Dacă dețineți stablecoin-uri precum

USDT,

USDC sau

DAI fără a le pune la treabă, s-ar putea să ratați oportunități potențiale de a vă crește deținerile. În timp ce stablecoin-urile tradiționale oferă stabilitate a prețului, ele nu generează randament de la sine, ceea ce înseamnă că capitalul dumneavoastră își poate pierde valoarea în timp din cauza inflației.

Aici intervin stablecoin-urile generatoare de randament. Aceste token-uri combină stabilitatea prețului stablecoin-urilor tradiționale cu o putere de câștig încorporată. Prin simpla deținere a acestora, începeți să câștigați venituri pasive, fără a fi necesară staking-ul, blocarea sau farming-ul

DeFi.

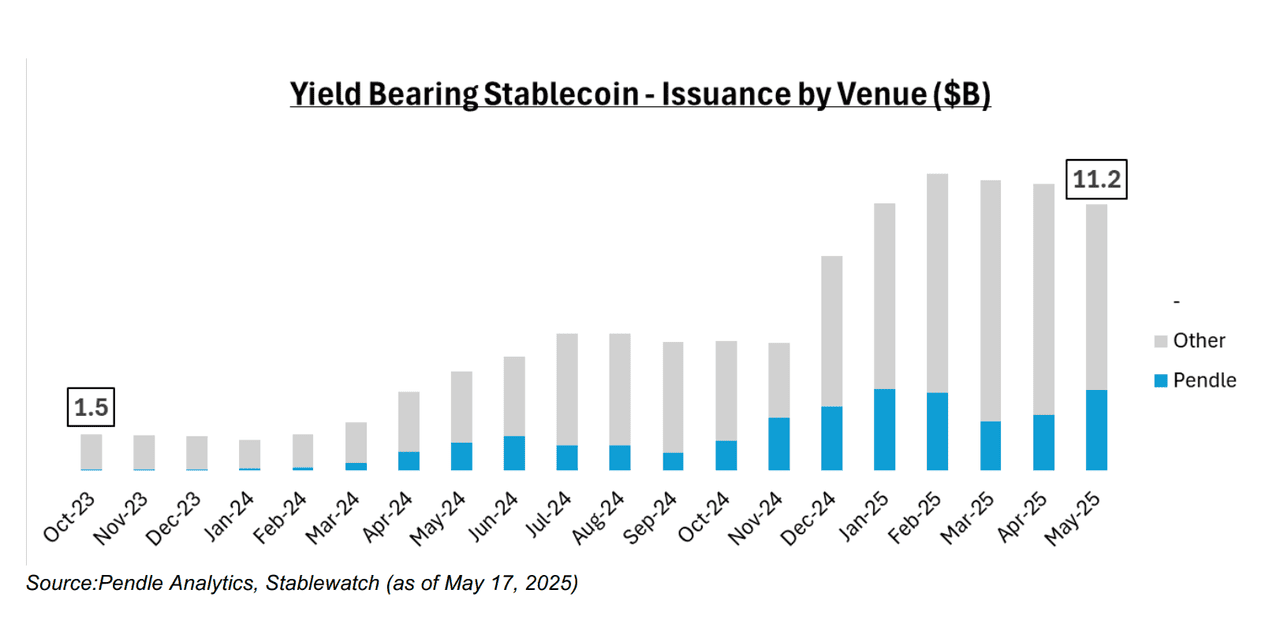

Capitalizarea de piață a stablecoin-urilor generatoare de randament | Sursa: Pendle

În puțin peste un an, capitalizarea de piață a stablecoin-urilor generatoare de randament a sărit de la aproximativ 1,5 miliarde de dolari la peste 11 miliarde de dolari, reprezentând acum mai mult de 4% din întreaga piață a stablecoin-urilor.

În acest ghid, veți afla ce sunt stablecoin-urile generatoare de randament, cum generează randamente prin DeFi, derivate și

active din lumea reală, pe care să le urmăriți în 2025 și riscurile cheie de luat în considerare înainte de a investi. Indiferent dacă sunteți nou în lumea cripto sau doriți să vă faceți stablecoin-urile să lucreze mai inteligent, acest articol vă va ajuta să înțelegeți cea mai interesantă evoluție din sectorul stablecoin-urilor.

Ce este un stablecoin generator de randament?

Un stablecoin generator de randament este un activ cripto care menține o valoare stabilă, de obicei ancorată la Dolarul S.U.A., generând în același timp venituri pasive pentru deținători. Spre deosebire de stablecoin-urile tradiționale precum USDC sau USDT, care stau inactive în portofelul dumneavoastră, stablecoin-urile generatoare de randament sunt concepute să crească în valoare în timp.

Crucial, randamentul provine de la stablecoin-ul însuși. Nu este nevoie să faceți staking, să împrumutați sau să blocați fondurile pentru a câștiga

APY-uri. Acest lucru le face o clasă de active fundamental diferită în DeFi, oferind randamente încorporate fără complexitatea protocoalelor suplimentare.

Aceste stablecoin-uri sunt susținute de rezerve generatoare de venituri, cum ar fi bonuri de trezorerie S.U.A. tokenizate, active din lumea reală (RWA) sau strategii DeFi precum împrumuturile și finanțarea derivatelor. Randamentele sunt distribuite prin mecanisme precum rebasing-ul, scalarea soldului sau modele cu două token-uri, astfel încât soldul dumneavoastră crește automat în timp ce vă păstrați controlul deplin asupra fondurilor.

Gândiți-vă la ele ca la conturi de economii bazate pe blockchain. Ele combină stabilitatea prețului activelor tradiționale ancorate la fiat cu randamentul on-chain, făcându-le ideale atât pentru persoane fizice, cât și pentru instituții. Aprobarea YLDS în 2025 ca prim stablecoin generator de randament înregistrat la SEC a marcat un pas important către recunoașterea reglementară. Pe măsură ce inflația erodează valoarea activelor inactive, aceste stablecoin-uri apar ca instrumente esențiale pentru a obține randamente previzibile într-un mod descentralizat și accesibil la nivel global.

Cum generează randament stablecoin-urile generatoare de randament?

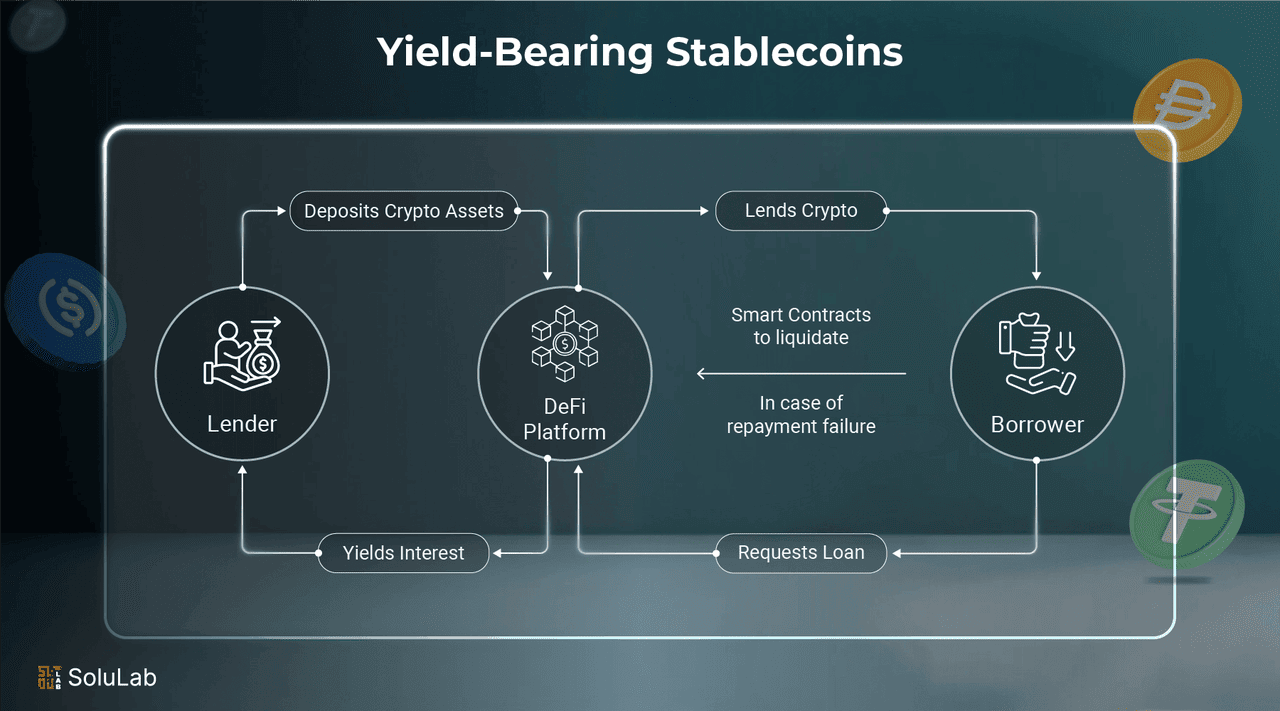

Cum funcționează stablecoin-urile generatoare de randament | Sursa: SoluLab

Stablecoin-urile generatoare de randament obțin randamente din trei surse principale. Fiecare utilizează o strategie diferită, dar își propune să mențină token-ul stabil, transferând în același timp randamentul către dumneavoastră.

1. Împrumuturi DeFi și Rebasing

Unele stablecoin-uri câștigă dobândă prin împrumutarea activelor pe platforme DeFi precum Aave sau MakerDAO. Aceste token-uri nu necesită gestionare activă. Doar dețineți-le, iar protocolul se ocupă de restul.

• sDAI este o versiune generatoare de randament a DAI, emisă atunci când depuneți DAI în Rata de Economii DAI (DSR) a MakerDAO. Se rebasează automat, ceea ce înseamnă că soldul dumneavoastră de sDAI crește în timp pe măsură ce se acumulează dobânda. Acest lucru îl face o modalitate simplă și eficientă din punct de vedere al costurilor de gaz de a câștiga venituri pasive în timp ce dețineți un stablecoin.

• aUSDC este token-ul generator de dobândă pe care îl primiți atunci când împrumutați USDC pe Aave, o platformă populară de împrumuturi DeFi. Pe măsură ce împrumutații plătesc dobândă în pool, soldul dumneavoastră de aUSDC reflectă partea dumneavoastră din aceste câștiguri. Randamentul variază în funcție de cererea și oferta de pe piața de împrumuturi Aave.

2. Susținere RWA / Finanțe Tradiționale (TradFi)

Aceste stablecoin-uri obțin randament din active din lumea reală, cum ar fi bonuri de trezorerie S.U.A., fonduri de piață monetară sau datorii corporative pe termen scurt. Ele conectează utilizatorii cripto la randamentele finanțelor tradiționale, fără a fi nevoie de un cont de brokeraj. Exemple includ:

• USDY (Ondo Finance) este un stablecoin generator de randament susținut de bonuri de trezorerie S.U.A. pe termen scurt și depozite bancare. Oferă un randament anual de 4–5% și este conceput special pentru investitorii non-S.U.A. care caută expunere la dolar cu venituri pasive. Combină stabilitatea fiat cu randamentele din finanțele tradiționale.

• USDM (Mountain Protocol) este un stablecoin pe deplin reglementat în Bermuda, care generează randament din bonuri de trezorerie S.U.A. tokenizate. Plătește câștigurile zilnic folosind un model de rebasing, ceea ce înseamnă că soldul dumneavoastră USDM crește automat în timp. Se adresează utilizatorilor care caută active generatoare de randament transparente și conforme.

• YLDS (Figure Markets) este primul stablecoin generator de randament înregistrat la SEC, ancorat la dolarul S.U.A. și susținut de active legate de SOFR. Oferă un randament fix de aproximativ 3,85% anual. YLDS reprezintă un pas major către claritatea reglementară și adoptarea instituțională în spațiul stablecoin-urilor.

•

USDe (Ethena) este un stablecoin sintetic care obține randament din colateral off-chain, legat de fiat, printr-o strategie delta-neutră. Deși nu este pe deplin susținut de dolari din lumea reală, utilizează o combinație de derivate și hedging pentru a-și menține ancorarea și a genera venituri. Este o abordare mai complexă, dar inovatoare, a randamentului stabil în cripto.

3. Modele bazate pe derivate

Unele stablecoin-uri obțin randament prin strategii avansate de tranzacționare folosind derivate cripto. De exemplu, stablecoin-ul Ethena USDe (USDE) utilizează o strategie de futures perpetue delta-neutră. Echilibrează deținerile long de

ETH cu pozițiile short pe futures. Atunci când ratele de finanțare ale pieței sunt pozitive, Ethena obține un randament și îl transmite deținătorilor de USDe.

Acest model este mai complex, dar poate oferi randamente mai mari. De asemenea, reduce volatilitatea prin hedging-ul riscului de piață.

Cele mai bune stablecoin-uri generatoare de randament de urmărit în 2025

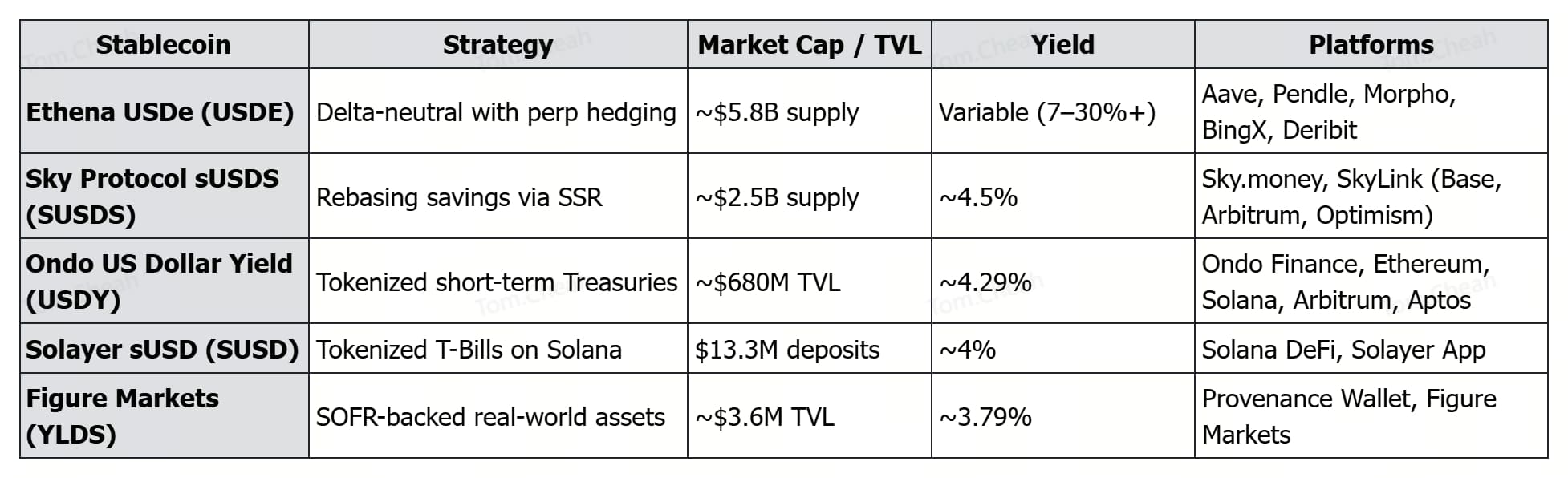

Piața stablecoin-urilor generatoare de randament evoluează rapid, cu mai multe proiecte remarcabile care deschid calea în 2025. Iată cele mai bune stablecoin-uri de urmărit, fiecare oferind modalități unice de a câștiga venituri pasive, menținând în același timp o ancorare stabilă la dolar.

Ethena USDe (USDE)

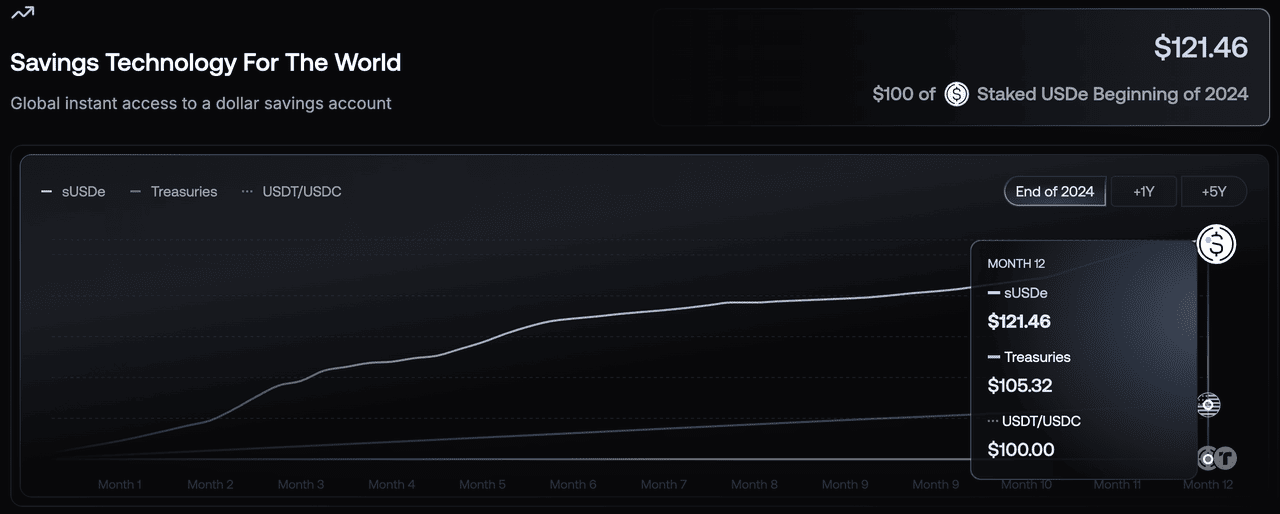

Ethena USDe vs. Trezoreria S.U.A. vs. randamente USDT/USDC | Sursa: Ethena

USDe de la Ethena este un stablecoin sintetic generator de randament, conceput să funcționeze ca dolari digitali pentru economia internetului. Spre deosebire de monedele susținute de fiat, cum ar fi USDC, USDe este susținut de o combinație de active cripto, în principal ETH staked,

BTC și USDT/USDC, asociate cu futures perpetue short pentru a menține o poziție delta-neutră. Această strategie îl ajută să mențină o ancorare stabilă la dolarul S.U.A., generând în același timp randamente ridicate prin ratele de finanțare ale derivatelor. În 2024, protocolul a atins un randament mediu de 19% pe sUSDe, varianta sa staked, cu

APY-uri curente oscilând în jurul valorii de 7–7,4% în funcție de condițiile pieței. USDe deține acum peste 5,8 miliarde de dolari în ofertă, făcându-l unul dintre cele mai mari și mai rapide stablecoin-uri de pe piața cripto.

Puteți utiliza USDe pe platforme majore DeFi și CeFi, inclusiv

Aave,

Pendle,

Morpho, BingX și Deribit. Pentru a câștiga randament, pur și simplu faceți staking cu USDe pentru a primi sUSDe, soldul dumneavoastră va crește automat în timp. Ethena prioritizează transparența cu date de susținere în timp real, atestări săptămânale de dovadă a rezervelor și soluții de custodie off-exchange care reduc riscul de contrapartidă. Cu sprijinul partenerilor instituționali precum Wintermute și integrări cu

blockchain-ul TON, USDe devine rapid un activ generator de randament esențial în finanțele descentralizate.

sUSDS (SUSDS)

sUSDS este versiunea generatoare de randament, axată pe economii, a USDS, stablecoin-ul nativ al Protocolului Sky descentralizat, o evoluție a sistemului original MakerDAO. La fel ca sDAI înainte de el, sUSDS câștigă recompense în timp prin simpla deținere în portofel, cu o Rată de Economii Sky (SSR) actuală de aproximativ 4,5% anual. Nu este nevoie să blocați sau să faceți staking cu fondurile dumneavoastră pentru a începe să câștigați. În schimb, sUSDS se rebasează în portofelul dumneavoastră, ceea ce înseamnă că soldul dumneavoastră crește automat pe măsură ce se acumulează randamentul. Este o soluție non-custodială și transparentă, construită pentru utilizatorii obișnuiți, permițându-vă să economisiți fără a renunța la controlul fondurilor dumneavoastră.

Protocolul Sky își extinde, de asemenea, utilitatea cu Sky Token Rewards, oferind utilizatorilor și mai multe stimulente pentru a deține și utiliza sUSDS. Cu peste 14 miliarde de dolari în valoare totală blocată și sute de mii de utilizatori, protocolul se dovedește a fi o actualizare de vârf a infrastructurii DeFi moștenite. Puteți mint USDS prin upgrade de la DAI la un raport de 1:1, și apoi puteți începe să economisiți prin Sky.money, interfața principală pentru ecosistem. SkyLink suportă, de asemenea, transferul sUSDS peste

Ethereum și rețele Layer 2 precum Base,

Optimism și

Arbitrum, oferind taxe mai mici și tranzacții mai rapide.

Ondo US Dollar Yield (USDY)

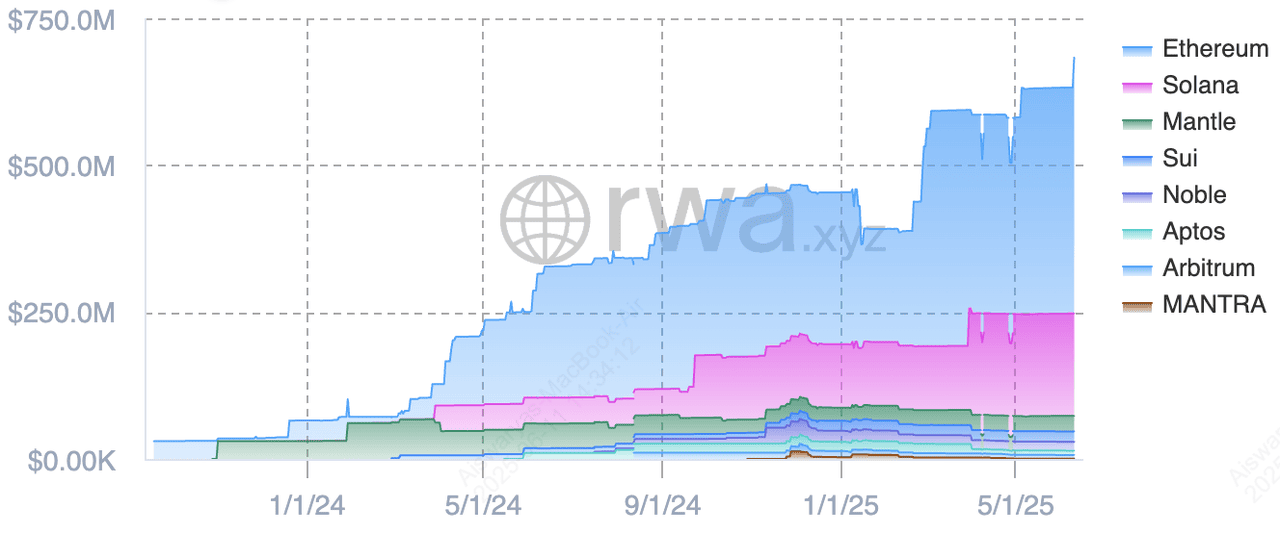

TVL USDY | Sursa: RWA.xyz

Ondo US Dollar Yield (USDY) este un token generator de randament care permite utilizatorilor, în special rezidenților non-S.U.A., să câștige venituri pasive prin împrumutarea USDC în bonuri de trezorerie S.U.A. pe termen scurt tokenizate și depozite bancare. Cu un randament anualizat de aproximativ 4,29% în prezent, USDY oferă o alternativă convingătoare la stablecoin-urile tradiționale prin combinarea acumulării zilnice de randament cu accesibilitatea on-chain. Este disponibil pe blockchain-uri de top precum Ethereum,

Solana, Arbitrum și

Aptos și suportă minting și răscumpărare 24/7. Investitorii pot alege între două formate, acumulare (USDY) sau rebasing (rUSDY), în funcție de preferințele lor de randament și nevoile contabile.

USDY face parte din ecosistemul mai larg Ondo Finance, care construiește infrastructură de nivel instituțional pentru active din lumea reală (RWA). Ondo Chain, o

rețea Layer 1 proof-of-stake, permite interoperabilitatea și compozabilitatea omnichain, permițând produselor financiare tradiționale, cum ar fi bonurile de trezorerie S.U.A., să se integreze perfect în DeFi. Cu peste 680 de milioane de dolari în valoare totală blocată (TVL), rezerve auditate și susținere din partea custozilor și instituțiilor financiare de top, USDY oferă o modalitate sigură, transparentă și conformă de a câștiga venituri fixe în cripto. Cu toate acestea, accesul este limitat la persoane fizice și entități non-S.U.A., și, la fel ca toate instrumentele financiare, deținerea USDY implică riscuri, inclusiv pierderea potențială de capital.

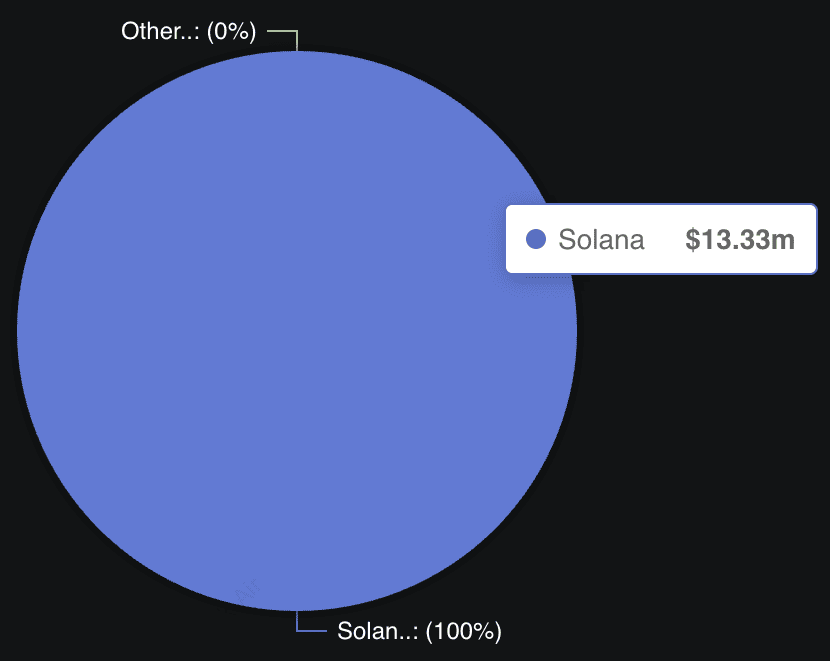

Solayer sUSD (SUSD)

TVL sUSD | Sursa: DefiLlama

Solayer’s sUSD este primul stablecoin generator de randament pe blockchain-ul Solana, oferind utilizatorilor venituri pasive susținute de bonuri de trezorerie S.U.A. tokenizate. Ancorat 1:1 la dolarul S.U.A., sUSD câștigă aproximativ 4% APY, făcându-l o îmbunătățire convingătoare față de stablecoin-urile tradiționale precum USDC sau USDT. Construit folosind extensia Token 2022 cu dobândă, sUSD crește automat în valoare în portofel prin scalarea soldului, permițând acumularea dobânzii fără a necesita revendicare activă. Cu peste 25.000 de depunători și 13 milioane de dolari în depozite, sUSD oferă randament zilnic, sigur, direct utilizatorilor, integrat nativ în infrastructura rapidă și cu taxe mici a Solana.

Dincolo de simple economii, sUSD este conceput pentru o adoptare mai largă în DeFi și finanțele din lumea reală. Colateralul său de înaltă calitate, susținut de bonuri de trezorerie tokenizate evaluate de Moody's, îl poziționează ca un activ stabil pentru împrumuturi, plăți, gestionarea trezoreriei și chiar securizarea sistemelor descentralizate precum oracolele și rollup-urile. sUSD oferă lichiditate deplină, transparență de nivel instituțional și compatibilitate cu protocoalele DeFi majore, făcându-l ideal atât pentru utilizatorii individuali, cât și pentru investitorii instituționali. Pe măsură ce

ecosistemul stablecoin-urilor Solana crește, sUSD își propune să servească drept strat principal de

lichiditate al rețelei, stimulând atât eficiența capitalului, cât și adoptarea pe termen lung.

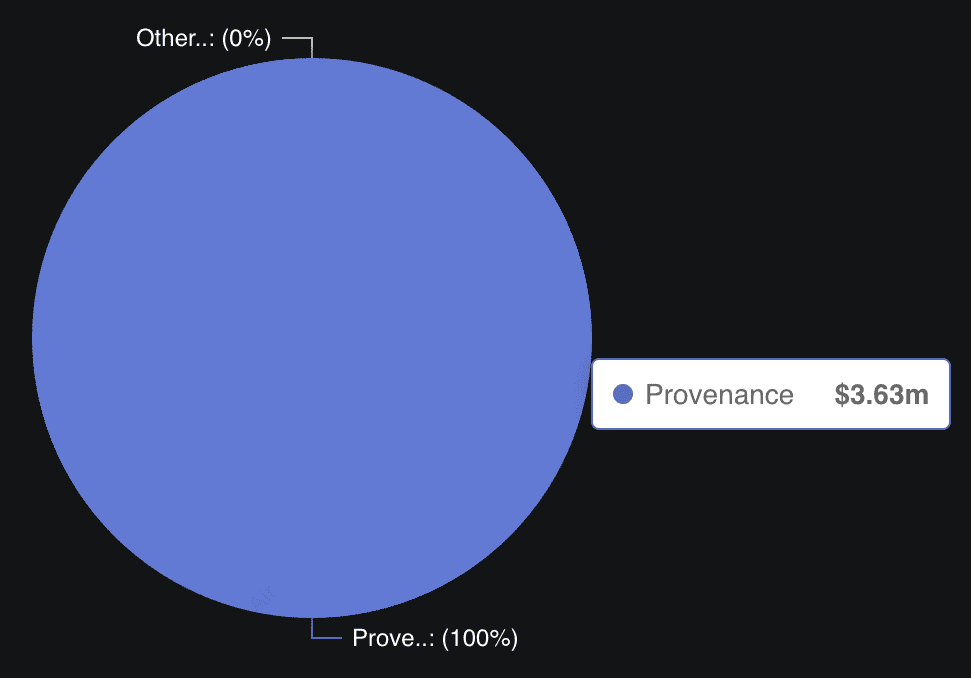

Figure Markets (YLDS)

TVL YLDS | Sursa: DefiLlama

YLDS este un activ digital generator de randament lansat de Figure Markets și înregistrat la Comisia pentru Valori Mobiliare și Burse din S.U.A. (SEC), fiind primul stablecoin de acest gen aprobat de SEC. Ancorat 1:1 la dolarul S.U.A., YLDS plătește un randament de aproximativ 3,79% anual, derivat din active din lumea reală legate de SOFR. Spre deosebire de stablecoin-urile tradiționale precum USDC sau USDT, YLDS este structurat ca o valoare mobiliară și acumulează dobândă zilnic, cu plăți lunare. Construit pe Provenance Blockchain, YLDS oferă transferuri peer-to-peer fără probleme, lichiditate 24/7 și capacitatea de a tranzacționa direct pentru alte active precum

Bitcoin pe Figure Markets. Utilizatorii pot cumpăra YLDS folosind transferuri bancare sau stablecoin-uri și pot începe imediat să câștige randament, menținând în același timp accesul la o infrastructură reglementată și transparentă a piețelor de capital.

Deși YLDS oferă randamente mai mari în comparație cu stablecoin-urile convenționale, vine cu un profil de risc distinct. Activul nu este asigurat de FDIC și este susținut exclusiv de Figure Certificate Company (FCC), fără rezerve delimitate, ceea ce înseamnă că, în cazul insolvenței emitentului, protecțiile investitorilor pot fi limitate. Rezervele sale sunt investite în titluri de valoare similare cu cele deținute de fondurile de piață monetară prime, care pot include instrumente garantate cu active și non-guvernamentale, introducând mai mult risc decât fondurile de piață monetară exclusiv guvernamentale. Cu toate acestea, YLDS reprezintă un pas îndrăzneț în fuzionarea finanțelor tradiționale cu infrastructura descentralizată, deschizând potențial calea pentru o adoptare mai largă a activelor on-chain generatoare de randament reglementate.

Ecosistemul de stablecoin-uri generatoare de randament al Pendle

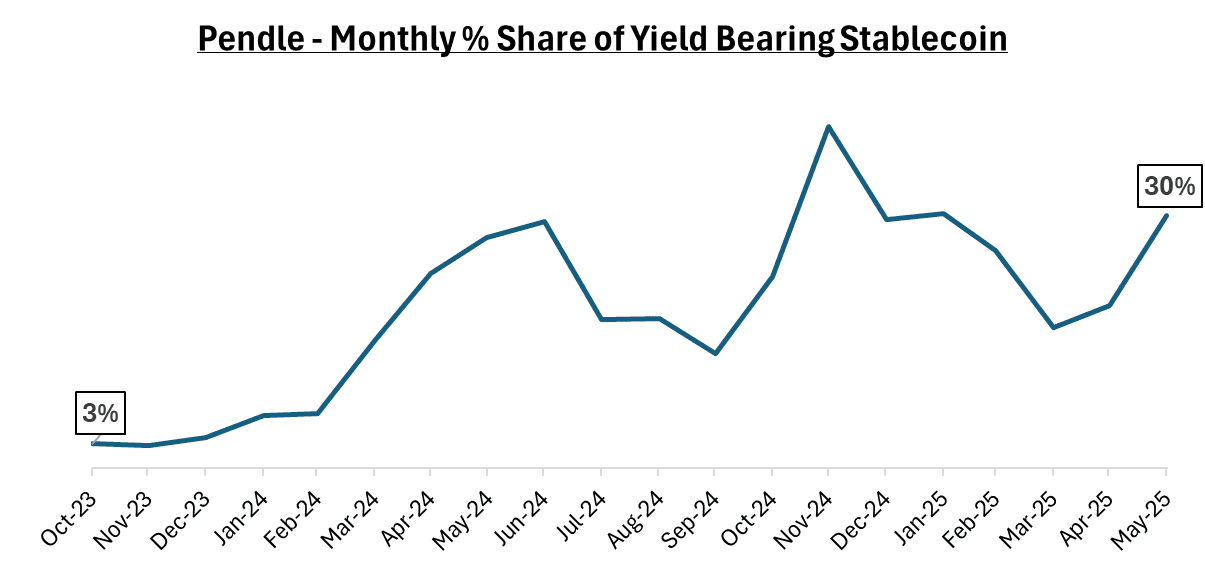

Cota Pendle din stablecoin-urile generatoare de randament | Sursa: Spartan Group

Pendle joacă un rol esențial în ecosistemul emergent al stablecoin-urilor generatoare de randament, oferind o piață unică ce permite utilizatorilor să separe principalul de randament, permițând atât strategii de venit fix, cât și variabile. Deși nu este un stablecoin în sine, Pendle susține stablecoin-uri precum sDAI și USDe și captează aproximativ 30% din întregul TVL al stablecoin-urilor generatoare de randament, în prezent peste 3 miliarde de dolari. Prin infrastructura sa, utilizatorii pot bloca randamente fixe sau pot specula pe fluctuațiile randamentului prin tranzacționarea token-urilor de principal (PT) și a token-urilor de randament (YT). Acest model a făcut Pendle atractiv pentru utilizatorii avansați de DeFi care caută randamente previzibile sau expunere direcțională la ratele dobânzilor, precum și pentru protocoalele care caută o inițiere eficientă a capitalului pentru lichiditate și descoperire.

Creșterea Pendle reflectă expansiunea mai largă a stablecoin-urilor generatoare de randament, care au crescut de la 1,5 miliarde de dolari la peste 11 miliarde de dolari în ultimele 18 luni. TVL-ul stablecoin-urilor pe Pendle a sărit de peste 60 de ori în aceeași perioadă, determinat inițial de speculațiile cu airdrop-uri cu proiecte precum

Eigenlayer, și mai recent de adoptarea constantă de către noi emitenți precum Ethena, Open Eden și Reserve. Astăzi, 83% din TVL-ul Pendle este în active stabile, iar platforma suportă o gamă largă de stablecoin-uri cu coadă lungă dincolo de Ethena. Cu inovații continue de produse, integrări de protocoale (de exemplu, Aave v3) și extindere la noi blockchain-uri precum Solana și TON, Pendle se poziționează ca piața de randament lider și un strat de infrastructură DeFi de bază în această nouă eră a finanțelor on-chain bazate pe dolar.

Cumpără Pendle

Cum să câștigi venituri pasive cu stablecoin-uri generatoare de randament

Stablecoin-urile generatoare de randament vă oferă control, venituri pasive și o modalitate de a rămâne înaintea inflației, totul din portofelul dumneavoastră. Începerea este ușoară, chiar dacă sunteți nou în lumea cripto. Urmați acești pași simpli:

1. Alegeți un stablecoin care se potrivește obiectivelor dumneavoastră

Alegeți un stablecoin în funcție de ceea ce contează cel mai mult pentru dumneavoastră. Dacă doriți randamente mai mari, opțiuni precum USDe sau USDY pot oferi randamente mai bune. Pentru o liniște sufletească sporită și supraveghere reglementară, YLDS sau sDAI sunt alegeri mai sigure, cu cadre de conformitate mai clare.

2. Configurați un portofel compatibil

Instalați un portofel compatibil cu stablecoin-ul pe care intenționați să-l utilizați. Pentru active bazate pe Ethereum, cum ar fi sDAI, aUSDC sau USDY,

MetaMask este o alegere populară și prietenoasă pentru începători, care funcționează ca extensie de browser sau aplicație mobilă. Dacă utilizați YLDS, Provenance Wallet este opțiunea preferată, construită special pentru ecosistemul Figure.

Indiferent de portofelul pe care îl alegeți, asigurați-vă că vă salvați în siguranță

fraza de recuperare (seed phrase). Această frază de recuperare este singura modalitate de a vă restaura portofelul dacă pierdeți accesul, așa că stocați-o offline și nu o partajați niciodată cu nimeni.

3. Cumpărați sau schimbați în moneda generatoare de randament

Începeți prin a cumpăra un stablecoin de bază precum USDC sau DAI direct pe BingX. Odată ce fondurile sunt în contul dumneavoastră, transferați-le în portofelul personal care suportă versiunea generatoare de randament.

Apoi, vizitați protocolul oficial care emite moneda generatoare de randament, cum ar fi Ondo Finance pentru USDY sau portalul DSR al MakerDAO pentru sDAI. Acolo, puteți depune stablecoin-urile dumneavoastră și veți primi în schimb versiunea actualizată, generatoare de randament. Acest pas activează funcția de randament pasiv, menținând în același timp activele dumneavoastră stabile și on-chain.

4. Dețineți sau faceți staking pentru a câștiga randament

Odată ce ați primit stablecoin-ul dumneavoastră generator de randament, tot ce trebuie să faceți este să-l dețineți în portofel. Token-uri precum sDAI, USDe și USDM acumulează randament automat. Soldul dumneavoastră crește în timp fără a fi nevoie să faceți manual staking sau să vă blocați activele. Unele monede pot necesita delegare sau pași suplimentari, dar majoritatea sunt concepute pentru venituri pasive fără intervenție.

5. Retrageți sau reinvestiți când sunteți gata

Când sunteți gata să încasați, puteți răscumpăra token-ul dumneavoastră generator de randament înapoi în USDC, DAI sau chiar fiat prin protocolul original sau o bursă suportată. Alternativ, vă puteți păstra fondurile în ecosistem și le puteți reinvesti în alte strategii DeFi, cum ar fi împrumuturile, pool-urile de lichiditate sau bonurile de trezorerie tokenizate, pe măsură ce încrederea și experiența dumneavoastră cresc.

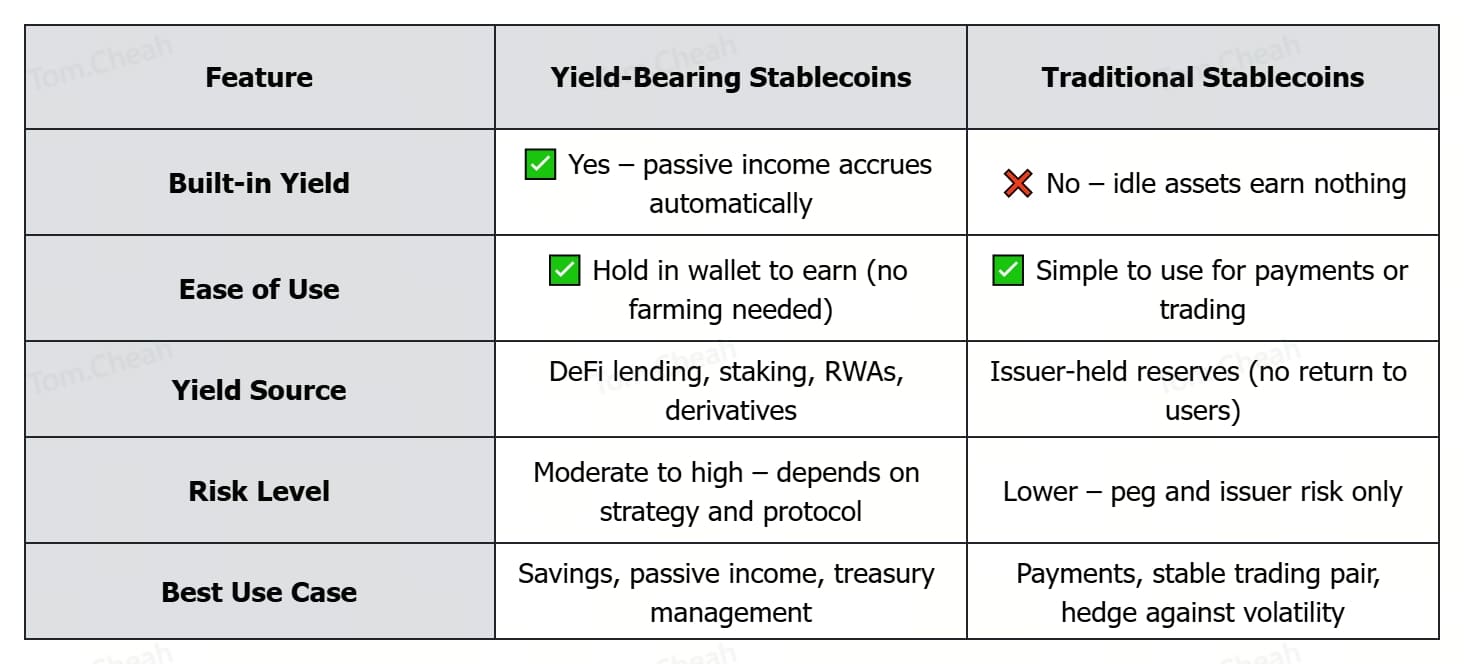

Stablecoin-uri generatoare de randament vs. stablecoin-uri tradiționale: Diferențe cheie

Iată cum se compară stablecoin-urile generatoare de randament cu opțiunile tradiționale precum USDT și USDC:

Stablecoin-urile generatoare de randament vă permit să câștigați venituri pasive, menținând în același timp fondurile stabile. Aceste token-uri sunt concepute pentru a genera randament automat, adesea prin împrumuturi DeFi, expunere la active din lumea reală sau strategii delta-neutre. Sunt ideale pentru utilizatorii care doresc să maximizeze randamentele stablecoin-urilor inactive, mai ales într-un mediu cu rate ridicate ale dobânzilor. Cu toate acestea, ele pot implica riscuri legate de

contractele inteligente, volatilitatea ancorării sau incertitudinea reglementară. Sunt cel mai potrivite pentru economii, staking sau deținere pe termen lung.

Stablecoin-urile tradiționale precum USDT și USDC, pe de altă parte, sunt simple, lichide și larg suportate pe burse și portofele. Ele nu oferă randament încorporat, dar sunt extrem de fiabile pentru tranzacții zilnice, tranzacționare pe termen scurt și transferuri transfrontaliere. Dacă prioritizați ușurința în utilizare și securitatea în detrimentul câștigurilor pasive, stablecoin-urile tradiționale rămân o opțiune solidă.

Considerații cheie înainte de a utiliza stablecoin-uri generatoare de randament

Stablecoin-urile generatoare de randament vă permit să câștigați venituri pasive, menținând în același timp activele stabile, dar nu sunt lipsite de riscuri. Înainte de a investi, iată ce trebuie să știți.

Riscurile stablecoin-urilor generatoare de randament

• Vulnerabilități ale contractelor inteligente: Majoritatea stablecoin-urilor generatoare de randament rulează pe contracte inteligente. Dacă există o eroare sau un exploit, fondurile dumneavoastră ar putea fi în pericol. Rămâneți la proiecte bine auditate, cu un istoric solid de securitate.

• Risc de de-ancorare și crize de lichiditate: Deși aceste monede își propun să rămână aproape de 1 dolar, volatilitatea pieței le poate face să se de-ancoreze temporar. În condiții de stres, lichiditatea scăzută poate îngreuna, de asemenea, răscumpărarea sau tranzacționarea fără pierderi.

• Variabilitatea randamentului: Randamentele se pot schimba în funcție de condițiile pieței. Dacă ratele dobânzilor DeFi sau randamentele Trezoreriei scad, la fel se va întâmpla și cu câștigurile dumneavoastră. Unele strategii, cum ar fi hedging-ul delta-neutru, implică, de asemenea, complexitate și risc.

• Incertitudine reglementară: Stablecoin-urile generatoare de randament ar putea fi supuse unei examinări mai stricte. Legile propuse, cum ar fi STABLE Act și GENIUS Act în S.U.A., ar putea reclasifica aceste token-uri ca valori mobiliare, afectând modul și locul în care sunt oferite.

Peisajul reglementar al sectorului stablecoin-urilor

În 2025, reglementarea ajunge în sfârșit din urmă inovația cripto, în special în sectorul stablecoin-urilor. YLDS, emis de Figure Markets, a devenit primul stablecoin generator de randament care a primit aprobarea SEC din S.U.A. Această piatră de hotar stabilește un nou reper pentru activele digitale conforme care generează venituri pasive. Între timp, Circle, compania din spatele USDC,

a depus cerere pentru o listare publică, semnalând acceptarea generală și o integrare mai strânsă între stablecoin-urile susținute de fiat și finanțele tradiționale.

Europa, de asemenea, intensifică eforturile. Cadrul MiCA (Markets in Crypto-Assets), care a intrat în vigoare la mijlocul anului 2024, oferă reguli standardizate pentru emitenții de stablecoin-uri în întreaga UE. Acest lucru oferă atât utilizatorilor, cât și instituțiilor mai multă încredere atunci când se angajează cu active digitale reglementate. La nivel global, cererea instituțională se accelerează. Lideri precum CEO-ul

Polygon și băncile majore avansează tokenizarea activelor din lumea reală, în special a bonurilor de trezorerie S.U.A., ca o modalitate conformă de a oferi randament on-chain.

Aceste schimbări indică o piață în maturizare, unde transparența și conformitatea contează mai mult ca niciodată. Ca utilizator, este important să alegeți stablecoin-uri generatoare de randament cu o poziție legală clară, colateral fiabil și protocoale auditate. Rămânerea informat vă va ajuta să navigați în acest peisaj în continuă schimbare, minimizând în același timp riscul.

Concluzie: Ar trebui să investiți în stablecoin-uri generatoare de randament?

Stablecoin-urile generatoare de randament oferă o nouă modalitate de a vă crește economiile cripto. Ele combină stabilitatea stablecoin-urilor tradiționale cu capacitatea de a câștiga venituri pasive. Fie prin împrumuturi DeFi, active din lumea reală sau derivate, aceste token-uri vă pun fondurile inactive la treabă.

Dar recompensele vin cu riscuri. Defectele contractelor inteligente, volatilitatea pieței și reglementările în evoluție vă pot afecta deținerile. De aceea este important să vă faceți propria cercetare (

DYOR) înainte de a vă implica.

Lecturi conexe

Întrebări frecvente despre stablecoin-urile generatoare de randament

1. Ce sunt stablecoin-urile generatoare de randament?

Stablecoin-urile generatoare de randament sunt active digitale care rămân ancorate la o monedă fiat (cum ar fi dolarul S.U.A.), dar câștigă venituri pasive în timp. Ele generează randament prin mecanisme încorporate, cum ar fi împrumuturile DeFi, staking-ul sau investițiile în active din lumea reală, cum ar fi bonurile de trezorerie S.U.A.

2. Cum diferă stablecoin-urile generatoare de randament de stablecoin-urile obișnuite?

Stablecoin-urile obișnuite precum USDC sau USDT mențin o valoare stabilă, dar nu câștigă dobândă. Stablecoin-urile generatoare de randament, pe de altă parte, generează automat randamente în timp ce le dețineți, făcându-le mai degrabă conturi de economii în lumea cripto.

3. Care sunt cele mai sigure stablecoin-uri generatoare de randament de utilizat în 2025?

Opțiunile mai sigure includ sDAI (alimentat de DSR-ul MakerDAO), USDY (susținut de bonuri de trezorerie S.U.A. prin Ondo) și YLDS (un stablecoin înregistrat la SEC pe Provenance). Aceste proiecte se concentrează pe transparență, susținere solidă a activelor și conformitate reglementară.

4. Cum încep să câștig venituri pasive din stablecoin-uri generatoare de randament?

Alegeți un stablecoin generator de randament care se potrivește nevoilor dumneavoastră, configurați un portofel compatibil (cum ar fi MetaMask) și cumpărați USDC sau DAI pe BingX. Apoi, convertiți acele active în token-uri generatoare de randament prin platforme oficiale precum Maker, Ondo sau Figure Markets. Dețineți token-ul, iar randamentul va începe să se acumuleze automat.

5. Stablecoin-urile generatoare de randament prezintă riscuri?

Fiți atenți la erorile contractelor inteligente, instabilitatea ancorării, crizele de lichiditate și reglementările în schimbare. Randamentele pot varia, iar unele strategii (cum ar fi derivatele sau restaking-ul) sunt mai greu de înțeles. Cercetați întotdeauna dezvăluirile de risc ale proiectului înainte de a investi.