Tranzacționarea zilnică de criptomonede nu înseamnă doar să ghicești vârfurile sau să reacționezi la știri, ci și să construiești un proces care identifică, execută și revizuiește în mod consistent tranzacțiile cu precizie. Profesioniștii se bazează pe fluxuri de lucru structurate: se pregătesc pentru volatilitate, planifică tranzacțiile în avans, definesc riscul în mod clar și jurnalizează cu o onestitate necruțătoare.

În haosul

pieței de criptomonede care funcționează 24/7, distragerile și emoțiile pot sabota chiar și cele mai bine puse la punct planuri. Aici strălucește ChatGPT, nu ca un oracol care prezice piața, ci ca un asistent puternic care aduce structură, logică și repetabilitate la fiecare pas al procesului de tranzacționare.

De la pregătirea de dimineață la reflecția post-tranzacționare, vezi cum

integrarea funcțiilor AI ale ChatGPT te poate ajuta să tranzacționezi criptomonede zilnic cu claritate, consecvență și un avantaj cu adevărat profesional.

Cum să îți Structurezi Ziua de Tranzacționare Crypto Cu Asistență AI

O sesiune disciplinată începe înainte ca prima lumânare să se printeze. Pentru traderii intermediari, avantajul constă în cât de bine interpretezi dezvoltările de peste noapte, anticipezi zonele de volatilitate și aliniezi prejudecata cu factorii macro. ChatGPT servește ca un instrument de pregătire în timp real pentru a extrage semnalul din zgomot.

1. Dezvoltă o Rutină Pre-Tranzacționare Înainte de a Deschide Graficele

O zi puternică de tranzacționare începe înainte să începi să te uiți la grafice și piețe. Folosește ChatGPT ca partenerul tău de pregătire matinală pentru a aduce ordine și perspectivă în inundația de informații.

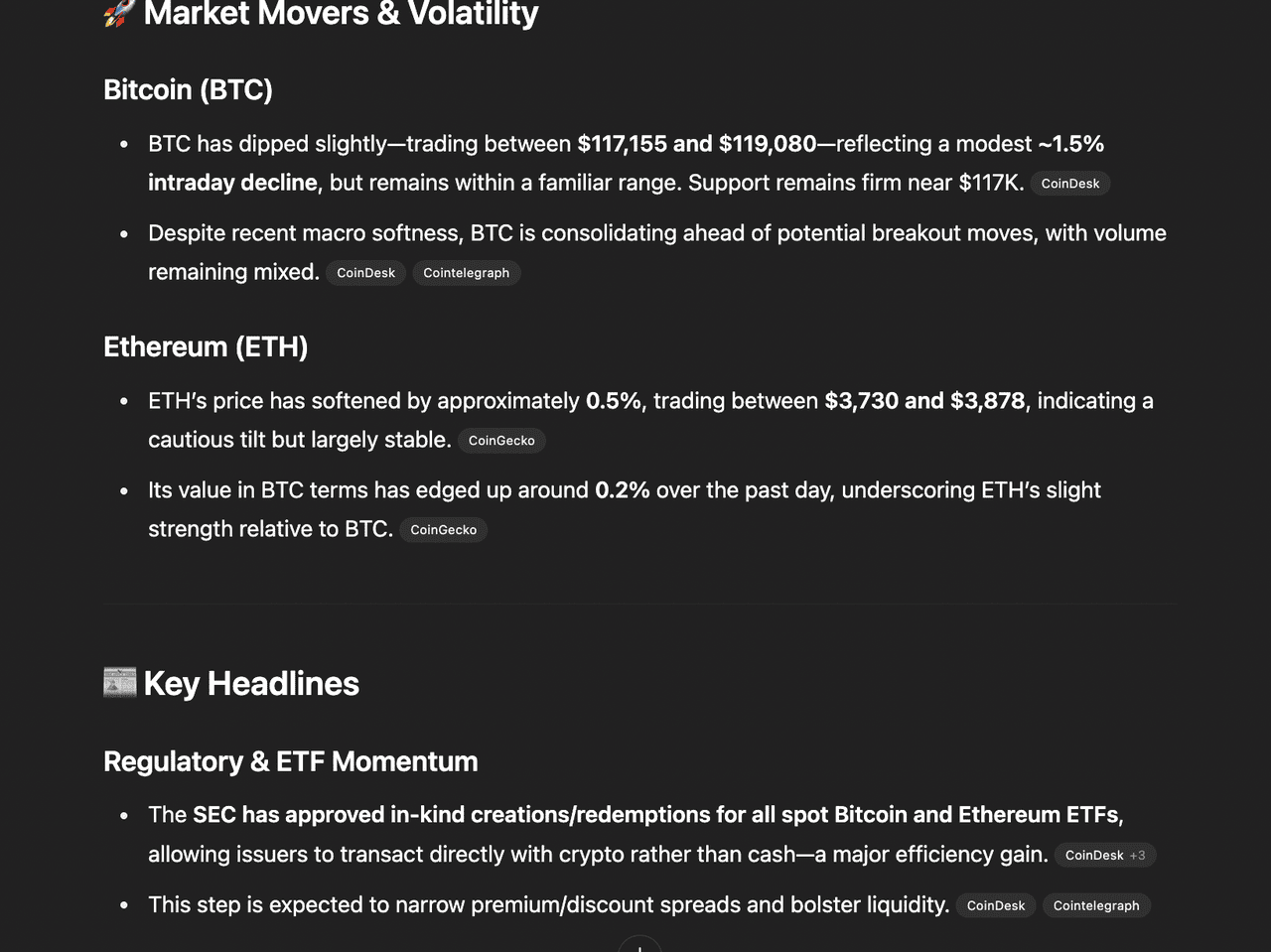

Prompt: “Rezumă cele mai mari mișcări și știri crypto din ultimele 8 ore.”

Sursă: ChatGPT

Începe ziua cerându-i ChatGPT să revizuiască activitatea pieței de peste noapte. Acest lucru te ajută să prinzi mișcările majore de preț, volatilitatea neașteptată și știrile cu impact mare înainte ca piața mai largă să reacționeze. ChatGPT poate evidenția rapid:

• Top câștigători și perdanți

• Activitate notabilă de balenă sau lichidări

• Titluri cheie (ex. dezvoltări ETF, probleme exchange, date macro)

• Tendințe timpurii de sentiment pe platforme precum X și Reddit

Această scanare rapidă economisește timp și asigură că tranzacționezi cu contextul complet din sesiunea anterioară—special important dacă tranzacționezi în timpul unei noi deschideri de piață precum Europa sau SUA.

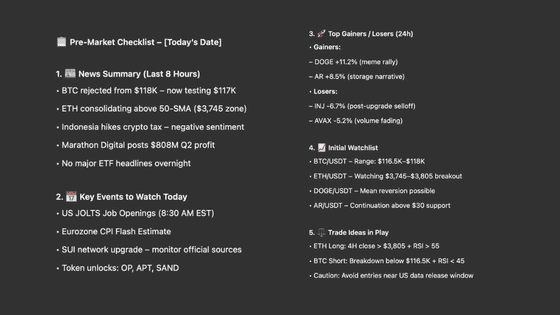

2. Mapează Evenimente cu Impact Mare

Prompt:“Listează evenimentele cheie din calendarul economic de astăzi pentru crypto—anunțuri Fed, CPI, date despre locuri de muncă sau actualizări majore de proiecte.”

Înainte de a intra în orice tranzacții, este esențial să știi ce evenimente programate ar putea genera volatilitate. Folosește ChatGPT pentru a extrage lansări de date macroeconomice cheie (precum CPI, FOMC sau NFP) și actualizări specifice crypto precum deblocări de tokenuri, actualizări de protocol sau anunțuri majore de listare.

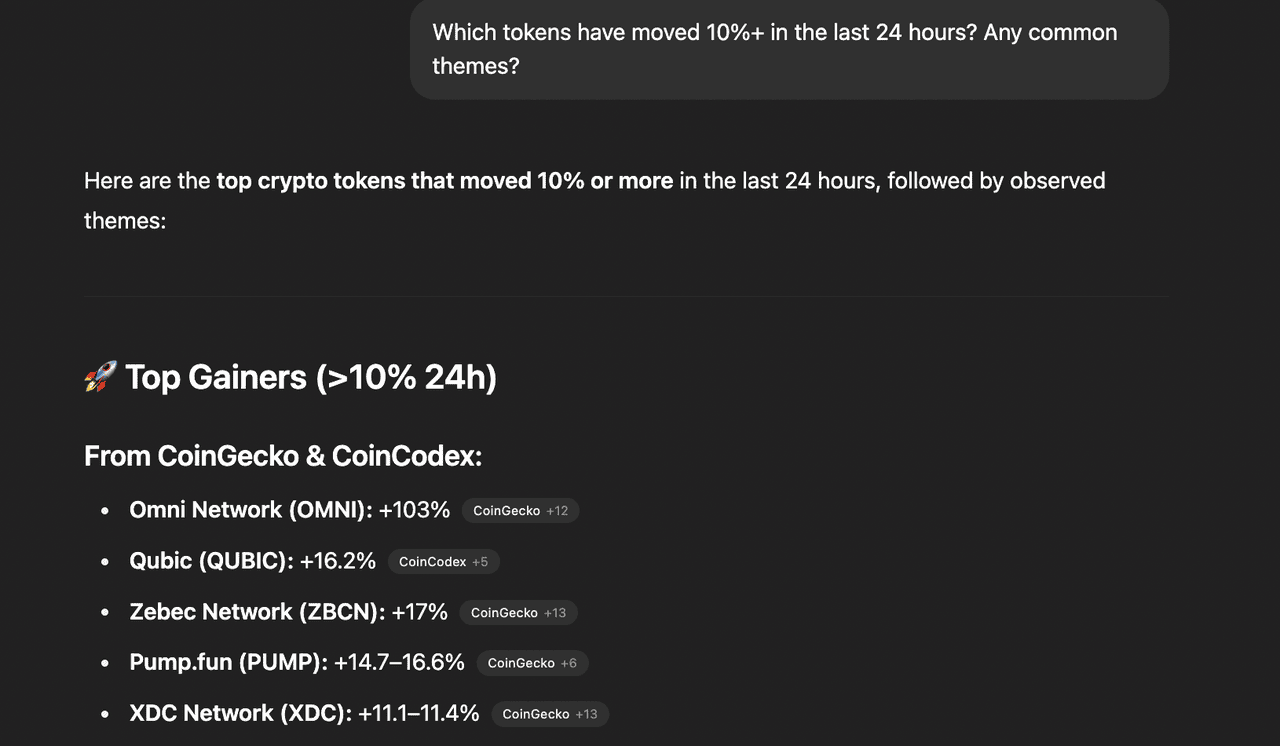

3. Scanează pentru Top Câștigători/Perdanți

Prompt: “Care tokenuri s-au mișcat cu 10%+ în ultimele 24 de ore? Există teme comune?” ChatGPT te poate ajuta să identifici jocurile de momentum, rotațiile de sectoare sau schimbările bruște de sentiment de piață.

Sursă: ChatGPT

4. Construiește o Listă de Verificări Matinale

Prompt:“Creează-mi lista de verificări pre-piață pentru sesiunea de tranzacționare de astăzi.” (Exemplu de output: Rezumat știri, evenimente de urmărit, top câștigători/perdanți, listă inițială de urmărire.)

Cum să Generezi și Validezi Configurări de Tranzacționare Crypto Cu ChatGPT

Traderii intermediari își cunosc deja tiparele preferate, steagurile, retestările și breakout-urile. Avantajul real constă în validarea obiectivă a acelor configurări, maparea rezultatelor opuse și testarea sub presiune a logicii.

1. Planificarea Tranzacțiilor Multi-Scenariu

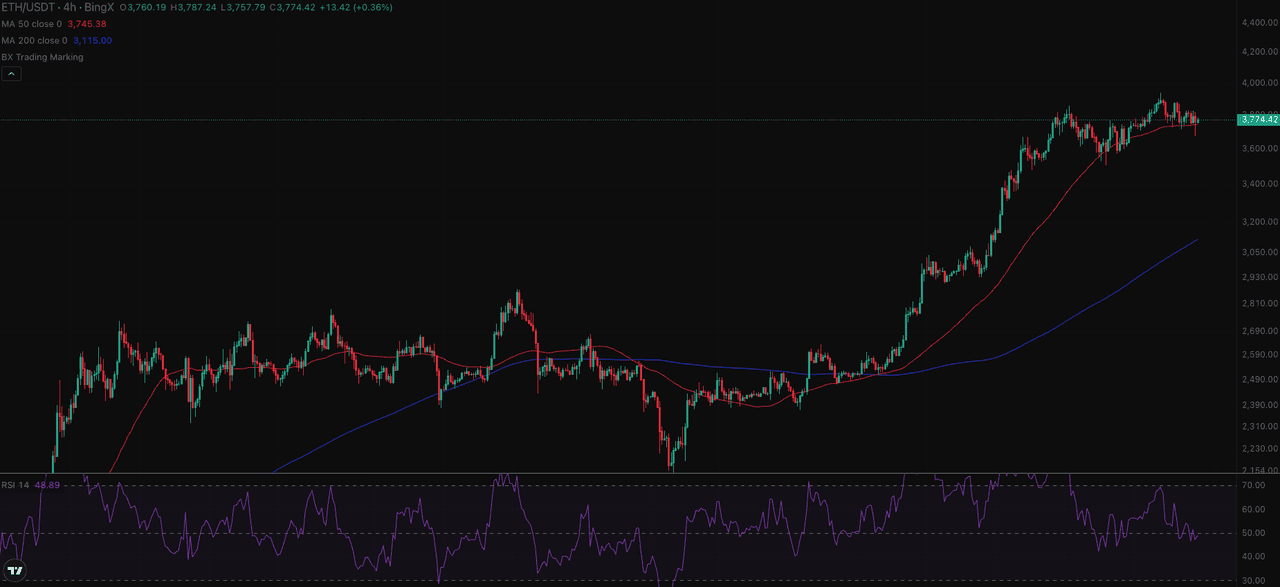

Scenariu Long: Rebound Bullish de la 50-SMA

• Intrare: închidere 4H peste $3,805

• Confirmare: RSI > 55

• Ținte: $3,890 / $3,970 / $4,130

• Invalidare: închidere sub $3,730

Scenariu Short: Breakdown Sub 50-SMA

• Intrare: închidere 4H sub $3,730

• Confirmare: RSI < 45, MACD bearish

• Ținte: $3,640 / $3,570 / $3,430

• Invalidare: Recucerire de $3,805

Acest lucru te pregătește să reacționezi la confirmare, nu să ghicești direcția.

2. Interpretarea Fluxului de Ordine și Reevaluarea

Prompt: “Dacă BTC sare în volum la rezistență dar nu reușește să străpungă, ce sugerează asta despre forța cumpărătorilor? Cum ar trebui să afecteze asta structura tranzacției?”

ChatGPT ajută să evaluezi psihologia din spatele prețului:

• Absorbție > continuare

• Long-uri prinse în capcană = risc de inversare

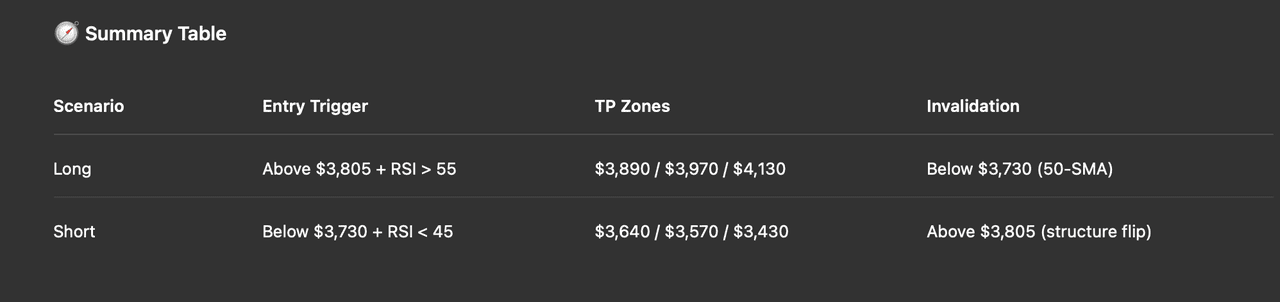

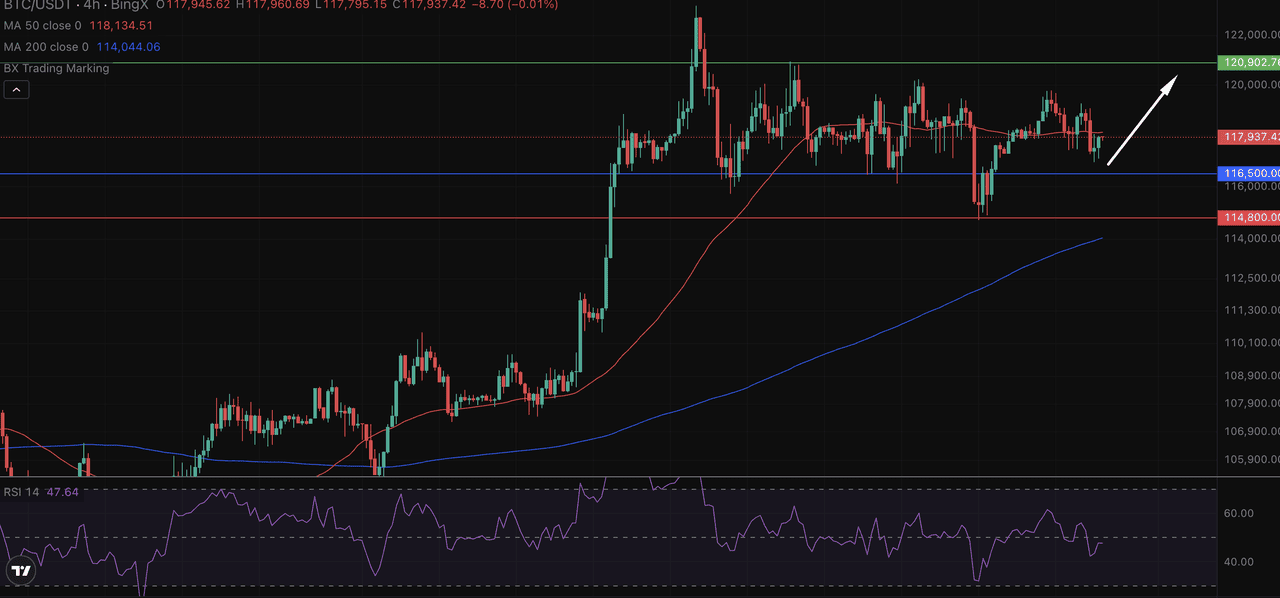

Context BTC/USDT 4H

BTC a eșuat să mențină banda de rezistență $117,800–$118,000 după încercări repetate de breakout. Prețul se tranzacționează acum sub 50-SMA, cu RSI slăbindu-se în jurul valorii 41, semne clasice de epuizare a cumpărătorilor.

Dacă această corecție a urmat unei împingeri cu volum mare:

• Cumpărătorii au fost absorbiți la rezistență

• Long-uri prinse peste $118K

• Interesul deschis probabil a crescut în timp ce prețul s-a blocat (un semn de alarmă roșu)

Sursă: Graficul de Tranzacționare

BTC/USDT pe BingX

Cum să Ajustezi Structura

Dacă long:

• Stop-uri strânse sub $116,500

• Ieșire la pierderea structurii sub 50-SMA

• Evită re-intrarea până când $118K nu este recucerit cu suport de volum

Dacă flat sau short-biased:

• Trigger short sub $116,500 cu confirmare de breakdown

• Țintă: $114,300–$114,500 (în apropiere de 200-SMA)

• Invalidează peste $118,200 (recucerire bullish)

De ce Contează: ChatGPT nu poate să îți arate live tape-ul, dar te poate ajuta să raționalizezi ce implică breakout-urile eșuate: absorbție > continuare. Acea schimbare mentală este adesea diferența dintre a menține riscul și a tăia rapid.

3. Generarea Ideilor de Tranzacționare: Structură, Confirmare, Invalidare

Prompt:“Care e o configurare BTC cu probabilitate mare astăzi bazată pe RSI, MACD și structura graficului?” Primește un rezumat al posibilelor configurări (ex. breakout-uri triangle, bounce-uri de suport) și semnale de confirmare.

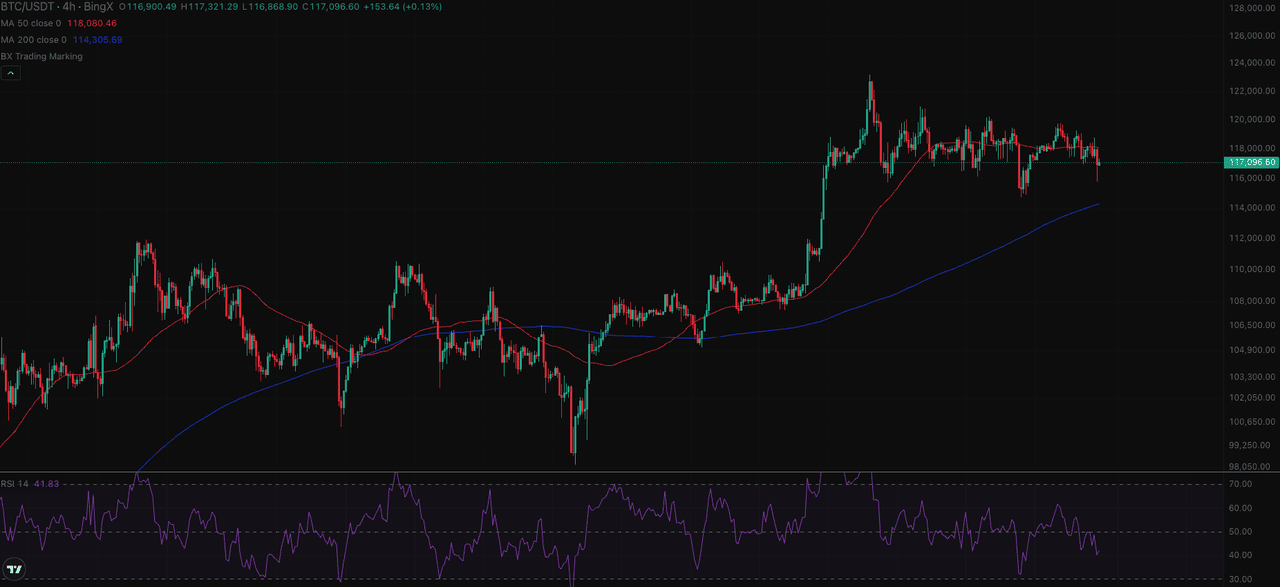

Folosește ChatGPT pentru a scana posibilele configurări de tranzacționare bazate pe indicatori comuni și structura vizuală a prețului. În graficul exemplu (BTC/USDT, timeframe 4H), iată cum ar putea răspunde ChatGPT:

Sursă: Graficul de Tranzacționare

BTC/USDT pe BingX

Exemplu Output ChatGPT (bazat pe graficul încărcat):

• Structură: BTC se consolidează sub MA-ul de 50 de perioade ($118,133), cu suport în jurul valorii $116,000 și rezistență în apropierea $119,000

• RSI: Plutește în jurul valorii 47, arătând momentum neutru fără condiție clară de supracumpărare/supravânzare

• Ideea de configurare: Posibile condiții de range sau o spirală înainte de breakout. Un bounce din zona $116K cu o recucerire a MA de 50 ar putea oferi o configurare long

• Semnale de confirmare: Breakout peste $118.1K (MA 50) cu RSI în creștere către 60

• Invalidare: Breakout sub $116K și RSI în scădere sub 40

Cum să Folosești Asta: Odată ce primești acest răspuns, suprapune-l cu propriile nivele sau sistem de tranzacționare. Folosește perspectiva generată de AI pentru a valida sau contesta prejudecata ta și evită să urmărești configurări incerte.

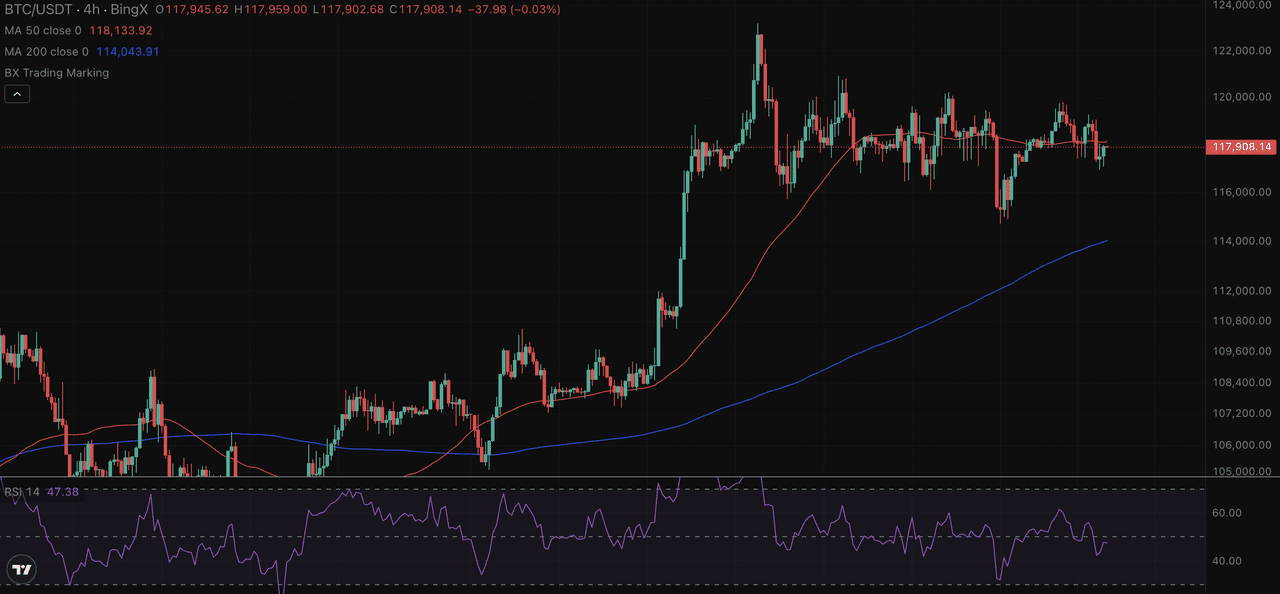

4. Cum să Definești Riscul și să Gestionezi Tranzacțiile în Timp Real

ChatGPT poate ajuta să modelezi riscul cu logică structurată, util când volatilitatea forțează ajustări rapide.

Prompt: “Dacă BTC este la $116,500, care e o intrare logică, stop-loss și take-profit bazate pe volatilitatea recentă și structură?”

• Intrare: $116,500

• Stop: $114,800

• TP: $118,800 / $120,500

• R:R: 1.3 la 2.3 în funcție de nivelul TP

Sursă: Graficul de Tranzacționare

BTC/USDT pe BingX

Cum să Folosești ChatGPT pentru a-ți Gestiona Tranzacțiile Live

Chiar și cele mai bine planificate tranzacții pot merge prost. În timpul piețelor cu mișcare rapidă, a avea un asistent calm, bazat pe logică poate face toată diferența. ChatGPT te ajută să reevaluezi pozițiile deschise, să ajustezi stop-urile, să răspunzi la știrile de ultimă oră și să îți gestionezi emoțiile, toate fără să te îndoiești de tine.

Mai jos sunt prompt-uri cheie care aduc structură la deciziile în timp real:

Actualizări în Timp Real

Prompt: “Care sunt ultimele despre breakout-ul

SOL? Vreo știre sau schimbare de volum?”

Ajustări SL/TP

Prompt: “Ar trebui să mut stop-loss-ul la breakeven după această mișcare de 4%?”

Gestionarea Impactului Știrilor

Prompt: “Tocmai au apărut știri despre aprobarea

ETH ETF. Cum ar trebui să adaptez tranzacția mea ETH deschisă?”

Controlul Emoțiilor

Prompt: “Tocmai am fost oprit, ajută-mă să evit tranzacționarea de răzbunare.”

Cum să Efectuezi Revizuiri Post-Tranzacționare Cu ChatGPT

O rutină profesională de tranzacționare nu se termină cu închiderea poziției; se termină cu revizuirea. ChatGPT te ajută să reflectezi asupra deciziilor tale, să recunoști triggerii emoționali și să îți rafinezi playbook-ul pentru mâine. Transformând experiența în date, devine mai ușor să te îmbunătățești cu fiecare sesiune. Folosește aceste prompt-uri pentru a încheia ziua de tranzacționare cu claritate și structură:

Jurnalizarea Tranzacțiilor

Prompt:“Rezumă tranzacțiile de astăzi: intrare, ieșire, rezultat și motive.” Excelent pentru logare și recunoașterea tiparelor.

Recunoașterea Tiparelor Emoționale

Prompt: "Am arătat vreo prejudecată emoțională sau ezitare astăzi? Cum pot să mă îmbunătățesc?” ChatGPT te poate ajuta să identifici probleme recurente precum FOMO, ezitarea sau supratranzacționarea.

Revizuirea Greșelilor și Câștigurilor

Prompt:“De ce am ieșit devreme din long-ul meu BTC? A fost justificat de acțiunea prețului sau doar nervi?”

Logarea Perspectivelor pentru Mâine

Prompt: "Ce lecții cheie ar trebui să car în sesiunea de mâine?” Jurnalizarea cu ChatGPT te menține responsabil și mereu în învățare.

Top Prompt-uri pentru Traderii de Zi: Referință Rapidă

Iată o bibliotecă cu acces rapid de prompt-uri pentru fiecare fază a zilei de tranzacționare:

1. “Rezumă volatilitatea de peste noapte și top știrile crypto.”

2. “Listează evenimentele cu impact mare pentru sesiunea crypto de astăzi.”

3. “Sugerează o configurare de tranzacționare BTC cu nivele de confirmare și invalidare.”

4. “Simulează R:R pentru long ETH de la $3,800 cu stop $3,730.”

5. “Revizuiește performanța mea de tranzacționare și identifică prejudecata emoțională.”

Gânduri Finale

ChatGPT nu este un bot de semnale. Este un partener de gândire care îți ascuțește planificarea, îmbunătățește viteza de luare a deciziilor și te sprijină sub presiune. Când este folosit eficient, comprimă timpul de cercetare, reduce prejudecata și creează o buclă mai disciplinată de la idee la execuție la revizuire.

Dacă ai deja un sistem, ChatGPT nu îl va înlocui, îl va face mai strâns. Începe următoarea sesiune cu ChatGPT alături. Nu vei mai vrea să tranzacționezi fără el din nou.

Articole Înrudite

Întrebări Frecvente despre Tranzacționarea Zilnică de Crypto cu ChatGPT

1. Poate ChatGPT să dea semnale de tranzacționare crypto în timp real?

Nu. ChatGPT nu oferă semnale live sau feed-uri de preț. Te ajută să îți structurezi rutina de tranzacționare, să analizezi sentimentul și să planifici configurări de tranzacționare folosind logica și prompt-uri.

2. Cum pot folosi ChatGPT pentru a mă pregăti pentru tranzacționarea de zi?

Folosește ChatGPT pentru pregătirea pre-piață: rezumă volatilitatea de peste noapte, listează evenimente cheie, scanează câștigători/perdanți și generează scenarii de tranzacționare cu parametri de risc.

3. Este ChatGPT precis pentru predicțiile pieței crypto?

Nu, nu te poți baza doar pe ChatGPT pentru a prezice piețele. Te ajută să procesezi știrile, sentimentul și configurările tehnice mai eficient pentru a putea lua decizii informate.

4. Poate ChatGPT să ajute în timpul tranzacțiilor live?

Da. Poți întreba ChatGPT dacă să ajustezi stop-loss-urile, să interpretezi știrile în mijlocul tranzacției sau să gestionezi răspunsurile emoționale. Totuși, acționează ca o verificare logică, nu ca un bot de tranzacționare, așa că asigură-te să îți faci propria cercetare înainte să îți pui banii pe piață.

5. Care sunt cele mai bune prompt-uri de folosit cu ChatGPT pentru tranzacționarea de zi?

Depinde de obiectivele și strategiile tale de investiție. Totuși, poți încerca următoarele prompt-uri, includ:

• “Rezumă știrile crypto din ultimele 8 ore.”

• “Care e o configurare BTC cu probabilitate mare astăzi?”

• “Listează evenimentele cu impact mare de astăzi.”

• “Calculează mărimea poziției pentru un cont de $10K, riscând 1.5%.”

• “Revizuiește tranzacțiile mele și semnalează prejudecata emoțională.”