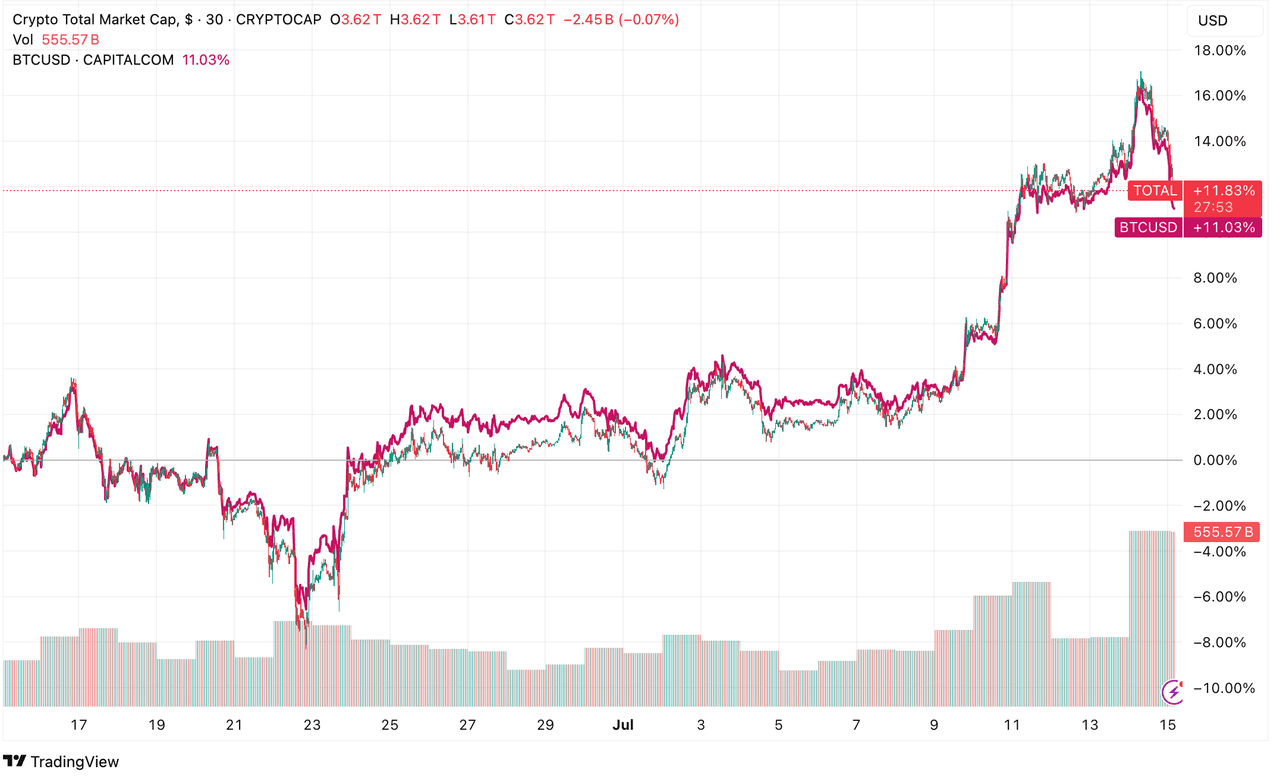

The cryptocurrency market is experiencing a historic moment in July 2025 as the U.S. House of Representatives kicks off “Crypto Week,” a multi-day legislative sprint to vote on landmark digital asset bills. With

Bitcoin surging past $123,000 and total crypto market capitalization topping $3.8 trillion on July 14, 2025, traders and investors are watching closely.

Crypto market cap and Bitcoin surge during US crypto week | Source: TradingView

Crypto Week centers around three key pieces of legislation: the

GENIUS Act, which establishes a comprehensive framework for

stablecoins; the CLARITY Act, which defines market structures for digital assets and clarifies regulatory oversight; and the Anti-CBDC Surveillance State Act, aimed at blocking the creation of a U.S. central bank digital currency. Together, these bills have the potential to drive mass institutional adoption of crypto and position the United States as a global leader in digital assets, creating significant volatility and trading opportunities that investors cannot afford to overlook.

What Is US Crypto Week (July 14-18, 2025)?

“Crypto Week” (July 14–18, 2025) is a landmark moment for the U.S. cryptocurrency sector. During this period, the House of Representatives will debate, amend, and vote on three major bills aimed at reshaping how digital assets are regulated in the United States. These bills form the core of President Trump’s digital asset agenda, which seeks to position the U.S. as a global leader in blockchain innovation and financial technology. Together, they represent the most comprehensive attempt yet to create clear federal rules for cryptocurrencies, stablecoins, and digital finance.

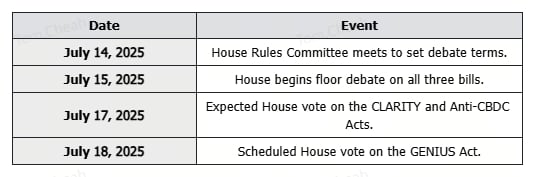

Key Dates and Events During Crypto Week

The following events highlight the critical timeline as the U.S. House of Representatives moves to debate and vote on major crypto legislation. On July 14, the House Rules Committee met to set debate procedures for the GENIUS Act, CLARITY Act, and Anti-CBDC Act. Floor debates on all three bills began July 15, with votes on the CLARITY Act and Anti-CBDC Act scheduled for July 17. The final vote on the GENIUS Act, which focuses on regulating stablecoins, is set for July 18.

These milestones mark pivotal moments for the crypto industry, as their outcomes could reshape U.S. digital asset policy and trigger significant market movements. If passed, these bills will go to President Trump’s desk for signature. He has already pledged to sign them into law before the August recess.

Key highlights of the U.S. Crypto Week | Source: X

1. The GENIUS Act: Regulating Stablecoins at a Federal Level

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) focuses on creating a regulatory framework for stablecoin issuers. This bill would require all entities issuing stablecoins to:

• Maintain full reserves of liquid assets, such as U.S. dollars and short-term Treasury securities, backing their tokens on a one-to-one basis.

• Provide monthly public disclosures detailing the composition of their reserves, ensuring transparency and consumer confidence.

• Obtain federal or state licenses to issue stablecoins, subjecting them to regulatory oversight similar to banks or money service businesses.

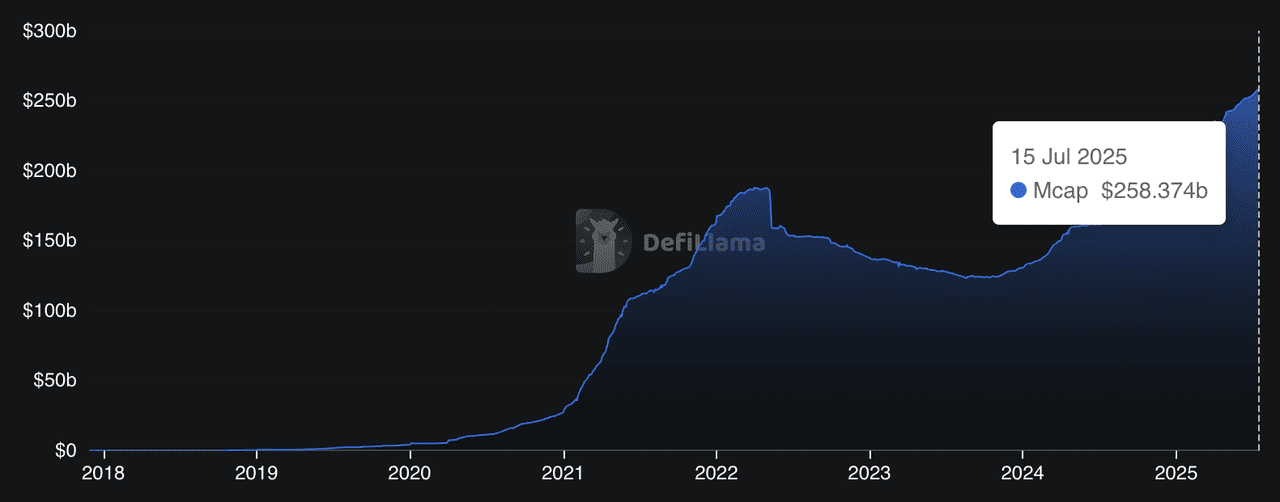

This legislation aims to strengthen trust in the $258 billion+ stablecoin market, which has seen explosive growth in recent years.

Tether (USDT) and

USD Coin (USDC) currently dominate, together accounting for over 80% of global stablecoin issuance. Proponents argue that these new rules could pave the way for U.S. banks and fintech companies, including JPMorgan and Amazon, to launch their own stablecoins and accelerate mainstream adoption.

Read more:

2. The CLARITY Act: Defining Digital Asset Market Structure

The Digital Asset Market Clarity (CLARITY) Act addresses one of the biggest challenges facing the crypto industry: regulatory uncertainty. This bill seeks to clarify:

• When a digital asset is classified as a security or a commodity, establishing whether it falls under the jurisdiction of the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

• The rules for secondary market trading, ensuring that crypto exchanges, brokers, and custodians understand their compliance obligations.

• Exemptions for decentralized protocols and blockchain projects meeting specific criteria, which could encourage innovation while maintaining investor protections.

This framework could significantly reduce legal disputes like those seen during the Biden administration, where the SEC pursued multiple lawsuits against major crypto exchanges. By offering clear definitions and jurisdictional boundaries, the CLARITY Act aims to provide confidence for institutional investors and startups building in the crypto market.

3. The Anti-CBDC Surveillance State Act: Blocking a Digital Dollar

• Prohibit the Federal Reserve from developing or issuing a digital dollar for retail use.

• Ensure that only Congress has the authority to authorize a CBDC in the future.

• Address concerns about privacy, surveillance, and potential misuse of government-controlled digital money.

Supporters argue that blocking a U.S. CBDC protects Americans’ financial privacy and limits government overreach. Critics, however, warn it could leave the U.S. lagging behind nations like China, which has already launched its digital yuan.

What Does Crypto Week Mean for Bitcoin and Other Digital Assets?

The events of Crypto Week are sending ripples across the

cryptocurrency market, as traders and institutions anticipate a major shift in U.S. digital asset policy. The potential passage of the GENIUS Act, CLARITY Act, and Anti-CBDC Act has created a surge of optimism among investors, triggering notable price movements and trading activity.

Bitcoin has surged to a new all-time high above $123,000, marking a 27% year-to-date gain as investors bet on a more favorable U.S. regulatory environment. This rally reflects growing confidence that regulatory clarity could unlock sidelined institutional capital. Similarly, stablecoins such as Tether (USDT) and USD Coin (USDC) are experiencing record transaction volumes, with large financial institutions and fintech companies reportedly preparing to enter the market once federal rules are established.

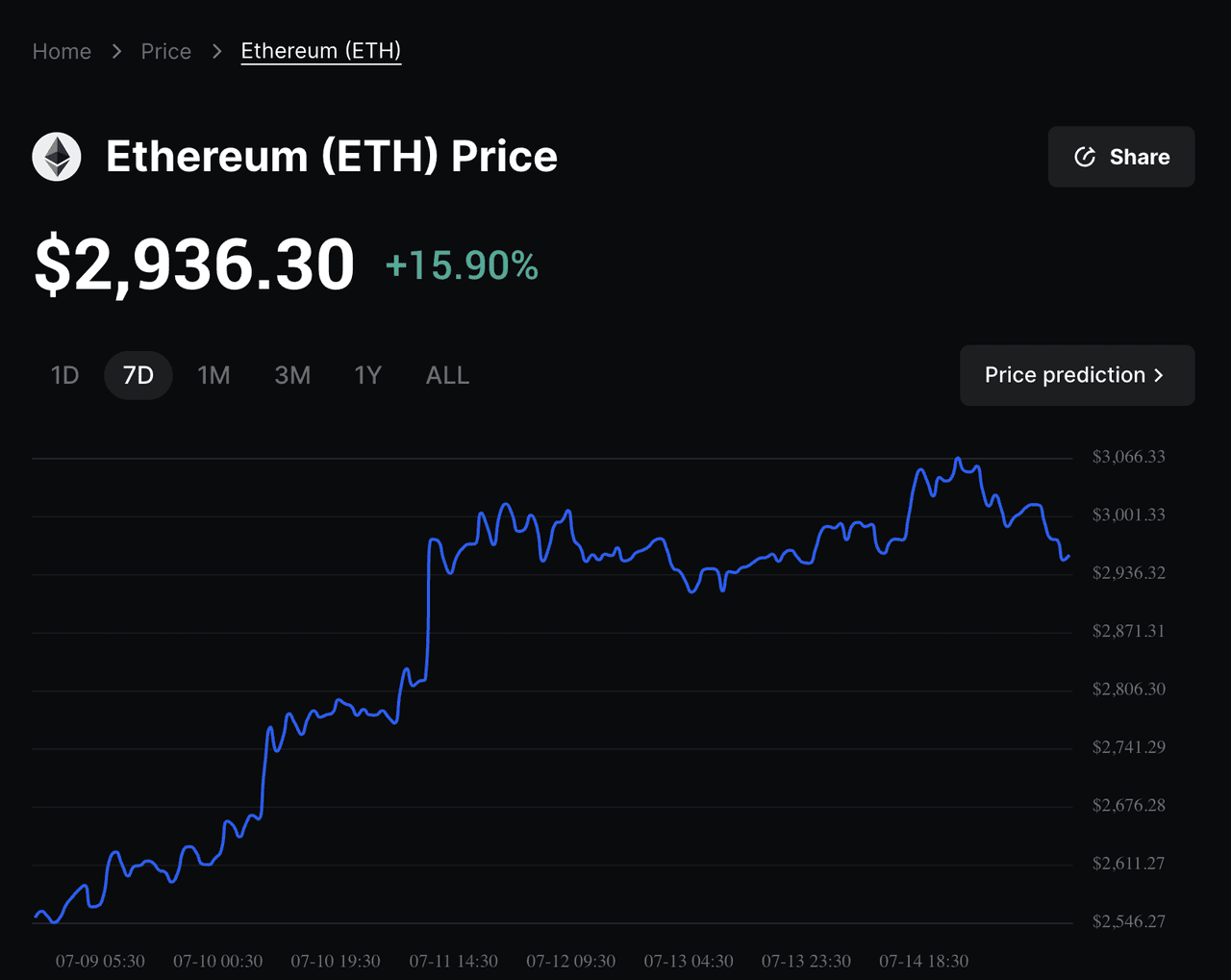

Altcoins on networks like

Ethereum and

Solana are also benefiting from the momentum. Traders expect clearer compliance pathways under the CLARITY Act to foster growth in decentralized finance (DeFi) and tokenized assets, further diversifying the crypto ecosystem.

U.S. Genius Act Put the Focus on Stablecoins

Stablecoin market cap crosses $258 billion | Source: DefiLlama

Stablecoins, which are digital tokens designed to maintain a stable value by pegging 1:1 to the U.S. dollar or other fiat currencies, have become a critical component of the global financial system. They act as a bridge between traditional finance and cryptocurrencies, facilitating seamless trading, payments, and remittances across borders. In July 2025, the stablecoin market has grown to over $258 billion in circulating supply, with Tether (USDT) and USD Coin (USDC) together dominating more than 80% of global issuance.

The GENIUS Act aims to formalize this rapidly expanding market by introducing the first comprehensive federal framework for stablecoin issuers in the United States. Under the proposed legislation:

1. Full reserve backing is mandatory, meaning every issued stablecoin must be backed 1:1 with high-quality liquid assets such as U.S. dollars, short-term Treasury bills, or equivalent. This requirement is designed to prevent runs on stablecoin issuers during market stress and to ensure token holders can redeem their assets at any time.

2. Monthly public disclosures of reserve compositions would be required, increasing transparency and building trust with both retail and institutional users.

3. Compliance with the Bank Secrecy Act (BSA) would bring stablecoin issuers under existing anti-money laundering (AML) and counter-terrorism financing regulations, classifying them as financial institutions subject to federal oversight.

This framework is expected to unlock massive institutional participation. Major financial institutions such as JPMorgan Chase and technology giants like Amazon are reportedly developing plans to issue their own stablecoins, once the regulatory pathway becomes clearer. For example, Amazon’s rumored “Amazon Dollar” could be used for e-commerce transactions, loyalty programs, and even global payroll systems.

Analysts view the GENIUS Act as a potential turning point for mainstream adoption. By enabling banks, fintech firms, and even retailers to issue fully regulated, dollar-backed digital currencies, the legislation could transform stablecoins from niche trading tools into foundational infrastructure for global payments, decentralized finance (DeFi), and tokenized financial products. This shift would not only strengthen the U.S. dollar’s dominance in digital finance but also accelerate the integration of blockchain technology into everyday financial activities worldwide.

However, there are still risks to consider. Critics warn that hasty regulation could favor large incumbents, potentially stifling smaller innovators. Amendments proposed by Democratic lawmakers, such as banning politicians and their families from holding or promoting cryptocurrencies, add further uncertainty to the legislative process. This mix of optimism and caution means traders should expect heightened volatility in the crypto markets throughout Crypto Week.

Top Strategies to Trade the US Crypto Week on BingX

The unfolding events of Crypto Week present traders with a rare combination of opportunity and risk as the U.S. debates landmark crypto legislation. Rapid price swings, new institutional interest, and potential market-moving headlines mean BingX traders should prepare with a clear strategy. Here are four approaches to consider:

1. Trade the Market Volatility with BingX Futures

Crypto Week has already driven Bitcoin to a record $123,000, with sharp intraday swings as votes approach. You can take advantage of these movements by using BingX perpetual contracts on major pairs like BTC/USDT and ETH/USDT.

• Go long or short depending on your market outlook as bills advance or face opposition.

• Use tight stop-loss orders to protect against unexpected reversals caused by political announcements.

• Consider lower leverage during high-volatility periods to manage risk effectively.

This strategy suits traders who are comfortable reacting quickly to news-driven price changes.

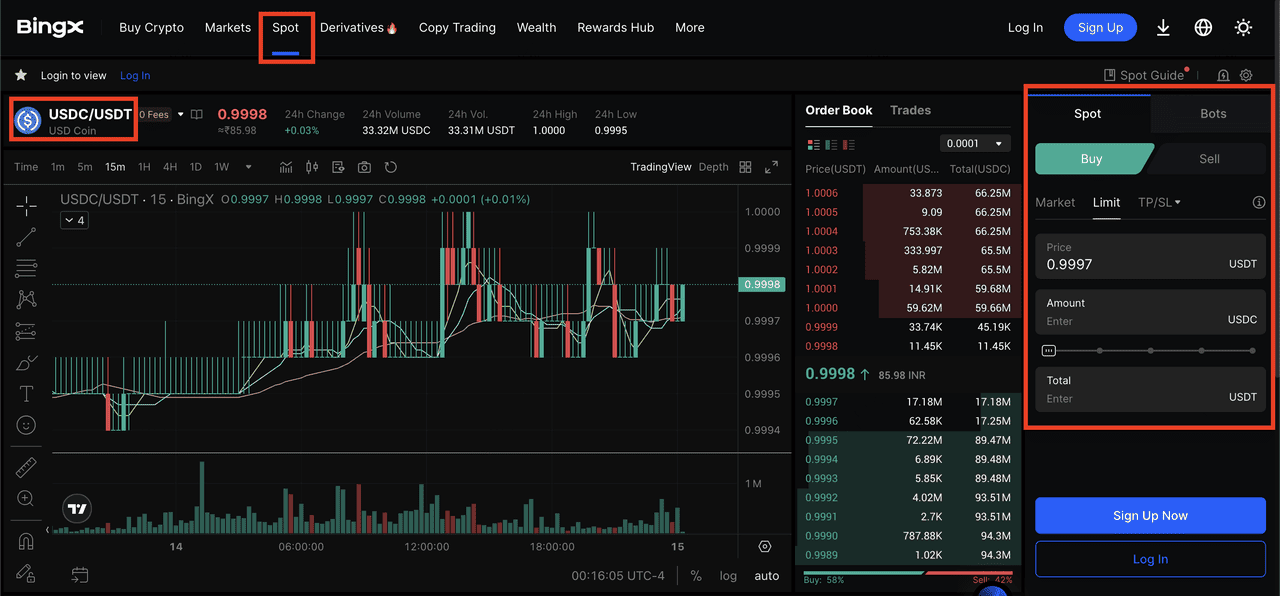

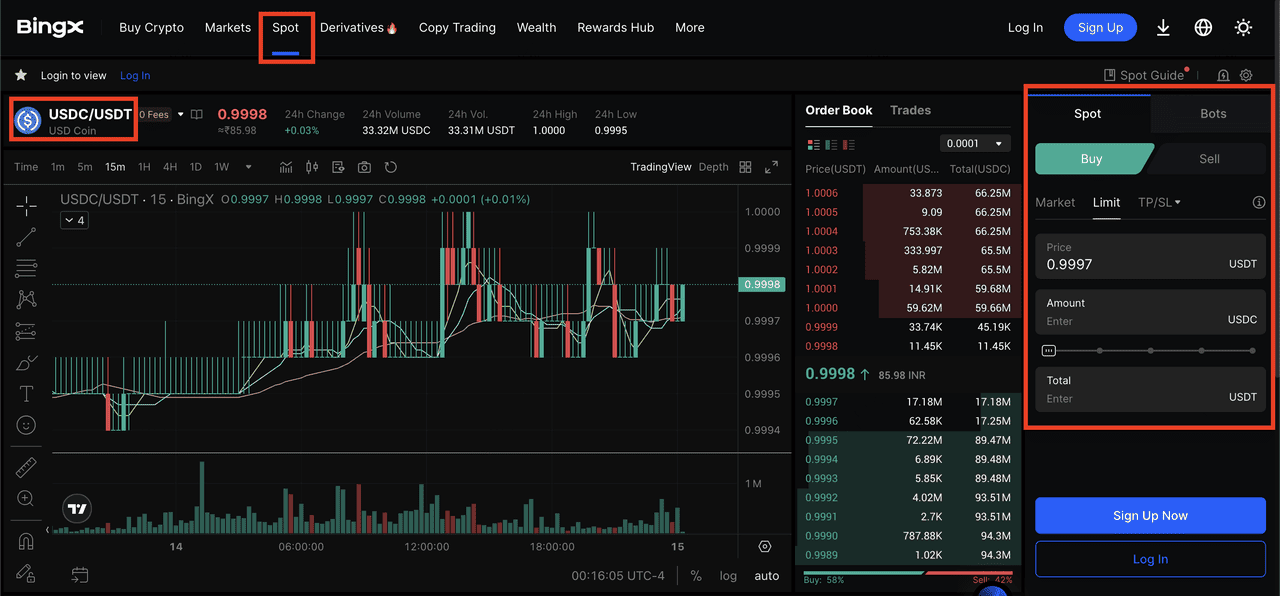

2. Accumulate Stablecoins as a Safe Haven

If the legislative process creates uncertainty or sudden market pullbacks, stablecoins can offer a temporary safe harbor. USDT and USDC are not only pegged to the U.S. dollar but are also central to the GENIUS Act, making them key assets to watch during Crypto Week.

• Use BingX to easily swap between USDT and USDC on the spot market.

• Park profits in stablecoins to preserve capital during volatile sessions.

• Monitor BingX liquidity for major stablecoin pairs to avoid slippage during periods of heavy trading.

This approach is ideal for traders looking to reduce exposure without fully exiting the market.

3. Watch Altcoins Linked to Regulatory Clarity

Altcoins built on compliance-friendly ecosystems like Ethereum (ETH) and Solana (SOL) could benefit from the CLARITY Act, which aims to define their regulatory status.

• Accumulate positions in ETH, SOL, or other large-cap altcoins using BingX spot trading.

• Consider grid trading strategies on BingX to profit from price ranges if volatility remains elevated.

• Stay informed on how specific sectors (DeFi, tokenized assets) could react to potential legislative outcomes.

This strategy fits longer-term traders aiming to position ahead of anticipated growth in regulated DeFi markets.

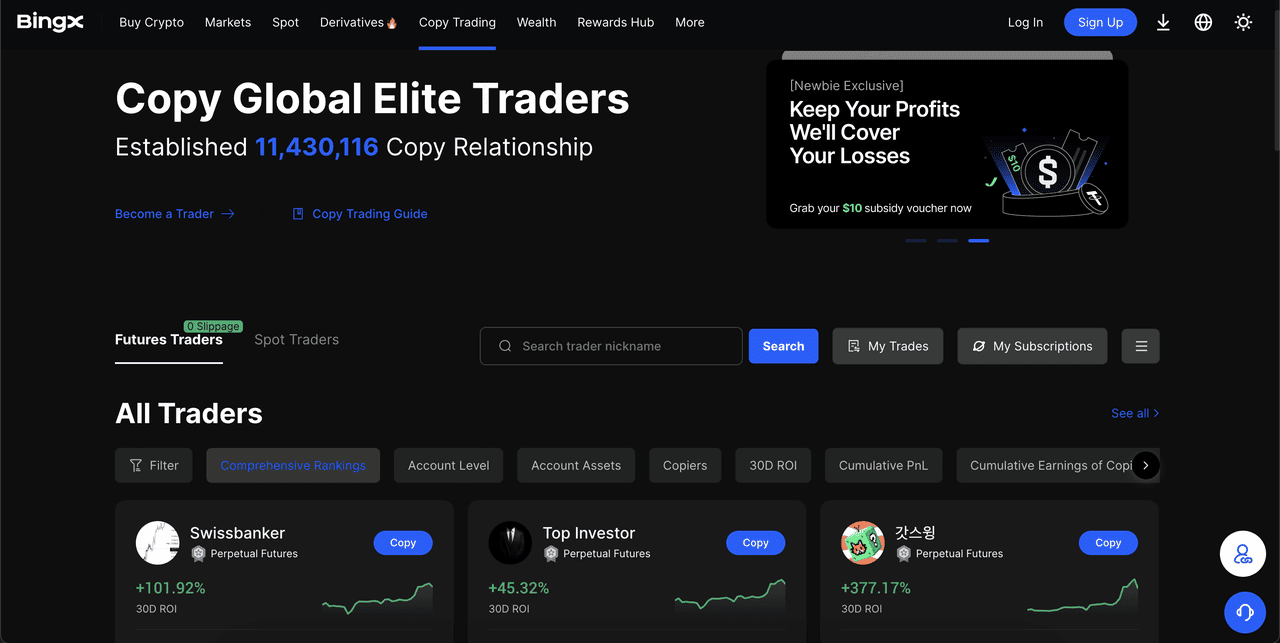

4. Leverage BingX Copy Trading for Market Expertise

Not sure how to trade headline-driven markets?

BingX’s Copy Trading feature allows you to mirror the strategies of experienced traders who specialize in navigating news events.

• Search for top-ranked traders active on BTC/USDT, ETH/USDT, or stablecoin pairs.

• Review their performance during previous volatile periods to find a style that matches your risk tolerance.

• Allocate only a portion of your portfolio to copy trading to diversify your exposure.

This is a great option for beginners or those preferring a hands-off approach during unpredictable market conditions.

Pro Tip: How to Prepare for the Market Volatility This Week

Crypto Week could be the most important legislative moment for digital assets in years. Whether the bills pass or face delays, traders on BingX have tools like futures, spot trading, stablecoin swaps, and copy trading to adapt quickly and capitalize on market opportunities.

Outlook: Is This a Defining Week for Crypto?

With the U.S. moving closer to its first comprehensive regulatory framework for digital assets, Crypto Week could mark a pivotal moment for the global crypto industry. For traders, it represents a unique intersection of political decision-making and market dynamics that may shape the trajectory of Bitcoin, stablecoins, and altcoins in the months ahead.

While the passage of these bills could unlock new institutional capital and drive further adoption, it is important to recognize the risks. Political negotiations, unexpected amendments, or delays in the legislative process could introduce heightened volatility and sudden market swings. BingX traders should remain cautious, use appropriate risk management tools, and avoid overexposure during this period of uncertainty.

By staying informed and disciplined, you can better navigate the opportunities and challenges presented by Crypto Week.

Related Reading