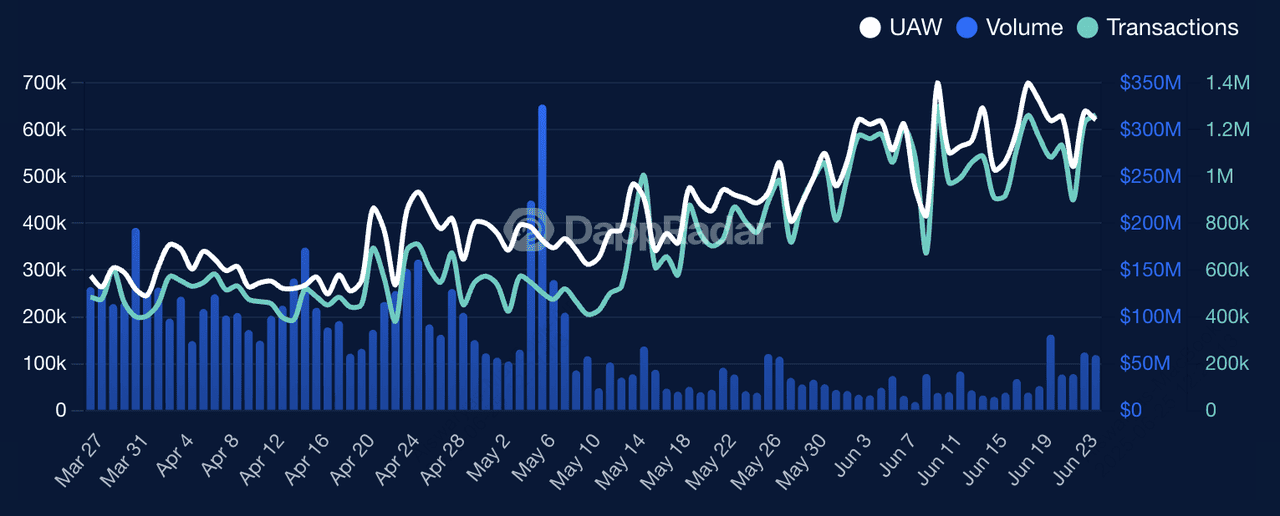

Sei dApp activity | Source: DappRadar

Sei’s ecosystem is rapidly expanding in 2025, with strong growth across DeFi, NFTs, gaming, and cross-chain infrastructure.

In DeFi, Sei is home to major protocols like DragonSwap, the first EVM-compatible DEX on the network, and Sailor, a Cosmos-native

orderbook exchange. Lending platforms such as Yei Finance, which holds over 60% of Sei’s DeFi TVL, and Takara Lend provide borrowing and yield opportunities similar to

Aave. Thanks to Sei’s native order-matching engine and sub-second finality, these apps deliver low fees, deep liquidity, and advanced trading features ideal for institutional and retail users alike.

Sei is also optimized for high-frequency trading (HFT). With 400ms block finality, batch auctions, and built-in frontrunning resistance, it enables precise and fair order execution on-chain.

On the NFT side, platforms like Pallet Exchange offer creators fast and affordable minting and trading. Low fees and instant settlement enhance the user experience for both collectors and marketplaces.

In gaming, Sei supports projects that demand fast, responsive gameplay. Titles like World of Dypians, Archer Hunter, and Enchanted Isles are gaining traction, contributing to a 79% spike in gaming activity in Q1 2025. These games blend NFT ownership, real-time interaction, and DeFi mechanics, showing Sei’s potential in the Web3 entertainment space.

Sei is also a hub for interoperability. Built on the Cosmos SDK, it natively supports IBC (Inter-Blockchain Communication), enabling seamless asset transfers with chains like Osmosis, Injective, and Secret Network. Bridges such as

Axelar,

Wormhole, and Skip Protocol allow users to move assets like

USDC,

ETH, and wBTC from Ethereum and other major ecosystems, making Sei a key player in the multi-chain DeFi landscape.

SEI Token Utility and Tokenomics

The SEI token is the native cryptocurrency of the Sei Network. It powers the core functions of the blockchain and plays a key role in keeping the network secure, decentralized, and user-friendly.

What Is the SEI Token Used For?

SEI has several key utilities across the ecosystem:

1. Transaction Fees: You pay gas fees in SEI when making trades, minting NFTs, or interacting with smart contracts. Its low fee structure helps keep apps affordable and efficient.

2. Staking: Sei uses a delegated proof-of-stake (dPoS) system. You can stake SEI to become a validator or delegate your tokens to others and earn staking rewards. Staking also helps secure the network and improve decentralization.

3. Governance: SEI holders can vote on major protocol upgrades and governance proposals. This includes decisions about network parameters, treasury usage, and ecosystem development.

4. DeFi & Collateral Use: SEI is also widely used within DeFi apps on the network. You can use it as collateral in lending protocols, provide liquidity in DEXs, or earn rewards through farming and incentive campaigns.

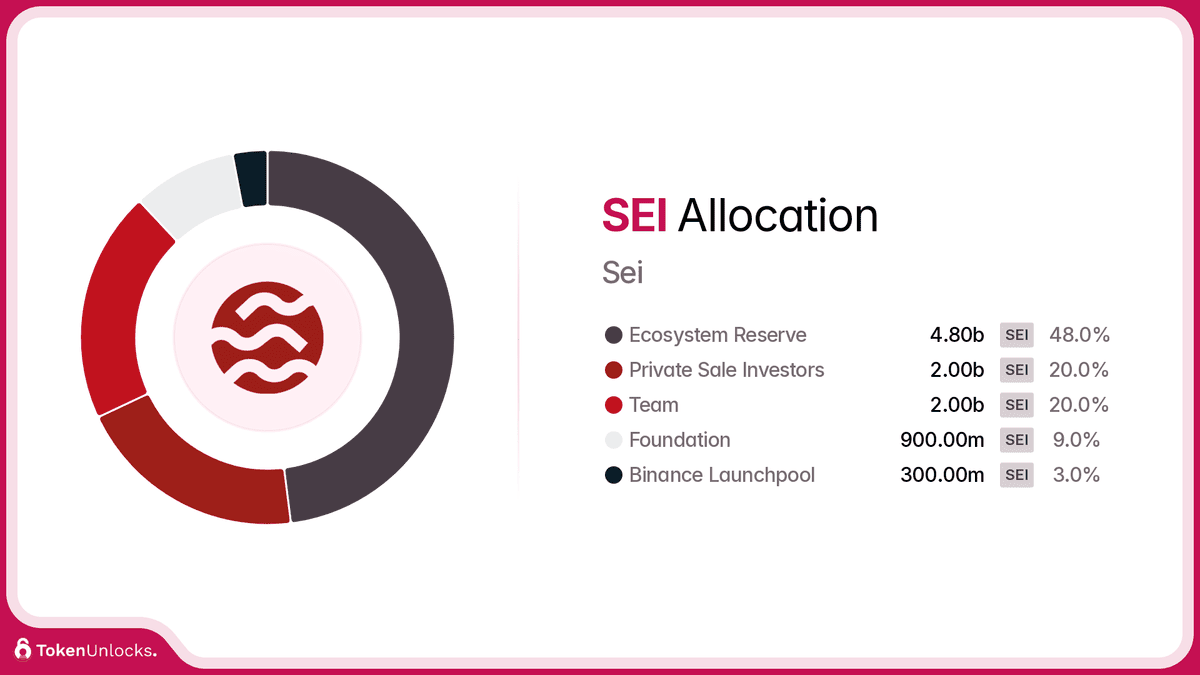

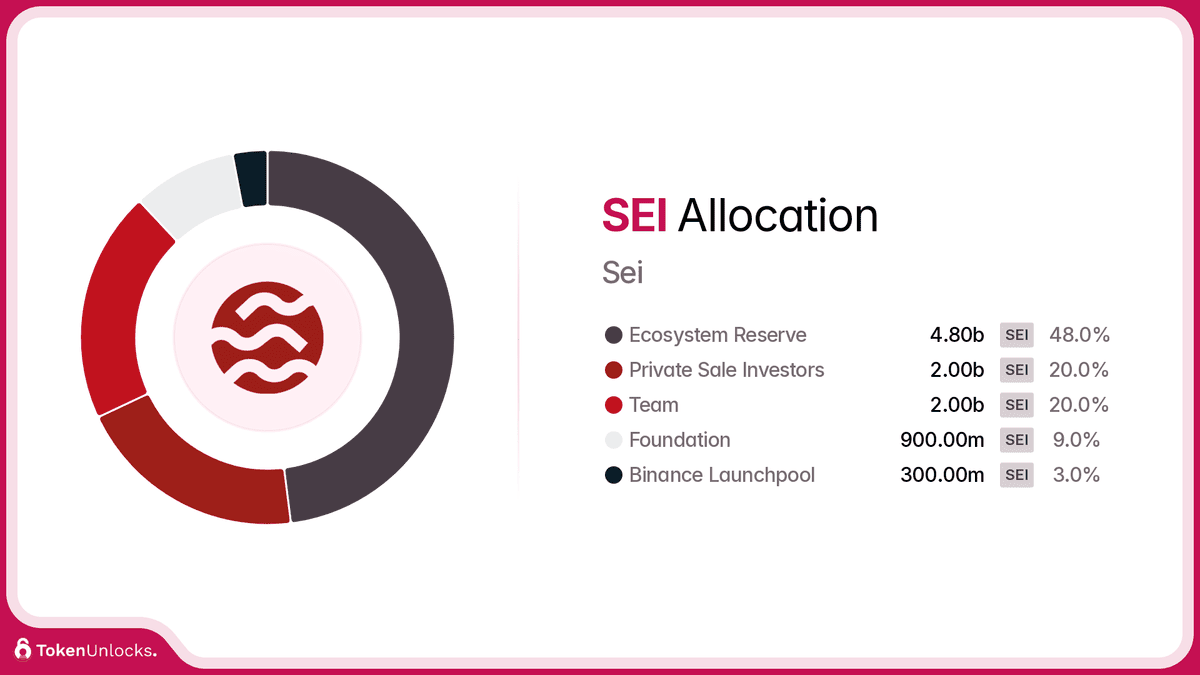

SEI Token Allocation Breakdown

SEI token distribution | Source: TokenUnlocks

SEI has a fixed total supply of 10 billion tokens, designed for long-term sustainability and community participation. Here's a general breakdown:

• Ecosystem Development – ~48%: Supports DeFi growth, dApp incentives, and network expansion

• Core Team & Contributors – ~20%: Rewards builders and early contributors with long-term vesting

• Investors – ~20%: Allocated to strategic backers and venture capital firms

• Foundation Reserve – ~9%: Used for grants, partnerships, and long-term sustainability

• Community & Airdrops – ~3%: Distributed to early users and community members to encourage adoption

Note: Some of these allocations are subject to vesting periods to promote responsible token release and avoid sudden market impacts.

How to Trade SEI on BingX: A Step‑by‑Step Guide

Ready to trade SEI? Here’s how to do it easily on BingX:

1. Sign up or log in to your BingX account and complete your

KYC.

2. Deposit funds via bank transfer, credit/debit card, or P2P.

4. Under the trading interface, choose your order type:

• Limit Order: Executes when SEI reaches your target price.

5. Enter the amount of SEI or

USDT, then hit Buy or Sell to complete.

• Monitor your open positions, and review filled orders in your order history.

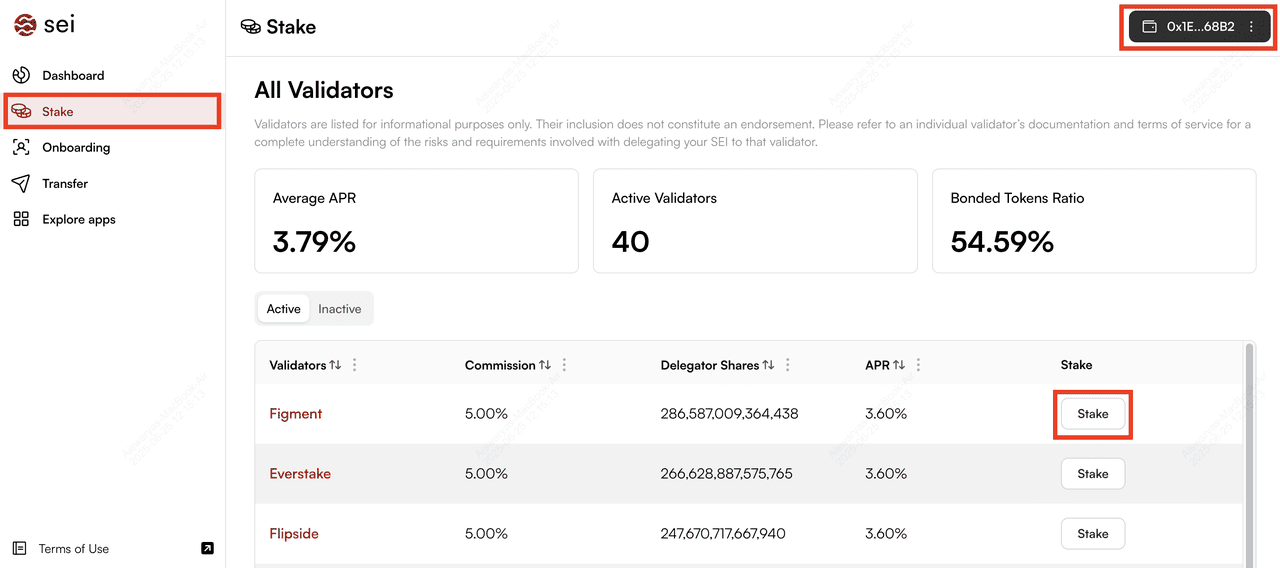

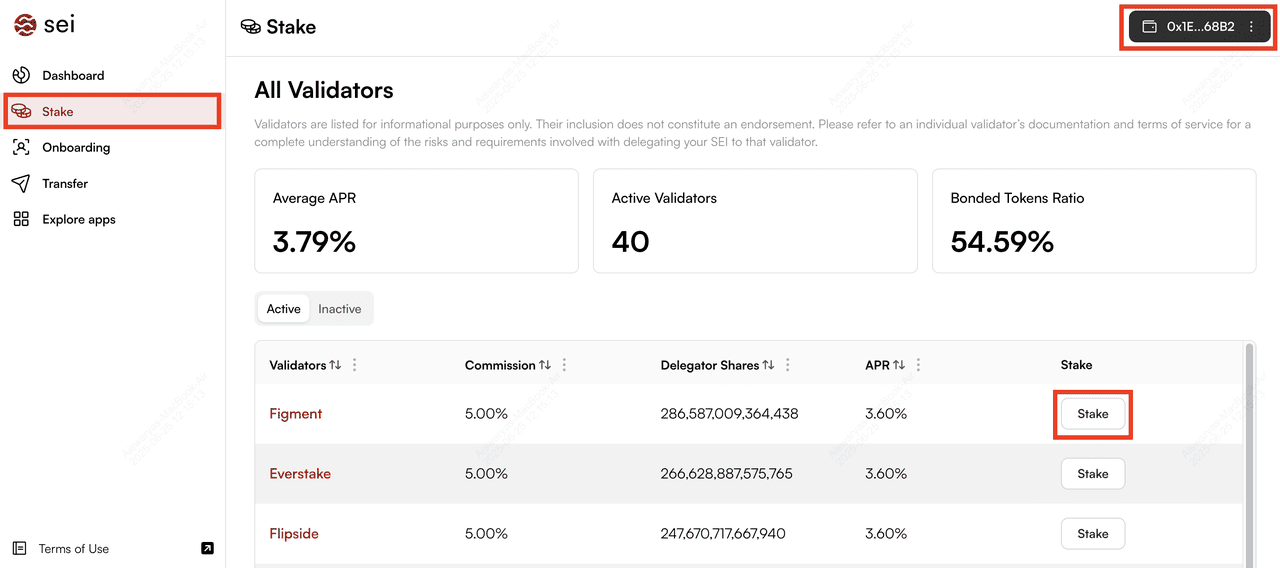

How to Stake SEI on Sei Network

Staking SEI tokens | Source: Sei app

Stake your SEI to earn passive rewards, and help secure the network. Here's how:

1.

Choose a wallet: Use

MetaMask, Keplr, Gem, or Compass/Everstake.

2. Add the Sei network in your

wallet settings.

3. Send SEI tokens to your wallet (min. ~1 SEI to cover fees).

4. Open the wallet’s Staking or Earn tab and select SEI.

5. Choose a reliable validator (e.g., Figment, Everstake).

6. Enter the amount to stake and confirm the transaction.

7. Your tokens are locked and earning rewards. Monitor your rewards in the staking dashboard.

To unstake, navigate to Unstake, then wait for the 21-day unbonding period.

Conclusion

Sei Network stands out in 2025 as the fastest parallel Layer 1 blockchain. It blends sub-second finality, EVM compatibility, and Cosmos interoperability, all powered by Twin‑Turbo Consensus and a native order-matching engine. With strong DeFi, gaming, and cross-chain growth, and rising institutional interest, Sei offers a unique proposition in the crypto market.

But remember: this is still early-stage technology. Keep your risk in check,

do your research, and only invest what you can afford. Stay informed on protocol updates and market trends as you explore the speed and innovation Sei has to offer.

Related Reading

SEI price surge | Source: BingX

SEI price surge | Source: BingX

Sei's DeFi TVL | Source: DefiLlama

Sei's DeFi TVL | Source: DefiLlama Sei dApp activity | Source: DappRadar

Sei dApp activity | Source: DappRadar SEI token distribution | Source: TokenUnlocks

SEI token distribution | Source: TokenUnlocks

Staking SEI tokens | Source: Sei app

Staking SEI tokens | Source: Sei app