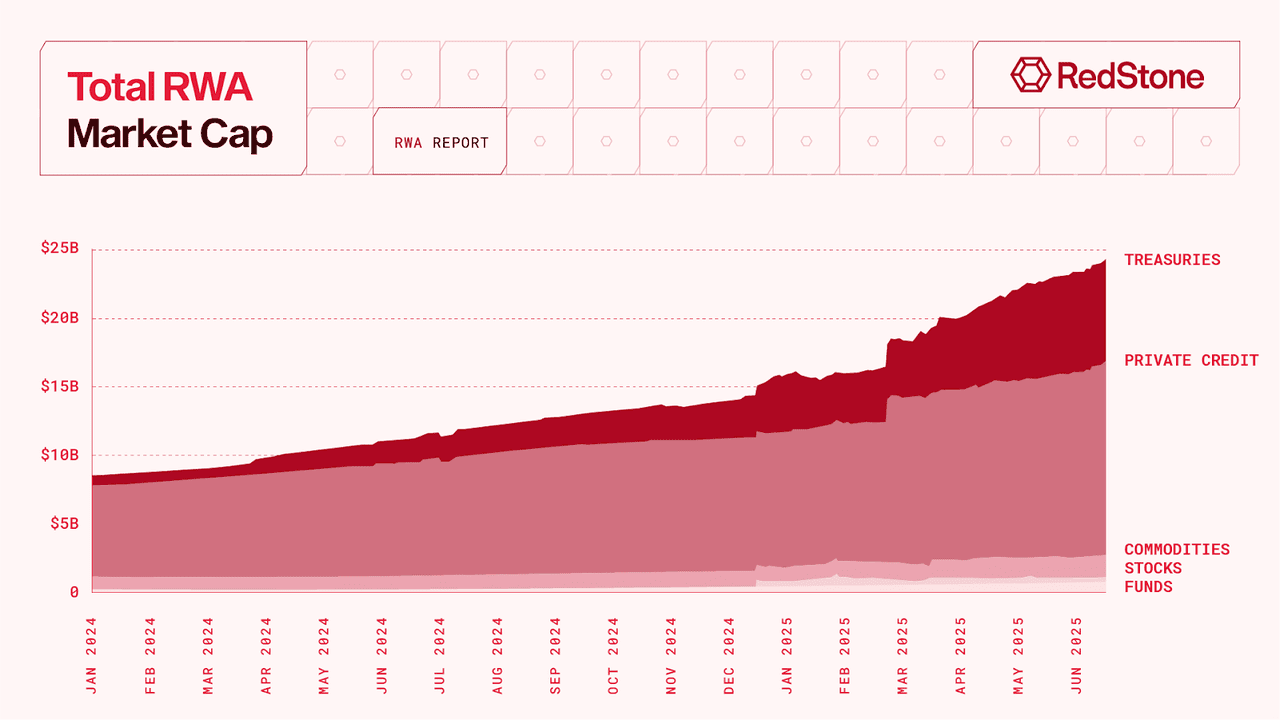

Total RWA market cap | Source: Redstone

Analysts from Boston Consulting Group project the tokenized RWA sector could reach $16 trillion by 2030, while Citi’s “Money, Tokens and Games” report estimates it could surge to $4 trillion to $5 trillion in tokenized securities alone by 2030. With blockchain networks now enabling the representation of physical assets. like real estate, art, bonds, or commodities, onchain, RWAs unlock

liquidity, transparency, and global accessibility for traditionally illiquid markets. This shift is positioning tokenization as a critical pillar of the future financial system.

If you’re investing in an RWA project, choosing the right blockchain is crucial. This guide provides practical insights into the ten best blockchains for RWA projects in 2025. Each has unique strengths. Understanding them will help you make informed decisions.

What Is Real-World Asset (RWA) Tokenization and How Does It Work?

RWA tokenization is the process of creating digital representations of physical or financial assets on a blockchain. These digital tokens represent ownership or rights to assets such as real estate, commodities, bonds, or artwork. Once tokenized, these assets can be traded, divided into smaller units for fractional ownership, and transferred easily across borders.

Here’s how it works:

1. First, the asset is identified and legally prepared for tokenization, ensuring it meets regulatory requirements.

2. Next, a

smart contract is deployed on a blockchain to issue tokens that reflect the asset’s value and ownership rights.

3. These tokens can then be listed on blockchain-based platforms, enabling investors to buy, sell, or trade them. A tokenized property, for example, might allow hundreds of people to own a share and receive proportional rental income directly to their digital

wallets.

This process bridges the gap between traditional finance and blockchain technology. It gives both institutional and retail investors access to high-value markets that were previously limited by geography, capital requirements, or intermediaries.

Why Is RWA Tokenization Gaining Attention in 2025?

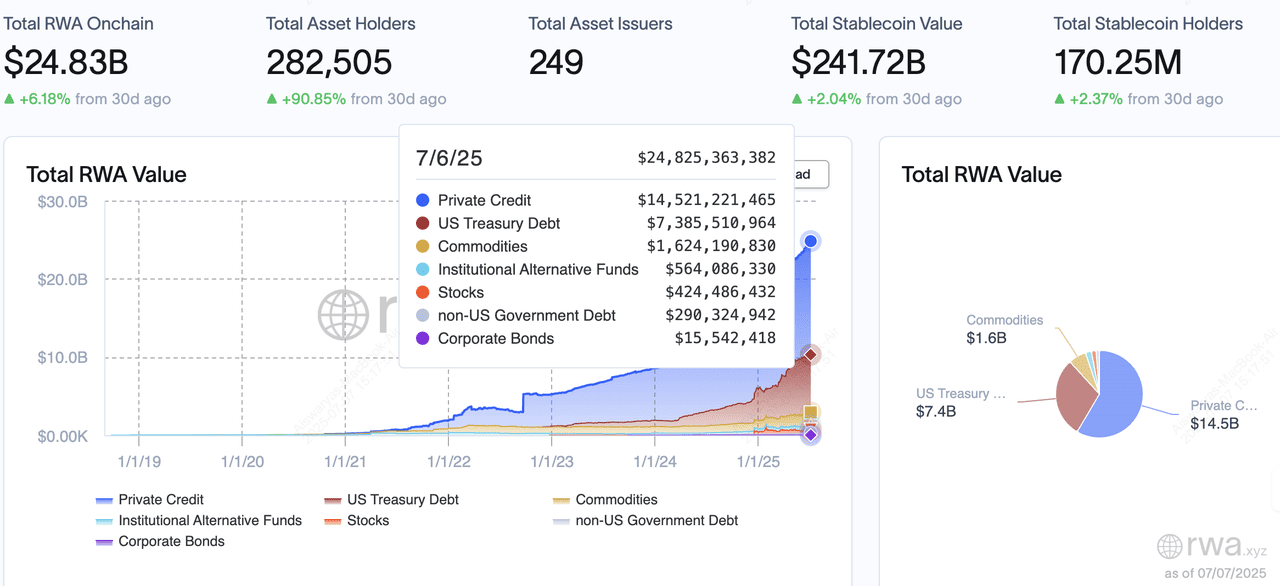

RWA market in July 2025 | Source: RWA.xyz

RWA tokenization is emerging as one of the fastest-growing sectors in blockchain, with the market value surpassing $23 billion by mid‑2025. Several factors are driving this surge in attention.

First, institutional adoption is accelerating. Global asset managers like BlackRock and Franklin Templeton are launching tokenized money market funds and treasuries, showcasing blockchain’s ability to modernize traditional financial products. Second, RWA tokens offer fractional ownership, allowing everyday investors to participate in high-value asset classes like real estate and private credit. This makes investing more accessible and inclusive.

Third, improved blockchain infrastructure supports faster, cheaper, and more secure tokenization processes. High-performance networks like

Solana and purpose-built platforms like

Plume enable RWA projects to scale efficiently. Finally, evolving regulatory frameworks in regions like the U.S., Singapore, and Europe are creating clearer paths for compliant tokenization, which is critical for mainstream adoption.

Together, these trends make 2025 a pivotal year for RWA projects, positioning them at the center of blockchain innovation and financial inclusion.

What Makes a Blockchain Ideal for Tokenizing RWAs?

Tokenizing real-world assets (RWAs) is not as simple as minting a token. It requires a blockchain that can handle complex financial and legal requirements while ensuring security, speed, and user accessibility. Here are six key factors to evaluate when choosing the right blockchain for your RWA project:

1. Regulatory Support and Identity Tools: RWA platforms often deal with highly regulated assets like real estate, bonds, or commodities. Blockchains that support built-in compliance tools such as

KYC (Know Your Customer), AML (Anti-Money Laundering), and permissioned tokens help projects stay aligned with legal requirements. For example,

Ethereum supports ERC‑3643 security token standards, while

Algorand’s ASA framework includes features for enforcing jurisdictional rules.

2. Scalability and Low Transaction Fees: RWA systems may process thousands of small transactions daily, such as rental income distributions or interest payments. Blockchains must handle high volumes quickly and affordably to avoid delays and excessive fees for users. Solana processes over 50,000 transactions per second (TPS) with near-zero fees, while XRPL (

XRP Ledger) and

Stellar also offer fast and cost-effective settlements.

3. Smart Contract Flexibility: Tokenizing real-world assets requires programmable contracts to manage revenue sharing, voting rights, and transfer restrictions. Blockchains like Ethereum and

Tezos support highly customizable smart contracts, allowing developers to embed complex financial logic securely. This flexibility ensures RWA tokens behave like their real-world counterparts and meet investor expectations.

4. Security and Decentralization: RWAs often represent high-value assets with long lifespans, making security a top priority. A secure and decentralized blockchain minimizes risks of hacks, downtime, or governance failures. Networks like Algorand and

Hedera Hashgraph use advanced consensus mechanisms and governance models to maintain high security and operational resilience.

5. Ecosystem Maturity: A mature blockchain ecosystem provides strong developer tools, active communities, and liquidity options. This reduces development time and helps your RWA project integrate with

DeFi platforms or exchanges. Ethereum leads with thousands of developers and over $70 billion in DeFi TVL (total value locked), while

Polygon and Solana are also gaining traction for RWA use cases.

6. Cross-Chain Interoperability: RWAs benefit from cross-chain compatibility to reach more users and liquidity across different blockchains. Interoperable networks allow tokenized assets to move seamlessly between ecosystems without losing compliance or security. Platforms like Plume use their SkyLink protocol to deliver RWA yields across 18+ chains, while

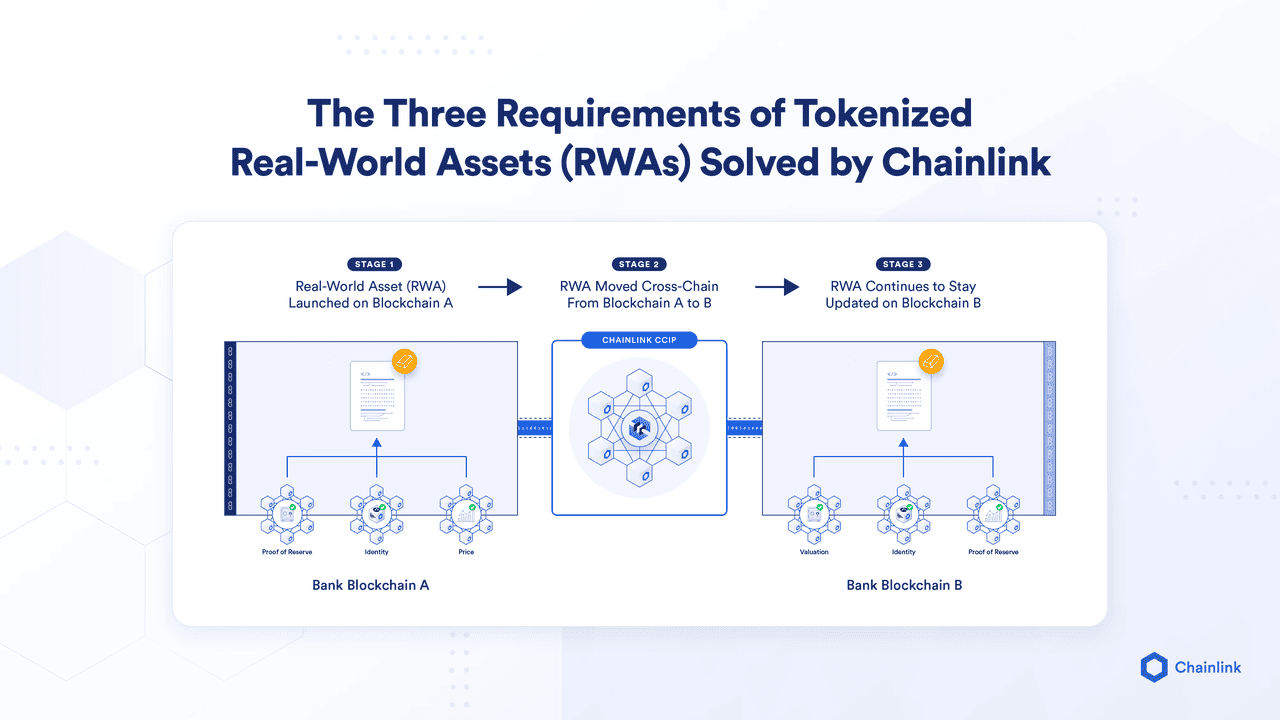

Chainlink’s CCIP enables secure multi-chain communication.

Top 10 RWA Blockchains to Watch in 2025

These ten blockchain networks are at the forefront of RWA innovation. Each offers unique strengths in areas like compliance, scalability, and real-world use. Below, you’ll find a snapshot of each chain, what makes it RWA-ready, and a standout project illustrating its capabilities.

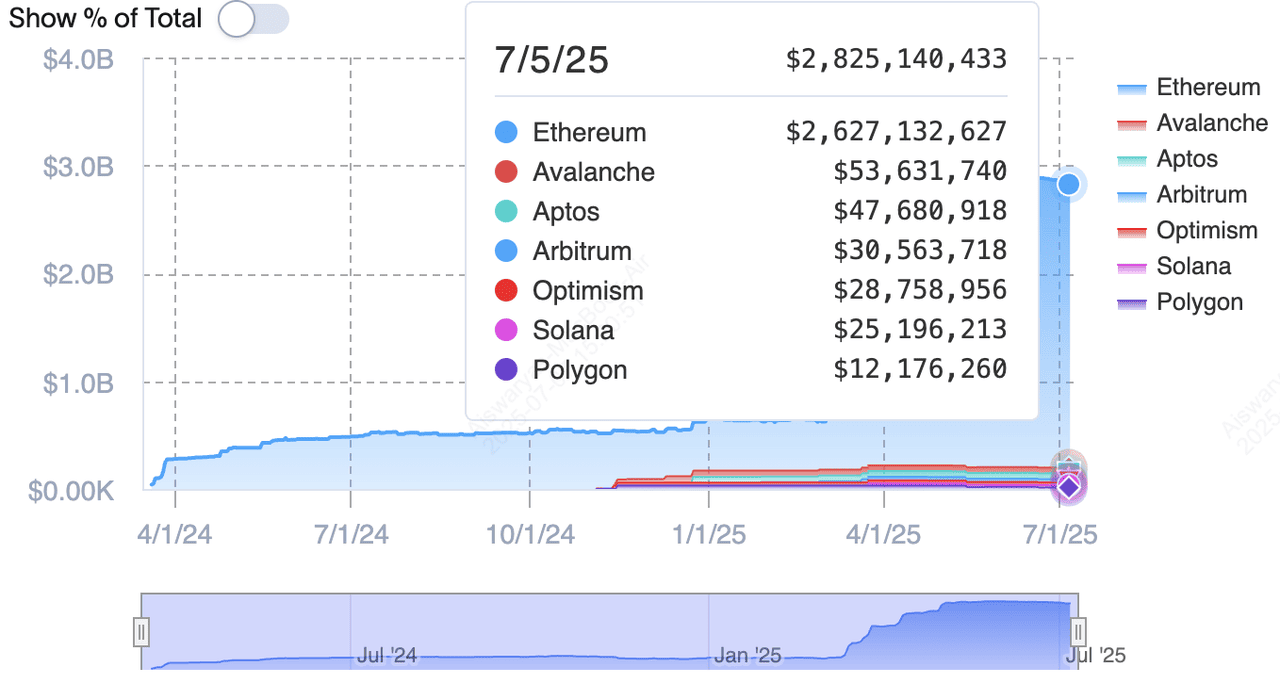

1. Ethereum

Ethereum remains the leading blockchain for RWA tokenization due to its mature ecosystem, wide adoption, and strong developer community. It operates on a Proof-of-Stake (

PoS) consensus mechanism and processes around 15 transactions per second (TPS), with ongoing upgrades aimed at improving scalability and cost efficiency. Ethereum supports advanced token standards like ERC‑1400 and ERC‑3643, which are specifically designed for security tokens and compliant asset issuance. Centrifuge, a flagship RWA project, has tokenized over $300 million in assets, including invoices and real estate, and integrated with major DeFi platforms like MakerDAO and

Aave to bring liquidity into these traditionally illiquid markets. BlackRock’s BUIDL fund and Securitize’s tokenized securities further reinforce Ethereum’s position as the preferred platform for institutional-grade RWA initiatives.

The Ethereum ecosystem is also expanding through

Layer-2 solutions such as

Optimism,

Arbitrum, and

ZKsync Era, which offer faster transactions and significantly lower fees while maintaining Ethereum’s security guarantees.

Ondo Finance, a rising player in RWA tokenization, has leveraged Ethereum and its Layer-2 infrastructure to tokenize U.S. Treasurys and corporate bonds, enabling on-chain investors to access yield-bearing real-world assets efficiently. Additionally, specialized Layer-2 networks like Converge, built by Securitize and

Ethena, are being designed specifically to cater to institutional requirements, combining DeFi composability with permissioned compliance features. This layered approach positions Ethereum as a highly versatile and trusted hub for both retail and institutional RWA activity.

2. Solana

Solana is a high-performance blockchain designed for speed and cost-efficiency, combining Proof-of-History with Proof-of-Stake to deliver over 50,000 transactions per second (TPS) and average settlement times of just 400 milliseconds. Its low transaction fees, averaging $0.013, make it ideal for real-world asset (RWA) tokenization that requires frequent, high-volume transactions. Solana’s ecosystem includes advanced compliance tooling like Solana Permissioned Environments (SPEs) and token extensions with built-in KYC support. Projects such as SPYx demonstrate the platform’s capabilities by processing ETF-like transfers exceeding $100,000 daily, while Credix has enabled tokenized assets in Brazil to improve access to affordable loans. As of mid-2025, Solana hosts over $413 million in tokenized RWA value across 79 assets, with more than 51,000 holders, a growth of over 600% in just 30 days, positioning it as a key player in the RWA sector.

3. Chainlink

Chainlink's role in real-world asset tokenization | Source: Chainlink

Chainlink is not a blockchain but the leading

decentralized oracle network that connects real-world data to blockchain ecosystems. It plays a critical role in RWA tokenization by providing secure, real-time price feeds,

proof-of-reserve audits, and cross-chain interoperability. Over 80% of tokenized RWA platforms, including projects like Backed Finance, Matrixport, and Ondo Finance, rely on Chainlink’s oracles for accurate off-chain data and regulatory compliance. In June 2025, Chainlink powered a groundbreaking cross-chain treasury settlement between JPMorgan’s Kinexys network and Ondo Chain’s testnet, using its Chainlink Runtime Environment (CRE) to orchestrate delivery-versus-payment (DvP) transactions. With the Chainlink Cross-Chain Interoperability Protocol (CCIP), institutions like Swift and DTCC are exploring multi-chain RWA tokenization at scale. As the RWA market surpasses $23 billion in mid-2025, up 260% year-to-date, Chainlink’s role as the “middleware” for secure and compliant asset tokenization continues to expand, enabling tokenized assets to move seamlessly across public and private blockchains.

4. Plume

Plume is an EVM-compatible Layer-1 blockchain purpose-built for real-world asset (RWA) tokenization and integration into decentralized finance (DeFi). It achieves around 1,000 transactions per second (TPS) with low fees and features native compliance tools like KYC/AML, permissioned tokens, and tax infrastructure at the protocol level. As of July 2025, Plume hosts over $128 million in tokenized RWA value and 128,000 holders, with its total value locked (TVL) surging 87% in just 30 days, driven by innovations like SkyLink, which enables cross-chain yield distribution across 18+ networks. The network recently partnered with

World Liberty Financial (WLFI), integrating its

USD1 stablecoin as the reserve asset for Plume’s pUSD, further strengthening its RWA finance (RWAfi) ecosystem. Plume’s rapid growth, powered by 200+ deployed protocols, 20M+ transactions, and $4.5 billion in tokenized assets to date, positions it as a rising hub for institutions and crypto users seeking seamless, compliant RWA tokenization.

5. XRP Ledger (XRPL)

XRP Ledger (XRPL) is a high-performance blockchain using Federated Consensus to achieve ~1,500 transactions per second (TPS) with minimal costs, making it ideal for enterprise-grade RWA tokenization. Its native architecture supports permissioned token issuance and on-chain compliance metadata, features essential for regulated financial instruments. The network has become a preferred choice for major institutions entering the RWA space. Mercado Bitcoin, Latin America’s largest crypto exchange, recently tokenized over $200 million in fixed-income and equity assets on XRPL. In addition, Ondo Finance launched its $693M OUSG treasury token on the ledger, while Guggenheim Partners announced tokenized US commercial paper offerings, part of Dubai’s $16 billion property tokenization initiative on XRPL. As of mid-2025, XRPL hosts over $157 million in RWA volume, reflecting 34% growth in recent months as it solidifies its role in bridging traditional finance with blockchain-based ecosystems.

6. Stellar

Stellar is a fast and low-cost blockchain using the Stellar Consensus Protocol (SCP), capable of ~1,000 transactions per second with micro-fees ideal for cross-border payments and asset tokenization. Its native KYC anchor framework makes it attractive for bridging fiat and crypto systems while maintaining regulatory compliance. Stellar’s RWA ecosystem has seen rapid growth, with the network hosting over $590 million in tokenized assets and processing more than $3 billion in RWA transaction volume by mid-2025. High-profile projects include Franklin Templeton’s “Benji” tokenized fund, the first of its kind managed on a public blockchain, and WisdomTree Prime’s tokenized investment funds. Recent partnerships with Paxos, Ondo, and Société Générale Forge aim to push Stellar’s RWA value to $3 billion by year-end, highlighting its expanding role as a leading platform for compliant asset tokenization and global financial access.

7. Algorand

Algorand has emerged as a dominant force in RWA tokenization, commanding 70% of the market share with over $425 million in tokenized assets as of mid-2025. Its Pure Proof-of-Stake (PPoS) consensus enables ~1,000 TPS and sub-5 second finality, while the Algorand Standard Asset (ASA) framework supports compliant asset issuance and instant settlements. Flagship projects like Lofty.ai use Algorand to tokenize U.S. real estate, enabling fractional ownership and seamless income distributions. With institutional adoption accelerating, highlighted by Midas’s tokenized T-Bills and Mitsui O.S.K. Lines’ carbon tokens, Algorand’s robust infrastructure, micro-fees, and developer tools like AlgoKit 3.0 position it as a preferred blockchain for RWAfi innovation and large-scale tokenization.

8. XDC Network

XDC Network is an enterprise-grade

Layer-1 blockchain optimized for trade finance and RWA tokenization, using a delegated Proof-of-Stake (dPoS) mechanism for near-zero fees, sub-second latency, and robust scalability. Designed for institutional adoption, it features built-in compliance layers and interoperability with global standards like ISO 20022 and MLETR. The network powers major initiatives such as tokenizing trade invoices, bonds, and private credit, reducing settlement times from days to seconds. Partnerships with LIQI for a $500M RWA initiative and integrations with custodians like Utila showcase its growing role in bridging traditional finance and blockchain. Through the Plug and Play RWA Accelerator, XDC also fosters innovation in tokenization, supporting projects like Plume and Clearpool in building next-generation financial products.

9. Aptos

Aptos, a modern Proof-of-Stake Layer-1 blockchain built with Move-based smart contracts, has quickly emerged as a leading platform for institutional-grade RWA tokenization. Designed for compliance and identity verification, it has attracted major players like BlackRock and Franklin Templeton, who deployed tokenized U.S. Treasury funds on its network. The Aptos ecosystem now hosts over $540 million in RWAs, driven by 13 tokenized assets including BlackRock’s BUIDL and Franklin Templeton’s BENJI funds. Aptos was also shortlisted by Wyoming’s Stable Token Commission as the top technical candidate for its WYST stablecoin pilot, underscoring its institutional appeal. With high throughput, low fees, and growing integrations, Aptos is becoming a key player in bridging traditional finance and blockchain.

10. Sei

Sei is a high-performance, parallelized

EVM-compatible Layer-1 blockchain designed for financial applications, boasting sub-400ms finality and 12,500 TPS with near-zero fees. Its architecture, featuring innovations like Twin Turbo Consensus and Optimistic Parallelization, enables scalable, low-latency infrastructure ideal for tokenizing real-world assets. Sei has attracted fintech leaders and platforms like Zero Hash for settling tokenized assets, and its RWA-focused dApps hit record transaction volumes and TVL in early 2025. Recently shortlisted for Wyoming’s WYST stablecoin pilot, Sei is positioning itself as a key player for institutional-grade tokenization and rapid cross-border settlements.

Emerging Trends in RWA Tokenization

The tokenization of real-world assets is one of the fastest-growing sectors within the crypto market, with several key trends shaping its trajectory in 2025. One of the most significant developments is the rise of cross-chain yield streams. Platforms like Plume Network are pioneering tools such as SkyLink, which allow tokenized assets, whether they represent treasury bonds or real estate shares, to interact across multiple blockchains. This innovation enables investors to earn yields on their holdings by participating in DeFi protocols across Ethereum, Solana, and Polygon simultaneously, improving liquidity and accessibility. According to a report by rwa.xyz, cross-chain RWA deployments now account for over 15% of the $24 billion tokenized asset market, underscoring the growing importance of interoperability in this sector.

Another trend gaining momentum is the reliance on decentralized oracle networks to provide secure off-chain data. Chainlink, for example, plays a critical role by delivering real-time asset prices, proof-of-reserve audits, and macroeconomic indicators that ensure tokenized assets maintain their real-world value. A 2025 Chainlink report highlights that over 80% of tokenized RWA platforms now use oracle services to comply with financial regulations and investor trust requirements.

BlackRock's BUIDL fund | Source: RWA.xyz

At the same time, institutional adoption is accelerating. BlackRock’s $2.9 billion BUIDL fund on Ethereum and Franklin Templeton’s Benji tokenized money market fund on Stellar are notable examples of large-scale experiments proving the viability of RWAs in traditional finance. This shift is complemented by purpose-built blockchains like XRPL, XDC Network, and Plume, which offer features such as permissioned tokens and built-in compliance frameworks tailored to enterprise needs. As the market matures, these specialized infrastructures are expected to play a pivotal role in supporting large-scale RWA adoption and regulatory alignment globally.

Closing Thoughts

Real-world asset tokenization is reshaping how value is stored, transferred, and accessed. By 2025, the sector has grown into a $23 billion market, attracting both startups and global financial institutions. Choosing the right blockchain for an RWA project is critical because it affects scalability, compliance, and user adoption. Ethereum and Solana stand out for their mature ecosystems and strong developer support, while Chainlink is indispensable for accurate off-chain data integration. For projects requiring built-in compliance and cross-chain functionality, purpose-built platforms like Plume, XRPL, and XDC Network offer clear advantages.

However, it’s important to remember that RWA tokenization is still an emerging field. Regulatory frameworks are evolving, and technical risks such as smart contract vulnerabilities or oracle failures remain. Enterprises and investors should conduct thorough due diligence, choose audited platforms, and stay informed about local laws before committing to RWA systems. By aligning blockchain capabilities with project needs, you can build a secure, compliant, and future-ready tokenization platform.

Related Reading