La sfârșitul anului 2025, piața cripto a depășit 4 trilioane de dolari, pe măsură ce

Bitcoin a atins un nou maxim istoric de peste 124.000 de dolari în august, cu

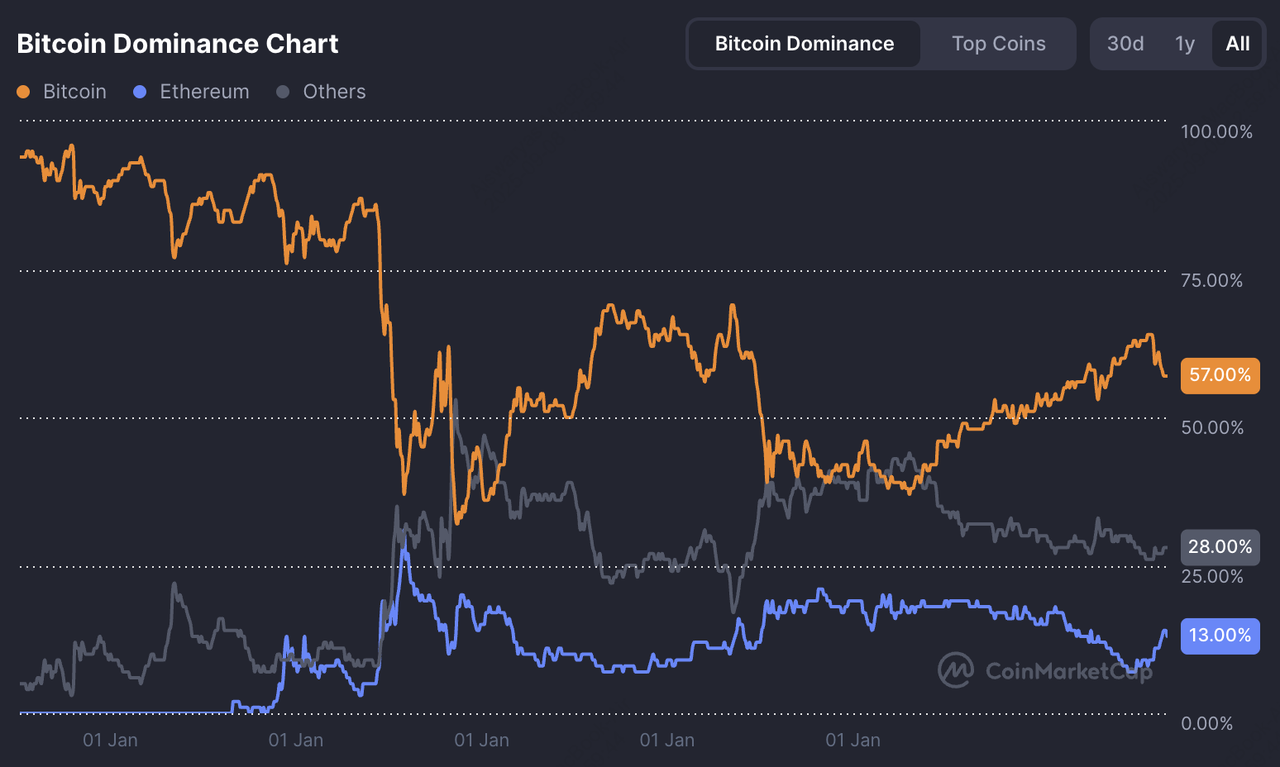

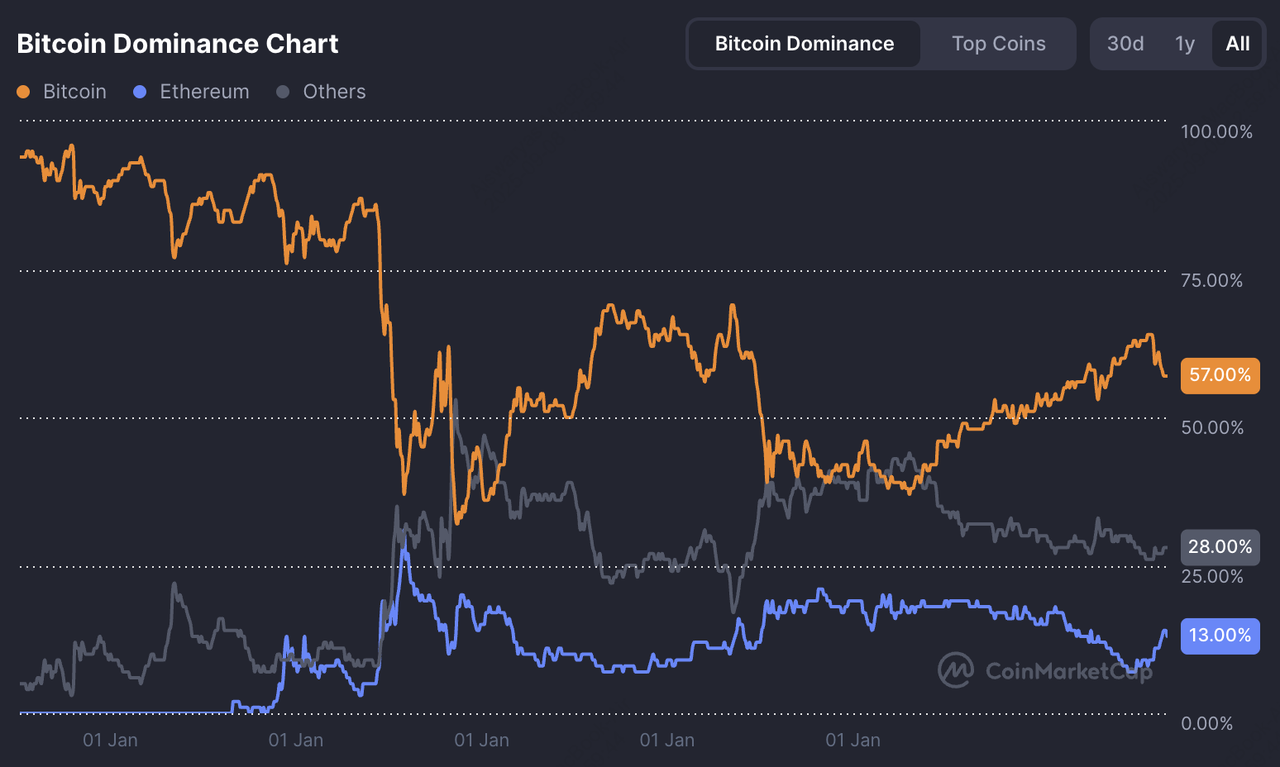

dominanța Bitcoin atingând 57% și

stablecoins depășind 290 de miliarde de dolari. Pe măsură ce adoptarea se accelerează și investitorii așteaptă cu nerăbdare un

sezon de altcoin în curând, crește și urgența pentru o auto-custodie mai puternică, făcând portofelele hardware unul dintre cele mai importante instrumente pentru securizarea averii digitale.

Dominanța Bitcoin atinge 57% în septembrie 2025 | Sursa: Coinmarketcap

Dacă doriți să stocați cripto pe termen lung sau pur și simplu doriți protecție offline împotriva amenințărilor precum malware-ul și colapsurile burselor, cea mai bună apărare rămâne un portofel hardware de încredere, cunoscut și sub denumirea de portofel rece. Acest articol explorează cele mai bune portofele hardware din 2025, combinând recenzii ale experților, experiența reală a utilizatorilor și specificațiile oficiale ale produselor pentru a evidenția avantajele, dezavantajele și caracteristicile lor remarcabile.

Ce Este un Portofel Hardware și Cum Funcționează?

Un portofel hardware este un dispozitiv fizic conceput pentru a stoca cheile private ale criptomonedelor offline, păstrându-le în siguranță de amenințările online precum malware-ul, atacurile cibernetice asupra burselor și

schemele de phishing. Gândiți-vă la el ca la o cutie de valori digitală; aveți nevoie de dispozitiv în mână pentru a aproba orice transfer. Fiecare tranzacție necesită o acțiune fizică (cum ar fi apăsarea unui buton, introducerea unui PIN sau scanarea amprentei digitale), ceea ce face accesul neautorizat extrem de dificil.

Atunci când configurați pentru prima dată un portofel hardware, acesta generează o frază de recuperare sau o frază seed de 12-24 de cuvinte. Această frază este backup-ul suprem pentru fondurile dumneavoastră. Dacă dispozitivul este pierdut sau distrus, puteți restaura criptomonedele pe un portofel nou folosind aceeași frază. Fără ea, fondurile sunt pierdute pentru totdeauna. Estimările industriei realizate de Ledger sugerează că între 2,3 milioane și 3,7 milioane de bitcoin, echivalentul a aproximativ 11-18% din oferta maximă de 21 de milioane, sunt pierdute permanent, adesea din cauza cheilor private rătăcite, a frazelor seed uitate sau a stocării distruse. Acest lucru subliniază de ce securizarea corectă a backup-urilor de recuperare este atât de critică.

Portofele Hardware (Reci) vs. Portofele Hot

Portofelele hardware sau reci sunt dispozitive offline precum Ledger, Trezor sau Tangem. Deoarece sunt deconectate de la internet, sunt mult mai puțin vulnerabile la atacuri cibernetice. Sunt cele mai potrivite pentru deținătorii pe termen lung și pentru cei care stochează cantități semnificative de criptomonede. Conform cercetărilor de piață realizate de Mordor Intelligence, adoptarea portofelelor hardware este de așteptat să crească cu o rată anuală de 24-30% până în 2030, pe măsură ce atât investitorii de retail, cât și cei instituționali trec la auto-custodie.

Portofelele hot sau portofelele software (aplicații mobile, extensii de browser sau portofele de bursă) care rămân conectate la internet. Sunt convenabile pentru tranzacții zilnice, DeFi și tranzacționare, dar mai expuse la

phishing, malware și riscuri legate de burse. Portofelele hot sunt ideale pentru sume mici la care aveți nevoie de acces rapid, dar nu sunt recomandate pentru stocarea pe termen lung.

În termeni simpli, portofelele hot sunt cele mai bune pentru cheltuielile zilnice și acces rapid, în timp ce portofelele reci sunt concepute pentru economii pe termen lung și securitate maximă. Împreună, vă permit să echilibrați comoditatea cu protecția. Prin combinarea celor două, mulți investitori cripto găsesc un echilibru între comoditate și securitate.

De Ce Ar Trebui Să Luați în Considerare un Portofel Hardware în 2025?

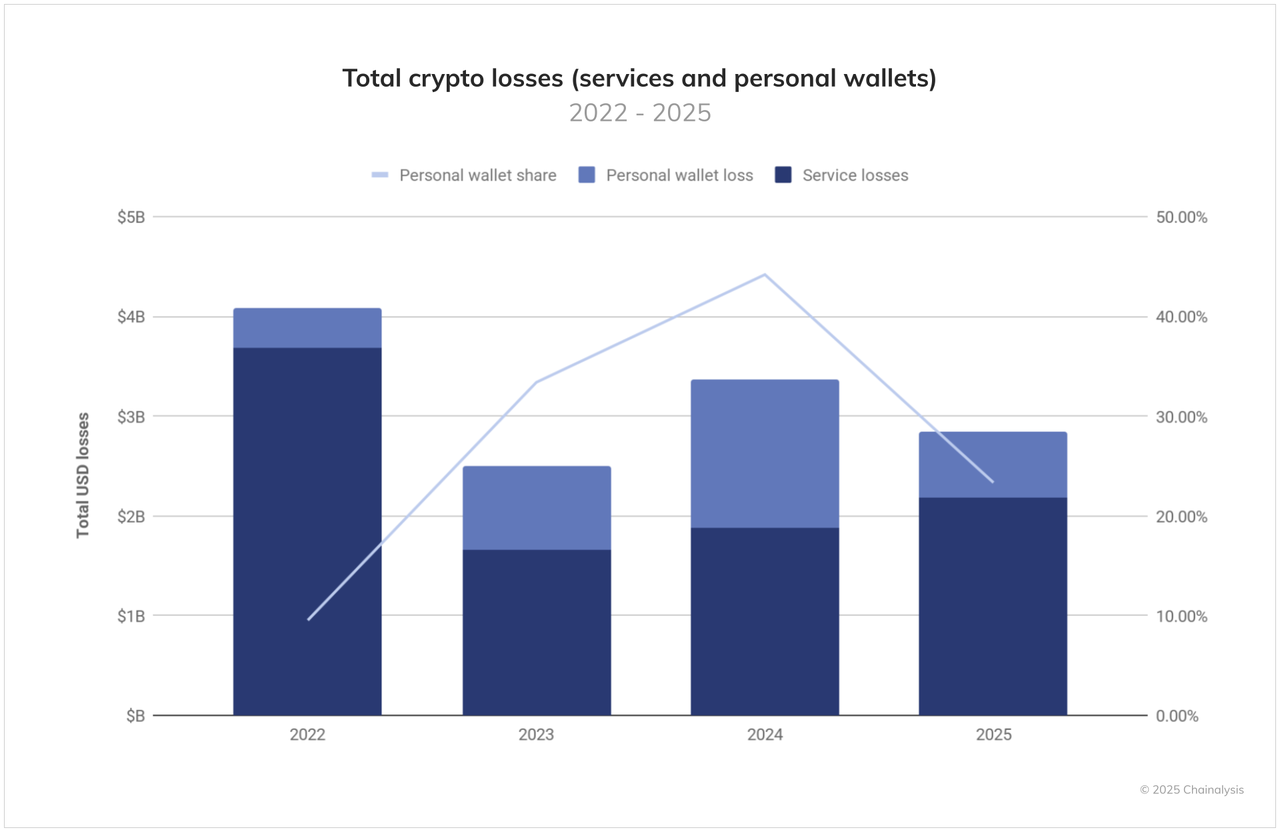

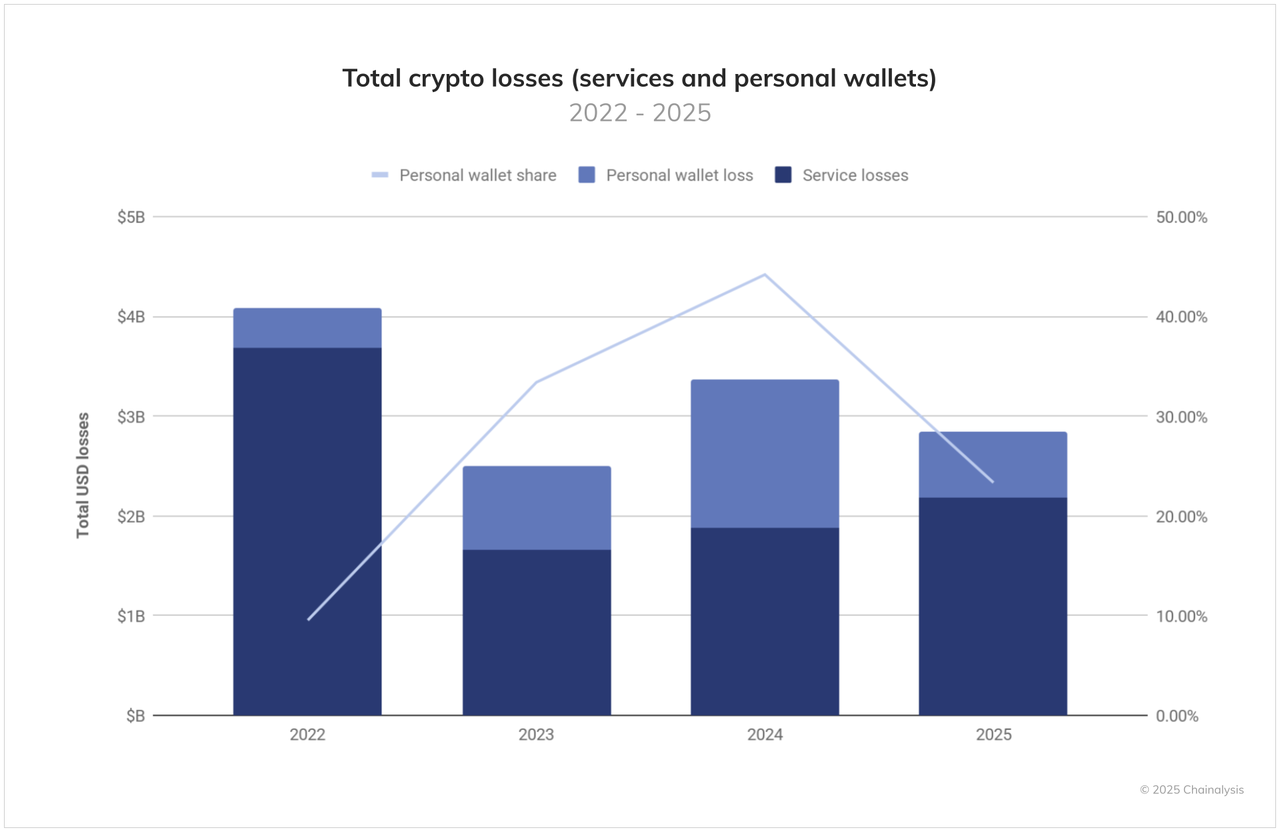

Creșterea amplorii pieței a adus și riscuri record. Până la jumătatea anului 2025, peste 2,17 miliarde de dolari fuseseră furați din servicii cripto, conform Chainalysis, cu 16 atacuri cibernetice numai în august, care au drenat 163 de milioane de dolari. Campaniile de phishing au crescut cu 40% de la an la an, alimentate de kituri de golire a portofelelor și site-uri web false de schimb.

Total criptomonede pierdute din servicii și portofele personale | Sursa: Chainalysis

Ca răspuns, vânzările de portofele hardware au crescut cu ~31% în acest an, conform cercetărilor Mordor Intelligence, analiștii proiectând o creștere anuală de 24-30% până în 2030, pe măsură ce atât investitorii de retail, cât și instituțiile se orientează către stocarea offline. Concluzia: pe măsură ce criptomonedele devin mai valoroase, păstrarea cheilor private în siguranță offline nu a fost niciodată mai critică.

Utilizarea unui portofel hardware în 2025 nu este doar despre securitate, ci și despre independență și reziliență. Prin păstrarea cheilor offline, reduceți dependența de burse, custodi și terți care rămân ținte atractive pentru atacatori. Portofelele hardware protejează, de asemenea, împotriva erorilor umane, deoarece fiecare tranzacție necesită confirmare fizică. Pentru oricine ia în serios criptomonedele, de la deținătorii pe termen lung la traderii activi care își protejează profiturile, stocarea la rece nu mai este opțională, ci esențială.

Top 7 Portofele Hardware de Utilizat în 2025

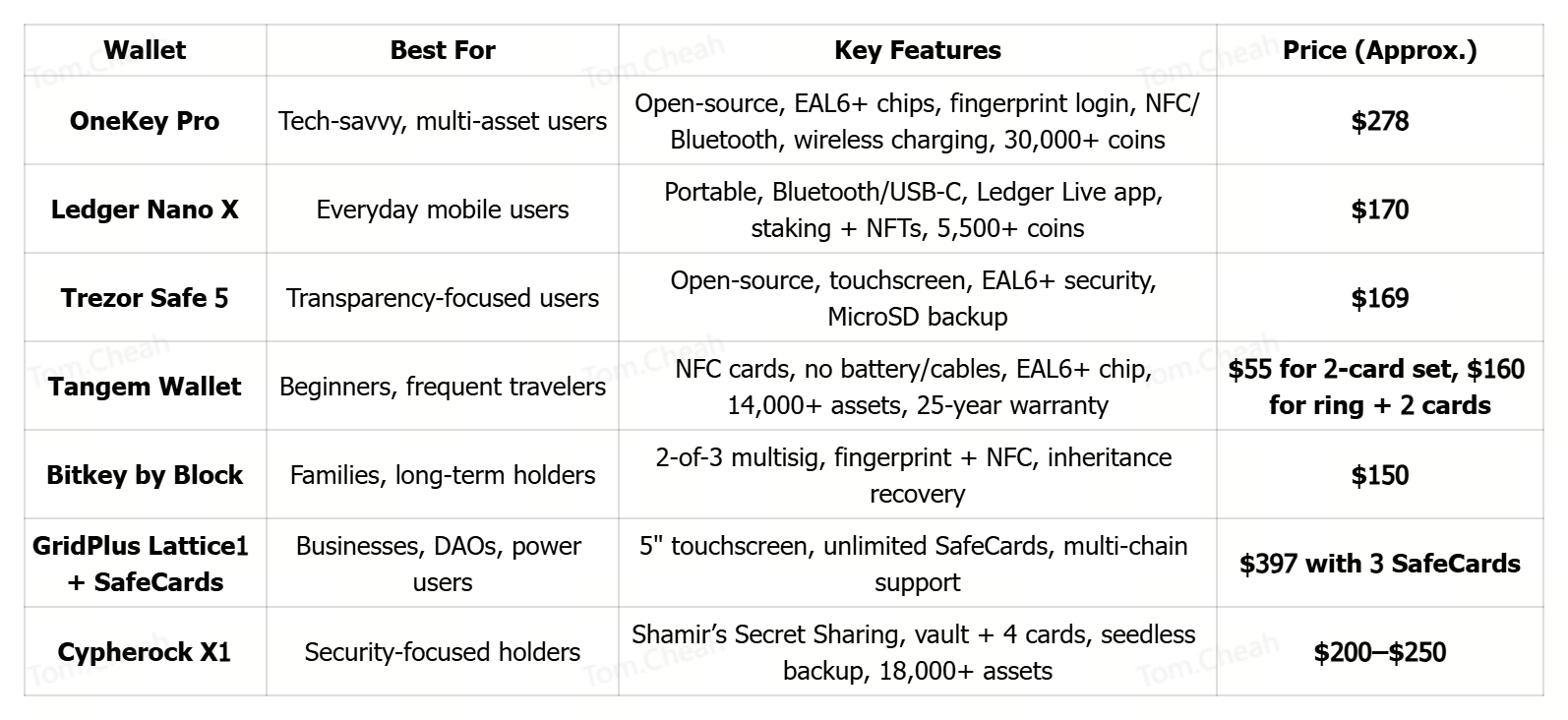

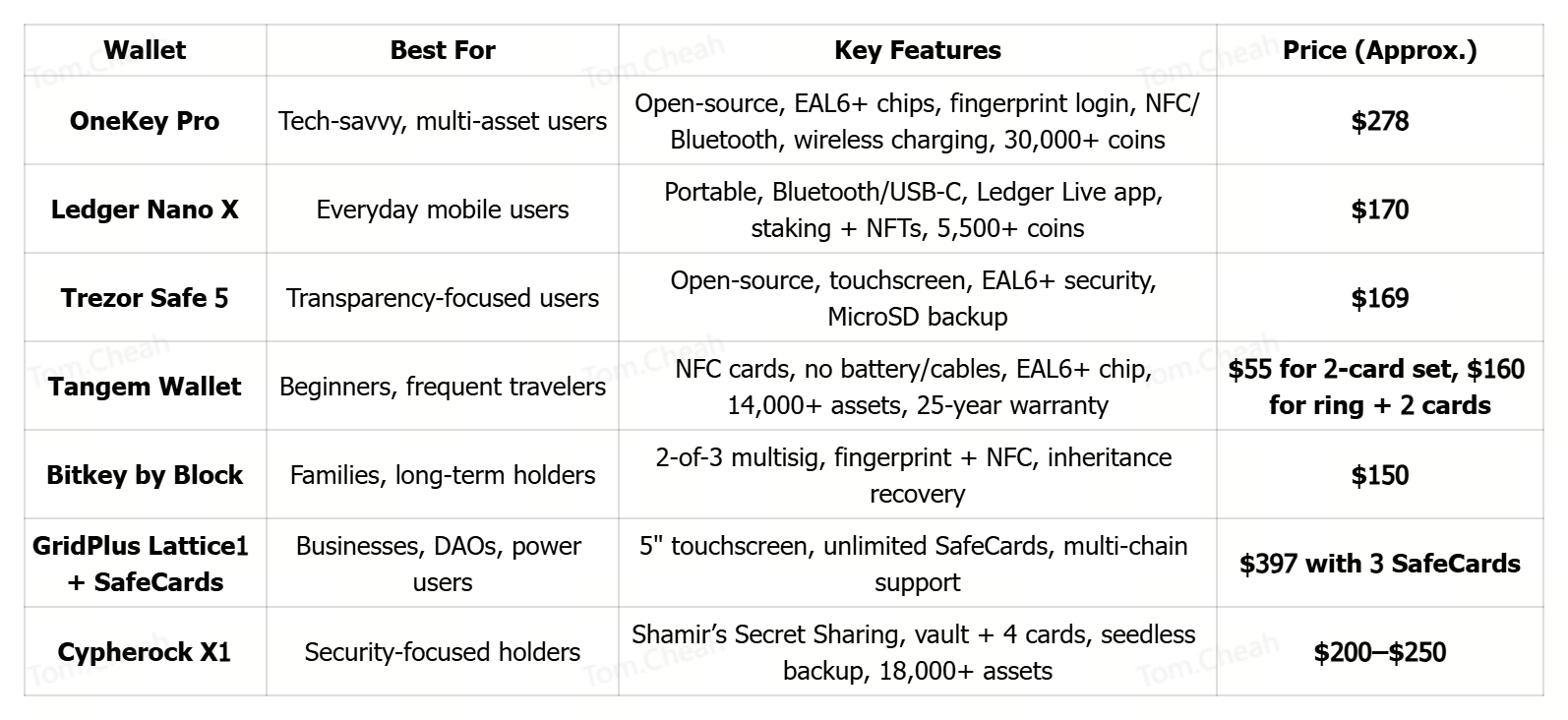

Alegerea portofelului hardware potrivit depinde de nevoile dumneavoastră, fie că este vorba de stocare simplă, comoditate mobilă sau funcții avansate precum planificarea moștenirii. Mai jos sunt șapte dintre cele mai bune portofele hardware din 2025, fiecare fiind de încredere pentru utilizatorii cripto din întreaga lume pentru păstrarea în siguranță a fondurilor.

1. Ledger Nano X

Ledger Nano X este unul dintre cele mai populare portofele hardware în 2025, cunoscut pentru combinarea portabilității cu o securitate offline puternică. Utilizează un cip de element securizat CC EAL5+ (Evaluation Assurance Level) și sistemul de operare proprietar BOLOS de la Ledger pentru a izola cheile private de amenințările online.

Cântărind doar 34 de grame, se conectează atât la smartphone-uri, cât și la desktop-uri prin Bluetooth sau USB-C, facilitând gestionarea în mișcare. Prin aplicația Ledger Live, utilizatorii pot stoca și gestiona peste 5.500 de active, inclusiv Bitcoin,

Ethereum,

Solana, monede stake precum

Tezos,

Cosmos și

Polkadot, sau chiar pot împrumuta stablecoins pentru venituri pasive. Cu un preț de aproximativ 170 de dolari, este disponibil în mai multe culori și include ocazional oferte bonus, cum ar fi Bitcoin în valoare de 50 de dolari.

Avantaje

• Cip CC EAL5+ cu securitate dovedită de nivel bancar

• Suportă peste 5.500 de monede și tokenuri cu opțiuni de staking și împrumut

• Portabil, ușor și funcționează atât cu mobilul, cât și cu desktop-ul

• Conectivitate Bluetooth și USB-C pentru flexibilitate

• Disponibil în mai multe culori cu bonusuri promoționale ocazionale

Dezavantaje

• Necesită aplicația Ledger Live pentru funcționalitate completă

• Mai scump decât modelele entry-level

• Bluetooth ridică mici preocupări de securitate pentru utilizatorii ultra-cauteli

2. Trezor Safe 5

Trezor Safe 5 este conceput pentru utilizatorii care prețuiesc transparența open-source și protecția puternică. Rulează integral pe firmware auditat de comunitate și utilizează un cip Secure Element EAL6+ pentru securitate de nivel industrial. Un ecran tactil color de 1,54” cu feedback haptic face confirmarea tranzacțiilor clară și simplă, în timp ce suportul pentru PIN, frază de acces și card MicroSD oferă siguranță suplimentară.

Cântărind doar 23 de grame, este compact, dar durabil, cu un ecran Gorilla Glass rezistent la zgârieturi, care rezistă bine utilizării zilnice. Împreună cu aplicația Trezor Suite, puteți gestiona mii de active, de la Bitcoin și Ethereum la NFT-uri și tokenuri DeFi, precum și să faceți staking de monede și să vă monitorizați portofoliul. Cu un preț de aproximativ 169 de dolari, Safe 5 oferă un echilibru între utilizabilitate, portabilitate și încredere pe termen lung.

Avantaje

• Firmware și design complet open-source pentru audit comunitar

• Element Securizat EAL6+ cu protecție PIN și frază de acces

• Ușor (23g) cu durabilitate Gorilla Glass

• Suportă recuperare cu 12, 20 și 24 de cuvinte plus backup-uri multi-partajate

• Funcționează cu Trezor Suite și aplicații terțe precum

MetaMaskDezavantaje

• Cost mai mare decât portofelele entry-level

• Configurarea prin ecran tactil poate părea complexă pentru utilizatorii începători

• Nu este la fel de compact ca portofelele bazate pe carduri precum Tangem

3. Portofel Tangem (Carduri și Inel)

Portofelul Tangem oferă o alternativă bazată pe carduri la dispozitivele USB, utilizând smartcarduri de dimensiunea unui card de credit sau Inelul Tangem cu cipuri securizate Samsung EAL6+ care generează chei private offline. Tranzacțiile sunt confirmate prin atingeri NFC pe telefonul dumneavoastră, fără a fi nevoie de baterii, cabluri sau actualizări de firmware.

Fiecare set include 2-3 carduri pentru redundanță, suportă peste 14.000 de monede și tokenuri și se asociază cu aplicația Tangem pentru cumpărare, schimb, staking și chiar cheltuieli legate de Visa. Construit pentru a rezista, cu rezistență la apă, praf și raze X, plus o garanție de 25 de ani, Tangem este ideal pentru începători, călători și utilizatori orientați spre mobil care doresc o stocare la rece simplă și durabilă. Prețurile încep de la aproximativ 55 de dolari pentru un set de 2 carduri și aproximativ 160 de dolari pentru un pachet inel + 2 carduri.

Avantaje

• Sistem simplu NFC tap-to-use, fără încărcare sau cabluri necesare

• Cipul securizat EAL6+ asigură că cheile private nu părăsesc niciodată cardul

• Aproape indestructibil, cu rezistență la apă, praf și raze X

• Redundanța multi-card permite backup și recuperare ușoară

• Suportă peste 14.000 de tokenuri plus integrare de plată legată de Visa

Dezavantaje

• Interfață fizică limitată comparativ cu portofelele bazate pe ecran

• Modelul de backup fără seed poate părea neobișnuit pentru utilizatorii tradiționali

• Se bazează puternic pe aplicația mobilă Tangem pentru gestionarea activelor

4. OneKey Pro

OneKey Pro este un portofel hardware de ultimă generație în 2025, conceput pentru utilizatorii care prioritizează atât securitatea de nivel enterprise, cât și flexibilitatea multi-chain. Dispune de patru cipuri Secure Element EAL6+, un ecran tactil de 3,5 inch, semnare QR air-gapped, autentificare cu amprentă digitală, Bluetooth/NFC, încărcare wireless și o cameră încorporată cu lanternă.

Firmware-ul și aplicația sa complet open-source, auditate de firme precum SlowMist, asigură transparență maximă. Suportând peste 30.000 de tokenuri și integrare perfectă cu portofele precum MetaMask și

Bitcoin Core, echilibrează utilizabilitatea prietenoasă pentru începători cu opțiuni avansate de securitate. Cu un preț de aproximativ 278 de dolari, OneKey Pro este unul dintre cele mai complete portofele disponibile astăzi.

Avantaje

• Patru cipuri Secure Element EAL6+ pentru protecție maximă

• Semnare QR air-gapped cu cameră pentru tranzacții mai sigure

• Complet open-source și auditat independent

• Suportă peste 30.000 de tokenuri pe mai multe blockchain-uri

• Autentificare cu amprentă digitală, Bluetooth/NFC și încărcare wireless

Dezavantaje

• Preț mai ridicat de ~278 de dolari comparativ cu alte portofele

• Dimensiunea mai mare poate fi mai puțin portabilă decât portofelele de tip card sau USB

• Funcțiile avansate pot părea copleșitoare pentru începători

5. Bitkey de la Block

Portofelul Bitkey, dezvoltat de Block Inc., echipa din spatele Square și Cash App, este un portofel hardware conceput pentru a face auto-custodia Bitcoin simplă și accesibilă. Utilizează un sistem multisig 2 din 3, cu o cheie stocată pe dispozitiv, una în aplicația mobilă și o a treia criptată pe serverul Block, astfel încât să nu fiți niciodată blocat dacă una este pierdută.

Caracteristicile cheie includ autentificarea cu amprentă digitală, asocierea NFC și un sistem unic de recuperare a moștenirii care permite moștenitorilor sau co-semnatarilor să acceseze fondurile în cazul în care vi se întâmplă ceva. Cu un preț de aproximativ 150 de dolari, Bitkey este construit pentru familii, deținători pe termen lung și utilizatori zilnici de Bitcoin care doresc securitate puternică fără complexitate.

Avantaje

• Sistem multisig 2 din 3 asigură redundanță și recuperare

• Funcție de recuperare a moștenirii pentru planificarea activelor pe termen lung

• Autentificare cu amprentă digitală și asociere NFC pentru comoditate

• Susținut de Block Inc., o companie axată pe Bitcoin

• Preț accesibil de ~150 de dolari

Dezavantaje

• Suport doar pentru Bitcoin, fără funcționalitate multi-chain

• Se bazează parțial pe serverul Block pentru a treia cheie

• Mai puține funcții avansate comparativ cu portofelele premium

6. GridPlus Lattice1 și SafeCards

GridPlus Lattice1, împreună cu SafeCards, este un portofel hardware conceput pentru investitori serioși, DAO-uri și instituții care necesită securitate avansată și scalabilitate. Dispune de un ecran tactil color mare de 5 inch pentru o revizuire clară a tranzacțiilor și suportă SafeCards nelimitate, fiecare acționând ca un portofel independent pentru împărțirea fondurilor între conturi, utilizatori sau echipe.

Construit cu o enclavă securizată, o plasă de detectare a manipulării și stocare offline a cheilor, suportă Ethereum, Bitcoin, Solana,

Binance Smart Chain, L2-uri și alte rețele compatibile EVM. Cu un preț de aproximativ 397 de dolari, incluzând trei SafeCards, este mai voluminos decât portofelele standard, dar oferă flexibilitate și control de nivel enterprise.

Avantaje

• Ecran tactil mare de 5 inch pentru verificare ușoară a tranzacțiilor

• SafeCards nelimitate pentru utilizare multi-cont și în echipă

• Suportă Bitcoin, Ethereum, Solana, BSC, L2-uri și tokenuri EVM

• Enclavă securizată cu plasă de detectare a manipulării pentru stocarea offline a cheilor

• Ideal pentru DAO-uri, afaceri și deținători mari care necesită controale avansate

Dezavantaje

• Preț mai mare (~397 de dolari) decât portofelele de consum

• Design mai mare, mai puțin portabil

• Complexitatea poate fi excesivă pentru utilizatorii ocazionali sau începători

7. Cypherock X1

Cypherock X1 este un portofel hardware construit în jurul Shamir’s Secret Sharing (SSS), împărțind cheia privată în cinci părți, una stocată în X1 Vault și patru pe smartcarduri separate, activate NFC. Pentru a aproba tranzacțiile, aveți nevoie de Vault plus cel puțin un card, asigurându-vă că pierderea unei singure piese nu vă compromite fondurile. Fiecare card conține un cip de element securizat EAL6+, oferind securitate de nivel bancar, și poate fi stocat în diferite locații pentru redundanță.

Suportând peste 18.000 de active, DeFi, NFT-uri și WalletConnect, Cypherock X1 elimină necesitatea frazelor seed, prioritizând în același timp redundanța și liniștea sufletească. Cu un preț competitiv în gama portofelelor premium, este cel mai potrivit pentru familii, deținători pe termen lung și investitori care gestionează portofolii mai mari.

Avantaje

• Shamir’s Secret Sharing împarte cheile între vault + carduri pentru siguranță suplimentară

• Nu este necesară fraza seed, reducând riscurile de furt sau pierdere

• Element securizat EAL6+ pentru securitate de nivel bancar

• Suportă peste 18.000 de active, DeFi, NFT-uri și WalletConnect

• Cardurile pot fi stocate separat pentru redundanță sau planificare a moștenirii

Dezavantaje

• Configurare mai complexă decât portofelele bazate pe carduri sau USB

• Necesită urmărirea mai multor smartcarduri

• Preț mai mare decât portofelele entry-level

Cum să Alegi Cel Mai Bun Portofel Hardware pentru Tine

„Cel mai bun” portofel hardware depinde de nevoile, bugetul și modul în care intenționați să utilizați criptomonedele. Iată câteva profiluri practice pentru a vă ajuta să decideți:

• Pentru Începători și Utilizatori Zilnici: Dacă sunteți nou în auto-custodie, începeți cu ceva simplu, cum ar fi Ledger Nano X sau OneKey Classic 1S. Ambele oferă configurare ușoară, asociere mobilă și interfețe simple care le fac mai puțin intimidante pentru utilizatorii începători.

• Pentru Investitori Conștienți de Securitate sau Multi-Chain: Dacă dețineți active pe mai multe blockchain-uri, portofele precum OneKey Pro, Trezor Safe 5 și Ledger Nano X oferă suport larg pentru tokenuri cu protecție offline puternică. Aceste opțiuni echilibrează utilizabilitatea cu securitatea ridicată, făcându-le ideale pentru portofolii active și diversificate.

• Pentru Stocare la Rece pe Termen Lung: Dacă stocați criptomonede pe termen lung, alegeți dispozitive durabile, cu întreținere redusă, cum ar fi OneKey Classic 1S Pure (fără baterie) sau Tangem Wallet Cards. Aceste soluții se concentrează pe fiabilitate și redundanță, perfecte pentru „vault” savings strategies.

• Pentru Utilizatori Minimaliști, Orientati spre Mobil: Dacă doriți comoditate fără cabluri sau aplicații, Tangem Cards/Ring și Bitkey oferă funcționalitate tap-and-go cu NFC și verificare prin amprentă digitală. Sunt compacte, ușor de transportat și construite pentru confirmări rapide în mișcare.

• Pentru Susținătorii Open-Source: Dacă transparența este prioritatea dumneavoastră principală, OneKey Pro, OneKey Classic 1S și Trezor Safe 5 se remarcă. Firmware-ul lor open-source permite audituri comunitare, oferindu-vă o liniște sufletească suplimentară că portofelul dumneavoastră este lipsit de riscuri ascunse.

Gânduri Finale

Nu există un singur portofel hardware „cel mai bun”, ci doar cel care se potrivește priorităților dumneavoastră. Unii utilizatori pot aprecia comoditatea mobilă, în timp ce alții preferă transparența open-source sau stocarea offline ultra-securizată. Portofelele evidențiate mai sus se numără printre cele mai de încredere opțiuni în 2025, fiecare oferind un echilibru între utilizabilitate și protecție.

Acestea fiind spuse, gestionarea propriilor chei vine cu responsabilitate. Faceți întotdeauna backup în siguranță frazei de recuperare, nu cumpărați niciodată dispozitive second-hand și verificați tranzacțiile direct pe ecranul portofelului. Criptomonedele sunt un activ la purtător; dacă vă pierdeți cheile, fondurile dumneavoastră sunt pierdute. Tratați portofelul hardware nu doar ca un instrument, ci ca fundamentul suveranității dumneavoastră digitale.

Lecturi Conexe

Întrebări Frecvente despre Portofelele Reci (Hardware)

1. Sunt sigure portofelele hardware?

Da. Portofelele hardware se numără printre cele mai sigure opțiuni pentru stocarea criptomonedelor, deoarece cheile private rămân offline, dar siguranța depinde și de securizarea frazei de recuperare și de achiziționarea dispozitivelor direct de la surse de încredere.

2. Cum să transferi criptomonede într-un portofel hardware?

Pe BingX, accesați Retragere, alegeți criptomoneda (ex: BTC sau ETH), introduceți adresa de primire a portofelului hardware și confirmați cu 2FA. Testați întotdeauna cu o sumă mică înainte de a transfera fonduri mai mari.

3. Costă bani transferul de criptomonede către și dinspre un portofel hardware?

Da. Mutarea fondurilor către sau dinspre un portofel hardware implică plata taxelor de rețea blockchain (ex: taxe de gaz sau de miner). Aceste taxe variază în funcție de rețea, dar nu sunt legate de portofelul în sine.

4. Poți face staking de criptomonede dintr-un portofel hardware?

Da. Multe portofele hardware se integrează cu aplicații precum Ledger Live sau Trezor Suite, permițându-vă să faceți staking de active precum ETH, ATOM sau DOT direct, păstrând în același timp cheile offline.

5. Cât costă un portofel hardware?

Majoritatea portofelelor hardware variază între 50 și 300 de dolari, în funcție de caracteristici precum ecrane tactile, Bluetooth, firmware open-source sau suport multi-chain. Modelele de bază sunt mai ieftine, în timp ce dispozitivele avansate de nivel enterprise costă mai mult.