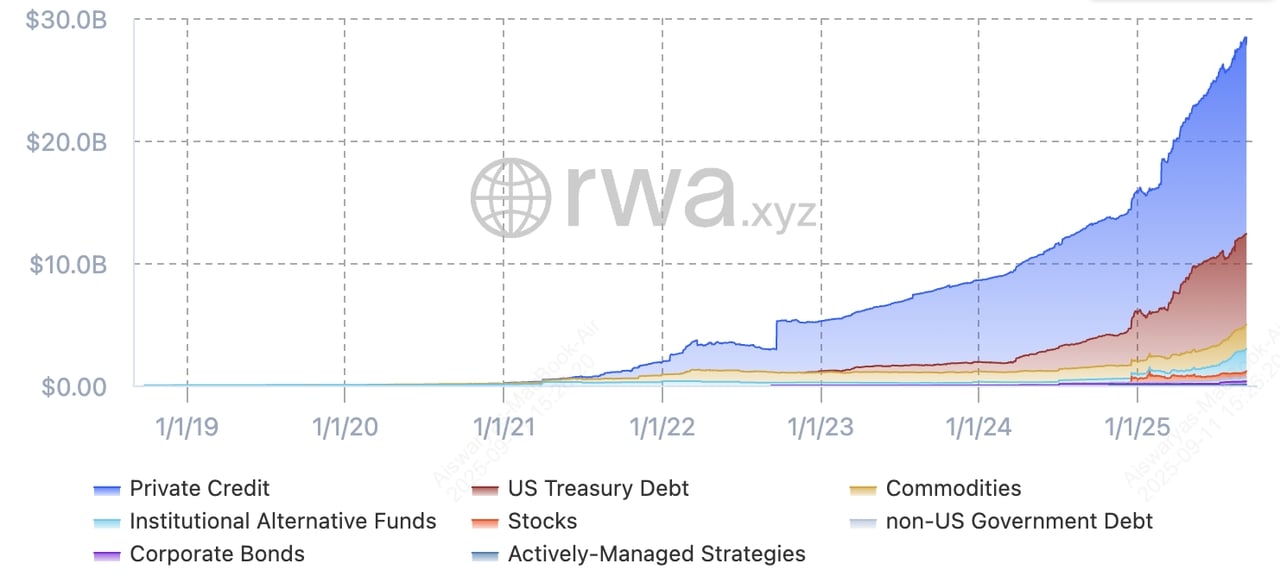

This growth reflects rising institutional confidence. RWA tokens provide steady income streams from rent, bond coupons, or dividends, while blending DeFi’s efficiency with the stability of real-world assets. At the same time, regulators are moving from silence to structured support.

Discover the leading RWA tokenization projects that are shaping the market in 2025. These ten platforms stand out for their regulatory compliance, on-chain activity, and proven use cases across real estate, bonds, commodities, and more.

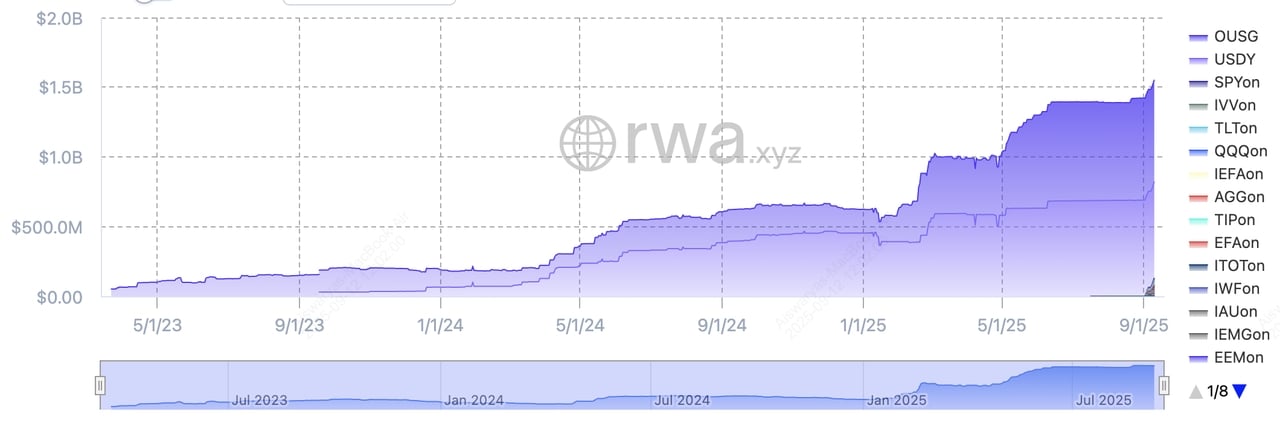

1. Ondo (ONDO)

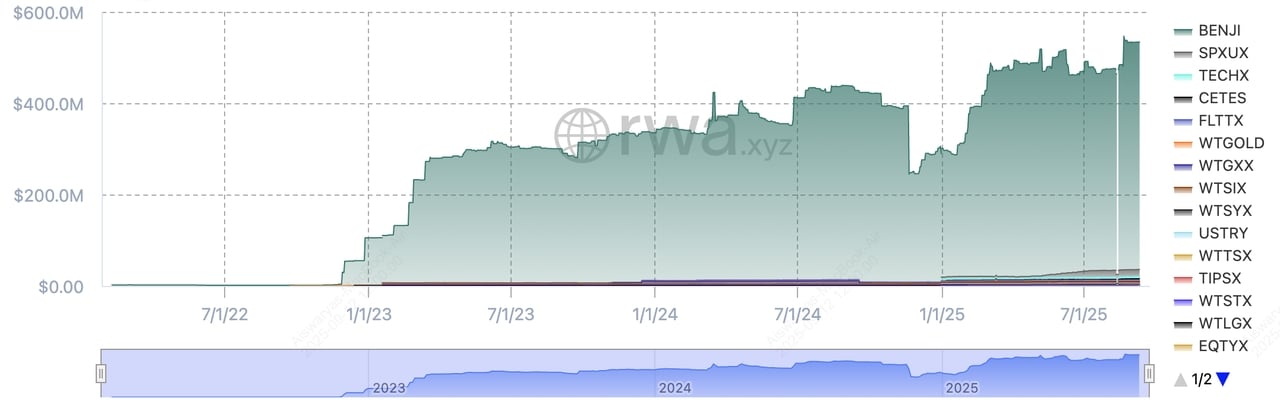

OUSG AUM across blockchains | Source: RWA.xyz

Ondo (ONDO) is a regulated U.S. Money Services Business (MSB) that specializes in tokenizing short-term U.S. Treasuries and high-quality bonds. Its flagship OUSG fund has over $446.9M TVL across

Ethereum,

Solana, and

Polygon , offering a ~4% APY with low fees. Backed 1:1 by securities and verified through monthly audits, OUSG gives on-chain investors compliant exposure to traditional debt markets.

In September 2025,

Ondo expanded into tokenized equities with Ondo Global Markets, a platform offering over 100 U.S. stocks and ETFs on-chain (scaling to 1,000+ by year-end) through a partnership with Alpaca. These assets trade 24/7, settle instantly, and can be used in DeFi like stablecoins, opening U.S. equity access to non-U.S. investors in Asia, Africa, and Latin America. This move positions Ondo as one of the most comprehensive RWA providers—bridging Treasuries, bonds, and now tokenized stocks and ETFs into the blockchain economy.

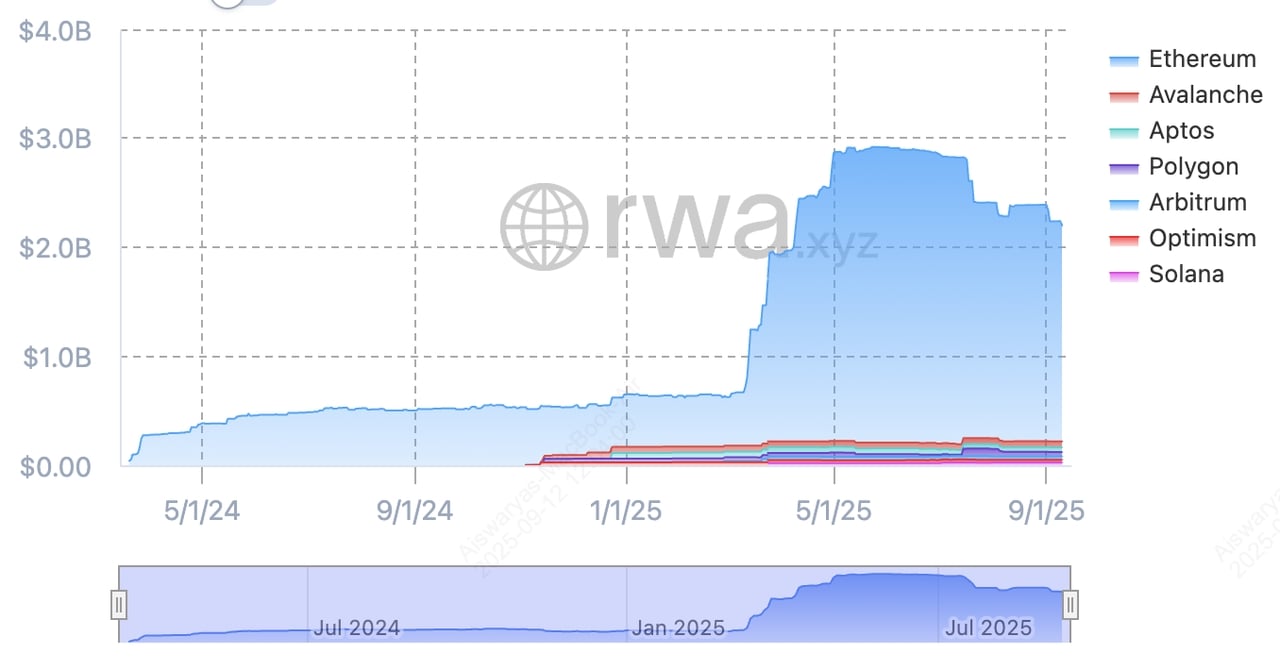

2. BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

BlackRock BUIDL AUM across blockchains | Source: RWA.xyz

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is the largest tokenized Treasury product to date, with $2.3–$2.9 billion AUM and a stable $1.00 NAV. Designed for U.S. accredited and institutional investors, it invests exclusively in U.S. Treasuries, cash, and repo agreements, distributing yield in the form of new BUIDL tokens. Subscriptions typically require $5M+ minimums, KYC/AML checks, and whitelisted wallets, making it an institutional-grade option for earning safe, on-chain yield.

Built on Securitize and operating across Ethereum, Polygon,

Avalanche,

Optimism,

Arbitrum,

Aptos, and Solana, BUIDL provides 24/7 liquidity with near-instant settlement. Custody is handled by BNY Mellon with audits by PwC, while integrations with Anchorage Digital, BitGo, Coinbase, and Fireblocks provide secure transfer and collateralization. Already accepted as collateral on major crypto platforms, BUIDL combines BlackRock’s scale and regulatory rigor with blockchain efficiency, setting the benchmark for tokenized money-market funds.

3. Stellar (XLM)

Tokenized asset value on Stellar network | Source: RWA.xyz

Stellar (XLM) is a blockchain built for real-world asset tokenization and global payments, enabling institutions to issue tokenized treasuries, bonds, stablecoins, and other assets with built-in compliance controls. Trusted for over a decade, Stellar powers 24/7 settlements in 180+ countries, connecting banks, fintechs, and humanitarian organizations through a low-cost, transparent network. With features like native asset management tools (approve, revoke, freeze), interoperability via Hyperledger Cacti connectors, and partnerships with major players like Circle, Paxos, and SG-FORGE, Stellar offers a practical way to bring RWAs on-chain while ensuring regulatory compliance and global accessibility.

4. Chainlink (LINK)

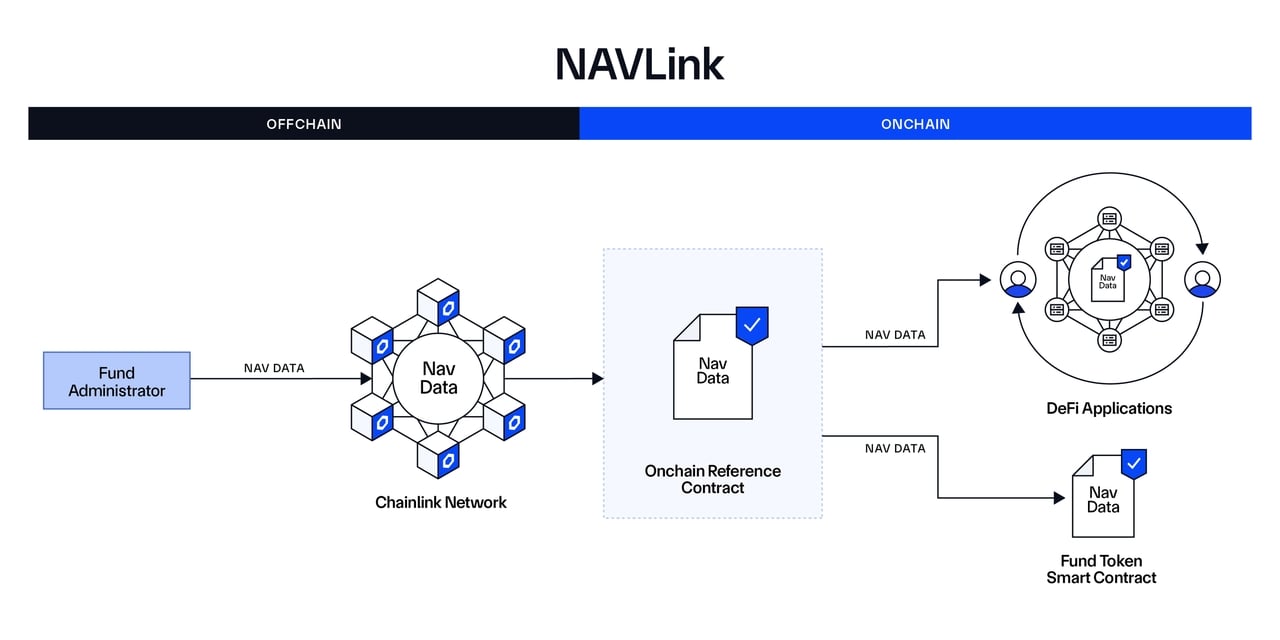

An overview of Chainlink's NAVLink for RWA tokenization | Source: Chainlink

Chainlink (LINK) has become the backbone of real-world asset tokenization by delivering the data infrastructure that makes tokenized finance work. Its

Proof of Reserve feeds verify that tokenized Treasuries, commodities, and funds are fully backed, while NAVLink ensures accurate net asset values are streamed on-chain in real time. This infrastructure powers workflows like cross-chain delivery-versus-payment pilots with J.P. Morgan and Ondo Finance, and is already trusted by global institutions including Swift, Euroclear, Fidelity International, UBS, and Mastercard. With over $25 trillion in transaction value enabled, Chainlink provides the trust layer required for RWAs to scale securely.

In practice, Chainlink oracles give investors confidence that tokenized assets are legitimate and compliant. For example, BlackRock’s BUIDL and Franklin Templeton’s BENJI rely on Chainlink modules to publish proof-of-reserve data, while DeFi platforms like

Aave and

Pendle use Chainlink price feeds to integrate RWAs into lending and yield markets. By automating settlement, compliance checks, and cross-chain messaging, Chainlink bridges TradFi and DeFi, ensuring RWAs can be traded 24/7 with the same reliability as traditional markets but with the efficiency and composability of blockchain.

5. Plume (PLUME)

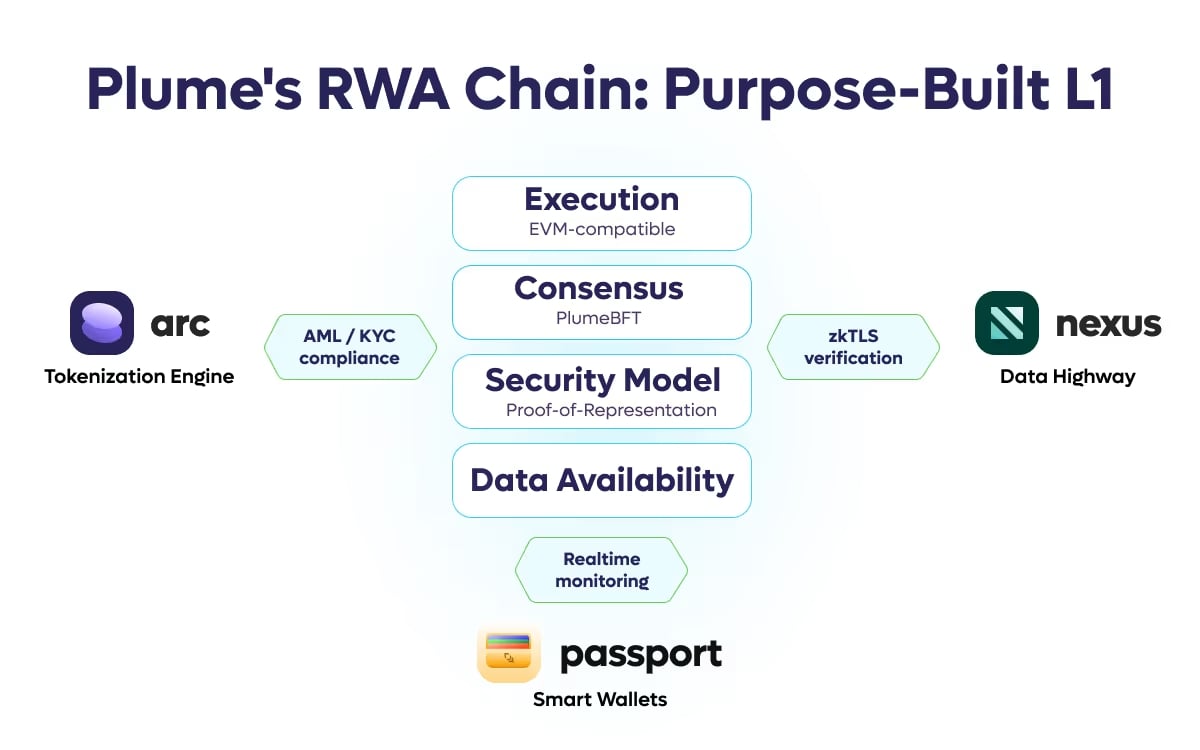

Plume's RWA Chain | Source: Plume

Plume (PLUME) is an EVM-compatible blockchain purpose-built for real-world assets (RWAs), supporting tokenization of real estate, private credit, ETFs, commodities, and even new categories like GPUs. With more than 200 ecosystem partners, $392M+ in TVL, and $5B in assets in its pipeline, Plume enables users to earn yield, borrow liquidity, or invest in diversified vaults backed by RWAs. The platform introduces tools like Plume USD (pUSD), a USDC-backed stablecoin, and Plume ETH (pETH), a liquid staking derivative, making it practical for everyday DeFi strategies.

Beyond infrastructure, Plume is scaling fast with over 3M community members and major partnerships, including Apollo, Mercado Bitcoin, and Superstate. Its built-in compliance, such as AML screening at the sequencer level, ensures institutional confidence while maintaining accessibility for retail users.

6. XDC Network (XDC)

Source: XDC Network

XDC Network (XDC) is a hybrid EVM-compatible Layer 1 blockchain tailored for enterprise-grade trade finance and real-world asset tokenization. It handles 2,000+ transactions per second with near-zero gas fees of around $0.00013, making it practical for tokenizing U.S. Treasuries, trade receivables, and commodities at scale. With ISO 20022–compliant payment rails and interoperability bridges to Corda and Wanchain, XDC connects seamlessly with banking systems. Its built-in on-chain escrow modules secure collateral in smart contracts, enabling automated settlements that reduce counterparty risk. This blend of low cost, high throughput, and regulatory-ready infrastructure positions XDC as a go-to network for RWA finance.

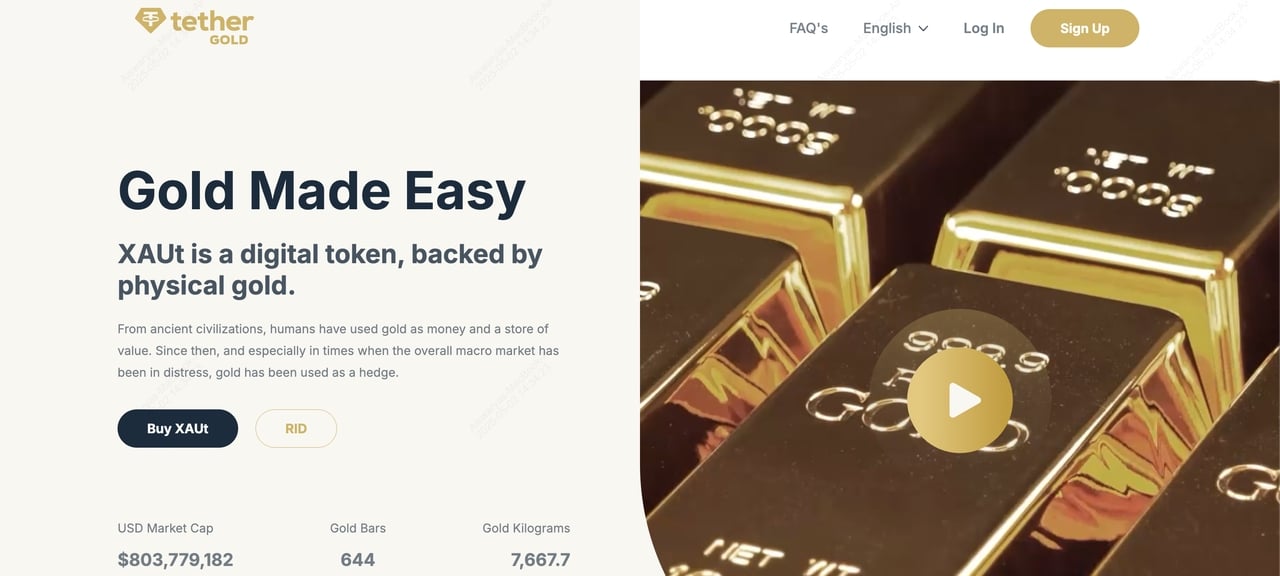

7. Tether Gold (XAUT)

Source: Tether Gold

Tether Gold (XAUT) is a gold-backed stablecoin that gives you direct ownership of physical gold, with each token backed 1:1 by LBMA-accredited bars stored in Swiss vaults. As of September 2025, it represents over $1.36B in market cap across 966 bars or 11,693.4 kg of fine gold. You can trade XAUT 24/7 on Ethereum,

BNB Chain, and

Tron, or even redeem tokens for physical delivery in Switzerland. The token is divisible down to 0.000001 troy ounce, audited regularly for transparency, and widely used as a hedge against inflation, combining the reliability of gold with the portability and accessibility of crypto.

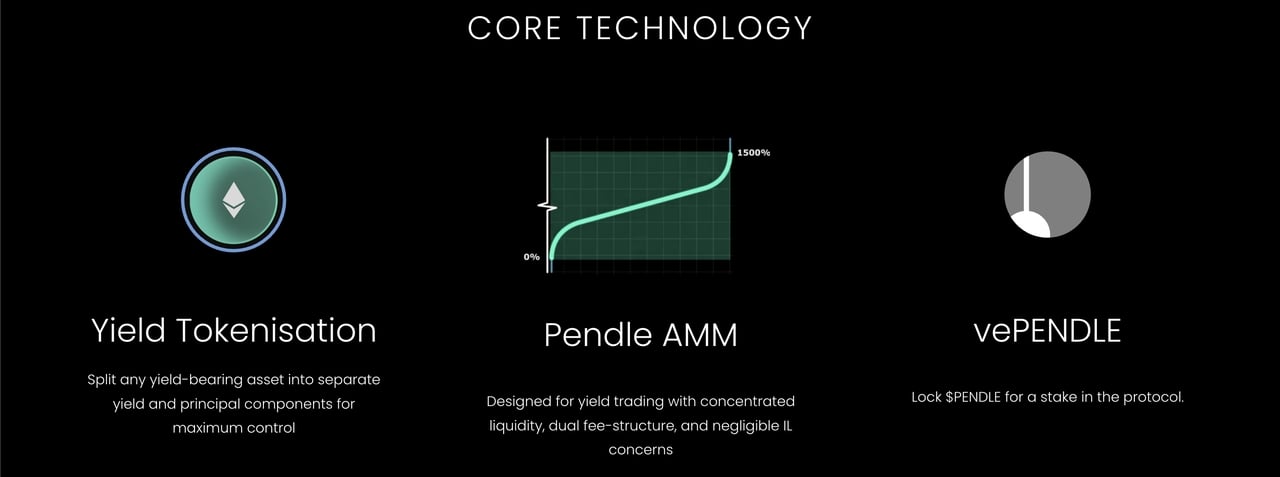

8. Pendle (PENDLE)

How Pendle works | Source: Pendle Finance

Pendle (PENDLE) is the leading DeFi protocol for yield-tokenization, letting you split real-world bonds into two tradeable assets: Principal Tokens (PTs) that secure the bond’s face value and Yield Tokens (YTs) that capture future interest payments. This setup makes it easy to lock in fixed income with PTs or speculate on changing yields by trading YTs in Pendle’s secondary markets. With over $12B TVL, integrated leverage tools, and support for Ethereum,

Arbitrum, BNB Chain, and

Optimism, Pendle gives investors a practical way to optimize returns and manage risk when earning from tokenized real-world assets.

9. Ethena USDe (USDE)

An overview of Ethena's USDe | Source: Ethena

Ethena USDe (USDe) is a synthetic dollar backed by short-term U.S. Treasuries and stablecoin reserves, with a protocol backing ratio above 100% for stability. As of September 2025, it has a market cap of ~$13.2B and over 795,000 users, making it one of the largest RWA-backed stable assets. Users can mint USDe at a $1 peg and stake it into sUSDe to earn up to ~8% APY, with weekly proof-of-reserve audits and monthly custodian attestations ensuring transparency. Integrated with platforms like Binance, Aave, and TON, USDe is used for savings, trading collateral, and DeFi strategies, giving investors a practical way to earn yield while holding a stable dollar-denominated asset.

10. Polymesh (POLYX)

Polymesh RWA tokenization | Source: Polymesh

Polymesh (POLYX) is a public permissioned blockchain purpose-built for regulated assets like equity, debt, real estate, and commodities. With native KYC/AML compliance, identity verification, governance, and settlement layers, it eliminates the need for third-party smart contracts, cutting costs and streamlining workflows. Over 40 companies already build on Polymesh, supported by 93 operator nodes, and users can stake POLYX (earning ~22% rewards) to secure the network. Its API and SDK make it practical for financial institutions to issue, manage, and trade security tokens directly within existing legal frameworks, ensuring regulatory alignment from day one.

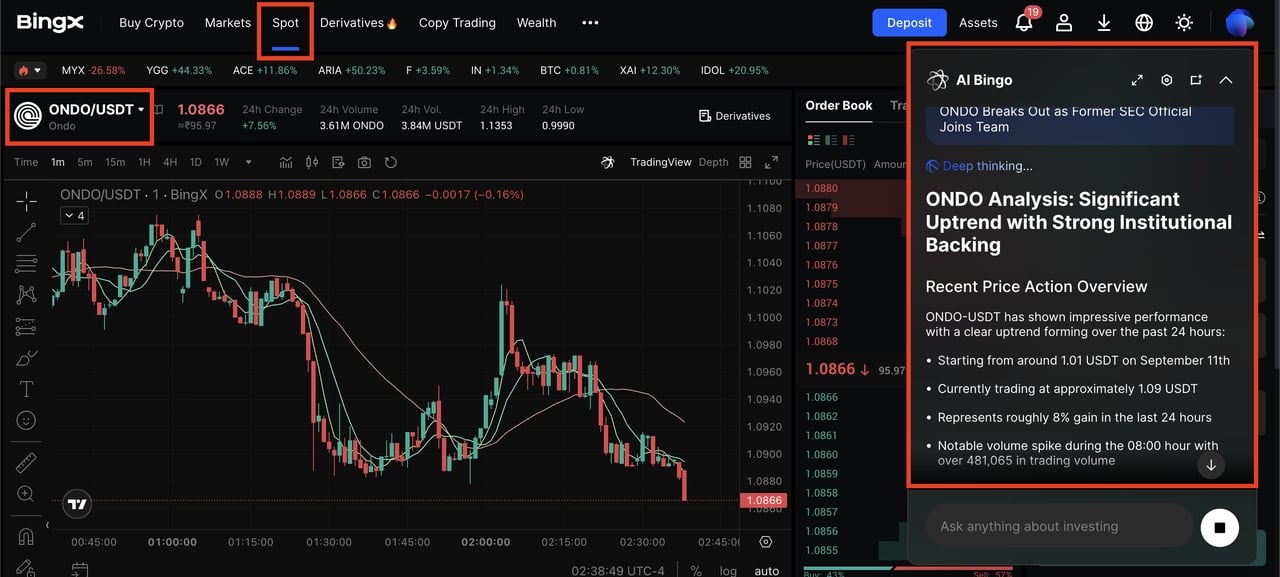

How to Trade RWA Tokens on BingX

ONDO/USDT trading pair on the spot market, powered by BingX AI

Here’s a quick guide to buying and selling RWA tokens on

BingX’s spot market.

BingX AI enhances the process by offering real-time trading insights, AI-powered signals, and risk management tips, helping you trade smarter.

1. Sign Up & Verify: Create your free BingX account with an email or phone number. Complete

KYC by uploading an ID and selfie. Enable

two-factor authentication (2FA) for extra security, and set a withdrawal whitelist to secure your assets.

2. Deposit USDT or ETH: Go to Assets → Deposit and select USDT or ETH. Choose a low-fee network like TRON (TRC20) or Polygon (ERC-20 with MATIC gas). Copy the deposit address and transfer funds from your external wallet or exchange. Your balance updates within minutes.

3. Find the Pair: Navigate to Trade → Spot Trading. Use the search bar to find the RWA token pair you want, e.g.,

ONDO/USDT,

XAUT/USDT, or

LINK/USDT. BingX AI can help you analyze price charts and order books to identify the best entry points.

4. Place Your Order: Select your order type:

• Market Order for instant execution at the current best price.

• Limit Order to buy or sell at a set price.

Enter the amount and confirm. BingX AI assists by tracking trade performance and providing tailored insights so you can manage risk effectively.

Key Considerations Before Investing in RWA

Before you invest in RWA tokens, carefully evaluate these key factors to protect your capital and manage risk.

1. Regulatory Compliance: Always verify that the token provider holds proper licenses, such as SFC approval in Hong Kong, MSB registration in the U.S., or SEC filings. Licensed issuers follow strict rules to protect investors.

2. Audit Transparency: Look for third-party proof-of-reserve reports and on-chain smart-contract audits. Regular audits show that the underlying assets truly back the tokens and that the code is secure.

3. Underlying Asset Verification: Check how the asset is held. Real estate should be in a legally recognized SPV or trust. Bonds should list a clear custodian. Precious metals need vault receipts from accredited institutions.

4. Yield vs. Risk: Understand each token’s yield source - rent, dividends, or coupon payments. Review lock-up periods, withdrawal windows, and fee structures. Higher yields can come with longer lock-ups or lower liquidity.

Closing Thoughts

RWA tokenization blends TradFi stability with DeFi flexibility and opens new yield and diversification opportunities, but it carries risks like smart-contract bugs, regulatory changes, and potential liquidity constraints. Always conduct thorough due diligence: verify audits, confirm legal structures, and understand lock-up terms before you invest. Stay informed, diversify your holdings, and use clear exit strategies as this evolving market unfolds.

Related Reading