În 2025, Donald Trump a devenit una dintre cele mai proeminente figuri care a impulsionat dinamica în spațiul cripto. Schimbarea sa post-electorală către activele digitale a contribuit la împingerea

Bitcoin peste 104.000 de dolari la începutul acestui an, cu un nou

raliu bull trimițându-l recent peste 123.000 de dolari. Dar dincolo de câștigurile pieței, revenirea lui Trump a pregătit terenul pentru o transformare mai amplă a modului în care cripto este abordat în Statele Unite.

Susținut de politici pro-inovație și numiri strategice, Trump este acum strâns legat de o gamă tot mai largă de proiecte cripto. Acestea includ un

stablecoin USD1 complet susținut de fiat, o platformă de infrastructură și plăți

World Liberty Financial,

memecoin-uri precum

TRUMP și

MELANIA, și o serie de colecționabile digitale și campanii

NFT. Împreună, aceste proiecte reflectă un efort coordonat de a-și extinde prezența în spațiul activelor digitale.

Ceea ce a început ca câteva lansări separate a devenit una dintre cele mai atent urmărite tendințe în cripto anul acesta.

Agenda Cripto a lui Trump în 2025: Politici Cheie și Impactul asupra Pieței

Revenirea lui Trump la putere a adus o schimbare bruscă de politică în favoarea activelor digitale. Administrația sa a transformat cripto într-un subiect de discuție național, îmbinând reglementarea, strategia și mesajele publice într-un efort coordonat care a impactat deja atât sentimentul pieței, cât și participarea instituțională.

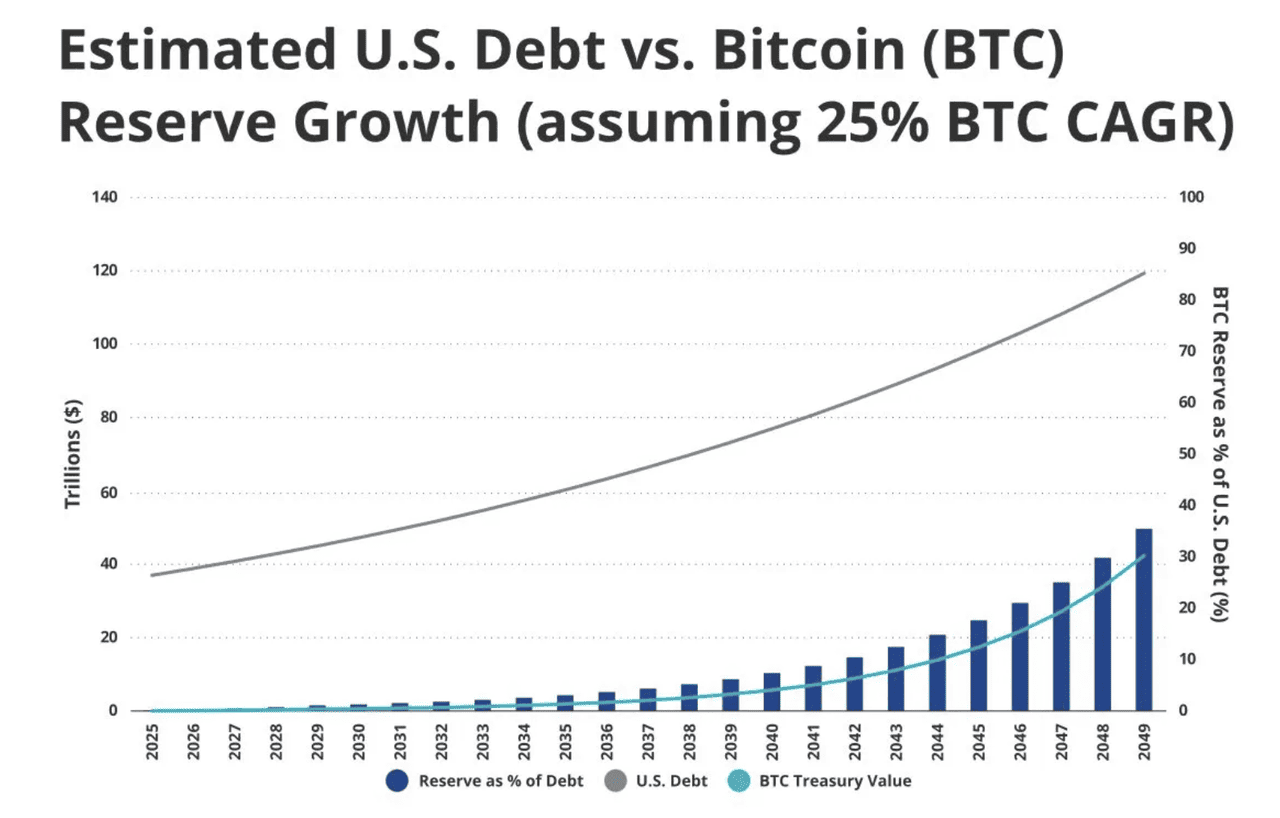

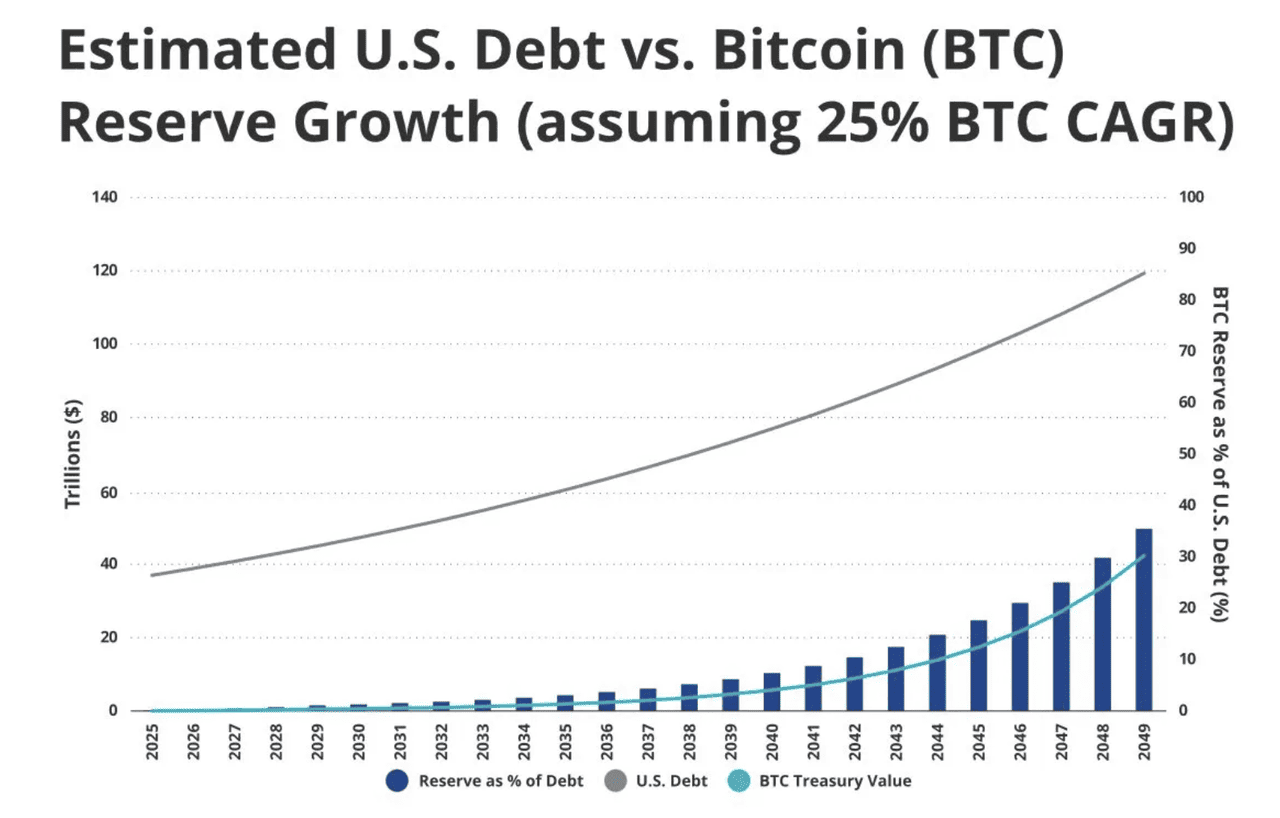

1. Rezerva Strategică de Bitcoin: Un Pariu al Trezoreriei Naționale pe BTC

Cum o Rezervă de Bitcoin a SUA ar putea compensa datoria SUA în timp | Sursa: VanEck

Într-o mișcare îndrăzneață și extrem de simbolică, administrația a propus crearea unei Rezerve Strategice de Bitcoin, care ar aloca o porțiune din rezervele naționale ale SUA către Bitcoin. Dacă ar fi implementată, aceasta ar marca prima dată când guvernul SUA recunoaște oficial Bitcoin ca un activ de grad suveran, plasându-l alături de aur și titlurile de trezorerie americane în deținerile pe termen lung.

Propunerea reia mișcări similare ale trezoreriilor corporative și fondurilor suverane globale care s-au orientat către Bitcoin ca o acoperire împotriva devalorizării monetare și a instabilității geopolitice. De asemenea, reflectă convingerea mai largă a administrației că activele digitale, în special Bitcoin, vor juca un rol fundamental în viitoarele sisteme monetare. Deși detaliile privind custodia, programele de achiziție și dimensiunea alocării sunt încă în discuție, mesajul este clar: Bitcoin nu mai este tratat ca un activ marginal.

2. Impuls Legislativ: Legea Genius și Săptămâna Cripto a SUA

În timpul

Săptămânii Cripto a SUA, administrația a dezvăluit un set coordonat de propuneri legislative menite să pună bazele unui mediu de active digitale mai structurat și mai competitiv în Statele Unite.

• Legea Genius: Vizează stabilirea unui cadru național pentru emiterea și adoptarea de

stablecoin-uri. Proiectul de lege se concentrează pe susținerea

stablecoin-urilor susținute de SUA ca instrument financiar strategic, încurajând colaborarea public-privată și asigurându-se că furnizorii de stablecoin-uri îndeplinesc standarde clare de transparență, susținere a rezervelor și interoperabilitate multi-platformă. Este încadrat ca parte a unui efort mai amplu de a promova dominanța dolarului american în plățile digitale.

• Legea Clarității: Concepută pentru a stabili categorii de reglementare mai clare pentru token-urile digitale, determinând dacă acestea intră sub supravegherea SEC sau CFTC, majoritatea fiind așteptate să fie reglementate de CFTC. Legislația vizează rezolvarea incertitudinilor de reglementare care au împins proiectele cripto în străinătate. A fost adoptată de Camera Reprezentanților în timpul "Săptămânii Cripto" și este acum în considerare în Senat.

• Legea Anti-CBDC: Blochează Rezerva Federală să emită o monedă digitală a băncii centrale (CBDC) orientată către retail, invocând preocupări legate de confidențialitate și supraveghere financiară. În schimb, susține utilizarea stablecoin-urilor emise privat.

Aceste proiecte de lege, deși încă își fac drum prin Congres, reprezintă o schimbare semnificativă de ton. Împreună, ele formează coloana vertebrală a politicii a ceea ce ar putea deveni cea mai cuprinzătoare strategie federală cripto de până acum.

3. Numiri Cheie: Conducere Pro-Cripto la Vârf

Una dintre primele mișcări ale administrației a fost numirea lui David Sacks ca "Țar Cripto și AI" oficial. Sacks a fost însărcinat cu coordonarea inter-agenții privind tehnologiile emergente, cu accent pe reglementarea favorabilă inovației.

Între timp, Paul Atkins, un fost comisar SEC cunoscut pentru viziunile sale de dereglementare, a fost numit să conducă din nou SEC. Numirea sa semnalează un impuls pentru reducerea tacticilor bazate pe aplicarea legii și o cale mai clară pentru firmele cripto care caută conformitate.

4. Răspunsul Pieței: Sentiment Optimist și Impuls Reînnoit

Piața cripto a răspuns rapid la schimbarea de poziție a administrației Trump. Bitcoin a urcat peste 104.000 de dolari la scurt timp după alegeri, apoi a depășit 123.000 de dolari într-un raliu bull reînnoit. Altcoin-urile au urmat, cu capitalul revenind atât în activele consacrate, cât și în cele emergente, și un potențial sezon altcoin la orizont.

Investitorii văd acest lucru ca un potențial punct de cotitură, nu doar pentru prețuri, ci și pentru politica cripto a SUA în ansamblu. Finanțarea de capital de risc și dezvoltarea de proiecte sunt în creștere, iar bursele majore se pregătesc pentru o expansiune internă mai profundă.

Schimbarea de politică a coincis, de asemenea, cu o adoptare instituțională în creștere, susținută de intrările în o gamă tot mai largă de ETF-uri cripto listate în SUA. Acestea includ

Bitcoin spot și

ETF-uri Ethereum, precum și fonduri diversificate de active digitale care acoperă sectoare precum DeFi și infrastructura

Web3. Odată cu atenuarea incertitudinii de reglementare, aceste produse câștigă tracțiune ca puncte de intrare mai accesibile și conforme pentru investitori. Zeci de aplicații suplimentare pentru ETF-uri, inclusiv cele pentru

ETF Solana,

ETF XRP și indici sectoriali mai largi, sunt în prezent în curs de examinare.

Pentru mulți constructori, mediul de reglementare mai clar a redeschis ușa către creșterea bazată în SUA. Sentimentul nu mai este condus doar de speculații. Direcția politicii joacă acum un rol central în modelarea încrederii.

Top 6 Proiecte Cripto Majore Legate de Trump de Urmărit în 2025

Poziția pro-cripto a lui Trump nu se limitează la politică. Un ecosistem în creștere de token-uri, stablecoin-uri, platforme și colecționabile legate de brandul său a apărut pe piață. Deși unele au început ca meme-uri politice sau experimente de noutate, mai multe au câștigat o tracțiune semnificativă, îmbinând atractivitatea ideologică cu utilitatea reală on-chain. Împreună, ele reflectă un efort mai amplu de a transforma cripto într-o platformă atât culturală, cât și financiară pentru publicul aliniat lui Trump.

1. World Liberty Financial (WLFI)

World Liberty Financial (WLFI) a apărut ca hub-ul central al ecosistemului cripto în creștere al lui Trump. Poziționat ca un proiect de infrastructură aliniat politic, WLFI își propune să construiască o rețea financiară alternativă care să susțină activele digitale aliniate cu valori precum piețele libere, confidențialitatea și suveranitatea națională. Se promovează ca un răspuns la ceea ce descrie ca fiind depășirea atribuțiilor de către instituțiile tradiționale și platformele centralizate.

WLFI funcționează ca mai mult decât un simplu token. Acesta alimentează o suită mai largă de produse, inclusiv stablecoin-ul USD1, platforma de dezvoltare BUILDon și integrări pe diverse platforme pro-cripto. Poziționarea sa reflectă o strategie deliberată: combinarea mesajelor ideologice cu instrumente financiare practice pentru a atrage utilizatorii care caută alternative rezistente la cenzură.

Lansat inițial ca un token de guvernanță netransferabil, WLFI a trecut la tranzacționabilitate în 2025, în urma unui vot de 99,94% al deținătorilor de token-uri în favoarea activării tranzacțiilor peer-to-peer și pe piața secundară. Proiectul a strâns, de asemenea, un total de 550 de milioane de dolari prin două vânzări de token-uri, poziționându-se ca un jucător bine finanțat și cu vizibilitate ridicată în spațiul activelor digitale în evoluție. Deși încă la începutul adoptării, WLFI este din ce în ce mai mult văzut ca stratul fundamental al impulsului de active digitale cu branding Trump.

2. Stablecoin USD1 (USD1)

USD1 este un stablecoin complet susținut de fiat, lansat la începutul anului 2025 de World Liberty Financial, comercializat ca primul dolar digital aliniat politic, susținut direct de Donald Trump. Conceput pentru a promova dominanța dolarului american în plățile cripto globale, USD1 se poziționează ca o alternativă fără comisioane, de nivel instituțional, la stablecoin-urile offshore precum USDT și USDC.

Tokenul este susținut 1:1 de titluri de trezorerie americane pe termen scurt și este deținut în custodie de BitGo Trust, cu accent pe conformitatea reglementară, decontarea rapidă și rezistența la cenzură. USD1 este deja integrat în platformele afiliate WLFI, unde servește ca stablecoin implicit pentru plăți, transferuri și activități DeFi. Marcat cu sloganul „America’s Stablecoin”, acesta reflectă, de asemenea, obiectivul mai larg al WLFI de a face activele ancorate la dolarul american standardul global de decontare pentru economia digitală.

3. Memecoin: Trump Oficial (TRUMP)

Trump Oficial (TRUMP) este un memecoin cu tematică politică ce a câștigat avânt în timpul ciclului electoral din 2024. Lansat pe 17 ianuarie 2025, cu doar câteva zile înainte de a doua inaugurare a lui Trump, tokenul a marcat o schimbare clară față de scepticismul său cripto anterior. Trump l-a anunțat pe rețelele sociale cu mesajul: „Noul meu Meme Oficial Trump este AICI!”, prezentând strigătul său de raliere „LUPTĂ LUPTĂ LUPTĂ” cu referire la răspunsul său după ce a supraviețuit unei tentative de asasinat în 2024. Tokenul a atins un maxim istoric de 75,35 dolari cu doar câteva ore înainte de inaugurare.

Deși înrădăcinat în cultura meme, TRUMP a oferit mai mult decât simplul hype online. Cel mai exclusivist beneficiu al său a fost Cina de Gală Trump, organizată pe 22 mai 2025, la Trump National Golf Club din Washington, D.C. Primii 220 de deținători de TRUMP au fost invitați pe baza soldului mediu de token-uri, iar primii 25 au primit beneficii VIP, cum ar fi un tur privat al Casei Albe. Printre participanții notabili s-au numărat fondatorul

Tron Justin Sun, CEO-ul Messari Ryan Selkis și alți lideri cripto.

80% din oferta de token-uri este deținută de entități afiliate lui Trump sub un program de vesting pe trei ani. Deși etichetat ca nefiind o investiție, TRUMP a devenit un studiu de caz despre cum brandingul politic și cripto se pot îmbina, cu peste 148 de milioane de dolari cheltuiți de deținători pentru o șansă de a cina cu Președintele în exercițiu al SUA.

4. Memecoin: Melania Trump (MELANIA)

Melania Trump (MELANIA) este un memecoin lansat pe 19 ianuarie 2025, la o zi după tokenul $TRUMP al soțului ei, creând o perturbare imediată a pieței care a făcut ca moneda lui Trump să se prăbușească cu peste 45%, pe măsură ce investitorii s-au grăbit către noua ofertă.

Tokenul a prezentat imagini elegante alb-negru ale Primei Doamne, creând un contrast vizual cu brandingul agresiv „LUPTĂ LUPTĂ LUPTĂ” al lui Trump. Spre deosebire de tokenul lui Trump, $MELANIA a avut o

tokenomics diferită, cu doar 35% rezervat pentru echipă și un program de deblocare mai rapid de 13 luni.

Moneda a fost gestionată de MKT World LLC, aceeași entitate pe care Melania a folosit-o pentru inițiativele sale digitale anterioare. A atins un

maxim istoric de 13,73 dolari în ziua inaugurării. Lansarea a stârnit preocupări legate de tranzacționarea cu informații privilegiate, când investigația a relevat că 24 de portofele au achiziționat token-uri în valoare de 2,6 milioane de dolari cu doar două minute și jumătate înainte de anunțul public, aducând cumpărătorilor timpurii un câștig neașteptat de 99,6 milioane de dolari.

5. BUILDon (B)

BUILDon(B) este un

memecoin bazat pe AI care servește ca un strat de utilitate în ecosistemul World Liberty Financial, conceput pentru a îmbina cultura meme cu funcționalitatea DeFi reală pe BNB Chain. Lansat în aprilie 2025 printr-o lansare echitabilă pe Four.meme, BUILDon utilizează arhitectura Agent-la-Agent (A2A) care permite

agenților inteligenți AI autonomi să automatizeze cercetarea on-chain, luarea deciziilor și ciclurile de execuție.

Proiectul s-a transformat dintr-un memecoin modest într-un jucător central în infrastructura stablecoin-ului USD1, când a integrat USD1 ca pereche de tranzacționare principală la mijlocul lunii mai 2025. BUILDon a devenit rapid cea mai mare sursă de volum de tranzacționare USD1 non-stablecoin, reprezentând peste 90% din activitatea USD1 pe

bursele descentralizate (DEX-uri).

Susținerea și achiziția de către World Liberty Financial a peste 636.000 de token-uri B a declanșat o creștere a prețului de 1.340%, stabilind BUILDon atât ca token de guvernanță, cât și ca mecanism de stimulare a ecosistemului pentru

tokenizarea activelor din lumea reală (RWA) și aplicațiile de

contracte inteligente în cadrul ecosistemului USD1.

6. NFT-uri Cărți de Tranzacționare Digitale Trump

NFT-urile Cărți de Tranzacționare Trump au fost una dintre cele mai timpurii inițiative cripto legate direct de brandul personal al lui Donald Trump. Lansată pentru prima dată în decembrie 2022 pe blockchain-ul Polygon, colecția a prezentat 45.000 de opere de artă digitale care îl înfățișau pe Trump în diverse ținute tematice, inclusiv costume de supereroi, pălării de cowboy, echipament de astronaut și decoruri patriotice. În ciuda scepticismului inițial, proiectul s-a epuizat rapid la 99 de dolari fiecare.

Ecosistemul

NFT a evoluat prin multiple colecții și blockchain-uri, extinzându-se de la

Polygon la

Ordinale Bitcoin cu lansări exclusive. Trump a lansat cel puțin patru colecții, cu pachete premium ajungând la 24.750 de dolari, care includeau adidași aurii marca Trump, cărți fizice și invitații exclusive la cină.

Mai degrabă decât să rămână obiecte de colecție de noutate, NFT-urile au devenit o formă de abonament digital care acordă acces la beneficii exclusive, cum ar fi obiecte de colecție semnate, cine VIP și ieșiri la golf. Succesul a generat peste 7 milioane de dolari în venituri și a stabilit un șablon pentru obiecte de colecție digitale cu branding politic, contribuind la normalizarea recompenselor din lumea reală legate de proprietatea activelor digitale.

Cum să Tranzacționezi Proiecte Cripto Legate de Trump pe BingX

BingX facilitează tranzacționarea activelor cripto legate de Trump, cum ar fi

TRUMP,

WLFI și

USD1, toate într-o singură platformă. Indiferent dacă utilizezi

piața spot,

contracte futures perpetue sau

copy trading, BingX oferă o suită completă de funcții, concepută atât pentru începători, cât și pentru traderi avansați.

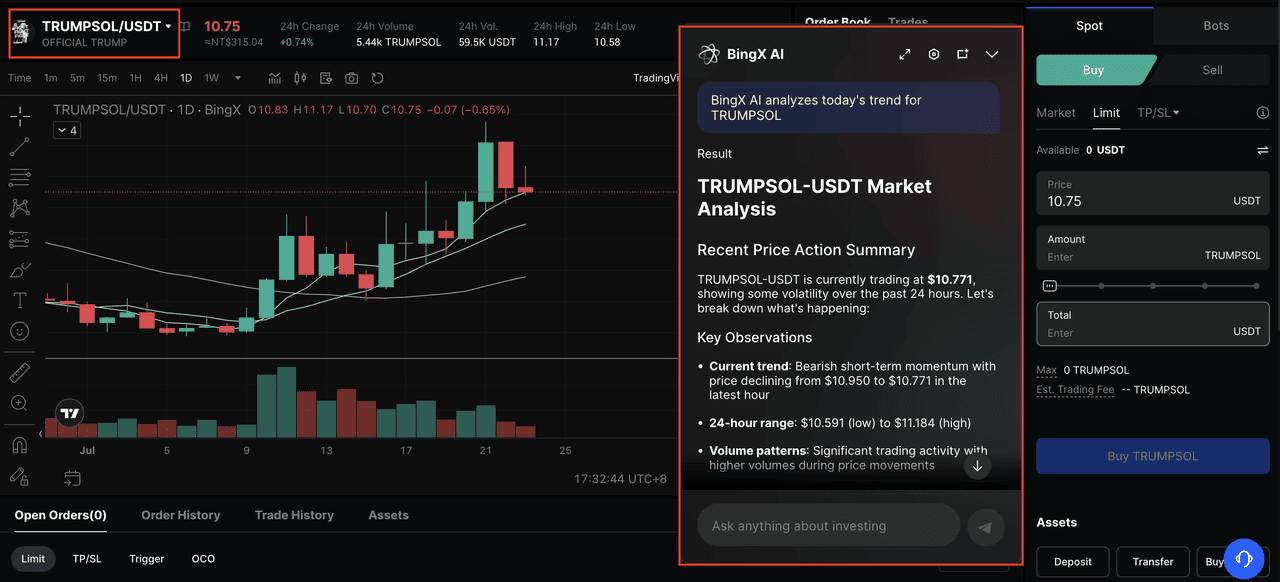

AI-ul BingX încorporat te ajută să analizezi tendințele pieței, să detectezi tipare și să planifici intrări mai inteligente cu informații în timp real.

Pasul 1: Căutare și Tranzacționare Tastează perechea de tranzacționare (cum ar fi TRUMPSOL/USDT) în bara de căutare de pe piața spot BingX sau în contractele futures perpetue. Alege între un ordin de piață sau un ordin limită, în funcție de strategia ta de tranzacționare.

Pasul 2: Utilizează AI BingX pentru Analiză Pe interfața de tranzacționare, apasă pictograma AI pentru a activa AI BingX. Acesta va analiza mișcările prețurilor în timp real, va detecta tipare și va explica semnificația lor potențială în mediul actual al pieței.

Pasul 3: Planifică Intrări Mai Inteligente Valorifică informațiile AI BingX pentru a evalua punctele de intrare, a urmări impulsul tendinței și a identifica nivelurile cheie de rezistență sau suport înainte de a plasa o tranzacție.

Perspective de Viitor

Pe măsură ce ecosistemul cripto aliniat lui Trump continuă să se extindă, acesta reflectă o convergență în creștere între identitatea politică, brandingul cultural și infrastructura financiară. De la schimbări de politică la lansări de proiecte, adoptarea activelor digitale de către fostul președinte a devenit atât un motor narativ, cât și o forță structurală pe piețele cripto din SUA.

Privind în perspectivă, mult va depinde de modul în care aceste inițiative evoluează dincolo de ciclul actual de hype. Rămân întrebări legate de utilitatea pe termen lung, răspunsul de reglementare și participarea susținută a comunității. Dar dacă impulsul actual continuă, token-urile și platformele susținute de Trump ar putea juca un rol din ce în ce mai vizibil în modelarea percepției generale a cripto în America.

Fie ca vehicul de marketing, catalizator de politică sau sistem financiar experimental, mișcarea cripto a lui Trump a lăsat deja o amprentă. Și s-ar putea să abia înceapă.

Lecturi Conexe