Crypto markets don’t always trend in one direction. Quite often, charts move sideways in what’s called a range bound market, where price bounces between support and resistance levels without breaking out. Many traders view this as wasted time, waiting for a big move that never comes.

Smart money, however, sees these choppy markets differently. Predictable swings within a trading range can offer steady opportunities if traded with structure. By applying simple strategies such as buying at support, selling at resistance, and using momentum indicators for confirmation, traders can profit even when volatility is low.

This guide explains how to recognize range bound conditions and apply practical strategies, tools, and risk controls to trade them effectively.

What Is a Range-Bound Crypto Market and How to Identify It?

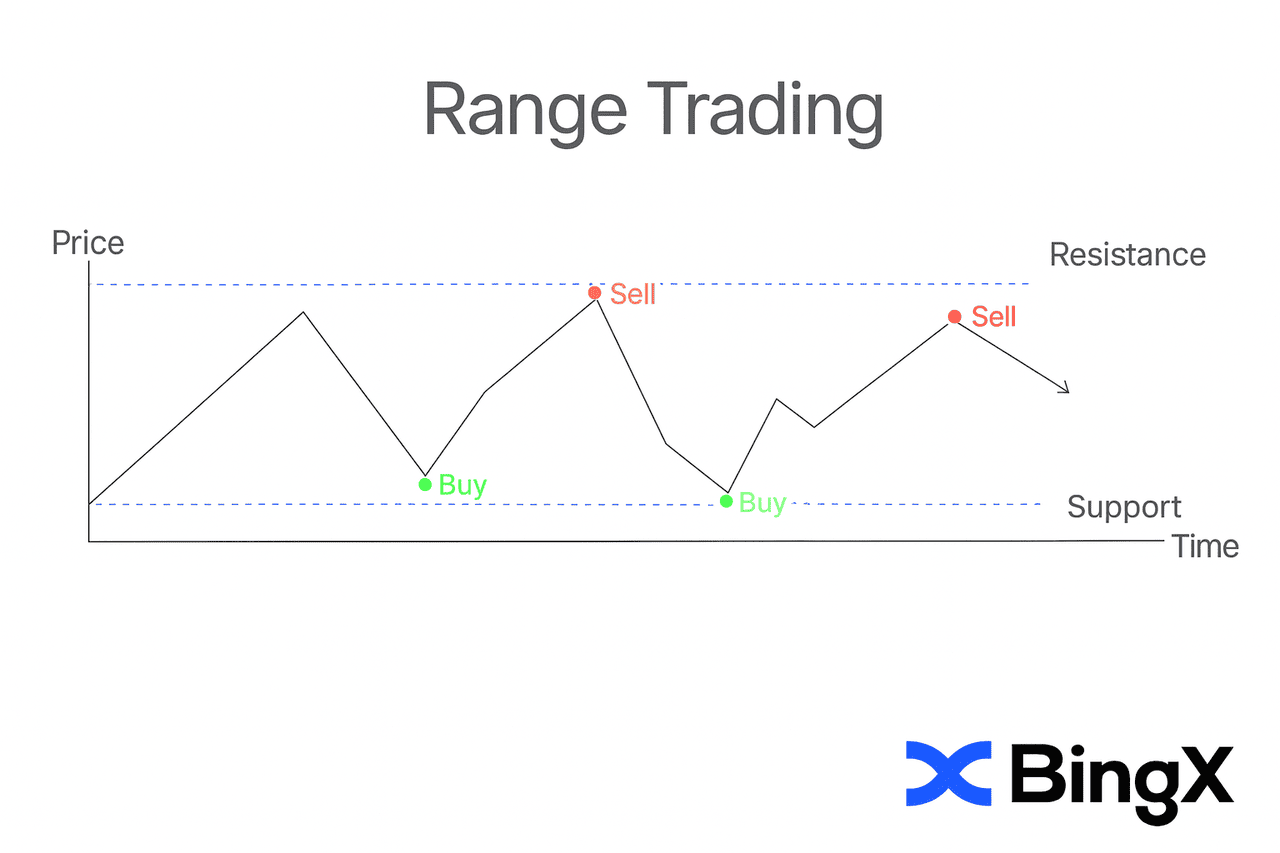

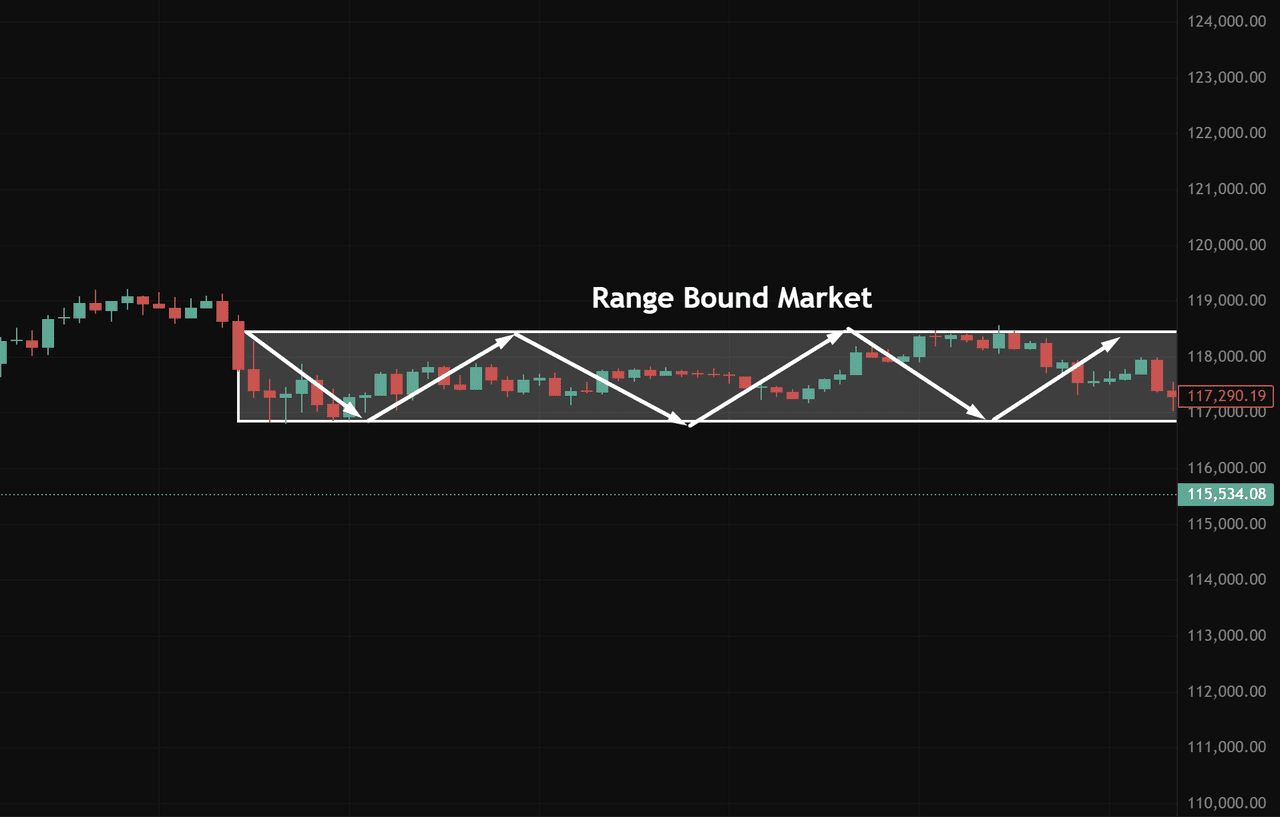

A range bound market occurs when an asset moves sideways within clear boundaries rather than trending up or down. Instead of forming higher highs or lower lows, price fluctuates between support and resistance, creating a “box” or trading range.

This sideways action is common across crypto, forex, and stocks. While it may look uneventful, it often provides structured opportunities for disciplined traders.

Key characteristics of a sideways market:

• Flat support and resistance levels with repeated swings between range edges.

• Average True Range (ATR): declining values show reduced volatility.

• Bollinger Bands: tightening upper and lower bands signal limited expansion.

• Momentum Indicators (RSI/Stochastic): oscillating between overbought and oversold zones.

Top Range Trading Strategies

Once a range is identified, traders can focus on setups designed for sideways action. Unlike trending markets, where price moves strongly in one direction, range trading seeks to profit from repeated swings between boundaries.

1. Buy at Support, Sell at Resistance

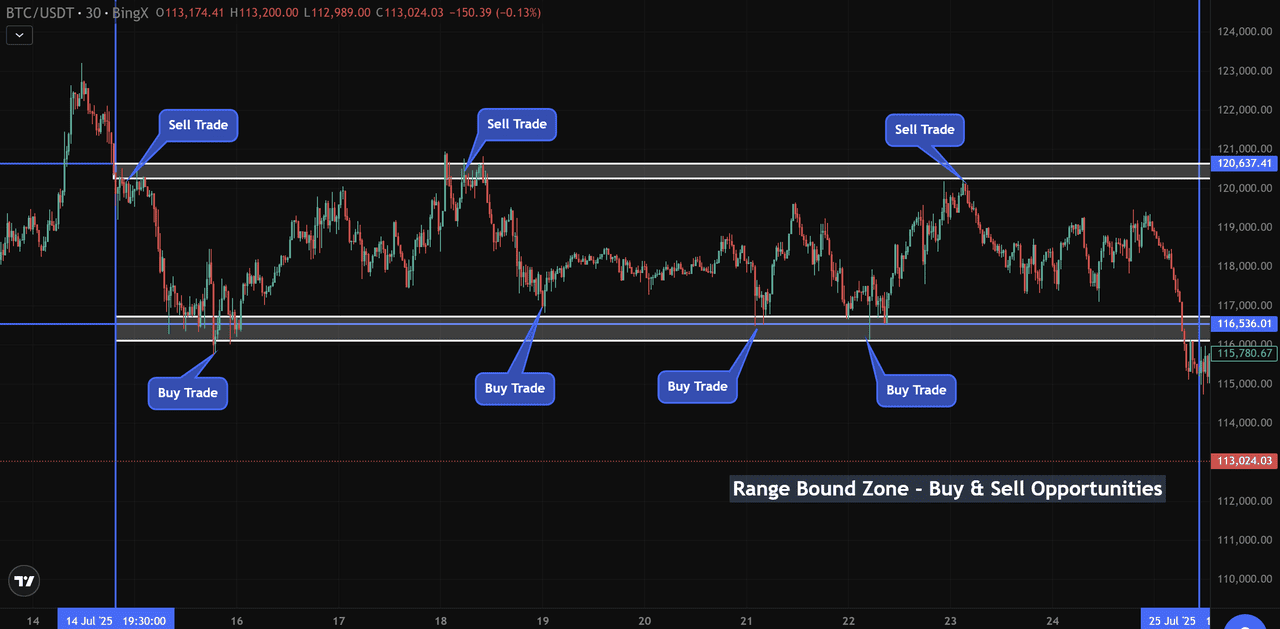

One of the most effective strategies in a range bound market is to buy at support and sell at resistance. In sideways conditions, price often oscillates between these boundaries, creating structured opportunities. Support acts as a floor where demand prevents further declines, while resistance serves as a ceiling where supply caps upward moves. Recognizing these levels allows traders to capture swings without needing a strong trend.

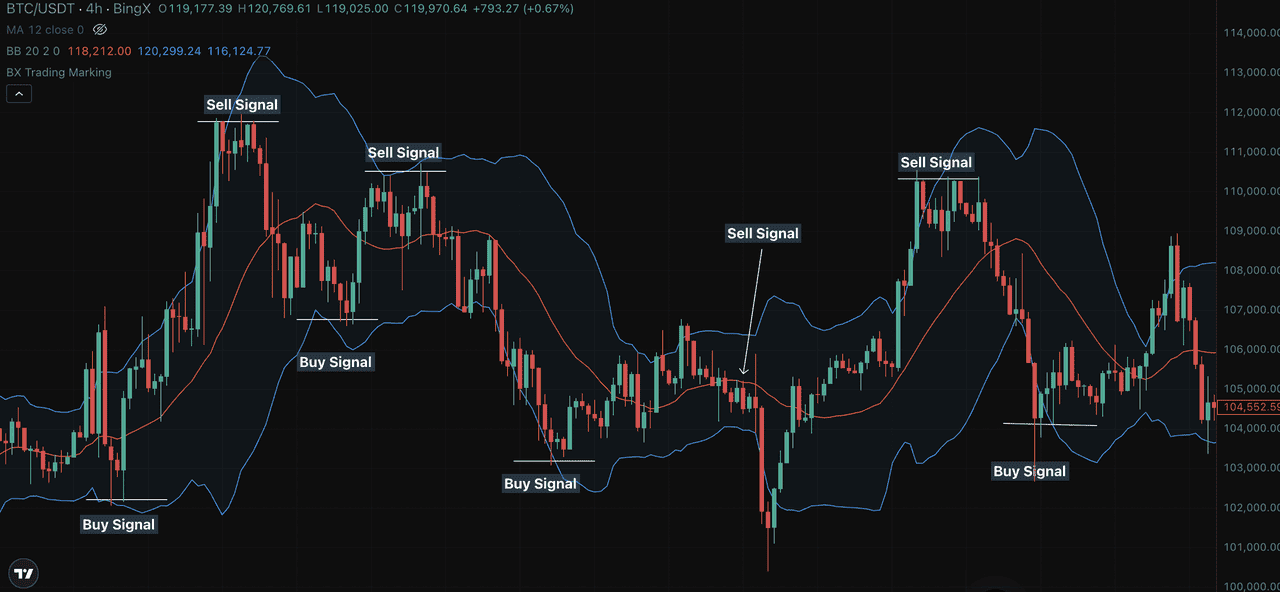

On the BTC/USDT chart, support around $116,500 and resistance near $120,600 defined a clear trading range. Each test of support triggered buying opportunities that pushed price higher, while moves toward resistance provided short setups as the market failed to break out. Traders applying this method could take multiple profitable trades during what many consider a flat market.

Risk management is crucial. Stop loss orders should be placed just beyond support or resistance to guard against false breakouts. This ensures protection if the range evolves into a trending move. With disciplined execution and a proper risk-to-reward ratio, buying at support and selling at resistance becomes a straightforward and repeatable strategy for sideways markets.

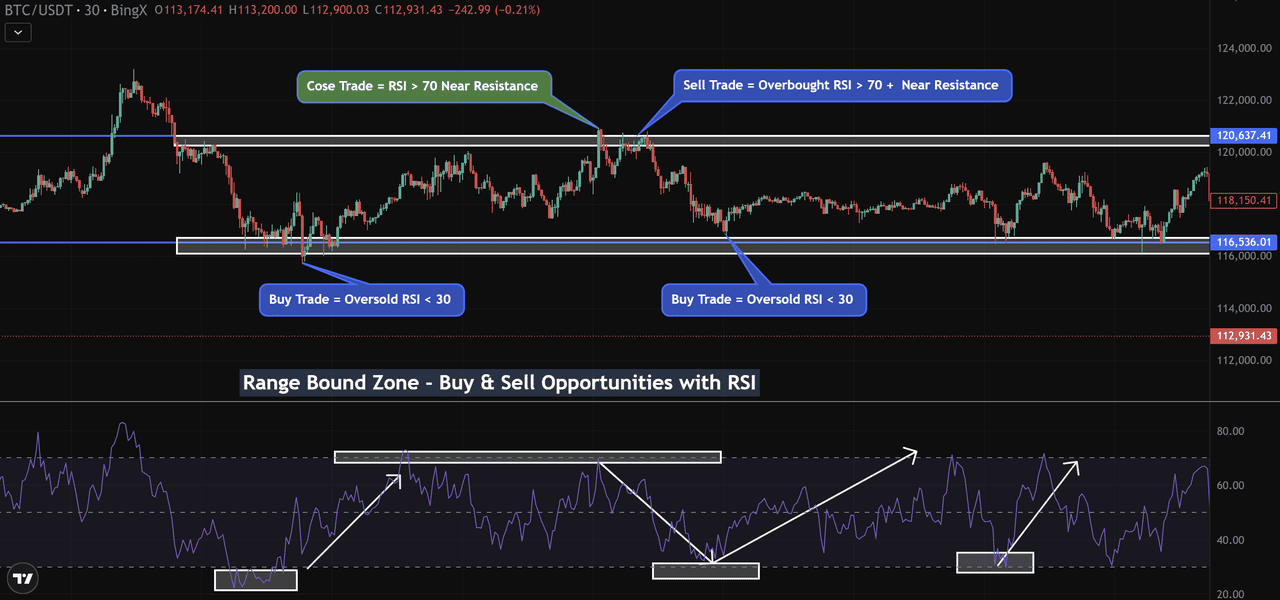

2. Oscillator-Based Entries

In range bound trading, oscillators such as the

Relative Strength Index (RSI),

Stochastic Oscillator, or

Commodity Channel Index (CCI) can be used to refine entries and improve accuracy. These momentum indicators measure whether an asset is overbought or oversold, helping traders avoid false signals and focus on higher-probability setups. Instead of relying only on support and resistance, oscillators add an extra layer of confirmation for trade decisions in choppy markets.

In the BTC/USDT chart, RSI dipped below 30 each time price tested support near $116,500, signaling oversold conditions and increasing the probability of a bounce. Conversely, when price approached resistance around $120,600, RSI climbed above 70, highlighting overbought levels and signaling potential short opportunities. Combining these signals with range edges made entries more precise and reduced false setups.

The same approach applies to Stochastic and CCI, which often capture momentum shifts at range boundaries. In choppy markets, where false breakouts are a common occurrence, using oscillators alongside price action provides stronger confirmation and helps traders filter out noise. This layered approach improves accuracy and supports better decision-making in sideways conditions.

3. Bollinger Bounce Strategy

Another useful method for sideways markets is the

Bollinger Bounce Strategy, which takes advantage of price reacting to the upper and lower Bollinger Bands. When the bands are relatively flat, they often act as dynamic resistance and support levels, making them well-suited for range bound conditions.

How it works:

• Enter a buy trade when price touches the lower band.

• Enter a sell trade when price reaches the upper band.

• Use the 20-period SMA (the middle line) as a trailing stop.

• Exit trades when price returns to the midline.

For example, if BTC/USDT is trading within a tight range and price taps the lower band, traders can look for short-term buy setups and close the position as price moves back toward the middle band. This strategy works best in range bound markets where Bollinger Bands are flat, but it should be avoided in trending conditions, where price may continue running beyond the bands.

4. Fade False Breakouts

False breakouts are common in range bound markets. Price may briefly move above resistance or below support, only to quickly return inside the trading range. Traders who chase these moves often get trapped, while those who wait for confirmation can profit by trading in the opposite direction. This approach is known as “fading” the breakout.

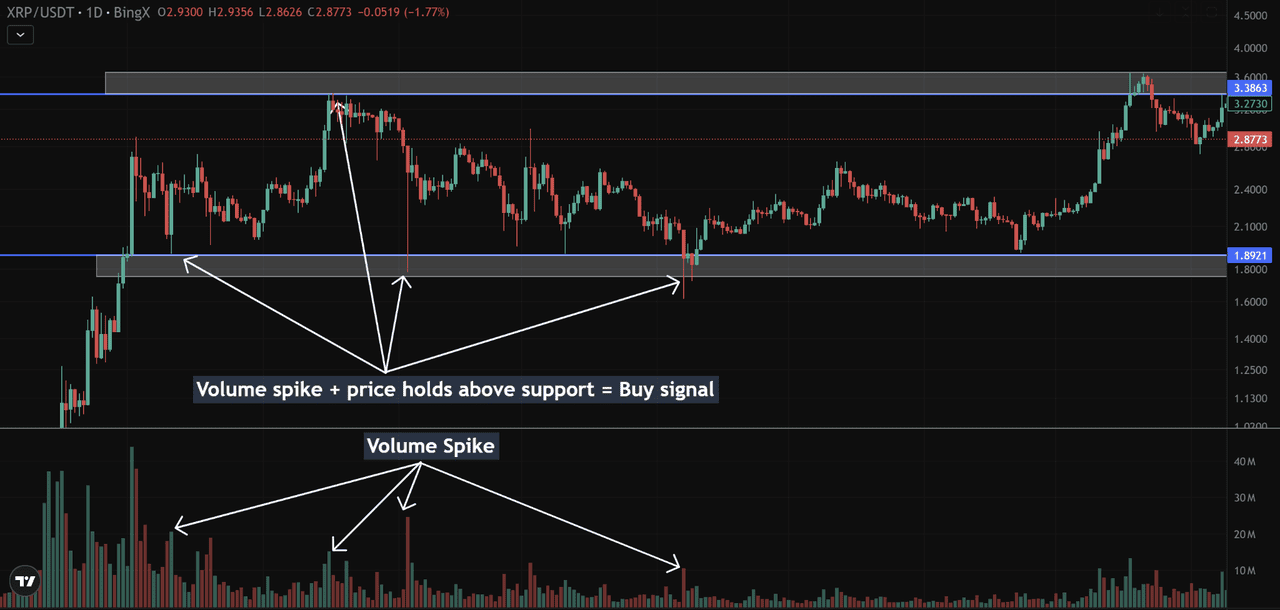

In the XRP/USDT chart, price attempted to break above resistance near $3.38 several times but failed to sustain the move. Each rejection brought the market back into the range, providing short opportunities toward support near $1.89. Traders who waited for confirmation after these failed moves were able to capture profitable setups.

A key filter here is volume. Breakouts that occur on low volume are often false and more likely to reverse, while genuine breakouts are supported by high volume and momentum. The key is patience, avoiding entering the very first breakout candle. Instead, wait for signs of weakness, such as rejection wicks or a quick return below resistance, before fading the move. This makes the setup more reliable in choppy market conditions.

How to Manage Risk When Trading in Choppy Markets

Range bound trading can be profitable, but only if risk is managed with discipline. A basic rule is to aim for a risk-to-reward ratio of at least 1:2, ensuring that potential gains outweigh the risk on each trade. Because sideways markets often involve sharp but limited swings, stop loss placement is especially important.

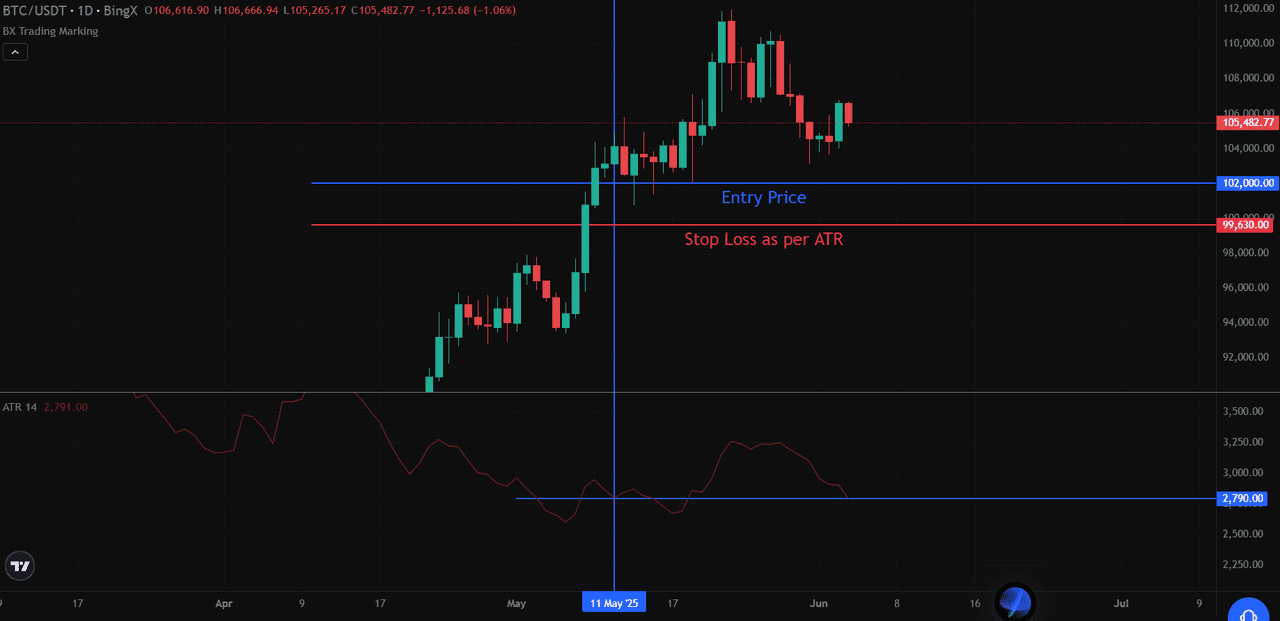

Many traders use the

Average True Range (ATR) to size stops according to volatility. ATR-based stops adapt to changing market conditions and reduce the chance of being prematurely stopped out by normal price fluctuations.

For example, if Bitcoin breaks above $100,000 with a 14-day ATR of $2,790, a 1.5× ATR move equals about $4,185. A strong close above resistance near $105,000 confirms momentum, while a stop placed just below the breakout zone (adjusted by ATR) provides protection if the move fails.

Trailing stops can also be applied. If BTC rallies from $102,000 to $108,000, a 3× ATR trailing stop would be set around $99,630, allowing the stop to follow price higher while leaving room for natural swings. Day traders may choose tighter multipliers, while swing traders can allow wider stops.

Finally, avoid overtrading in the middle of the range, where signals are weaker and risk is higher. Sticking to range edges with well-placed stops keeps losses small and profits consistent.

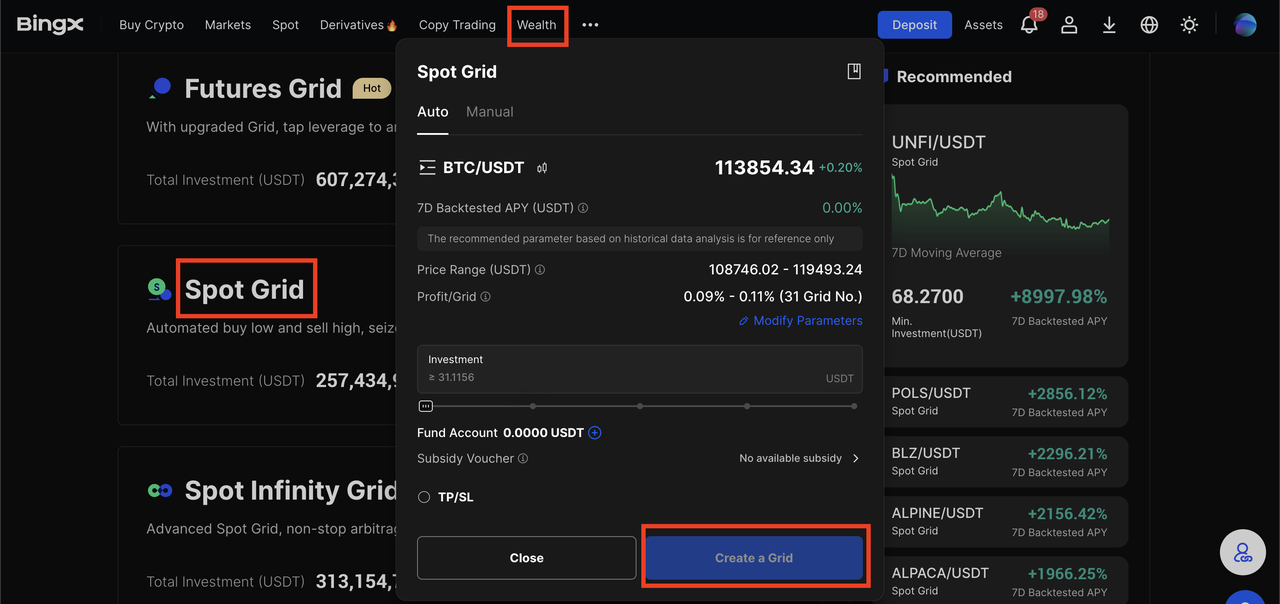

How to Trade Choppy Markets with BingX Grid Trading Bot

Creating a BTC/USDT spot grid trading bot on BingX

Sideways markets can be tough to navigate, but BingX’s

Grid Trading Bot makes it simple. Here’s how you can get started:

Choppy, sideways markets are ideal for grid trading. BingX offers Spot Grid and Futures Grid bots to help you trade automatically. Here’s how to get started:

1. Log In to BingX: Open the BingX website or app and sign in to your account.

2. Navigate to Grid Trading: From the menu, go to Grid Trading under “Markets” or “Derivatives.” You’ll see options for Spot Grid, Infinity Grid, and Futures Grid.

3. Choose Spot or Futures Grid

• Spot Grid – Best for beginners. It automatically buys low and sells high within your chosen price range. Profits are settled in the

spot market without leverage.

• Futures Grid – Designed for advanced users. It works the same way as Spot Grid but adds leverage to amplify potential profits (and risks).

4. Select a Trading Pair: Pick the crypto pair you want to trade, such as

BTC/USDT or

ETH/USDT.

5. Set Your Parameters

• Define your upper and lower price limits for the grid.

• Choose the number of grids (the levels of buy/sell orders).

• Enter your investment amount.

• (For Futures Grid) select your leverage level.

6. Start the Bot: Click Create to launch. The bot will now run 24/7, automatically executing trades as the price oscillates between your grid levels.

Tip: The Grid Trading Bot works best in choppy or range-bound markets where price repeatedly bounces between support and resistance.

Common Mistakes in Rangebound Crypto Trading

Trading range bound markets can be effective, but several mistakes often reduce performance:

• Misjudging market conditions – applying trend strategies in flat markets where price lacks clear direction.

• Ignoring volatility and volume shifts – failing to notice rising ATR or strong volume, which may signal an end to the range.

• Increasing risk too quickly – raising position size after a few wins, which can magnify losses if the next trade fails.

• Placing stops too close – setting stop loss orders directly at support or resistance, leading to unnecessary exits from normal price movement.

Using tools like ATR for stop placement and monitoring volume changes can help avoid these issues and keep trades aligned with market conditions.

Conclusion

Range bound trading is one of the most practical strategies for navigating non-trending markets. Instead of waiting for a clear trend, traders can capture opportunities within sideways action by focusing on price ranges, risk-to-reward setups, and disciplined execution.

Tools such as

Bollinger Bands, the Average True Range (ATR), and momentum indicators like RSI or Stochastic add valuable confirmation when price moves between support and resistance.

The main advantage of this approach is consistency. Flat markets often appear uneventful, but with the right strategy they can provide frequent, controlled setups. The key is to stay patient, avoid trading in the middle of the range, and manage positions with properly placed stop loss orders.

Key takeaway: sideways markets should not be overlooked; when traded with structure and discipline, they can deliver steady results and strengthen overall trading performance.

FAQs on Trading Rangebound and Choppy Markets

1. What is a rangebound market in crypto trading?

A range bound market is when price moves sideways between defined support and resistance levels without forming higher highs or lower lows.

2. How can crypto traders profit in a choppy market?

Traders can profit by buying at support, selling at resistance, and using momentum indicators like RSI or Stochastic to confirm reversals.

3. What indicators work best in range bound trading crypto?

The most common are the Average True Range (ATR) for volatility, Bollinger Bands for range edges, and momentum oscillators to confirm entry points.

4. How do you avoid false breakouts in sideways markets?

False breakouts are filtered by checking volume. Low-volume breakouts often fail, while genuine moves are backed by strong, high-volume momentum.

5. What is the best risk management rule for range crypto trading?

Traders should aim for a minimum risk-to-reward ratio of 1:2 and place stop loss orders beyond support or resistance, often adjusted using ATR.