Trecerea Ethereum la Proof-of-Stake (PoS) a revoluționat modul în care investitorii obțin venituri pasive din deținerile lor de criptomonede. Staking-ul joacă acum un rol central în securizarea rețelei și recompensarea participanților, dar staking-ul tradițional vine cu un dezavantaj major: ETH-ul tău este blocat pentru o perioadă stabilită, limitând flexibilitatea și accesul la capitalul tău.

Lido, cea mai mare platformă de

staking lichid Ethereum, schimbă acest lucru oferind o modalitate de a câștiga recompense din staking, menținând în același timp activele lichide. Această abordare a facilitat participarea atât a investitorilor obișnuiți, cât și a instituțiilor la staking-ul Ethereum, fără a renunța la controlul fondurilor lor.

În 2025, cu participarea la staking-ul

Ethereum la cote record și activitatea

DeFi în revenire, Lido a devenit o alegere preferată pentru oricine caută recompense din staking fără a sacrifica lichiditatea. Indiferent dacă deții ETH pe termen lung sau dorești să-i maximizezi utilitatea, înțelegerea modului în care funcționează Lido te poate ajuta să profiți la maximum de activele tale.

Ce este Lido Finance și cum funcționează?

În septembrie 2022, Ethereum a finalizat The Merge, trecând de la Proof-of-Work la Proof-of-Stake (PoS). Sub PoS,

validatorii securizează rețeaua prin staking de ETH și câștigă recompense. Staking-ul tradițional, cel mai frecvent realizat prin solo staking sau prin platforme de custodie și schimb, necesită un minim de 32 ETH pentru a rula un nod validator. Există doar câteva opțiuni DeFi care urmează același model non-lichid. În toate cazurile, activele blocate rămân blocate pentru o perioadă stabilită, cu retrageri supuse cozilor de ieșire și întârzierilor. Deși acest lucru susține stabilitatea rețelei, limitează lichiditatea și împiedică utilizarea ETH-ului blocat în altă parte pe durata blocării.

Lido este un protocol descentralizat de staking lichid creat pentru a rezolva această problemă. În loc să blochezi ETH direct cu un validator, staking-ul prin Lido emite stETH (Ether blocat) pe o bază 1:1 cu suma depusă. Soldul stETH crește automat în timp pe măsură ce se adaugă recompense.

Fiind un token lichid, stETH poate fi tranzacționat, utilizat ca garanție sau integrat în protocoale de finanțe descentralizate, continuând în același timp să acumuleze recompense din staking. Lido distribuie ETH-ul blocat printr-o rețea de validatori profesioniști, sporind descentralizarea și reducând dependența de un singur operator.

Ce face Lido Finance unic în staking-ul ETH?

• Lichiditate Retenută: Fă stake la ETH și primește stETH, care poate fi tranzacționat sau implementat în DeFi în timp ce câștigi recompense.

• Intrare Flexibilă: Lido elimină minimul de 32 ETH necesar pentru a rula un validator, permițând staking-ul oricărei sume, menținând în același timp lichiditatea prin stETH.

• Compunerea Recompenselor: Soldurile stETH se actualizează automat pentru a reflecta recompensele acumulate.

• Rețea Extinsă de Validatori: Stake-ul este distribuit pe mai mulți validatori profesioniști pentru a spori securitatea și descentralizarea.

• Integrare DeFi: stETH este larg acceptat în împrumuturi, pool-uri de lichiditate și alte aplicații DeFi pentru oportunități suplimentare de randament.

Ce determină dominanța Lido în staking-ul lichid și entuziasmul din jurul tokenului Lido

Proeminența Lido în acest an este determinată de o combinație de impuls de piață, implicare instituțională și execuție strategică.

1. Cea mai mare platformă de staking lichid Ethereum cu TVL de peste 38 miliarde $ și o creștere de 78% a prețului LDO

În 2025, Lido continuă să domine piața de staking lichid Ethereum. Conform

DefiLlama, deține în prezent cea mai mare

valoare totală blocată (TVL) dintre toate proiectele DeFi pe Ethereum și se clasează pe locul al doilea în toate lanțurile. Această poziție de lider este susținută de peste 38 de miliarde de dolari în active blocate prin protocol. Recuperarea prețului Ethereum a amplificat interesul pentru staking, în timp ce integrarea Lido în ecosistemul DeFi asigură că acesta captează o parte semnificativă din această activitate. Extinderea participării instituționale și capacitatea protocolului de a se adapta la condițiile de piață în schimbare i-au consolidat și mai mult poziția. Acești factori au contribuit la o creștere bruscă a LDO, care a crescut cu peste 70% în ultima lună, reflectând încrederea reînnoită a pieței.

2. Creștere Instituțională din ETF-uri Ethereum, ETF-uri de Staking și Utilizarea în Trezorerie

Interesul instituțional pentru staking-ul Ethereum a accelerat, alimentat de aprobarea

ETF-urilor spot Ethereum, discuțiile privind

ETF-urile de staking ETH și includerea ETH în strategiile de trezorerie corporativă. Amploarea Lido, rețeaua descentralizată de validatori și upgrade-urile tehnice orientate spre conformitate îl fac un candidat puternic pentru instituțiile care doresc să genereze randament din staking fără a sacrifica lichiditatea. Tokenul stETH al protocolului este deja susținut de platforme de custodie și tranzacționare de top, facilitând integrarea în fluxurile de lucru instituționale. Pe măsură ce instituțiile caută din ce în ce mai mult active digitale generatoare de randament care pot servi și scopurilor strategice în gestionarea trezoreriei, cota de piață și vizibilitatea Lido vor beneficia.

3. Operațiuni Mai Eficiente și Optimizarea Costurilor Consolidează Poziționarea pe Termen Lung

La începutul lunii august 2025, Lido și-a redus forța de muncă cu 15% ca parte a unui plan strategic de optimizare a costurilor, semnalând un accent pe sustenabilitatea pe termen lung și eficiența operațională. Co-fondatorul Vasiliy Shapovalov a subliniat că decizia a vizat costurile, nu performanța, și a avut ca scop alinierea operațiunilor cu prioritățile deținătorilor de tokenuri LDO. În ciuda reducerilor, Lido a generat venituri de 44,68 milioane de dolari în acest an, depășind bugetul cu 147 la sută, și menține un TVL de 32 de miliarde de dolari cu aproximativ 90 de milioane de dolari în venituri anualizate. Susținut de fundamente solide și inițiative continue, cum ar fi extinderea Tehnologiei de Validare Distribuită (DVT) și cadrul de Retrageri Declansabile, Lido continuă să demonstreze capacitatea sa de a inova, păstrând în același timp disciplina fiscală.

Cum să faci Stake la ETH cu Lido Finance: Un Ghid Pas cu Pas

Staking-ul ETH prin Lido oferă o modalitate de a câștiga recompense, menținând în același timp activele lichide prin stETH. Procesul este simplu și poate fi finalizat în doar câțiva pași.

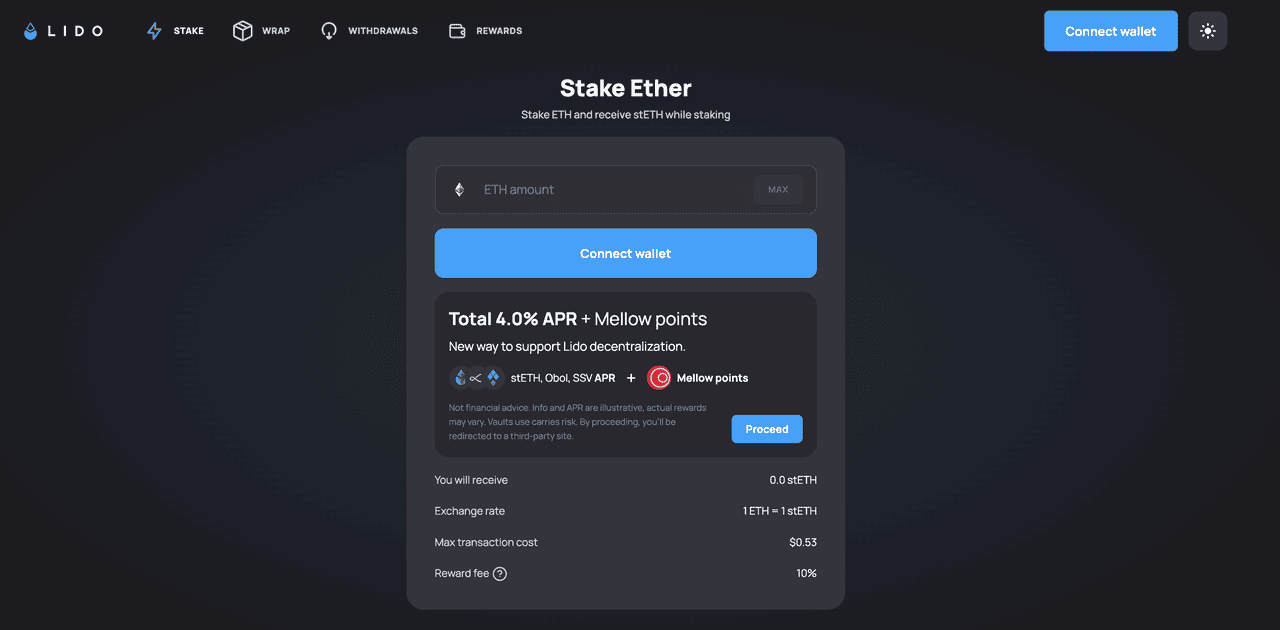

Pasul 1: Pregătește un Portofel Compatibil Web3 și Accesează Lido

Configurează un portofel securizat

compatibil Ethereum, cum ar fi

MetaMask,

Ledger sau

Trust Wallet. Asigură-te că deține suma de ETH destinată staking-ului, împreună cu o mică rezervă pentru taxele de gaz. Odată pregătit, vizitează

Pagina de Staking Lido și conectează portofelul prin interfața platformei, verificând autenticitatea site-ului înainte de a continua.

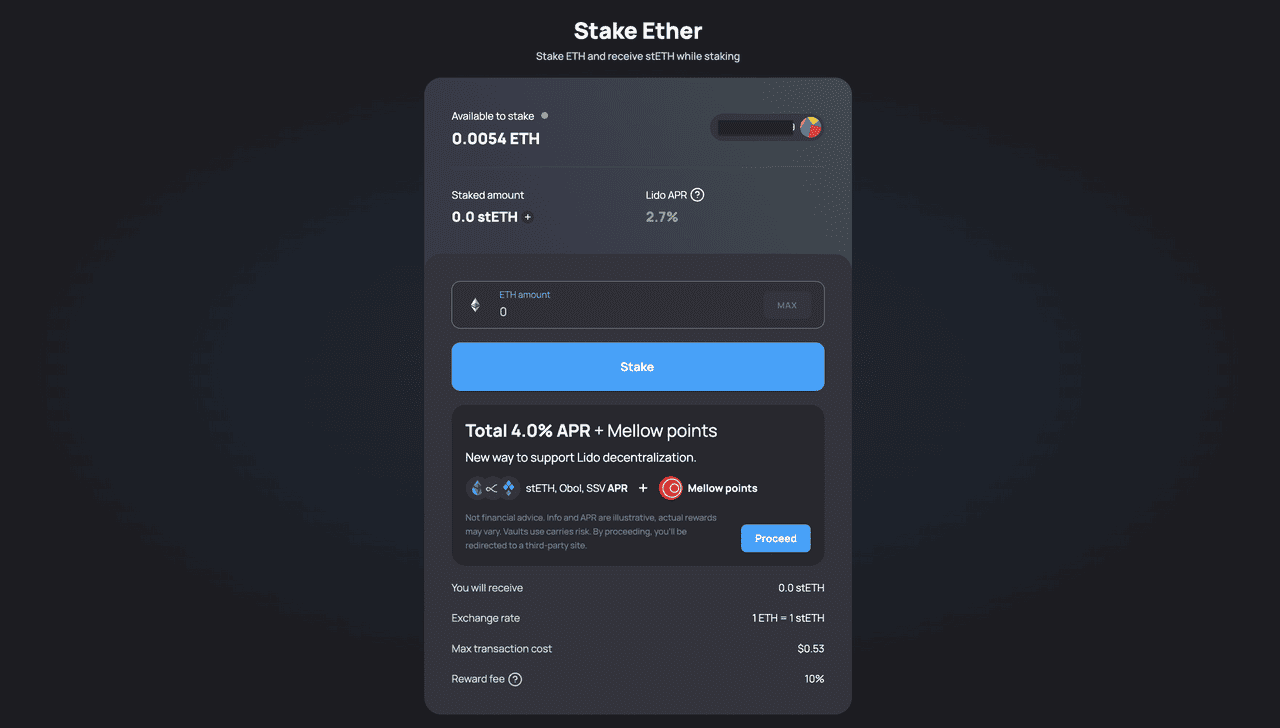

Pasul 2: Selectează Suma pentru Staking

Introdu suma de ETH care urmează să fie blocată. Platforma va afișa echivalentul stETH care va fi primit, împreună cu o estimare a recompenselor potențiale.

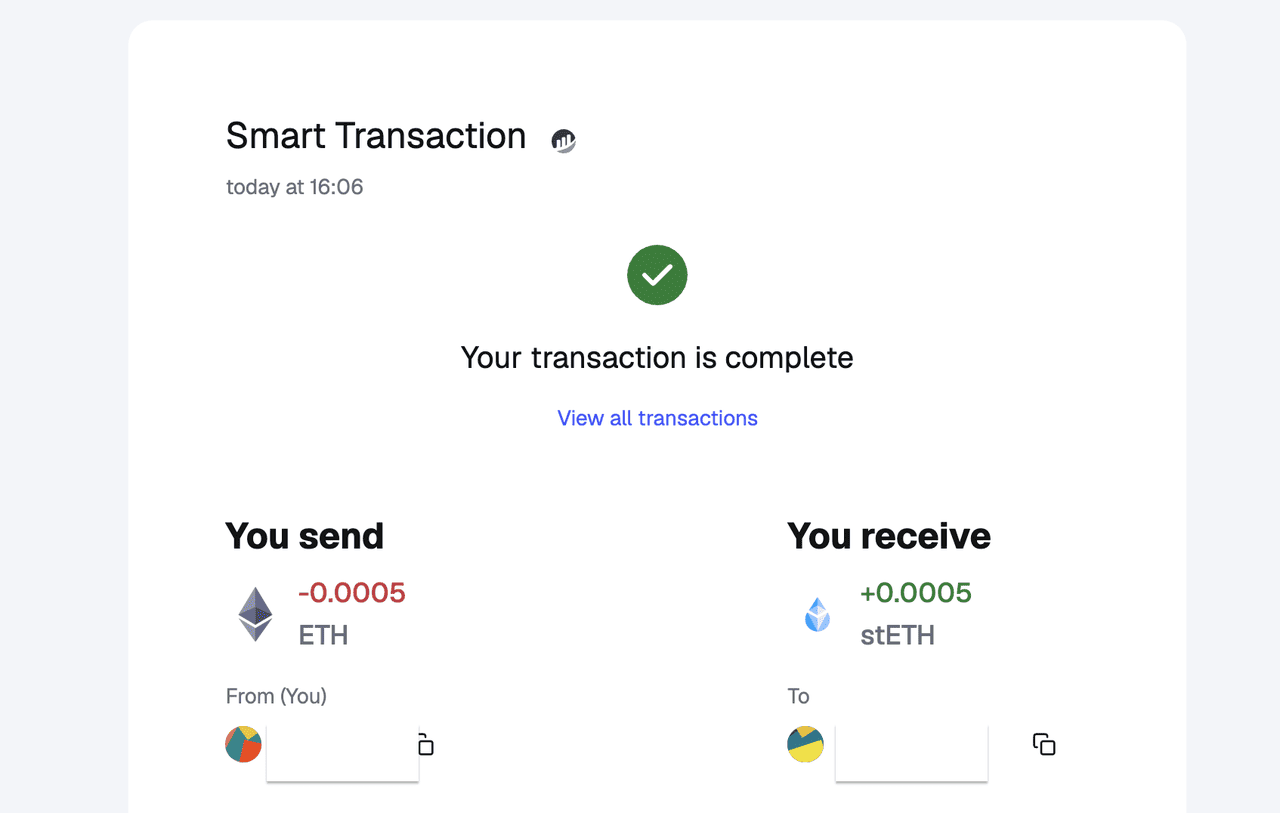

Pasul 3: Confirmă Tranzacția

Aprobă tranzacția de staking în cadrul portofelului. Odată confirmată în rețeaua Ethereum, stETH va fi emis și va apărea în portofelul conectat.

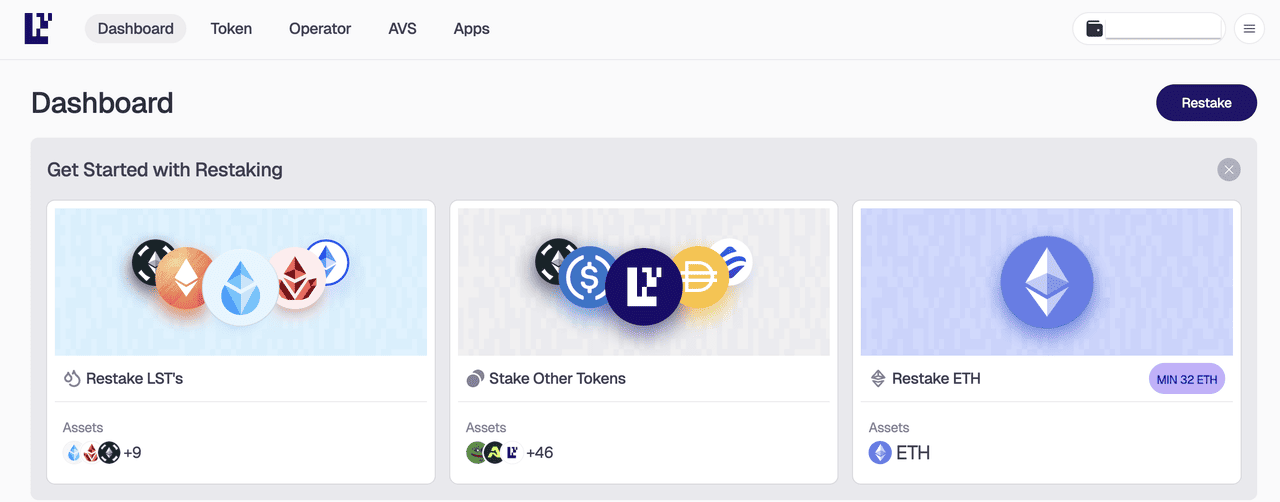

Pasul 4: Utilizează stETH în DeFi (Opțional)

stETH poate fi utilizat în împrumuturi, pool-uri de lichiditate, restaking și alte protocoale DeFi, de ex.

Eigenlayer, pentru a genera randament suplimentar, continuând în același timp să acumuleze recompense din staking.

Cum să tranzacționezi tokenul de guvernanță Lido LDO pe BingX

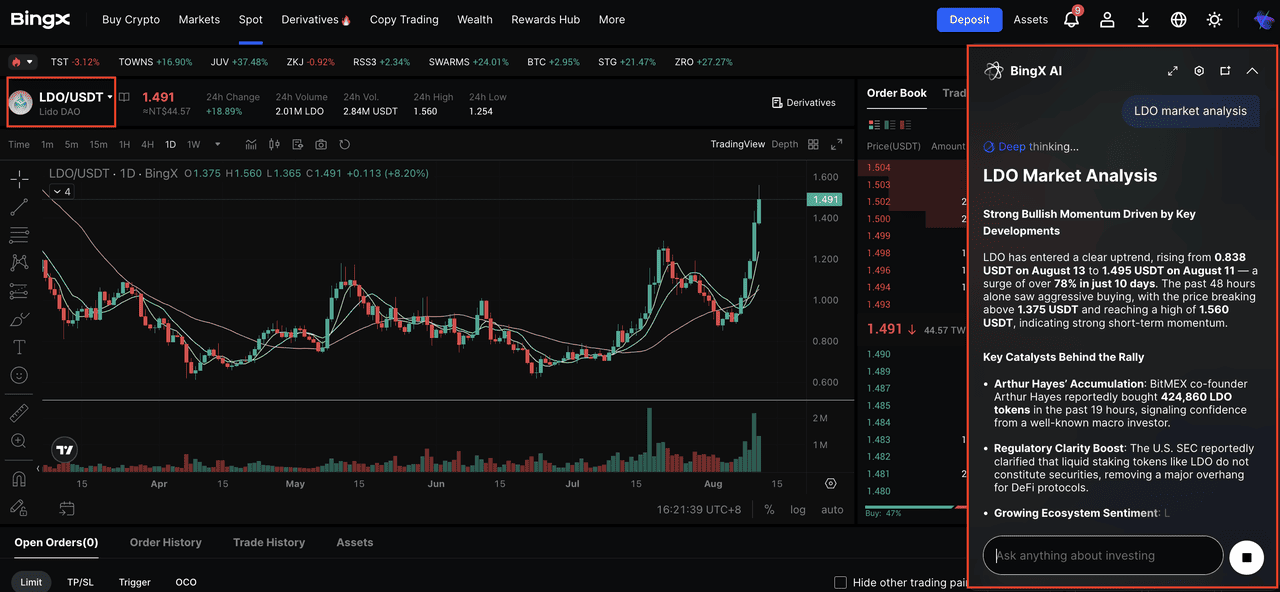

Lido (LDO) este tokenul de guvernanță al protocolului de staking lichid Lido, unul dintre cele mai mari proiecte DeFi pe Ethereum. LDO este disponibil atât pe Piața Spot BingX, cât și pe Piața de Contracte Futures Perpetue, oferind opțiuni flexibile pentru traderi, fie că își construiesc o poziție pe termen lung, fie că profită de mișcările de piață pe termen scurt. BingX oferă, de asemenea, analize de piață în timp real prin

BingX AI pentru a ajuta la identificarea unor configurații de tranzacționare mai bune.

Pasul 1: Caută LDO/USDT pe Piața Spot sau pe Piața de Contracte Futures Perpetue

Pentru Tranzacționare Spot

Accesează

Piața Spot pe BingX și introdu

LDO/USDT în bara de căutare. Plasează un ordin de piață pentru a cumpăra instantaneu la prețul curent sau setează un ordin limită pentru intrarea dorită. Tranzacționarea spot se potrivește celor care urmăresc să acumuleze LDO pe termen lung sau să-l dețină ca parte a unui portofoliu cripto diversificat.

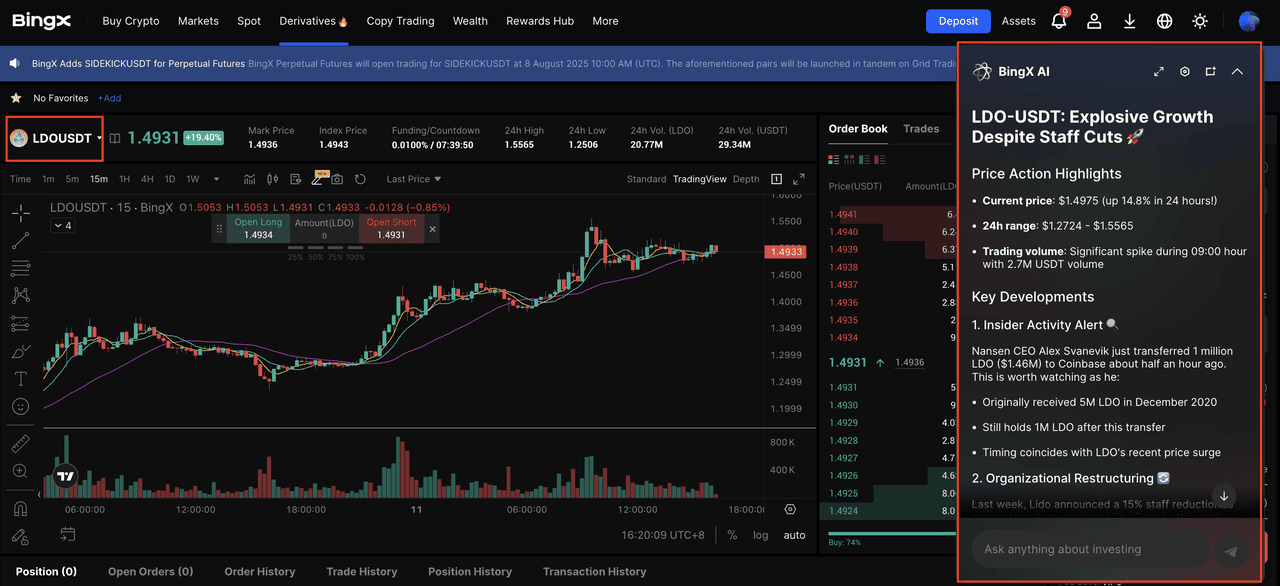

Pentru Tranzacționare Contracte Futures Perpetue

Traderii experimentați pot utiliza

Piața de Contracte Futures Perpetue căutând

LDO/USDT. Contractele futures perpetue permit deschiderea de poziții long sau short pe LDO fără o dată de expirare, permițând strategii atât pentru condiții de piață bullish, cât și bearish. Levierul poate amplifica randamentele potențiale, dar crește și riscul, deci gestionarea atentă a riscului este esențială.

Pasul 2: Activează BingX AI pentru Analiză de Piață în Timp Real

Pe graficul de tranzacționare, apasă pictograma AI pentru a lansa

BingX AI. Acest instrument scanează acțiunea prețului, marchează zonele cheie de suport și rezistență și identifică direcția trendului pentru a ajuta la identificarea intrărilor optime și la evitarea tranzacțiilor impulsive. Pentru Lido (LDO), BingX AI evidențiază, de asemenea, evoluțiile recente care au influențat piața, cum ar fi clarificările SEC privind staking-ul lichid, care a fost un factor cheie în spatele creșterii recente a prețului.

Pasul 3: Planifică Tranzacții cu Informații AI și Cercetare de Piață

Utilizează informațiile BingX AI pentru a rafina intrările, a seta nivelurile de take-profit și a ajusta stop-loss-urile. Pentru context suplimentar, urmărește evoluțiile legate de Lido, cum ar fi upgrade-urile protocolului, ratele de adoptare a staking-ului și performanța pieței Ethereum, deoarece acestea pot influența puternic prețul LDO. Combinarea analizei tehnice bazate pe AI cu cercetarea fundamentală informată poate îmbunătăți luarea deciziilor de tranzacționare.

Riscuri și Considerații Înainte de a Face Stake pe Lido

Deși Lido oferă o modalitate flexibilă de a câștiga recompense din staking-ul Ethereum, mai multe riscuri ar trebui evaluate înainte de a angaja fonduri:

• Vulnerabilități ale Contractelor Inteligente: Lido operează în întregime prin

contracte inteligente. O eroare critică sau un exploit ar putea duce la pierderea fondurilor.

• Deviația Prețului stETH: Deși stETH este conceput să urmărească ETH 1:1, prețul său de piață poate diverge temporar în perioade de volatilitate ridicată sau stres de lichiditate.

• Risc de Slashing al Validatorului: Performanța slabă sau comportamentul necorespunzător al validatorilor poate duce la penalități de slashing, care reduc recompensele din staking.

• Incertitudine Reglementară: Modificările reglementărilor pot afecta disponibilitatea sau termenii serviciilor de staking în anumite jurisdicții.

• Risc de Expunere DeFi: Utilizarea stETH în alte protocoale DeFi introduce riscuri suplimentare din partea acelor platforme, inclusiv eșecuri ale contractelor inteligente sau probleme de lichiditate.

Evaluarea atentă a acestor factori, diversificarea strategiilor de staking și utilizarea doar a platformei oficiale Lido pot contribui la atenuarea dezavantajelor potențiale.

Gânduri Finale

Lido a redefinit staking-ul Ethereum oferind o modalitate de a câștiga recompense fără a bloca activele, combinând lichiditatea cu participarea la rețea. În 2025, poziția sa de cea mai mare platformă de staking lichid, integrările profunde DeFi și adoptarea instituțională în creștere i-au consolidat rolul de piatră de temelie a ecosistemului Ethereum.

Pentru cei care doresc să maximizeze utilitatea ETH-ului lor în timp ce participă la staking, Lido oferă o soluție dovedită și larg adoptată. Cu toate acestea, la fel ca toate protocoalele DeFi, prezintă riscuri care ar trebui luate în considerare cu atenție înainte de participare. Echilibrarea beneficiilor sale cu o înțelegere clară a dezavantajelor potențiale va asigura o strategie de staking mai informată și mai sustenabilă.

Lectură Recomandată