In cryptocurrency markets, whales are individuals, institutions, or exchanges that hold very large amounts of digital assets. A single whale may control thousands of

Bitcoin or millions of dollars in

altcoins. Because of this, their movements between wallets, exchanges, or cold storage can affect liquidity, sentiment, and price volatility.

Large transactions are rarely random. Accumulation, when whales move funds into cold storage, often signals confidence and reduces supply on exchanges. Distribution, when whales transfer coins to exchanges, can increase supply and create selling pressure. For traders, tracking these shifts helps anticipate potential changes in market conditions and avoid decisions based only on short-term noise.

This is where

whale alerts and

blockchain analytics tools play a role. They provide real-time visibility into large transfers, allowing traders and investors to integrate whale data into their analysis. Used correctly, these alerts improve awareness of how influential holders shape the

cryptocurrency market and help market participants make more informed decisions.

What Are Crypto Whales?

In crypto, whales are wallet addresses holding 1,000 or more Bitcoin or the equivalent in large altcoin positions. Their size gives them the ability to influence market prices with just a single transaction.

Whales usually fall into three groups:

• Early adopters and miners – people who acquired large holdings when Bitcoin was cheap or mined coins in the early years.

• Exchanges and institutions – platforms like Binance or companies such as MicroStrategy that hold reserves for trading or investment.

• High-net-worth individuals and funds – investors who built significant portfolios through direct purchases.

Some whales are well known.

Satoshi Nakamoto, Bitcoin’s creator, is estimated to hold over one million BTC that have never moved.

MicroStrategy has become a benchmark for corporate Bitcoin accumulation. Major exchange wallets such as Binance are also among the largest on-chain addresses.

The importance of whales lies in their impact on volatility and sentiment. A large inflow of coins to exchanges can suggest upcoming selling, while transfers to cold storage often show accumulation and long-term confidence. For traders, watching whale activity helps to understand how a small number of influential players shape broader market dynamics.

Why Whale Movements Matter in Crypto

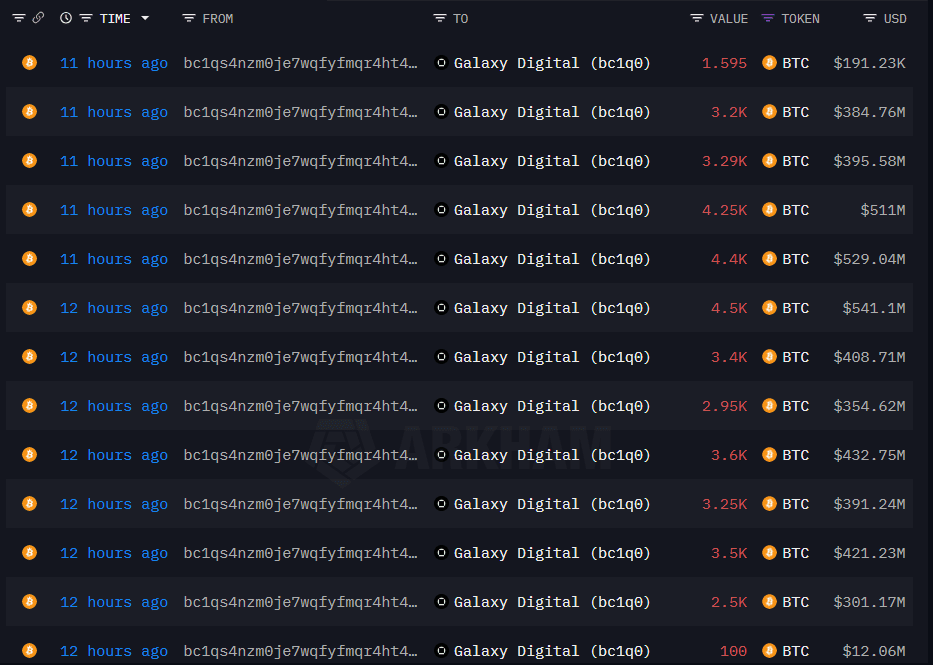

Whale transactions in 2025 showed how a single move can influence the entire market. For instance, in July 2025, a dormant wallet from the Satoshi era transferred 80,000 BTC worth $8.6 billion. Within hours, Bitcoin fell by nearly 4% as traders speculated that the funds were being prepared for sale.

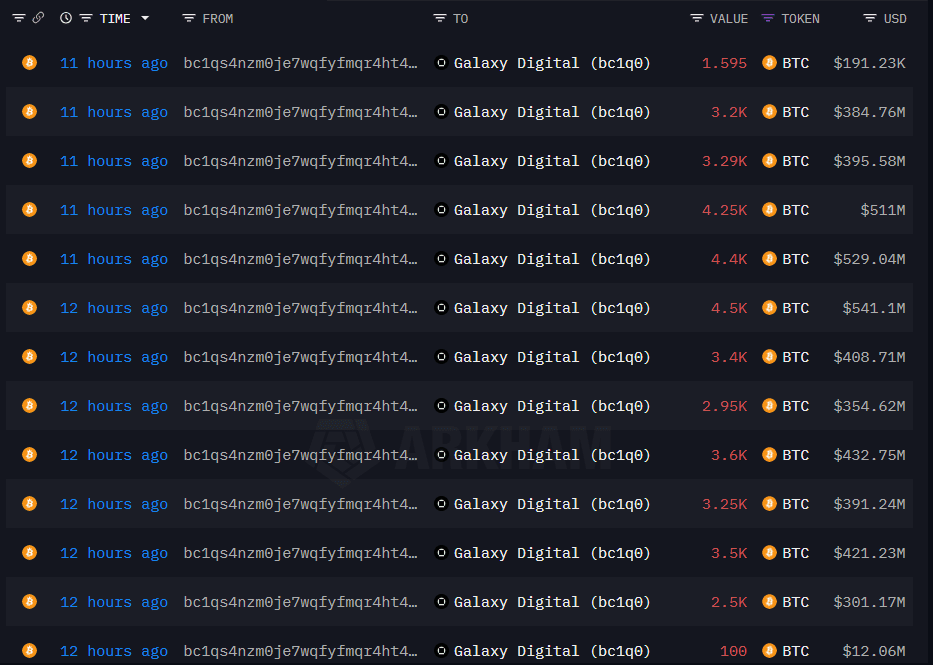

Whale Wallet Data (On-chain Data)

Shortly after, reports confirmed that 40,191 BTC had been transferred to Galaxy Digital, signaling a possible sale preparation.

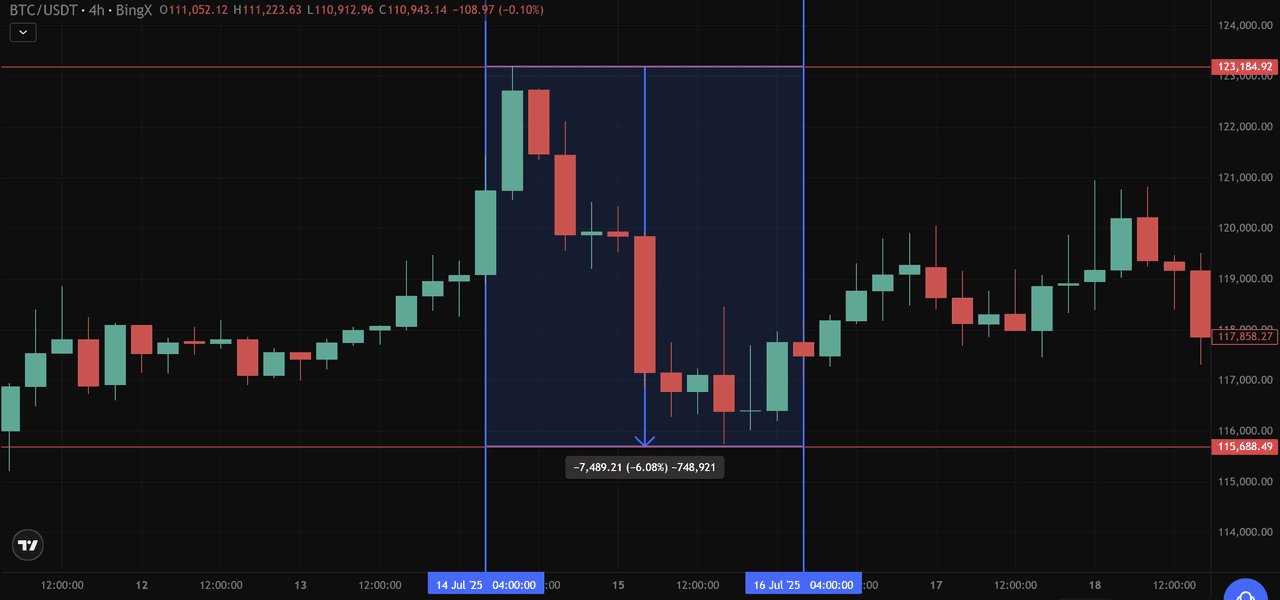

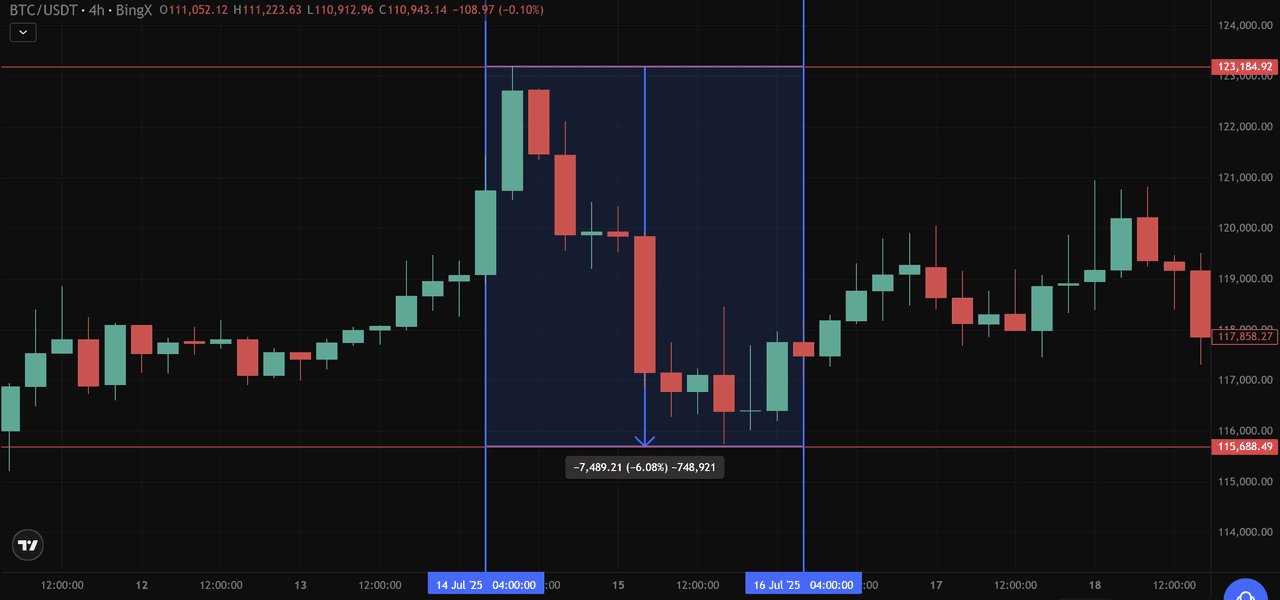

BTC/USDT, July 14–16, 2025: Whale-triggered sell-off caused a 6% drop - Source:

BingX

As shown on the chart,

BTC fell from around $123,000 to $115,500, a 6% drop within 48 hours. The move was triggered by speculation that a large portion of coins were being prepared for liquidation. Traders anticipating further selling added to the pressure, amplifying the correction.

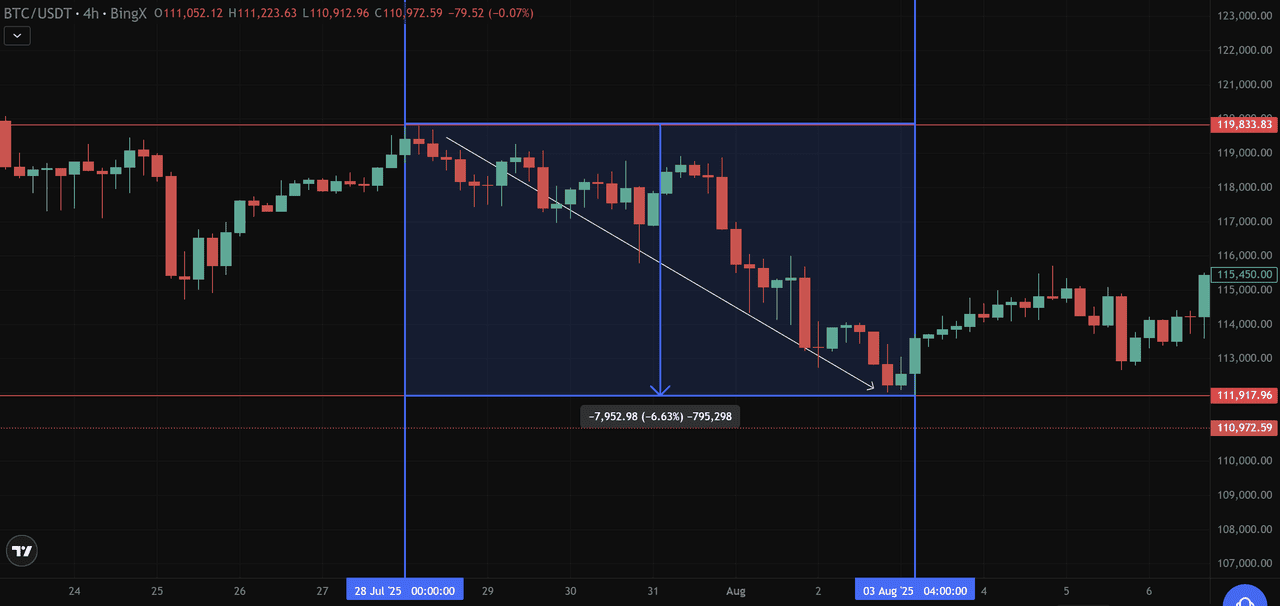

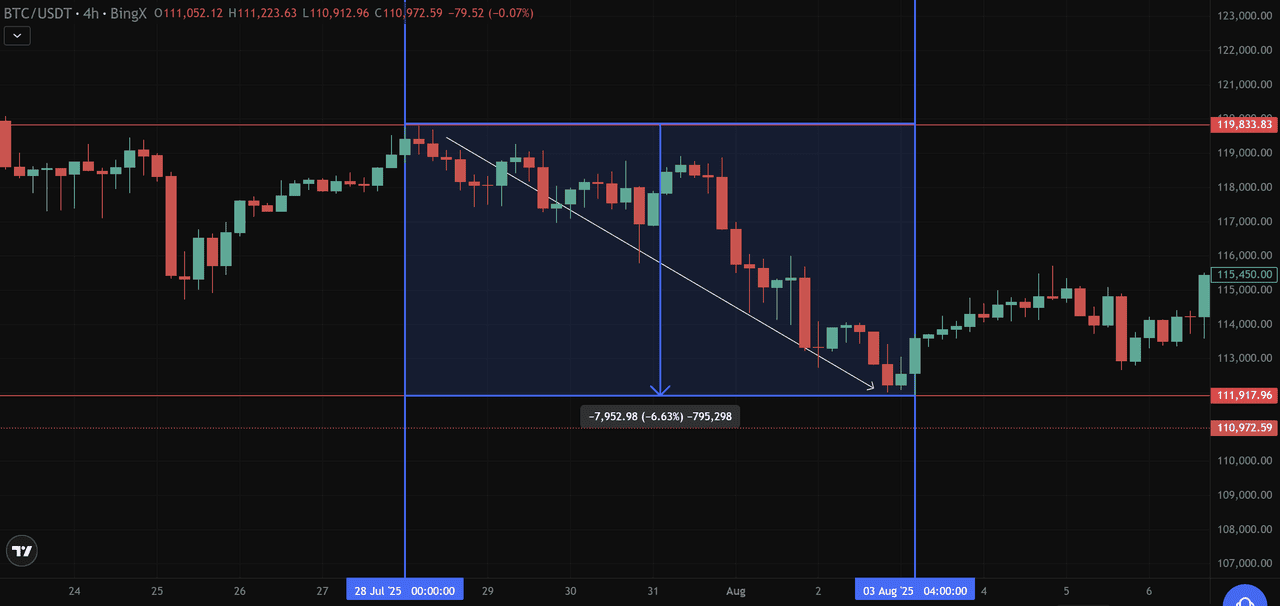

Later that month, the same whale reportedly sold the full 80,000 BTC, worth $9.6 billion. The sale triggered another sharp decline, with Bitcoin sliding about 6% and briefly breaking below the $112,000 level before stabilizing.

BTC/USDT, July 28–Aug 03, 2025: Whale-triggered sell-off caused a 6% drop - Source:

BingX

Earlier in the year, in Q1 2025, two long-dormant wallets holding a combined 20,000 BTC (~$2 billion) became active, creating volatility even without immediate selling.

These cases highlight why whale activity matters. Transfers to exchanges often signal potential selling pressure, while transfers to cold storage are usually read as long-term accumulation. Traders often react to these signals, amplifying the original move.

However, not all whale activity is meaningful. Some transfers are internal wallet reorganizations with no impact on supply. The challenge is separating genuine accumulation or distribution from routine movements.

For traders, whale alerts should be used as one input alongside technical analysis, liquidity, and sentiment data. When interpreted correctly, they provide early warnings of potential accumulation phases before rallies, or distribution phases ahead of corrections.

Top Tools to Track Crypto Whale Activity

Monitoring whale activity has become easier thanks to a range of free blockchain explorers, alert systems, and analytics platforms. Each offers a different level of detail and usability, making them valuable for both advanced users and retail traders.

1. Blockchain Explorers

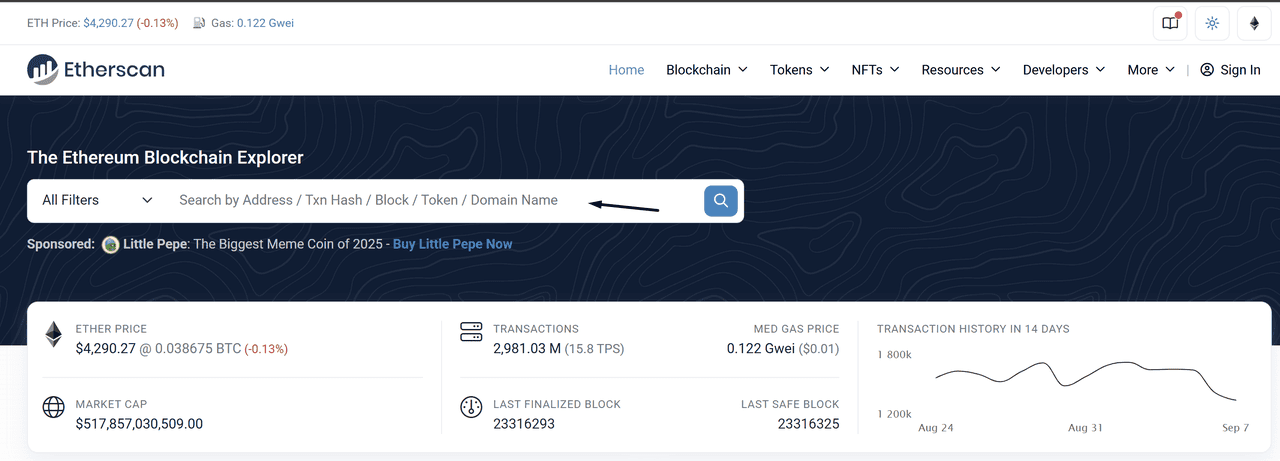

i. Pick the explorer: Blockchain explorers such as

Etherscan (Ethereum) and

Blockchain (Bitcoin) provide direct access to wallet addresses, transaction histories, and transfer volumes. They allow traders to see when a large sum of Bitcoin or Ethereum moves on-chain, but interpreting the context often requires additional tools.

ii, Grab the traceable item: Copy the transaction hash or wallet address from a whale alert.

Source: https://etherscan.io/

iii. Search and open: Paste into the explorer search bar. Open the Transaction (for a tx) or Address page.

iv. Verify basics: Check the asset, amount (BTC + USD), timestamp, and block status. This confirms you’re looking at the right data.

v. Identify counterparties: Look at From → To. If the destination is labeled Binance, Coinbase, Kraken, or BingX, it usually means funds are heading to an exchange.

vi. Assess the intent

• Cold → Exchange: potential selling pressure. Example: A wallet sends 2,500 BTC to Binance. Within hours, BTC drops and volume spikes, a likely distribution event.

• Exchange → Cold/new wallet: usually accumulation, as coins leave exchanges.

• Wallet → Wallet (unlabeled): neutral until the next hop is clear.

vii. Review history (address page): Check total received/sent, Final balance, and recent transactions to see behavior over time.

viii. Use analytics: Etherscan’s Analytics → Balance/Netflows or Blockchain.com’s Transactions help confirm whether balances are rising (accumulation) or falling (distribution).

ix. Follow one hop: Click the To address. If it aggregates deposits, it’s likely an exchange hot wallet, which increases sell risk.

x. Confirm with repetition: One transfer is noise. Repeated inflows to exchanges strengthen the bearish signal.

xi. Cross-check before acting: Always compare with price action, order book depth, funding, and news before trading on whale data.

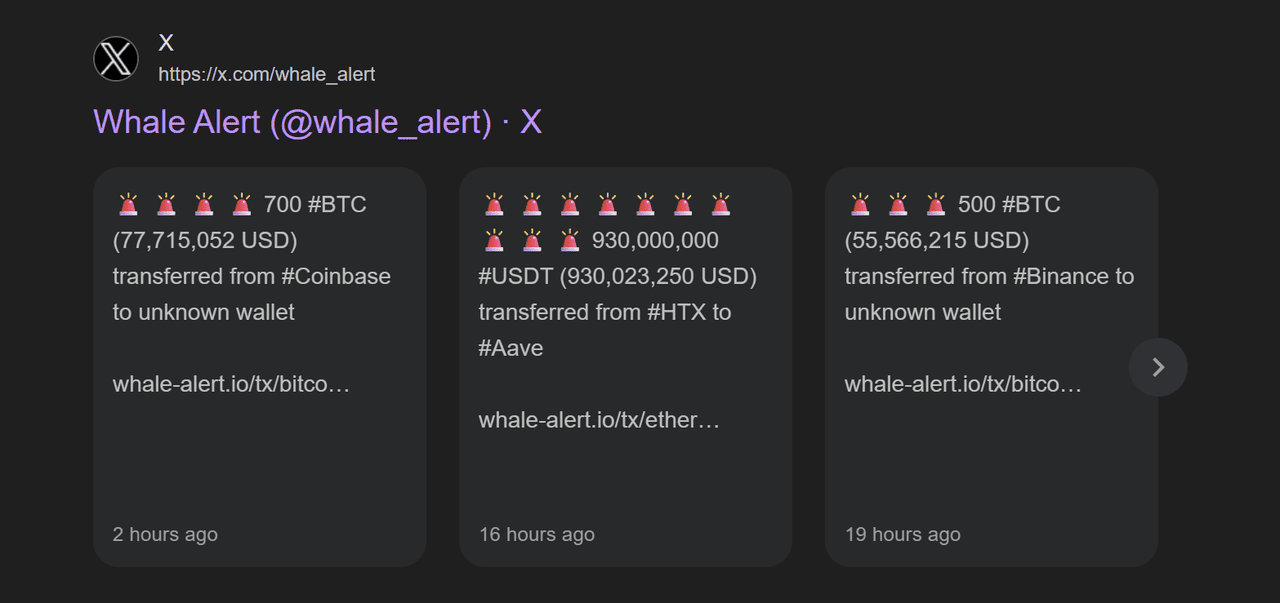

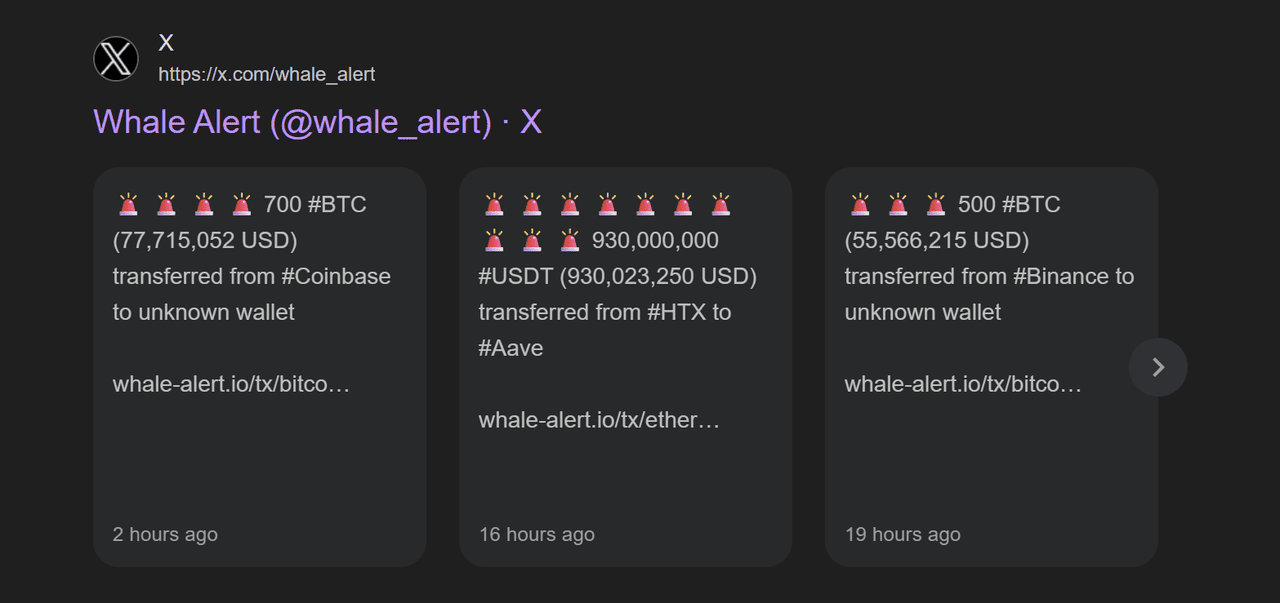

2. Whale Alert Systems

Whale alert systems track large on-chain transfers and present them in a simple, user-friendly way. Instead of manually digging through blockchain explorers, you get instant notifications when a whale moves funds.

Popular whale alert platforms

• Whale Alert (Twitter/X): posts real-time updates such as “2,500 BTC sent from unknown wallet to Binance.”

Source: x.com (whale_alert)

• WhaleMap: shows whale activity on charts, including price zones where whales accumulated coins.

• Santiment: adds context by combining whale transfers with sentiment and funding data.

3. Blockchain Analytics Tools

For deeper insights, platforms such as Glassnode, Nansen, and CryptoQuant analyze wallet clusters, exchange balances, and accumulation patterns. However, these platforms are not fully free and most advanced options require a subscription. They help determine whether a transfer is linked to long-term storage or potential liquidation. Key features to look for:

• Real-time monitoring of large transfers.

• Custom alerts for the coins you trade.

• Transparent wallet tracking with history.

Example: If a whale moves 5,000 BTC from cold storage into an exchange wallet, explorers confirm the transaction, whale alert systems flag it instantly, and analytics tools show whether this is part of a larger outflow trend. Together, these layers help traders judge whether selling pressure is likely and prepare for volatility.

How to Interpret Whale Transactions

Tracking whale transfers is useful only if you can interpret what they mean. Different types of movements have different implications.

1. Transfers to exchanges: When large amounts of Bitcoin or altcoins are sent to an exchange, it often indicates potential selling pressure. These coins become available for trading, which can increase supply and push prices lower. For example: in July 2025, a whale moved 40,000+ BTC to Galaxy Digital, triggering speculation of a major sale and a sharp drop in Bitcoin.

2. Transfers to cold storage: When funds leave exchanges for private wallets, it usually suggests accumulation or long-term holding. Supply on exchanges decreases, which can be supportive for prices. Analysts often treat this as a bullish sign.

3. Wallet-to-wallet transfers: Not every transaction signals intent to buy or sell. Whales often shuffle funds between related wallets or custodians for security. These moves are typically neutral until the next destination becomes clear.

4. Patterns vs. single moves: A single large transfer may cause short-lived volatility, but consistent inflows or outflows over several days are stronger signals of a whale’s strategy.

5. Always add context: Whale alerts should be checked against price action, liquidity, and sentiment. Accumulation during a market dip may mark the start of a bullish cycle. Continuous inflows after a strong rally may indicate a distribution phase ahead of a correction.

For traders, the goal is not to chase every alert but to use whale data as one input alongside technical and fundamental analysis. Done correctly, this helps identify accumulation phases before rallies and distribution phases before downturns.

How to Incorporate Whale Alerts Into Trading Strategies

Whale alerts are most effective when treated as one part of a wider analysis, not as standalone trading signals.

For retail traders, alerts should be combined with technical indicators and sentiment data. For example, if a large Bitcoin inflow is detected on Binance, traders should confirm the signal with price action, order book depth, and trading volume. This avoids reacting to false signals such as internal exchange transfers. The purpose is to add context, not to trade solely on the alert.

For advanced traders, whale activity can be integrated into algorithmic and quantitative strategies. Conditions can be set to trigger automatic responses to large inflows or outflows, such as adjusting position size or placing hedges during volatile periods. This allows for faster execution while keeping risk controls in place.

Practical ways to use whale alerts include:

• Monitoring only the cryptocurrencies you actively trade.

• Tracking the share of the Bitcoin supply held by whales to assess long-term concentration.

• Preparing for volatility when large transfers occur during periods of thin liquidity.

Whale alerts are best viewed as supporting information. Combined with trend analysis, liquidity metrics, and macro events, they help traders refine decisions and improve timing. The value lies in understanding how whale activity interacts with broader conditions, rather than following whales directly.

What Are the Limitations and Risks of Whale Tracking?

Whale tracking can highlight important on-chain movements, but it does not reliably predict market direction. A large transfer to an exchange might appear bearish, yet it could simply be an internal wallet shift with no link to selling. Without context, alerts like these can mislead traders.

Another challenge is the speed at which alerts spread across social media. Smaller traders often react quickly, entering or exiting positions before verifying the data. This leads to poorly timed trades and unnecessary exposure.

There is also the risk of relying too heavily on whale activity. Market trends are shaped by many factors, including fundamentals, liquidity, technical signals, and macro events. Focusing only on whale data leaves gaps and can cause traders to miss the bigger picture.

Whale tracking works best when used as a supporting tool within a broader strategy.

Best practice checklist:

• Verify the transfer source and destination.

• Compare with price action and trading volume.

• Check exchange inflows/outflows against broader trends.

• Confirm with news or sentiment before acting.

Conclusion

Whale alerts give traders a clearer view of how the largest holders influence cryptocurrency markets. By tracking significant transfers and wallet activity, traders can better understand shifts in liquidity, sentiment, and potential price pressure.

On their own, however, whale alerts do not determine market direction. A large transfer may signal selling, accumulation, or simply internal wallet management. To avoid misinterpretation, alerts should always be checked against technical indicators, exchange balances, trading volume, and broader market news.

For retail traders, whale alerts provide context that supports better entry and exit decisions. For advanced traders, they can be integrated into systematic models and used to automate responses during volatile conditions. In both cases, the value lies in treating whale data as one layer of analysis rather than a complete strategy.

By combining whale tracking with real-time monitoring, blockchain analytics, and market analysis, traders can anticipate potential volatility, manage risk more effectively, and make more informed decisions.

Related Reading

FAQs on Tracking Crypto Whale Moves

1. What is a crypto whale?

A crypto whale is an individual, institution, or exchange that holds a large amount of cryptocurrency, often 1,000+ BTC or millions in altcoins.

2. Why do whale movements matter in the crypto market?

Whales can influence market sentiment, liquidity, and volatility. Exchange inflows often signal selling pressure, while cold storage transfers suggest accumulation.

3. How do crypto traders track whales?

Traders use blockchain explorers, whale alert systems, and analytics tools to monitor wallet activity, large transfers, and exchange inflows or outflows.

4. What are the top free crypto whale alerts?

Popular free tools include Whale Alert (Twitter/X + API), WhaleMap, Etherscan trackers, and Glassnode’s free dashboards. Many exchanges and platforms like BingX also highlight large trades and on-chain flows.

5. Are whale alerts always accurate?

No. Some transfers are internal wallet movements and do not affect supply. Traders should confirm alerts with price data, volume, and news.

6. Can whale tracking improve crypto trading strategies?

Yes. When combined with technical analysis and sentiment indicators, whale tracking helps traders anticipate potential volatility and adjust risk.

7. What are the risks of relying only on whale data?

Over-reliance can lead to false signals and mistimed trades. Whale tracking should complement, not replace, other forms of market analysis.