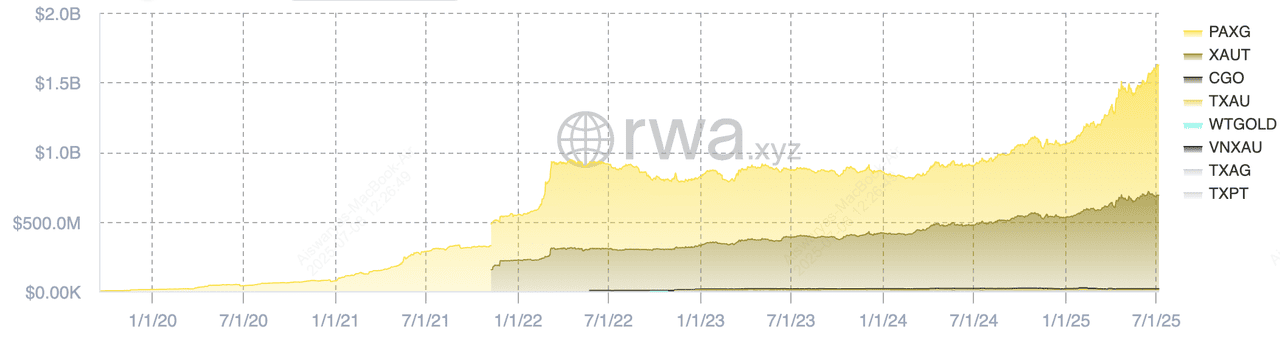

Stablecoin-urile susținute de mărfuri sunt token-uri digitale ancorate la active tangibile precum aurul și argintul. În 2025, capitalizarea lor de piață a atins 1,9 miliarde de dolari, o creștere de 67,8% față de 2024. Cu toate acestea, ele reprezintă încă doar 0,8% din piața stablecoin-urilor susținute de monede fiduciare. Aceste token-uri oferă o protecție stabilă, bazată pe blockchain, în perioadele de incertitudine economică.

TVL mărfuri tokenizate | Sursa: RWA.xyz

Descoperiți cele mai bune 5 stablecoin-uri susținute de mărfuri din 2025, inclusiv PAXG și XAUT, și aflați cum aceste token-uri de aur și argint aduc

active din lumea reală în blockchain pentru investiții sigure și rentabile.

Ce Sunt Stablecoin-urile Susținute de Mărfuri?

Stablecoin-urile susținute de mărfuri sunt token-uri digitale ancorate la valoarea activelor fizice precum aurul, argintul sau alte materii prime. Fiecare token reprezintă o revendicare 1:1 asupra unei mărfuri tangibile stocate în siguranță în seifuri asigurate. Puteți tranzacționa aceste token-uri pe platforme blockchain sau, în multe cazuri, le puteți răscumpăra pentru activul subiacent. Această configurație vă permite să accesați mărfuri din lumea reală fără a manipula direct lingouri de aur sau argint.

Începând cu iulie 2025, CoinMarketCap listează aproape 40 de stablecoin-uri susținute de mărfuri, cu o capitalizare de piață combinată de peste 1,8 miliarde de dolari și un volum zilnic de tranzacționare care depășește 102 milioane de dolari. Conform raportului RWA al CoinGecko din 2025, capitalizarea de piață a token-urilor susținute de mărfuri a crescut cu 67,8% de la an la an, adăugând 773,9 milioane de dolari și atingând un maxim istoric de 1,9 miliarde de dolari. Această creștere a fost alimentată în mare parte de creșterea prețurilor aurului, deoarece investitorii au căutat active de refugiu în timpul tensiunilor geopolitice și incertitudinii economice.

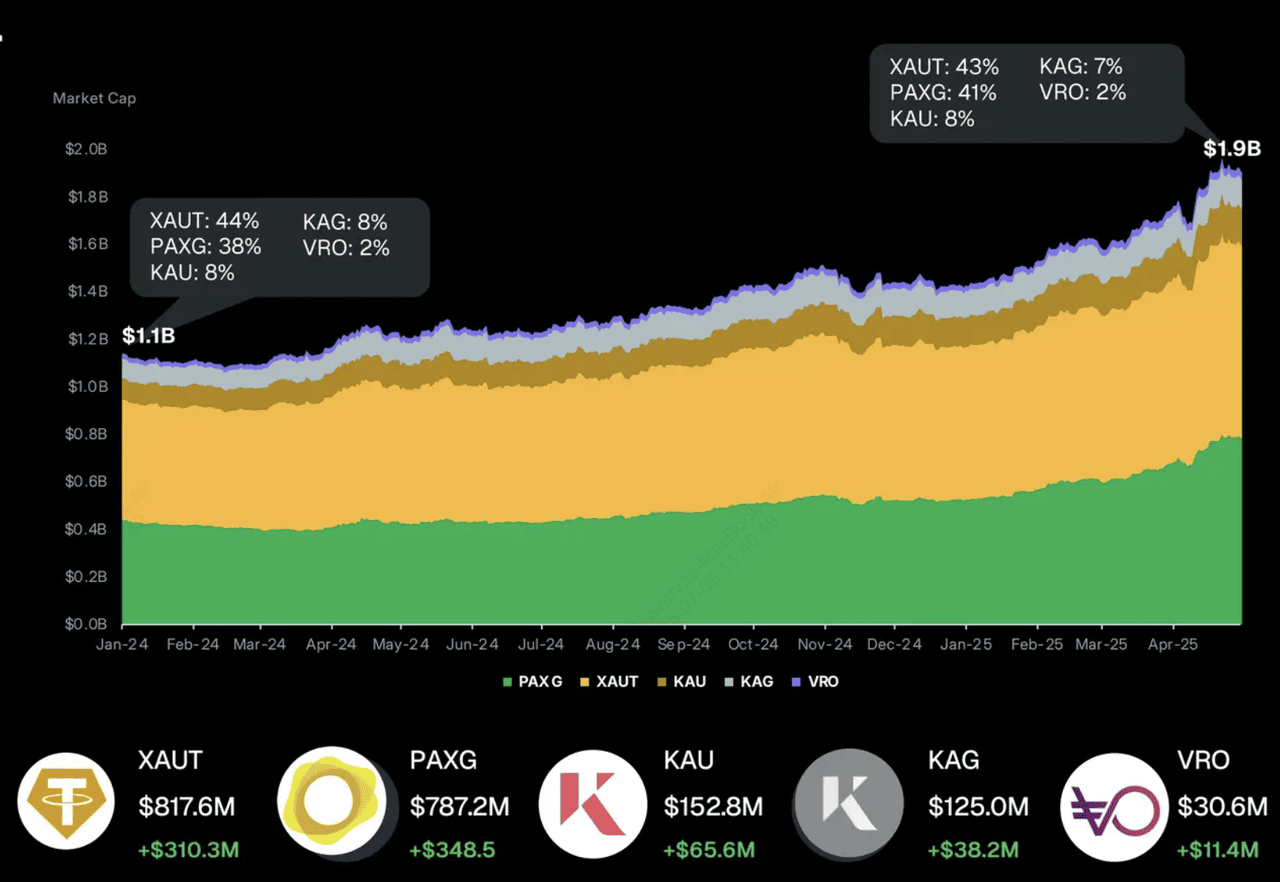

Creșterea capitalizării de piață a token-urilor susținute de mărfuri | Sursa: CoinGecko

Cu toate acestea, aceste token-uri rămân un segment mic al

pieței stablecoin-urilor, reprezentând doar 0,8% din capitalizarea totală de piață a stablecoin-urilor susținute de monede fiduciare. Chiar și cu o creștere semnificativă, token-urile susținute de mărfuri rămân în urma celor susținute de monede fiduciare (creștere de 67,8% față de 76,4%), reflectând atractivitatea lor de nișă.

Tether Gold (XAUT) și

Paxos Gold (PAXG) domină acest spațiu, reprezentând 84% din capitalizarea de piață a metalelor prețioase tokenizate.

Deși aceste stablecoin-uri oferă transparență prin audituri regulate și acces digital prin platforme

DeFi, există și limitări. Taxele de stocare, riscurile de custodie și lichiditatea mai scăzută în comparație cu

stablecoin-urile susținute de monede fiduciare vă pot afecta capacitatea de a le tranzacționa sau răscumpăra eficient. Pentru începători, este esențial să înțelegeți acești factori înainte de a adăuga token-uri susținute de mărfuri în portofoliul dvs. de criptomonede.

Top 5 Stablecoin-uri Ancorate la Mărfuri în 2025

Iată primele cinci stablecoin-uri ancorate la mărfuri în 2025, care oferă o modalitate sigură de a obține expunere la metale prețioase fără a le deține fizic.

| Token |

Activ |

Locație de Susținere |

Cap. (USD) |

Volum Zilnic |

Lanțuri |

Răscumpărabil |

| PAXG |

Aur |

Seifuri Londra |

$933 M |

$45 M |

ETH, BSC, Solana… |

Da (lingouri) |

| XAUT |

Aur |

Seifuri Elveția |

$821 M |

$25 M |

ETH, TRON, TON |

Da |

| KAU |

Aur |

Seifuri asigurate |

$156 M |

Mediu |

ERC-20 |

Da |

| KAG |

Argint |

Seifuri asigurate |

$153 M |

Scăzut |

ERC-20 |

Da |

| XAUM |

Aur |

Asia (seif LBMA) |

$45 M |

Scăzut |

ERC-20, BEP-20 |

Probabil |

1. PAX Gold (PAXG)

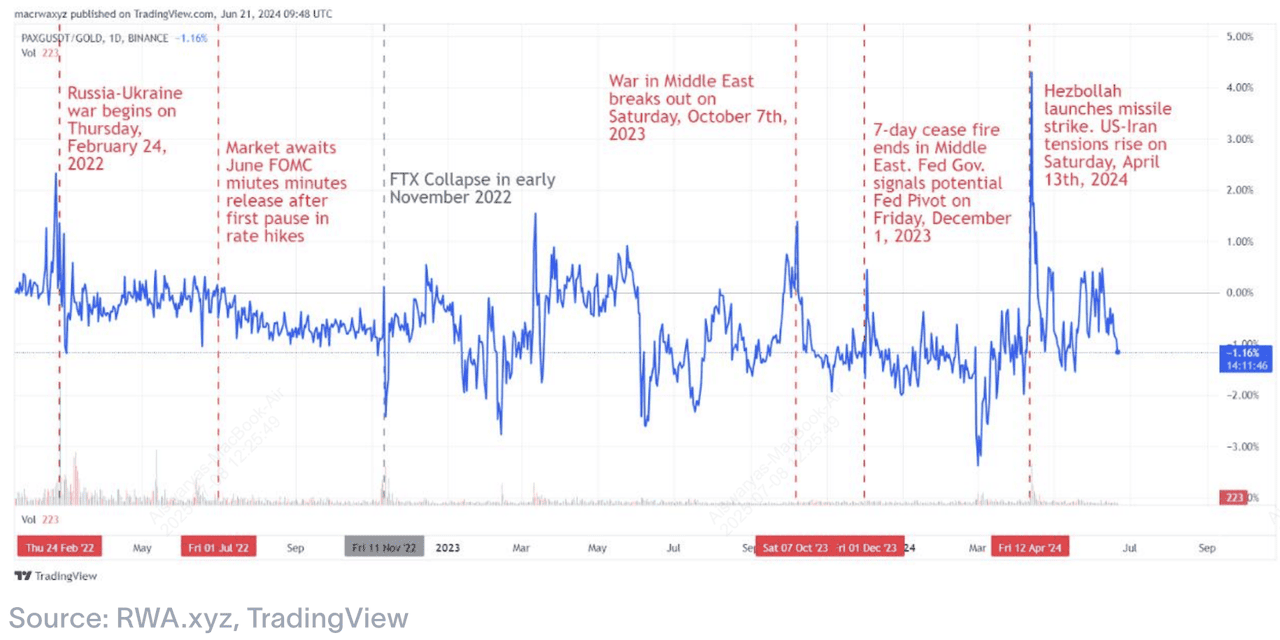

Contracte financiare PAXG/susținute de aur | Sursa: RWA.xyz

PAX Gold (PAXG) este un activ digital reglementat, de grad investițional, care vă oferă proprietatea asupra aurului fizic cu toată viteza și flexibilitatea tehnologiei blockchain. Fiecare token PAXG reprezintă o uncie troy fină de aur stocată în siguranță în seifuri acreditate LBMA din Londra. Emis de Paxos Trust Company, reglementată de NYDFS, PAXG este pe deplin susținut,

auditat lunar de KPMG și oferă o modalitate rentabilă de a accesa aurul cu zero taxe de stocare și fără risc de decontare.

Spre deosebire de ETF-urile sau contractele futures tradiționale pe aur, PAXG permite proprietatea fracționată începând de la doar 0,01 uncii troy (~20 USD) și decontare aproape instantanee pe Ethereum. Investitorii pot răscumpăra token-uri pentru lingouri de aur LBMA Good Delivery, aur Loco London nealocat sau USD la ratele pieței, făcându-l unul dintre puținele token-uri de aur cu opțiuni de răscumpărare fizică. Cu o capitalizare de piață de aproximativ 933 milioane de dolari și volume zilnice de tranzacționare de 45 milioane de dolari, PAXG este foarte lichid și acceptat pe mai multe lanțuri (

Ethereum,

BSC,

Solana și

Arbitrum). Cu toate acestea, rețineți că răscumpărarea aurului fizic implică taxe de procesare, iar custodia este centralizată sub Paxos.

2. Tether Gold (XAUT)

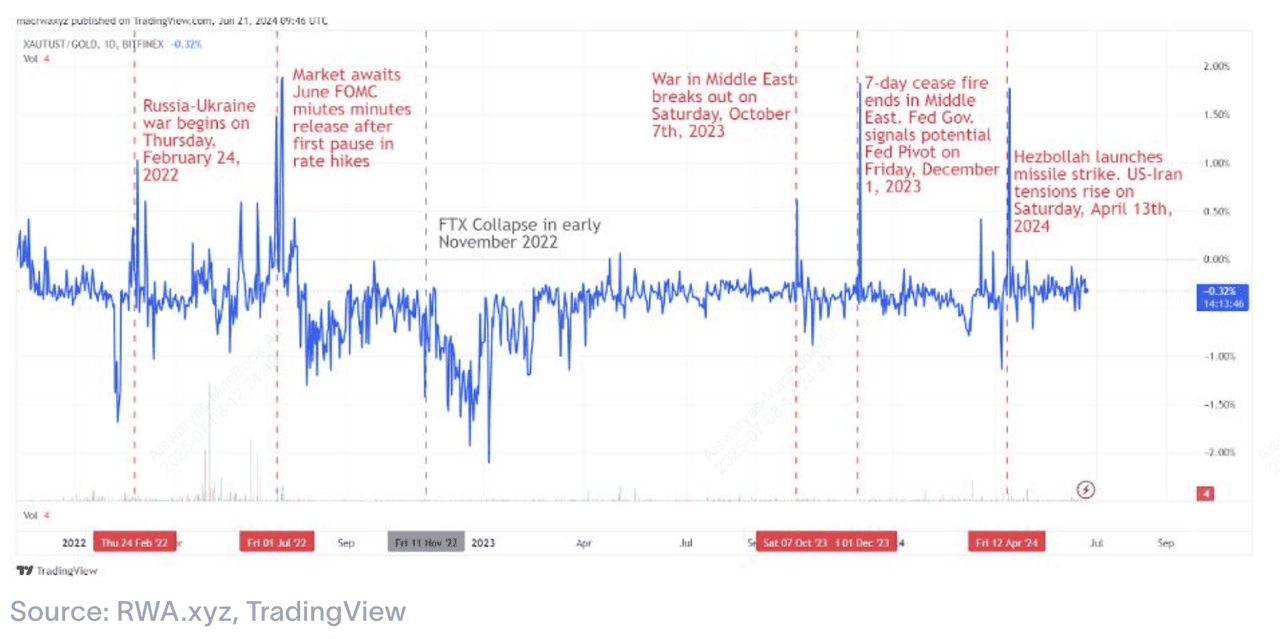

Contracte financiare XAUT/susținute de aur | Sursa: RWA.xyz

Tether Gold (XAUt) este un token digital care vă oferă proprietatea directă asupra aurului fizic stocat în siguranță în seifuri elvețiene. Fiecare token XAUt reprezintă o uncie troy fină de aur acreditat LBMA, cu o susținere totală de aproximativ 644 lingouri de aur (7.667 kg) începând cu iulie 2025. Emis de Tether Ltd., XAUt combină stabilitatea aurului cu flexibilitatea blockchain-ului, permițându-vă să tranzacționați, să transferați și să stocați aurul fără efort, la fel ca orice alt activ cripto. Suportă mai multe lanțuri, inclusiv Ethereum,

TRON și

TON, și este foarte accesibil atât pentru investitorii de retail, cât și pentru cei instituționali.

Cu o capitalizare de piață de aproximativ 821 milioane de dolari și peste 246.000 de token-uri în circulație, XAUt oferă o lichiditate puternică și este integrat în diverse platforme DeFi. Investitorii beneficiază de zero taxe de custodie, divizibilitate ușoară (până la 0,000001 oz) și tranzacționare 24/7 la nivel mondial. Puteți chiar să vă răscumpărați token-urile pentru lingouri de aur fizice, deși acest lucru este limitat la livrările în Elveția și este supus unor taxe suplimentare și unor sume minime de răscumpărare. Spre deosebire de Paxos Gold (PAXG), auditurile Tether sunt mai puțin frecvente, iar modelul său de custodie centralizată înseamnă că utilizatorii trebuie să se bazeze pe integritatea operațională a Tether.

3. Kinesis Gold (KAU)

Kinesis Gold (KAU) este o monedă digitală susținută de aur, care vă oferă proprietatea legală deplină asupra aurului fizic stocat în seifuri asigurate, auditate independent, la nivel mondial. Fiecare token KAU reprezintă un gram de aur fin (puritate 999,9), alocat integral pe numele dumneavoastră și răscumpărabil pentru lingouri de aur aprobate LBMA începând de la 100 de grame. Cu o capitalizare de piață de aproximativ 156 milioane de dolari, KAU oferă o combinație unică de stabilitate și utilitate, permițându-vă să cheltuiți, să tranzacționați și să trimiteți aur la nivel global prin Kinesis Virtual Card, utilizabilă oriunde este acceptat MasterCard.

Utilizatorii câștigă randamente lunare în aur fizic pentru deținerea, tranzacționarea sau minting-ul KAU, cu peste 20 de milioane de dolari deja distribuiți comunității. Platforma nu percepe taxe de stocare datorită parteneriatului său cu Allocated Bullion Exchange (ABX) și efectuează audituri independente bianuale pentru a verifica rezervele de aur. Deși KAU oferă o modalitate rentabilă de a utiliza aurul ca bani, rămâne centralizat sub Kinesis și are hub-uri de răscumpărare limitate, necesitând cantități minime pentru livrare.

4. Kinesis Silver (KAG)

Kinesis Silver (KAG) este o monedă digitală pe deplin susținută de o uncie troy de argint fin (puritate 999) stocată în seifuri asigurate, auditate independent, în întreaga lume. Emis de Kinesis Money și gestionat prin partenerul său strategic, Allocated Bullion Exchange (ABX), KAG oferă deținătorilor proprietatea legală deplină asupra argintului fizic care poate fi răscumpărat de la doar 200 de uncii la hub-uri localizate pe șase continente. Conceput pentru a face argintul din nou o formă utilizabilă de bani, KAG vă permite să cheltuiți, să tranzacționați, să trimiteți și să câștigați argint la nivel global folosind Kinesis Virtual Card, care vă convertește activele în timp real la punctul de cumpărare.

Investitorii beneficiază, de asemenea, de un model de partajare a taxelor care plătește randamente lunare în argint fizic pentru deținerea, cheltuirea sau minting-ul KAG. Deși oferă o modalitate rentabilă și accesibilă de a integra argintul într-un portofoliu, în special pentru cei care caută diversificare dincolo de aur, lichiditatea mai scăzută a KAG și volatilitatea istorică mai mare a prețului argintului îl fac o opțiune ușor mai riscantă pentru începători.

5. Matrixdock Gold (XAUM)

Matrixdock Gold (XAUm) este un activ de aur tokenizat care aduce aur pur 99,99% acreditat LBMA în blockchain, oferind proprietate fracționată și acces ușor on-chain la aur fizic stocat în seifuri de încredere din Asia, inclusiv Singapore și Hong Kong. Fiecare token XAUm reprezintă o uncie troy de aur, cu o ofertă totală de 13.534 de token-uri susținute de 421 de lingouri de aur deținute în facilități de custodie sigure, aprobate LBMA.

Cu o capitalizare de piață de aproximativ 45,3 milioane de dolari și un volum de tranzacționare de 24 de ore de 181.900 de dolari, XAUm atrage investitorii care caută o alternativă flexibilă, centrată pe Asia, pentru expunerea la aur. Suportă standardele

ERC-20 și BEP-20, permițând o accesibilitate ridicată și o integrare perfectă cu platformele DeFi, oferind în același timp o caracteristică unică: capacitatea de a "împacheta" token-uri XAUm în

NFT-uri care reprezintă lingouri de aur specifice pentru alocări fixe. Opțiunile de răscumpărare includ livrarea fizică pentru cantități calificate și audituri dinamice de alocare pentru transparență. Cu toate acestea, ca platformă mai nouă, XAUm se confruntă cu provocări legate de lichiditatea mai mică și conștientizarea globală limitată în comparație cu token-uri de aur mai mari precum PAXG și XAUT.

Cum să Tranzacționați Token-uri de Mărfuri pe BingX: Un Ghid Pas cu Pas

Începerea tranzacționării cu stablecoin-uri susținute de mărfuri pe BingX este simplă. Indiferent dacă doriți să cumpărați PAX Gold (PAXG), Tether Gold (XAUT) sau alte token-uri, urmați acești pași:

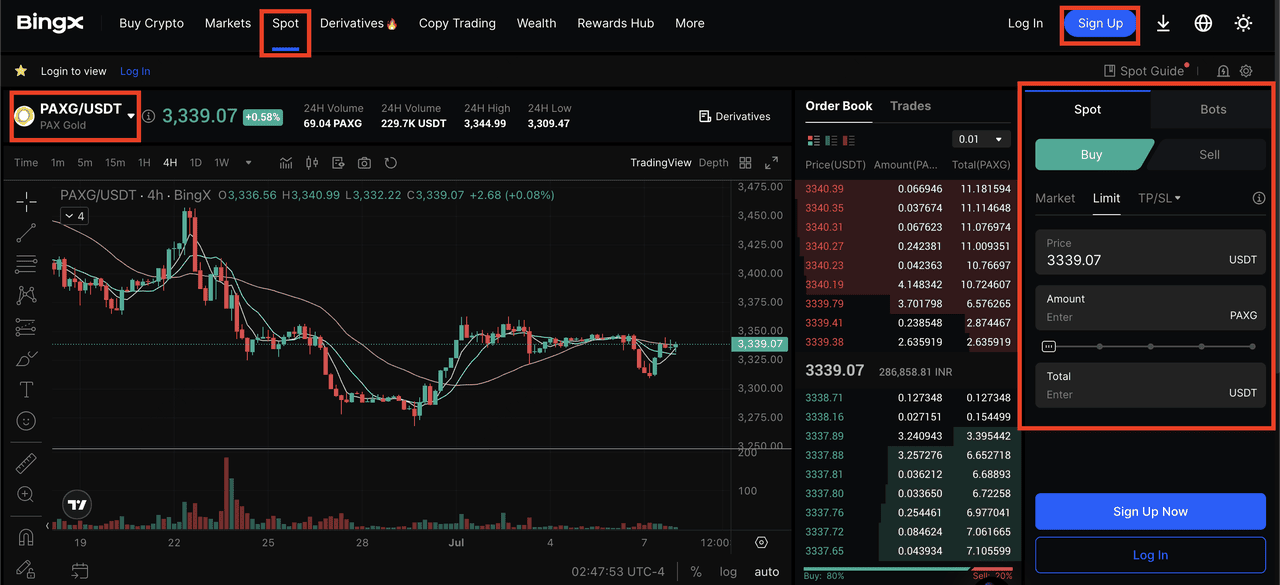

1. Căutați Token-ul Dvs. de Marfă: După ce vă înregistrați și finalizați KYC, conectați-vă la contul dvs. BingX și accesați

Piața Spot. Utilizați bara de căutare pentru a găsi token-ul dorit, cum ar fi

PAXG/USDT sau

XAUT/USDT. Faceți clic pe perechea de tranzacționare pentru a deschide pagina de tranzacționare a token-ului.

2. Depuneți Fonduri: Adăugați fonduri în contul dvs. depunând monede fiduciare precum USD sau EUR folosind metode de plată acceptate (de exemplu, transfer bancar, Visa/Mastercard). Puteți depune și criptomonede precum

USDT sau

BTC dacă le dețineți deja.

3. Cumpărați Token-ul Dvs. Susținut de Marfă: Odată ce contul dvs. este finanțat, plasați un ordin de cumpărare pentru token. Puteți alege un

ordin de piață pentru cumpărare instantanee la prețul curent sau un ordin limită pentru a seta prețul preferat. După finalizarea tranzacției, token-urile dvs. vor apărea în portofelul dvs. spot BingX.

4. Răscumpărați sau Convertiți Înapoi: Când sunteți gata, vă puteți vinde token-urile înapoi în fiat sau cripto pe Piața Spot. Pentru unele token-uri, puteți avea și opțiunea de a solicita răscumpărarea fizică a aurului sau argintului subiacent. Rețineți că răscumpărarea este supusă unor sume minime, timpi de procesare și taxe aplicabile.

🛡️ Sfat: Înainte de a tranzacționa, revizuiți termenii de răscumpărare ai token-ului, taxele de stocare și custodie și rețelele blockchain acceptate. Acest lucru vă asigură că vă puteți muta sau răscumpăra token-urile în siguranță atunci când este necesar.

Beneficiile Stablecoin-urilor Susținute de Mărfuri

Stablecoin-urile susținute de mărfuri oferă avantaje unice pentru utilizatorii de criptomonede care doresc expunere la metale prețioase fără bătăile de cap ale proprietății fizice. Iată câteva dintre beneficiile cheie ale token-urilor susținute de mărfuri pe care trebuie să le cunoașteți:

• Valoare Stabilă Legată de Aur și Argint: Aceste token-uri oglindesc prețul aurului sau argintului, oferind o

protecție împotriva inflației și volatilității valutare.

• Acces Digital la Active din Lumea Reală: Puteți tranzacționa sau deține active susținute de aur on-chain fără a avea nevoie de stocare în seifuri sau logistică de livrare.

• Compatibilitate DeFi: Multe token-uri precum PAXG și XAUT pot fi utilizate ca garanții, adăugate la pool-uri de

lichiditate sau mizate pentru recompense în ecosistemele DeFi.

• Accesibilitate Globală: Cumpărați, vindeți și transferați aceste active 24/7 peste granițe fără a vă baza pe bănci sau brokeri tradiționali.

• Proprietate Fracționată: Începeți cu puțin - dețineți o fracțiune dintr-un lingou de aur sau o uncie de argint, făcându-l mai accesibil pentru investitorii începători.

Considerații Cheie Înainte de a Investi

Deși stablecoin-urile susținute de mărfuri oferă o poartă de acces ușoară la metale prețioase, ele vin și cu riscuri. Custodia centralizată înseamnă că vă încredeți în emitenți și operatorii de seifuri pentru a proteja rezervele. Vulnerabilitățile

contractelor inteligente ar putea expune deținerile dvs. la exploatări tehnice. Lichiditatea variază considerabil; în timp ce PAXG și XAUT sunt foarte lichide, token-uri mai mici precum XAUM sau KAG pot avea volume de tranzacționare mai scăzute. În cele din urmă, răscumpărarea fizică poate implica sume minime mari, întârzieri de procesare și taxe suplimentare, ceea ce poate limita flexibilitatea pentru investitorii mici.

Ar Trebui să Adăugați Stablecoin-uri de Mărfuri în Portofoliul Dvs.?

Stablecoin-urile susținute de mărfuri reunesc valoarea activelor fizice precum aurul și argintul cu flexibilitatea tehnologiei blockchain. Ele oferă o modalitate de a vă proteja împotriva inflației și volatilității pieței, rămânând în ecosistemul cripto. Opțiunile de top precum PAXG și XAUT domină volumele de tranzacționare și oferă o lichiditate puternică, făcându-le ideale pentru începători. Între timp, XAUM, KAU și KAG atrag investitorii care caută expunere de nișă sau

diversificare în active regionale și alternative.

Cu toate acestea, aceste token-uri nu sunt lipsite de riscuri. Centralizarea custodiei, vulnerabilitățile contractelor inteligente și nivelurile variabile de lichiditate vă pot afecta capacitatea de a tranzacționa sau răscumpăra. Pe măsură ce interesul instituțional crește și mai multe mărfuri precum platina sau petrolul sunt tokenizate, transparența și supravegherea reglementară sunt, de asemenea, susceptibile să crească. Înainte de a le adăuga în portofoliul dvs., verificați întotdeauna termenii de custodie, condițiile de răscumpărare și suportul platformei. Rămâneți informat și echilibrați-vă expunerea cu atenție pentru a evita surprizele neașteptate.

Lectură Recomandată