Extensiile Fibonacci sunt instrumente puternice de analiză tehnică ce ajută traderii cripto să identifice ținte de preț potențiale și niveluri cheie de rezistență dincolo de zonele standard de retragere. Bazate pe principiile matematice ale secvenței Fibonacci, aceste extensii îi ajută pe traderi să prognozeze mișcările viitoare ale prețurilor și să stabilească ținte de profit. Stăpânește extensiile Fibonacci pentru a proiecta ținte de preț cripto, a identifica zone de rezistență și a îmbunătăți strategiile de ieșire folosind instrumente obiective de analiză tehnică.

Spre deosebire de retragerile Fibonacci, care se concentrează pe nivelurile potențiale de retragere în timpul unei tendințe, extensiile proiectează în mod specific cât de departe s-ar putea mișca un preț dincolo de maximul sau minimul său anterior după finalizarea unei retrageri. Acest lucru le face deosebit de valoroase pentru determinarea punctelor de ieșire și stabilirea unor ținte de profit realiste pe piețele în tendință.

Acest ghid te va ajuta să înveți cum să utilizezi extensiile Fibonacci în tranzacționarea cripto pentru a identifica ținte cheie de preț, a îmbunătăți planificarea strategiei și a optimiza deciziile risc-recompensă.

Ce sunt extensiile Fibonacci? Fundamente matematice

Secvența Fibonacci (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55...) este o serie în care fiecare număr este suma celor două precedente. Din această secvență, sunt derivate mai multe rapoarte cheie care apar frecvent în natură, arhitectură și piețele financiare.

Cele mai semnificative niveluri de extensie Fibonacci utilizate în tranzacționare includ:

• 127.2%: Primul nivel major de extensie

• 161.8%: Cunoscut ca "extensia de aur" sau raportul de aur

• 200%: Dublul mișcării inițiale a prețului

• 261.8%: Un nivel puternic de extensie pentru tendințe semnificative

Aceste rapoarte nu sunt întâmplătoare—ele sunt derivate din relații matematice în cadrul secvenței Fibonacci. De exemplu, nivelul de extensie de 161.8% provine din împărțirea numerelor Fibonacci consecutive, aproximând 1.618 (raportul de aur).

Cum să calculezi și să desenezi extensiile Fibonacci: Proces pas cu pas

Pentru a aplica extensiile Fibonacci pe graficele tale de tranzacționare cripto, urmează acești pași simpli:

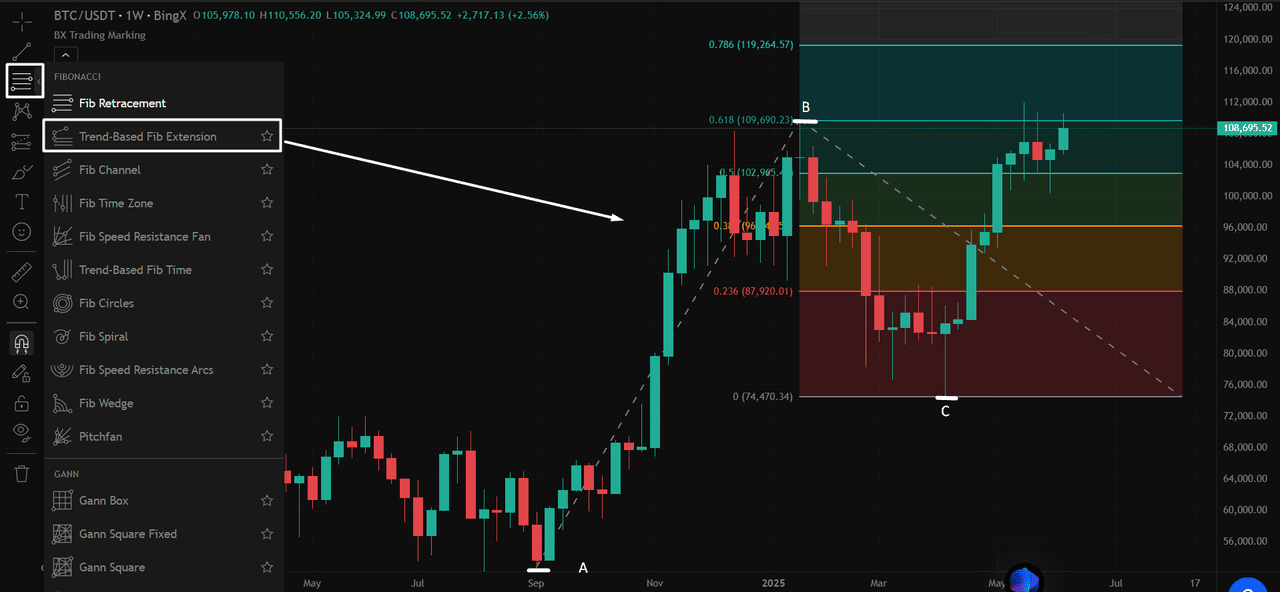

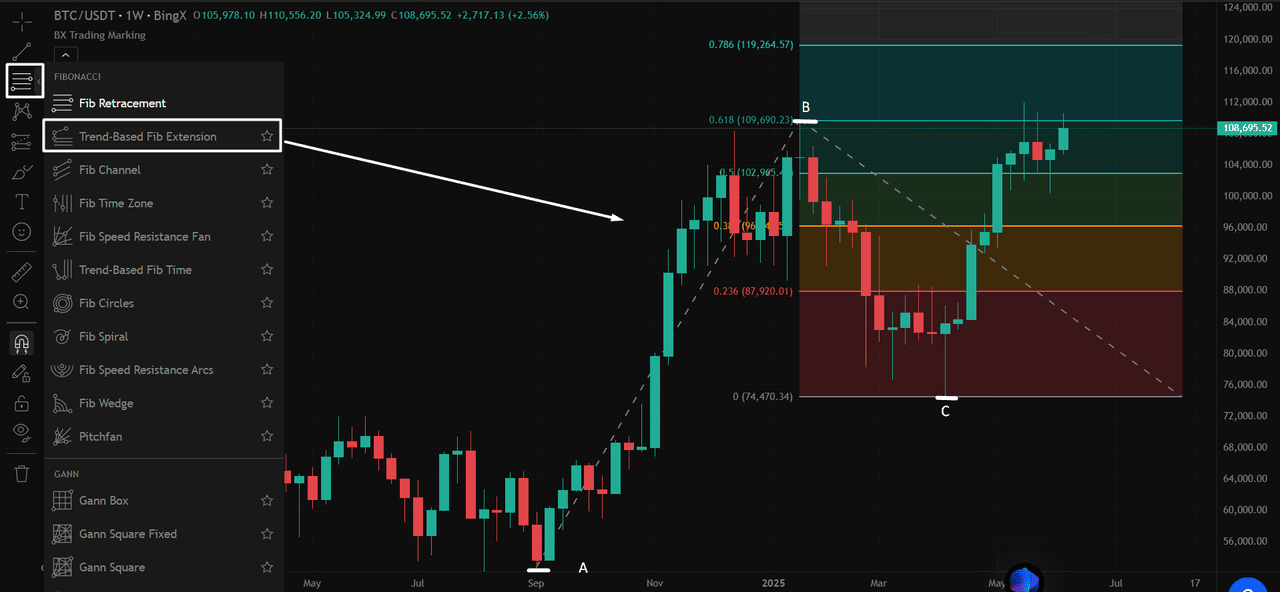

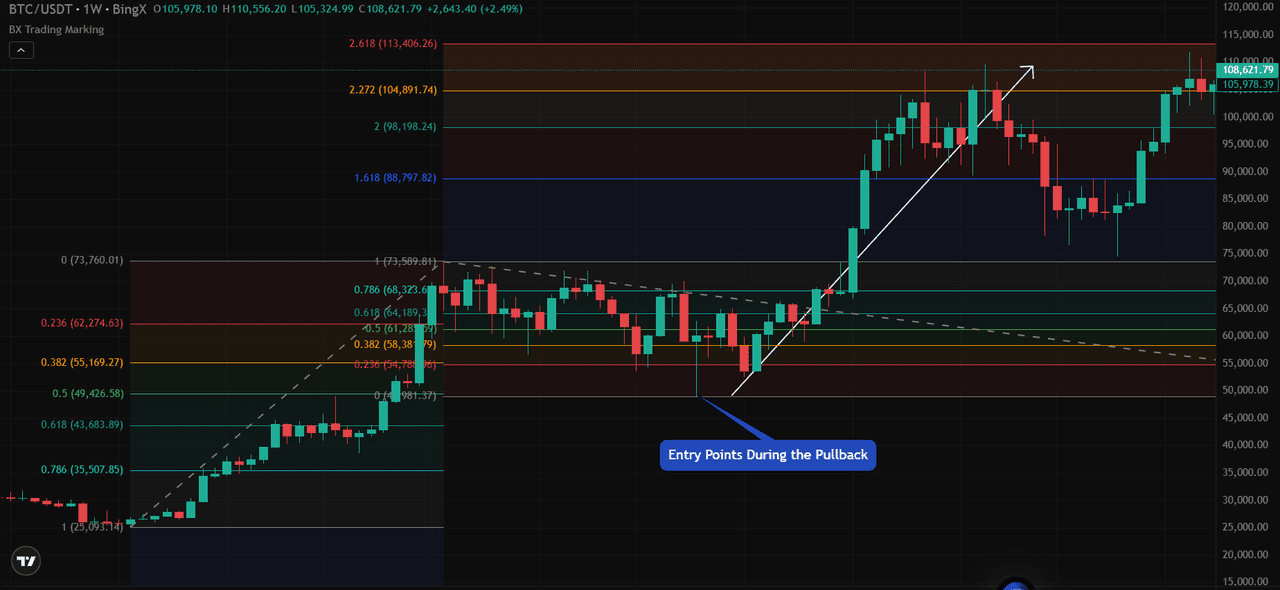

Sursă: Graficul de tranzacționare BTC/USDT pe BingX

1. Identifică trei puncte cheie pe graficul tău:

• Punctul A: Punctul de pornire al unei tendințe (minim de oscilație într-o tendință ascendentă, maxim de oscilație într-o tendință descendentă)

• Punctul B: Punctul final al mișcării inițiale a prețului

• Punctul C: Sfârșitul retragerii împotriva acelei mișcări

2. Selectează instrumentul de extensie Fibonacci pe platforma ta de tranzacționare (cum ar fi BingX)

3. Desenează extensia făcând clic pe aceste trei puncte în ordine

4. Analizează nivelurile de extensie proiectate care apar automat pe graficul tău

Calculul efectiv implică măsurarea distanței dintre punctele A și B, înmulțirea acelei distanțe cu rapoartele Fibonacci și apoi proiectarea acestor valori din punctul C în direcția tendinței originale.

Cum să calculezi nivelul de extensie Fibonacci: Exemplu BTC/USDT

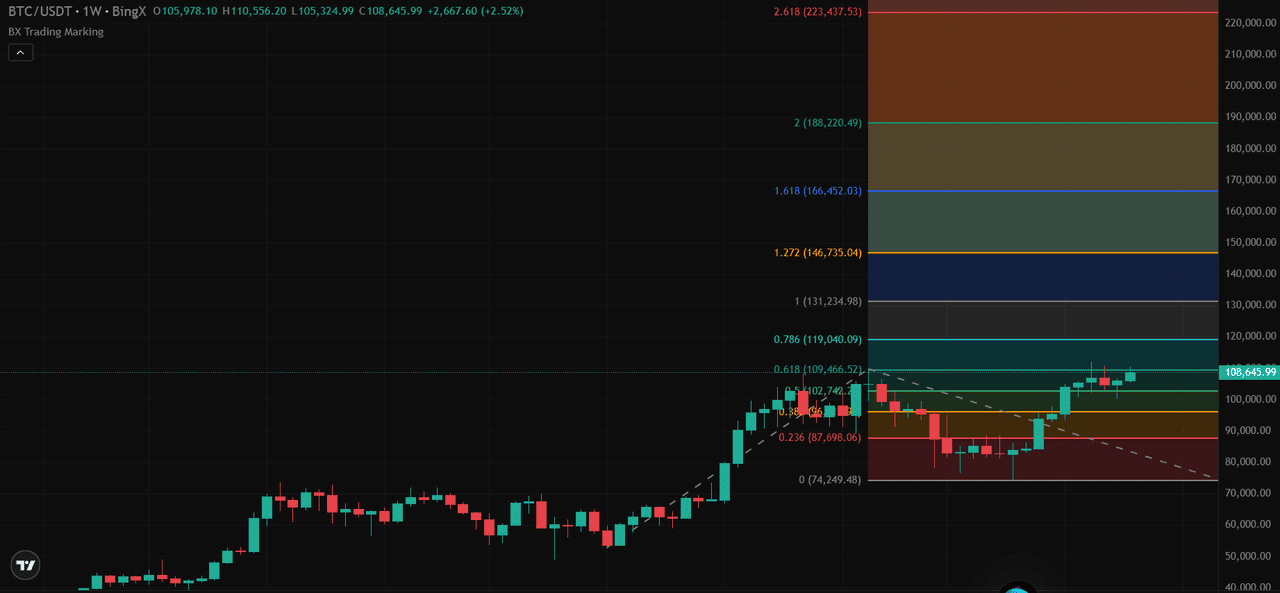

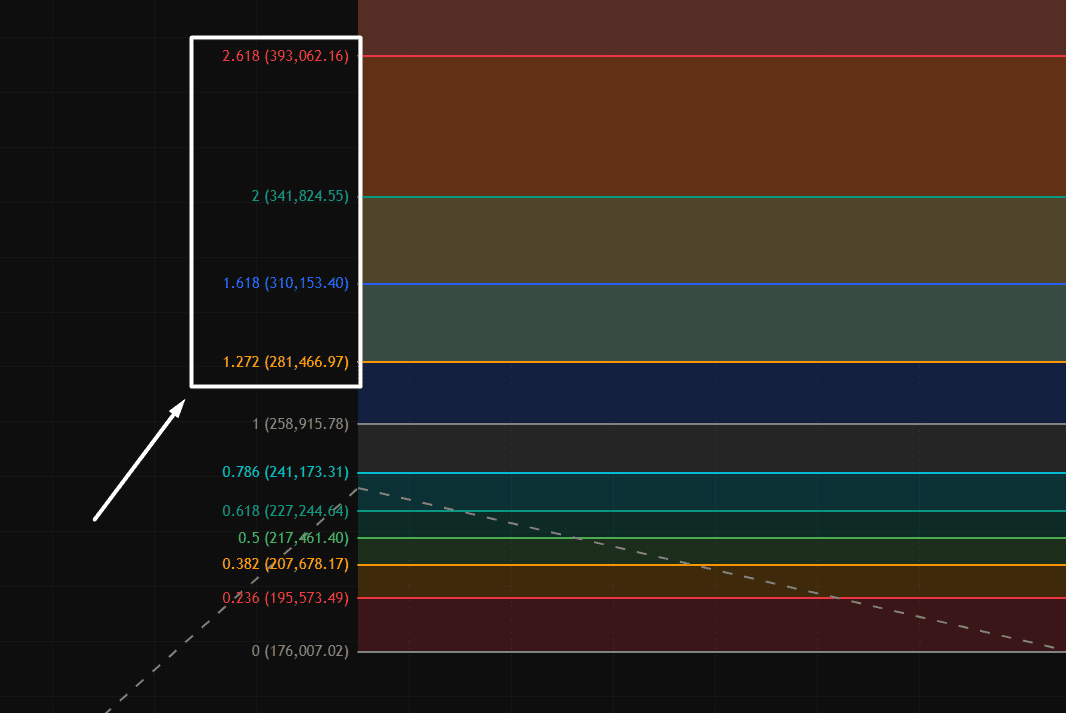

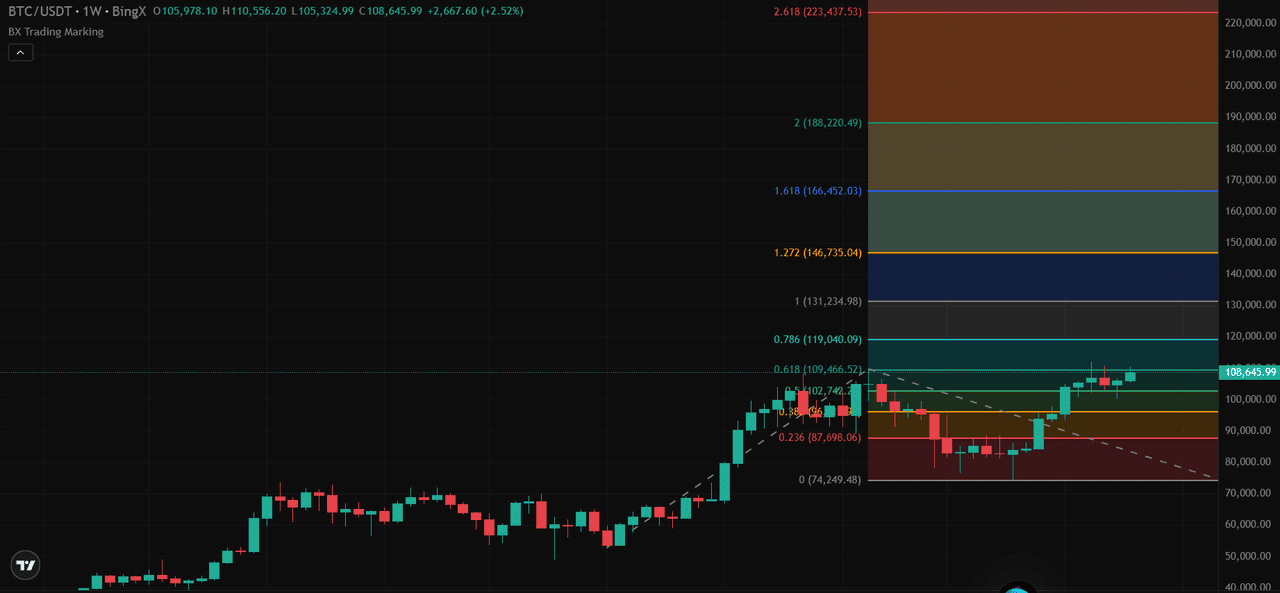

Sursă: Graficul de tranzacționare BTC/USDT pe BingX

În graficul de mai sus (BTC/USDT pe BingX), utilizăm instrumentul de extensie Fibonacci conectând trei puncte cheie:

• Punctul A (Minim de oscilație): $74,249

• Punctul B (Maxim de oscilație): $109,690

• Punctul C (Minim de retragere): $87,698

Acest nivel marchează o țintă intermediară puternică. Traderii se așteaptă adesea la luarea de profit sau la o rezistență temporară aici. Dacă este spart, semnalează o forță bullish și deschide calea către ținte mai înalte.

2. Extensie 161.8% ≈ $166,452

Cunoscută sub numele de „extensia de aur”, este utilizată pe scară largă pentru stabilirea țintelor primare de creștere. O închidere deasupra acestui nivel, mai ales cu volum puternic, sugerează o spargere susținută și continuarea tendinței.

3. Extensie 200% ≈ $188,220

Acest nivel dublează mișcarea de la minimul la maximul de oscilație. Reprezintă o țintă agresivă și se poate alinia cu condiții de supracumpărare. Util pentru traderii avansați cu strategii de stop-loss dinamic.

4. Extensie 261.8% ≈ $223,437

De obicei, se observă în faze euforice sau în creșteri parabolice. Este o țintă mai puțin comună, dar importantă pentru identificarea epuizării tendinței sau pregătirea pentru o posibilă inversare.

Aceste niveluri proiectate îi ajută pe traderii care utilizează BingX nu doar să anticipeze unde ar putea ajunge BTC, ci și să stabilească ținte de profit realiste și să gestioneze riscul mai eficient pe măsură ce prețul se apropie de aceste zone.

Utilizează aceste niveluri ca o zonă potențială de profit, combinându-le cu alți indicatori pentru confirmare.

Cum să utilizezi extensiile Fibonacci în tranzacționarea cripto: Strategii de top

1. Strategia de continuare a tendinței

Extensiile Fibonacci sunt deosebit de eficiente pe piețele cu tendințe puternice. Atunci când o criptomonedă se află într-o tendință ascendentă sau descendentă clară și experimentează o retragere temporară, extensiile pot ajuta la identificarea locului unde ar putea ajunge prețul odată ce tendința continuă.

Cum se implementează:

• Așteaptă stabilirea unei tendințe clare

• Utilizează retragerea Fibonacci pentru a identifica punctele de intrare în timpul retragerii

• Aplică extensiile Fibonacci pentru a proiecta ținte de profit potențiale

• Ia în considerare luarea de profituri în apropierea nivelurilor cheie de extensie, cum ar fi 161.8% sau 261.8%

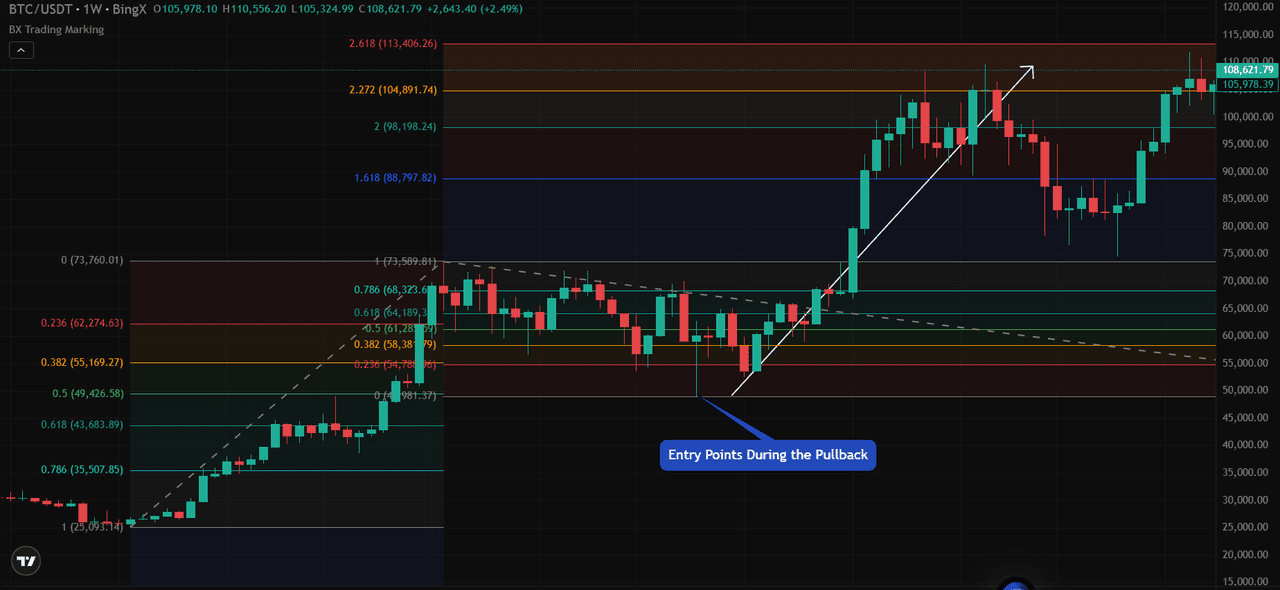

Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Conform graficului de mai sus, BTC/USDT pe BingX, după o retragere în zona de retragere de 50% în apropierea a aproximativ 49.425 USD, Bitcoin și-a reluat tendința ascendentă. Traderii care au intrat în timpul retragerii ar putea viza nivelul 1.618, în jurul a 88.797 USD, și potențial chiar mai sus la nivelul 2.272, care corespunde la aproximativ 104.891 USD pentru ieșiri.

2. Strategia de confluență

Puterea extensiilor Fibonacci crește semnificativ atunci când acestea se aliniază cu alți indicatori tehnici sau niveluri de preț. Această "confluență" creează zone de suport sau rezistență mai puternice.

Combinațiile eficiente includ:

• Extensii + Medii mobile: Când un nivel de extensie Fibonacci coincide cu o medie mobilă cheie

• Extensii + RSI: Utilizarea RSI pentru a confirma dacă piața este supracumpărată sau supravândută la nivelurile de extensie

• Extensii + Suport/Rezistență: Când un nivel de extensie se aliniază cu suportul sau rezistența istorică

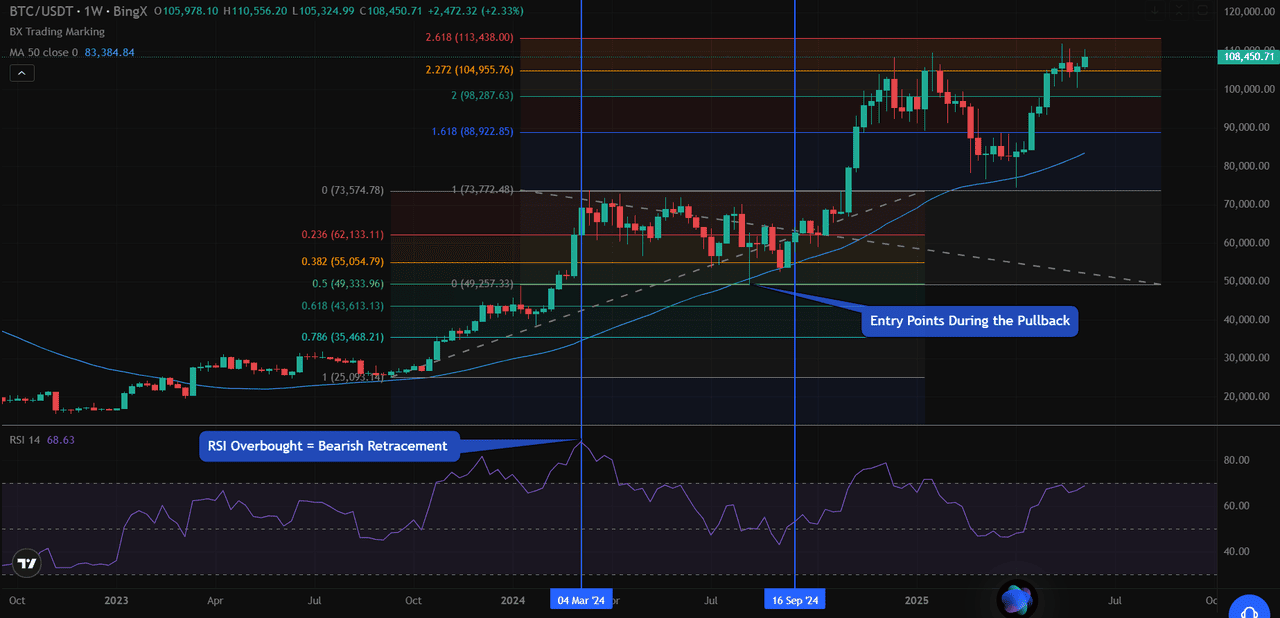

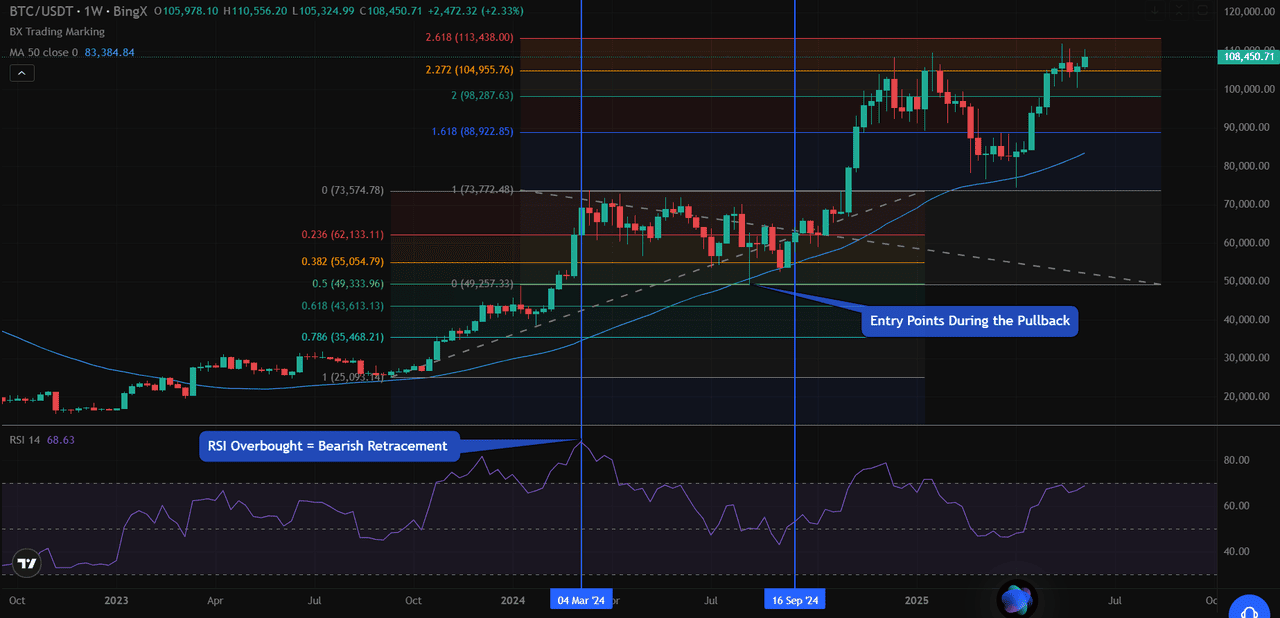

Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Exemplu din grafic (BTC/USDT - BingX)

Pe 4 martie 2024, RSI se afla în teritoriu de supracumpărare, aliniindu-se cu o retragere bearish chiar lângă nivelul Fibonacci de 50% de 49.425 USD. Pe 16 septembrie 2024, prețul a revenit de la nivelul de retragere de 50%, cu media mobilă (MA) pe 50 de săptămâni oferind suport de confluență.

Aceste zone de intrare s-au aliniat atât cu semnalele Fibonacci, cât și cu cele RSI, evidențiind modul în care confluența ajută la identificarea zonelor de tranzacționare cu probabilitate ridicată.

În peisajul volatil al criptomonedelor, utilizarea extensiilor Fibonacci în combinație cu indicatorii de momentum și tendință adaugă profunzime strategiei tale și îmbunătățește precizia intrărilor/ieșirilor.

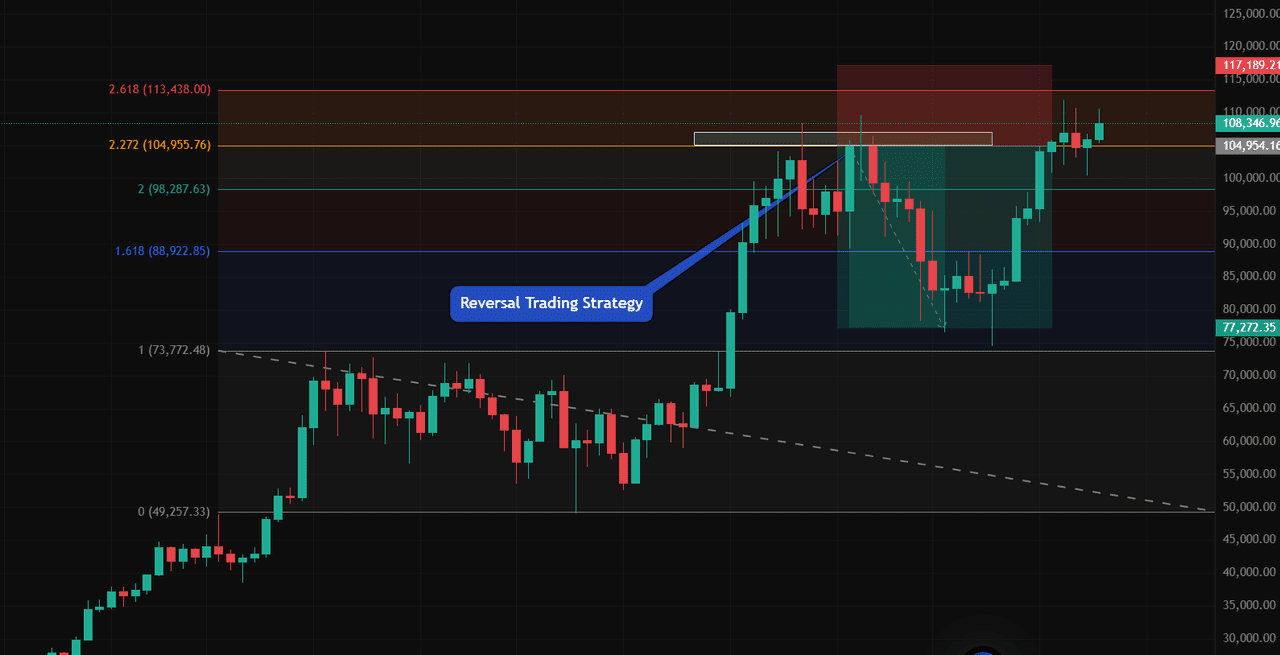

3. Strategia de tranzacționare a inversării

Deși extensiile sunt adesea utilizate pentru a proiecta continuări de tendință, ele pot identifica și puncte potențiale de inversare. Nivelurile majore de extensie, cum ar fi 161.8% și 261.8%, acționează frecvent ca rezistență sau suport puternic, unde prețul se poate inversa.

Abordare de implementare:

• Identifică nivelurile de extensie în direcția tendinței

• Urmărește modelele de lumânări de inversare în apropierea acestor niveluri de extensie

• Caută confirmare din partea indicatorilor de volum sau momentum

• Plasează ordine stop-loss dincolo de nivelul de extensie

Așa cum se arată în graficul de mai sus, Bitcoin a scăzut brusc după ce a atins nivelul de extensie Fibonacci de 200% în apropierea a 98.285 USD. Aceasta a acționat ca o zonă puternică de rezistență și ar fi putut oferi traderilor o oportunitate potențială de vânzare.

Cele mai bune practici pentru utilizarea extensiilor Fibonacci

Pentru a profita la maximum de extensiile Fibonacci în tranzacționarea cripto, este esențial să urmezi câteva bune practici care îmbunătățesc precizia și luarea deciziilor:

1. Combină cu alți indicatori: Extensiile Fibonacci nu ar trebui niciodată utilizate izolat. Pentru semnale mai precise, combină-le cu:

• Medii mobile: Pentru a confirma direcția generală a tendinței

• RSI (Indicele de Forță Relativă): Pentru a verifica dacă piața este supracumpărată/supravândută

• Indicatori de volum: Pentru a valida forța mișcărilor prețului

• Niveluri de suport și rezistență: Pentru a identifica puncte cheie psihologice de preț

2. Concentrează-te pe nivelurile cheie de extensie: Deși există multe niveluri de extensie Fibonacci, traderii se concentrează de obicei pe:

• 161.8%: Cel mai semnificativ nivel de "extensie de aur"

• 127.2%: Adesea o primă țintă în tendințele moderate

• 261.8%: O țintă pentru tendințe mai puternice

3. Practică gestionarea riscului: Chiar și cu extensiile Fibonacci, gestionarea corectă a riscului este esențială:

• Setează ordine stop-loss rezonabile: Plasează stopuri sub suport în tendințe ascendente sau deasupra rezistenței în tendințe descendente

• Ia în considerare luarea parțială de profit: Ia unele profituri la nivelurile de extensie anterioare, lăsând o parte din poziția ta să ruleze către ținte mai înalte

• Evită supra-îndatorarea: Extensiile Fibonacci nu sunt predictori perfecți, așa că menține dimensiuni adecvate ale pozițiilor

Capcane comune de evitat la utilizarea extensiilor Fibonacci

Deși extensiile Fibonacci pot fi instrumente puternice, traderii ar trebui să fie conștienți de capcanele comune care pot duce la predicții inexacte sau la o execuție slabă a tranzacțiilor:

1. Dependența excesivă de extensiile Fibonacci: Deși puternice, extensiile Fibonacci ar trebui să facă parte dintr-o strategie de tranzacționare cuprinzătoare, nu să fie singura bază pentru decizii. "Regula celor 90" indică faptul că 90% dintre traderii noi pierd 90% din capitalul lor inițial în decurs de 90 de zile, adesea din cauza dependenței excesive de indicatori unici precum Fibonacci.

2. Ignorarea contextului pieței: Extensiile Fibonacci funcționează cel mai bine pe piețele în tendință și pot fi mai puțin fiabile în condiții de piață volatile sau laterale. Întotdeauna ia în considerare contextul mai larg al pieței, inclusiv sentimentul pieței, evenimentele de știri și structura generală a pieței.

3. Utilizarea punctelor de oscilație incorecte: Eficacitatea extensiilor Fibonacci depinde de selectarea punctelor de oscilație corecte. Utilizarea mișcărilor de preț nesemnificative poate duce la proiecții inexacte. Întotdeauna selectează cele mai semnificative puncte de maxim și minim de oscilație în intervalul tău de timp.

Concluzie: Cum să integrezi extensiile Fibonacci în strategia ta de tranzacționare cripto

Extensiile Fibonacci oferă o abordare structurată pentru stabilirea țintelor de profit și identificarea zonelor potențiale de inversare pe piețele cripto. Atunci când sunt utilizate corect și în combinație cu alte instrumente de analiză tehnică, ele pot îmbunătăți semnificativ precizia și profitabilitatea tranzacționării tale.

Pentru traderii cripto, aceste instrumente sunt deosebit de valoroase datorită naturii volatile a piețelor de criptomonede, unde a avea puncte de ieșire predeterminate poate ajuta la menținerea disciplinei și la reducerea luării deciziilor emoționale.

Prin stăpânirea aplicării extensiilor Fibonacci și înțelegerea limitărilor acestora, poți dezvolta strategii de tranzacționare cripto mai eficiente, care capitalizează pe mișcările prețurilor bazate pe principii matematice obiective, mai degrabă decât pe presupuneri.

Ești gata să-ți testezi strategia? Încearcă să aplici extensiile Fibonacci pe

BTC/USDT folosind instrumentele de graficare BingX astăzi și identifică următoarea ta țintă de preț potențială.

Lecturi conexe

Întrebări frecvente despre extensiile Fibonacci

1. Care este diferența dintre retragerile și extensiile Fibonacci?

Retragerile ajută la identificarea zonelor potențiale de retragere în cadrul unei tendințe. Extensiile proiectează cât de departe s-ar putea mișca prețul după finalizarea retragerii, ajutând traderii să stabilească ținte de profit.

2. Care sunt cele mai importante niveluri de extensie Fibonacci?

Nivelurile cheie pe care traderii le urmăresc sunt 127.2%, 161.8% (raportul de aur), 200% și 261.8%. Acestea acționează adesea ca zone puternice de rezistență sau suport pe piețele în tendință.

3. Pot utiliza extensiile Fibonacci singure pentru deciziile de tranzacționare?

Nu este recomandat să utilizezi extensiile Fibonacci ca indicator tehnic de sine stătător. Extensiile funcționează cel mai bine atunci când sunt combinate cu alte instrumente precum RSI, volumul, mediile mobile sau liniile de tendință pentru a confirma semnalele.

4. Funcționează extensiile Fibonacci pe toate intervalele de timp?

Da, dar sunt mai fiabile pe intervale de timp mai mari, cum ar fi graficele zilnice sau săptămânale, mai ales atunci când sunt utilizate pentru a stabili ținte pe termen mediu și lung.

5. Cât de precise sunt extensiile Fibonacci în tranzacționarea cripto?

Deși niciun instrument nu este 100% precis, extensiile Fibonacci oferă niveluri cu probabilitate ridicată bazate pe comportamentul istoric al prețurilor și psihologia pieței. Fiabilitatea lor se îmbunătățește atunci când le combini cu alți indicatori tehnici populari.

Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Sursă: Graficul de tranzacționare BTC/USDT pe BingX Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Sursă: Graficul de tranzacționare BTC/USDT pe BingX Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Sursă: Graficul de tranzacționare BTC/USDT pe BingX Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Sursă: Graficul de tranzacționare BTC/USDT pe BingX Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Sursă: Graficul de tranzacționare BTC/USDT pe BingX Sursă: Graficul de tranzacționare BTC/USDT pe BingX

Sursă: Graficul de tranzacționare BTC/USDT pe BingX