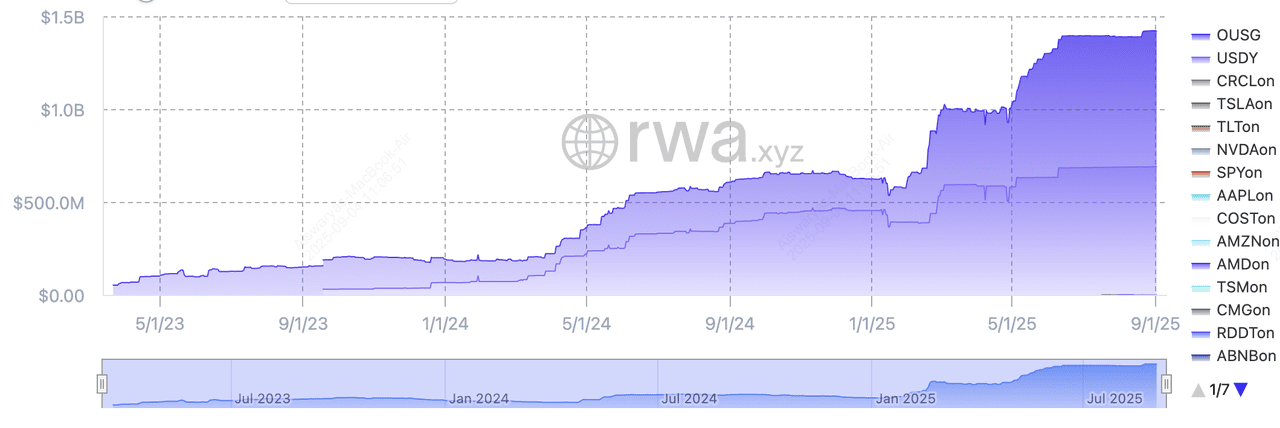

Ondo Finance (ONDO) has quickly risen to become a dominant player in bringing real-world financial assets on-chain. As of mid-2025, the platform boasts $1.39 billion in Total Value Locked (TVL), a testament to its rapid adoption in the tokenized treasury market.

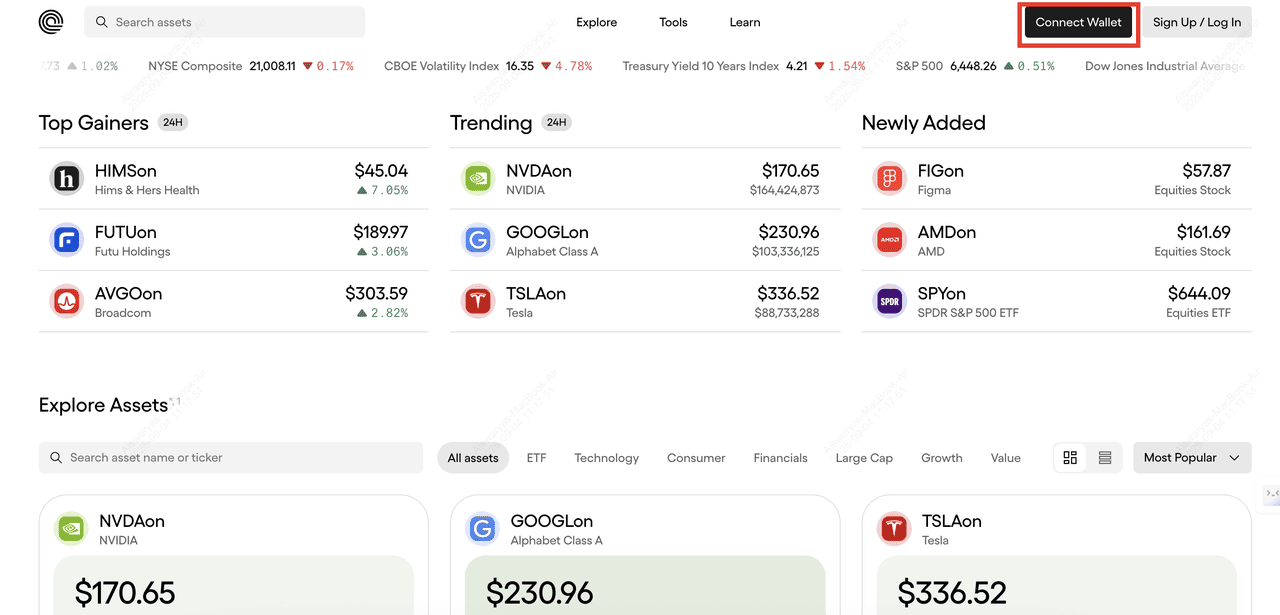

On September 3, 2025, the company expanded beyond treasuries by launching Ondo Global Markets, debuting more than 100

tokenized U.S. stocks and ETFs on

Ethereum. The rollout includes major names like

Apple (AAPL),

Tesla (TSLA), and ETFs from Fidelity and BlackRock, with plans to scale to 1,000+ tokenized assets by the end of 2025 across Ethereum,

Solana, and

BNB Chain.

This article explores Ondo’s ecosystem, what Ondo Global Markets' tokenized equities are and how they work, and how beginners can practically participate in this new frontier of DeFi.

What Is Ondo Finance (ONDO) and How Does It Work?

Ondo Finance is a blockchain platform designed to bring traditional financial assets, like U.S. Treasuries and stocks, into the digital economy through tokenization. By converting these assets into blockchain-native tokens, Ondo gives investors around-the-clock access to yield-bearing products and the flexibility to use them in decentralized finance (DeFi). This makes instruments that were once restricted to large institutions more accessible to global retail and institutional users.

Ondo ecosystem TVL | Source: RWA.xyz

The platform has grown rapidly, with its TVL surpassing $1.3 billion as of September 2025, a strong indicator of market trust and adoption. Ondo’s ecosystem combines asset products, DeFi protocols, and its own Layer 1 blockchain infrastructure, creating a complete stack for

tokenized real-world assets (RWAs) to thrive securely and efficiently.

Key Products and Mechanisms in the Ondo Ecosystem

Ondo’s ecosystem is built around products, protocols, and infrastructure that together make real-world assets usable on-chain, giving investors both yield opportunities and DeFi functionality.

1. USDY (U.S. Dollar Yield Token): USDY is a

yield-bearing stablecoin backed by short-term U.S. Treasuries and bank deposits. It functions like a

stablecoin with added yield, accruing daily interest for non-U.S. users. Investors can choose between an accumulating version, where the token’s price rises as yield builds, and a rebasing version (rUSDY), where the token supply increases while the price remains pegged at $1.

2. OUSG (Ondo Short-Term U.S. Treasuries): OUSG gives institutional investors tokenized exposure to a managed portfolio of U.S. Treasuries and government-backed securities, often sourced through asset managers like BlackRock and Fidelity. Like USDY, OUSG comes in both accumulating and rebasing versions, allowing flexibility for different types of investors.

3. Flux Finance: Flux Finance is Ondo’s decentralized lending protocol, modeled on

Compound V2. It allows users to lend and borrow against both open-access tokens like USDC and permissioned assets such as OUSG. Governance is handled by the Ondo DAO, which empowers the community to vote on upgrades, risk models, and supported assets.

4. Ondo Chain: Ondo Chain is a dedicated Layer 1 blockchain, built with the

Cosmos SDK, designed for tokenized finance. It features permissioned validators, proof-of-reserves, and RWA-backed staking, ensuring compliance and security. Ondo Chain also provides seamless cross-chain bridging and institutional-grade infrastructure to scale tokenized assets across global markets.

What Are Ondo Global Markets' Tokenized U.S. Equities and Why Do They Matter?

Launched in September 2025, Ondo Global Markets introduces more than 100 tokenized U.S. stocks and ETFs on Ethereum, giving qualified non-U.S. investors blockchain-based access to equities like Apple (AAPL), Tesla (TSLA), and funds from BlackRock and Fidelity. Each token is backed 1:1 by the underlying security held with regulated broker-dealers, ensuring that it tracks the real asset’s price, dividends, and corporate actions.

Unlike traditional stocks that settle in two business days, Ondo’s tokenized equities can be minted, traded, or transferred on-chain 24/5, with peer-to-peer transfers available anytime. This unlocks faster settlement, fractional ownership, and DeFi integration, making U.S. equities accessible to a broader global audience. The platform is supported by

Alpaca for brokerage,

Chainlink for price oracles, and

LayerZero for cross-chain interoperability, while wallets like

Trust Wallet and

Ledger already support these assets. Ondo plans to expand from 100 to 1,000 tokenized assets by the end of 2025, including stocks, ETFs, and bonds across Ethereum, Solana, and BNB Chain.

How Do Tokenized Stocks Work?

Tokenized stocks are digital tokens that represent real company shares. They are issued on a blockchain but backed by the actual stock held with a licensed custodian. This means holding a tokenized Apple share gives you the same price exposure as the real stock, but with added benefits such as instant on-chain settlement, 24/7 transferability, and fractional access. For example, instead of buying one full share of Tesla through a broker, you could own a fraction of it as a token, stored in a self-custody wallet and even used as collateral in DeFi protocols.

How to Get Started with Ondo Tokenized Stocks

Getting started with Ondo Global Markets is designed to be simple and accessible, even for first-time users of tokenized assets.

1. First, check your eligibility. At launch in September 2025, the platform is open to qualified investors across regions like Asia-Pacific, Africa, Latin America, and parts of Europe, while users in the U.S., U.K., and EEA remain excluded due to regulatory restrictions.

2. Next, complete the onboarding process. This may include verifying your identity, connecting your wallet address, and signing basic agreements to comply with local regulations. Once approved, you can deposit stablecoins such as USDC to mint tokenized U.S. stocks and ETFs.

3. From there, the tokenized equities can be traded on-chain during U.S. market hours and transferred peer-to-peer at any time. Investors can also integrate these tokens into decentralized finance strategies, such as lending or using them as collateral, opening up opportunities that go beyond traditional stock trading.

Key Considerations and Risks of Investing in Tokenized Equities

While Ondo Global Markets opens exciting new opportunities for investors, it’s important to understand the limitations and risks before getting started.

1. Regulatory limitations: Tokenized U.S. equities are currently restricted in markets like the U.S., U.K., and EEA, and holders do not gain shareholder rights such as voting or direct ownership.

2. Smart contract risks: As with any DeFi product, vulnerabilities in the underlying code could expose users to hacks or technical failures if not carefully audited.

3. Custodial and backing risks: Although assets are held by regulated broker-dealers, investors must trust custodians to properly manage and safeguard the underlying securities.

4. Liquidity constraints: Trading volumes for tokenized assets may be lower than traditional exchanges, which could impact pricing and execution.

5. Evolving compliance landscape: Regulatory frameworks for tokenized securities are still developing, and future rules could affect availability, transferability, or taxation.

Final Thoughts

Ondo Finance is creating new pathways between traditional finance and blockchain by digitizing U.S. equities and making them accessible on-chain with institutional-grade backing. For global investors, Ondo Global Markets offers a practical way to diversify portfolios, experiment with DeFi strategies, and gain exposure to high-value assets without relying on traditional brokers.

That said, tokenized securities remain an emerging market. Regulatory restrictions, smart contract risks, and evolving compliance standards mean investors should proceed with caution and never commit more than they can afford to lose.

Related Reading

FAQs on Ondo Global Markets and Tokenized Stocks

1. Who can access Ondo Global Markets?

The platform is available to qualified investors in regions like Asia-Pacific, Africa, Latin America, and Europe, but currently excludes users in the U.S., U.K., and EEA.

2. How do I buy tokenized U.S. stocks on Ondo?

Eligible users can complete onboarding, deposit stablecoins such as USDC, and mint tokenized versions of U.S. equities directly on-chain.

3. What are the main risks of investing in tokenized equities?

Risks include limited liquidity, evolving regulations, lack of shareholder rights, and exposure to smart contract vulnerabilities.

4. How many tokenized assets will Ondo offer by the end of 2025?

Ondo plans to expand from its initial 100+ tokenized U.S. stocks and ETFs to more than 1,000 assets, including bonds and international equities.

5. Can I trade Ondo’s tokenized equities 24/7?

They can be minted and transferred on-chain at any time, but trading activity is currently aligned with U.S. market hours (24/5), with full 24/7 trading expected in the future.