Ethereum has fully transitioned to Proof-of-Stake (PoS) since The Merge in September 2022, meaning you can no longer mine

ETH, only stake it. And

staking has quickly become a cornerstone of Ethereum’s economy. As of September 2025, over 35.6 million ETH (≈29.4% of the total supply, worth more than $150 billion) is locked in staking contracts, secured by 1.07 million active validators. The average network yield sits around 2.9–3.1% APR, though top providers sometimes push rates above 4%.

Ethereum net staking flows over the past one year | Source: StakingRewards

For everyday investors, this shift is more than a technical change; it’s a chance to turn idle ETH into a steady income stream. This guide walks you through four practical ways to stake ETH in 2025, ranging from one-tap exchange staking to running your own validator, plus risks, tips, and step-by-steps you can act on right now.

What Is Ethereum Staking and How Does It Work?

Ethereum staking is the process of locking up your ETH to help secure the Ethereum network and, in return, earn passive rewards. Instead of miners burning electricity to validate transactions (as in Proof-of-Work), Ethereum’s Proof-of-Stake system relies on validators, people or entities who commit ETH as collateral to keep the chain honest.

Think of it as putting ETH in a digital vault: while it’s locked, you’re helping process and verify transactions. In exchange, you earn new ETH rewards, a bit like earning interest in a savings account, but paid in crypto.

How Much ETH Do You Need to Start Staking?

• Don’t have 32 ETH? No problem. You can still stake smaller amounts via centralized exchanges like BingX, staking pools, DeFi platforms.

How Do ETH Staking Rewards Work?

When you stake ETH, you earn two kinds of rewards:

1. Consensus-layer rewards come from doing your validator duties correctly, checking and attesting to blocks, and these steadily build up in your validator balance. Once your balance grows past the required 32 ETH, the extra is automatically sent to your withdrawal address.

2. Execution-layer rewards are different: they include gas tips from users and MEV (Maximal Extractable Value) when your validator proposes a block, and these get paid instantly to your fee-recipient address. On average in 2025, staking yields about 2.9–3.5% APR, with more than 35.6 million ETH (~$120 billion) locked to secure the network.

How to Unstake ETH and Withdraw Rewards

Unstaking ETH isn’t instant, and that’s by design. If you decide to exit, your validator must first wait in the exit queue, which adjusts based on how many other validators are leaving at the same time. After that, there’s a mandatory ~27-hour delay (256 epochs) before your ETH is eligible for withdrawal.

Once the waiting period ends, both your staked ETH and any pending rewards are automatically transferred to your withdrawal address in scheduled sweeps. This system prevents sudden mass exits and keeps Ethereum’s network stable and secure.

Why Stake Ethereum (ETH) in 2025?

Ethereum staking has never been more attractive. Over 35.7 million ETH (≈31% of supply) is now staked, worth around $162 billion, and the staking entry queue recently hit its highest level since 2023 with more than 860,000 ETH (~$3.7 billion) waiting to be staked. This surge reflects growing institutional confidence, corporate treasuries adding ETH to balance sheets, and favorable market conditions such as rising prices and low gas fees. At the same time, the exit queue has eased, reducing fears of large-scale sell-offs and signaling that more investors are choosing to lock up ETH for yield rather than cash out.

Institutional adoption is reinforcing this momentum.U.S.

Ethereum spot ETFs continue to attract billions in inflows, while new SEC clarity on liquid staking could soon pave the way for staking-enabled ETFs that combine price exposure with 3–5% annual yields. Meanwhile,

Ethereum corporate treasury funds now control over 4.7 million ETH (~$20.4 billion, nearly 4% of supply), and most are staking their holdings to enhance returns.

Ethereum price gains | Source: BingX

With ETH trading near $4,300 after a 160% rally from April lows and analysts projecting long-term targets between $7,000–$10,000, staking offers not just passive income but also exposure to Ethereum’s expanding role in DeFi,

stablecoins, and

real-world asset tokenization. Together, these forces make staking in 2025 both a practical yield strategy and a way to participate in Ethereum’s evolving position as financial infrastructure for the digital economy.

What Are the Top 4 Ways to Stake Your ETH to Earn Rewards?

Staking Ethereum isn’t one-size-fits-all. In 2025, you can choose from several methods, ranging from beginner-friendly exchange staking to advanced solo validators, depending on how much ETH you hold, your technical skills, and your risk tolerance.

1. Stake ETH on Centralized Exchanges (CEXs)

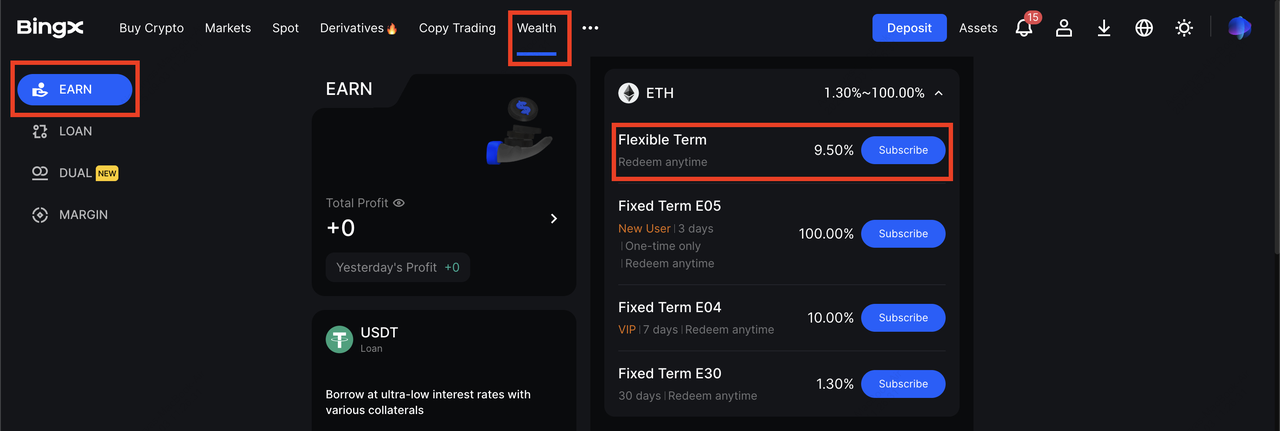

If you’re new to staking, the easiest place to start is on a centralized exchange like BingX. With

BingX Earn, you don’t need technical skills, validator hardware, or 32 ETH, just an account and a few clicks.

You can choose between Flexible plans, which let you redeem anytime, or Fixed-term plans, which offer higher APYs if you commit your ETH for a set period. For example, a flexible ETH product may yield ~3% APY, while fixed-term staking could push returns higher depending on lock-up length.

How to Start Staking ETH on BingX Earn

2.

Buy Ethereum on the

spot market before getting started. You can also transfer your existing ETH tokens to your BingX account.

3. Go to Wealth → Earn in the app or web dashboard.

4. Select ETH from the asset list.

5. Choose Flexible or Fixed-term, review the APY and lock-up details.

6. Agree to the terms and conditions, click Subscribe, and your ETH starts generating rewards automatically.

This method is perfect for beginners because everything is managed inside the BingX platform: staking, tracking rewards, and redeeming. The trade-off is that BingX holds custody of your ETH, which provides convenience but also means you rely on the exchange’s safeguards. To protect user funds, BingX employs cold-storage wallets, multi-factor authentication (MFA), and its dedicated

Shield Fund, offering an added layer of security for assets held on the platform.

2. Stake ETH via DeFi Platforms or Staking Pools

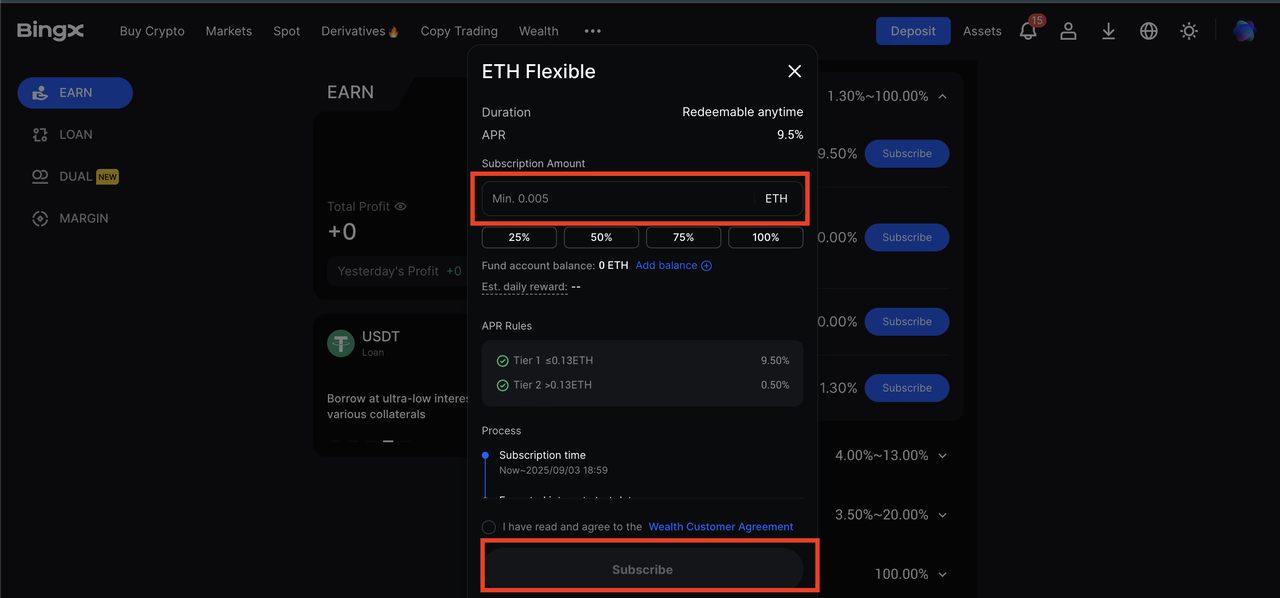

How a staking pool works | Source: Consensys

If you prefer to keep full control of your ETH in a

self-custody wallet, staking through a DeFi platform or staking pool is a great option. Instead of needing 32 ETH for a validator, you can stake any amount, even less than 1 ETH, while still earning rewards. Average yields sit around 3–4% APY for Ethereum, and the process is straightforward once your wallet is connected.

Lido is the most

popular liquid staking protocol. When you stake ETH on Lido, you receive

stETH (rebasing) or wstETH (wrapped, non-rebasing). Both represent your staked ETH and continue to earn staking rewards. The big advantage is that you can also use these tokens in DeFi, for example, lending them out, trading, or farming additional yield. Most bridges and DeFi protocols now prefer wstETH because it avoids rebasing issues.

Rocket Pool takes a slightly different approach. Regular users can deposit ETH into the pool to earn rewards, while advanced stakers can run their own minipool with as little as 8 or 16 ETH plus

RPL collateral, with Rocket Pool topping it up to the full 32 ETH. This lowers the entry barrier for operating a validator while spreading risk across the network.

What Are the Pros and Cons of Pool Staking ETH?

Staking through DeFi platforms offers clear advantages; there’s no high minimum requirement, you keep control of your ETH in a self-custody wallet, and liquid staking tokens like stETH or wstETH allow you to earn rewards while still using your assets across DeFi. The trade-off is higher risk: these tokens depend on smart contracts, can lose their 1:1 peg during volatile markets, and long-term returns may be influenced by protocol governance and validator performance.

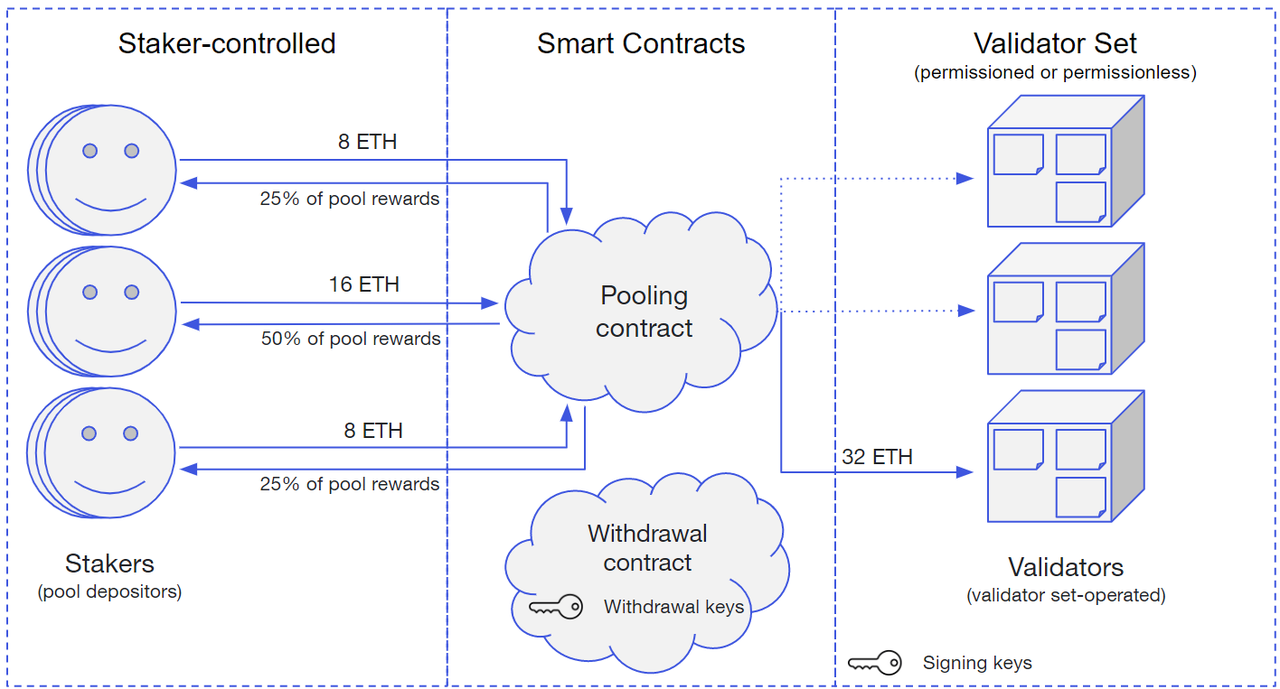

3. Stake via a Delegator or Staking-as-a-Service (SaaS)

How staking-as-a-service works on Ethereum | Source: Messari

Delegated staking, also called staking-as-a-service (SaaS), is ideal for ETH holders who meet the 32 ETH requirement but don’t want the hassle of running validator hardware themselves. Instead of setting up servers and keeping them online 24/7, you partner with a professional operator who runs the validator on your behalf. You still control your withdrawal keys in most setups, meaning your ETH stays tied to your own address, but the operator handles all the technical work. In return, you pay a small service fee (often 5–10% of rewards).

To get started, you’ll need to choose a trusted provider. Look for a track record of uptime, diverse client use, and third-party audits. Next, generate your validator credentials using the provider’s instructions, then deposit 32 ETH into Ethereum’s official staking contract via the Ethereum Launchpad. Once your validator clears the entry queue, it becomes active, and you begin earning rewards directly from the network.

The main benefit is that you earn native Ethereum rewards without the stress of maintaining equipment, while still participating in network security. The trade-off is reliance on your operator’s performance: downtime or errors on their end can impact your earnings, and slashing penalties still apply. This makes SaaS a solid middle ground; lower effort than solo staking, but more control than exchange staking.

4. Solo Staking 32 ETH as a Validator

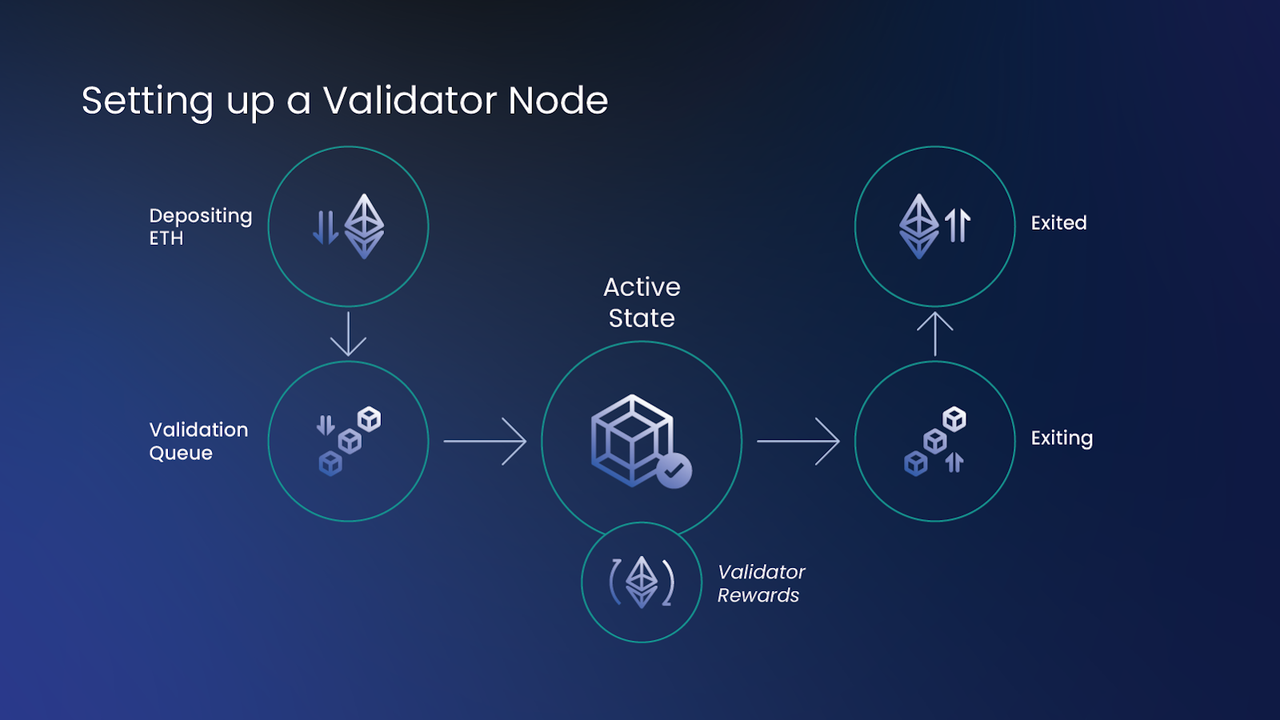

How to stake ETH as a solo validator on the Ethereum network | Source: Hex Trust

Solo staking is the gold standard for Ethereum staking. By running your own validator, you keep 100% of the rewards, strengthen network decentralization, and maintain full control over your ETH. To qualify, you must stake 32 ETH per validator (over $110,000 as of September 2025) and operate your own hardware with 24/7 uptime. Typical yields average around 3–4% APR, but performance depends on your node’s reliability.

Setting up a validator requires both hardware and technical skills. You’ll need a dedicated machine with a reliable CPU, 16–32 GB of RAM, a 2TB SSD, and an always-on internet connection. On the software side, you must install three clients: an execution client, a consensus client, and a validator client. After generating validator keys, you deposit 32 ETH into Ethereum’s official deposit contract via the

Staking Launchpad. Your validator then enters the activation queue, and once live, you’ll begin performing duties like proposing blocks and attesting to transactions.

To stop staking, you submit a voluntary exit. After a waiting period of about 256 epochs (~27 hours) plus potential queue delays, your validator status changes to withdrawable, and both your staked ETH and rewards are automatically swept to your withdrawal address. This design ensures network stability, even if many validators exit at once.

The biggest advantage of solo staking is maximum independence, no third-party fees, no reliance on service providers, and direct participation in Ethereum’s security. However, it comes with operational risks: if your validator goes offline, misconfigured, or malicious, you could lose rewards or face slashing penalties. Solo staking is best for advanced users who are comfortable managing hardware, monitoring systems, and keeping everything updated. For beginners, starting with exchange or pool staking is usually safer before leveling up to solo validator status.

Which Ethereum Staking Method Is Right for You?

The “best” way to stake ETH depends on how much ETH you hold, your comfort with technology, and your tolerance for risk. Here’s a breakdown to help you choose:

1. Just starting out / want it simple → BingX Earn: Perfect for beginners. You can subscribe to Flexible plans (redeem anytime) or Fixed-term plans (lock up for higher APY) directly in the BingX app. No validator setup, no wallets to manage; just a few clicks and your ETH starts earning rewards. This is the most practical entry point if you’re new to staking.

2. Prefer self-custody + DeFi flexibility → Lido or Rocket Pool: If you want to keep ETH in your own wallet and stake with less than 32 ETH, liquid staking platforms are a good fit. Lido gives you stETH/wstETH, while Rocket Pool issues rETHl tokens that keep earning staking yield but can also be used in DeFi (lending, trading, yield farming). This method is more capital-efficient, but comes with smart-contract and peg risks.

3. Hold 32 ETH but don’t want to run hardware → Staking-as-a-Service (SaaS): Providers like Kiln, Stakefish, or exchanges with non-custodial setups run validators for you. You keep withdrawal rights, pay a small fee, and skip the hassle of 24/7 uptime. Before committing, verify the fee structure, who controls withdrawal keys, and the provider’s track record. This is best if you want validator rewards without managing servers.

4. Experienced user with 32 ETH → Solo Validator: If you’re comfortable with servers, Linux, and 24/7 monitoring, running your own validator is the most independent option. You deposit 32 ETH via

Ethereum Launchpad, set up execution + consensus clients, and earn the full share of rewards. It’s the highest-control, highest-reward path, but also the most technical. Slashing risks mean mistakes can cost real ETH.

In short: Start staking ETH with BingX Earn if you’re new, move to liquid staking for flexibility, use SaaS if you want validator rewards without the work, and go solo only if you’re ready for the responsibility.

What Risks Should You Manage When Staking Ether (ETH)?

Staking ETH can be rewarding, but it’s not risk-free. Whether you use BingX Earn, a DeFi pool, or run your own validator, you’ll need to manage a few key risks to protect both your funds and your rewards. Here’s what to watch for:

• Slashing & penalties: If a validator signs conflicting messages (e.g., double-proposing or double-attesting), part of its stake can be “slashed.” For solo stakers or SaaS users, this means lost ETH. To reduce the chance of slashing, choose reliable operators, keep validator clients updated, and follow community best practices.

• Liquidity constraints: Staked ETH is not instantly redeemable. When you exit, your validator joins a queue, and withdrawals are processed in scheduled batches. During high demand, delays can stretch from hours to several days. Always plan ahead if you think you’ll need access to your ETH.

• Smart-contract & liquid staking token (LST) risks: DeFi staking with platforms like Lido or Rocket Pool involves smart contracts, which can contain bugs, and liquid staking tokens (e.g., stETH, wstETH, rETH) that may lose their 1:1 peg with ETH during market stress. Stick to audited, widely used protocols and understand the difference between stETH (rebasing) and wstETH (non-rebasing, preferred by most DeFi apps).

• Custodial risk on CEXs: Centralized exchanges make staking easy, but you don’t control your keys; meaning your ETH is held in custody by the platform. Mitigate this by choosing trusted exchanges like BingX, which secures assets with cold-storage wallets, multi-factor authentication (MFA), and its dedicated Shield Fund. Always enable all available security features on your account.

Final Word

Staking ETH in 2025 offers multiple paths, whether it’s simple one-tap staking through BingX Earn, flexible liquid staking via platforms like Lido or Rocket Pool, delegation to a trusted operator, or running a full validator for maximum independence. The best method depends on how much ETH you hold, your technical comfort level, and your tolerance for lock-ups and risks.

That said, staking is never risk-free. Slashing penalties, liquidity delays, smart-contract vulnerabilities, and custodial reliance can all impact outcomes. Always double-check addresses, enable strong security like MFA, and review provider audits and documentation before committing your ETH. Start small, learn the process, and scale up only when you’re confident in managing both the rewards and the risks.

Related Reading

FAQs on Ethereum Staking

1. Is Staking Ethereum Worth It in 2025?

Yes, Ethereum staking remains one of the most reliable ways to earn passive income in crypto. With average rewards of ~3% per year, staking provides steady yield while contributing to network security. However, whether it’s “worth it” depends on your goals and risk tolerance. Exchange staking offers simplicity, liquid staking adds flexibility, and solo staking maximizes rewards but requires technical skills. Keep in mind risks like price volatility, slashing penalties, and liquidity delays before committing funds.

2. How Much Can You Earn by Staking Ethereum?

Your earnings depend on how much ETH you stake, the method you choose, and network conditions. As of September 2025, Ethereum staking yields around 2.9–3.5% APR. For example, staking 10 ETH (~$34,000) could earn you about 0.3 ETH (~$1,000) per year in rewards. Solo validators with 32 ETH earn the full share, while users in pools or SaaS setups may earn slightly less after operator fees.

3. How Did Ethereum Move from Mining to Staking?

Ethereum officially switched from mining to staking during the Merge in September 2022. Mining rewards ended, and validators replaced miners as the network’s backbone. This reduced Ethereum’s energy use by over 99%, making it far more eco-friendly. Since then, ETH holders earn rewards by staking instead of mining, while those interested in mining can still mine Ethereum Classic (ETC), which remains Proof-of-Work.

4. Does ETH Staking Cost Gas Fees?

Yes, staking Ethereum involves paying gas fees because staking transactions, like depositing ETH into the contract, claiming rewards, or unstaking, happen on-chain. The cost depends on network congestion but is usually a few dollars’ worth of ETH. If you use a centralized exchange like BingX Earn, these steps are handled for you, so you don’t pay separate gas fees. In DeFi, always keep a small ETH balance in your wallet to cover transaction costs.

5. Is Ethereum (ETH) Staking Safe?

Ethereum staking is generally safe, but it depends on the method you choose. Solo staking gives you maximum control but requires technical discipline to avoid slashing. Delegated staking and liquid staking rely on third-party operators or smart contracts, so you must trust their security. Exchange staking is beginner-friendly but comes with custodial risk, meaning you rely on the exchange’s safeguards. To stay safe, use reputable platforms, enable multi-factor authentication, and consider diversifying across staking methods.

6. Can You Lose Money Staking Ether?

Yes, there are risks. Validators can face slashing penalties if they act dishonestly or go offline, reducing their rewards. In staking pools or liquid staking protocols, smart contract vulnerabilities could also expose funds to risk. And while your ETH remains staked, price volatility may reduce the dollar value of your rewards. To minimize risk, use reputable providers, enable strong security (like MFA on exchanges), and diversify across staking methods.

7. How Long Does It Take to Unstake ETH Tokens?

Unstaking ETH isn’t instant. When you exit staking, your validator joins a queue that varies with network demand. After that, there’s a mandatory waiting period of ~256 epochs (~27 hours) before funds are marked as withdrawable. Finally, your ETH and rewards are automatically swept to your withdrawal address in scheduled batches. In practice, withdrawals can take from a day to several days, so always plan ahead for liquidity needs.