Tranzacționarea criptomonedelor poate fi complexă și consumatoare de timp, mai ales dacă sunteți începător.

Copy Trading-ul (Copierea Tranzacțiilor) BingX vă permite să urmăriți și să replicați automat tranzacțiile traderilor experți, astfel încât să puteți participa pe piețe fără o gestionare activă și manuală.

În acest ghid, comparăm Copy Trading-ul Spot cu Copy Trading-ul de Futures, ajutându-vă să determinați care cale se aliniază cel mai bine cu toleranța dvs. la risc, nivelul de experiență și obiectivele financiare.

Ce tipuri de Copy Trading oferă BingX?

BingX oferă multiple moduri de Copy Trading adaptate la diferite profiluri de traderi, niveluri de risc și clase de active, facilitând participarea la piața cripto atât pentru începători, cât și pentru utilizatorii experimentați.

1. Copy Trading Spot: În acest mod, copiați tranzacțiile de pe

piața Spot în timp real (de exemplu,

BTC/USDT) direct de la traderi experți fără a utiliza efectul de levier. Dețineți activele cripto subiacente și sunt copiate doar ordinele de piață complet executate. Este o opțiune prietenoasă pentru începători, cu risc scăzut, cu o cotă fixă de profit de 10% din câștigurile nete și o dimensiune maximă a tranzacției de 10.000 USDT.

2. Copy Trading de Futures Standard: Acest tip utilizează metoda „Copiere prin Marjă Fixă” în contul de Futures Standard. Alegeți o sumă fixă de USDT pentru fiecare tranzacție, oferind o expunere și un control previzibile. Este potrivit pentru utilizatorii care doresc să echilibreze riscul cu randamente constante, cu rate de participare la profit variind între 8% și 12%, în funcție de nivelul traderului.

Aflați mai multe: Cum să Începeți Copy Trading de Futures pe BingX

3. Copy Trading de Futures Perpetue – Mod Marjă Fixă: Bazată și pe marjă fixă per ordin, această versiune se aplică Futures-urilor Perpetue USDT-M. Vă permite să mențineți controlul total asupra dimensiunii tranzacției, indiferent de strategia traderului. Profitul este partajat doar după ce pozițiile sunt închise complet, iar limitele de marjă (de exemplu, până la 10.000 USDT) ajută la gestionarea riscului.

4. Copy Trading de Futures Perpetue – Mod Raport Poziție: Acest mod reflectă dimensiunea poziției unui trader pe baza raportului său de utilizare a contului, aliniind automat efectul dvs. de levier și expunerea la risc cu cele ale sale. Este ideal pentru utilizatorii care doresc să replice fidel performanța și profilul de risc al unui trader de top. Cota de profit variază în funcție de nivel, de la 10% pentru nivelul Bronz la 32% pentru traderii de nivel Diamant.

La mijlocul anului 2025, BingX a facilitat peste 11 milioane de relații de Copy Trading, reflectând o adoptare puternică. Cu metrici de performanță transparente, cum ar fi ROI, rata de câștig, drawdown-ul maxim și PnL-ul cumulat, puteți compara mii de traderi și îl puteți alege pe cel care se potrivește cel mai bine profilului dvs. de risc și obiectivelor.

Ce este Copy Trading Spot pe BingX?

Copy Trading Spot pe BingX vă permite să replicați automat tranzacțiile de pe piața Spot ale traderilor experți, folosind propriul dvs. USDT. Spre deosebire de Futures, nu există riscul de levier sau de lichidare, ci doar cumpărarea și vânzarea efectivă de criptomonede precum

BTC,

ETH sau

SOL direct în portofelul dumneavoastră. Acest lucru vă oferă proprietatea deplină asupra tokenurilor, oferind în același timp o modalitate prietenoasă pentru începători de a participa pe piață fără monitorizare constantă.

Puteți răsfoi traderii cu filtrele bazate pe IA de la BingX, puteți seta dimensiuni de tranzacționare începând de la doar 5 USDT și vă puteți urmări rezultatele în timp real. O taxă transparentă de 10% din cota de profit se aplică doar câștigurilor nete și puteți opri sau ajusta în orice moment. Deși randamentele sunt legate de mișcările naturale ale pieței și depind de traderul pe care îl urmăriți, Copy Trading Spot oferă un punct de intrare simplu și cu risc scăzut pentru a vă dezvolta portofoliul, învățând de la profesioniști cu experiență.

Ce este Copy Trading de Futures?

Copy Trading de Futures pe BingX vă permite să replicați automat tranzacțiile cu efect de levier ale

traderilor de Futures profesioniști. Spre deosebire de Copy Trading Spot, vă permite să profitați atât de piețele în creștere, cât și de cele în scădere, prin strategii long și short. Puteți alege între două moduri de copiere: Raport Poziție (Position Ratio), care reflectă proporțional alocarea marjei unui trader pentru rezultate aproape identice, sau Marjă Fixă (Per Ordin), care vă permite să setați o sumă fixă per tranzacție pentru un control previzibil. Acest lucru îl face potrivit atât pentru utilizatorii pasivi, cât și pentru cei care caută o gestionare mai strictă a riscului.

Cu BingX, puteți răsfoi traderii utilizând filtre bazate pe IA, personaliza setările de copiere (TP/SL, limite zilnice, poziții maxime) și monitoriza performanța în timp real printr-un tablou de bord dedicat. Taxele de partajare a profitului (10-32%) se aplică numai câștigurilor nete și sunt decontate săptămânal. Deși efectul de levier crește potențialul de randament, acesta amplifică și riscurile, făcând esențiale setările de protecție și selectarea traderului. În general, Copy Trading de Futures oferă o modalitate simplă de a accesa strategii de tranzacționare avansate și un potențial de creștere mai mare fără a necesita cunoștințe tehnice aprofundate.

Copy Trading Spot vs. Futures: O Comparație

Atunci când decideți între Copy Trading Spot și Futures pe BingX, este important să înțelegeți cum funcționează, nivelul de risc implicat și care se aliniază cel mai bine cu obiectivele dvs. financiare. Ambele vă permit să urmăriți automat traderi experți, dar rezultatele și strategiile sunt foarte diferite.

| Caracteristică |

Copy Trading Spot |

Copy Trading de Futures |

| Tip de Activ |

Active cripto fizice (ex: BTC, ETH) |

Instrumente derivate – Contracte pentru poziții Long/Short cu levier |

| Proprietate |

Da, dețineți direct criptomoneda |

Nu, speculați pe mișcările de preț |

| Efect de Levier |

Niciunul |

Da (până la 125x, în funcție de pereche și trader) |

| Nivel de Risc |

Scăzut, fără risc de lichidare |

Ridicat, potențial de lichidare dacă marja este insuficientă |

| Potențial de Profit |

Moderat, limitat la creșterea prețului activului |

Ridicat, câștiguri (sau pierderi) amplificate prin levier |

| Cel Mai Potrivit Pentru |

Începători, deținători pe termen lung, investitori cu risc scăzut |

Cei care învață activ, persoane cu risc ridicat, traderi pe termen scurt |

| Partajarea Profitului |

Fix 10% în săptămânile profitabile |

10%–32%, în funcție de nivelul și performanța traderului |

| Controale de Tranzacționare |

Dimensiune fixă a ordinului (5–10.000 USDT), fără levier |

TP/SL, limite de marjă, mod 0 slippage, moduri multiple de copiere |

| Mod de Copiere |

Per Ordin (doar sumă fixă) |

Per Ordin (marjă fixă) sau Raport Poziție (reflectă utilizarea riscului de către trader) |

| Flexibilitatea Capitalului Utilizatorului |

Poate începe cu doar 5 USDT |

Majoritatea traderilor necesită 10–100 USDT per tranzacție, în funcție de strategie |

1. Proprietatea Asigurată a Activelor

Cu Copy Trading Spot (la vedere), cumpărați active cripto reale precum BTC, ETH sau SOL. Aceste tokenuri ajung direct în Portofelul dumneavoastră Spot, ceea ce înseamnă că le dețineți și le puteți păstra, transfera sau retrage oricând. Chiar dacă încetați să mai copiați un trader, activele dumneavoastră rămân în siguranță și vă aparțin.

În Copy Trading Futures, nu dețineți monedele subiacente. În schimb, tranzacționați contracte care reflectă mișcările de preț. Profiturile sau pierderile dumneavoastră depind în întregime de aceste poziții deschise, și nu de deținerea tokenurilor.

2. Utilizarea Efectului de Levier

Copy Trading Spot nu implică efect de levier. Câștigurile sau pierderile dumneavoastră provin doar din cât se schimbă prețul de piață al tokenurilor, făcându-l mai simplu și mai sigur pentru începători.

Copy Trading Futures utilizează efectul de levier, ceea ce înseamnă că vă puteți multiplica expunerea. De exemplu, cu un efect de levier de $10\times$, o tranzacție de $100$ $ acționează ca o tranzacție de $1.000$ $$. Acest lucru poate spori semnificativ profiturile, dar amplifică și pierderile și poate duce la lichidare dacă piața se întoarce împotriva dumneavoastră.

3. Profilul de Risc

Tranzacțiile Spot prezintă un risc mai scăzut, deoarece dețineți direct tokenurile și nu există riscul de lichidare. Chiar dacă prețurile scad, puteți alege să vă păstrați activele pentru o recuperare pe termen lung.

Tranzacționarea Futures vine cu un risc mult mai mare. Din cauza efectului de levier, chiar și mișcările mici de preț vă pot șterge marja pe această piață volatilă. De aceea, instrumentele de protecție precum setările

stop-loss (SL) și take-profit (TP) sunt cruciale atunci când copiați traderi de Futures.

4. Potențialul de Profit

În Copy Trading Spot, profitul dumneavoastră depinde de creșterea naturală a prețurilor criptomonedelor în timp. Este o abordare mai lentă și mai constantă, perfectă pentru acumularea pe termen lung și construirea treptată a unui portofoliu.

Cu Copy Trading Futures, puteți profita atât pe piețele în creștere, cât și pe cele în scădere. Luând poziții long (de cumpărare) sau short (de vânzare în lipsă) și utilizând efectul de levier, deschideți ușa către câștiguri mult mai mari. Totuși, acest lucru vine cu riscul de pierderi amplificate dacă tranzacțiile merg prost.

5. Instrumente și Setări de Tranzacționare

Copy Trading Spot este simplu. Setați o dimensiune de tranzacție, plătiți o taxă forfetară de partajare a profitului, iar platforma reflectă automat acțiunile traderului. Necesită foarte puțin management, fiind ușor pentru nou-veniți.

Copy Trading Futures oferă opțiuni avansate. Puteți alege Modul Raport de Poziție (reflectând expunerea unui trader) sau Modul Marjă Fixă (o sumă prestabilită pe tranzacție). De asemenea, aveți instrumente precum TP/SL, limite zilnice și chiar „

Copiere fără Slippage (0 Slippage)” pentru o execuție mai precisă.

6. Partajarea Profitului

În Copy Trading Spot, structura taxelor este simplă. Plătiți o taxă fixă de partajare a profitului de $10\%$, care este percepută doar pe câștigurile nete și decontată săptămânal.

Copy Trading Futures are un model flexibil. Taxele de partajare a profitului variază între $10\%$ și $32\%$, în funcție de nivelul traderului (de la Bronz la Diamant). Taxele sunt percepute săptămânal și numai dacă tranzacțiile copiate sunt profitabile.

7. Adecvare și Obiective

Copy Trading Spot este cel mai potrivit pentru începători și investitorii conservatori care doresc să își construiască un portofoliu de criptomonede în siguranță. Este, de asemenea, o alegere bună pentru cei care caută creștere pe termen lung fără a fi nevoie să monitorizeze tranzacțiile în mod constant.

Copy Trading Futures este potrivit pentru utilizatorii care doresc randamente mai mari și se simt confortabil cu un risc sporit. Este conceput pentru strategii pe termen scurt, tranzacționarea volatilității și pentru cei care doresc să utilizeze efectul de levier pentru a spori profiturile, cu condiția să gestioneze riscurile cu atenție.

8. Investiția Minimă

Copy Trading Spot are o barieră de intrare scăzută. Puteți începe cu doar $5$ USDT pe tranzacție, ceea ce îl face prietenos cu începătorii și accesibil investitorilor mici.

Copy Trading Futures poate fi, de asemenea, început cu sume mici, uneori chiar de la $10$ USDT. Cu toate acestea, a avea mai mult capital vă oferă o flexibilitate mai mare în gestionarea marjei și a riscului, ceea ce este deosebit de important atunci când utilizați efectul de levier.

Copy Trading Spot oferă o cale mai sigură și mai lentă către creșterea pe termen lung, oferindu-vă proprietatea directă asupra activelor, în timp ce Copy Trading Futures oferă oportunități cu risc mai mare și recompense mai mari prin efectul de levier și strategiile pe termen scurt. Mulți utilizatori BingX încep cu Spot pentru a câștiga încredere și stabilitate, apoi trec treptat la Futures odată ce dobândesc experiență în gestionarea riscurilor.

Copy Trading Spot vs. Copy Trading Futures: Pe care să-l alegeți?

Alegeți Copy Trading Spot dacă:

• Sunteți la început în lumea cripto și doriți un punct de intrare simplu și cu risc scăzut.

• Prețuiți proprietatea directă asupra activelor; ideal pentru investitorii pe termen lung care își construiesc un portofoliu de criptomonede.

• Preferăți o creștere stabilă în timp, fără presiunea de a cronometra piața sau riscul de lichidare.

• Doriți să setați și să uitați; tranzacțiile Spot sunt, în general, mai puțin frecvente, necesitând intervenție minimă.

Alegeți Copy Trading Futures dacă:

• Aveți un apetit pentru risc mai mare și vă simțiți confortabil cu efectul de levier și fluctuațiile pieței.

• Căutați randamente mai mari într-un interval de timp mai scurt, inclusiv pe piețele în scădere.

• Doriți să copiați traderi care utilizează instrumente avansate precum take-profit/stop-loss, ajustarea marjei și $0$ slippage.

• Sunteți interesat să învățați cum folosesc profesioniștii gestionarea riscurilor și dimensionarea pozițiilor în timp real.

Începeți cu Copy Trading pe BingX

Ești gata să începi Copy Trading pe BingX? Urmează acești pași simpli și prietenoși pentru începători pentru a-ți configura contul și a începe să copiezi traderi experți:

1. Creează și verifică-ți contul BingX: Accesează

bingx.com, înregistrează-te și finalizează

verificarea identității (KYC). Apoi, depune USDT în contul tău folosind metoda preferată (de exemplu, transfer cripto, card bancar sau

P2P).

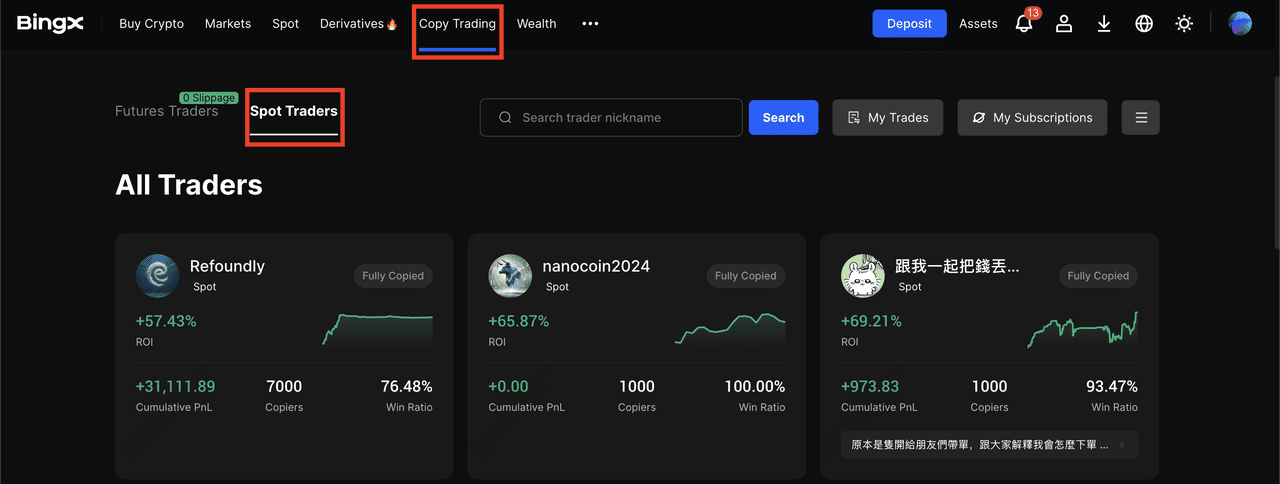

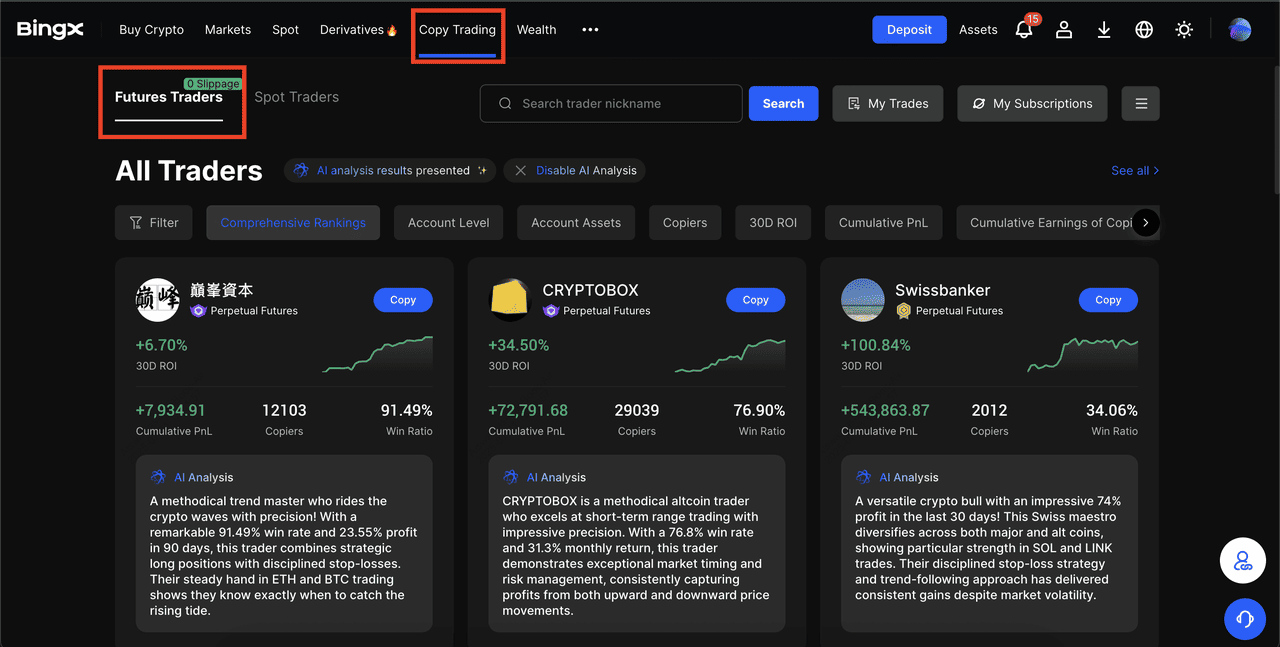

2. Mergi la secțiunea Copy Trading: Din meniul de sus, selectează „Copy Trading” și alege dacă vrei să copiezi Traderi Spot sau Traderi Futures.

3. Revendică-ți voucherul gratuit: Utilizatorii noi pot obține un voucher gratuit pentru a încerca copy trading cu o acoperire de asigurare de 20 USDT, reducând riscul în timp ce testezi funcția.

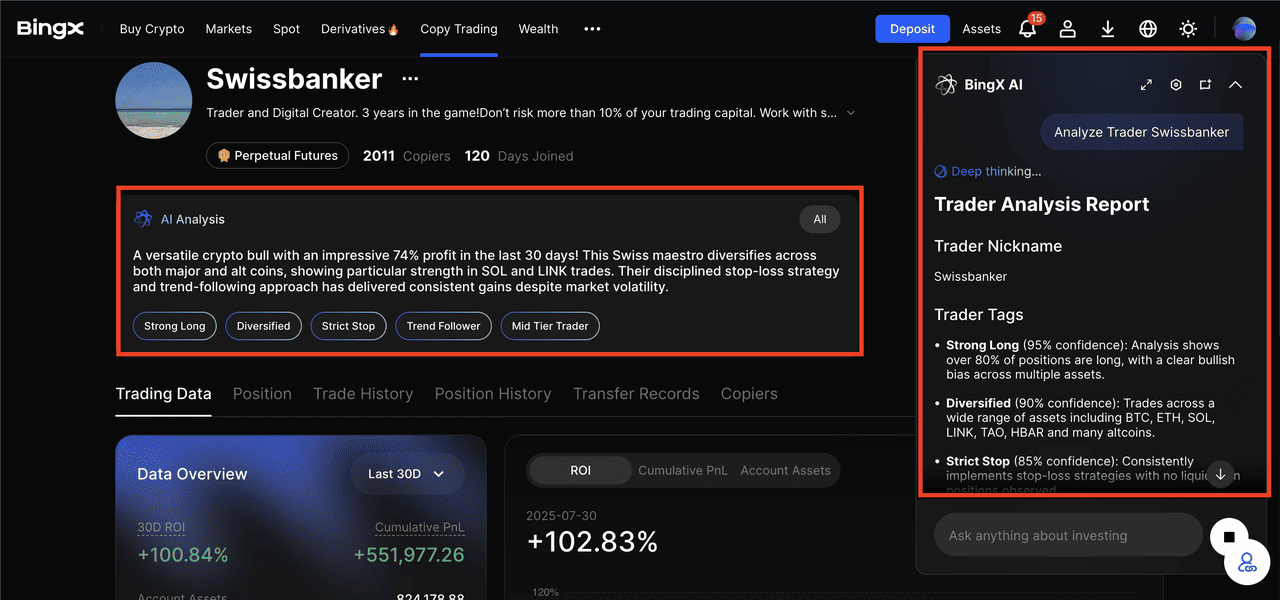

4. Găsește un trader de copiat: Poți aplica filtre precum ROI pe 30 de zile, rata de câștig, numărul de urmăritori sau drawdown-ul maxim pentru a compara performanța. Sau lasă BingX AI să-ți recomande traderi care se potrivesc profilului tău.

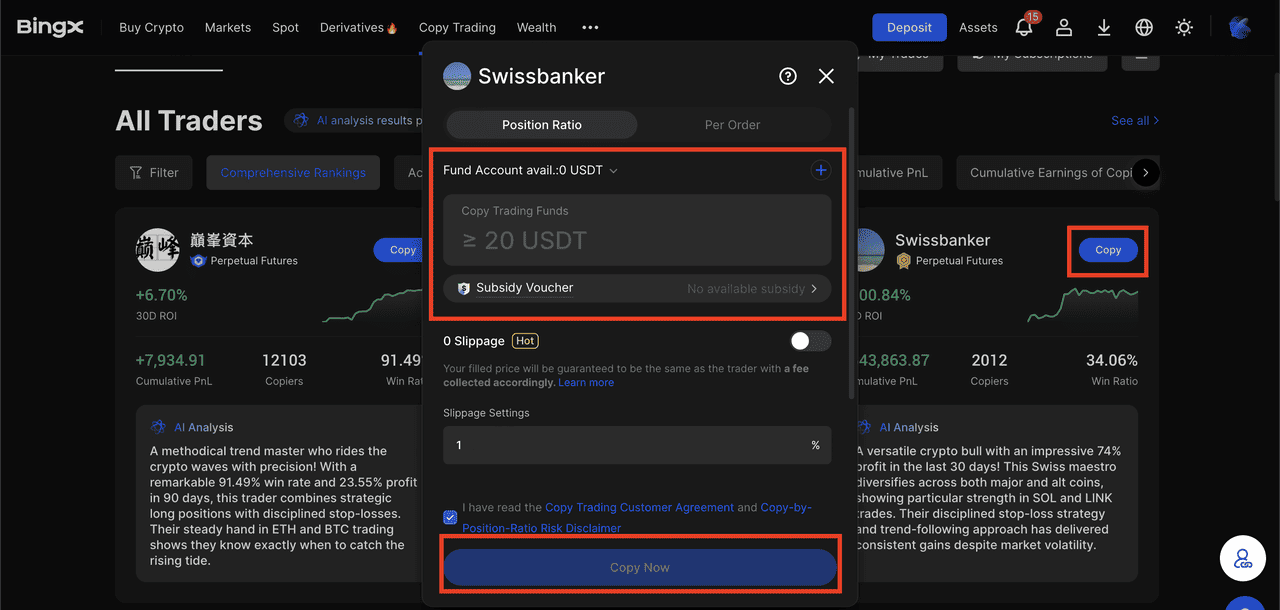

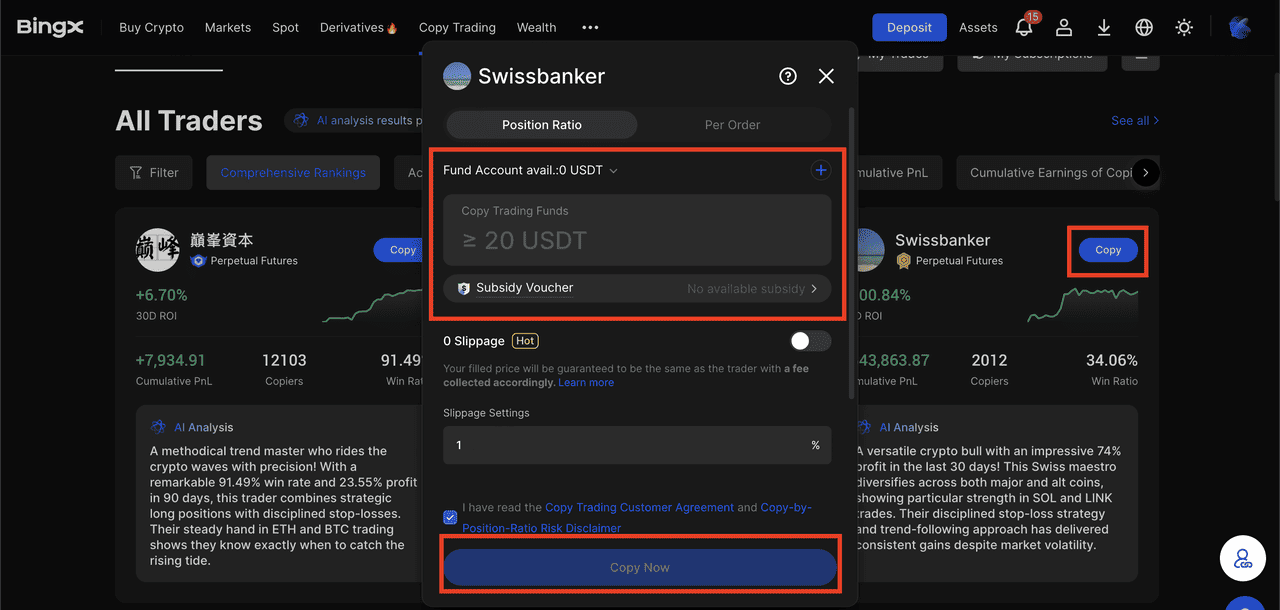

5. Setează-ți metoda de copy trading și alocarea fondurilor.

• Pentru Copy Trading Spot, alege o sumă fixă pe ordin (de exemplu, 5–10.000 USDT).

• Pentru Copy Trading Futures, selectează Marjă Fixă (sumă stabilită pe tranzacție) sau Raport de Poziție (reflectă utilizarea capitalului de către trader). Poți, de asemenea, să configurezi TP/SL (take-profit/stop-loss), să activezi modul 0 slippage și să definești limite de risc.

6. Activează Copierea și monitorizează performanța: Apasă „Copiază” pentru a începe. Urmărește-ți tranzacțiile în „Tranzacțiile Mele $\rightarrow$ Copy Trading”, unde poți vizualiza PnL-ul live, ajusta alocarea sau opri copierea în orice moment pe baza rezultatelor.

Acest proces simplificat face ușor atât pentru începători, cât și pentru utilizatorii avansați să urmeze traderi experți și să gestioneze tranzacțiile cripto cu un efort minim.

Cum să folosești BingX AI pentru a te îmbunătăți în Copy Trading

BingX integrează instrumente puternice bazate pe AI pentru a te ajuta să iei decizii mai inteligente și bazate pe date atunci când faci copy trading. Iată cum să folosești

BingX AI pentru a-ți spori rezultatele:

1. Găsește cei mai buni copy traderi cu AI: Analiza Traderilor Experți BingX AI recomandă traderi care se potrivesc nivelului tău de risc, preferințelor de perechi de tranzacționare și obiectivelor de profit, astfel încât să nu trebuiască să ghicești pe cine să urmărești.

2. Explorează mai mulți copy traderi pentru a-ți diversifica strategia. În loc să te bazezi pe un singur trader, urmărește mai mulți traderi cu stiluri diferite, cum ar fi scalping-ul pentru mișcări pe termen scurt, swing trading-ul pentru tendințe pe termen mediu și jocurile de poziție pe termen lung, pentru a-ți echilibra riscul și randamentele.

3. Folosește AI pentru a-ți dimensiona pozițiile mai inteligent. În loc să setezi doar limite manuale, BingX AI poate analiza strategia de tranzacționare a fiecărui copy trader, împreună cu condițiile pieței, pentru a sugera dimensiuni de poziție mai adecvate pentru tranzacțiile tale copiate.

4. Analizează-ți pozițiile de copy trading cu AI. Folosește tablourile de bord și fișele de scor BingX AI pentru a revizui ROI-ul, rata de câștig și drawdown-ul. Acest lucru te ajută să decizi când să adaugi mai mult capital sau să-ți ajustezi strategia.

Combinând BingX AI cu instrumente de risc încorporate, poți face copy trading cu mai multă încredere, îmbunătăți eficiența capitalului și gestiona volatilitatea ca un profesionist.

Gânduri Finale

Copy Trading Spot și Futures pe BingX oferă fiecare beneficii unice, în funcție de obiectivele și toleranța ta la risc. Copy Trading Spot este simplu și prietenos pentru începători, făcându-l un bun punct de plecare pentru traderii noi. Copy Trading Futures, pe de altă parte, poate oferi randamente potențiale mai mari prin efectul de levier, dar necesită, de asemenea, o gestionare atentă a riscurilor și o înțelegere mai solidă a dinamicii pieței.

Copy Trading 2.0 de la BingX oferă instrumente îmbunătățite, analize detaliate și suport AI pentru a te ajuta să iei decizii mai informate.

Indiferent de strategia pe care o alegi, este esențial să începi cu puțin, să diversifici printre mai mulți traderi și să-ți monitorizezi performanța în mod regulat. Aminteste-ți întotdeauna că copy trading implică riscuri reale de piață; nu există randamente garantate și pot apărea pierderi. Folosește instrumentele disponibile cu înțelepciune și rămâi informat pentru a naviga responsabil pe piață.

Lecturi Conexe